What is Cold Storage Market Size?

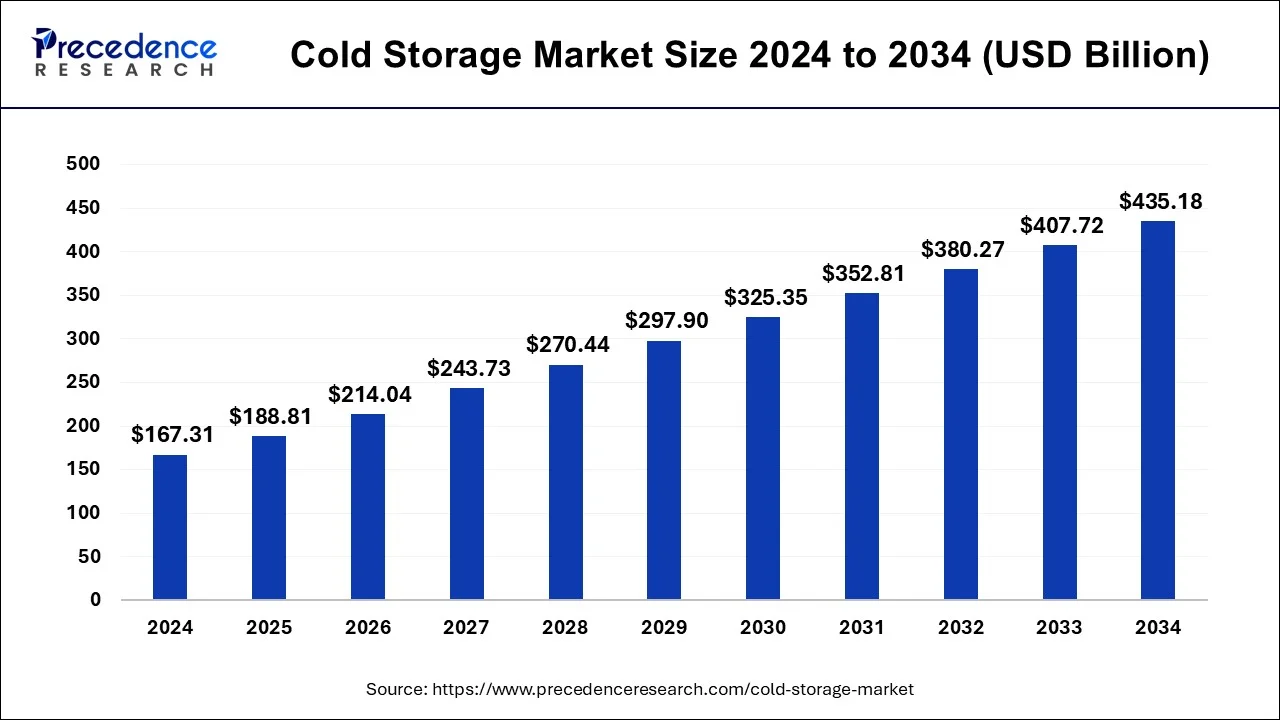

The global cold storage market size is valued at USD 188.81 billion in 2025 and is anticipated to reach USD 462.63 billion by 2035 and is poised to grow at a CAGR of 9.38% from 2026 to 2035.

Market Highlights

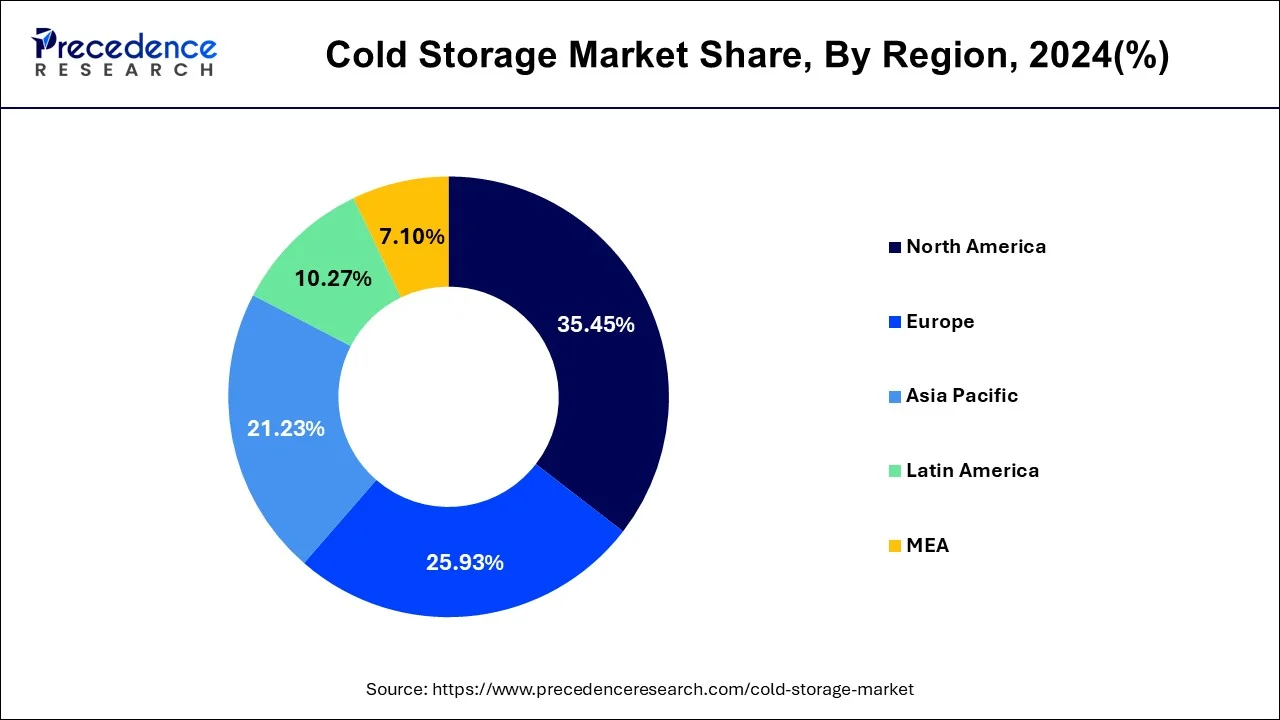

- North America contributed more than 35.45% of revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR of 10.46% between 2026 and 2035.

- By Warehouse Type, the private segment has held the largest market share of 63.65% in 2025.

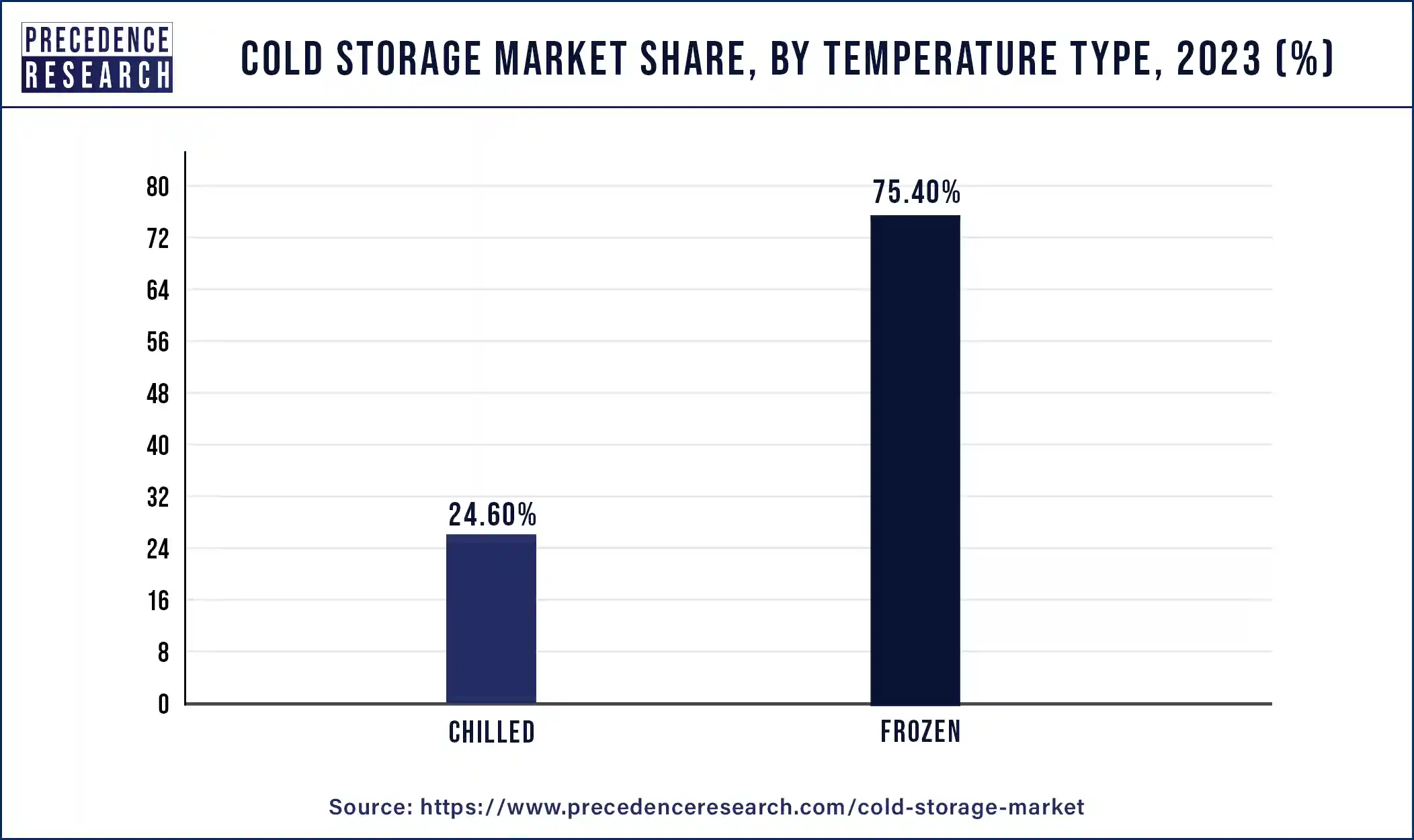

- By Temperature Type, the frozen segment generated over 77.95% of revenue share in 2025.

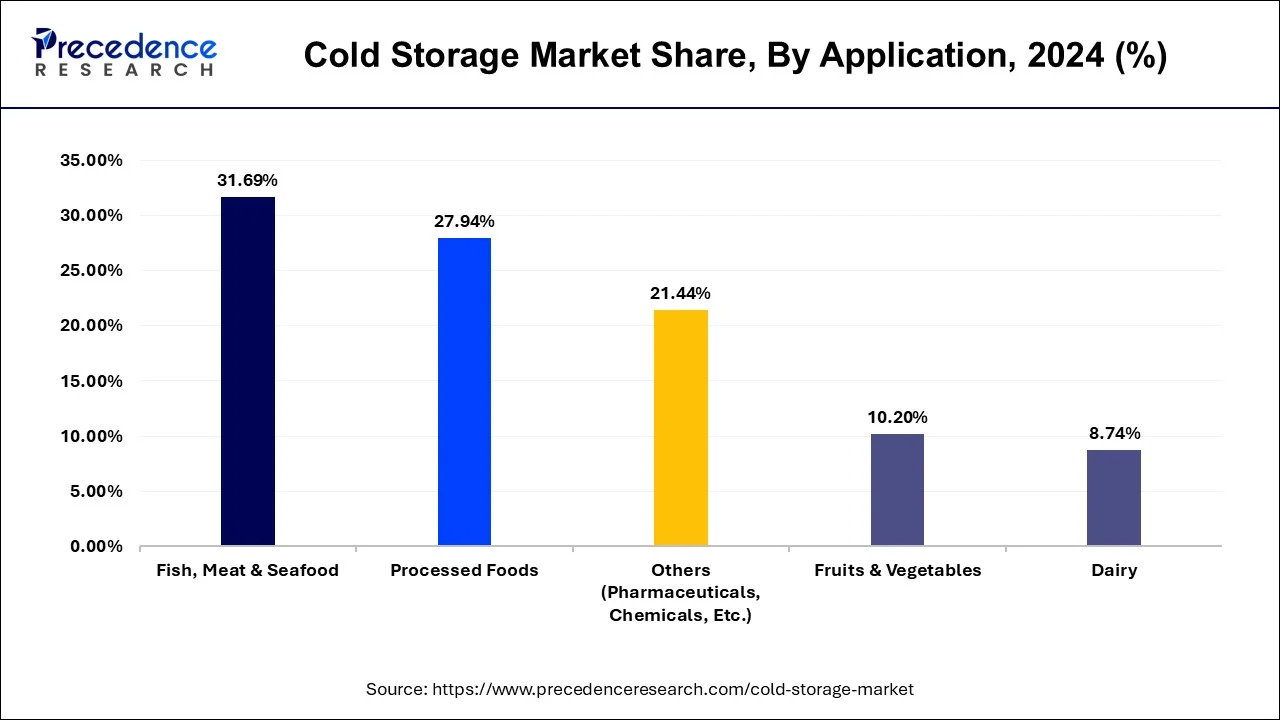

- By Application, the fish, meat, and seafood segment had the largest market share of 31.69% in 2025.

- By Application, the dairy segment has captured 12.09% revenue share in 2025.

Market Overview

Cold storage is substantially more complicated than dry storage because of the regulations around refrigerated freight. Because chilled warehousing is more expensive, many manufacturers choose to outsource their cold storage to third-party logistics companies. As the demand for refrigerated products transportation grows, so does the demand for value-added services like repacking and consolidation. Because of these higher expectations, 3PLs have a poorer return on investment for cold storage and must enhance their processes and facilities to stay viable.

Many 3PLs struggle to manage one-size-fits-all warehouses as clients have a rising number of customized requests depending on the needs of their end users. With so many different customer requirements, 3PLs are increasingly creating specialized cold storage facilities for their clients. While this allows 3PLs to work more efficiently based on the demands of a specific customer, it is a hazardous venture because it is difficult to lock price-sensitive customers into long-term contracts.

The evolution of the cold storage sector is being shaped by a variety of consumer needs, which aren't restricted to added value services. They have to do with the nature of the things being stored as well. Different items have different shelf life, temperature ranges in which they must be stored, and the amount of time they can spend between a cold storage facility and a transportation vehicle without spoiling.

Some products that may necessitate cold storage or at the very least a temperature-controlled warehousing solution include:

- Perishable nutrient products

- Perishable food (vegetables, fruits, meat and seafood, dairy products)

- Flowers and plants

- Biopharmaceutical products

- Artwork

How has AI benefited the cold storage market?

Product development process using AI is optimizing cold storage and making it smarter. Companies can use AI to monitor, track temperatures, humidity, and even energy consumption. AI can catch malfunctions that humans may not be aware of, such as a drop in temperature, a failing compressor, or even a door left ajar. By automating this Artificial Intelligencecan cut negating product spoilage, reducing monetary loss while simultaneously storing a customer's product with real-time protective measurements. Based on historical data, AI can also take into consideration the best use of space for storage and show a user where fast-selling products should go for fastest retrieval. In warehouses, these insights are now being used in conjunction with robotic solutions to retrieve and take out goods at a faster rate, ensuring they meet delivery deadlines. AI can also assist with producing shipping plans by analyzing traffic and weather patterns. This allows better movement of frozen and chilled goods through local or cross-country channels.

- For instance, Lineage Logistics in the U.S. is currently using AI and Machine Learning to minimize energy consumption in their cold storage warehouses and manage the temperatures. By using such AI and wireless sensors, the company was able to reduce its annual electricity consumption by 33 million kilowatt-hours, which saved them around US$4 million while maintaining required temperature standards.

Major Trends of the Cold Storage Market

- Artificial Intelligence Enhancements to Cold Storage Operations:By leveraging machine learning tools and predictive analytics platforms, cold storage managers are creating better demand forecasts for their products, where they will have significantly reduced spoilage, and they will optimally use temperature control for managing their warehouses (cold storage facilities) accurately.

- Smart Cloud-Based Cold Storage Monitoring Systems: The trend continues with cold storage facilities strategically utilizing IoT-enabled sensors along with cloud-based platforms for monitoring warehouse temperature in real time, providing visibility and expediting corrective actions of their assets.

- Energy Efficiency in Refrigeration Equipment: Due to the upward trend of electricity rates, cold storage operators will be implementing improvements to insulation technology, utilizing low-energy compressors, and employing alternative refrigeration/cooling technologies.

- Urban Micro Cold Storage Locations: Rapid increase in development of quick shopping commerce platforms and online grocery delivery service providers, creating an increase in the number of small cold storage (micro) hubs that are being developed near densified urban geographic consumption centers.

- Supply Chain Transparency Using Blockchain: The implementation of blockchain technologies will provide enhanced traceability, accountability, and responsible regulatory adherence for cold storage in food and pharmaceuticals.

Cold Storage Market Trade Analysis

- Growth of Global Trade in Perishable Products:Increased cross-border movements of frozen foods, seafood, dairy products, and vaccines are leading to an increased need for significant growth and support of new compliant cold storage systems and infrastructures globally.

- Increased Compliance and Regulatory Requirements for Trade: The heavyweight of regulatory compliance in the areas of food safety and pharmaceutical products is supporting the development and growth of certified cold storage facilities throughout the world due to these regulatory requirements.

- Growth of Export Opportunities in Developing Economies: These developing nations are improving their cold storage capabilities in order to support agricultural export from their country, as well as reducing post-harvest loss.

Market Outlook

- Industry Growth Overview:The recent expansion of the cold storage industry is attributed to growing consumer demand for both frozen food and biopharmaceutical products. Additionally, improvements in the supply chain logistics process have positively affected the growth of this sector, along with the increasing overall amount of organized retail facilities being built across the globe.

- Sustainability Trends: Cold storage companies are focusing on utilizing more sustainable business practices, such as using eco-friendly refrigerants, renewable energy sources, and energy-efficient operating equipment, in order to increase operational efficiency while decreasing greenhouse gas emissions.

- Global Expansion: Cold storage development is being accelerated by increasing rates of industrial development in emerging markets, rising demand for food consumption worldwide, and increased governmental support for cold chain infrastructure in Southeast Asia, Latin America, and emerging markets in the Middle East region.

- Startup Ecosystem: Startups in the cold storage market have become a major source of innovation through the development of AI-enabled cold chain analytics, temperature-monitoring applications, and automated storage solutions, which are helping to improve operational efficiencies while reducing risk.

Cold Storage Market Growth Factors

The global cold storage market is primarily driven by the increased trade of the perishable products. The increased health consciousness regarding the benefits of healthy food consumption such as consumption of fresh dairy products, fruits & vegetables, meat, eggs, and seafood owing to their protein content is boosting the growth of the cold storage market. Cold storage helps to preserve the essential nutrients like protein in the perishable food products for longer time period. The rising demand for the food products among the consumers is increasing the importance of cold storage. Moreover, the free trade of food products across the globe owing to the globalization played a crucial role in the development of the cold storage market. The rising demand for the enhanced supply chain and logistics is propelling the demand for the cold storage systems across the globe. The distribution system plays a crucial role for delivering products to the end users and hence the demand for the advanced cold storage system is on the rise to prevent the loss of food products owing to the passage of time.

The rapidly growing organized retail sector is expected to propel the demand for the cold storage systems during the forecast period. The rapid growth of the retails chains such as supermarkets, hypermarkets, convenience stores, and other retailers, especially in the developed markets of Europe and North America has significantly boosted the growth of the cold storage market in the past. The food retail giants such as Walmart, 7 Eleven, and Tesco requires large transport fleet for the distribution of the perishable goods. The growing penetration of these retail chains in the developing countries like India, Brazil, Argentina, UAE, and Saudi Arabia is expected to present a lucrative growth opportunities for the cold storage manufacturers in the forthcoming years. Moreover, rising population, developing infrastructure, rising demand for food, and rising disposable income in the developing countries is expected to boost the demand for the perishable food products exponentially, which in turn would drive the growth of the cold storage market.

- The emerging global commerce in perishables such as dairy, meats, seafood, fruits, and vegetables brings about the cold storage demand to preserve the nutrient qualities of food.

- Preference of consumers towards health and protein-rich food products is keeping pressure on the demand for the modern systems of cold chain.

- The global expansion of retail chains, including hypermarkets and supermarkets, is a strong contributing factor to the demand for an efficient storage and distribution network.

- Increasing globalization, in conjunction with free trade agreements, enhances cross-border food movements, thus encouraging the development of reliable cold storage facilities.

- Rising population coupled with urbanization and rising disposable incomes in developing economies are some of the factors that have contributed towards the demand for perishables, thereby spurring market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 188.81 Billion |

| Market Size in 2026 | USD 214.04 Billion |

| Market Size by 2035 | USD 462.63 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.38% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Warehouse Type, Temperature Type, Application,Construction,and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for dairy products to drive the demand for cold storage

During the COVID-19 epidemic, the dairy industry has shown remarkable resilience. Fresh liquid milk and fresh dairy products were particularly sensitive to supply chain disruptions due to their perishable nature; nonetheless, the dairy sector was not as badly affected as other industries on a worldwide scale. The pandemic's effects varied by location, with negative consequences ranging from shipping container shortages to surplus goods disposal. Other countries, on the other hand, rapidly and successfully reacted to production and labor concerns, with minor disruptions to their normal trade environment. Many countries imposed restrictions on away-from-home consumption, which often includes a high proportion of dairy products; however, at-home consumption (retail sales) compensated for part of these losses. There were no serious shortages or surpluses worldwide as a result of swift production and packaging modifications.

Over the projection period, global milk production (approximately 81 percent cow milk, 15% buffalo milk, and 4% for goat, sheep, and camel milk combined) is expected to expand at 1.7 percent each year (to 1 020 Mt by 2030, faster than most other major agricultural commodities). Because herds are expected to grow faster in nations with lower yields and with herds made up of lower yielding animals, the forecast growth in the number of milk-producing animals (1.1 percent per year) is larger than the estimated average yield growth (0.7 percent) (i.e. goats and sheep). India and Pakistan, both major milk producers, are predicted to contribute more than half of the rise in global milk output during the next ten years, accounting for more than 30% of global production in 2030. Due to rules on sustainable production and slower domestic demand growth, the European Union, the world's second largest milk producer, is predicted to increase at a slower rate than the worldwide average.

The majority of dairy production is consumed in the form of unprocessed or barely processed fresh dairy products (i.e. pasteurized or fermented). Fresh dairy products' proportion of global consumption is predicted to grow over the next decade, owing to robust demand growth in India, Pakistan, and Africa, fueled by rising income and population. Per capita consumption in rich nations is expected to increase modestly from 23.6 kg in 2018-20 to 25.2 kg (milk solids) in 2030, compared to 10.7 kg to 12.6 kg in underdeveloped countries. In developed countries, processed dairy products are preferred, whereas in underdeveloped countries, fresh dairy products account for more than 75 percent of average per capita dairy intake in milk solids. In developing countries, regional inequalities are enormous, with fresh dairy product consumption ranging from 99 percent in Ethiopia to 5.8 percent in the Philippines.

Global dairy product consumption, 2018-2025 (KT PW)

| Average 2018-20 | 2021 | 2023 | 2025 | |

| Fresh Dairy Products | 4,28,250 | 4,36,411 | 4,61,316 | 4,82,439 |

| Butter | 11,632 | 12,053 | 12,581 | 13,086 |

| Cheese | 24,044 | 24,658 | 25,342 | 25,921 |

Processed dairy product consumption varies greatly by area. Cheese is the second most important dairy product in terms of milk solids consumed (after fresh dairy products). Cheese is predominantly consumed in Europe and North America, and consumption in both countries is increasing. Butter is the most popular processed dairy product in Asia, accounting for over half of all milk solids consumed in the region. Butter is also expected to develop at the fastest rate, although starting from a low foundation in comparison to Europe and North America. The majority of processed dairy consumption in milk solids in Africa is made up of cheese and WMP (whole milk powder). SMP, on the other hand, is predicted to grow the fastest over the next ten years, albeit from a smaller consumption base.

Market Restraint

High energy consumption required by cold storage solutions to restrain market growth

Almost every stage of the supply chain requires temperature management. Cooling has become a requirement for maintaining present food supply networks and meeting global food demand. A number of societal, economic, and technological factors have resulted in refrigeration reliance. People began to have more money to spend but less time to shop for food as a result of higher household incomes, which spurred the development of supermarkets and home refrigerators. People's dietary choices shifted as well, with a greater desire for processed and frozen meals, as well as foods not produced locally, such as imported fruit and vegetables that travel vast distances.

As a result, effective long-term safe food storage along the supply chain has become critical for the continued operation of present food systems. Refrigeration, packaging, food transportation, food product improvements, and numerous socio-economic developments have all contributed to the creation of highly energy-dependent cultural norms and practices.

When economic progress brings higher demand for food safety, freshness, and quality, and when some economies rely on exporting food to more industrialized countries, it's impossible to avoid refrigeration dependency. Given the world's limited fossil fuel supplies, as well as fluctuating and growing costs, there are concerns about how this may affect future food supply chains, as well as the urgent need to reconsider the role of energy when contemplating possibilities for enhancing food systems. Because commodity prices, including food, are often tied to global energy prices, energy use is particularly crucial. Food costs fluctuate and trend upward in tandem with global energy prices, resulting in a rapid increase in food insecurity.

Cold Storage Market Opportunity

Renewable refrigeration technologies to open new market opportunities

Cooling is the fastest-growing energy usage, but it's also one of the most critical energy discussion blind spots today. In many nations, rising cooling demand is putting great strain on electrical infrastructure and driving increasing emissions. In order to reach the EU's climate targets by 2050, the European Commission's Heating and Cooling Strategy cites initiatives such as "raising the percentage of renewables" and "reuse of energy waste from industry" as two critical areas for decarbonizing cooling. As a result, new technology development and adoption are crucial to satisfy end users' timely need by flexibly 'absorbing' renewable energy and/or waste heat and then 'converting into' and ‘storing' cooling energy.

The work tackled the most difficult aspect of developing and using cryogenic slurry, which is the suspension of PCM microcapsules in a carrier fluid. Cryogenic slurries are ideal cold storage candidates because they can be transported by pumps (high fluidity), and their effective temperature-dependent heat capacity can be easily designed by combining different capsules with low freezing point core PCMs to reduce exergy loss during charging and discharging processes.

Furthermore, experts in the School of Chemical Engineering are directing a green cooling technologies program including 12 research institutions and 5 industrial enterprises from across the world, with the goal of bringing new cooling technologies to market faster. The EU's Horizon 2020 program's Marie Sklodowska-Curie Research and Innovation Staff Exchange program is funding a four-year project called CO-COOL.

Segment Insights

Warehouse Type Insights

The private segment dominated the cold storage market share in 2025. The segment dominance is attributed to the rising investments by private retailers, especially in offering fast delivery solutions. Certain industries, especially those dealing with perishable goods and pharmaceuticals, have stringent regulatory requirements. Private cold storage facilities can be designed and operated to comply with these standards, ensuring product integrity and safety.

Private warehouses often provide businesses with the flexibility to scale their cold storage capacity based on demand. This scalability is essential for companies with fluctuating storage needs, enabling efficient capacity planning.

On the other hand, the public segment is observed to witness the fastest rate of growth during the forecast period. Public warehouses often operate on a larger scale, allowing them to benefit from economies of scale. This can lead to cost savings, making their cold storage services more cost-effective for businesses compared to establishing and maintaining private cold storage facilities. Public warehouses allow multiple businesses to share storage space and resources. This shared model can result in more efficient use of facilities, equipment, and personnel, optimizing overall operations.

Global Cold Storage Market Revenue, By Warehouse Type, 2022-2024 (USD Million)

| By Warehouse Type | 2022 | 2023 | 2024 |

| Private | 85,189.8 | 94,810.3 | 1,05,996.0 |

| Public | 47,990.6 | 54,125.3 | 61,318.3 |

Temperature Type Insights

The frozen food segment dominated revenue share in 2025 and is projected to witness remarkable CAGR over the forecast period. The increased consumption of the frozen food products in the developed markets and rising demand for the frozen food in the developing markets are the significant contributors of the frozen segment growth. The major items stored in frozen temperature type segment includes fruits, vegetables, fish, meat, dry fruits, eggs, dairy products, and various others. This segment is expected to remain dominant throughout the forecast period owing to the rising demand for the perishable food products and the increasing awareness regarding the unaltered nutrients in the frozen food. Further, the busy and hectic lifestyle of the consumers have led to the increased demand for the ready-to-cook and ready-to-eat food products, which spurs the growth of this segment.

The chilled segment is expected to register a significant CAGR during the forecast period. Chilling is in demand as it prevents the spoilage of food by preventing harmful bacteria growth. To store the perishable products for longer time period, the segment is expected to foresee a significant growth rate.

Global Cold Storage Market Revenue, By Temperature Type, 2022-2024 (USD Million)

| By Temperature Type | 2022 | 2023 | 2024 |

| Frozen | 1,01,035.7 | 1,12,307.6 | 1,25,401.7 |

| Chilled | 32,144.7 | 36,628.1 | 41,912.6 |

Construction Insights

Bulk storage dominates this segment in the cold storage market due to the economies of scale advantage. Bulk storage can hold a huge inventory, significantly reducing the cost per unit stored. This is ideal for large volumes of frozen meat, seafood, dairy, and even grains. Bulk storage options vary, supporting both frozen and chilled products, and these are usually housed in giant facilities that act as a buffer between production facilities and end markets, especially for seasonal products. Many developed nations already have large-scale bulk cold storage hubs, especially near agricultural and seafood-producing regions.

On the other hand, ports are projected to expand rapidly in the market in the coming years. Globalization has led to high demand for perishables such a fruit, meat, seafood, and even pharmaceuticals, which require temperature control. Cold storage facilities at ports reduce time spent between product handoffs, preserving quality and boosting overall food and medicine safety. Ports are already trade hubs, and adding cold storage facilities near them allows for better integration between temperature-controlled trucks, air freight, and containers. There is already existing infrastructure in most countries catering to ports, allowing for seamless integration for new businesses. Post-pandemic, ports are becoming hubs for biologics, vaccines, and temperature-sensitive chemicals, accelerating demand for advanced cold storage near shipping terminals.

Application Insights

The fish, meat, and seafood segment held the largest share in 2025. The segment is observed to sustain the position throughout the forecast period. The growth of retail chains and supermarkets, which offer a wide range of fresh and frozen products, has contributed to the demand for cold storage solutions to maintain the quality and safety of fish, meat, and seafood in these outlets.

The increasing global population and urbanization have led to higher consumption of protein-rich foods, including fish, meat, and seafood. Cold storage facilities support the efficient distribution of these products to meet the rising demand.

On the other hand, the dairy segment is expected to grow at the fastest rate during the forecast period. Dairy products, such as milk, cheese, and yogurt, are highly perishable and require specific temperature control to maintain freshness and prevent spoilage. Cold storage facilities provide the necessary temperature-controlled environment to extend the shelf life of these products. Cold storage helps extend the shelf life of dairy products, reducing the risk of spoilage and minimizing waste. This is crucial for the dairy industry, where product freshness is a key factor influencing consumer preferences.

Global Cold Storage Market Revenue, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Fruits & Vegetables | 13,418.2 | 15,098.1 | 17,065.1 |

| Dairy | 11,358.3 | 12,861.3 | 14,627.5 |

| Fish, Meat & Seafood | 42,478.4 | 47,348.2 | 53,016.5 |

| Processed Foods | 37,665.3 | 41,863.5 | 46,740.1 |

| Others (Pharmaceuticals, Chemicals, Etc.) | 28,260.2 | 31,764.5 | 35,865.2 |

Regional Insights

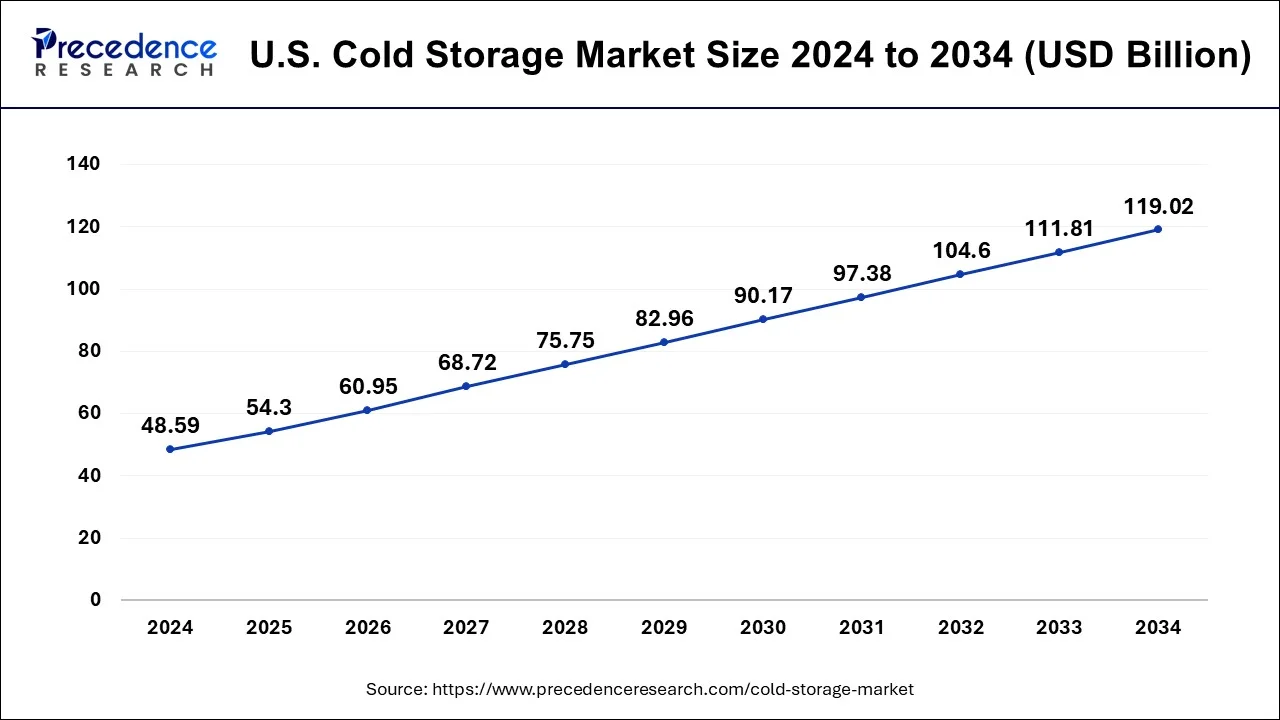

U.S. Cold Storage Market Size and Growth 2026 to 2035

The U.S. cold storage market size reached USD 54.3 billion in 2025 and is predicted to be worth around USD 126.23 billion by 2035, growing at a CAGR of 8.8% from 2026 to 2035

North America accounted 35.45% revenue share in 2025 and is projected to sustain its dominance over the forecast period. The increased adoption of cold storage in the organized retail sector has significantly boosted the growth of the cold storage market in the region. The increased awareness regarding the frozen food among the consumers, busy and hectic schedules of the consumers, and increased disposable income are the major factors that boosted the growth of the cold storage market in North America.

Asia Pacific is estimated to be the most opportunistic market. The rising urban population, rising disposable income, rising awareness regarding frozen food, rising penetration of organized retail sector, and increased demand for the convenience food among the consumers is fostering the demand for the cold storage systems in the region.

- The Asia Pacific cold storage market size was valued USD 35520.82 million in 2024 and expected to reach around USD 97,364.2 million by 2034 with a CAGR of 11.86% from 2025 to 2034.

- The North America cold strorage market size was valued USD 59,324.9 million in 2024 and is projected to hit around USD 1,48,652.7 million by 2034 with a registered CAGR of 10.75% from 2024 to 2034.

- The Europe cold storage market size was valued USD 43,403.7 million in 2024 and is increasing over USD 1,09,823.8 million by 2033 with a CAGR of 10.87% from 2025 to 2034.

U.S.

The U.S. is the leading cold storage market in North America because of its large and rapidly growing food and pharmaceutical industries. Many people in the U.S. shop online for groceries, which include food that needs to be cold-stored throughout the process. The U.S. has large companies that store frozen food and ship it. Strict regulations on food safety force the need for proper storage. A lot of cold storage facilities in the U.S. are employing modern technology such as Artificial Intelligence and automation to help fast-track growth. There is also a great opportunity for the U.S. to get ahead of the curve in sustainable storage solutions using green energy creators and environmentally friendly refrigeration systems.

- Americold developed solar panels at its Laverton, Melbourne site. The solar panel installation produces enough electricity to offset the energy use of more than 220 homes for one year, while avoiding more than 1,200 tons of CO? emissions annually.

- Flagler Global Logistics in Miami implemented a food cold?chain approved by the USDA to extend the shelf life of fruits and vegetables and create a hub for perishable imports from Latin America.

China

The cold storage market is growing quickly in China due to the increasing consumption of different types of fresh foods, including seafood, meats, and dairy products. In major cities, online food shopping is also quite popular, which requires cold storage to ensure safe delivery. As a result, China is investing in warehouses/ facilities to store and view these products properly. It is also important to note how the government is further investing in cold storage, through financial investment and the establishment of better regulations surrounding food storage. Smart technology is now being used across many companies, and some are even investing heavily in the development of cold storage technology to improve inventory management, logistics, and ultimately the experience for consumers. Furthermore, cold storage can also be described by its importance at a global level, for example, it is significant for vaccines and medicine, and there is also a progressing need for China to support with health care needs of its oversized and rapidly changing population. With a rapidly growing population, evolving health and welfare systems, and significant physical geography and lifestyle changes, there are a variety of opportunities for developing the cold storage market in China.

- For instance, in Chinese ports such as Shanghai and Tianjin, food products like meat have caused nearly full utilization of chilled storage capacity for imported goods. Importers were also forced to move their goods inland at an added expense as cold storage use volumes at port facilities approached their physical capacity limits prior to peak consumption seasons. This showcases the heavy usage of cold storage and its importance during the peak consumption season in China.

Value Chain Analysis

- Raw material sourcing (steel, plastic, electronics): Procurement and management of quality steel for structural support, plastics for insulation, and electronics for monitoring systems to maintain structural integrity and thermal efficiency.

Key Players: Tata Steel and JSW Steel Limited

- Component manufacturing (engines, transmissions, etc.): There is manufacturing of refrigeration compressors and control systems that are specialized and energy-efficient, rather than a certain manufacturing of vehicle components.

Key Players: Emerson Electric Co., Johnson Controls International PLC

- Vehicle assembly and integration: Integration of refrigeration units and monitoring systems into temperature-controlled storage facilities and vehicles, not general vehicle assembly.

Key Players: Snowman Logistics, Lineage Logistics

- Testing and quality control: Thorough testing and certification to ensure that temperature and humidity controls meet stringent regulatory and product-specific requirements before acceptance for storage or further handling.

Key Players: Food and Drug Administration (FDA),

- Distribution to dealers and OEMs: Organizing logistics and routing for perishable goods through the refrigerated fleet, rather than distributing manufacturing components to dealers.

Key Players: ColdEx Logistics Pvt Ltd., Americold Logistics

- Retail sales and financing: Selling storage service to end users alongside farmers and pharmaceutical companies, and providing financing for the operation and expansion.

Key Players: WareIQ, IIFL Finance

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

- In January 2020, Americold Logistics completed the acquisition of Nova Cold Logistics to expand and strengthen its position in Canada.

The various developmental strategies like acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

Cold Storage Market Top Companies

- Americold Logistics

- Lineage Logistics Holdings

- Nichirei Corporation

- Burris Logistics

- Agro Merchants Group

- Kloosterboer

- United States Cold Storage

- Tippmann Group

- VersaCold Logistics Services

- Henningsen Cold Storage Co

- Coldman

- Congebec Inc.

- Conestoga Cold Storage

- NewCold

- Hanson Logistics

Recent Developments

- In May 2025, DP World opened a new temperature-controlled warehouse in Taloja, Navi Mumbai, which experienced a Grade-A facility with an area of 110,000 sq ft with 11,000 pallet positions for dairy, frozen foods, seafood, pharmaceutical and perishable produce, and provided sustainable refrigerants, real-time tracking of the environment, fire protection, and had location benefits to Mumbai for airport and port to increase India's logistics.

[Source: https://www.themaritimestandard.com] - In August 2025, Americold submitted plans for an opening and expansion to its cold storage capacity in Melbourne, Australia. The global provider of outsourced temperature-controlled logistics said there was overwhelming demand for additional chilled and frozen food storage due to a rapidly growing population and e-commerce.[Source: https://greenstreetnews.com]

- In June 2025, Lineage, Inc. announced that it acquired four cold storage warehouses from Tyson Foods in Pennsylvania, Kansas, Illinois, and Arizona. The US$247 million deal added approximately 49 million cubic feet and 160,000 pallet positions. Lineage also committed over US$740 million toward new automated warehouses to be built in the U.S. under the same agreement.[Source: https://www.skooknews.com]

- In September 2025, BESSt Company, founded by Tesla alum Joley Michaelson, introduces a proprietary REDOX flow battery for power, data centers, cold storage, and AI infrastructure, offering safety, affordability, and supply chain resilience. (Source:https://www.prnewswire.com)

- In July 2025, Maersk launched a new logistics center in Olmos, Peru, to support the country's thriving agro-export sector, ensuring speed and freshness in Peru's fresh fruit exports.(Source:https://www.maersk.com)

Segments Covered in the Report

By Warehouse Type

- Private

- Public

By Temperature Type

- Frozen

- Chilled

By Construction

- Bulk Storage

- Production Stores

- Ports

By Application

- Dairy

- Processed Food

- Fruits & Vegetables

- Fish, Meat, & Seafood

- Pharmaceuticals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting