What is the LIDAR Market Size?

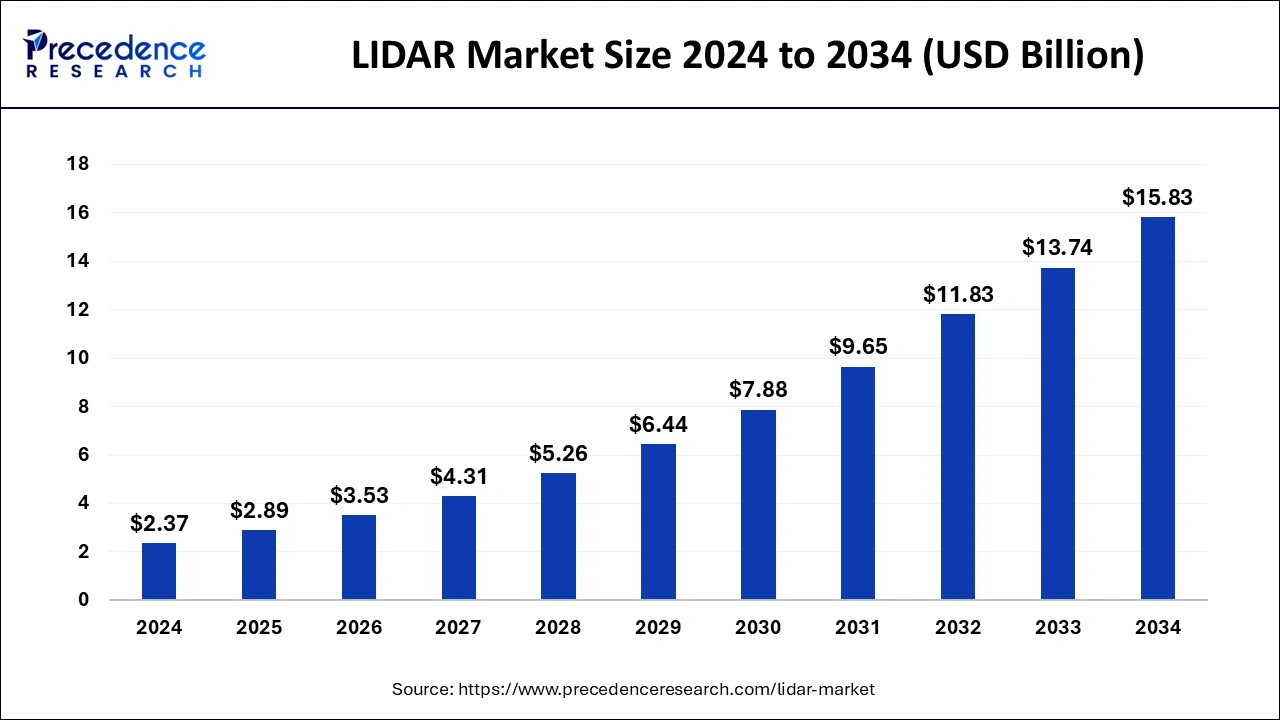

The global LiDAR market size is accounted at USD 2.89 billion in 2025 and predicted to increase from USD 3.53 billion in 2026 to approximately USD 15.83 billion by 2034, expanding at a CAGR of 20.91% from 2025 to 2034.

LIDAR MarketKey Takeaways

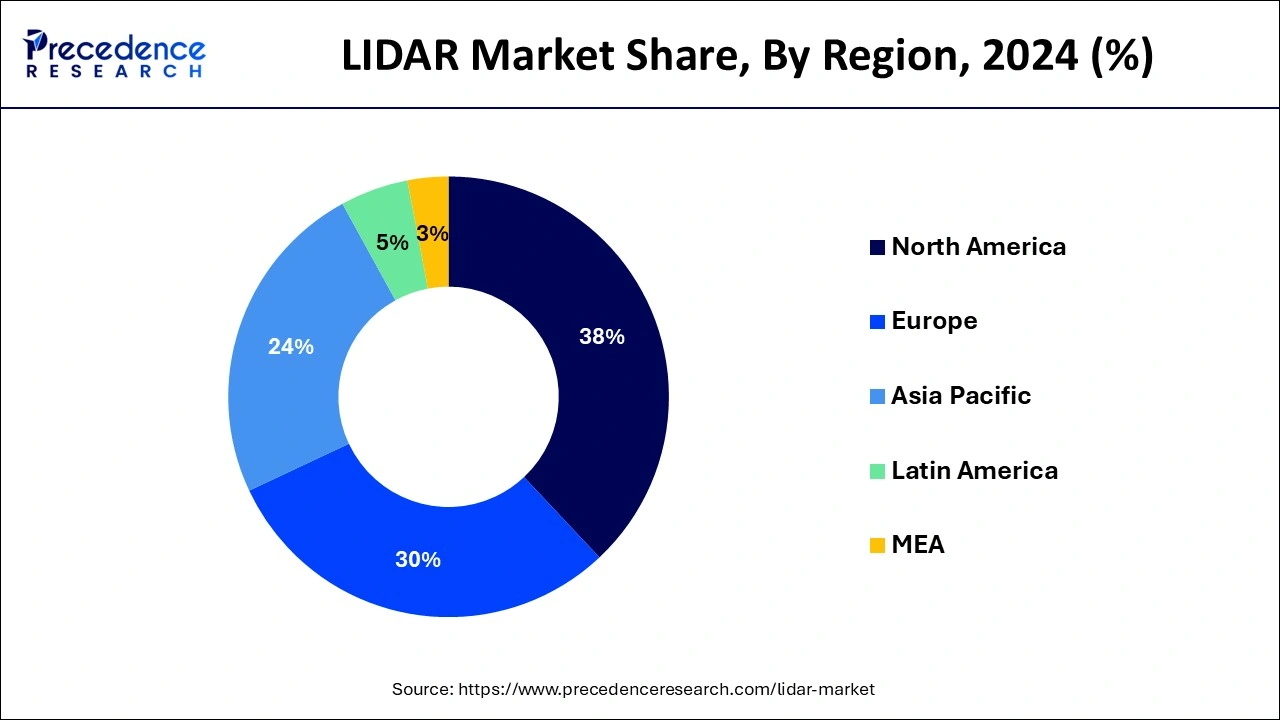

- North America contributed the highest share of 38% in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the aerial segment generated the highest revenue share of 47% in 2024 and is expected to expand at the fastest CAGR of 8.2% over the projected period.

- By component, the laser segment generated the highest revenue share of 43% in 2024.

- By component, the inertial navigation system segment is expected to expand at the fastest CAGR over the projected period.

- By application, the corridor mapping segment generated the highest revenue share of 39% in 2024.

- By application, the exploration & detection segment is expected to expand at the fastest CAGR of 14.1% over the projected period.

- By end user, the civil engineering segment generated the highest revenue share of 45% in 2024.

- By end user, the forestry & agriculture segment is expected to expand at the fastest CAGR of 8.3% over the projected period.

LIDAR Market Overview: The Next Generation Automation

LiDAR (Light Detection and Ranging) is a remote sensing technology that uses laser light to measure distances and create detailed, three-dimensional maps of the environment. The market encompasses various applications, products, and services related to LiDAR technology. The basic principle of LiDAR involves emitting laser pulses and measuring the time it takes for the light to return after hitting an object or surface. By calculating the time-of-flight of the laser pulses, LiDAR systems can accurately determine the distance to objects and create detailed point clouds that represent the surface geometry of the surroundings.

The LiDAR market includes the production and sale of LiDAR sensors, systems, and software, as well as the provision of LiDAR-related services such as data processing and analysis. The market has seen significant growth due to the increasing adoption of LiDAR technology across various industries, driven by advancements in sensor technology, reduced costs, and the demand for more accurate and efficient mapping and sensing solutions. The technology has seen significant advancements in recent years, resulting in smaller, more efficient LiDAR sensors and systems, making it more accessible for a variety of applications.

LIDAR Market Growth Factors

- Autonomous vehicles and mobility solutions: The development and deployment of autonomous vehicles heavily rely on LiDAR technology for real-time mapping and object detection. The increasing interest and investments in autonomous transportation contribute significantly to the growth of the LiDAR market.

- Smart cities and urban planning: The trend toward smart city development, which involves the integration of technology for improved urban living, drives the demand for LiDAR in applications such as city modeling, infrastructure planning, and traffic management.

- Advancements in LiDAR technology: Ongoing advancements in LiDAR sensor technology, including the development of smaller, lighter, and more cost-effective sensors, make LiDAR solutions more accessible for a wider range of applications, fostering market growth.

- Environmental monitoring and climate change studies: LiDAR is increasingly used for environmental monitoring, including deforestation assessment, land cover mapping, and monitoring changes in coastal areas. The growing awareness of environmental issues and the need for accurate data contribute to the demand for LiDAR solutions.

- Precision agriculture: LiDAR technology plays a crucial role in precision agriculture by providing detailed information about crop health, topography, and terrain. As agriculture becomes more data-driven and focused on efficiency, the demand for LiDAR in this sector continues to rise.

- Infrastructure development and construction: LiDAR is widely used in civil engineering and construction projects for tasks such as topographic mapping, site planning, and monitoring construction progress. The global infrastructure development trend contributes to the demand for LiDAR solutions.

- Mining and natural resources Exploration: LiDAR is utilized in the mining industry for exploration and monitoring activities. Its ability to provide accurate 3D mapping of terrains and structures is valuable for resource assessment and extraction planning.

- Reduced costs and Increased accessibility: As technology advances and economies of scale come into play, the cost of LiDAR sensors has been decreasing. This reduction in costs makes LiDAR solutions more accessible to a broader range of industries and applications.

LIDAR Market Outlook: The Road Ahead

- Industry Growth Overview: Increasing adoption of autonomous vehicles, expanding application in various sectors, and advancements in solid-state technology, reducing cost, are contributing to the industry growth of the market.

- Major Investors: Large institutional asset management firms, strategic corporate partners, and specialized venture capital firms are the major investors in the market. Ford and Baidu, Intel Capital, and BlackRock are the major investors.

- Startup Ecosystem: Development of affordable, compact, and high-performance solid-state sensors is the focus of the startup ecosystem. Startups like Aeva Technologies, AEye, Baraja, etc, are actively participating in the market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 20.91% |

| Market Size in 2025 | USD 2.89 Billion |

| Market Size in 2026 | USD 3.53 Billion |

| Market Size by 2034 | USD 15.83 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Type, End User, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

LiDAR technology in precision agriculture

LiDAR technology witnesses robust demand for its capabilities in transforming farming practices. In the agricultural landscape, where precision and efficiency are paramount, LiDAR plays a vital role in revolutionizing how farmers manage their fields. The ability of LiDAR sensors to generate highly accurate, three-dimensional maps of terrain and crops empowers farmers with unprecedented insights into their agricultural landscapes.

LiDAR's applications in precision agriculture encompass terrain mapping, crop monitoring, and yield optimization. By providing detailed information about topography, soil health, and crop conditions, LiDAR enables farmers to make informed decisions on irrigation, fertilization, and pest control, ultimately enhancing overall crop productivity. The technology facilitates the creation of precise elevation models, aiding in the identification of optimal planting patterns and improving resource allocation.

Moreover, LiDAR-equipped agricultural machinery, such as drones and tractors, can navigate fields autonomously, optimizing the deployment of resources and minimizing environmental impact. As agriculture becomes increasingly data-driven and sustainable practices gain prominence, the demand for LiDAR technology in precision agriculture is on a steady rise. The integration of LiDAR not only enhances operational efficiency but also contributes to the broader goals of resource conservation and environmental stewardship in modern farming practices. In this way, LiDAR technology emerges as a transformative force, driving significant demand within the burgeoning precision agriculture sector.

Restraint

Cost considerations

Cost considerations represent a substantial restraint for the LiDAR market, hindering its widespread adoption across various industries. Despite significant advancements in LiDAR technology, the expense associated with manufacturing high-quality LiDAR sensors remains a considerable barrier, particularly for businesses and sectors with stringent budget constraints. The intricate components and precision engineering required for LiDAR systems contribute to their elevated production costs.

In sectors such as agriculture, urban planning, and environmental monitoring, where cost-effectiveness is paramount, the affordability of alternative sensing technologies poses a competitive challenge to LiDAR adoption. Industries exploring LiDAR integration often grapple with the dilemma of balancing the technology's undeniable benefits with the financial implications of its implementation.

Moreover, as industries seek scalable solutions and deployment in large-scale applications, the cumulative cost of outfitting multiple systems with LiDAR sensors can be prohibitive. This cost sensitivity is especially pronounced in sectors where profit margins are slim, dissuading potential users from embracing LiDAR technology despite its capabilities.

Addressing the cost constraint involves ongoing efforts in research and development to produce more cost-effective LiDAR sensors, economies of scale, and strategic collaborations. As the LiDAR market strives to overcome these cost challenges, advancements that enhance affordability without compromising performance will be crucial for unlocking the technology's full potential across diverse industries.

Opportunity

Industrial automation and robotics

Industrial automation and robotics present a ripe landscape of opportunities for the LiDAR market, marking a transformative synergy between advanced sensing technology and the evolving needs of modern manufacturing. LiDAR sensors play a pivotal role in enhancing the autonomy and precision of industrial robots, enabling them to navigate complex environments, avoid obstacles, and interact seamlessly with their surroundings. In manufacturing settings, LiDAR facilitates real-time mapping of factory floors, ensuring efficient material handling and streamlined logistics.

The demand for LiDAR in industrial automation arises from its ability to provide accurate and three-dimensional perception, allowing robots to adapt dynamically to changing conditions. LiDAR's capacity for high-resolution mapping ensures the safe and efficient movement of robotic systems, reducing the risk of collisions and optimizing workflow efficiency. This is particularly crucial in environments where human-machine collaboration is integral, enhancing overall safety standards.

As industries increasingly embrace Industry 4.0 principles and strive for greater operational efficiency, the integration of LiDAR into robotic systems aligns with the broader trend toward smart manufacturing. The applications extend beyond traditional manufacturing, encompassing sectors such as logistics, warehouses, and fulfillment centers. The LiDAR market stands to benefit significantly from the rising demand for intelligent automation solutions, positioning itself as a cornerstone technology in the ongoing revolution of industrial processes.

Type Insights

In 2024, the aerial segment had the highest market share of 47% on the basis of type. Aerial LiDAR systems are mounted on aircraft or drones to capture data from an elevated perspective. This type is widely used for large-scale mapping, forestry management, and terrain modeling. Aerial LiDAR enables efficient coverage of vast areas, providing valuable insights for various industries.

Component Insights

In 2024, the laser segment had the highest market share of 43% on the basis of the component. The laser scanner is the core component of a LiDAR system. It emits laser beams, often in the form of pulses, towards the target area and measures the time it takes for the light to reflect. The laser scanner is responsible for capturing the detailed point cloud data that forms the basis for creating 3D maps of the environment.

The inertial navigation system segment is anticipated to expand fastest over the projected period. The inertial navigation system aids in determining the LiDAR system's position, velocity, and orientation. It helps in accurately georeferencing the LiDAR data by compensating for the platform's motion during data acquisition, ensuring precise mapping and spatial awareness.

Application Insights

In 2024, the corridor mapping segment had the highest market share of 39% on the basis of the application. LiDAR is extensively employed in corridor mapping applications, which involve the detailed mapping of linear features such as roads, railways, power lines, and pipelines. Corridor mapping with LiDAR provides accurate and high-resolution data that is crucial for infrastructure planning, maintenance, and development projects.

The exploration & detection segment is anticipated to expand at a CAGR of 14.1% over the projected period. LiDAR is utilized in exploration and detection applications across various industries. In fields such as mining, natural resources exploration, and archaeology, LiDAR aids in mapping terrains, identifying geological features, and uncovering hidden structures. It enhances the efficiency of exploration efforts and contributes to the discovery of valuable resources.

End-User Insights

In 2024, the civil engineering segment had the highest market share of 45% on the basis of the end user. Civil engineering represents a significant end-user sector for LiDAR. The technology is employed in various civil engineering applications, including topographic mapping, infrastructure planning, construction monitoring, and surveying. LiDAR aids in creating accurate and detailed models of terrain and structures.

The forestry & agriculture segment is anticipated to expand at a CAGR of 8.3% over the projected period. LiDAR plays a crucial role in forestry and agriculture by providing detailed information about forests, vegetation health, and crop conditions. In forestry, LiDAR is used for forest inventory, canopy analysis, and monitoring changes over time. In agriculture, LiDAR aids in precision farming and crop management.

Regional Insights

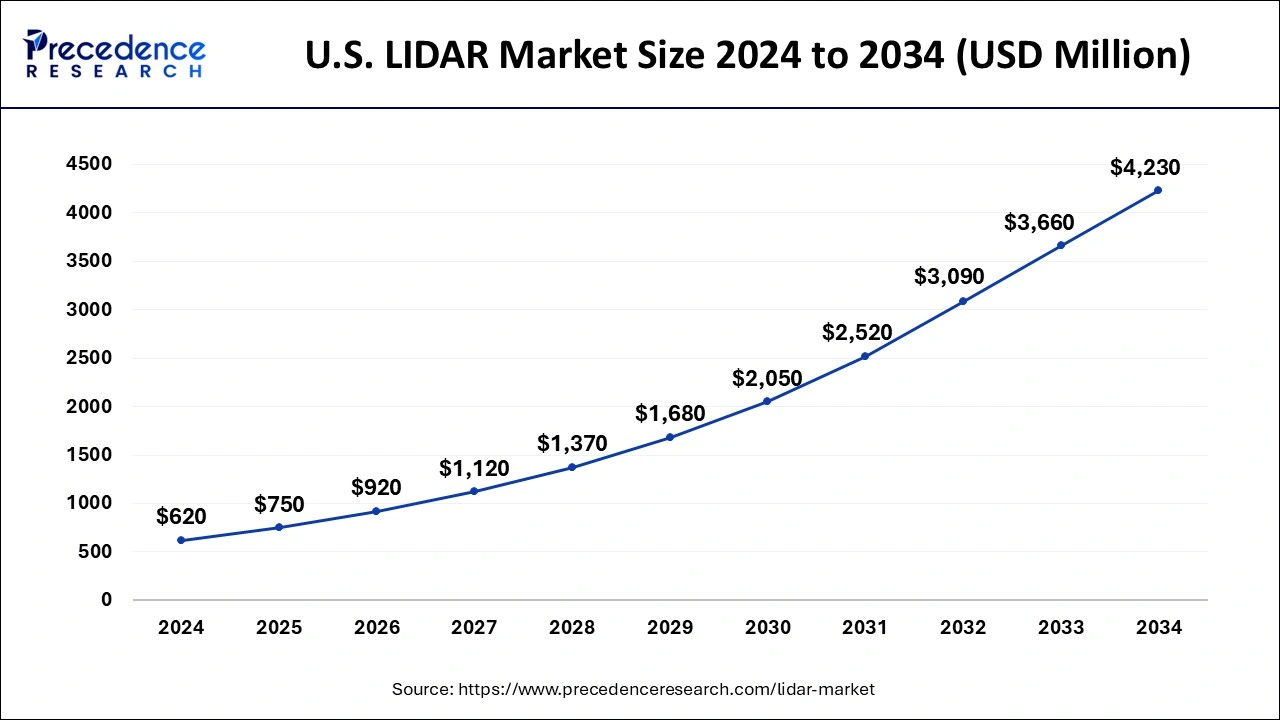

U.S. LIDAR Market Size and Growth 2025 to 2034

The U.S. LiDAR market size is exhibited at USD 750 million in 2025 and is projected to be worth around USD 4,230 million by 2034, growing at a CAGR of 21.17% from 2025 to 2034.

Diverse Applications Boost North America

North America has held the largest share of 38% in 2024. North America is a dynamic and rapidly evolving sector, driven by various applications across industries. The region has witnessed substantial growth in LiDAR adoption, and key factors contributing to this trend such as development and testing of autonomous vehicles have been a significant driver of the LiDAR market in North America. LiDAR sensors play a crucial role in providing real-time mapping and object detection, essential for the safe navigation of self-driving cars.

Asia Pacific Driven by Rapid Urbanization

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific is characterized by rapid urbanization and infrastructure development. LiDAR technology is crucial for urban planning, smart city initiatives, and efficient infrastructure development, contributing to the demand for LiDAR solutions. LiDAR is also used for natural resource management, including forestry, environmental monitoring, and geological surveys. The diverse landscapes and ecosystems in the region make LiDAR valuable for assessing and managing natural resources.

Increasing Applications Drive Europe

Europe has been experiencing growth, driven by diverse applications across industries and the region's emphasis on technological innovation. It has been actively involved in the development and testing of autonomous vehicles, including both road and airborne vehicles. LiDAR technology plays a crucial role in providing the necessary sensing capabilities for safe navigation, contributing to the growth of the LiDAR market.

Robust R&D Ecosystem Propels U.S.

Due to the presence of a robust R&D ecosystem, the innovation of the LIDAR is increasing in the U.S. The companies are also investing in their development to enhance their performance and affordability. Moreover, the growth in the autonomous vehicle is also increasing its demand. Therefore, the companies are actively participating in their growth, which is further supported by the government investments.

Expanding Infrastructure Fuels India

The expanding infrastructure in India is increasing the demand for LIDAR for accurate mapping and surveying. The rapid urbanization backed by government investments is also driving the use and adoption rates. The companies are also utilizing them in the development of the drones, which are used for mining or inspection purposes, where demand across natural resources management is also increasing.

Germany's LIDAR Market Accelerates

Germany's LIDAR market is experiencing significant growth, primarily driven by the automotive sector's strong push toward autonomous driving and advanced driver-assistance systems (ADAS) applications. Industrial automation and rising demand for sophisticated mapping solutions also contribute to this rapid expansion, leveraging advanced sensor technologies.

Rapid Urbanization Facilitates South America

South America is expected to grow significantly in the LIDAR market during the forecast period, due to rapid urbanization. This, in turn, is increasing their use for accurate surveying across highways, railways, metros, etc. Additionally, they are used to monitor the mining process, volumetric analysis, and geological mapping. At the same time, they are also being used for deforestation tracking, biodiversity studies, landslides, etc., which is promoting the market growth.

Growing Mining Operations Stimulate Brazil

The growing mining operations are increasing the demand for LIDAR for mine planning, volumetric calculations, pit monitoring, etc. At the same time, the expanding infrastructure is also increasing its demands across various sectors. Additionally, the growing government investments are increasing their adoption and use in drones as well for inspections and surveys.

LIDAR Market Innovators: Key Players' Offering

- Velodyne Lidar, Inc.: Puck, Puck Hi-Res, Velarray series, etc., are provided by the company.

- RIEGL Laser Measurement Systems GmbH: The company provides VUX-18024, VZ-600i, and VMX-2HA.

- Mira Solutions, Inc.: Magus LiDAR is provided by the company.

- Yellowscan: The company offered Yellowscan Explorer, Yellowscan Mappers, etc.

- SICK AG: MRS1000, LMS Series, TiM Series, and microScan3 Core are provided by the company.

- FARO: Portable 3D scanners, software, and laser trackers are provided by the company.

- Firmatek: The company provides LiDAR-equipped drones.

Recent Developments

- October 2023: SILC launched 4 LiDAR sensors for short distances to over 1,250 meters by means of FMCW technology in Germany.

- September 2023: Balko launched its first modular drone Lidar, Connectiv and its e-Connect application. It enables sensors, inertial platforms and cameras to be interchanged according to the requirements of different projects.

- April 2023: SICK launched multiScan136 that enables time of flight (TOF) measurement to create a 3D perception of its surroundings.

LIDAR Market Companies

- Aerometrex

- LEOSPHERE (Vaisala)

- Velodyne Lidar, Inc.

- RIEGL Laser Measurement Systems GmbH

- Mira Solutions, Inc

- Yellowscan

- SICK AG

- Leica Geosystems AG

- FARO

- Firmatek

Segments Covered in the Report

By Component

- GPS GNSS

- Laser

- Inertial Navigation System

- Camera

- Micro electro mechanical system

By Type

- Terrestrial

- Mobile

- Short Range

- Aerial

By End User

- Archaeology

- Forestry and Agriculture

- Mining

- Transportation

- Civil Engineering

- Defense and Aerospace

By Application

- Seismology

- Exploration and Detection

- Corridor Mapping

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content