Autonomous Data Platform Market Size and Forecast 2025 to 2034

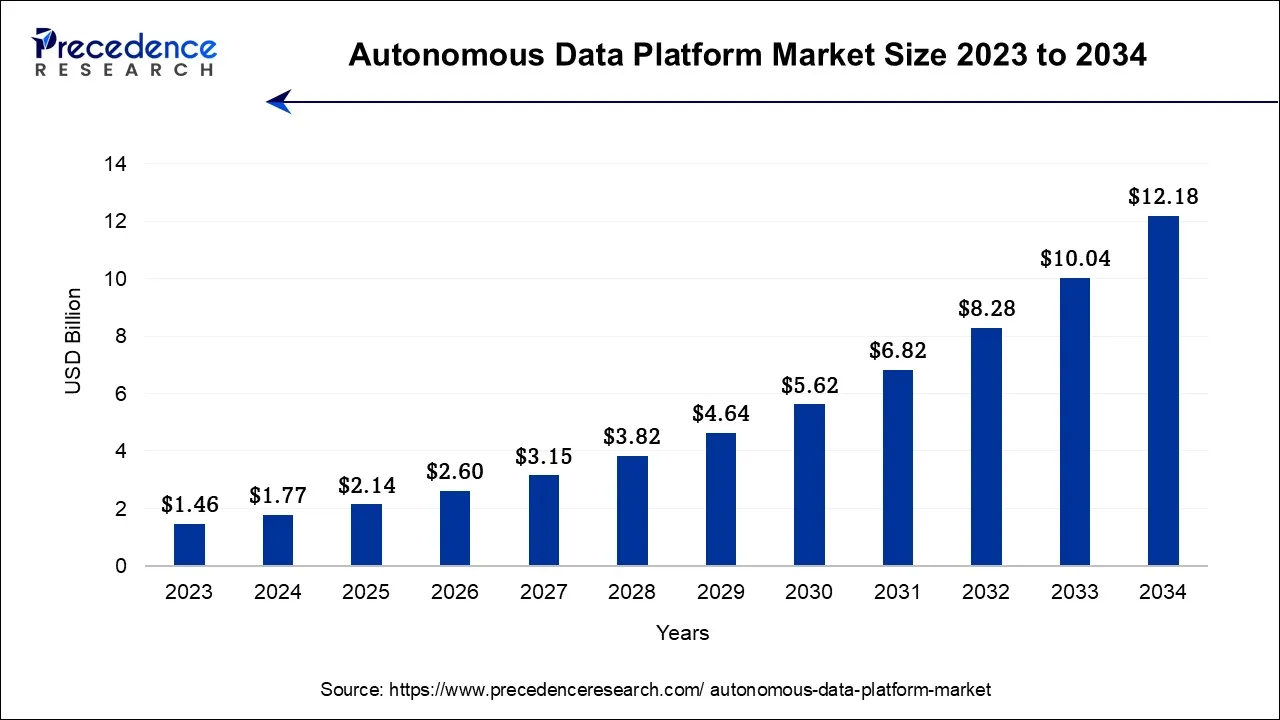

The global autonomous data platform market size was valued at USD 1.77 billion in 2024, and is projected to hit around USD 2.14 billion by 2025, and is anticipated to reach around USD 12.18 billion by 2034, expanding at a CAGR of 21.27% over the forecast period from 2025 to 2034.

Autonomous Data Platform Market Key Takeaways

- In terms of revenue, the market is valued at $2.14 billion in 2025.

- It is projected to reach $12.18 billion by 2034.

- The market is expected to grow at a CAGR of 21.27% from 2025 to 2034.

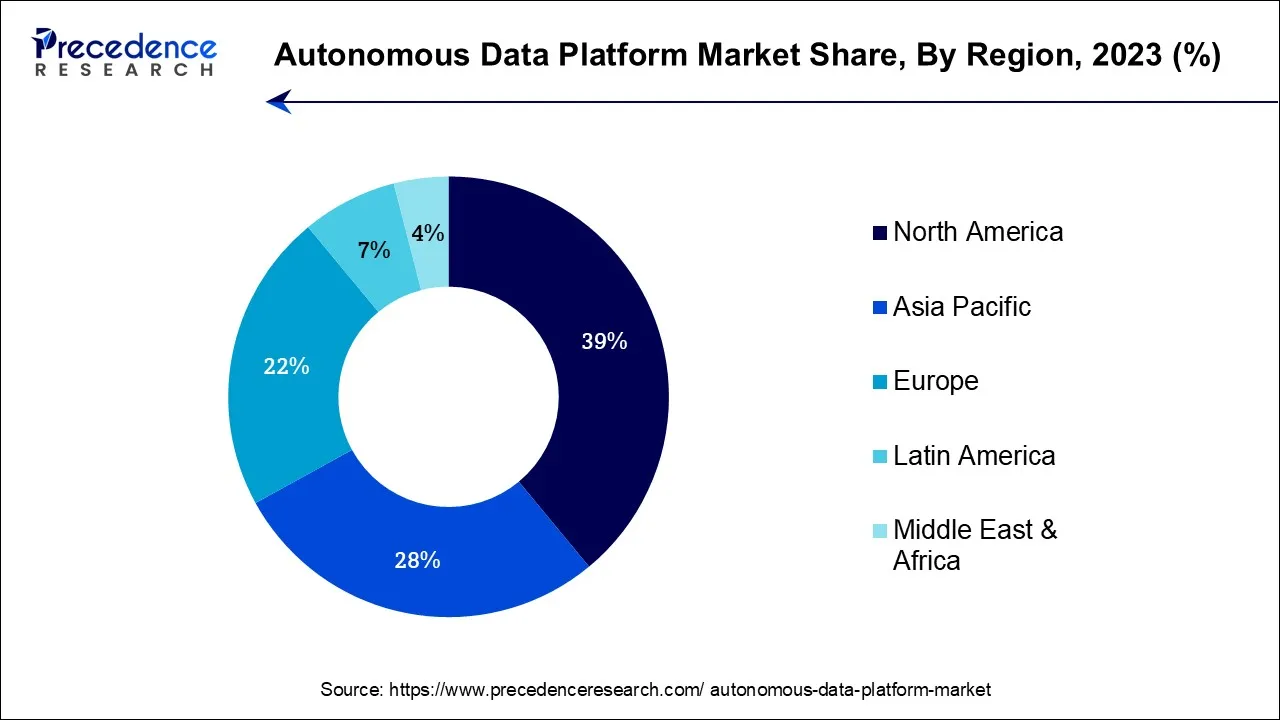

- North America contributed more than 39% of revenue share in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR over the forecast period.

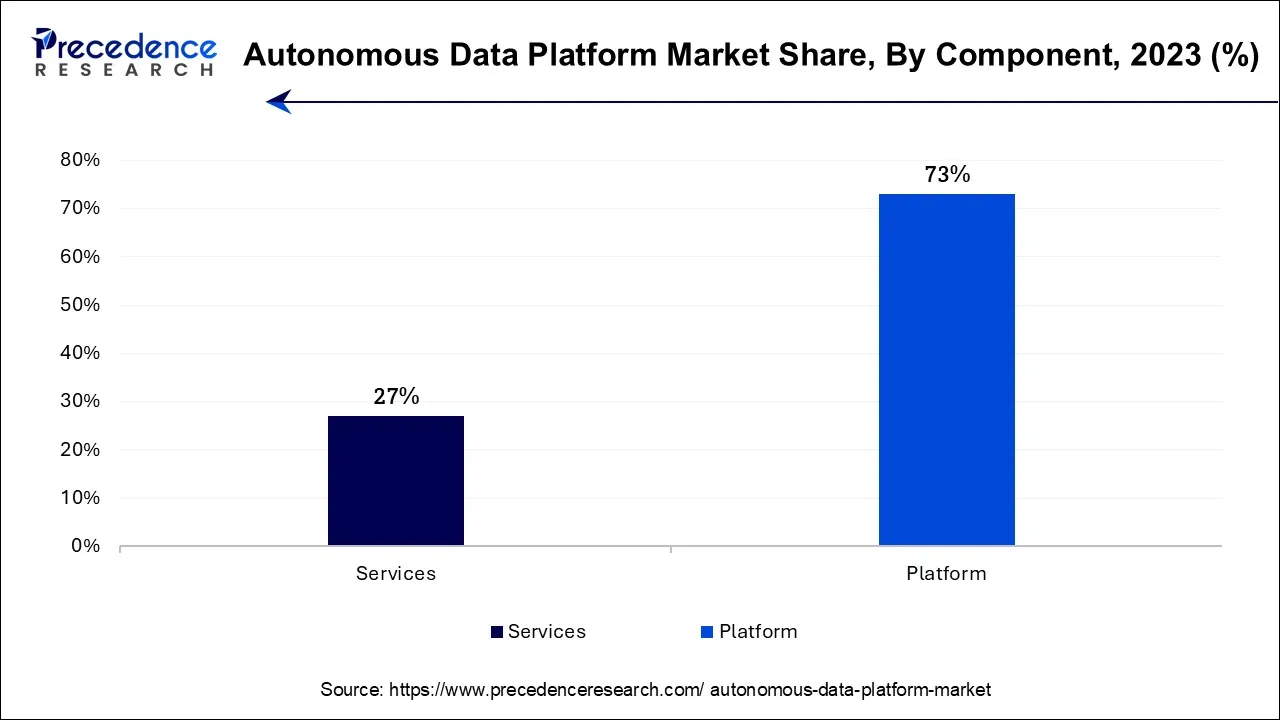

- By Component, the platform segment captured more than 73% of revenue share in 2024.

- By Component, the service segment is expected to expand at the fastest CAGR of 27.8% during the projected period.

- By Deployment, the on-premises segment contributed the largest market share of 53% in 2024.

- By Deployment, the cloud segment is projected to grow at the fastest rate over the projected period.

- By Enterprise Size, the large enterprise segment led the global market with the largest market share of 65.8% in 2024.

- By Enterprise Size, the middle enterprise segment is expected to expand at the fastest CAGR over the projected period.

- By End-use, the BFSI segment held the highest revenue share of 25% in 2024.

- By End-use, the retail segment is predicted to grow at the fastest CAGR of 25.6% over the predicted period.

U.S. Autonomous Data Platform Market Size and Growth 2025 to 2034

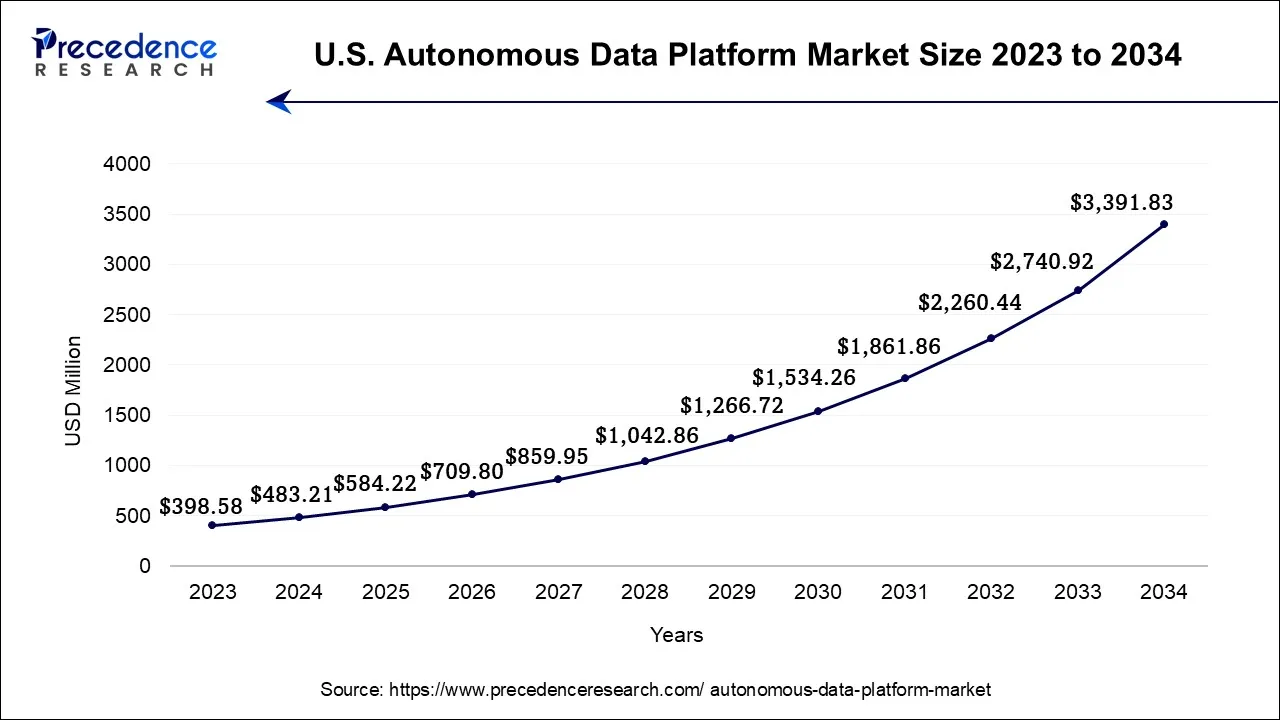

The U.S. autonomous data platform market size accounted for USD 483.21 million in 2024 and is projected to be worth around USD 3,391.83 million by 2034, poised to grow at a CAGR of 21.51% from 2025 to 2034.

North America has held the largest revenue share of 39% in 2024. In North America, the autonomous data platform market is witnessing robust trends driven by the region's advanced technological infrastructure and data-driven economy. Key trends include increased adoption of Artificial Intelligence (AI) and machine learning for data automation and insights, growing emphasis on data security and compliance, and the rising popularity of cloud-based autonomous data platforms. Furthermore, North American businesses are focusing on industry-specific solutions and data monetization strategies, harnessing the potential of data for competitive advantage and innovation. These trends reflect the region's dynamic and evolving landscape in data management and analytics.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, trends in the autonomous data platform market are on the rise. The growing adoption of autonomous data platforms in Asia-Pacific is driven by the need to harness data analytics and automation effectively. This trend is further fueled by the region's expanding tech industry and the increasing prevalence of data-intensive applications like e-commerce and IoT, which demand advanced data management solutions to cope with the data deluge efficiently. Additionally, as businesses prioritize digital transformation, the need for autonomous data platforms to support data-driven decision-making and streamline operations has surged. Cloud-based offerings are gaining traction, facilitating scalable and cost-effective solutions, making Asia-Pacific a vibrant and growing market for autonomous data platforms.

Market Overview

The autonomous data platform market encompasses a sector within data management characterized by advanced technologies like artificial intelligence (AI) and automation. These platforms autonomously handle data processes such as collection, integration, processing, analysis, and management. Their nature is defined by reducing human intervention, thereby improving data accuracy and enabling data-driven decision-making. These platforms are designed to address the challenges of handling large volumes of data efficiently, offering businesses the means to harness data for various purposes, including analytics, business intelligence, and machine learning, in a self-governing and self-optimizing manner.

Technological Advancements

The autonomous data platform market is being increasingly adopted due to the growing demand for data analytics in real-time and reduced manual effort in data management. In 2024, more than 60% of enterprises in the finance and healthcare sectors adopted AI-driven platforms for the autonomous processing of data, according to reports from multiple organizations. Among others, companies like Snowflake and Databricks launched various AI-based tools capable of continuous data optimization, which improve the intelligent infrastructure used to scale effectively while minimizing human input.

Autonomous Data Platform Market Growth Factors

- Several key trends and growth drivers shape the autonomous data platform market. There is a rising demand for real-time data processing and analysis, driven by the need for rapid decision-making in a fast-paced business environment. Autonomous data platforms can provide timely insights, making them increasingly essential.

- Moreover, the expansion of big data and the proliferation of the Internet of Things (IoT) have resulted in a substantial increase in data volume and intricacy. This has created a compelling need for advanced automation to effectively handle and extract valuable insights from this vast and intricate information landscape.

- The integration of artificial intelligence (AI) and machine learning is another prominent trend, enabling autonomous data platforms to continuously improve their performance and predictive analytics capabilities. Additionally, data security and compliance are driving the adoption of autonomous data platforms, as these systems can enhance data governance and privacy measures, addressing critical concerns in today's data-driven world.

- Autonomous data platforms can offer tailored solutions for various industries, addressing specific data management needs. As organizations recognize the importance of data in their operations, there is a growing demand for consulting and implementation services to maximize the benefits of these platforms.

- The market also presents opportunities for innovation in AI and machine learning algorithms to enhance autonomous data processing and analysis. Furthermore, it addresses data security and compliance needs through specialized solutions that can open up new markets and customer segments.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.18 Billion |

| Market Size in 2025 | USD 2.14 Billion |

| Market Size in 2024 | USD 1.77 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 21.27% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Services, Deployment, Enterprise, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Real-time decision-making, data security and compliance

Real-time decision-making is a critical driver for the burgeoning demand in the autonomous data platform market. In today's fast-paced business environment, organizations require immediate access to data insights for agile and informed decision-making. Autonomous data platforms deliver the capability to rapidly process and analyze data, providing real-time information that empowers businesses to respond swiftly to market changes and seize opportunities.

The increasing need for timely and precise decision support makes these platforms essential, driving their adoption and solidifying their role as a cornerstone in modern data management strategies. Moreover, data security and compliance are critical factors surging market demand for autonomous data platforms. As data privacy regulations become stricter, organizations must ensure robust data governance and security measures. autonomous data platforms offer integrated solutions that automate compliance tasks, enforce data protection policies, and enhance data security. This capability is increasingly appealing to businesses aiming to avoid regulatory penalties, protect their reputation, and secure sensitive data, thus driving the adoption of these platforms for effective data management and compliance assurance.

Restraint

Complex implementation and customization challenges

Complex implementation processes act as a restraint on the market demand for autonomous data platforms. The intricate nature of deploying these platforms, which involves integrating them into existing IT ecosystems, configuring them to specific organizational needs, and ensuring seamless interoperability, can be resource-intensive and time-consuming. Organizations may hesitate to invest in solutions that require extensive implementation efforts, potentially leading to delays in adoption and limiting the market demand for these otherwise beneficial platforms. Moreover, customization challenges restrain market demand for autonomous data platforms. Customizing these platforms to meet specific business needs can be complex, time-consuming, and costly.

Over-customization can lead to difficulties in platform upgrades and long-term maintenance. Organizations may hesitate to invest in solutions that require extensive customization, hindering widespread adoption. Striking the right balance between customization and standardization is critical for ensuring that autonomous data platforms can efficiently meet diverse business requirements and sustain market demand.

Opportunity

Industry-specific solutions, AI, and ML advancements

Industry-specific solutions are driving market demand for autonomous data platforms. These tailored platforms address unique data management requirements, compliance regulations, and challenges specific to various sectors like healthcare, finance, and manufacturing. By offering specialized solutions, autonomous data platform providers enable organizations to harness the full potential of their data, ensuring relevancy and accuracy. This surge in demand reflects the growing recognition that industry-specific solutions can significantly enhance operational efficiency, decision-making, and compliance adherence, making autonomous data platforms indispensable tools for diverse sectors. Moreover, AI and ML advancements are catalysts for surging the market demand in the autonomous data platform sector.

These technologies empower data platforms to continuously improve data processing, predictive analytics, and insights generation. By harnessing the capabilities of AI and ML, autonomous data platforms provide organizations with increasingly sophisticated and accurate data-driven solutions, enhancing their decision-making processes and enabling them to extract greater value from their data. This heightened effectiveness and innovation drive businesses to adopt and invest in autonomous data platforms, amplifying market demand.

Component Insights

According to the component, the platform segment has held 73% revenue share in 2024. In the autonomous data platform market, the platform component serves as the core infrastructure that combines automation, AI, and analytics to manage data seamlessly. This data processing, analysis, and management, reduces human intervention and enhances data-driven decision-making. Current trends include the integration of advanced AI and machine learning algorithms to improve predictive capabilities, real-time data processing for agile decision-making, and robust security features to address data privacy concerns. Additionally, there is a growing emphasis on scalability and cloud-based solutions to accommodate increasing data volumes and support remote work trends.

The service sector is anticipated to expand at a significant CAGR of 27.8% during the projected period. Services within the autonomous data platform market encompass consulting, implementation, training, and support. These offerings assist organizations in deploying and optimizing autonomous data platforms, ensuring effective utilization. The market is witnessing a rising demand for consulting services as organizations seek expert guidance for data strategy. Implementation services are crucial for seamless integration, and training helps users harness the full potential of autonomous data platforms. Support services are evolving with increased emphasis on real-time troubleshooting and updates, reflecting the dynamic nature of data management. Overall, services play a vital role in ensuring successful adoption and ongoing value from autonomous data platforms.

Deployment Insights

On-premises is anticipated to hold the largest market share of 53% in 2024.On-premise deployment in the Autonomous Data Platform Market refers to the installation and operation of data platforms within an organization's physical infrastructure. It offers data control, security, and customization, making it suitable for industries with strict compliance requirements. However, the trend has shifted towards cloud-based deployments for scalability and flexibility. On-premise deployment is a major shareholder in the autonomous data platform market, especially within heavily regulated sectors mandating in-house data control. Concurrently, a rising trend involves hybrid deployments, which amalgamate on-premises and cloud capabilities. This approach effectively uses for security advantages of on-premises solutions with the flexibility offered by cloud-based options, providing organizations with a balanced and adaptable data management strategy.

On the other hand, the cloud sector is projected to grow at the fastest rate over the projected period. In the Autonomous Data Platform market, the "cloud" deployment refers to hosting and accessing these platforms on remote servers over the internet. Cloud deployment offers scalability, flexibility, and cost-effectiveness, enabling organizations to leverage autonomous data platforms without the need for on-premises infrastructure. Key trends in cloud deployment for autonomous data platforms include a growing shift towards cloud-based solutions, driven by the need for remote accessibility, scalability, and real-time analytics. Additionally, cloud providers are enhancing security measures and compliance features to address data privacy concerns, further promoting the adoption of autonomous data platforms in the cloud.

Enterprise Insights

In2024, the large enterprise segment had the highest market share of 65.8% on the basis of the installation. Large enterprises, typically organizations with significant revenues, extensive operations, and a substantial employee base, are pivotal players in the autonomous data platform market. They are increasingly adopting autonomous data platforms to manage vast datasets, streamline data analytics, and leverage AI for insights. Large enterprises demand solutions that offer scalability, real-time analytics, and advanced data governance to support their complex and dynamic data needs. These organizations are also driving trends toward customized autonomous data platforms, industry-specific solutions, and extensive cloud adoption to meet their diverse data management requirements and stay competitive in a data-driven landscape.

The middle enterprise is anticipated to expand at the fastest rate over the projected period. Middle enterprises, also known as mid-sized enterprises (SMEs), typically consist of organizations with moderate revenue and employee counts, falling between small businesses and large corporations. In the Autonomous Data Platform Market, mid-sized enterprises are increasingly adopting autonomous data solutions to streamline data management, enhance analytics capabilities, and boost competitiveness. A significant trend is the demand for cost-effective cloud-based solutions tailored to their needs. These organizations seek user-friendly platforms with AI-driven features, enabling them to harness data efficiently for informed decision-making and business growth, reflecting a growing focus on data-driven strategies within the mid-sized enterprise segment.

End-use Insights

The BFSI segment held the largest revenue share of 25% in2024. The Banking, Financial Services, and Insurance (BFSI) sector is a prominent end user of autonomous data platforms. These platforms empower BFSI institutions to manage vast volumes of financial data efficiently, enhancing risk assessment, fraud detection, and customer insights. Recent trends in the BFSI sector include increased adoption of autonomous data platforms to bolster cybersecurity, improve customer experiences through personalized services, and comply with stringent regulatory requirements. Additionally, the sector leverages AI and machine learning within these platforms to optimize operations, making them a critical component for BFSI's data-driven strategies.

The retail segment is anticipated to grow at a significantly faster rate, registering a CAGR of 25.6% over the predicted period. In the autonomous data platform market, the retail segment refers to the use of autonomous data platforms within the retail industry. This entails leveraging advanced data management and analytics solutions to optimize inventory management, enhance customer insights, and improve the overall shopping experience. Trends in this segment include the adoption of real-time analytics for demand forecasting, personalized marketing driven by AI, and inventory optimization. Retailers are increasingly relying on autonomous data platforms to gain a competitive edge by offering tailored products and services, ensuring efficient supply chains, and delivering a seamless omni-channel shopping experience to customers.

Autonomous Data Platform Market Companies

- Oracle Corporation

- International Business Machines Corporation

- Amazon Web Services

- Teradata Corporation

- Qubole Inc

- MapR Technologies, Inc.

- Alteryx Inc.

- Ataccama Corporation

- Cloudera, Inc.

- Gemini Data Inc.

- Datrium, Inc.

- Denodo Technologies

- Paxata, Inc.

- Zaloni Inc.

Recent Developments

- In May 2025, Badger Technologies, a product division of Jabil Inc., announced the launch of its new Digital Teammate solution platform. The platform is powered by Badger Technologies' multipurpose, next-generation autonomous robot, with capabilities that enhance employee productivity through mobile data and analytics, computer vision, and artificial intelligence.

- In February 2025, BUSINESSNEXT, a global leader in composable enterprise solutions for the financial services sector, introduced triple-layer AI-powered Retail Banking Customer 360, designed to help banks gain deep customer insights and enable autonomous actions within seconds. The advanced industry-specific 'Customer 360' provides a unified data platform, entailing consolidated data on employees, customers, and the branch.

- In February 2025, TIER IV, the pioneering force behind the world's first open-source software for autonomous driving, launched a pioneering project in February to collect driving data using taxis equipped with a data recording system (DRS) developed by TIER IV.

- In January 2025, NVIDIA announced NVIDIA Cosmos™, a platform comprising state-of-the-art generative world foundation models, advanced tokenizers, guardrails, and an accelerated video processing pipeline built to advance the development of physical AI systems such as autonomous vehicles (AVs) and robots.

- In January 2025, ServiceNow, the AI platform for business transformation, announced a new integration with Oracle to enhance ServiceNow Workflow Data Fabric capabilities. Zero-copy data sharing and bi-directional data exchange will connect data in real-time between Oracle Autonomous Database with its fully automated threat detection and remediation capabilities, Oracle Database 23ai, and the ServiceNow platform, fueling intelligent decision-making and operational efficiency at scale.

- In May 2024, Syncari, the leader in data unification and automation, announced the launch of its Autonomous Data Management platform. This platform offers distributed 360° data, centralized governance, and democratized access, essential for powering transformative digital and AI technologies.

Segments Covered in the Report

By Component

- Platform

- Services

By Services

- Advisory

- Integration

- Support & Maintenance

By Deployment

- On-premises

- Cloud

By Enterprise

- Large Enterprise

- Small and Medium Enterprise (SME)

By End Use

- BFSI

- Healthcare

- Retail

- Manufacturing

- IT and Telecom

- Government

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting