Autonomous Mobile Robots Market Size and Forecast 2025 to 2034

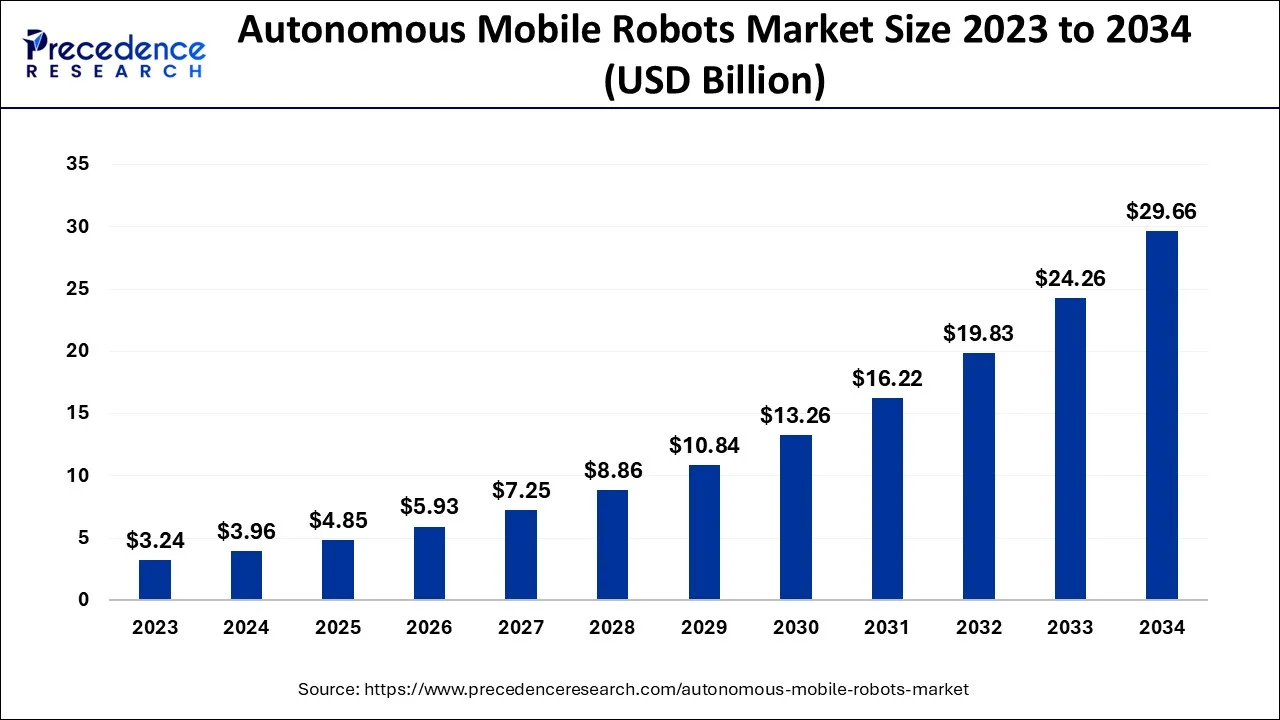

The global autonomous mobile robots market size is exhibited at USD 3.96 billion in 2024 and is predicted to surpass around USD 29.66 billion by 2034, growing at a CAGR of 22.31% from 2025 to 2034. An autonomous mobile robot is a kind of robot that can understand and explore its environment on its own. AMRs differ from autonomous guided vehicles (AGVs), which are typically supervised by humans and depend on tracks or predefined trajectories.

Autonomous Mobile Robots Market Key Takeaways

- In terms of revenue, the market is valued at $4.85 billion in 2025.

- It is projected to reach $29.66 billion by 2034.

- The market is expected to grow at a CAGR of 22.31% from 2025 to 2034.

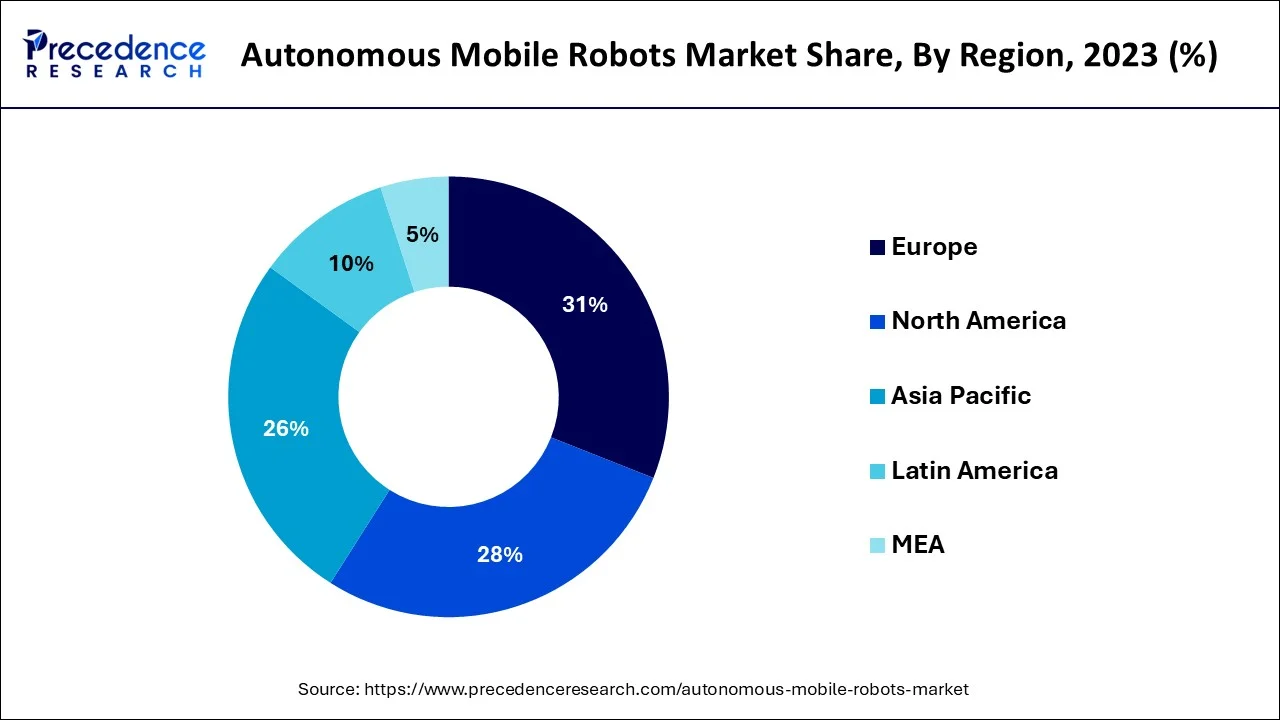

- The Europe region held the highest revenue share of around 31% in 2024.

- By component, the hardware sector had the highest revenue share of around 68.40% in 2024.

- By type, the goods-to-person picking robots captured more than 50% of the revenue share in 2024.

- By battery type, the lead battery market sector accounted for more than 50% of revenue share in 2024.

- By end use, the manufacturing sector had the biggest revenue share of around 77% in 2024.

Europe Autonomous Mobile Robots Market Size and Growth 2025 to 2034

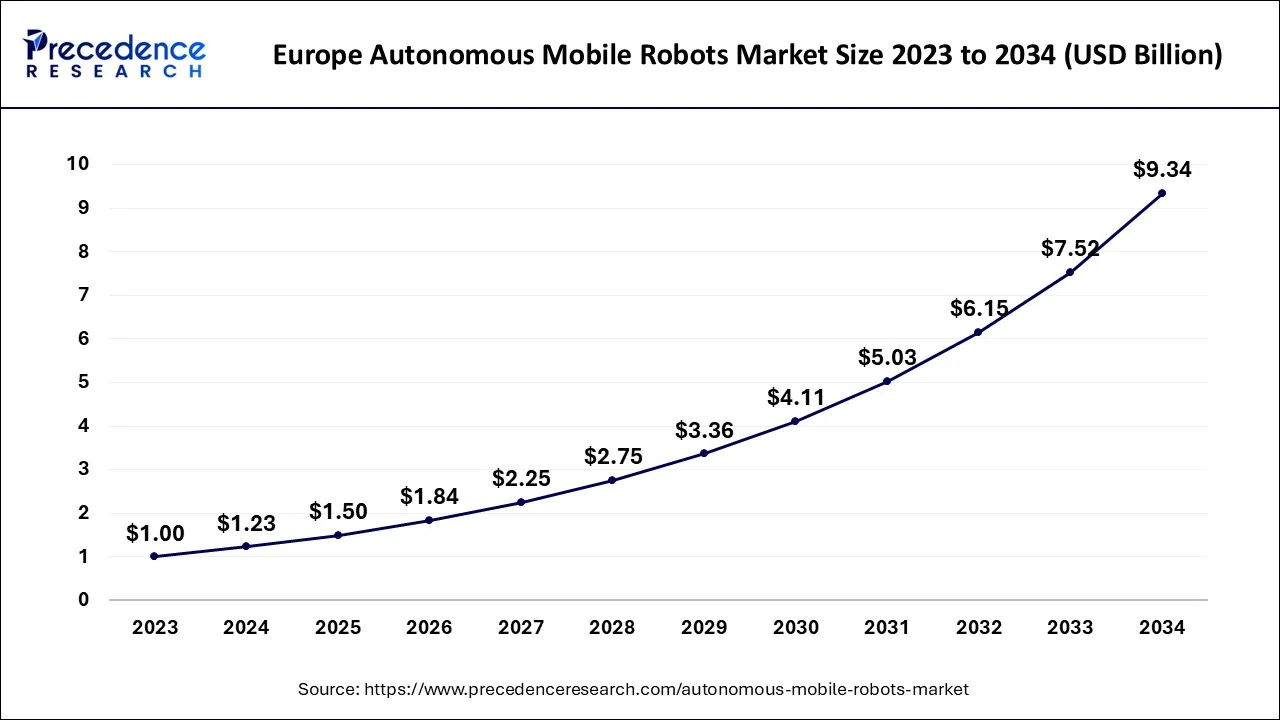

The Europe autonomous mobile robots market size is estimated at USD 1.5 billion in 2025 and is expected to be worth around USD 9.34 billion by 2034, rising at a CAGR of 22.47% from 2025 to 2034.

With a market share of almost 31%, Europe dominated the market in 2024. This might be linked to the incumbents in the manufacturing industry's increasing need for material-handling tools. Growth is also being fueled by ongoing process automation in other industry verticals and sectors.

Over the projection period, Asia Pacific is predicted to experience a considerable CAGR. The use of autonomous mobile robots for warehouse inventory management is being encouraged by the expanding electronic commerce sector in Asia Pacific's rising nations. Due to the fierce rivalry that exists within the e-commerce sector as e-commerce businesses attempt to differentiate themselves by slashing the time it takes to deliver items, the adoption of AMRs is also gaining momentum.

AMRs are being used by e-commerce businesses to automate intra-logistics processes including sorting, picking, and palletizing. For instance, Hai Robotics, a producer of ACRs located in Shenzhen, raised $200M in two stock transactions in September 2021. The money will be used to modernize the robot fleet and enable it to compete on a global scale, as well as to assist supply chain management and hire new personnel.

North America is observed to grow at a considerable growth rate in the upcoming period, fueled by the swift implementation of automation in logistics, manufacturing, and retail industries. The rise of e-commerce, along with innovations in AI and robotics, is driving the use of AMRs to improve operational efficiency and lower labor expenses. Government efforts that support Industry 4.0 and smart manufacturing are hastening market growth. Businesses are increasingly investing in AMR technologies to tackle labor shortages and satisfy the increasing need for faster and more efficient delivery systems. The region's vibrant economic environment and technological progress position it as a key player in the global AMR market.

The United States is leading the way in AMR adoption, capitalizing on its strong technological foundation and a commitment to automation to boost efficiency across various sectors. The boom in e-commerce has spurred a growing demand for AMRs in warehouses and distribution hubs, improving inventory management and order fulfillment. Partnerships between technology firms and logistics companies are driving innovation, reinforcing the U.S.'s dominance in the AMR market.

Autonomous Mobile Robots Growth Factor

One of the key elements that are anticipated to assist the market's growth is the expanding use of robots in numerous industrial sectors. Some of the reasons that are projected to fuel the expansion of the market include technical advancement, increasing awareness of the advantages of autonomous robots in emerging economies, and expanding application areas for autonomous robots. However, some of the key restraints that may have an impact on the market's expansion are the slow pace at which robots move and the malfunction of robots. Additionally, the industry has a chance to expand due to the growing use of mobile robots for patrolling.

The market is growing as a result of factors including the increased demand for smart devices in automobiles and the increasing use of advanced driver assistance technologies. The government's enforcement of stringent telematics regulations has also accelerated the market's growth. Real-time traffic and event notifications are also necessary, and this is helping the industry grow. However, market development is being hampered by the high cost of implementation and the unequal distribution of internet access.

- Growing Need for Smooth Workflow in the Face of the Epidemic Promoted Market Growth

- The rise in global e-commerce activity is driving up demand for autonomous mobile robots.

- Growing usage of these robots across a variety of sectors and expanding warehouse automation are anticipated to drive the market's expansion. This is due to these robots' independence in navigating complex situations.

- The growing use of automated material handling combined with developments like lights-out automation

Major Key Trends in Autonomous Mobile Robots Market

- AI-Enhanced Navigation and Decision-Making: The incorporation of artificial intelligence allows AMRs to traverse complex environments, make instantaneous decisions, and adjust to changing operational conditions, thereby improving overall efficiency and productivity.

- Collaboration Between Humans and Robots: An increasing trend is observed where AMRs collaborate with human employees, boosting productivity and safety in shared work environments, especially in manufacturing and logistics sectors.

- Tailored Solutions for Industry-Specific Needs: Companies are designing AMRs customized to meet distinct industry requirements, addressing specific challenges in fields such as healthcare, agriculture, and retail, thereby expanding the range of AMR applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 29.66 Billion |

| Market Size in 2025 | USD 4.85 Billion |

| Market Size in 2024 | USD 3.96 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 22.31% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered |

Component,Type,Battery Type,End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growth of the e-commerce sector

- The e-commerce sector's explosive growth over the past several years is what is primarily driving up AMR demand in the logistics sector. For instance, Walmart's online sales increase by 300% during the beginning of the epidemic. Walmart expanded several of its stores with Market Fulfillment Centres, a sort of small warehouse, in order to handle the increase in online orders. In these centers, mobile robots are used to acquire goods and prepare them for pickup.

- Another factor encouraging warehouses to deploy more mobile robots is the high cost of labor and pay. The expenditures of AMR's acquisition, installation, and maintenance are comparatively affordable. Long-term, purchasing AMRs is less expensive than paying compensation to employees.

- The use of AMR in various industries is becoming considerably simpler thanks to new technologies. Utilizing fleet management software for more intelligent and adaptable navigation is one recent development in AMR. This makes it easier for AMRs to maneuver in situations that are more intricate than warehouses, such as those seen in the manufacturing industry, which has more complex operations and sectors. AMRs can see and manage pathways in real-time thanks to fleet management software, which increases flexibility.

Key Market Challenges

- The cost of purchasing market tools and using the services provided by the major participants in the world market is rather significant. Small and emerging businesses lack the necessary resources to buy these robots and use them in a variety of departments and industry verticals. This is probably going to prevent the predicted growth of the market for autonomous robots.

Key Market Opportunities

- Rising e-commerce industry - Due to the e-commerce sector's exponential growth, warehouse and distribution center operators may now concentrate on turning manual processes into automated ones in order to adapt to consumers' shifting purchasing habits. The U.S. Department of Commerce announced in February 2020 that 15.9% of all sales in 2019 were made online. In the end, it is helping the top e-commerce companies integrate autonomous technology throughout their fulfillment operations.

Component Insights

In 2024, the hardware sector had the highest revenue share at over 68.40%. The section discusses the components that go into making the AMRs, including the controllers, encoders, wheels, brakes, motors, sensors, actuators, batteries, and power systems.

Over the projection period, the software category is anticipated to have the greatest CAGR. The section discusses the tools used to create the AMRs. Software for autonomous mobile robots comprises, among other things, motion planning, safety systems, navigation systems, control systems, fleet management systems, payload, and software for scanning and visual processing.

Type Insights

In 2024, the category for goods-to-person picking robots was responsible for more than 50 percent of the revenue share. The ongoing use of autonomous robots to replace manual picking techniques is responsible for the high share. Robots that pick up items for people can also be programmed to push carts and take a variety of paths to get the commodities from one station to another.

Autonomous mobile robotic picking systems are provided by a number of robotics firms, such as Blum, and IAM Robotics, and they may be able to bring new levels of efficiency to warehouse and industrial processes. For example, Locus Robotics, a business that automates robotic processes, asserts that their picking robots may boost production by 3 to 5 times by cutting personnel costs associated with overtime, travel time, and training expenses.

Over the course of the projection period, a noticeable shift in demand is anticipated in the self-driving forklift market. Forklifts which are self-driven are perfect for routine cargo handling tasks that frequently require traveling great distances. Automated forklifts are available from Linde Material Handling, a German producer of warehouse equipment and forklift trucks, and they come with the front as well as rear scanners, navigation lasers, auditory and visual warning signs, and 3D camera vision.

Battery Type Insights

The lead battery market sector kept the top rank in 2024 with a revenue share of more than 50%. The high percentage can be attributed to lead batteries' low-cost advantages over other battery types. Because they ensure stable voltage, high reversibility, and long useful life, lead batteries are appropriate for a range of industrial applications.

The lithium-ion battery category is predicted to have substantial growth throughout the forecast period. Compared to lead batteries, lithium-ion batteries frequently cost more. However, lithium-ion batteries deliver high-power charge and discharge while also satisfying a variety of industrial requirements, such as high energy density, exceptional temperature tolerance, and prolonged cycle life.

It is anticipated that certain advantages associated with lithium-ion batteries would persuade manufacturers of AMR to utilize them as a power source. For instance, Tennant Company, a supplier of automated floor cleaning tools, declared in April 2022 that lithium-ion batteries will be made available in its AMRs. Two benefits of the advanced battery technology employed in its autonomous mobile robots are long run times and easy maintenance. Long run times will improve cleaning effectiveness and make the most use of staff resources.

Application Insights

In 2024, the manufacturing sector had the highest revenue share at almost 77%. The substantial proportion can be attributable to the global manufacturing industry's ongoing process automation. The market is further divided into the following subsectors: FMCG, automotive, aerospace, electronics, chemicals, medicines, and plastics.

The automotive industry also had a sizable market share as a result of the aggressive adoption of AMRs for a variety of operations, including assembly, sealing, machine tending & part transfer, painting, coating, materials removal, as well as internal logistics related to automotive manufacture.

Over the projection period, it is predicted that the aerospace and military industries would display a significant CAGR. Due to the necessity to handle large-sized components like fuselages, nacelles, engine pods, and wings, production facilities related to the aerospace and military sector verticals are sometimes enormous. However, the lanes that these parts must go through to get to the production plant are frequently rather small. Aerospace and defense businesses are rapidly implementing AMRs to move bulky components inside the facility on predetermined or changing routes in order to prevent any potential accidents and mishaps resulting from human mistakes when transferring large parts through constrained spaces.

Autonomous Mobile Robots Market Companies

- Material Handling Systems. (U.S.)

- Fetch Robotics, Inc. (U. S.)

- IAM Robotics (U. S.)

- NextShift Robotics (U.S.)

- Stanley Robotics (U.S.)

- Robotnik. (Spain)

- SESTO Robotics. (Singapore)

- HAHN Robotics GmbH (Germany)

- Vecna Robotics (U.K.)

- AutoGuide Mobile Robots (England)

- SoftBank Robotics (France)

Recent Developments

- In March 2025, Waymo has announced the expansion of its commercial robotaxi services to Silicon Valley and Austin, Texas. In Austin, Waymo has teamed up with Uber, enabling riders to hail its self-driving vehicles through the Uber app. This expansion is part of Waymo's larger growth strategy aimed at scaling its autonomous ride-hailing services.

- In February 2025, Uber has extended its robot food delivery service to Jersey City, New Jersey, marking its first implementation on the East Coast. This initiative is part of Uber's broader plan to incorporate autonomous technology into its services, with the goal of improving delivery efficiency and minimizing operational costs.

- In February 2025, May Mobility has shifted its shuttle service in Peachtree Corners, Georgia, to a "driver out" model, marking the company's first commercial deployment without a human safety operator. The autonomous shuttle service is now available to the public, operating along a four-mile route and enhancing urban mobility through autonomous technology.

- To expand its current product range and better meet the demands of its clients, Mobile Industrial Robots (MiR) released two autonomous mobile robots (AMRs) with the names MiR600 and MiR1350 in August 2020. The new mobile autonomous robots have a larger cargo capacity. The company aims to develop its business in the North American market with this launch.

- The ASTI Mobile Robotics Group (ASTI), a producer of autonomous mobile robots (AMR), was bought by ABB in June 2021. ABB will be able to increase its selection of automation and robotics thanks to the purchase. The full range for the upcoming generation of flexible automation will now be offered by ABB.

Segment Covered in the Report

By Component

- Hardware

- Software

- Services

By Type

- Goods-to-Person Picking Robots

- Self-Driving Forklifts

- Autonomous Inventory Robots

- Unmanned Aerial Vehicles

By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-Based Battery

- Others

By End Use

- Manufacturing

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Others

- Wholesale & Distribution

- E-commerce

- Retail Chains/Conveyance Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting