What is Frozen Food Market Size?

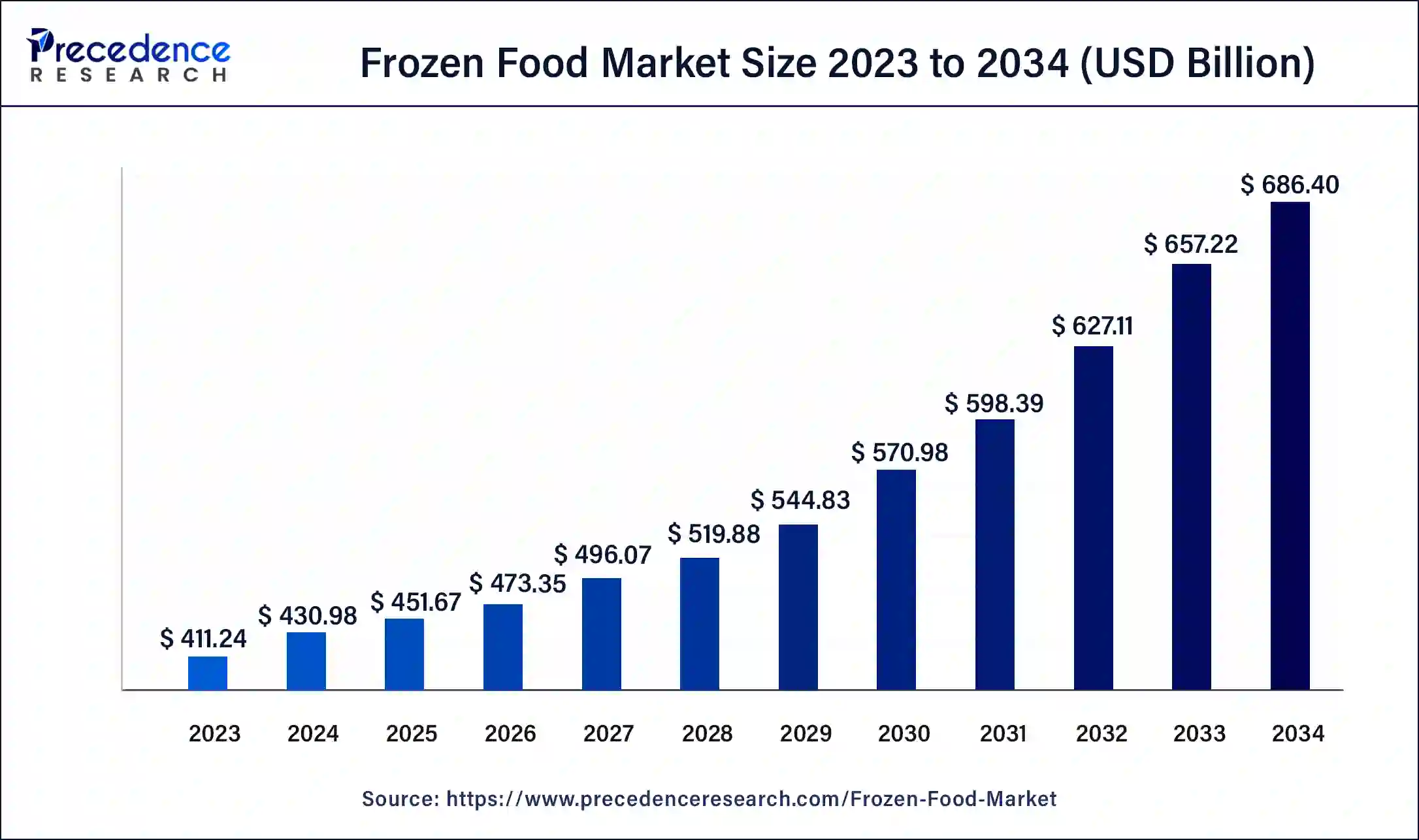

The frozen food market size accounted for USD 451.67 billion in 2025, and is anticipated to hit USD 473.35 billion by 2025, and is predicted to reach around USD 716.20 billion by 2035, growing at a CAGR of 4.72% from 2026 to 2035

Market Highlights

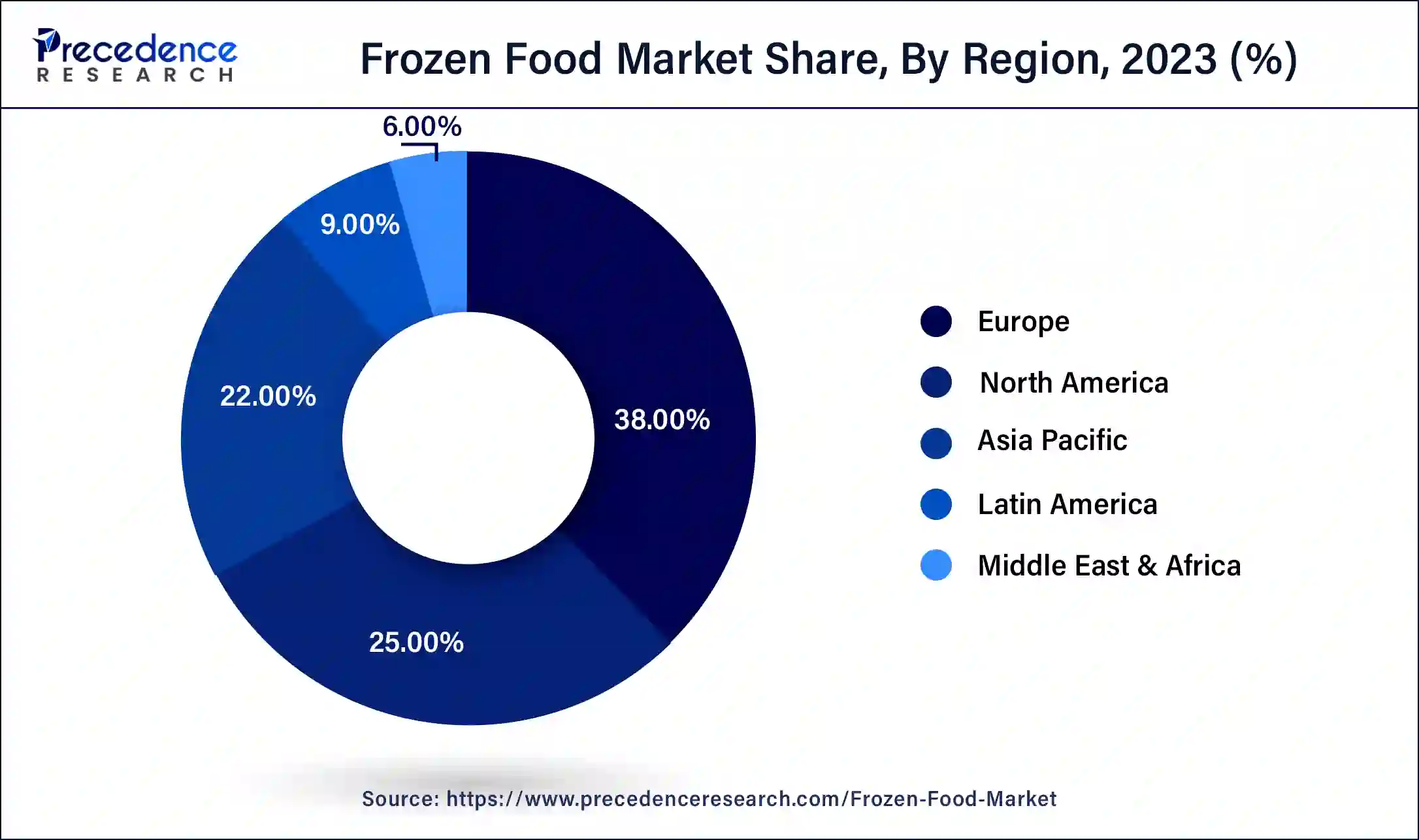

- Europe led the global market with the highest market share of 38% in 2025.

- By product, the frozen ready meals segment accounted largest revenue share of around 33% in 2025.

- By product, the fruits & vegetable segment is expected to grow at a CAGR of 6.1% from 2026 to 2035.

- By distribution channel, the offline segment has held a revenue share of around 88.9% in 2025.

- By distribution channel, the online segment has generated a revenue share of 11.1% in 2024 and growing at a CAGR of 5.4% from 2026 to 2035.

Market Overview

The global frozen market is increasing as there is increasing FDI in many developing nations. The frozen products market is expected to expand in the near future. Rising demand for convenience food technological advancements in the cold chain market and the developments in retail stores are driving forces for the growth of this market. As frozen food products require less time and effort as compared to cooking meals at home this market is expected to grow during the forecast. Freezing the food slows down the decomposition process and inhibits the growth of bacterial species. The use of preservatives is extremely less in frozen food products as the microorganisms do not grow at a temperature all 15 degrees Fahrenheit which happens to be sufficient in itself to prevent food spoilage. Most frozen food undergoes a mechanical process that uses vapor compression refrigerator technology. Advancements in these technologies have provided devices similar and better technologies for freezing foods. One of the main problems surrounding the freezing method is that the pathogens are deactivated but they do not get killed.

Frozen Food Market Growth Factors

The processed food or the frozen food market is driven by the greater need for food that is convenient to make and eat owing to the busy lifestyle of consumers. In developed as well as developing economies there are dual-income households so ready-to-cook foods are an easy option there's an increase in consumer preference for convenience food as they require a very less amount of time and effort as compared to the traditional cooking methods. Increasing disposable income is one of the factors which largely influences the growth of the frozen food market as there is an increase in the buying power amongst the consumers and they shall help in the growth of the market during the forecast. Latest trends are helping in the growth of the market as online grocery shopping by using various apps makes it extremely convenient for customers to pick their preferred frozen food through these websites. With doorstep delivery options, the market is expected to see growth. The nutritional value of frozen food does not deteriorate hence this is a healthy option. Owing to all of these factors the frozen food market is expected to grow well during the forecast period.

Market Outlook

- Market Growth Overview: The frozen food market is growing steadily, driven by increasing urbanization, rising consumer preference for convenient and ready-to-eat meals, and busy lifestyles. Health-conscious trends and the demand for nutritious, low-fat, and organic frozen options are further fueling market expansion.

- Global Expansion: The market is expanding worldwide as consumers in emerging regions adopt frozen foods due to rising disposable incomes and improved cold-chain infrastructure. Opportunities are significant in regions like Latin America, Asia-Pacific, and the Middle East & Africa, where urbanization, retail expansion, and e-commerce platforms are enhancing product accessibility.

- Major Investors: Key investors include multinational food companies, private equity firms, and venture capitalists that fund product innovation, distribution expansion, and cold-chain infrastructure development. Their investments help drive technological advancements, improve supply chains, and introduce healthier and convenient frozen food options to the market.

MarketScope

| Report Coverage | Details |

| Market Size in 2025 | USD 451.67 Billion |

| Market Size in 2026 | USD 473.35 Billion |

| Market Size by 2035 | USD 716.20 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.72% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Distribution Channel, Consumption, Type, and Freezing Technique and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Restraining Factors

Cold chain logistics is an essential requirement for the storage of frozen food in all nations. Emerging nations are still lacking in the infrastructure of cold chains and are not able to provide safe products to their populace. Though these foods' shelf life is very long, adequacy of infrastructure leads to the wastage of these food products resulting in a loss to its producers. Investments are very less in developing nations due to the financial crisis, which in turn is hampering the growth of cold chain businesses in this area. However, emerging nations have a lot of lucrative opportunities for funding on account of the changing consumer preferences towards frozen foods and the increasing acceptance of them.

According to Nielsen Market Research Company, frozen and shelf-stable foods were prominent in shopping carts during the COVID-19 pandemic. Consumers stocked up on these food items which helped to reduce the number of trips they needed to make to the grocery store. Nielsen data shows that frozen foods were in the top five food categories with significant sales growth from March to June 2020

While some consumer purchasing habits, such as buying frozen products, may extend beyond the pandemic, other factors may also influence frozen food sales in the future. The impact of the pandemic, and therefore the impact on purchasing power, is not equal among consumer groups. Financially impacted consumer groups may adopt new shopping strategies, for instance, some may opt for more frozen foods over fresh foods to reduce costs. Apart from pandemic impacts, frozen food is one of the most convenient ways for consumers to find meal solutions. In recent years, food manufacturers have given the frozen food category a sharper focus by developing a greater number of tasty and nutritionally-rich products. Given these facts, it is worth getting some insights into frozen food sales trends in Alberta. Such analysis could help Alberta food processors pursue potential opportunities in frozen food manufacturing.

Tomorrow of Frozen Food

Manufacturers of frozen food are employing technologies like Individually Quick-Frozen (IQF) technology to enhance food quality. Through this technology, food products are placed on a conveyor belt to transfer them to the blast freezer which freezes the product in no time. With this technology, each molecule in the product is frozen well, which is totally inverse of block or bulk freezing. This technology helps in getting an improved quality of products with higher nutritional values. IQF prevents the freezer from the formation of snow by lowering the dryness of the items. Reduced dehydration in the items helps food processing companies to turn up more profit. This technology saves a significant amount of energy, owing to frequency converters deployed over every fan. This setup does not need much refrigeration in an effort to chill off the heat created through fans. This technology provides tender handling and a better division of the items at all phases of the process. It gives an absolute premium item with a conventional look as an end result.

Segment Insights

Product Insights

On the basis of the product type, the frozen ready meals segment has generated highest revenue share in 2023. The ready-to-eat meals or the convenient meals segment is expected to dominate the market during the forecast period. In recent years convenient and ready-to-eat meals have seen major growth. The reason that contributes to the growth of the frozen food market is the changing and busy lifestyles of people across the world and an increase in the consumption of frozen foods due to the high amount of disposable income and increased spending power. Even though frozen food is packed food the nutritional value of this food does not deteriorate frozen food is healthy to eat hence even their health-conscious customers wouldn't refrain from buying frozen foods. As there is a high acceptance of these convenient and ready meals which are available through various distribution channels this market segment is expected to grow.

Frozen ready-to-eat meals are complete meals that do not require any other additional ingredients in order to enhance the taste. They are a healthy alternative to fresh food. It is extremely affordable convenient and helps in saving time as the food requires hardly any time to cook. The revenue for ready meals is expected to reach US$ 138.56 billion by the year 2030. Due to the technological innovations in the frozen food industry, these ready-to-cook meals are microwaveable, portion-controlled, and shelf stable. An increased number of women entering the workplace and changing lifestyles is boosting the demand for frozen meals across many nations. Frozen ready-to-cook meals are easy for people who have a hectic lifestyle, people who stay alone and do not want to prepare an entire meal, and also for people who are trying to lose weight.

Distribution Channel Insights

The online retail segment is expected to have the largest market share during the forecast period. The online retail segment shall have a CAGR of 9% during the forecast. After the pandemic, the sales of frozen fruit through online retails have grown drastically this segment helps in offering convenience to the customers and a variety of options to choose from. The e-commerce platform for food had the greatest growth through the pandemic which had a gain of about 84%. The offline market segment should also have a good market share during the forecast. The technologically advanced infrastructure in various hypermarkets and convenience stores that have provisions for freezing and temperature control facilities will drive the market of this segment during the forecast.

Type Insights

The type segment of the frozen foods market is categorized into raw material, ready-to-eat, ready-to-cook, and ready-to-drink. Among these segments, ready to cook sub-segment is estimated to grow at the fastest rate. Ready-to-cook products are highly suitable for working professionals as they consume less time than conventional ones. The growth of ready to cook segment is attributed to factors such growing populace across the globe, a major shift in the lifestyles of individuals, an increasing number of working women globally, and an increase in disposable income.

Regional Insights

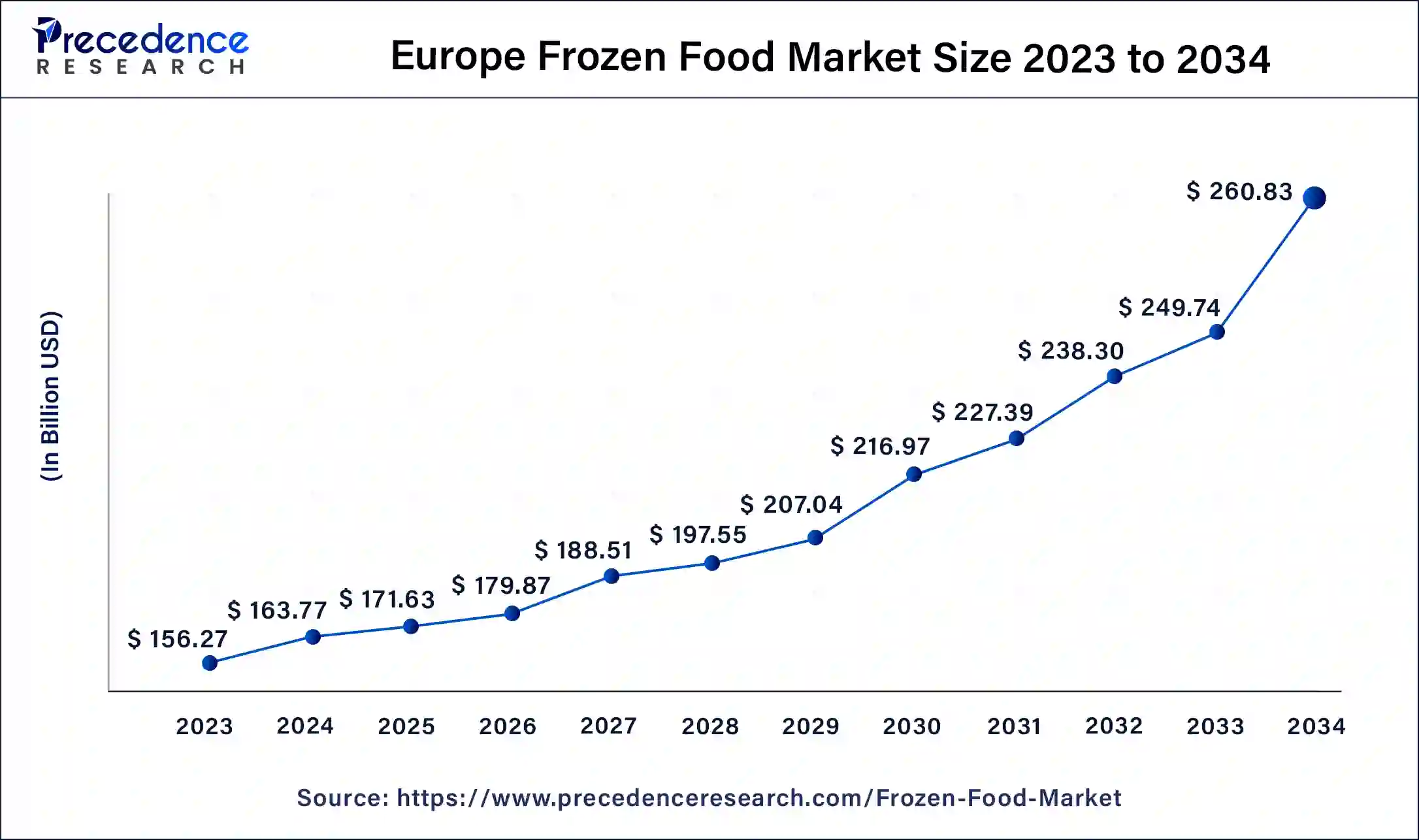

Europe Frozen Food Market Size and Growth 2026 to 2035

The Europe frozen food market size is estimated at USD 171.63 billion in 2025 and is predicted to be worth around USD 272.15 billion by 2035, at a CAGR of 4.72% from 2026 to 2035.

Europe region has accounted largest revenue share of around 38% in 2024. Rising requirement for flexible food options and changing lifestyles in European countries create a significant factor for the market to expand in such areas. The COVID-19 pandemic created significant potential for the frozen foods market in Europe to expand as the pandemic disrupted supply chains for multiple areas where people continued their emphasis over frozen foods. Additionally, Europe's well established cold chain infrastructure has promoted the growth of the market in past few years. Similarly, people opting for vegan options in food and beverages create another potential for the market to grow.

In Europe, the UK led the market owing to convenience, increasing prices, and shifting consumer preferences. Also, innovations in freezing/packaging technologies and a surge in online grocery shopping are also contributing to this growth. The proliferation of hypermarkets and supermarkets with freezer sections, coupled with the increasing need for healthier food options, impacts positive market growth further in the country.

Depending upon the geography the Asia Pacific region shall have the largest market share for the frozen food market during the forecast. It shall have a CAGR of 9.2% till the year 2034. Countries like India and China shall have the largest market share in the Asia Pacific region. There are many reasons for the growth in these countries. An increased per capita income, increased disposable income and an ever-increasing population in these nations shall make them the largest markets for frozen food. The market for frozen food shall have good growth during the forecast period in the European region. Improved standard of living and increasing need for convenience is driving the market for frozen food in European nations. There's a higher level of consumption of frozen food in many nations. The sentence competition in the frozen food sector makes the food extremely superior in taste as well as in quality. In the countries like United Kingdom Germany and France, there is major growth in the frozen Foods Market.

What Potentiates the Market in Asia Pacific?

In Asia Pacific, India dominated the market due to the increasing disposable incomes, rapid urbanization, and shifting lifestyle and dietary habits along with the innovations in cold chain infrastructure. In addition, consumers are becoming increasingly aware of global food trends and seeking healthy food options and international cuisines, which are available in frozen form.

How is the Opportunistic Rise of North America in the Frozen Food Market?

North America is expected to grow at a notable rate over the forecast period. The growth of the region can be credited to the growing need for health and wellness options, convenience, and ready-to-eat meal solutions. Moreover, factors such as a surge in disposable incomes, busy lifestyles, and the extensive availability of convenient frozen food products are driving regional growth shortly.

What are the Major Factors Driving the Market in Latin America?

The frozen food market in Latin America is expected to grow significantly over the forecast period, driven by rapid urbanization and increasing consumer preference for convenient frozen products. Expansion of large retail chains like Carrefour and Walmart has improved accessibility for middle-income consumers, while Argentina and Chile lead the trade in frozen fruits, vegetables, and seafood. Additionally, the rise of e-commerce platforms, accelerated by the COVID-19 pandemic, has further enhanced access to ready-to-eat and frozen meals across the region.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) presents significant opportunities in the frozen food market, fueled by rising demand for convenient, ready-to-eat options and increasing urbanization. Fast-paced lifestyles are driving a preference for RTE meals and frozen snacks, while the industry is evolving through innovative products and a growing focus on sustainable, eco-friendly packaging. Consumers in the region are also becoming more health-conscious, driving demand for low-fat, nutrient-rich frozen options such as fruits, vegetables, gluten-free products, and organic meals. Manufacturers are responding by introducing “clean label” products and frozen foods that align with health and wellness standards.

Value Chain Analysis

- Raw Material Sourcing

This stage involves sourcing vegetables, fruits, meat, seafood, grains, and dairy. Raw materials must meet food safety and quality standards before processing them.

Key Players: Cargill, Dole, Tyson Foods - Manufacturing and Processing

In this stage, the food is washed, cooked, blanched, and then frozen with the help of IQF technology or blast freezing. Rapid freezing helps to preserve taste, texture, and nutrients.

Key Players: General Mills, Nestle, McCain - Distribution to Retail

In this stage, the packaged frozen food is distributed to supermarkets, convenience stores, and food service outlets.

Key Players: Walmart, Tesco, Amazon Fresh

Frozen Food Market Companies

- General Mills Inc (US)

- Conagra Brands, Inc. (US)

- Grupo Bimbo S.A.B. de C.V. (Mexico)

- Nestle SA (Switzerland)

- Associated British Foods plc (UK)

- Ajinomoto (Japan)

- Vandemoortele NV (Belgium)

- LantmannenUnibake International (Denmark)

- Cargill (US).

- Unilever (Netherlands)

- Kellogg Company (US)

- McCain Foods Limited (Canada)

- Kraft Heinz Company (US)

Recent Developments

- In June 2025, Booker announced to launch of a new fresh and frozen food brochure, designed to help independent retailers maximize opportunities in one of the fastest-growing areas of convenience retail. The brochure will highlight standout lines across Booker's Retail Partners (BRP) fresh and frozen ranges, including own-brand products such as Jack's.

(Source: https://www.betterretailing.com) - In February 2025, Kolkata-based ITC signed definitive agreements to acquire Prasuma, a company in India's frozen, chilled, and ready-to-cook foods space. Prasuma, which specializes in oriental cuisine (viz. momos, baos, Korean fried chicken), delicatessens, and raw meats, sells a wide assortment of 170+ products.

(Source: https://indianstartupnews.com) - In June 2025, Allana Consumer Products (ACPL) laucnhed its strategic foray into the adjacent frozen food segment with the launch of premium-quality French Fries. This move reflects ACPL's commitment to expanding its diversified portfolio and seizing a substantial share of the rapidly growing global frozen food market.

(Source: https://www.foodtechbiz.com) - In 2021, Nomad Foods Limited company completed what it previously announced which was the acquisition of Fortenova Group's frozen food business (Fortenova Frozen).

- In 2021, Tyson Foods Inc. launched a new line of plant-based products in select retail markets and e-Commerce markets across the Asia-Pacific region under the brand name First Pride, it will introduce frozen Bites, Stripsmade, and nuggets.

- In 2021, Nestle expanded its frozen food factory in South Carolina. Nestle invested an amount of USD 100 million in the company's brands like Stouffer's and Lean Cuisine.

Segments Covered in the Report

By Product Type

- Ready Meals

- Frozen Seafood

- Frozen Meat &Poultry

- Frozen Fruit &Vegetables

- Frozen Potatoes

- Frozen Soups

- Bakery Products

- Others

By Distribution Channel

- Offline

- Online

By Consumption

- Food Service

- Retail

By Type

- Raw material

- Ready-to-eat

- Ready-to-cook

- Ready-to-drink

By Freezing Technique

- Individual Quick Freezing (IQF)

- Blast Freezing

- Belt Freezing

- Other

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content