What is Freight Transport Market Size?

The global freight transport market size is calculated at USD 38.43 billion in 2025 and is predicted to reach around USD 100.81 billion by 2034, representing a CAGR of 11.31% from 2025 to 2034. The increasing demand for the retail industry and international trade across countries is boosting the market's growth.

Market Highlights

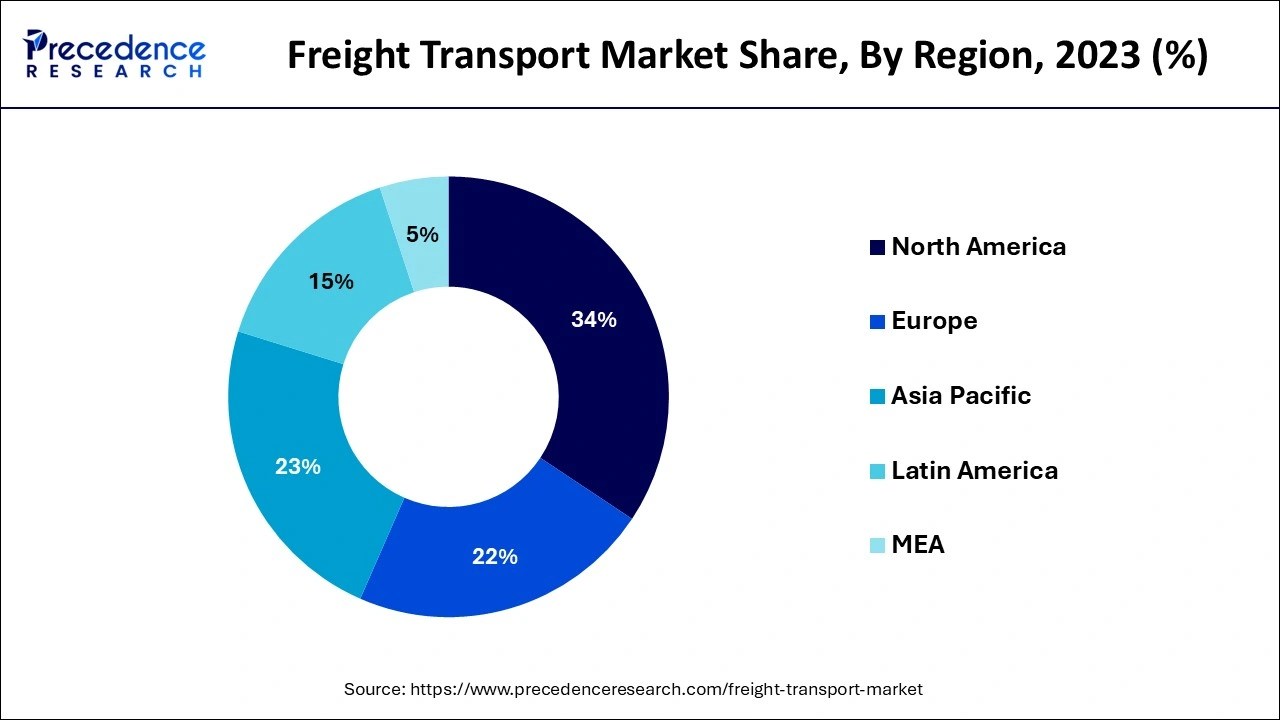

- North America dominated the freight transport market with the largest market share of 34% in 2024.

- Asia Pacific expects a significant CAGR during the forecast period.

- By offering, the service segment dominated the market in 2024.

- By offering the solution segment expects the fastest growth in the market during the predicted period.

- By mode of transport, the roadways segment led the market in 2024.

- By mode of transport, the airways segment will gain a significant market share over the studied period.

- By vertical, the retail and e-commerce segment dominated the freight transport market in 2024.

- By vertical, the pharmaceutical segment is predicted to witness significant growth in the market over the forecast period.

What is freight transport?

Freight transport is the transportation of goods or logistics from one place to another. Some common freight includes commodities, commercial goods, and merchandise in bulk. The freight transport is one of the major part of the global economic expansion. The freight transport further includes the scheduling, storing, products, equipment, and personnel. Freight transport can be done by several means, including road, rail, maritime, and airways. The quantity of the inventory, weight, and size of the goods, as well as high-value goods, need security. These are some of the factors that should be considered when planning for freight transportation. Maritime transportation is one of the leading modes of global trade, covering about 90% of the trading goods.

How Can AI Impact the Freight Transport Market?

The optimization of artificial intelligence in freight transport enhances the operations and efficiency in the transportation industry. AI in transportation and logistics influences the supply chain and distribution process through the real-time monitoring and tracking of the inventory in warehouses to optimize the demand for the inventory and help minimize the wastage in transportation costs. There are several benefits associated with AI integration in transportation and logistics, such as smart warehousing systems, demand-driven optimizing traffic management, on-time in full (OTIF) deliveries, and strategic asset utilization.

- In July 2024, Freight Technologies, Inc., a technology-driven logistics company, launched the Fr8App, AI and machine learning to enable its proprietary and industry-leading freight-matching platform that provides a real-time portal for domestic shipping and B2B cross-border shipping within the USMCA region, launched the Waavely, the revolutionalize platform designed for ocean freight booking and management for companies that are shipping the containers North America and ports rest of the world.

Market Outlook

- Industry Growth Overview:

The freight transport market is increasing, driven by growing trade volumes, e-commerce development, and infrastructure advancement. The rapid expansion of e-retail requires well-organized and timely delivery, increasing demand for solutions such as express and last-mile delivery. - Global Expansion:

The freight transport market is increasing worldwide, driven by growing spending in novel and advanced infrastructure, like highways and logistics hubs. The shift of populations to urban areas creates an increasing requirement for transporting goods to and from various cities. North America is dominant in the market due to strong regulatory needs for security and monitoring. - Major investors:

Major investors in the freight transport market include large logistics companies, venture capital organizations, and private equity firms. It includes KKR, Warburg Pincus, Caisse de depot et placement du Quebec, Ambit Pragma Advisors, Sequoia Capital, and Dynamo Ventures

Freight Transport Market Trends

The rise in the sustainability of the freight transport market

- In October 2024, Sheffield-based BB-EV (Busy Bee EV Ltd) introduced new e-cargo bikes aiming to meet the rising demand for sustainable transportation. The e-cargo bikes offer a revolutionary solution for last-mile deliveries and are customized for large-scale B2B customers such as large retailers, couriers, and parcel services.

- In December 2023, DP World introduced revolutionary SARAL, a rail freight service from Hazira in Surat Gujarat to the North Capital Region (NCR). It is designed for sustainable logistics for delivering door-to-door sustainable cargo solutions.

Freight Transport Market Growth Factors

- Rising transportation: The increasing transportation activities across the world owing to the rising population and the demand for the consumer goods and retail industry are driving the demand for the freight transport market.

- Rising international trade: The increasing international import and export facilities for logistic goods such as food and drugs, electronics, and other transportation and the government's trade between the countries are driving the expansion in freight transport.

- Increasing retail industry: The rising expansion in the retail industry, such as clothing, furniture, and others from various regions around the world, causes a higher demand for safer and quicker freight transport services.

- E-commerce industries: The rising adoption of the e-commerce platform for the shopping of different types of products and continued expansion in the e-commerce giants drive the demand for the freight transport market.

- Investment in cargo: The rising investment in efficient cargo and shipment facilities and the rise in logistics services across the world boost the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 38.43 Billion |

| Market Size in 2026 | USD 42.78 Billion |

| Market Size by 2034 | USD 100.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.31% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Mode of Transport, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The demand for the transportation industry

The increasing demand for the transportation and supply chain industry due to the rising retail and e-commerce industry is contributing to the expansion of the market. Freight transport is offering several benefits, including greater accessibility, efficiency, flexibility, cost-effectiveness, enhanced reliability, and minimization of environmental impacts. Additionally, the rising industrialization across the countries is driving the demand for the logistics, supply chain, and transportation industry, contributing to the growth of the freight transport market.

Restraint

Environmental impacts

The rising freight transport is driving the number of heavy-weight and high-emitting vehicles on the road or any other mode of transportation that negatively impacts the environment by the higher pollution is restraining the growth of the freight transport market.

Opportunity

Advancements in freight transport

The evaluation in the logistics and logistics industry with the significant advancements in technologies such as blockchain, IoT, automation, and robotics that help in enhancing the operational transparency, efficiency, sustainability, and resilience in the freight transport industry. Automation in freight transport streamlines warehouse operations, lowering costs and reducing errors.

Segment Insights

Cargo Type Insights

The dry-bulk cargo segment held the largest share of 28.60% in the freight transport market. The dry bulk cargo includes all-inclusive commodities such as grain, coal, cement, minerals, and iron ore. It is a boon for international trade as it involves the export and import of raw materials for multiple industries. It fuels economic growth, and so the dry bulk shipping market has been constantly growing, with its factors influencing the skyrocketing demand for raw materials and infrastructure development. Dry bulk shipping contributes endlessly to the energy sector by providing transportation of coal for power generation and various commodities involved in industrial processes. This attracts significant deals and drives the development of the dry-bulk cargo sector to maintain its long-term position.

The temperature-controlled cargo segment is expected to grow at a CAGR of 8.30% during the forecast period. The temperature-controlled cargo is essential for perishable goods (frozen) like food and dairy products, and also pharmaceutical-based drugs that require a certain temperature to travel a long way. The pharmaceuticals and dairy owners rely on temperature-controlled cargo for their products to reach patients and customers in a promised and effective condition. The rising prevalence of diseases needs drugs for quick recovery, and daily routine essentials dairy products, are just rapidly rising over demand bar respective of the growing population.

Offering Insights

The service segment dominated the freight transport market in 2024. The service segment is further divided into business services, managed services, and system integration. The rising demand for freight management and logistics supply from one place to another is driving the demand for the freight transport market by the residential and commercial applications. Freight transport allows businesses to manage and supply their goods efficiently and affordably. The freight transport services can help transport logistics for all sizes in the required time.

The solution segment expects the fastest growth in the market during the predicted period. There is an increasing demand for freight transport by several end-use industries for efficient logistics and shipment of goods. The rising industrialization and the increase in international import-export facilities are contributing to the expansion of the freight transport solution. There are several leading players who are heavily contributing to freight transport and helping several industries bring down their cargo requirements with reduced costs and better effectiveness.

Mode of Transport Insights

The roadways segment led the freight transport market in 2024. The rising adoption of roadway freight transport by the number of end-use industries is due to the lower cost of transporting as compared to other transporting mediums. The roadways take a shorter route to transport the goods and take much less time to transport. Roadways freight transport is known as the best choice for door-to-door transport services. Roadway freight transportation offers various benefits, including accessibility and flexibility, cost-effectiveness, increased speed and efficiency in delivering the goods; it provides easy tracking services, helps in transporting freight in remote areas, simplifies logistics, and lowers packaging costs with advanced packaging, minimizes the risk of damaging the goods and one of the major benefits like it supports the eCommerce growth in the country.

The airways segment will gain a significant freight transport market share over the studied period of 2023 to 2034. The rising economic growth in developing countries is driving the rapid development of airports and air cargo. Airways transportation aims to deliver goods rapidly, and the rising international trade between countries is driving the growth of the segment. There are several benefits associated with air freight, such as a faster shipping process, most reliable arrival and departure times, lower insurance premier, higher security, lower risk of thefts and damage, lower demand for warehousing, less packaging requirement, and the live tracking of cargos.

Vertical Insights

The retail and e-commerce segment dominated the freight transport market in 2024. The rising population and the increasing disposable income in the population are driving the demand for the retail industry. The rising living standards and the spending culture on daily living are driving the demand for industries such as consumer goods, technologies, electronics, food and beverages, and others, which drive the retail industry and demand for efficient transportation services or medium to provide the goods in the areas of demand. Additionally, the rise of the e-commerce industry is due to the rising inclination of the population towards online shopping. Freight transport is one of the most important parts of the e-commerce industry, and it helps manage and transport goods from the delivery facilities to the consumer's doorstep.

- In August 2024, CEO Sahil Barua, the founder of Delhivery, announced that they would provide delivery to e-commerce companies and shorten the delivery time to 2-4 hours. Delhivery is setting up a launch for the multi-tenant dark stores to provide faster in-city delivery for e-commerce companies.

The pharmaceutical segment is predicted to witness significant growth in the freight transport market over the forecast period. The pharmaceutical transportation is one of the most important parts of the logistics centers. Pharmaceutical transportation is a separate type of cargo from others; it has temperature control containers that help maintain the effectiveness of the drugs. The rising demand for pharmaceutical products in the countries and the increasing cases of international import and export of medicines are driving the demand for freight transport by the pharmaceutical industry.

- In October 2024, DHL Global Forwarding, AstraZeneca Rare Disease, Freight, and Alexion are extending their collaboration and stepping up with sustainability in pharmaceutical transportation. They will use hydrogenated vegetable oil (HVO) as an environmentally friendly alternative to conventional diesel in the European road transport of pharmaceutical products.

Delivery Distance Insights

The domestic freight segment held the largest share of 63.10% in the 2024 freight transport market. The domestic freight covers different hauls of distance according to the development and functions. It is major for regional and local distribution. Also, it's designed differently in countries' respective of infrastructure and regulations. The short haul (<500km) covers distribution and distance within regions and specific cities. The mid-haul (500-1,500 km) is a bridge to numerous regional markets to accelerate the export and import of goods within a country. This strengthens the supply chain. The long haul (>1,500km) is an expansion to the supply chain as it links regional supply chains to a vast international and national spectrum.

The international freight segment is expected to grow at a CAGR of 7.50% during the forecast period. The cross-border encompasses physical distance goods that travel throughout national borders. The longest distance is equal to a higher cost, while freight transport industries profit more from this distance globally. The goods transportation between multiple continents involves switching or including various modes of transport according to the distance and transport facilities for the goods.

Shipment Weight Insights

The medium-weight shipments (5-25 tons) segment held the largest share of 41.20% in the freight transport market. The medium-weight shipments are a weight that is calculated between the heavy and lightweight commodities in the range from hundred kilograms to 5-25 tons total. With this weight, the shipments are associated with several modes of transport like rail, air, sea, or road, according to the cost concerns, distance, and emergency. The freight transportation services generate significant profits due to their medium weight. Due to rapid growth in the e-commerce industry and consumers' fluctuating demands, the medium-weight shipment industry is rising above its standard growth.

The lightweight shipments (<5 tons) segment is expected to grow at a CAGR of 7.60% during the forecast period. The lightweight shipments industry is bolstering due to increasing e-commerce businesses. These shipments refer to a massive variety of goods consisting of industrial components, perishable goods, and consumer items. The lightweight shipments are in heavy demand due to their constant involvement in the consumer's daily routine. Its fastest delivery time attracts the mass market, to be able to meet more demand in the quickest time.

Service Type Insights

The freight forwarding segment held the largest share of 27.90% in the global freight transport market. The freight forwarding manages the logistics in and out of moving goods overseas. This includes coordination, execution, and planning of the shipment of goods from the origin to destined destination. The freight forwarding manages transportation for documentation and customer approval propose. Freight forwarders' role is crucial as they act as a bridge to expertise and networks of different carriers to improve the shipping process for massive businesses.

The intermodal/multimodal transport segment is expected to grow at a CAGR of 8.00% during the forecast period. The intermodal/multimodal transport consists of various modes of transport, such as trains, trucks, airplanes, and ships, to deliver goods. Though it is based on ‘what process is ticked under contract' and ‘what is manageable to the moving of goods'. The multimodal transport includes a single contract, most probably an individual entity is involved in the management of the entire travel, whereas intermodal transport consists of separate contracts for each step of the travel involving various carriers. The dealers in the freight transport industry experience profit and growth from different industries.

Regional Insights

U.S. Freight Transport Market Size and Growth 2025 to 2034

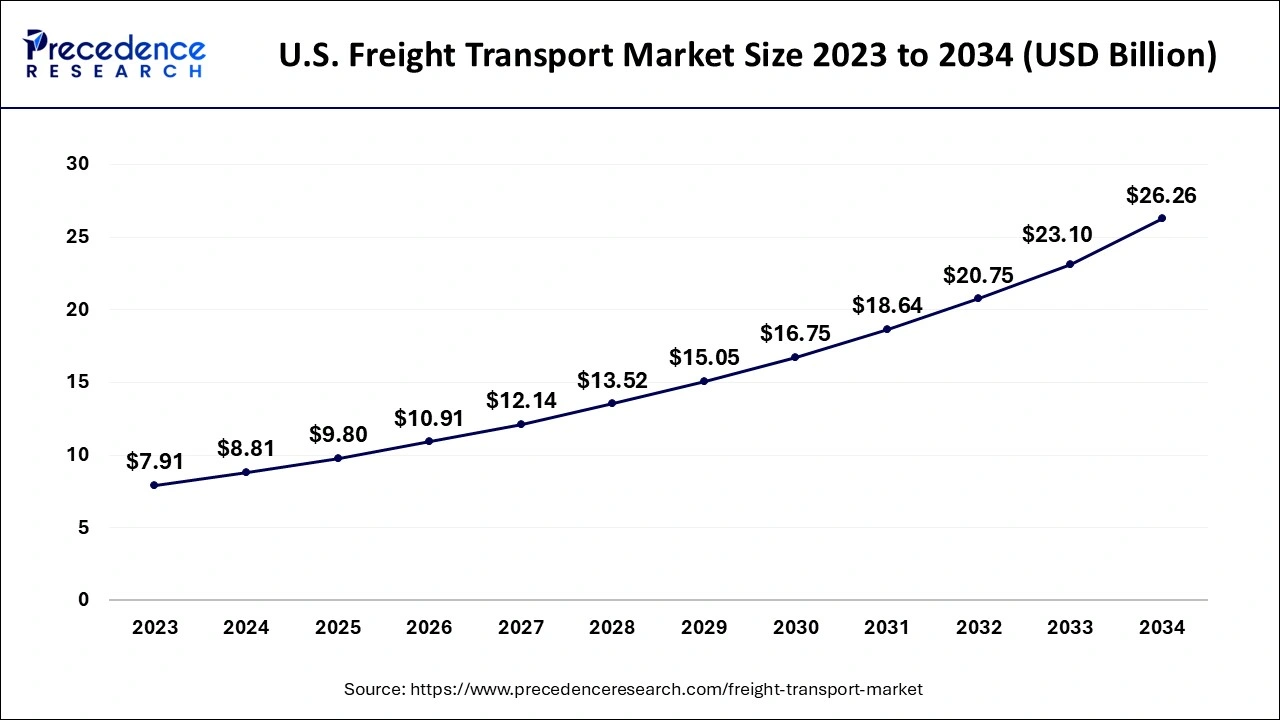

The U.S. freight transport market size is evaluated at USD 9.80 billion in 2025 and is projected to be worth around USD 26.26 billion by 2034, growing at a CAGR of 11.54% from 2025 to 2034.

U.S.: Significant investment in infrastructure

In the U.S., it's a massive and interconnected infrastructure, a large and diverse economy, and the central role of trucking. Huge network of railroads, highways, and waterways, a strong demand driven by a large population and e-commerce, and predominant government and private spending in modernization, technology, and logistics. Important investment in infrastructure upgrades and modernization plans continues to enhance efficiency.

North America: Presence of strong infrastructure and networks

North America dominated the freight transport market in 2024. The region has a well-developed industrial infrastructure, and the presence of the major manufacturing units of several products is accelerating the demand for freight transport for goods. Regional countries like the United States and Canada are experiencing a higher demand for various industrial goods, and the presence of the leading freight transporting leaders, e-commerce players, and logistics centers is driving the growth of the market. Additionally, the acceptance of technologies and advancements in transportation and logistics further boost the growth of the freight transport market in the region.

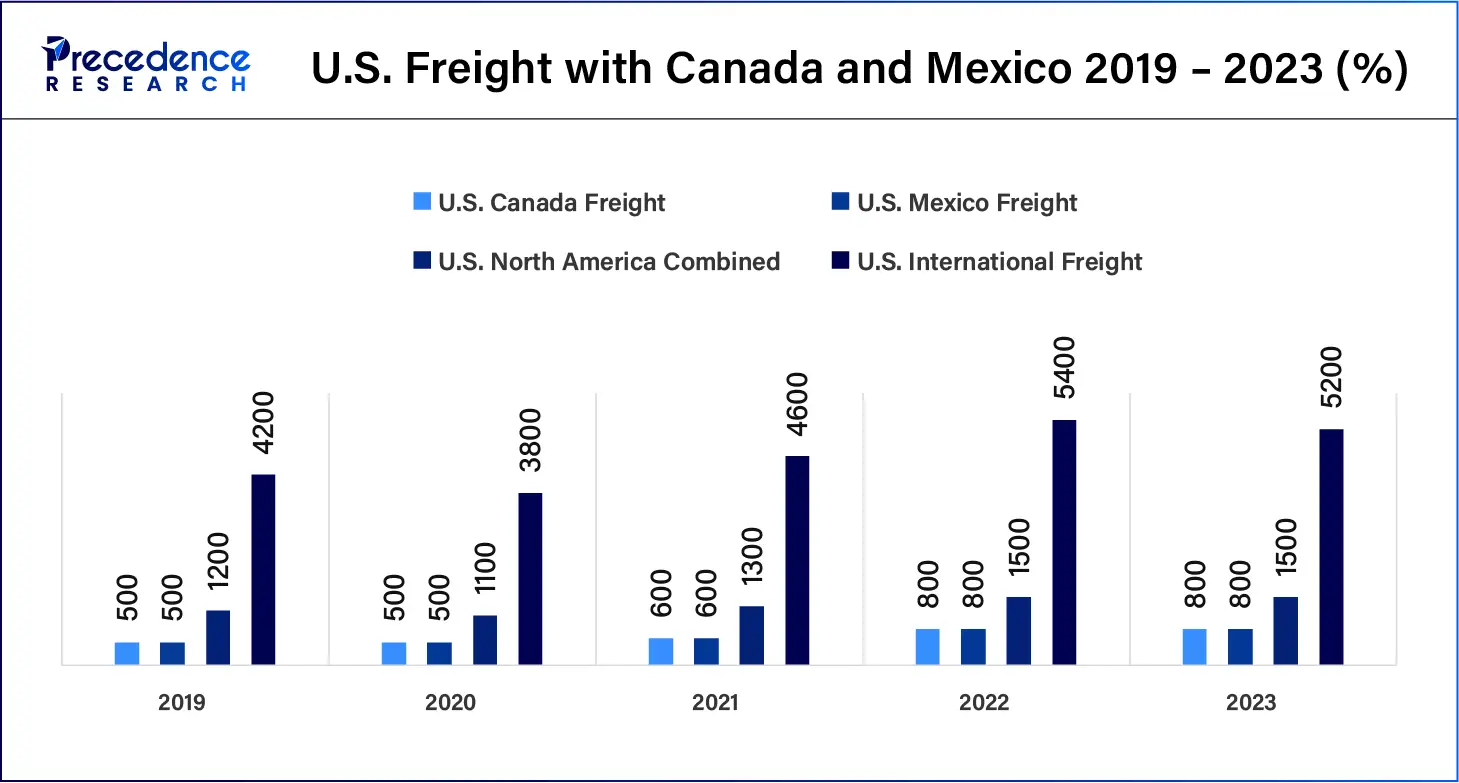

- In 2023, The United States, international trade was $5.1 trillion in which trade with Mexico and Canada comprised 30.8%. The United States freight flows with Mexico and Canada equaled $1.57 trillion dollars.

- The total Transborder freight was $1.57 trillion moved by all types of transportation, and there is a 0.0% change in compared to 2022.

- Freight between the U.S. and Canada: $773.9 billion, a decrease of 2.4% from 2022.

- Freight between the U.S. and Mexico: $798.8 billion, increased by 2.5% from 2022.

- The railways moved freight worth $209.2 billion, a 0.5% decrease from the 2022.

- The trucks moved freight worth $996.4 billion, a 5.1% increase from 2022.

- The pipeline moved freight worth $112.6 billion, a 24.5% decrease from 2022.

- The vessels moved freight worth $126.3 billion, a 9.0% decrease from the 2022.

- The Air moved freight worth $57.1 billion, a 1.2% decrease from 2022.

- The freight by the vessel and pipeline reduces due to the lower dollar value of mineral fuels.

Asia Pacific: Growing manufacturing and e-commerce

Asia Pacific is expected to grow at a significant CAGR during the forecast period. The growth of the market is owing to the rising population, rising economies, and industrial infrastructure, which are driving the demand for efficient freight transport for logistics and goods. The rapid development in the manufacturing industries in regional countries like China, India, and Japan and the international import and export facilities worldwide by the countries are driving the expansion of the freight transport market across the region.

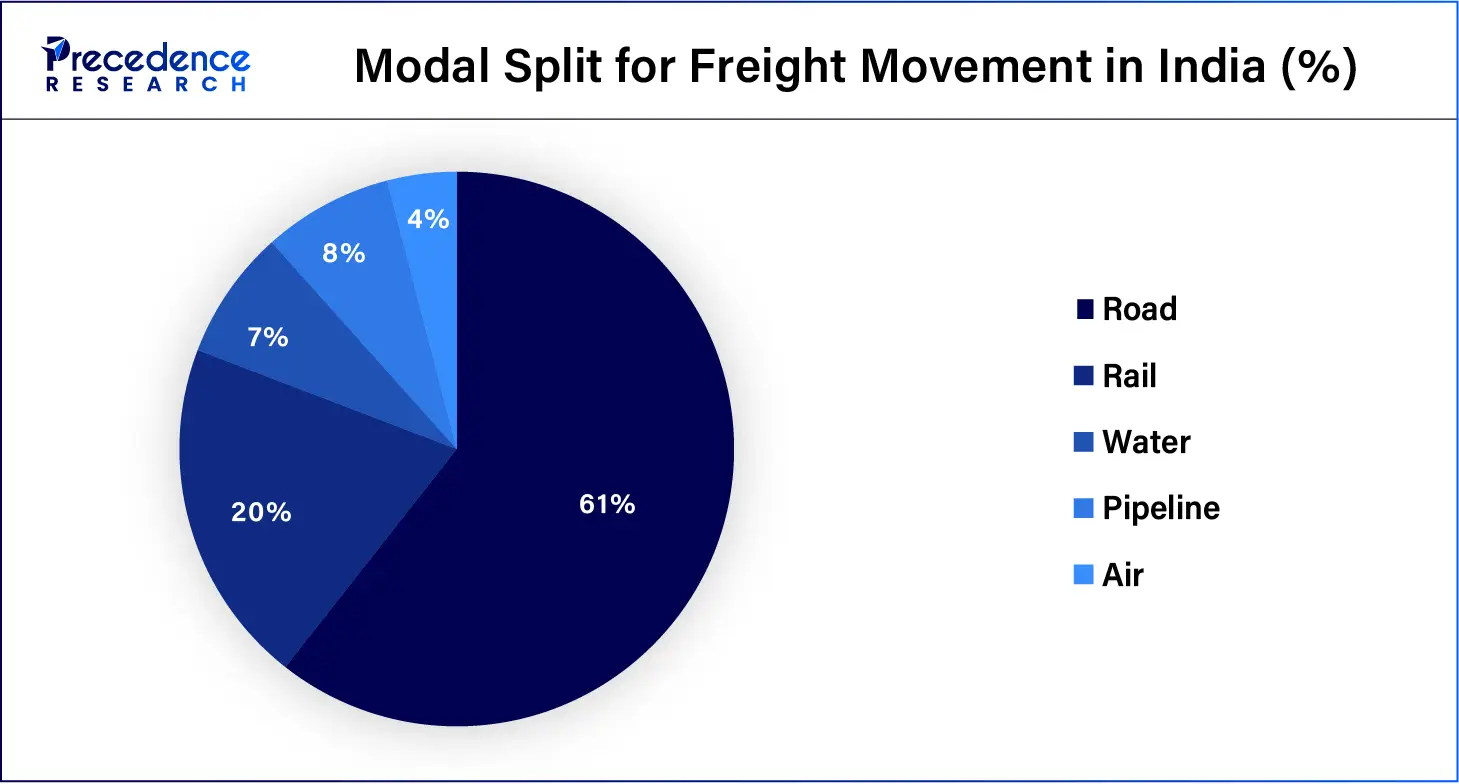

The Indian Logistics industry consists of over 10,000 types of products with a market size of INR 11 Lakh Crore. With the rising demand for goods, the movement of goods is expected to increase to 15.6 trillion tonnes in 2050. In India, about 71% of freight is transported by road and 17.5% by the railways.

China: Increasing government support

In China, increasing government spending in infrastructure, a huge manufacturing base that drives worldwide trade, and the output scale of its transport and shipping networks. The country has the world's largest high-speed rail network, which allows rapid movement of goods in the country, and a wide road network covering more than 5 million kilometers, which drives the growth of the market.

Europe: Increasing government policies for energy saving

Europe is significantly growing in the market as this region possesses an advanced-quality and wide-ranging transportation network of roads, waterways, and railways, coordinated and funded in part by EU-level projects. The EU's unified trade rules, consistent consumer procedures, and the Schengen Agreement's borderless travel meaningfully simplify cross-border freight movement, particularly by road.

UK: Strong public health initiatives

In the UK, rising government investment in infrastructure, like road improvements and logistics hubs, improves efficiency and lowers transit times. Guidelines are supporting the decarbonization of logistics fleets through investments in electric vehicles. The acceptance of novel technologies such as GPS tracking and route optimization software is transmuting the industry.

Freight Transport Market- Value Chain Analysis

- Raw Material Sourcing:

It includes strategically detecting such as and acquiring materials like aluminum, steel, oil, and rubber for vehicle production and maintenance

Key Players: DHL and FedEx - Package Design and Prototyping:

Package design for freight transport focuses on the functional necessities of shifting goods, rather than solely on customer demand.

Key Players: UPS and Maersk - Recycling and Waste Management:

Managing waste produced by transport activities and utilizing logistics to transport recyclables, which comprises waste segregation, using reusable packaging, and instigating specialized systems for risky waste.

Key Players: Adani Logistics and Delhivery

Top Vendors in the Freight Transport Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

FedEx |

Tennessee |

Strong brand recognition |

FedEx makes it simple to access regulatory news and updates that impact how ships are regulated and dangerous goods. |

|

United Parcel Service of America, Inc. |

Georgia |

Financial resilience |

In June 2025, UPS announced it had nearly gathered its air freight capacity between Delhi and Cologne with the addition of a Boeing 747-8 freighter. |

|

Deutsche Post AG |

Germany |

Diversified business model |

The company is hastening its digitalization strategy and investing in specific sectors such as life sciences and e-commerce, even as it navigates complex worldwide trade conditions. |

|

CEVA Logistics |

France |

Worldwide network |

In October 2025, CEVA Logistics inaugurates a new Amazon fulfillment center in Brazil. |

|

Schneider National, Inc. |

Wisconsin |

Comprehensive service portfolio |

In November 2025, Schneider National introduced a new premium intermodal service, Schneider Fast Track, aimed at shippers moving time-sensitive and high-service freight. |

Recent Developments

- In May 2024, Hyundai Motor officially launch the NorCAL ZERO Project, aiming for emission-free freight transportation in California's Central Valley and California's Central Valley.

- In October 2024, UAL BOCS Shipping Line (UBSL) is extending their breakbulk services to the Caribbean and the East Coast of South America. UBSL Caribbean Lines partnered with BOCS Bremen and Universal Africa Lines to introduce 21 modern geared multipurpose (MPP) vessels.

Segments Covered in the Report

By Mode of Transport

- Roadways

- Full Truck Load (FTL)

- Less-than-Truckload (LTL)

- Containerized Trucking

- Railways

- Intermodal Rail Freight

- Bulk Rail Freight

- Airways

- Express Air Freight

- Scheduled Air Freight

- Maritime freight (Seaways)

- Container Shipping

- Bulk Shipping (Dry Bulk, Liquid Bulk)

- Roll-On/Roll-Off (Ro-Ro)

- Inland Waterways

- Barge Services

- Ferries

- Pipeline Transport

- Crude Oil

- Natural Gas

- Refined Products

By Cargo Type

- Dry Bulk Cargo

- Coal

- Grains

- Minerals

- Liquid Bulk Cargo

- Crude Oil

- Chemicals

- LNG / LPG

- General Cargo

- Palletized Goods

- Packaged Food

- Containerized Cargo

- Consumer Goods

- Electronics

- Clothing & Apparel

- Temperature-Controlled Cargo

- Perishables (Food, Dairy)

- Pharmaceuticals

- Oversized & Project Cargo

- Machinery

- Construction Materials

By End-User Industry

- Retail & E-commerce

- Automotive

- Industrial Manufacturing

- Food & Beverages

- Oil & Gas

- Pharmaceuticals & Healthcare

- Chemicals

- Agriculture & Forestry

- Mining & Metals

- Aerospace & Defense

- Construction

By Delivery Distance

- Domestic Freight

- Short-Haul (<500 km)

- Mid-Haul (500–1,500 km)

- Long-Haul (>1,500 km)

- International Freight

- Cross-border (regional)

- Intercontinental (global)

By Shipment Weight

- Lightweight Shipments (< 5 tons)

- Medium Weight Shipments (5–25 tons)

- Heavy Shipments (>25 tons)

By Service Type

- Freight Forwarding

- Third-Party Logistics (3PL)

- Courier, Express & Parcel (CEP)

- Dedicated Contract Carriage

- Intermodal / Multimodal Transport

- Freight Brokerage Services

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting