What is the Electric Truck MarketSize?

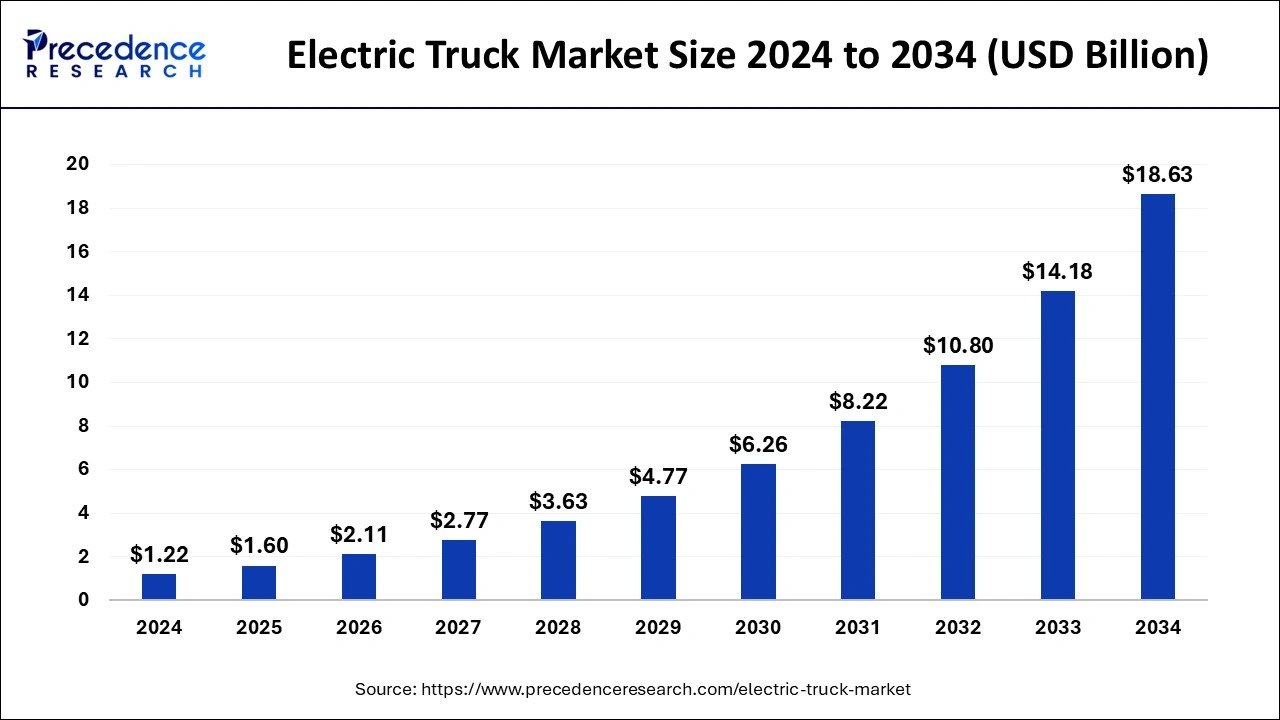

The global electric truck market size is calculated at USD1.60 billion in 2025 and is predicted to reach around USD 21.61 billion by 2035, expanding at a CAGR of 29.73% from 2026 to 2035. The rising demand to reduce air pollution, improve air quality and contribute towards greener transportation is encouraging the growth of the electric truck market.

Market Highlights

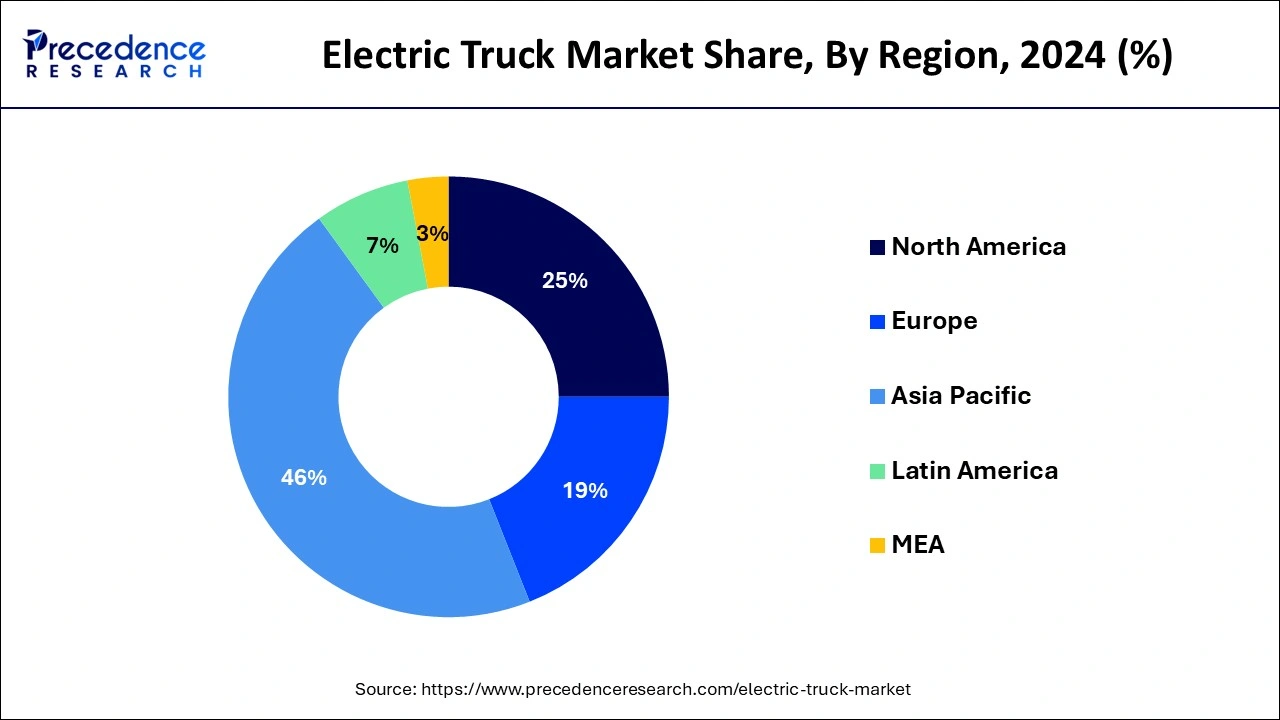

- Asia Pacific dominated the electric truck market in 2025.

- North America is projected to expand at the notable CAGR during the forecast period.

- By propulsion, the battery electric trucks segment dominated the electric truck market in 2025.

How is Artificial Intelligence (AI) Changing Electric Vehicle Industry?

Integration of artificial intelligence into electric trucks brings automation, enhanced safety features, GPS, battery optimization and many more. Overall, AI makes an electric truck be smarter transportation landscape. With the growth expansion, the automobile sector allows enterprises to track operations, optimize business planning, produce autonomous and semi-autonomous vehicles, and improve digital outcomes.Additionally, data science and machine learning technology support automotive companies to drastically enhance from research to design and manufacturing to everything in between.

According to an International Energy Agency survey, over 250,000 electric vehicles were sold every week in the last year worldwide. With this continuous progress, it is expected that EVs to account for 40% of car sales by 2030.

Electric Truck Market Growth Factors

- Electric trucks are known to significantly reduce carbon footprint and contribute towards a cleaner and greener environment. Electric vehicles eliminate the exhaust emission of NOx and PM2.5 and reduce particulates from brake wear.

- Electric truck offers a smoother driving experience with the help of better torque and acceleration in comparison to diesel trucks.

- As electric trucks have fewer parts, simpler powertrains and use regenerative braking which ultimately results in requiring less maintenance.

- The government of several regions are greatly taking interest in this particular topic, and offer financial incentives for businesses to adopt electric vehicles such as reduced taxes and lower registration fees.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 |

USD 1.60 Billion |

| Market Size in 2026 |

USD 2.11 Billion |

| Market Size in 2035 | USD 21.61 Billion |

| Growth Rate from 2026 to 2035 |

CAGR of 29.73% |

| Largest Market | Asia Pacific |

| Fastest Growing Makret | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Propulsion, Vehicle Type, Range, End User, Battery Capacity, Payload Capacity, Level of Automation, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

On the other hand, the factors such as insufficient charging infrastructure for electric vehicles and high cost of electric trucks is hindering the growth of the global electric truck market over the forecast period. In addition, the operating and maintenance costs of electric truck are quite high as compared to traditional vehicles and trucks. This factor is restricting the growth of the global electric truck market.

Due to rapid industrialization and urbanization, the demand for electric truck is expanding at a rapid pace. The electric truck is cost effective in nature and helps to save time at a same time. That's the reason the original equipment manufacturers (OEMs) have started manufacturing electric vehicles on a large scale. This is supporting the expansion and development of the global electric truck market. Furthermore, the technological advancements in the development of batteries are also opening new ways for the development of the market for electric truck.

Another factor that is boosting the growth of the worldwide electric truck market is the growing investments in research and development activities by key market players. The government agencies are constantly working with market players for the promotion of electric truck in the global market. In addition, these market players are adopting some unique strategies such as agreements, joint ventures, acquisitions, partnerships, and business expansions. All of these strategies are helping market players to increase their consumer reach and create significant position in the electric truck market all over the globe.

Segment Insights

Propulsion Insights

The battery electric trucks segment dominated the electric truck market in 2025. The electric trucks that run with the help of batteries are categorized as battery electric trucks. The batteries used in the electric trucks are ultracapacitors, lithium-ion battery, lead-acid, and nickel-metal hydride. Due to growing importance for clean energy, the government is emphasizing on the usage of electric vehicles that run on battery. This saves fuel on a large scale. In addition, technological developments are also paving way for the development of battery electric vehicles. Thus, this is driving the growth of the segment during the forecast period.

The hybrid trucks segment is fastest growing segment of the electric truck market in 2025. The hybrid electric trucks use two types of propulsion that is traditional combustion engine powertrain and electric powertrain. The hybrid electric trucks are very efficient in nature. Within 35 minutes, the vehicle is charged about 80% of capacity. This means that the hybrid electric trucks have long duration of batteries that can drive the truck for long period of time. In addition, the application of hybrid electric trucks is helping in reduction of greenhouse gases emissions.

Vehicle Range Insights

Electric trucks at a sub- or up to 300-mile range led the market due to their preference for urban and regional transportation. This class of trucks has a commendable balance between rangeability, applicability, and pricethus preferring logistic applications, municipal functions, or local deliveries. Reduced operating costs further increase support for their adoption by fleet operators.

Forager for extended long-haul and regional operations, 300- to 600-mile electric trucks range experiences rapid growth. Charging downtime is minimal or removed, and thus relieves range anxiety for fleet operators engaged in long runs. With improvements in battery technology and expanding charging infrastructure, longer-range electric trucks will be feasible, reliable, and cost-effective, thus driving rapid adoption in the commercial transport industry.

Application Insights

The Logistics & Delivery segment dominated the market with the ascending demand for efficient, sustainable last-mile delivery solutions. Electric trucks are well aligned with this segment and thus, besides being emission-free, have well-fixed route patterns and comparatively less operational costs. More and more electric trucks are being integrated into the fleets of logistics providers so that they can improve their performance while enhancing the environmental respect of their operations with an increased focus on e-commerce activities and corporate sustainability initiatives.

Waste management is expected to grow at the fastest rate during the forecast period as municipalities and private companies have begun to use electric trucks as a tool for reducing emissions and lowering fuel costs. The collection routes in such cases are very predictable, with plenty of stop-start operations that make these applications perfect for energy recuperation and energy efficiency. Improvements in payload capacity and range are further enhancing the feasibility of electric trucks for heavy-duty waste collection, which in turn promotes wider adoption in eco-friendly urban management schemes.

Regional Insights

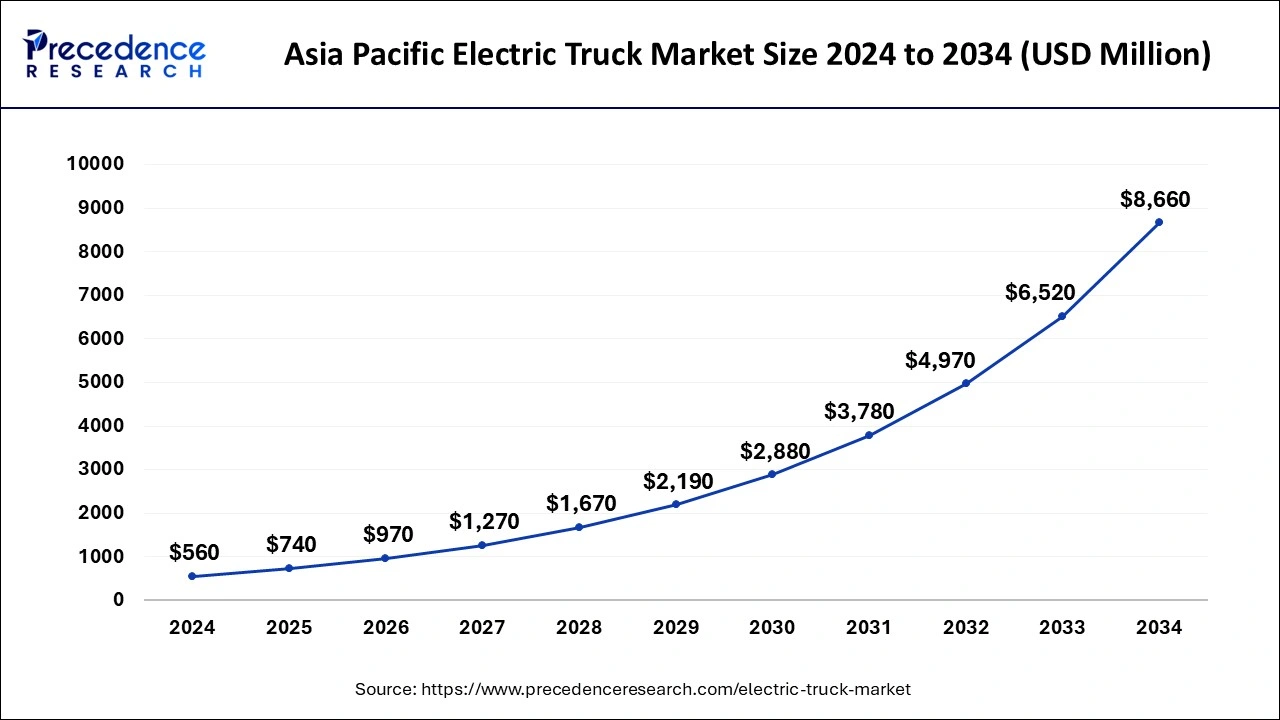

Asia Pacific Electric Truck MarketSize and Growth 2026 to 2035

The Asia Pacific electric truck market size is evaluated at USD 740 million in 2025 and is projected to be worth around USD 10,030 million by 2035, growing at a CAGR of 29.78% from 2026 to 2035

Africa is expected to witness highest CAGR of around 37.7% during 2026-2035. Asia-Pacific dominated the electric truck market in 2024. The China dominates the electric truck market in Asia-Pacific region. Due to rapid industrialization and urbanization, the market for electric truck is growing at a rapid pace. The other factors such as strict government laws and norms against pollution and global warming, high investments in research and development by government and key market players, and growing awareness among the people are driving the growth of the electric truck market in the Asia-Pacific region. In addition, the government is providing subsidies and incentives to the market players. This factor is also driving the growth and expansion of the Asia-Pacific electric truck market.

North America is expected to develop at the fastest rate during the forecast period. The factors such as technological advancements and adoption of innovative technologies are driving the growth of the electric truck market in the region. The fuel-based vehicles emit lot of toxic gases a result into increase in pollution levels. To curb the negative impact of fuel-based vehicles and trucks, the government is imposing stringent regulations and guidelines. These factors are propelling the growth of the electric truck market in the North America region.

Value Chain Analysis

- Raw Material Sourcing: Is for obtaining metals, polymers, and electronic materials for production, all according to cost, quality, and sustainability parameters.

Key Players: ArcelorMittal, POSCO, Nucor - Component Manufacturing: Is for the manufacturing of certain specific components, such as electric motors, battery packs, and control systems for better performance.

Key Players: Bosch, Continental AG, Magna International - Vehicle Assembly and Integration: Deals with core systems in chassis, batteries, and drivetrains to allow good energy and design integration.

Key Players: Tesla, Rivian, Volvo Trucks - Testing and Quality Control: Basically, tests for safety, performance, and reliability are conducted before the standards that concern the automotive and environmental domains.

Key Players: DEKRA, Bureau Veritas, Intertek - Distribution to Dealers and OEMs: The logistics network is administered so that finished vehicles go swiftly to retailers and manufacturing partners.

Key Players: Ryder System, Penske - Retail Sales and Financing: This process sells electric trucks through retail outlets, offering different finance and lease options to customers.

Key Players: Daimler Truck Financial Services - Aftermarket Services and Spare Parts: This involves services, diagnostics, and replacement of electric truck elements to support the long-term operations of electric trucks.

Key Players: O'Reilly Auto Parts, AutoZon.

Electric Truck Market Companies

- AB Volvo

- Workhorse

- BYD Company Ltd.

- Tata Motors

- Daimler AG

- Scania

- Dongfeng Motor Company

- Paccar Inc.

- Geely Automobiles Holdings Ltd.

- Man SE

Recent Developments

- In January 2025, Aramex a global leader in logistics and transportation solutions, launched a commercial fleet of electric trucks in the UAE. Aiming for a greener future for logistics in the oil and gas industry. This is achieved through the collaboration with UAE-based Admiral Mobility. This initiative is aimed at delivering strategic sustainable logistics solutions and reducing industrial supply chain environmental impacts.

- In January 2025, Montra Electric, a manufacturer of electric three-vehicles and commercial vehicles, plans to launch their e-SCV and Electric 3W supercargo at the Bharat Mobility Global Expo 2025. This launch will bring significant growth to the electric small commercial vehicle spaces and will encourage India's Mid-mile and last-mile mobility sectors.

Segments Covered in the Report

By Propulsion

- Battery Electric Truck

- Hybrid Electric Truck

- Plug-in Hybrid Electric Truck

- Fuel Cell Electric Truck

By Vehicle Type

- Light Duty Electric Truck

- Medium Duty Electric Truck

- Heavy Duty Electric Truck

By Range

- Upto 150 Miles

- 151-300 Miles

- Above 300 Miles

By End User

- Last Mile Delivery

- Long Haul Transportation

- Refuse Services

- Field Services

- Distribution services

By Battery Capacity

- Less Than 50kwh

- 50-250 Kwh

- Above 250 Kwh

By Payload Capacity

- Upto 10,000 lbs

- 10,001-26,000 lbs

- Above 26,001 lbs

By Level of Automation

- Semi-autonomous

- Autonomous

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting