What is the Truck Rental Market Size?

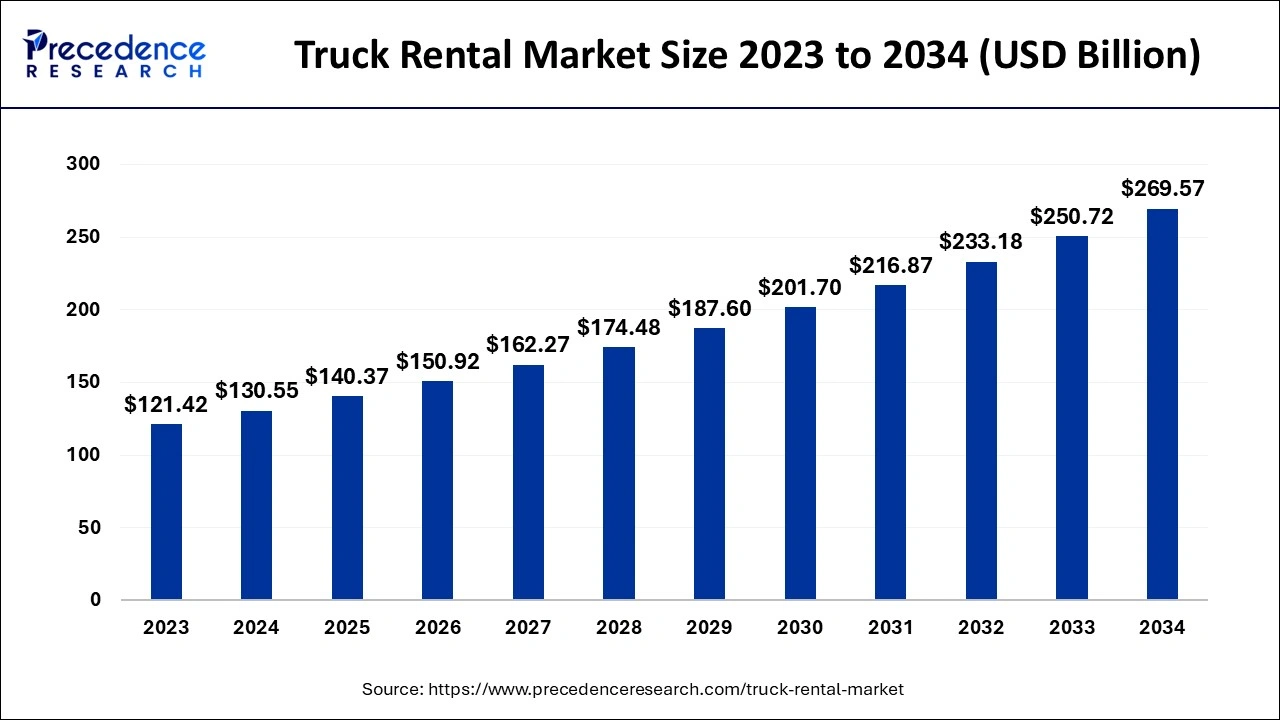

The global truck rental market size is calculated at USD 140.37 billion in 2025 and is predicted to increase from USD 150.92 billion in 2026 to approximately USD 269.57 billion by 2034, expanding at a CAGR of 7.52% from 2025 to 2034.

Truck Rental Market Key Takeaways

- In terms of revenue, the global truck rental market is valued at USD 140.37 billion in 2025.

- It is projected to reach USD 269.57 billion by 2034.

- The market is expected to grow at a CAGR of 7.52% from 2025 to 2034.

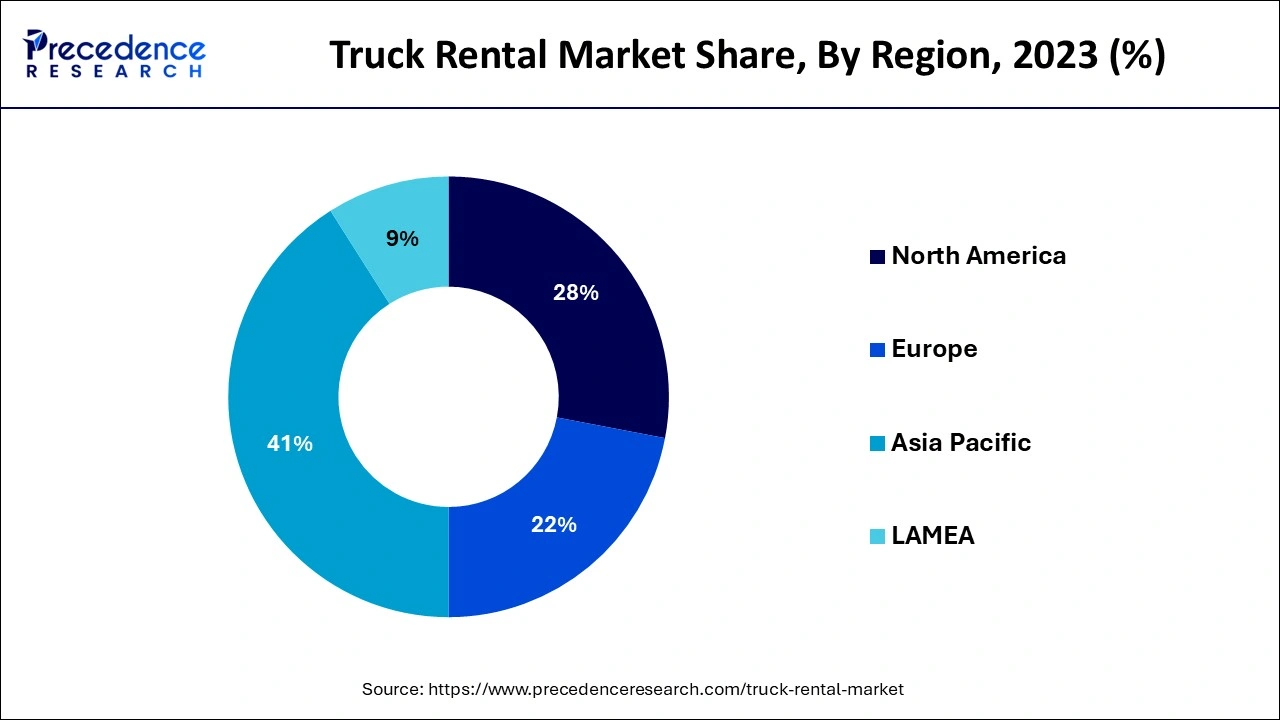

- Asia Pacific dominated the truck rental market and contributed more than 41% of the market share in 2024.

- North America is expected to show the fastest growth during the projected period.

- By truck, the light-duty segment generated the biggest market share of 70% in 2024.

- By truck, the heavy-duty segment is expected to grow at a significant rate over the forecast period.

- By duration, the short-term segment led the market in 2024 by holding the largest truck rental market share.

- By duration, the long-term segment is expected to grow at a significant rate during the projected period.

- By propulsion, the internal combustion engine (ICE) segment dominated the market in 2024.

- By propulsion, the electric segment is estimated to grow significantly over the studied period.

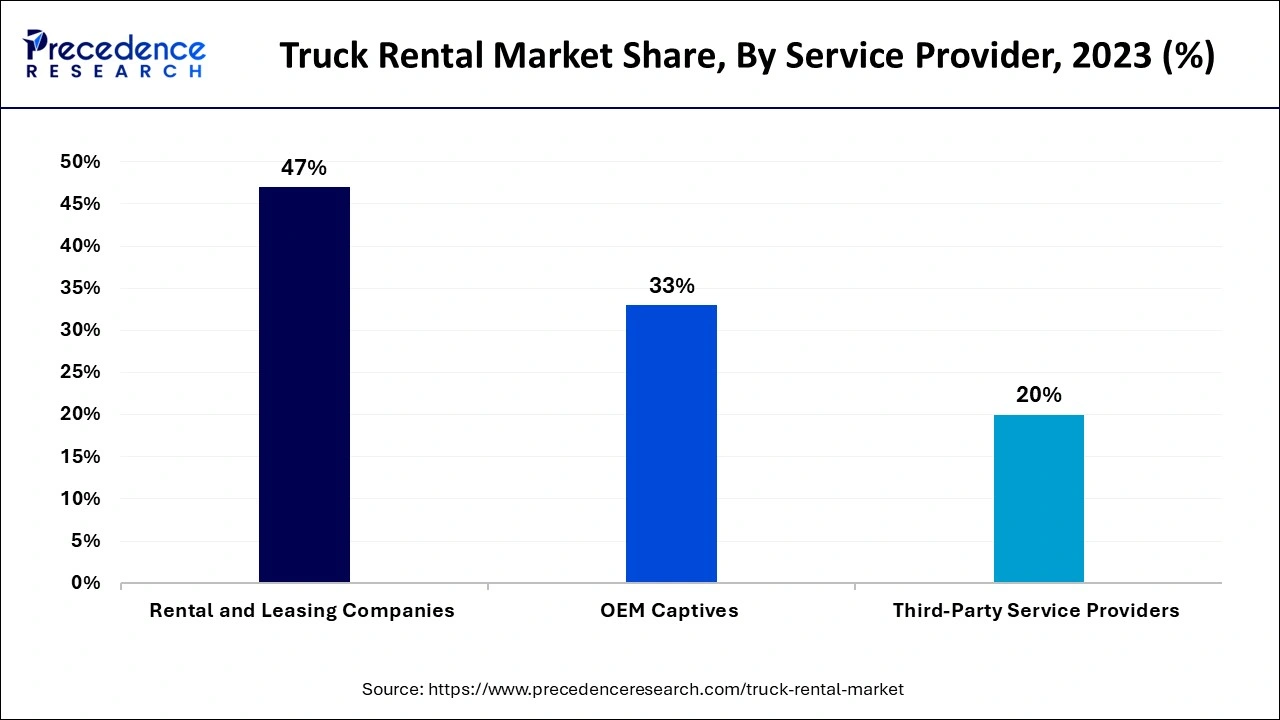

- By service provider, the rental and leasing companies segment accounted for the largest market share of 41% in 2024.

- By service provider, the OEM captives segment is projected to grow significantly throughout the forecast period.

Role of AI in the Truck Rental Market

AI technology can transform the way truck rental operations are performed optimize the rental processes and customer experiences, and contribute to the best industry practices. Furthermore, Artificial intelligence algorithms can simulate human intelligence while performing tasks related to truck rental operations, such as fleet optimization, reservation management, and maintenance scheduling.

- In April 2024, Penske Truck Leasing unveiled an industry-first AI platform that aims to revolutionize fleet management and offers real-time monitoring of fleet performance. Catalyst AI makes an important shift away from conventional industry standards that empowers fleet managers with actionable intelligence. by leveraging dynamic comparative data.

Market Overview

Truck rental is a process of hiring or leasing business trucks which generally serves agencies or companies that have their own truck fleets. Renting a truck reduces the operational cost and risk associated with seasonal transport demand. Renting a truck with full-service lease cuts the financial liability of maintenance, vehicle replacement and servicing. These factors help in the expansion of truck rental market growth.

- Industry Growth Overview: The truck rental market is experiencing steady growth driven by increasing demand from logistics, e-commerce, and construction sectors, along with rising urbanization and the need for cost-effective, flexible transportation solutions. The adoption of technology-enabled booking and fleet management platforms further contributes to market expansion.

- Global Expansion: The market is growing worldwide as businesses across logistics, construction, and e-commerce increasingly look for flexible, short-term transportation options. Growth is driven by urbanization, infrastructure development, and digital platforms that make fleet booking, management, and maintenance easier globally.

- Major Investors: Major investors in the market include fleet management companies, private equity firms, and logistics service providers, who fund fleet expansion, technology integration, and service network development, thereby supporting industry growth and enhancing operational efficiency across the commercial and industrial transportation segments.

- Startup Ecosystem: The startup ecosystem in the market is rapidly evolving, with new companies leveraging digital platforms, mobile apps, and IoT-enabled fleet management to offer on-demand, flexible, and cost-efficient rental solutions. These startups focus on last-mile logistics, sustainability, and enhanced customer experience.

Truck Rental Market Growth Factors

- A rise in demand for the optimization of operational risks is expected to fuel market growth soon.

- Growing demand for cost-effective solutions from fleet operating companies can boost the truck rental market growth further.

- The surge in freight transport supported by favorable trade policies will likely help the market expand shortly.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 269.57 Billion |

| Market Size in 2025 | USD 140.37 Billion |

| Market Size in 2026 | USD 150.92 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.52% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Truck, Duration, Propulsion, Service Provider, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising focus on total cost of ownership

Industries across the globe have become more focused on the total cost of ownership than ever before. Efforts to boost the same area drive the adoption of truck rental on a grand scale as companies look to grow their profits and minimize risks. Additionally, demand for deliveries across the world is growing rapidly, and this trend is enabling delivery service providers to use truck rental services. Trucks are a massive investment, so most delivery providers opt for these services.

- In February 2024, Daimler Truck announced plans to launch its first truck rental business in Brazil. This decision was made when the Brazilian economy faced several challenges, such as soaring vehicle prices, stringent emission regulations, and high interest rates that complicated vehicle financing. Providing a more flexible and cost-effective solution than outright purchasing.

Restraint

Driver shortage and training issues

The industry faces a lack of skilled drivers which can affect the availability of trucks for rental services and impact service quality. Moreover, drivers have to be trained and licensed to operate different types of rental trucks can further constrain the truck rental market growth. Truck rental providers also struggle to maintain optimal operational costs, hindering market growth.

Opportunity

The growth in global industrialization and urbanization

As the world economy undergoes substantial growth, industrial zones and urban areas will experience improved development and infrastructure. This progress is mainly facilitated by logistics and transportation, with commercial vehicles (CVs) acting as a fundamental element in establishing a robust global infrastructure. Furthermore, heavy-duty trucks like Light Commercial Vehicles (LCVs) play an important role in advancing industrial development in tasks such as trailer towing.

- In June 2024, an EXETER-based group unveiled a new vehicle rental business named Switch, which is a division of the company's strategic growth plans. The new Switch brand will operate alongside Scot Group's Van Rental operation and Thrifty Car.

Segment Insights

Truck Insights

The light-duty segment led the truck rental market in 2024. The dominance of the segment can be attributed to the growing demand for sophisticated transportation solutions among local and small-scale businesses. Light-duty trucks benefit companies like food vendors, local delivery services, and tradespeople. Additionally, the availability and affordability of rental services make these businesses work more efficiently without the economic burden of buying a vehicle.

- In April 2024, Daimler India Commercial Vehicles (DICV) said that it would unveil its first electric truck in India called ‘eCanter' within the next year. With eCanter, the German company will be entering the market in India.

The heavy-duty segment is expected to grow significantly over the forecast period. The expansion of the segment is driven by the growth of the supply chain sector and logistics. As global trade grows and supply chains become more tedious, there is an increasing requirement for reliable transportation of goods over large distances. Also, players in the logistics sector often seek to rent heavy-duty trucks to maintain seasonal demand during peak periods.

Duration Insights

The short-term segment led the market in 2024 by holding the largest truck rental market share. This is due to the surge of the gig economy along with the growing number of self-reliant contractors in the transportation and logistics sector, which fuels the growth of short-term truck rentals. Moreover, freelance drivers and on-demand delivery offerers prefer short-term rentals to fulfill particular job requirements, which drives the growth of the segment in the truck rental market.

The long-term segment is expected to grow significantly during the projected period. The expansion of the segment is credited to the increasing depreciation risk coupled with the rising focus on the core vehicle operations by end users. Furthermore, trucks and commercial vehicles can lose value as time passes, substantially impacting a company's balance sheet. This segment copes with this issue by transferring the burden of loss to the rental company.

Propulsion Insights

The internal combustion engine (ICE) segment led the truck rental market in 2024. This is because of the strong presence of firm Infrastructure and support systems. The infrastructure supporting ICE trucks, like maintenance facilities and refueling stations, is widely available and well-established. This wide network offers reliability and convenience for businesses that depend on ICE trucks.

The electric segment is estimated to grow significantly over the studied period. The growth is linked to the increase in urbanization and the deployment of low-emission zones in various cities. These zones limit access to areas with huge pollution levels, which makes electric trucks reliable for operations in these zones. This alignment with urban climate policies propels the segment growth.

- In August 2024, Euler Motors, a commercial electric vehicle producer, announced its expansion into the small commercial vehicle market. The company will likely introduce its first four-wheeler with a payload capacity of over 1,000 kg during the upcoming season.

Service Provider Insights

The rental and leasing companies segment led the truck rental market by holding 47% market share in 2024. The dominance of the segment is attributed to the enhanced services and customer support provided by these players. Many companies provide value-added services, including 24/7 roadside surveillance and catering leasing solutions specific to business needs. These developments in customer support and service quality enable rental and leasing options to be more favorable to many businesses.

The OEM captives segment is projected to grow significantly through the forecast period. Owning customized financing options that are more appealing than those offered by traditional lenders. OEM captives provide lower interest rates and flexible payment schedules. These flexible financing solutions reduce the financial burden linked with acquiring new trucks and, hence, optimize the supporting fleet.

Regional Insights

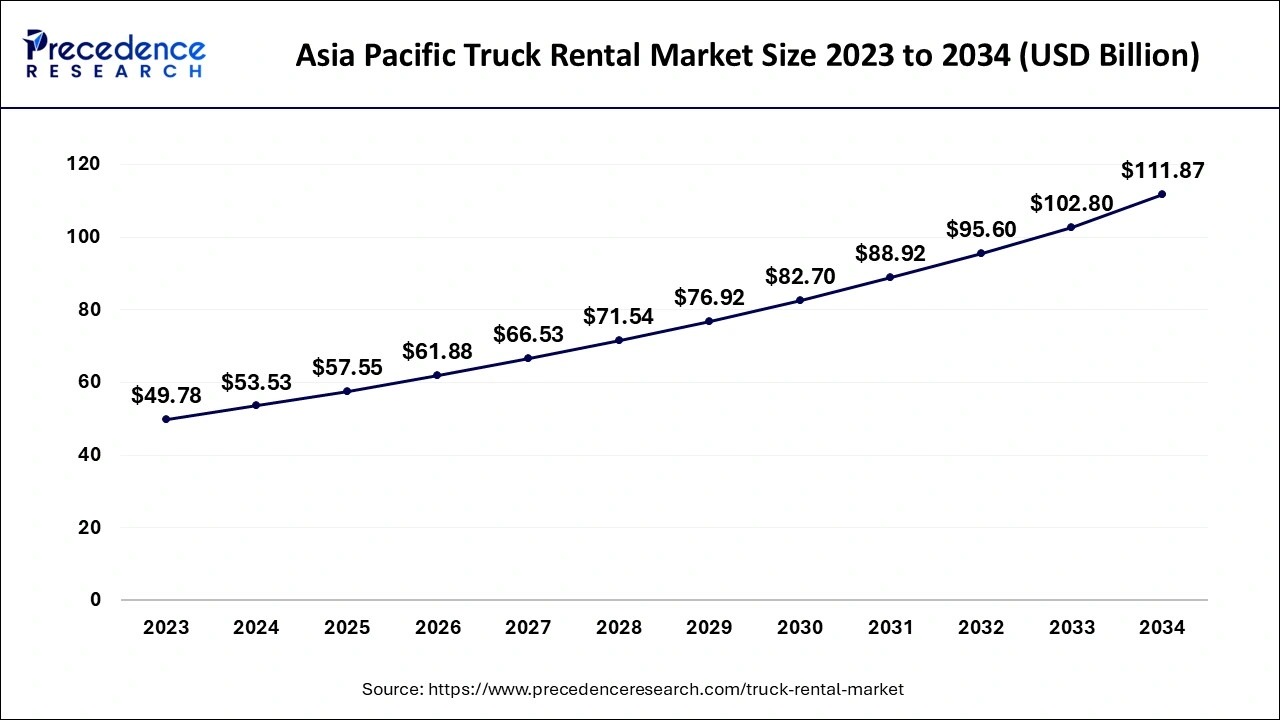

Asia Pacific Truck Rental Market Size and Growth 2025 to 2034

The Asia Pacific truck rental market size is evaluated at USD 57.55 billion in 2025 and is projected to be worth around USD 111.87 billion by 2034, growing at a CAGR of 7.65% from 2025 to 2034.

Which Factors Contribute to Asia Pacific's Dominance in the Market?

Asia Pacific dominated the truck rental market in 2024. The dominance of the region can be linked to the rising urbanization and industrialization which is stimulating the demand for truck rental services in this region. Furthermore, Introduction of numerous new infrastructure developments in countries such as India, China, and Japan are also opting to create new growth opportunities in the truck rental market.

China is a major contributor to the Asia Pacific truck rental market due to its rapidly expanding logistics and e-commerce sectors, which drive high demand for flexible, on-demand transportation solutions. Additionally, large-scale infrastructure development, urbanization, and a growing fleet of commercial vehicles support the widespread adoption of truck rental services across the country.

What Makes North America the Fastest-Growing Region in the Truck Rental Market?

North America is expected to show the fastest growth during the projected period. The growth of the region can be driven by the increasing need for urban delivery services created by the growth of on-demand services and online shopping. Moreover, Urban areas in North America face difficulties related to congestion and restrictions on vehicles. The truck rental market in the US is witnessing substantial growth in the North American region due to the diversification of services provided by rental companies.

The U.S. is a major contributor to the North America truck rental market due to its large logistics, construction, and e-commerce sectors that rely heavily on flexible, short- and long-term truck rental solutions. Strong infrastructure, extensive commercial vehicle networks, and high demand for cost-efficient fleet management further drive the adoption of truck rental services across the country.

- In August 2024, a Mobility platform for rental trucks and vans will launch in the UK. Flexter, based in Montreal, Canada, provides fleets access to different commercial vehicles from different providers through its online booking platform.

How Big is the Success of Europe in the Market?

Europe is growing at a notable rate in the truck rental market due to well-established logistics infrastructure, increasing demand from e-commerce and construction sectors, rising urbanization, and the adoption of technology-enabled fleet management solutions. Strong regulatory frameworks and efficient transportation networks further support market expansion across the region. Germany is a major contributor to the market due to its large logistics and transportation industry, advanced infrastructure, and high demand for flexible commercial vehicle solutions across manufacturing, retail, and construction sectors.

How Crucial is the Role of Latin America in the Truck Rental Market?

Latin America is expected to grow at a lucrative rate in the market due to increasing industrialization, rising e-commerce and retail distribution needs, and expanding construction activities. Improving road infrastructure, growing demand for flexible, cost-effective transportation solutions, and the adoption of digital fleet management platforms further enhance market opportunities across the region. Brazil is a major contributor to the Latin American market due to its large logistics, transportation, and e-commerce sectors, which require flexible, cost-effective vehicle solutions.

How Big is the Opportunity for the Market in the Middle East & Africa?

The Middle East & Africa present significant growth opportunities in the truck rental market, driven by expanding logistics, e-commerce, and construction sectors. Rising urbanization, infrastructure development, and government initiatives supporting trade and industrial expansion boost demand for flexible transportation solutions. Additionally, increasing adoption of digital fleet management, on-demand rental platforms, and cost-effective truck rental services allows businesses to optimize operations, reduce capital expenditure, and meet growing commercial and industrial transportation needs efficiently across the region.

The UAE dominates the market in the Middle East & Africa due to its advanced logistics infrastructure and strong construction and e-commerce sectors. High demand for flexible, cost-effective transportation solutions, the adoption of digital fleet management, and government support for trade and industrial development further reinforce the UAE's leading position in the regional market

Top Companies in the Truck Rental Market & Their Offerings

-

Ryder System, Inc.: Provides full-service truck leasing, rental, and fleet‑management solutions, serving commercial and logistics customers with long-term contracts and tailored fleet support.

-

Penske Truck Leasing: Offers a broad range of light to heavy‑duty trucks for hire or lease, with maintenance services, flexible rental durations, and fleet-management tools for businesses of all sizes.

-

Enterprise Truck Rental:Focuses on short-term and flexible rentals for businesses needing trucks quickly (e.g., for construction, logistics, or seasonal demand), with ease of booking and widespread availability.

-

Hertz Global Holdings, Inc.:Includes truck and van rental solutions in its mobility portfolio, catering to corporate clients and small businesses needing cargo transport or short-haul logistics.

-

Europcar Mobility Group:Operates truck and van rental services especially in Europe (and to some extent globally), offering flexible truck rental, light commercial vehicles, and mobility‑as‑a‑service solutions to SMEs and enterprise clients.

-

Sixt SE:Provides truck and van rental services with a focus on convenience, modern fleet, and user-friendly booking; targets businesses needing short‑ or medium‑term rentals across multiple geographies.

-

United Rentals, Inc.:Though known primarily for construction and equipment rental, it also offers truck and vehicle rentals for industrial, municipal, and commercial customers, supported by a very large vehicle fleet and global network.

Other Major Players

- Avis Rent A Car System, LLC

- NationaLease

- Daimler Truck AG

- Bush Truck Leasing

- Kenworth Sales Company

Recent Developments

- In February 2024, Mercedes Benz, a leading automotive company based in Germany, introduced its entry into the truck rental business in Brazil. The company decided to capitalize on the soaring prices of new vehicles, which is stimulating the demand for rental and leasing services.

- In February 2024, Flexter, an online marketplace for locating and sharing moving truck availability and costs in real-time, partnered with Green Motion, a supplier of rental software solutions. The partnership aims to expedite the short-term truck rental booking procedure worldwide.

- In July 2023, NHR Group and Hertz partnered to enhance the company's truck and van rental offerings. Through the partnership, Hertz's large fleet and logistical know-how will be combined with NHR Group's significant market share in New Zealand's commercial vehicle rental market.

Segments Covered in the Report

By Truck

- Light Duty

- Medium Duty

- Heavy Duty

By Duration

- Short Term

- Long Term

By Propulsion

- Internal Combustion Engine (ICE)

- Electric

By Service Provider

- Rental and Leasing Companies

- OEM Captives

- Third-Party Service Providers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting