What is the Autonomous Driving Software Market Size?

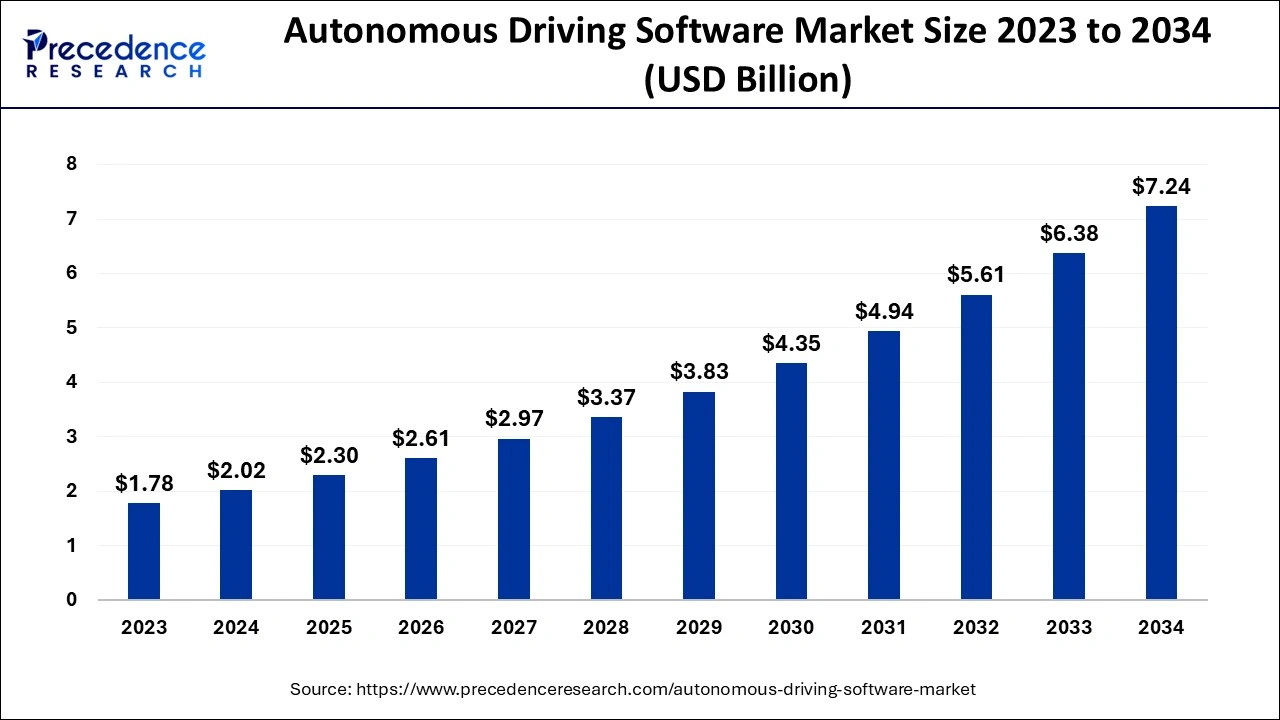

The global autonomous driving market size is calculated at USD 2.30 billion in 2025 and is predicted to increase from USD 2.97 billion in 2026 to approximately USD 8.04 billion by 2035, expanding at a CAGR of 13.33% from 2026 to 2035.

Autonomous Driving Software Market Key Takeaways

- The global autonomous driving software market was valued at USD 2.30 billion in 2025.

- It is projected to reach USD 8.04 billion by 2035.

- The autonomous driving software market is expected to grow at a CAGR of 13.33% from 2026 to 2035.

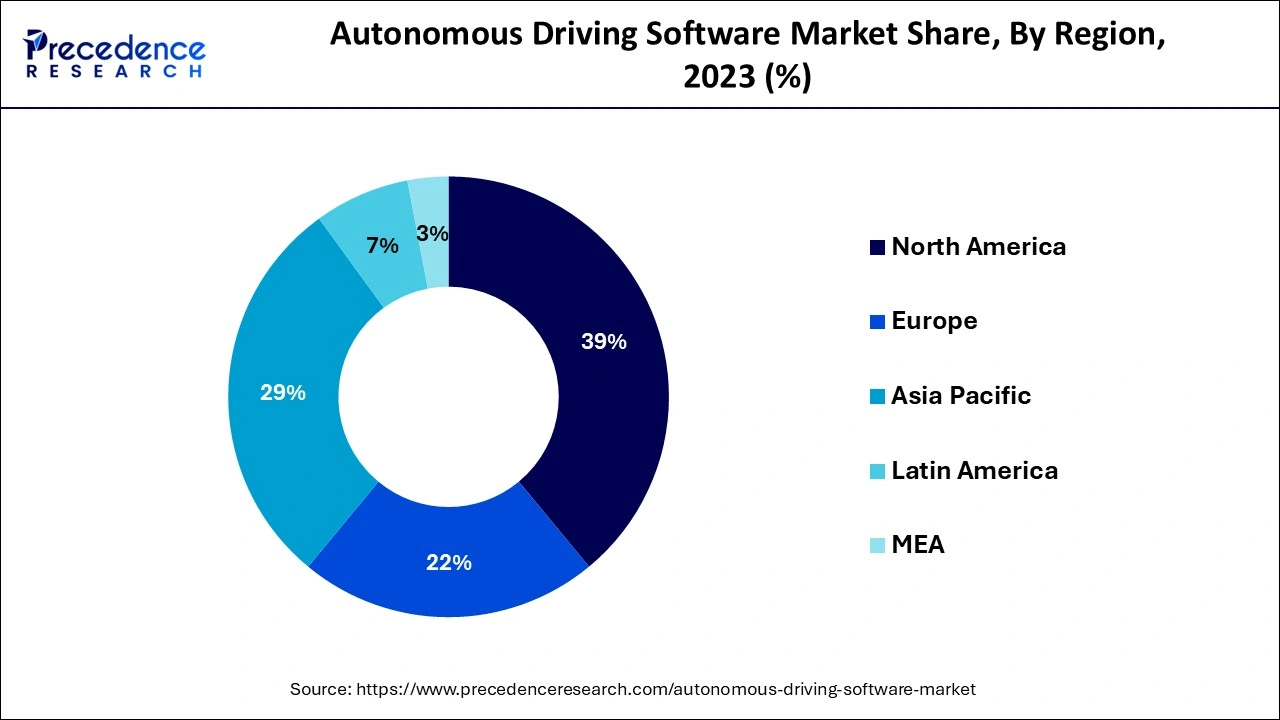

- North America dominated the autonomous driving software market and recorded the highest market share of 39% in 2025.

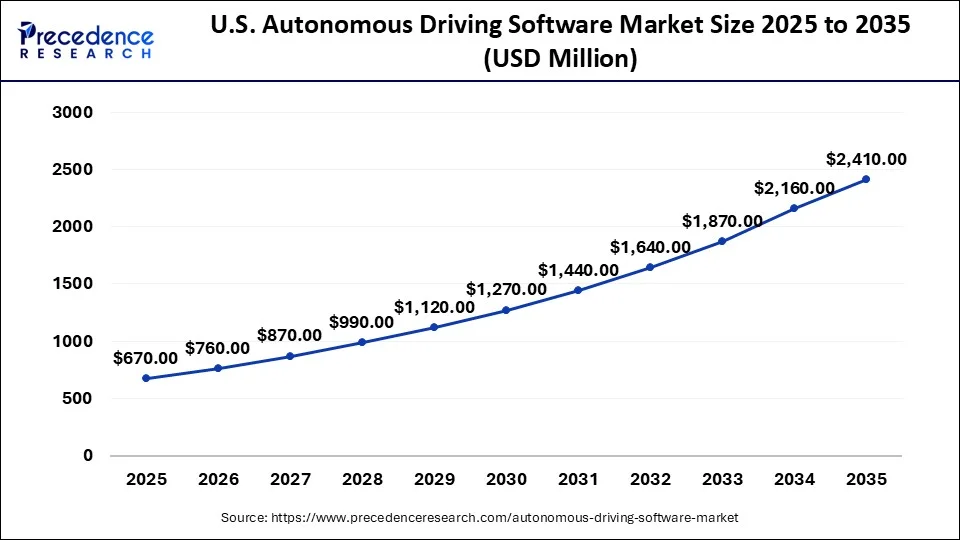

- The U.S. is expected to expand at a double-digit CAGR of 11.82% during the forecast period.

- Asia Pacific is projected to host the fastest-growing market in the coming years.

- By level of autonomy, the L2+ segment contributed the biggest market share of 63% in 2025.

- By level of autonomy, the L3 segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

- By vehicle type, the passenger cars segment accounted for a considerable share of the market in 2025.

- By vehicle type, the commercial vehicles segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By propulsion, in 2025, the ICE segment led the global market.

- By propulsion, the electric segment is projected to expand rapidly in the market in the coming years.

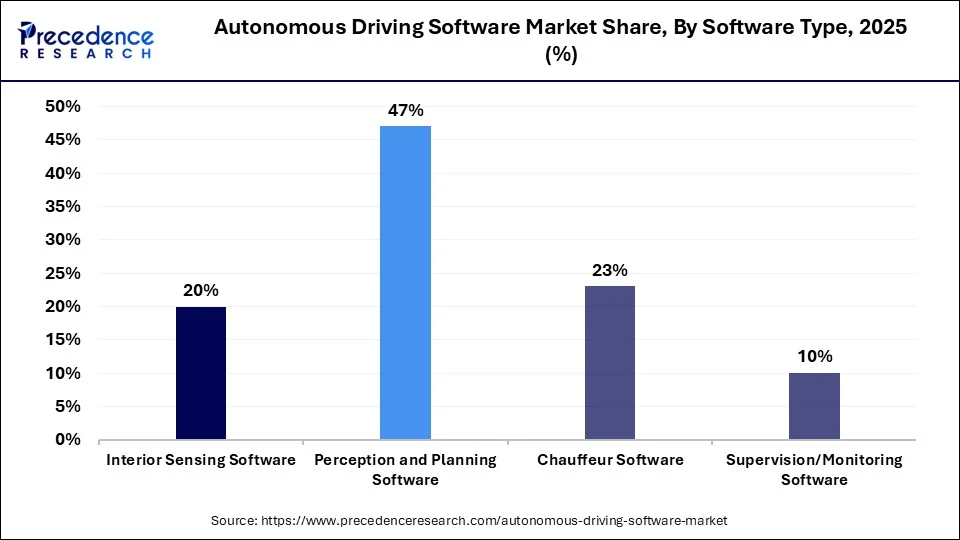

- By software type, the perception and planning software segment accounted for the biggest market share of 47% in 2025.

- By software, the chauffeur software segment is projected to grow at the fastest rate in the market in the future years.

Market Overview

The increased need for safe and efficient transportation solutions fuels the growth of the market for autonomous driving software. They found that autonomous driving technology is implemented in different levels of autonomy, which include Level 2 vehicles with assistant driving systems and Level 3 to 5, which are fully driverless cars. Such systems depend on difficult programming algorithms to analyze information collected from cameras, radar, or LiDARs to help vehicles see the environment, decide on actions, and perform them.

The increasing uptake of Artificial Intelligence (AI) and machine learning, along with the increasing investment in smart city technology, will further boost the autonomous driving software market in the coming years. The World Health Organization, which promotes road safety, agrees with such measures, stating that self-driving abilities reduce a large number of fatalities in accidents.

- In 2023, USD 100 million out of all the funds provided to the U.S. Department of Transportation would be designated for increasing AV understanding and building related resources.

Impact of Artificial Intelligence on the Autonomous Driving Software Market

In the autonomous driving software market, real-time analytics improved decision-making opportunities in the form of complex data pulled at high rates from sensors, cameras, and radar systems by AI-powered systems. This technology enables driving software to detect complex traffic conditions, identify the risks, and rapidly react to them. AI enables the identification of patterns that compromise the performance of a vehicle, which further minimizes breakdown risks and further crates demand for advanced AI-powered autonomous driving software. Furthermore, these technologies allow the exchange of information to improve traffic flow and reduce fuel consumption.

Autonomous Driving Software Market Growth Factors

- Increasing government funding and support for autonomous vehicle research is expected to spur market growth.

- Rising adoption of 5G networks is anticipated to enhance vehicle-to-everything (V2X) communication, boosting autonomous driving capabilities.

- Growing investments in smart city infrastructure are likely to promote the integration of autonomous driving solutions.

- Expanding partnerships between automotive manufacturers and technology firms are projected to accelerate software advancements.

- Increasing consumer demand for enhanced road safety features is expected to drive the adoption of autonomous driving technologies.

- A rising focus on reducing carbon emissions through electric vehicles and autonomous vehicles is likely to support market expansion.

- The growing implementation of autonomous driving technologies in the logistics and public transportation sectors is anticipated to fuel market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.24 Billion |

| Market Size in 2025 | USD 2.30 Billion |

| Market Size in 2026 | USD 2.61 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.33% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Level Of Autonomy, Vehicle Type, Software Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Rising consumer demand for driverless mobility solutions

Rising consumer demand for driverless mobility solutions is anticipated to fuel the autonomous driving software market. Increased customer interest in a self-driving transport system is due to the high levels of urbanization and a deteriorating traffic situation, which is offering demand for an alternative to their current modes of transport. The environmental issues, including the pressure to cut back on emissions, also contribute to the growth of driverless systems. Introducing self-driving cars has been estimated by federal ministries, such as the U.S. Department of Transportation, to strongly contribute to the decrease of traffic density and the improvement of safety. Moreover, various companies, such as Mercedes-Benz, have planned to introduce Level 3 autonomous vehicles in the markets of Nevada and California in 2024.

Restraint

Impede consumer safety concerns

Concerns regarding the safety of autonomous driving systems are likely to hinder the autonomous driving software market growth. There is still a great reluctance of many customers to entrust their lives to fully autonomous vehicles, as well as the possibility of failure, having an accident, or hacking. Such accidents include those involving the leading brands of self-driving cars, which have ramped up these concerns, causing delays among potential users. Changing the mind of the consumer that these systems are useful, efficient, safe, and utilized routinely to undertake their daily activities.

Opportunity

Surging technological advancements

Soaring technological advancements in AI and machine learning are likely to create immense opportunities for players competing in the autonomous driving software market. The rapidly developing tech spheres of artificial intelligence or machine learning give a unique opportunity to work on the autonomy of the car. The changes in sensor fusion, perception algorithms, and processing of real-time data make the cars respond better to the complex environment on the road. These changes improve the robustness of self-contained solutions and contribute to better decision-making in terms of safety and accuracy. Furthermore, a study conducted by the U.S. Department of Transportation states that the incorporation of AI capabilities into transport systems enhances traffic control, thus boosting the demand for autonomous driving software technology.

- According to the International Transport Forum report, intelligent AI systems bring down the death toll on roads by as much as 90% by the year 2030.

Autonomous Driving Software Market Segmant Insights

Autonomy Insights

The L2+ segment held a dominant presence in the autonomous driving software market in 2025, as it helped to improve safety and convenience at the same time, implying the need for human intervention. Such systems, which perform certain functions such as steering and acceleration, became popular in premium and mid-range cars as producers used demand for affordable and precise ADAS solutions. Moreover, government initiatives, such as the European Commission Vision Zero Initiative, further boost the segment.

According to the National Highway Traffic Safety Administration (NHTSA), L2+ equipped vehicles had 27% lower incidences of collision than their traditional counterparts in the calendar year 2023.

The L3 segment is expected to grow at the fastest rate in the autonomous driving software market during the forecast period of 2025 to 2034, owing to the ongoing development of this technology to process large amounts of real-time data. Regulatory support has promoted scale-up and commercialization of L3-capable vehicles. These systems provide precise control over limited autonomy models with human supervision. Moreover, this technology increases the general level of safety and contributes to improving the client's comfort during the driving process.

- The U.S. Department of Transportation expects L3 systems to be installed in 30% of newly manufactured vehicles by 2027.

- The United Nations Economic Commission for Europe (UNECE) has also adopted regulations commonly known as L3 cars in 2022, and these cars are capable of driving under certain circumstances, such as in automatic mode on a highway.

Vehicle Type Insights

The passenger cars segment accounted for a considerable share of the autonomous driving software market in 2025 due to the growing customer interest in the sophisticated ADAS in these types of vehicles. The upsurge of false accident claims and fatalities on roads due to negligence and reckless driving creates demand for autonomous driving software among passengers. This further encouraged car manufacturers to integrate autopilot components in the cars being produced. A report compiled by the U.S. Department of Transportation also revealed that there was growth in the sale of passenger cars that are fitted with L2+ and L3 systems, as they offer better safety, compliance with legal norms on fuel consumption, and enhanced maneuverability, especially in busy cities. Moreover, the European and other international committees approved the use of such technologies in passengers' care.

The commercial vehicles segment is anticipated to grow with the highest CAGR in the autonomous driving software market during the studied years, owing to the growth of autonomous trucks and ride-hailing services. The use of autonomous driving software technologies in commercial vehicles continues to grow due to the need to cut costs, enhance the efficiency of operations, and enhance safety in long-distance transport and distribution. Moreover, the rising demand for efficient and autonomous delivery and transportation services, especially in urban ecosystems, boosts the demand for autonomous driving software-equipped commercial vehicles.

- A report by the International Transport Forum estimated that up to 45% cut in total logistics costs through efficient fuel consumption and cutting down on driver costs, all by 2030.

Propulsion Type Insights

The ICE segment led the global autonomous driving software market. These vehicles have been familiar with modern ADAS mainly deployed in the premium and mid-range car models that help to make the drive better and safer. Established production and supply systems for mass ICE vehicles also worked in their favor, as manufacturers were able to apply these technologies at scale with minimal structural changes to the cars. Furthermore, the solid position in the ecosystem of autonomous drivers of ICE vehicles further contributes to boosting the segment.

The electric segment is projected to expand rapidly in the autonomous driving software market in the coming years, owing to the growing emphasis on emissions control and the integration of renewable energy sources worldwide. EVs are incorporated with highly developed software systems and electronic architecture. Additionally, the combination of electric propulsion and self-driving technology facilitates the widespread adoption of EVs.

- According to the International Energy Agency (IEA), electric vehicle sales rose by 40% in 2023, and there is a growing trend of seeking autonomous features in the segment.

Software Type Insights

The perception & planning software segment dominated the global autonomous driving software market in 2025 due to its importance in allowing vehicles to understand their environment and make instant decisions. This utilizes the collected input data from the camera, radar, and LiDAR. Basis on this software constructs a three-dimensional map of the car environment, which then enables the system to locate the obstacles, read traffic signs, and estimate traffic conditions. Furthermore, the growing demand for autonomous vaccines creates demand for these types of software.

The chauffeur software segment is projected to grow at the fastest rate in the autonomous driving software market in the future years. Chauffeur software enables the car to assume complete control of driving in the specific environment under conditions where Levels 3 and 4 automation are attained. The utilization of chauffeur software has grown due to the demand for autonomous cars, which subsequently provide a driving experience without requiring human interference. The features of the software include highway driving, urban commuting, and parking in very congested areas. Additionally, the development of self-driving cars is suitable for ride-hailing services and personal use.

Autonomous Driving Software Market Regional Insights

The U.S. autonomous driving software market size was exhibited at USD 670 million in 2025 and is anticipated to be worth around USD 2,410 million by 2035, growing at a CAGR of 12.23% from 2026 to 2035.

North America dominated the autonomous driving software market in 2025 due to its developed technology endowment, technology intensity of industries, and first-mover advantage in innovation and implementation of Level 4/5 AV technologies. The increase in investment in this segment is attributed to giants such as Tesla, Waymo, and General Motors, as well as huge R&D expenditures. Furthermore, the government policies and regulation systems, mainly in the United States, provided support and facilities to build and test autonomous driving systems.

Asia Pacific is projected to host the fastest-growing autonomous driving software market in the coming years, owing to continued urbanization, higher funding for smart mobility applications, and influential governmental policies supporting the improvement of self-driving cars. China, Japan, and South Korea are most active in this connection, and both public and private entities are actively engaged in the developmental processes of AV technology. The rapid rise in China's ambitions of becoming a world power for autonomous driving with the help of its industrial plan ‘Made in China 2025' and vast investments into artificial intelligence are expected in the region. Additionally, the region has a relatively large population, and more densely populated cities develop transport networks.

Europe has experienced substantial growth over the past few years. This rapid growth is driven by advancements in automotive technologies, the increasing demand for connected and autonomous vehicles, and the growing integration of artificial intelligence (AI) and machine learning (ML) tools in automotive systems. Regulations around ADAS, autonomous driving, and vehicle electrification in the region is encouraging the development of new and advanced software tools and platforms. As governments in the region continue to tighten regulations, the demand for automotive software will continue to grow even more.

Latin America is expected to pick up pace in the upcoming years. Emerging markets in the region are witnessing a rise in localized autonomous driving solutions that are tailored to specific needs and conditions. Companies are also seen developing software that are able to address unique road infrastructure, traffic patterns, and driving behaviors in these regions, thus ensuring better performance and acceptance. There is also a growing trend towards making autonomous driving technology more affordable and accessible in emerging markets, which includes factors like developing cost-effective sensor systems, computing platforms, and software solutions.

The Middle East and Africa is expected to grow quite substantially in the upcoming years, due to the rising focus on technological development the market expansion of the autonomous vehicles. The growing number of vehicles on Saudi Arabian roads has created a significant opportunity for ADS technologies, as more vehicles provide greater opportunities for integrating advanced autonomous driving systems. One of the key trends seen in the region is the gradual advancement of digitalization of transport and the increased integration of AI in vehicles.

Value Chain Analysis

- Raw material sourcing

Autonomous driving softwares rely on high quality sensor data from radar, cameras, ultrasonic sensors and GPS modules, all fed into perception and navigation algorithms. There is an increasing emphasis on high resolution LiDAR, solid state radar and low latency 5G connectivity, enabling better autonomy in urban areas as well as highway scenarios.

Key Players: VeloDyne, Luminar, Bosch - Software Development and Training

This stage consists of the development of perception, localization, planning and training of control software. It makes the use of AI and ML tools and systems to use real world and simulated driving scenarios. OEMs and software suppliers all over the world test heavily and extensively in digital twins, closed racks and public roads to help improve breaking, object detection, path planning and other safety protocols.

Key Players: Tesla Autopilot, Aptiv, Waymo - Product Design and Innovation

Autonomous driving software innovation focusses on level 4 or level 5 autonomy, redundancy and regulatory compliance. Companies all over the world are seen investing in human made machine interaction and fail safe protocols for better results. Its integration involves compatibility with ADAS systems, OTA updates and cybersecurity protection.

Key Players: Aurora, Tesla, Baidu

Autonomous Driving Software Market Companies

- Aptiv

- Aurora Innovation Inc.

- Baidu, Inc.

- Continental AG

- Huawei Technologies Co., Ltd.

- Mobileye

- Nvidia Corporation

- Pony.ai

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

Recent Developments

- In December 2025, Nvidia unveiled an open AI software that lets autonomous vehicles explain their decisions in real time, which is a transparency breakthrough that could accelerate the path to safer self-driving technology. The chip giant released Alpamayo-R1, an open-source AI model that narrates its driving logic as it navigates roads. The software tackles a problem that has plagued autonomous vehicle engineers for years. Earlier self-driving systems operated like black boxes, thus making decisions without explaining the logic behind them. When something went wrong, teams struggled to diagnose the issue.

https://www.technology.org/2025/12/02/nvidias-open-ai-model-alpamayo-r1-teaches-self-driving-cars-to-think-out-loud/ - In May 2024, Hyundai Motor Company, in partnership with autonomous driving software leader Plus, has revealed the first Level 4 autonomous Class 8 hydrogen fuel cell electric truck in the U.S. at the Advanced Clean Transportation (ACT) Expo, North America's premier event for advanced clean transportation technologies and fleets. This collaboration marks the beginning of the first Level 4 self-driving tests on a Class 8 fuel cell electric truck in the U.S., aiming to demonstrate the potential for safer, more efficient, and sustainable trucking.

https://indianautosblog.com/hyundai-unveils-level-4-autonomous-fuel-cell-truck-at-act-expo-p326748 - In February 2024, Plus launched the Open Platform for Autonomy, a modular software platform that supports all levels of autonomous driving. This innovative platform enables vehicle manufacturers to customize driving experiences and facilitates a smoother transition to higher autonomy levels using a foundational Level 4 software base. Plus, it aims to enhance flexibility and performance in autonomous vehicle development.

- In January 2024, Aurora announced the release of its latest self-driving software, designed for use in passenger vehicles and commercial fleets. The new system integrates advanced machine learning algorithms to enhance navigation and safety features, making it easier for OEMs to use important technologies. This development is part of Aurora's strategy to increase deployment efficiency in various vehicle types.

- In February 2024, Waymo introduced its upgraded autonomous driving software, which includes enhanced mapping capabilities. This upgrade is aimed at improving safety and efficiency in urban driving environments. Waymo's focus on software advancement supports its ongoing partnerships with major automotive manufacturers to integrate its technology into their vehicles.

Segments Covered in the Report

By Level of Autonomy

- L2+

- L4

- L3

By Vehicle Type

- Commercial Vehicles

- Passenger Cars

By Propulsion

- Electric

- ICE

By Software Type

- Interior Sensing Software

- Perception and Planning Software

- Chauffeur Software

- Supervision/Monitoring Software

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting