What is the Air Transport MRO Market Size?

The global air transport MRO market size was valued at USD 90.96 billion in 2025 and is anticipated to reach around USD 143.55 billion by 2034, expanding at a CAGR of 5.20% over the forecast period from 2025 to 2034.

Market Highlights

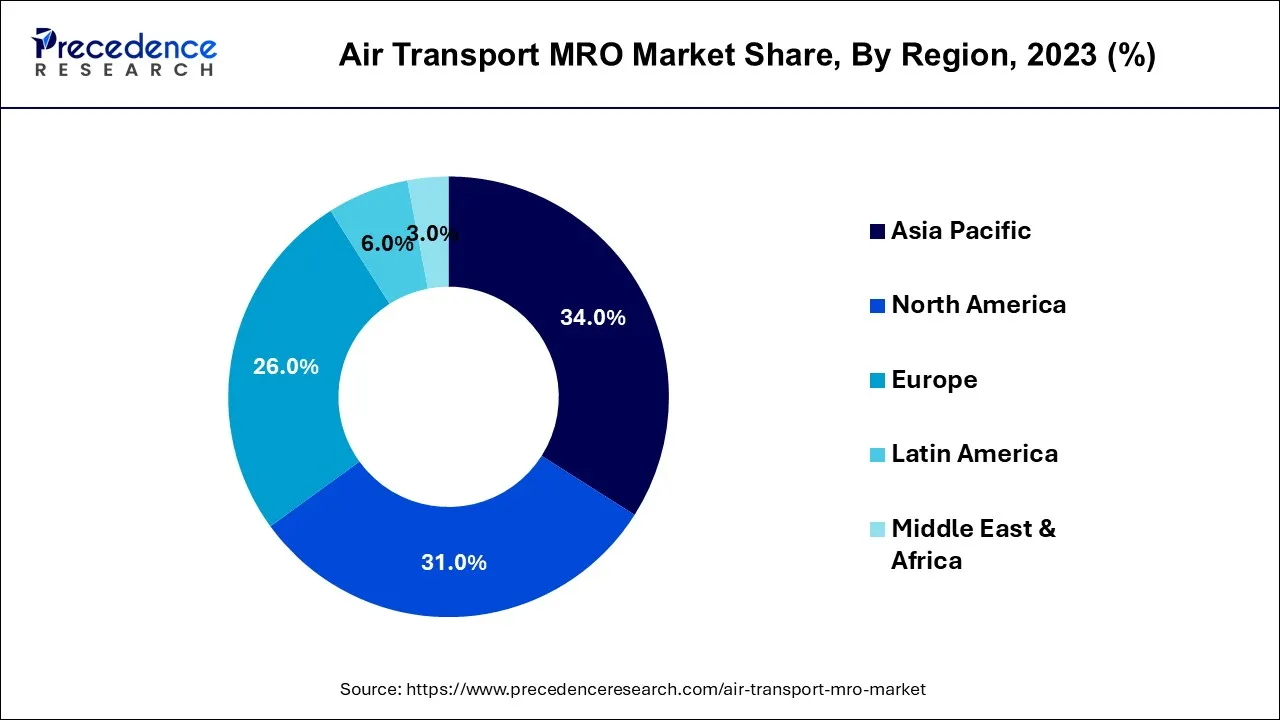

- Asia Pacific contributed more than 34% of revenue share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By service type, the engine overhaul segment has held the largest market share of 41% in 2024.

- By service type, the component segment is anticipated to grow at a remarkable CAGR of 6.3% between 2025 and 2034.

- By organization type, the independent MRO segment generated over 52% of revenue share in 2024.

- By organization type, the OEMs segment is expected to expand at the fastest CAGR over the projected period.

- By aircraft type, the narrow body segment generated over 55% of revenue share in 2024.

- By aircraft type, the wide-body segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 90.96 Billion

- Market Size in 2026: USD 95.69 Billion

- Forecasted Market Size by 2034: USD 143.55 Billion

- CAGR (2025-2034): 5.20%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

Air transport MRO, or maintenance, repair, and overhaul, is a critical sector within the aviation industry dedicated to ensuring the safety and operational efficiency of aircraft. It encompasses a wide range of activities, including routine inspections, scheduled maintenance, repairs, and the overhaul of aircraft components. MRO services are essential for prolonging the lifespan of aircraft, complying with safety regulations, and minimizing operational disruptions.

These services involve highly skilled technicians and engineers who perform intricate tasks such as engine overhauls, avionics upgrades, and structural repairs. The Air Transport MRO industry plays a pivotal role in aviation safety and the overall reliability of air travel. With advancements in technology and the increasing complexity of modern aircraft, MRO providers continually adapt to new challenges, incorporating innovative solutions and digital tools to enhance efficiency and maintain the highest standards of safety and reliability in the global aviation network.

Air Transport MRO Market Growth Factors

- The continuous growth of global air fleets necessitates increased MRO activities to maintain and service a larger number of aircraft.

- The aging of existing aircraft creates a demand for extensive maintenance and overhaul services to ensure prolonged operational life and compliance with safety standards.

- Stringent aviation regulations worldwide drive the need for MRO services to meet and uphold safety and compliance standards.

- Rapid advancements in aviation technology require MRO providers to invest in upgrading their capabilities and expertise to handle modern aircraft systems.

- The rise in air travel globally boosts demand for MRO services as airlines strive to keep their fleets in optimal condition to meet growing passenger needs.

- Airlines are increasingly outsourcing MRO services globally, leading to a broader market for MRO providers.

- The adoption of data analytics and predictive maintenance techniques improves efficiency and reduces downtime, driving the growth of MRO services.

- With a focus on environmental sustainability, MRO services are evolving to incorporate eco-friendly practices and technologies.

- The shift towards digital record-keeping and maintenance logs enhances transparency and efficiency in MRO processes.

- Emerging markets and regional hubs contribute to the expansion of the Air Transport MRO market as they develop their aviation infrastructure.

- Airlines opt to outsource MRO services to specialized providers, enabling them to focus on core operations while benefiting from specialized expertise.

- Airlines investing in aircraft upgrades and modifications to enhance performance and meet changing industry standards drive the demand for MRO services.

- The search for cost-effective MRO solutions pushes the industry to innovate and streamline maintenance processes.

- Increased defense budgets globally lead to growth in military aviation, boosting the MRO market for military aircraft.

- The introduction of new aircraft models creates opportunities for MRO providers to offer tailored maintenance solutions for these advanced platforms.

- The increasing demand for air cargo services requires efficient MRO support for cargo aircraft to ensure uninterrupted logistics operations.

- Supportive government policies and initiatives to boost the aviation industry contribute to the overall growth of the air transport MRO market.

Major Key Trends in Air Transport MRO Market

- Digital Transformation and Predictive Maintenance: MRO providers are increasingly utilizing digital tools and predictive analytics to foresee maintenance requirements, minimize downtime, and optimize resource distribution, which enhances operational efficiency.

- Sustainability and Green Initiatives:There is a heightened focus on environmentally friendly practices within the MRO sector, such as implementing sustainable materials, energy-saving processes, and waste reduction strategies to comply with environmental standards and meet customer demands.

- Workforce Development and Training: To tackle the skilled labor shortage, MRO companies are investing in training initiatives and collaborations with educational institutions to build a competent workforce equipped to manage advanced maintenance technologies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 90.96 Billion |

| Market Size in 2026 | USD 95.69 Billion |

| Market Size by 2034 | USD 143.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Organization Type, Aircraft Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Data-driven maintenance and digitalization of records

Data-driven maintenance and digitalization of records play pivotal roles in surging the demand for the air transport MRO market. The integration of data analytics and predictive maintenance techniques enhances operational efficiency by providing real-time insights into aircraft performance and component health. Airlines can proactively address potential issues, minimizing downtime and optimizing maintenance schedules.

Digitalization of records streamlines documentation processes, replacing traditional paper-based systems with electronic databases. This not only improves accessibility and accuracy but also facilitates quicker decision-making and compliance with regulatory standards. Airlines and MRO providers adopting these technologies experience cost savings, reduced paperwork, and enhanced overall productivity, driving a heightened demand for MRO services. As the industry embraces these advancements, the air transport MRO market is propelled forward, meeting the evolving needs of a technologically driven aviation landscape.

Restraint

Price volatility

The air transport MRO market faces significant constraints due to a skilled labor shortage and the cyclical nature of the aviation industry. The shortage of highly skilled and specialized technicians and engineers hampers the MRO sector's ability to meet the increasing demand for maintenance services. This scarcity not only limits capacity but also intensifies competition for skilled labor, potentially driving up labor costs. Moreover, the cyclical nature of the aviation industry introduces uncertainties, as economic downturns and fluctuations in air travel demand directly impact airline budgets.

During periods of reduced economic activity, airlines may cut back on MRO spending, affecting the overall market growth. The interplay of these factors highlights the challenges MRO providers face in maintaining a skilled workforce and navigating the industry's susceptibility to economic cycles, underscoring the need for strategic planning and flexibility within the air transport MRO market.

Opportunity

Globalization of MRO services and military aviation MRO

The globalization of MRO services and the expansion of military aviation MRO present significant opportunities in the air transport MRO market. The trend towards outsourcing MRO services globally allows providers to access new markets, diversify their customer base, and collaborate with international partners. This globalization fosters knowledge exchange and enables MRO providers to offer specialized services tailored to the unique needs of different regions.

Simultaneously, the increasing defense budgets globally open avenues for MRO providers to tap into the military aviation MRO sector. Offering maintenance and support services for military aircraft provides diversification and stability for MRO businesses. The expertise gained in military aviation MRO can also contribute to innovation and improved capabilities, creating a dual benefit for MRO providers. Embracing these opportunities requires strategic planning and adaptability to meet the specific demands of different markets and capitalize on the growth potential in both globalized MRO services and military aviation maintenance.

Segments Insights

Service Type Insights

In 2024, the engine overhaul segment had the highest market share of 41% based on the service type. Engine overhaul, a crucial segment in the air transport MRO market, involves comprehensive restoration and maintenance of aircraft engines. This service addresses wear and tear, enhancing engine performance and longevity. The trend in engine overhaul reflects a shift toward predictive maintenance using advanced analytics and data-driven insights.

Airlines increasingly prioritize proactive engine maintenance, reducing unscheduled downtime and optimizing operational efficiency. As technology evolves, the engine overhaul segment is witnessing a transition from traditional scheduled maintenance to more cost-effective and predictive approaches, ensuring a seamless and reliable air transport experience.

The component segment is anticipated to expand at a significant CAGR of 6.3% during the projected period. In the air transport MRO market, the component segment refers to the maintenance and repair of individual aircraft components such as avionics, landing gear, engines, and other essential parts.

Trends in this segment include a growing emphasis on predictive maintenance using data analytics, advancements in component technologies, and an increasing demand for eco-friendly upgrades. MRO providers specializing in components are adapting to these trends, offering innovative solutions to enhance reliability, reduce downtime, and meet the evolving needs of the modern aviation industry.

Organization Type Insights

According to the organization type, the independent MRO segment has held 52% revenue share in2024. The independent MRO segment in the air transport MRO market refers to standalone Maintenance, Repair, and Overhaul providers that operate independently of aircraft manufacturers or airlines. These organizations specialize in offering third-party MRO services, catering to a diverse range of aircraft from various manufacturers. A notable trend in this segment involves a growing preference among airlines for independent MRO providers due to competitive pricing, specialized expertise, and flexibility, driving the expansion of the independent MRO market as a crucial player in the aviation maintenance ecosystem.

The OEMs segment is anticipated to expand fastest over the projected period. Original Equipment Manufacturers (OEMs) in the air transport MRO market refer to companies responsible for manufacturing and supplying aircraft and their components. In recent trends, OEMs are expanding their presence in the MRO sector, offering integrated solutions and services throughout an aircraft's lifecycle. This shift towards comprehensive support services by OEMs reflects a strategic approach to customer engagement, providing airlines with one-stop solutions for maintenance, repair, and overhaul needs, thereby streamlining operations and fostering long-term partnerships.

Aircraft Type Insights

In 2024, the narrow body segment had the highest market share of 55% based on the aircraft type. The narrow-body segment in the air transport MRO market refers to single-aisle commercial aircraft with a fuselage width typically accommodating one row of seats on each side. This category includes popular models like the Boeing 737 and Airbus A320.

In recent trends, the narrow-body segment has seen significant growth due to its operational efficiency, fuel economy, and adaptability to diverse routes. MRO providers catering to narrow-body aircraft benefit from increased demand for maintenance services, driven by the expanding fleets and versatility of these aircraft in the aviation industry.

The wide-body segment is anticipated to expand fastest over the projected period. In the air transport MRO market, the wide-body segment refers to large, twin-aisle aircraft designed for long-haul flights. These aircraft, including models like the Boeing 777 and Airbus A350, present unique maintenance challenges due to their size and complex systems. Current trends in wide-body air transport MRO involve a focus on advanced technologies such as predictive maintenance, data analytics, and digitalization. MRO providers are leveraging these tools to enhance operational efficiency, reduce downtime, and meet the evolving needs of airlines operating long-range, wide-body fleets in the global aviation landscape.

regional Insights

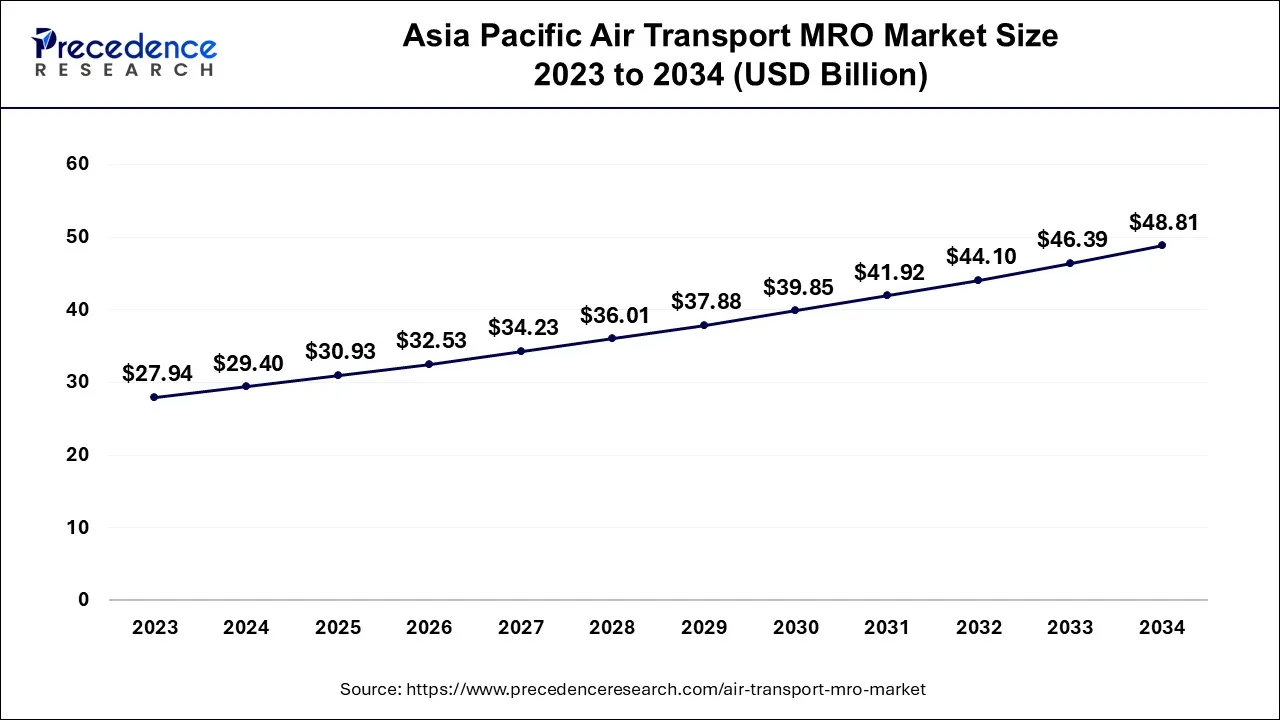

Asia Pacific Air Transport MRO Market Size and Growth 2025 to 2034

The Asia Pacific air transport MRO market size was accounted at USD 30/93 billion in 2025 and is projected to be worth around USD 48.81 billion by 2034, poised to grow at a CAGR of 5.25% from 2025 to 2034.

Asia Pacific has held the largest revenue share of 34% in 2024. Asia Pacific dominates the air transport MRO market due to the rapid expansion of the aviation industry, increasing air travel demand, and a growing fleet of aircraft. Countries like China and India have witnessed substantial economic growth, driving investments in aviation infrastructure and MRO services. Additionally, the region's strategic location as a global transportation hub further boosts its prominence in the air transport MRO market, attracting significant business from both domestic and international airlines seeking high-quality maintenance services for their expanding fleets.

North America is estimated to observe the fastest expansion. North America dominates the air transport MRO market due to a robust aviation industry, a large and diverse fleet of commercial aircraft, and significant technological advancements. The region hosts major MRO providers, OEMs, and a well-established infrastructure supporting aviation maintenance. Moreover, stringent safety regulations and a high level of awareness regarding the importance of regular maintenance contribute to a strong foothold. The presence of leading airlines, favorable government policies, and a focus on innovation position North America as a key hub for air transport MRO activities.

Europe is observed to grow at a considerable growth rate in the upcoming period, fueled by the rising demand for air travel and the need for maintenance of aging aircraft. The focus on sustainability and strict regulatory requirements in the region is encouraging MRO providers to implement advanced technologies and environmentally friendly practices. Moreover, the growth of low-cost airlines and increased e-commerce activity are leading to higher aircraft usage rates, which require more frequent maintenance services. Partnerships between airlines and MRO providers are becoming increasingly common to ensure efficient and cost-effective operations, establishing Europe as a vital player in the global MRO sector.

Germany

Germany is prominent in Europe's MRO industry, because of its strong aviation sector and high-tech infrastructure. The nation is home to several leading MRO providers that focus on engine, component, and airframe maintenance. Germany's commitment to innovation and quality has encouraged the adoption of predictive maintenance technologies and digital solutions, improving operational efficiency. Its geographic advantage and skilled workforce further reinforce Germany's status as a crucial hub for MRO services in Europe.

Air Transport MRO Market Companies

- Boeing Global Services

- Airbus S.A.S

- Lufthansa Technik AG

- GE Aviation

- SIA Engineering Company Ltd.

- ST Engineering Aerospace

- Delta TechOps

- AAR Corp

- Rolls-Royce plc

- Safran Aircraft Engines

- United Technologies Corporation

- Honeywell Aerospace

- HAECO Group

- MTU Aero Engines AG

- Turkish Technic Inc.

Recent Developments

- In May 2025, Hindustan Aeronautics Ltd's MRO facility in Nashik has successfully overhauled two Embraer aircraft for a private airline, marking its entrance into civilian aircraft maintenance. This follows a collaboration with Airbus to set up a 'C-Check' facility for the A320 fleet, with plans to overhaul over a dozen A320 aircraft annually.

- In April 2025, GE Aerospace intends to invest USD 1 billion over the next five years to upgrade its global MRO facilities, with the goal of reducing turnaround times by 30%. This initiative responds to rising demand for after-market services and seeks to improve efficiency in engine repair operations.

- In March 2025, Asia Digital Engineering in Malaysia is experiencing a spike in aircraft repairs due to the global shortage of new planes. The company plans to construct Malaysia's largest maintenance hangar and is developing predictive maintenance software to mitigate industry delays.

- In February 2021,SIA Engineering Company Ltd. made a strategic investment in a groundbreaking venture, establishing the Engine Services Division. This subdivision is dedicated to pioneering research and development in advanced aircraft engine servicing, comprehensive repairs, and innovative practices such as wing testing. Notably, it reflects the industry's shift towards cutting-edge technologies.

- In December 2021, Korean Air showcased its technological prowess with a remarkable demonstration—employing drone swarms for a thorough full-body inspection of an aircraft, accomplishing the task with remarkable efficiency using only four drones. The increasing integration of automation, including artificial intelligence, drones, and robots, is poised to revolutionize the Air Transport MRO market, significantly reducing maintenance and repair timelines in the forecast period.

Segments Covered in the Report

By Service Type

- Engine Overhaul

- Airframe Maintenance

- Line Maintenance

- Modification

- Components

By Organization Type

- Airline/Operator MRO

- Independent MRO

- Original Equipment Manufacturer (OEM) MRO

By Aircraft Type

- Narrow-body

- Wide-body

- Regional Jet

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting