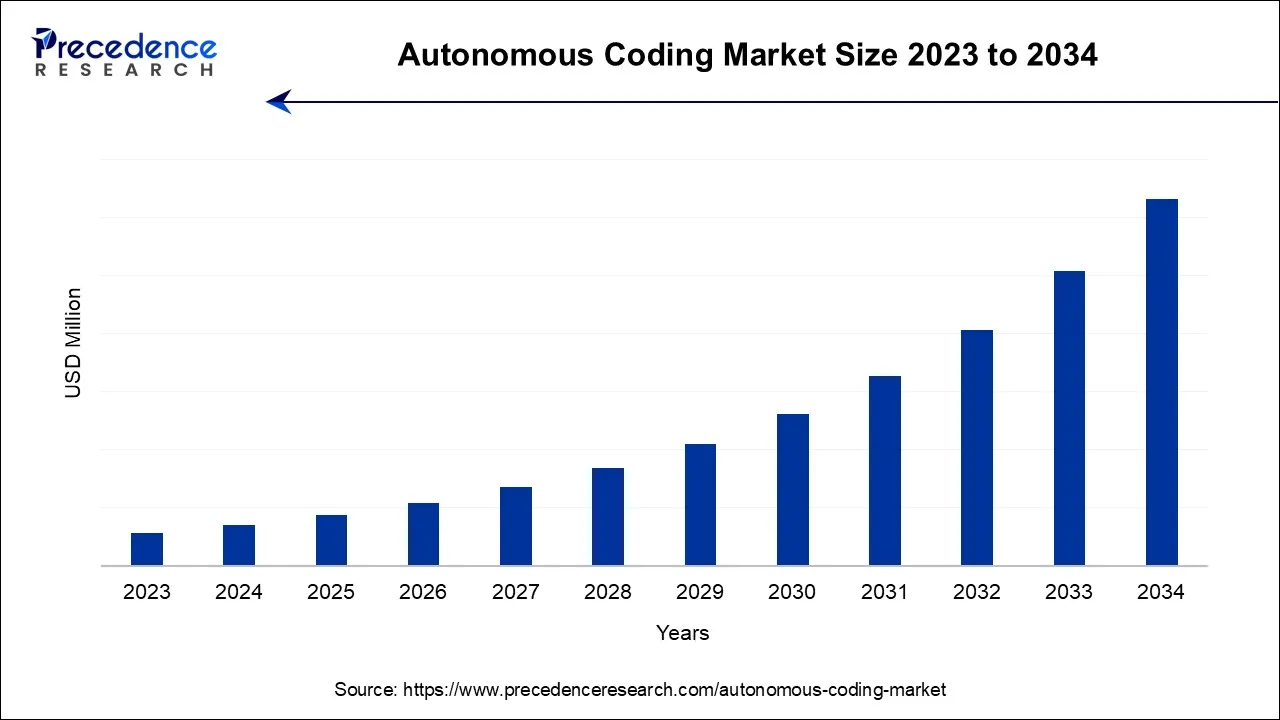

Autonomous Coding Market Size and Forecast 2024 to 2034

The global autonomous coding market is surging, with an overall revenue growth expectation of hundreds of millions of dollars during the forecast period from 2026 to 2035.

Autonomous Coding Market Key Takeaways

- North America will lead the global market between 2025 and 2035.

- By Usage, the machine learning segment captured the largest market share in 2025.

- By Mode of Delivery, the web & cloud-based segment recorded the largest market share in 2025.

- By End-user, the hospital's segment generated the largest market share in 2025.

Market Overview

A brand-new and cutting-edge technique called autonomous coding uses a completely automated AI solution to accurately and quickly code charts. Based on cutting-edge clinical language understanding (CLU) technology, autonomous coding is exceptional in its capacity to comprehend freely used medical terminology. CLU is the application of computational linguistics to clinical language along with medical expertise. It enables computers to build models defining the narrative of the doctor's documentation and to comprehend the logical linkages between various linguistic elements in the medical record. Although installing an AI product has several advantages, the primary objective in the medical billing and coding industry is to automate procedures that improve workflow and overall revenue cycle performance.

Productivity and code quality are two key performance indicators (KPIs) that continue to come under close scrutiny. Every clinical element of the medical record is identified by autonomous coding technology. It provides constantly accurate, top-notch medical coding because it comprehends relevancy as well as which codes should be assigned as being the most accurate. Just the charts that the software completely comprehends receive codes. Medical records that are not handled are marked for manual review. Scalable coding services are available from autonomous coding systems without sacrificing precision. Indeed, enormous productivity increases have been made. Medical encounters can be processed by autonomous platforms at a rate of less than five seconds each encounter, with an unlimited capacity. Chart volume fluctuations are handled by simply allocating additional or less computation capacity.

Organizations have been able to overcome coder shortages, streamline the billing process, and lower costs due to the gains in quality and productivity and the system's capacity to operate without human intervention. The audit performance of autonomous coding and its capacity to identify and promptly fix coding problems, without the need to refer encounters back to coders for resolution, are also gaining a lot of attention. Autonomous coding systems offer a transparent audit trail that fully explains the reasoning behind each and every issued code in addition to the recognition improvement.

A speedy validation of the assigned codes is made possible by this technological innovation, which is a byproduct of the fundamental CLU ability to comprehend clinical narrative. It also provides a strong platform for the management of denials and the appeals process. Accounts receivable days (AR), missing charges, and insufficient paperwork all improved for customers who used autonomous coding technology. Moreover, codes are recorded with the utmost level of clarity possible, which has been effective in lowering the number of denials and raising the percentage of clean claims.

Market Scope

| Report Coverage | Details |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Usage, By Mode of Delivery, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Future technological advancements in medical coding are anticipated to occur much more quickly. As the capabilities of artificial intelligence/machine learning (AI/ML) and natural language processing develop, numerous firms are actively looking into the widespread application of autonomous medical coding (AMC). The holy grail of medical coding, a mechanism that can convert clinical data into coded data and receive payment from insurance carriers without requiring human interaction is being developed by organizations using such technologies. AMC systems moreover encourage openness by providing an audit trail of autonomous code. This stage employs a machine learning technique to lessen the likelihood of errors and boost the model's accuracy when the AMC product deals with complex patient interactions.

Programs for medical and billing training require either a high school diploma or a general education development degree as eligibility requirements (GED). This is essential because one will be using very specific medical language. The high school education will provide him/her with the language and math skills they need to succeed in a medical billing and coding training program. So, if they have not earned their GED or completed high school, they do not meet the requirements to participate in a medical billing and coding training programme. If they wish to work as a medical biller and coder, they must finish an approved training course. There is a program for a certificate, diploma, or associate degree. They can find training programs by consulting community colleges, vocational schools, universities, hospitals, and other organizations that offer healthcare courses. The required training program to become a medical biller and coder may take 7 to 24 months to complete, depending on the type of curriculum they choose.

Segment Insights

Usage Insights

According to the usage segment, machine learning held the maximum market share in 2023. It is a branch of artificial intelligence that enables machines to learn directly from information, experience, and examples. By learning from examples or data rather than by following pre-programmed rules, machine learning enables computers to perform certain jobs intelligently and allows them to carry out complex procedures. Market expansion is being driven by advancing technology advancements that increase system accuracy. Humans interact with a range of machine learning-based systems, such as recommender systems, speech recognition, and image identification.

The rapid advancement of image recognition technology, which has increased the system's accuracy, has fueled the demand for machine learning in many systems. Due to the inclusion of machine learning in robotics, the machine learning industry has also grown. The quick advancement of sensor technology and materials has resulted in several advancements in robotics. Robots now have a greater ability to contribute to initiatives like autonomous vehicles and drones because to the advancement of machine learning. Also, the market has expanded as a result of an increase in demand for sophisticated robotic systems across a variety of sectors, including healthcare, automotive, electronics, food, and beverage.

Mode of Delivery Insights

By mode, Cloud-based solutions held the maximum market share in2023. They are a more recent strategy that is mostly used by businesses without the required internal infrastructure. These systems require less money to install. Also, this software does not require internal maintenance, which is perhaps the key factor behind its increasing popularity.

End User Insights

By end users, hospitals held the maximum share. Professionals in revenue cycle and health information management (HIM) face a confluence of challenges as the number of healthcare interactions rises. The availability of skilled coding specialists was limited by pandemic-related volatility as senior professionals left, medical leaves occurred, and other coding specialists changed positions. Healthcare provider organisations are under pressure to produce faster, higher-quality coding outputs in order to ensure revenue integrity, reduce reimbursement recoupments, and increase bottom lines as they recover from two years of uncertain cash flows. A 350-bed hospital's typical revenue cycle is $22 million (an estimated 3-5 percent of revenue). All these factors drive the demand for use of autonomous coding in hospitals.

Regional Insights

Due to technology advances and better healthcare infrastructure in several of the nations in this region, the North American autonomous coding market is anticipated to hold a sizable share over the projected period. The region's market is expanding as a result of increasing demand for coding services and the high demand for streamlining hospital billing operations due to the rise in chronic diseases, as well as strategic moves made by industry participants in the area.

The market is expanding in part due to the rising prevalence of chronic diseases in the various nations in the region. For instance, according to the American Cancer Society, there will be 1,918,030 new cancer cases in the United States in 2022, which will increase the need for streamlining. The market's growth is also being fueled by the strategic actions made by the market's participants. For example, in October 2022, Canadian company WELL Health Technologies Inc. signed a contract to buy Cloud Practice Inc. and three clinics from CloudMD Software & Services Inc. RBC purchased MDBilling.ca, a cloud-based platform that streamlines and automates medical billing for Canadian doctors, in October 2022.

U.S. Autonomous Coding Market Analysis

The U.S. market is expanding due to rising healthcare documentation volumes, coder shortages, and pressure to improve revenue cycle efficiency. Growing adoption of AI-driven clinical language understanding, demand for faster and more accurate medical coding, and the need to reduce claim denials and administrative costs are driving hospitals and healthcare providers to adopt autonomous coding solutions.

What Makes Asia Pacific the Fastest-Growing Region in the Autonomous Coding Market?

Asia Pacific is expected to grow at the fastest CAGR over the projection period due to rapid healthcare digitization, expanding hospital networks, and increasing adoption of AI-based health IT solutions. Rising patient volumes, growing demand for efficient medical billing, shortage of skilled coders, and government initiatives promoting digital health and automation are accelerating the adoption of autonomous coding systems across the region.

India Autonomous Coding Market Analysis

India's market is expanding as healthcare providers focus on faster claims processing and improved financial transparency. Growth is supported by the expansion of private hospitals, increasing use of telemedicine, and outsourcing medical billing services. Additionally, rising investments in health-tech startups and greater acceptance of AI-based decision tools are contributing to the market across the country.

Europe: A Notably Growing Region

Europe is expected to grow at a notable rate in the market due to increasing focus on healthcare automation, strict compliance requirements, and growing adoption of AI-driven clinical documentation tools. Expansion of digital health initiatives, rising demand for accurate medical coding across public healthcare systems, and investments in advanced health IT infrastructure are accelerating the uptake of autonomous coding solutions across the region.

UK Autonomous Coding Market Analysis

The UK market is growing as healthcare providers aim to improve coding accuracy and reduce administrative burden within the NHS. Growing pressure to shorten claim cycles, manage rising clinical documentation volumes, and improve audit readiness, along with greater acceptance of AI-driven health technologies, is driving the adoption of autonomous coding solutions across hospitals and care facilities.

Autonomous Coding Market Companies

- AQuity Access Healthcare: Provides clinical documentation improvement and AI-powered coding automation solutions to improve coding accuracy, reduce denials, and optimize revenue cycle performance for healthcare providers.

- Nym Health: Offers AI-driven autonomous clinical coding and workflow automation platforms that streamline medical billing, enhance documentation quality, and improve operational efficiency across healthcare organizations.

- DeliverHealth: Delivers coding, CDI, and revenue cycle solutions, using advanced technology and expert services to enhance coding accuracy, compliance, and financial performance for hospitals and health systems.

- Avasant: Provides digital transformation consulting and technology strategy services, including AI-driven health IT solutions that support autonomous coding adoption and healthcare operational efficiency.

- CorroHealth: Offers autonomous coding and clinical documentation improvement solutions using AI to automate coding tasks, reduce administrative burden, and improve revenue outcomes for healthcare providers.

- XpertDox: Delivers AI-enhanced clinical documentation and coding support tools that boost medical record accuracy, streamline coding workflows, and support efficient revenue cycle management.

- 3M: Provides comprehensive healthcare coding and documentation tools, including AI-enabled coding automation platforms that improve accuracy, compliance, and productivity in medical coding and billing processes.

Other Major Key Players

- Access Healthcare

- Artificial Medical Intelligence Inc

- TruCode LLC

Recent Developments

- In December 2025, Cavo Health launched its Autonomous Coder, an innovative solution providing accurate ICD-10 coding and Clinical Documentation Improvement at the Point-of-Care. Using Precise Word Matching, it captures the most accurate and specific ICDs, reducing physician burden and optimizing revenue, setting a new standard in autonomous coding.

(Source: cbs42.com ) - In December 2024, e4health acquired Phoenix-based eCatalyst Healthcare Solutions, enhancing its outsourced medical coding and clinical documentation integrity service offerings.

(Source: e4.health ) - Fund raising:In 2022, saw XpertDox, LLC., a revenue cycle startup based in Birmingham, Alabama, raised $1.5M from TN3, LLC, an Arizona-based private equity capital firm. The company specializes in autonomous medical coding powered by artificial intelligence.

- Product launch:DeliverHealth, a supplier of technology-enabled solutions for hospitals, health systems, and group practises, has recently launched autonomous coding powered by artificial intelligence (AI) as a quicker, easier approach to improve the revenue cycle. The autonomous coding platform helps administration and operations realize the value of their electronic health record (HER) investments while removing the inherent challenges faced by doctors and care teams.

- Product launch:Early adopters of AQuity Solutions' QCode platform attested to the QCodeAI launch's success. QCodeAI uses the most recent advancements in ML and NLP to automate essential coding operations that increase coder productivity and accuracy for quicker turnaround times and lower labour expenses. In order to support its growing portfolio of premium coding solutions, QCodeAI has added AI-based Autonomous Coding. This solution increases accuracy, decreases denials, and ensures optimal revenue capture, with early adopters frequently experiencing productivity improvements of 40% to 75%.

- Partnership:The autonomous medical coding technology developed by Nym Health, the forerunners of Clinical Language Understanding (CLU) technology, will be used by Geisinger in all nine of its hospital emergency rooms beginning in 2020. In Pennsylvania, Geisinger offers a medical school, two research centres, and nine hospital campuses. Clinical Intelligence and computational linguistics are used in Nym's CLU technology to comprehend provider narratives on charts and assign reimbursement codes. Healthcare providers may use autonomous coding to reliably produce accurate claims and deliver them to payers without human intervention thanks to Nym's 98% CLU coding accuracy and the native audit trail. The entire process is meticulously documented, and the system creates audit-ready, traceable codes with lightning speed for complete transparency.

There are both small and major enterprises in the intensely competitive global market for dental anaesthesia. To boost their market position and increase their market share, these companies have implemented crucial business strategies, such as joint ventures, strategic alliances & partnerships, product innovation, new product launches, and contracts.

Segments Covered in the Report

By Usage

- Machine Learning

- NLP

- Deep Learning

By Mode Of Delivery

- Web & Cloud-based

- On-Premises

By End User

- Hospitals

- Clinical Laboratories Logistics & Transportation

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting