What is the Electrochemical Sensors Market Size?

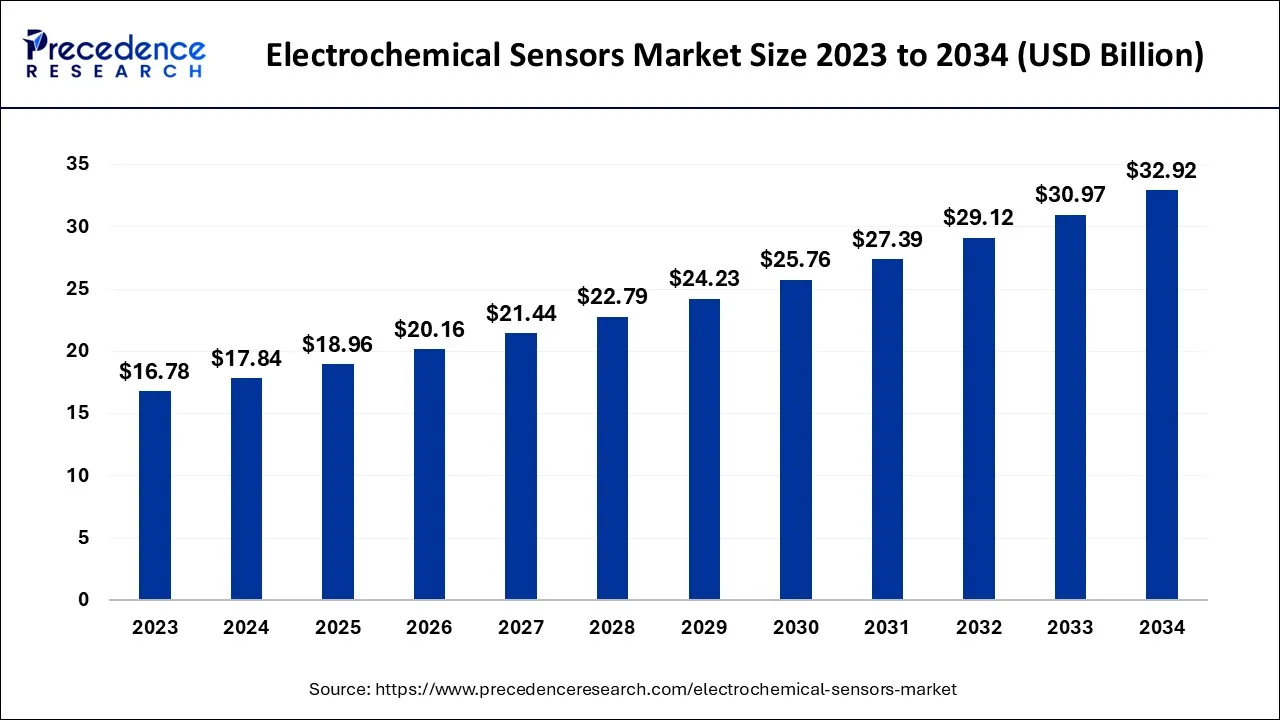

The global electrochemical sensors market size is calculated at USD 18.96 billion in 2025 and is predicted to increase from USD 20.16 billion in 2026 to approximately USD 34.80 billion by 2035, expanding at a CAGR of 6.26% from 2026 to 2035.

Electrochemical Sensors Market Key Takeaways

- North America region captured the maximum market share in 2025.

- The Asia Pacific is expected to expand at a fastest-growing region from 2026 to 2035.

- By type, the potentiometric sensors segment contributed the maximum shares in 2025.

- By product, the humidity sensor segment is expected to hold the majority market share of in 2025.

- By end-user, the healthcare & pharmaceutical segment hold maximum market share in 2025.

Market Overview

A sensor is a device that reacts to physical stimuli like heat, light, sound, pressure, magnetic, or movement and communicates the ensuing electrical impulse to measure any changes in the component material's intrinsic properties. The Roman verb sentire, which means to feel, is the source of the term sensor. Sensors can perceive their immediate surroundings and define a coupling relationship.

Electrochemical sensors employ an electrode as a transducer element when an analyte is present, particularly among chemical sensors. Physical, chemical, or biological characteristics may all be detected by modern electrochemical sensors using a variety of attributes.

Environmental monitoring, health and instrumentation sensors and sensors used in machines like cars, planes, mobile phones, and technological media are a few examples. Also, for the detection of oxygen at levels of percent of volume (% vol) and dangerous gases at the parts per million (ppm) level, electrochemical sensors are frequently utilized.

Electrochemical Sensors Market Growth Factors

Several sensors are being utilized more often in various sectors for advancements in electrical and sensing technologies. In the chemical, coal, environmental protection, and health sectors, sensors based on electrochemical principles have been extensively utilized to detect dangerous gases. Electrochemical sensors have demonstrated an essential role in detecting toxic gases since they are simple in construction, inexpensive, and can react to various harmful gases.

Electrochemical sensors can study proteins, quantify certain scents correctly, generate novel drugs, and treat diseases. All of these are feasible. Also, the detecting process is relatively easy to use and quick. The main factor making electrochemical sensors a research hotspot is that they are affordable and may be utilized with other technologies. Several applications for electrochemical sensors include industry analysis and medical research.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.96 Billion |

| Market Size in 2026 | USD 20.16 Billion |

| Market Size by 2035 | USD 34.80 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.26% |

| Largest Market | North America |

| Fastest-Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Product and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising demand for safety and real-time monitoring of chemical processes

More focus is being placed on explosion prevention by implicit monitoring throughout the hazardous zones of these end-user industries to provide a safer working environment. Due to the presence of poisonous and flammable gases in the harsh environment in the industrial and chemical sectors, explosions are happening more frequently, resulting in an increasing focus on explosion prevention.

In March 2021, DD-Scientific unveiled a new series of high-performance electrochemical gas sensors for industrial safety applications. The DceL suite of solutions not only offers the best performance and resilience in the market for monitoring harmful gases and oxygen, but they also include an ultra-compact design that reduces the size of the detector. The DceL family offers sensors for the most often measured hazardous species, including hydrogen sulphide, carbon monoxide, nitrogen dioxide, ammonia, and sulfur dioxide.

Restraints

Low lifecycle of electrochemical sensors

The sensors are often internally temperature adjusted since they are sensitive to temperature, and the sample temperature should be maintained as steady as feasible. Generally, an electrochemical sensor has a shelf life of six months to a year, depending on the gas it detects and the environment.

High temperatures and low humidity might dry up the electrolyte in the sensors, and the electrolyte is also depleted by target gas or cross-sensitivity gas exposure. Due to this factors, every one to three years, they need to be changed. The brand and the setting in which it is utilized are further factors. The lifetime may be increased if the protection is adequate.

Opportunities

Growing demand in healthcare

Due to the high sensitivity, specificity, and capacity for quick analysis, electrochemical biosensors are a vital component in developing point-of-care devices. In the COVID-19 diagnosis and screening framework, integrating electrochemistry with point-of-care technologies has assisted in practical operation, downsizing, and mobility. Regarding severe acute respiratory syndrome coronavirus 2, patient monitoring depends on identifying possible biomarkers for illness detection (SARS-CoV-2). For example, paper-based electrochemical sensors detect COVID-19 in less than five minutes.

Segment Insights

Type Insights

Based on type the electrochemical sensors divided into potentiometric, conductometric, amperometric sensors. Potentiometric sensors has major shares in the market. The need for up-to-date diagnostic techniques and improvements in microfabrication techniques have resulted in the creation of sensitive, focused, and efficient electrochemical sensors for clinical analysis. Investing in research and development to advance medical technologies costs billions of dollars. Due to the high demand for point-of-care applications like self-monitoring blood glucose meters, the growth of bio-sensors using electrochemical sensing technology has been gaining momentum.

Product Insights

According to product, the humidity sensor is anticipated to hold the largest market share of in 2023. Due to the growing industrial world, several nations have poor air quality, especially in metropolitan areas. The leading causes of air pollution include nitrogen oxides, Sulphur oxides, hydrogen sulphide, and various volatile organic compounds, which endanger human health.

Electrochemical gas sensors are increasingly being used more and more often to monitor and manage contaminants that impair air quality. Compared to conventional, more costly air quality monitors based on infrared spectroscopy and gas chromatography, they provide a less priced, more broad air monitoring option.

On the other hand, the hydrogen sulfide gas sensor and sulfur dioxide sensor are the fastest growing in the chemical, oil & gas, and other industries. Explosion prevention is receiving more attention in the manufacturing and chemical industries' unstable regions. Gases that are poisonous and flammable are the cause of this.

The monitoring of these dangerous sites contributes to safer workplaces. According to government and industry laws like COSHH and OSHA, workers must only be exposed to hazardous fumes and gases. Due to their enhanced sensitivity and selectivity for various harmful gases, electrochemical gas sensors have become more popular.

End-User Insights

Based on end-user insights the healthcare & pharmaceutical segment hold the largest market. Due to the high demand for point-of-care applications like self-monitoring blood glucose meters, bio-sensors have proliferated using electrochemical sensing technology.

Moreover, molecular point-of-care (POC) diagnostics include electrochemical sensors, which have enhanced the sensitivity and specificity of current near-patient and quick tests and expanded the diagnostic options at points of care, including hospital intensive care units, doctor's offices, and outpatient clinics throughout the globe.

The development of implanted glucose sensors for the treatment of diabetes has also benefited from improvements in precision printing and processing technologies as well as next-generation medical and diagnostic electrochemical biosensor product designs.

Several areas of science and technology crucial to the sustainability of humankind's future depend on electrochemistry. Several individuals rely on photovoltaics, batteries, and fuel cells on a daily basis. Electronic devices like computers and cell phones come standard with rechargeable batteries. While less widely used, electrochemical sensors are crucial for maintaining human health and welfare.

There is no denying that electrochemical glucose biosensors have significantly raised the standard of living for the world's hundreds of millions of people with diabetes. Automated clinical analyzers in hospitals use electrochemical sensors to measure blood gases and electrolytes. In chemical labs, potentiometric pH sensors are frequently used instruments.

Wireless signal transfer and miniaturized devices make more distributed and decentralized electrochemical analysis possible. The ongoing research and development of wearable electrochemical sensors for non-invasive biomarker monitoring in sweat or interstitial fluid is an intriguing example.

Regional Insights

What Made North America the Dominant Region in the Electrochemical Sensors Market?

North America has the largest market share due to the advanced research industries globally. The region's enormous demand is mainly due to expanding R&D efforts in the biomedical, automotive, building automation, and other sectors.

North America is also one of the world's biggest marketplaces for sophisticated electrical controls and gadgets. Large-scale domestic manufacturing, government support for disruptive technologies, and information technology innovation are the causes of this significant market share. In addition, the market for electrochemical sensors may be directly impacted by future expansion in the smart cities sector in North America as it transitions to energy-efficient and conservation-related solutions from the early adoption stage to mass adoption.

The market in the region will also profit from the expansion of light vehicle manufacturing and improvements in performance and fuel economy through the use of high-tech, expensive universal exhaust gas oxygen sensors (UEGO). Also, as industrial explosions have been more common recently, American safety groups are attempting to enforce the laws aggressively, driving up demand for electrochemical gas sensors for monitoring and quality control.

U.S.

The U.S. is the major contributor to the North American electrochemical sensors market due to its well-established industrial and healthcare sectors, strong R&D capabilities, and early adoption of advanced sensor technologies. Additionally, rising demand for environmental monitoring, medical diagnostics, and industrial process control drives widespread use of electrochemical sensors across the country.

What Makes Asia Pacific the Fastest-Growing Region in the Electrochemical Sensors Market?

The Asia Pacific is expected to emerge as the fastest-growing region over the forecast period. The development of this market may be attributable to the rise in sensor demand across several end-use sectors, including the environmental, medical, and industrial. Industry participants' growing spending also aids market expansion in R&D activities.

China

China leads the Asia Pacific electrochemical sensors market due to its large manufacturing base, rapid industrialization, and significant investments in research and development of sensor technologies. Additionally, growing applications in healthcare, environmental monitoring, and industrial automation are driving widespread adoption of electrochemical sensors across the country.

How is the Opportunistic Rise of Europe in the Market?

Europe is experiencing an opportunistic rise in the electrochemical sensors market, supported by strict environmental regulations, automotive emission standards, and a strong emphasis on industrial safety. The region benefits from advanced manufacturing capabilities, high penetration of sensing technologies, and increasing adoption of electrochemical sensors in renewable energy systems and smart city initiatives.

Germany

Germany plays a pivotal role in the European electrochemical sensors market, driven by its strong automotive, manufacturing, and environmental monitoring sectors. High demand for exhaust gas sensors, industrial process sensors, and workplace safety monitoring solutions, along with strong R&D capabilities, supports consistent market expansion within the country.

Electrochemical Sensors Market Companies

- Thermo Fisher Scientific, Inc.: Provides electrochemical sensors and analytical instruments for environmental monitoring, laboratory research, and healthcare applications.

- MSA Safety: Manufactures gas detection and electrochemical sensor solutions for industrial safety and hazardous environment monitoring.

- Emerson Electric Co.: Offers industrial automation and process control solutions, including electrochemical sensors for gas and liquid monitoring in manufacturing and energy sectors.

- Conductive Technologies Inc.: Develops and supplies electrochemical sensor technologies for chemical, environmental, and industrial applications, focusing on high-precision detection.

Other Major key Players

- Thermo Fisher Scientific, Inc.

- MSA Safety

- Emerson Electric Co.

- Conductive Technologies Inc.

- Delphian Corporation

- SGX Sensortech Ltd

- Ametek Inc.

- Figaro USA Inc.

- Dragerwerk AG

- MembraporAG

- Alphasense

- City Technology

- Figaro

- Draeger

- Winsen

- Dart

- General Electric

Recent Developments

- In October 2025, the Ministry of Electronics and Information Technology (MeitY) launched new sensor-based technologies and announced technology transfers as part of the AgriEnIcs program to enhance agricultural practices and environmental oversight. These initiatives aim to improve areas such as dairy production, crop quality, and environmental monitoring.

(Source: knnindia.co.in ) - In October 2025,NXP Semiconductors announced a new Battery Management System (BMS) chipset that integrates Electrochemical Impedance Spectroscopy (EIS) to provide lab-grade diagnostics for monitoring battery health in electric vehicles. This hardware-based solution offers nanosecond precision in battery health monitoring.

(Source: chargedevs.com ) - In November 2025, Abselion launched its Tagged Protein Quantification Kit His-tag and Tagged Protein Sensor His-tag Quantification at the PEGS Europe 2025 summit in Lisbon. This launch was announced at the PEGS Europe 2025 summit.

(Source: news-medical.net ) - In July 2022, Researchers at the Suzhou Institute of Biomedical Engineering and Technology (SIBET) announced proposing a hand-in-hand structured DNA assembly strategy and developed an electrochemical/fluorescent dual-mode biosensor for circulating tumor DNA based on methylene blue and red-emissive carbon nanodots.

- In September 2021, After extensive research and development in Volatile Organic Compounds, Alphasense launched two new electrochemical sensors, the VOC-A4 and VOC-B4, which have been developed specifically to target VOCs. The Alphasense VOC electrochemical VOC-A4 and VOC-B4 sensors are the perfect companions for the amperometric 4-electrode air quality sensors. The voltage for both the VOC-A4 and VOC-B4 can be altered to operate at V, 0.1V, 0.2V or 0.3V, allowing the option to detect a range of different gases.

- In September 2020, Medtronic received US Food and Drug Administration (FDA) approval for its MiniMed 770G hybrid closed-loop system. With the benefits of smartphone connectivity and a more comprehensive age indication down to the age of two, this most recent insulin pump system delivers the most sophisticated SmartGuard technology offered by the firm, which is present in the MiniMed 670G system.

Segments Covered in the Report

By Type

- Conductometric Sensors

- Potentiometric Sensors

- Amperometric Sensors

By Product

- Humidity sensor

- Nitrogen oxide sensor

- Hydrogen sulfide gas sensor

- Sulfur dioxide sensor

- Others

By End-User

- Oil & Gas

- Chemical & Petrochemicals

- Mining

- Environmental

- Healthcare & Pharmaceuticals

- Biotechnology

- Automotive

- Food & Beverage

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting