Cold Chain Market Size and Growth 2025 to 2034

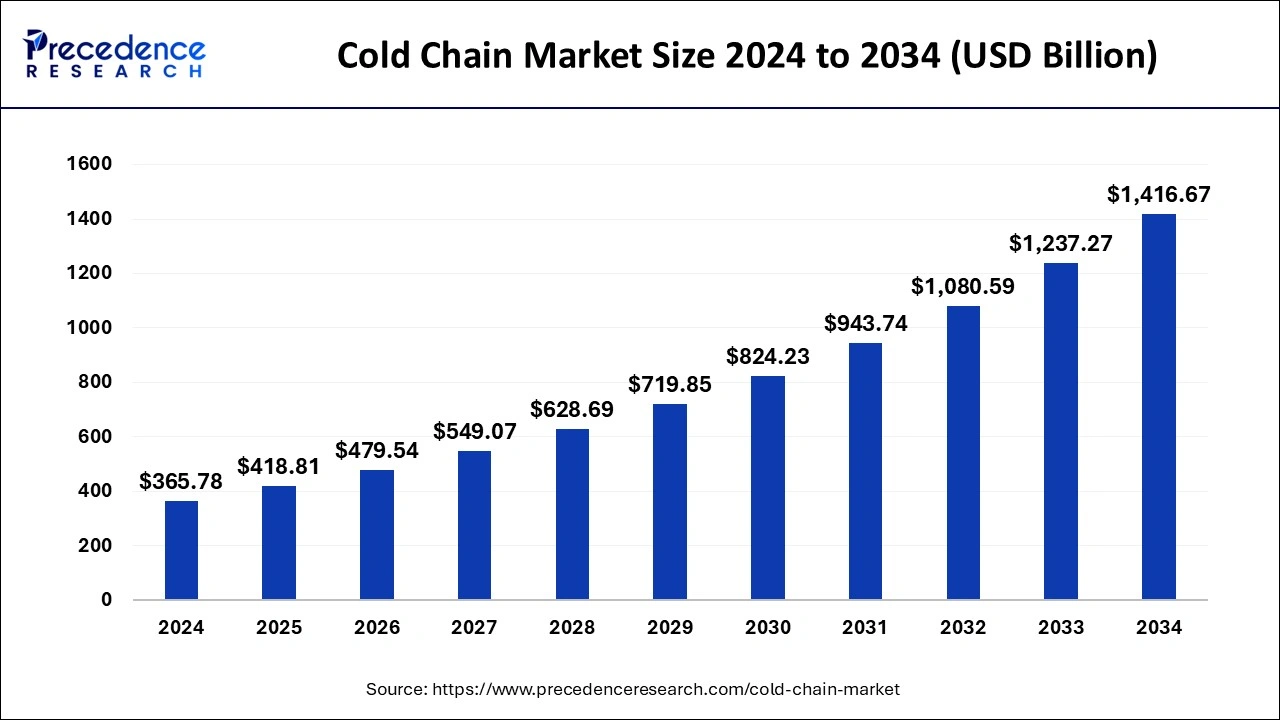

The global cold chain market size was estimated at USD 365.78 billion in 2024 and is expected to reach around USD 1,416.67 billion by 2034, expanding at a CAGR of 14.50% from 2025 to 2034.

Cold Chain Market Key Takeaway

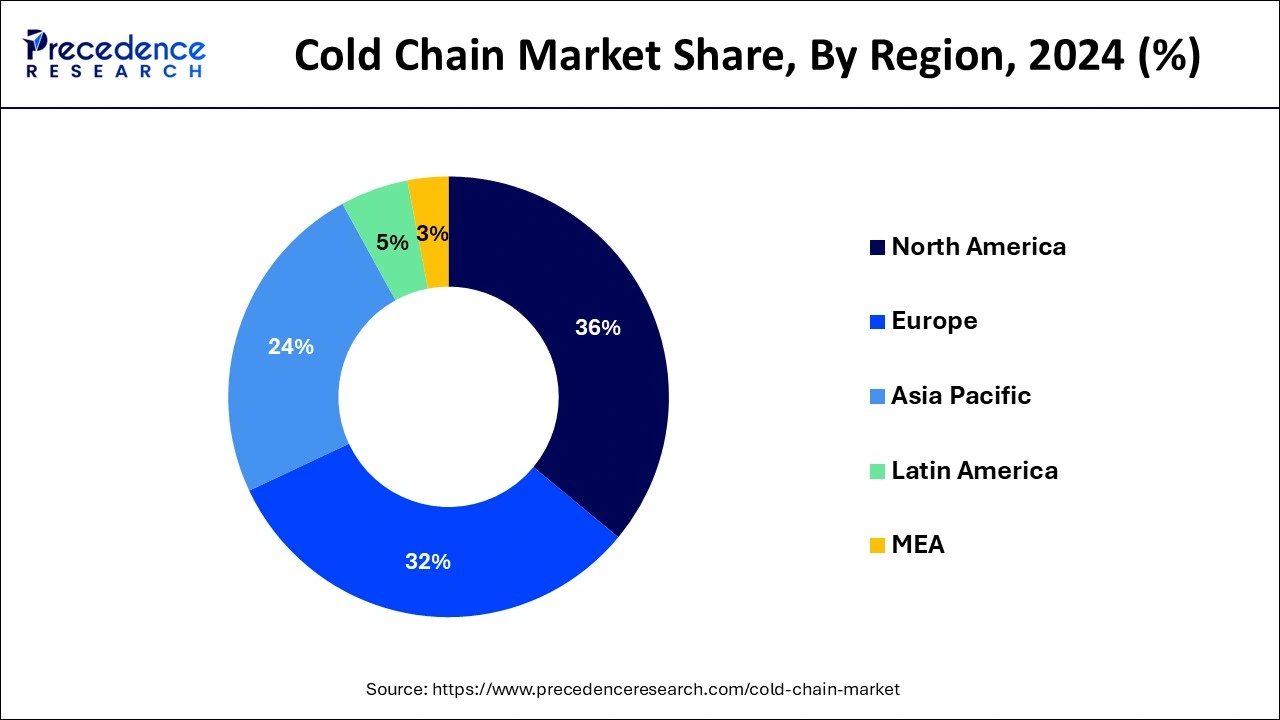

- The North America market has garnered a revenue share of around 36% in 2024.

- By type, the storage segment has accounted highest revenue share of around 60% in 2024.

- By packaging, the product packaging segment has captured a revenue share of around 74% in 2024.

- By equipment, the storage equipment segment has contributed a revenue share of around 76% in 2024.

- By application, the fish, meat, and seafood segment accounted highest revenue share of around 24% in 2024.

U.S. Cold Chain Market Size and Growth 2025 to 2034

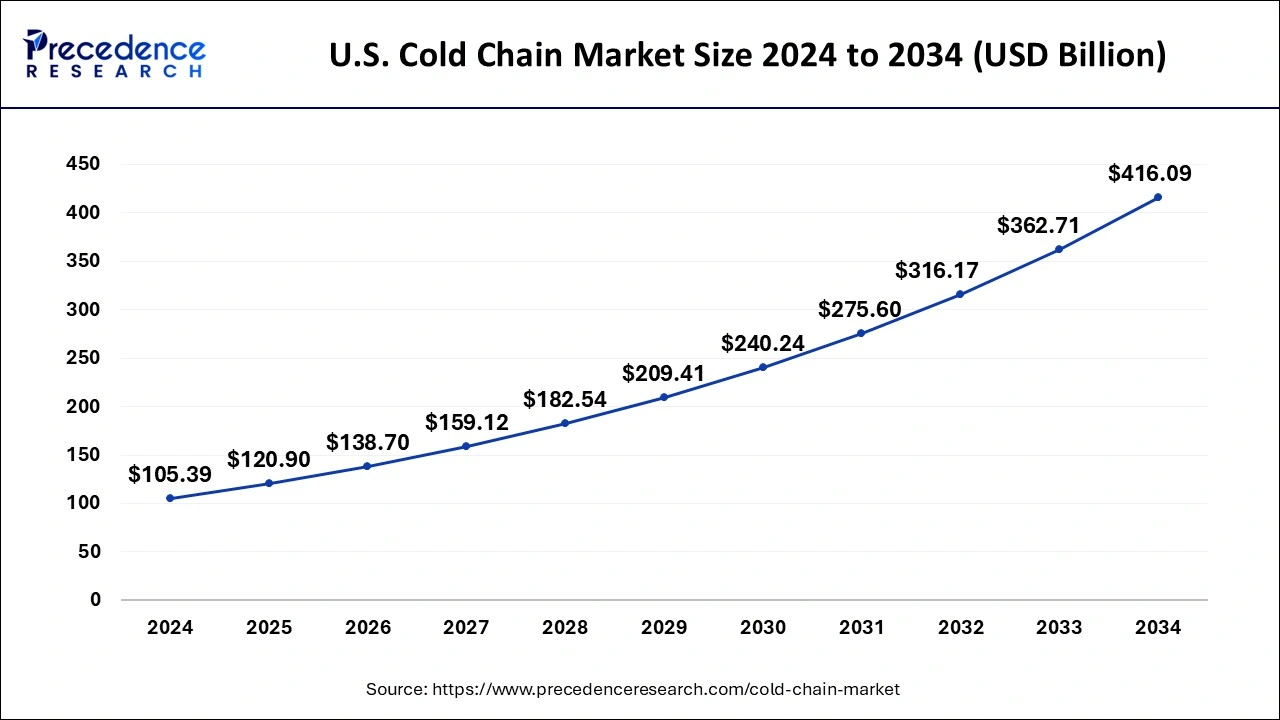

The U.S. cold chain market size was estimated at USD 105.39 billion in 2024 and is predicted to be worth around USD 416.09 billion by 2034, at a CAGR of 14.70% from 2025 to 2034.

North America hold the largest revenue share contributing more than 36% in 2024 and is expected to remain in dominant position during the forecast period. The significant growth in this region is due to the presence of major market players continuously involved in developing new technologies to produce an energy efficient cold chain system. Furthermore, the increasing demand for the perishable food products in the North American market contributes significantly towards the growth of the cold chain market.

- For instance, in April 2025, Identiv, Inc., a digital security and Internet of Things technology company and Tag-N-Trac formed a new strategic business development and marketing partnership, for developing and commercializing a smart labelling solution for cold chain tracking across pharmaceutical supply chains. The alliance aims at delivering real-time and item-level visibility insights from origin to delivery by leveraging Tag-N-Trac's SaaS platform, RELATIVITY combined with Identiv's advanced BLE smart labels designed for capturing raw environmental data throughout the transportation of a product.

Asia Pacific region is anticipated to be the fastest growing region owing to the rise in Government investments in order to develop advanced logistics infrastructure. In this region, China is expected to hold a significant share owing to the rise in demand for technological advancements in food processing, packaging and storage of seafoods. Moreover, the development in the pharmaceutical sector in India and China will fuel the growth of the cold chain market in this region.

Cold Chain Market Growth Factors

With the rapid technological advancements, the manufacturers of the temperature sensitive products are now extensively using the cold chain supply system and this is expected to drive the growth of the cold chain market. Furthermore, rise in demand for the temperature sensitive products such as meats, medicines and others across the globe have boosted the growth of the cold chain market.

The trade liberalization, focus on reducing food waste and expansion of retail chain in the market is anticipated to fuel the growth of the cold chain market. Furthermore, the rising disposable income of the consumers and the desire to consume ready to eat food products that needs to be preserved in a temperature-controlled environment is estimated to drive the growth of the cold chain market.

In recent times, there is a shift to protein rich foods in the developing economies and this factor is anticipated to drive the growth of the cold chain market. The surge in demand for refrigerated transportation vehicles in order to transport the perishable food product will contribute significantly in the growth of the cold chain market.

Furthermore, the growing Governments subsidies in order to boost the cold chain market are also a major attribute that will boost the growth of the cold chain market. Moreover, the significant growth of the ecommerce industry that delivers the perishable products is anticipated to fuel the growth of the cold chain market.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 365.78 Billion |

| Market Size in 2025 | USD 418.81 Billion |

| Market Size by 2034 | USD 1416.67 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.50% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Sector, Temperature Type, Packaging, Application, Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Type Insights

The storage segment is expected to hold the largest revenue share of more than 60% in 2024and will remain to dominate during the forecast period owing to the surge in demand for ready to eat and frozen foods across the globe. The rapid changing lifestyles of consumers and their dietary patterns are driving the demand for the packaged food products and this attribute is estimated to drive the growth of the cold chain market.

The cold chain systems are very efficient in preserving the temperature sensitive food products. Therefore, the cold chain systems are extensively used in transportation trucks, cold storages, retails shops and others. This factor is anticipated to boost the growth of the cold chain market.

With the rapid technological development, the cold storages are efficiently monitored with the help of remote temperature sensors, RFID devices and others that helps in ensuring the safety, integrity and efficiency of the cold chain systems. This attribute fuels the growth of the cold chain market.

Sector Insights

The public sector is expected to contribute significantly towards the market growth as these cold storages are operated by the Government in order to preserve the vegetable, medicines and other temperature sensitive products.

The private sector is also estimated to grow significantly during the forecast period owing to the increase in demand of perishable food products such as milk, meat, cheese and others. The rapid growth in the demand for packaged food products across the globe will contribute significantly towards the growth of the cold chain market. Moreover, the continuous research and developmental activities performed by the major market players to develop advanced cold chain systems will remarkably impact the growth of the cold chain market.

Temperature Type Insights

The manufacture of the packaged food products indulges in freezing the food products as this will help to enhance the shelf life of the food products. The freezing process lowers the biological and chemical reaction that prevents the food from getting decayed. The rising disposable income and change in food habits of the consumers leads to the demand for frozen food products and this is anticipated to drive the growth of the cold chain market.

Cold Chain Market Companies

- Agro Merchant Group

- Nordic Logistics and Warehousing LLC

- Preferred Freezer Services LLC

- Cold Chain Technologies Inc.

- Cryopack Industries Inc.

- Creopack

- Cold Box Express Inc.

Recent Developments

- In May 2025, Cold Chain Technologies (CCT), a provider of insulated packaging solutions, launched its latest product, TRUEtemp Naturals Shipper which is designed for first-mile, parcel-sized shipments offering a truly curbside recyclable, universal solution combining strong thermal performance, operational efficiency and cost-effectiveness, while retaining CCT's dedication for innovation and sustainability in cold chain logistics. The new product is qualified for ISTA 7E RFG profile and ensures a reliable temperature control within a range of 2°C – 8°C for up to 48 hours.

In May 2024, Identiv collaborated with InPlay Inc., a pioneering technology company, for developing an innovative portfolio of Bluetooth Low Energy (BLE) enabled smart labels for industrial IOT applications. InPlay's IN100 NanoBeacon SoC will power the smart labels enabling real-time tracking capabilities as well as sensor integration for temperature, humidity and motion monitoring with potential for high-value applications in asset tracking, cold-chain compliance, and pharmaceutical and food logistics. - In April 2025, Thermo King and Range Energy announced the conduction of operational trials which are designed for testing the capacity, capability and functionality of an electrified refrigerated transport technology with the potential for transforming the cold chain transport technology. With plans for large-scale deployment in late 2025, this latest line of cold chain electrification solution aims for setting a new standard in low-to no-carbon refrigerated transport.

- In April 2025, DHL Group, a leading shipping and logistics company, announced an investment of about $2.2 billion for strengthening its biopharma cold chain operations. The company plans at investing half of the total in Americas, while the remaining half will be split between Asia Pacific region, Europe, Middle East and Africa in the upcoming 5 years.

Segments Covered in the Report

By Type

- Storage

- Warehouses

- On-grid

- Off-grid

- Reefer Containers

- Warehouses

- Monitoring Components

- Hardware

- Software

- Transportation

- Road

- Sea

- Rail

- Air

By Sector

- Private

- Cooperative

- Public

By Temperature Type

- Frozen

- Chilled

By Packaging

- Product

- Crates

- Dairy

- Pharmaceuticals

- Fishery

- Horticulture

- Insulated Containers & Boxes

- Payload Size

- Large (32 to 66 liters)

- Medium (21 to 29 liters)

- Small (10 to 17 liters)

- X-small (3 to 8 liters)

- Petite (0.9 to 2.7 liters)

- Type

- Cold Chain Bags/Vaccine Bags

- Corrugated Boxes

- Others

- Payload Size

- Cold Packs

- Labels

- Temperature-controlled Pallet Shippers

- Crates

- Materials

- Insulating Materials

- EPS

- PUR

- VIP

- Cryogenic Tanks

- Others (Insulating Pouches, Hard Cased Thermal Boxes, and Active Thermal Systems)

- Refrigerants

- Fluorocarbons

- Inorganics

- Ammonia

- CO2

- Hydrocarbons

- Fluorocarbons

- Insulating Materials

By Application

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Fish, Meat, and Seafood

- Processed Food

- Pharmaceuticals

- Vaccines

- Blood Banking

- Bakery & Confectionary

- Others (Ready-to-Cook, Poultry)

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting