Fluoroalkyl-based Coatings Market Size and Forecast 2025 to 2034

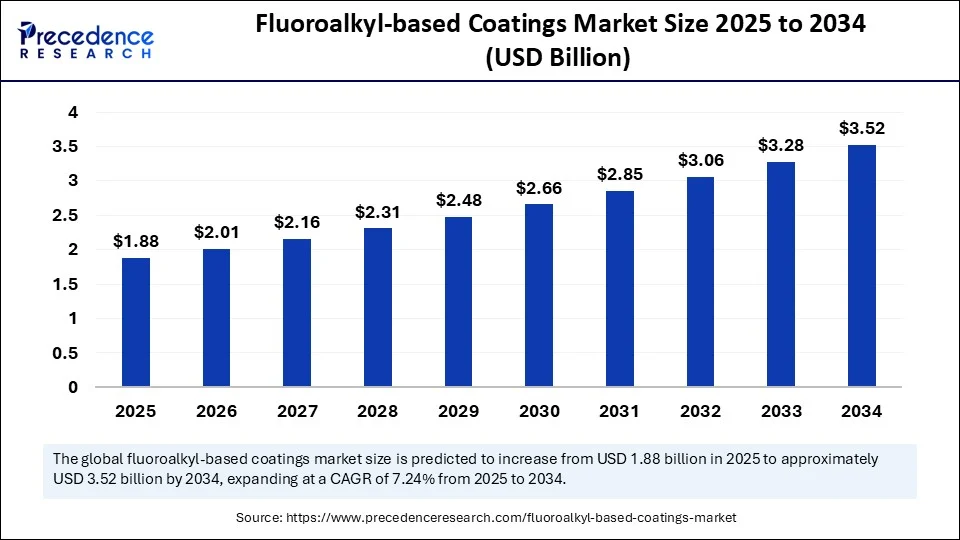

The global fluoroalkyl-based coatings market size was calculated at USD 1.75 billion in 2024 and is predicted to increase from USD 1.88 billion in 2025 to approximately USD 3.52 billion by 2034, expanding at a CAGR of 7.24% from 2025 to 2034. The fluoroalkyl-based coatings market is driven by rising demand for stain-resistant, weatherproof surfaces and expanding applications across construction, electronics, and automotive sectors.

Fluoroalkyl-based Coatings Market Key Takeaways

- In terms of revenue, the global fluoroalkyl-based coatings market was valued at USD 1.75 billion in 2024.

- It is projected to reach USD 3.52 billion by 2034.

- The market is expected to grow at a CAGR of 7.24% from 2025 to 2034.

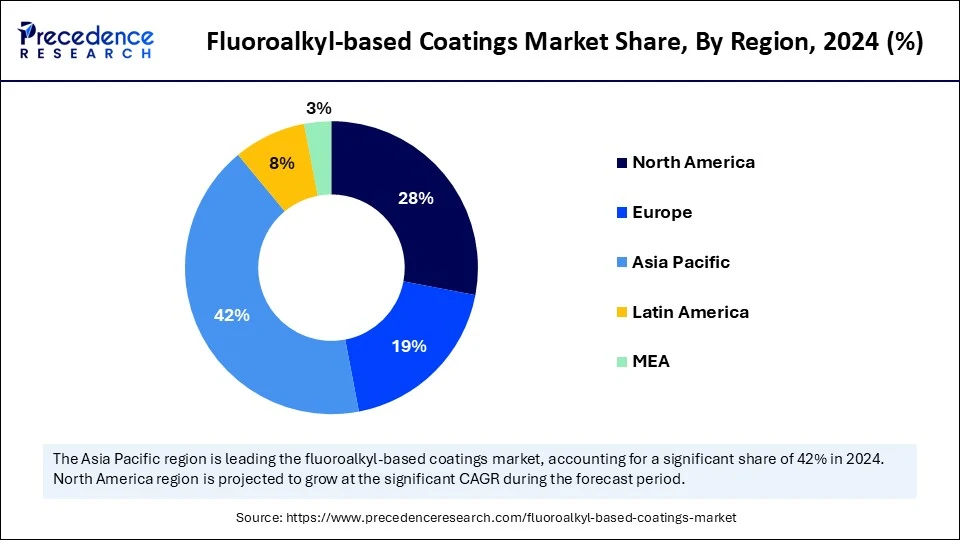

- Asia Pacific dominated the global fluoroalkyl-based coatings market with the largest market share of 40% in 2024.

- North America is anticipated to witness notable growth during the forecasted years.

- By product type, the fluoropolymer-based segment captured the biggest revenue share of 34% in 2024.

- By product type, the short-chain fluoroalkyl coatings segment is anticipated to show considerable growth over the forecast period.

- By substrate compatibility, the metals segment contributed the highest market share of 31% in 2024.

- By substrate compatibility, the plastics and composites segment is anticipated to show considerable growth over the forecast period.

- By technology, the solvent-based segment generated the major revenue share of 40% in 2024.

- By technology, the nano-coatings / UV-cured segment is anticipated to show considerable growth over the forecast period.

- By function/attribute, the hydrophobic and oleophobic segment accounted for remarkable market share of 36% in 2024.

- By function/attribute, the anti-fouling / anti-icing segment is anticipated to show considerable growth over the forecast period.

- By application, the electronics and semiconductors segment held the largest market share of 28% in 2024.

- By application, the medical devices and implants segment is anticipated to show considerable growth over the forecast period.

- By end-use industry, the electronics and electrical segment generated the major market share of 27% in 2024.

- By end-use industry, the healthcare and medical segment is anticipated to show considerable growth over the forecast period.

How is AI Transforming the Fluoroalkyl-based Coatings Market?

The introduction of artificial intelligence (AI) has changed the fluoroalkyl-based coatings market, allowing for optimization of R&D, manufacturing performance, and better customization of products. In the manufacturing industry, process control by AI guarantees production with consistent quality, low-waste rates, and downtime. Real-time intelligence and predictive maintenance enhance the reliability of the equipment and reduce the costs of operations through the assistance of AI.

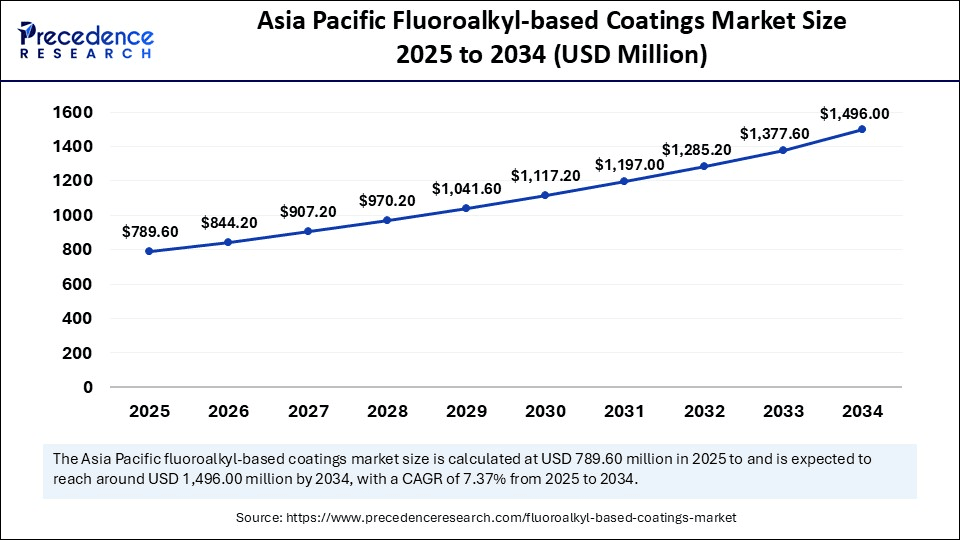

Asia Pacific Fluoroalkyl-based Coatings Market Size and Growth 2025 to 2034

The Asia Pacific fluoroalkyl-based coatings market size is exhibited at USD 789.60 million in 2025 and is projected to be worth around USD 1,496.00 million by 2034, growing at a CAGR of 7.37% from 2025 to 2034.

How did Asia Pacific Capture the Largest Market Share in 2024?

Asia Pacific led the global fluoroalkyl-based coatings market with the highest market share of 42% in 2024, owing to rising industrialization and extensive infrastructure development in significant countries like India, China, and Southeast Asian countries. Moreover, the trend of flourishing in renewable energy sources, particularly wind farm construction, which has been rising, is necessitating high demands for fluoropolymer coatings that can be anti-corrosive and ice-phobic. Current development in the electric vehicle powertrain manufacturing industry furthers the demand and application of fluoropolymers with low friction and thermal stability, further improving the performance and durability of each EV component.

China Fluoroalkyl-based Coatings Market Trends

China is extremely important in the Asia-Pacific region and is the largest fluoroalkyl-based coatings market. Its strength can be attributed to a solid chemical, electronics, and automotive manufacturing ecosystem that stimulates high demand for high-performance fluoropolymer coatings like PTFE and PVDF. Efforts by the governments to support high-technology industries and adherence to the standards of the environment have greatly increased the consumption of the highest-quality fluoropolymers.

What Are the Key Trends Driving the North America Fluoroalkyl-based Coatings Market?

The North American fluoroalkyl-based coatings market is expected to account for a substantial market share in 2024, due to strict environmental laws and a well-developed industry. The region in low-VOC and waterborne fluoropolymer systems is especially evident in fields like aerospace, chemical processing, and food equipment production, where the standards of safety and performance are considered to be of prime concern. Increase in offshore wind power, manufacture of electric vehicles (EVs), and lithium-ion battery gigafactories further exceeds the demand for advanced fluoropolymer coatings with chemical resistance, durability, and thermal stability.

The consumers in the US are requiring more durable, low-maintenance, and easy-to-clean coatings that are stain-resistant, also to be water, oil, and antimicrobial repellent. Such a tendency can be observed in the sphere of residential interiors, as well as in textiles and electronics, since this implies a concern with people being aware of indoor air quality and safety.

What Factors Are Fueling Growth in Europe's Fluoroalkyl-Based Coatings Market?

The European fluoroalkyl-based coatings market is growing steadily, combined with the high level of environmental regulation and renewable energy infrastructure investments. The focus of sustainability in the region, as seen through the adoption of low-VOC requirements, has noticeably increased the demand for the indicators of environmentally friendly coating across the regions distributed in the aerospace industry, automotive industry, and energy industry. Moreover, increased impetus of the energy-conserving and sustainable practices within the automotive industry, as well as the aerospace industry, is also helping the market boost the requirements for fluoropolymer coatings.

Germany is the largest market in the European region where fluoropolymer coatings are used, and this is due to its industrial strength, with its environmental policies on matters concerning energy efficiency and sustainability. In addition, the government measures to promote the implementation of technologies to make energy consumption more efficient and the digitalization of industries have opened up new possibilities for expansion.

Market Overview

Fluoroalkyl-based coatings are specialized coatings formulated using fluoroalkyl compounds that impart extreme hydrophobicity, oleophobicity, and chemical resistance to surfaces. These coatings are used to reduce surface energy, provide anti-fouling, anti-corrosion, and non-stick properties, and are widely employed in sectors demanding high-performance material protection, such as aerospace, electronics, construction, automotive, and healthcare.

The growth in the fluoroalkyl-based coatings market is being driven by the growing demand for high-performance raw materials with great chemical resistance, high friction, and low friction resistance. The coatings play a vital role in the construction, oil and gas, automotive, and electronics industries. A major factor that has contributed to the growth is the fast-growing offshore wind industry in the world, which uses the fluoropolymer coating as an anti-corrosive and ice-phobic coating.

What Factors Are Fueling the Rapid Expansion of the Fluoroalkyl-based Coatings Market?

- Increased demand for weather-resistant coatings: Fluoroalkyl coatings are non-corrosive, resistant to UV rays, and extreme weather conditions that making them suitable in infrastructure systems exposed to rough conditions, such as those in the marine environment. Offshore energy industries, coupled with offshore construction, are becoming more inclined to use these kinds of coatings to enhance the life of their equipment.

- Growth of the Electric Vehicle Industry: With the potential increase in the number of EVs enjoying the popularity of such effective solutions as the coatings that shield against threats and provide better thermal conditions, the a need for applying some lightweight and durable coating that can maximize battery protection and thermal management.

- Rise in Electronics and Semiconductors Use: Correlations of miniaturization and high-performance requirements in the electrical field need low-energy coating thickness and chemical resistance. The high utilization in semiconductors, displays, and circuit boards makes them reliable, particularly in 5G and high-speed computing devices, leading to market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.52 Billion |

| Market Size in 2025 | USD 1.88 Billion |

| Market Size in 2024 | USD 1.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.24% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Substrate Compatibility, Technology, Function / Performance Attribute, Application, End-use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing need for high-end protective coatings

Increasing demand for protective coating of good quality and performance is one of the key factors contributing to the growth of the fluoroalkyl-based coating market. Some of the industries are heavily exposed to the harsh environmental conditions, like the aerospace industry, automotive, construction, and electronic industries, where chemicals, UV radiation, high temperatures, and moisture present a harsh environment that may greatly affect the life span and effectiveness of equipment and materials. These are hydrophobic and oleophobic coatings best suited in places where surfaces need to be repellent to water, oil, and dirt. This reduces the cleaning and maintenance necessities, hence, low operating expenses and enhanced effectiveness.

Restraint

Environmental Concerns and Regulatory Hurdles

Long-chain fluorinated compounds have also been subjected to significant questioning and regulatory constraints, which are one of the inhibitors that impact the development of the fluoroalkyl-based coatings market. Consequently that governments and regulatory agencies around the world, such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), have been tightening the regulations on the manufacture, use, and disposal of PFAS (per- and polyfluoroalkyl substances). Also, the growth of awareness and negative attitude of people toward PFAS is posing reputational threats to companies dealing with these chemicals.

Opportunity

Transition towards bio-based coatings

The need to protect human health and the environment is driving faster regulation and adoption rates of safer and more sustainable coatings, with the U.S. Environmental Protection Agency's proactive PFAS reduction strategy serving. Along with increased consumer demand for non-toxic and biodegradable materials, such regulatory changes are beginning to push manufacturers to innovate next-generation fluoropolymer coatings without harmful per- and polyfluoroalkyl compounds. Renewable-based coatings provide a small carbon footprint and also fit into the worldwide sustainability agenda as well as the ESG (Environment, Social, and Governance) agenda of corporations. Moreover, academic institutions, start-ups, and established chemical companies are partnering up to address technological breakthroughs in green chemistry.

Product Type Insights

What Factors Contributed to the Fluoropolymer Segment Capturing 34% Revenue Share in 2024?

The fluoropolymer-based segment has captured a revenue share of 34% in 2024 due to the immense requirement in ever-growing electronics sector. The coatings will be preferred due to their high chemical resilience, thermal stability, and low surface energy, which are needed in high-performance industries like aerospace, automotive, and industrial manufacturing.

Long chain fluoroalkyl coatings offer better durability, flexibility, and abrasion, as well as showing good hydrophobic and Oleophobic properties. These coatings are applied in places where protection against moisture and contaminants is important, as in the electronics industry or improved durability of engine parts and the surface of the automobile, which may be subjected to hostile conditions.

The short-chain fluoroalkyl coatings segment is expected to grow at a significant CAGR over the forecast period, driven by rising regulatory concerns over long-chain PFAS compounds and a developing concern about the environment and human health sustainability.

- Regulatory efforts, such as the PFOA Stewardship Program instituted by the U.S. EPA, have been able to successfully eliminate long-chain versions of PFASs, leaving a market window open to shorter chain versions.

Industries like textile, construction, electronics, and the automotive industry are on case in embracing the formulations against stakeholder performance and compliance necessities. Also, the development of material science is improving the performance properties of the short-chain forms.

Substrate Compatibility Insights

What Led the Metals Segment to Achieve a 31% Revenue Share in 2024?

The metals segment has captured a 31% revenue share in 2024 owing to the omnipresence of the material across multiple industries. The growing demand in the automotive, aerospace, industrial, and construction industries. Fluoroalkyl coatings, developed from high-performing fluoropolymers, are preferable in metal treatments for their unique properties of high temperature, UV exposure, chemicals, and corrosion resistance. Such properties are essential in places where metals are used in rough operation or weather conditions like offshore oil platforms, aircraft bodies, underbodies of cars, and structural carcasses of buildings.

The plastics & composites segment is expected to grow substantially in the fluoroalkyl-based coatings market. Coatings based on fluoroalkyls are starting to gather momentum in this sector as they offer a combination of water and oil repellency, chemical resistance, thermal stability, and high mechanical strength like no other. Such coatings are particularly useful when it comes to the protection of lightweight plastic and composite parts in areas such as the aerospace industry, vehicle industry, electronics industry, the consumer products industry, and packaging. Fuel efficiency and performance have shifted to more lightweight materials in the aerospace and automotive industries, and composites are being more widely used, demanding high-performance coatings to prevent moisture, heat, and chemical exposure.

Technology Insights

Why Has the Solvent-Based Segment Emerged as a Market Leader in 2024?

The solvent-based segment has captured a revenue share of 40% in 2024 owing to the increased adhesion offered by for additional functionality. Fluoroalkyl coatings are commonly based on solvents, which are usually finished with fluoropolymers because they exhibit high chemical resistance and durability, strong and homogenous film formation on diverse substrates such as metal, plastics, and composites. Known benefits of solvent-based systems are easy application and improved drying speed, improving the efficiency of the production process and consistency in the coating performance, especially in complex geometrical shapes or porous surfaces.

The nano-coatings / UV-cured segment is expected to grow at a significant CAGR over the forecast period. Nano-coatings using fluoroalkyl replace nanoscale fillers that can increase the coating's hydrophobic, oleophobic, and anti-fouling characteristics to levels suitable for particular applications that require high levels of coating surface cleanliness and resistance to environmental deterioration. UV-cured technologies, however, are more amenable to a fast, energy-saving curing process, which means a safe, environmentally friendly process that works well with sensitive materials such as plastics and composites. The combination of the technologies of fluoroalkyl chemistry, nanotechnology, and UV-curing allows the creation of a thin, tough coating that can give long-term protection using a minimum amount of material.

Function / Attribute Insights

Why Has the Hydrophobic & Oleophobic Segment Emerged Strong in 2024?

The hydrophobic & oleophobic segment has captured a revenue share of 36% in 2024. The coating system using fluorinated molecules of low surface energy is created based on Fluoroalkyl, a protective layer that allows no adhesion of water, oils, and other pollutants on surfaces. This enables them to be very effective across many sectors, including the automotive and electronics, construction, and consumer goods sectors. They offer moisture and oil resistance in electronics to the circuit boards, helping avoid wear and tear as well as prolonging the life of the product. Based on the capability of preserving the functionality of surfaces and minimizing cleaning and repair efforts, these coatings are likely to keep gaining increased popularity in a variety of applications.

The anti-fouling / anti-icing segment is expected to grow at a significant CAGR over the forecast period. These are the coatings that produce super slippery surfaces that do not allow contaminants to attach to them, hence they are critical on marine vessels, offshore oil rigs, and infrastructure located in severe marine settings. Besides maritimes, related use is in aerospace, automotives, and buildings, where ice is a problem and creates operational unreliability and safety risks. The association with anti-fouling and anti-icing provides fluoroalkyl coatings with an anti-fouling, anti-icing, and anti-snagging effect, which in turn promotes a longer life of equipment with fewer maintenance requirements and a better efficiency rate.

Application Insights

Why Has the Electronics & Semiconductors Segment Emerged as a Market Leader in 2024?

The electronics & semiconductors segment has captured a 28% revenue share in 2024 by leading in the market owing to the growing demand for 5G network solutions and other modern technologies. High-performance fluoropolymers, consisting of Fluoroalkyl-based, offer an extraordinary degree of moisture and chemical resistance, which is an absolute requisite of the integrity and functionality of the much more vulnerable electronic devices. Such industries as semiconductor fabrication and consumer electronics, and telecommunications industries vastly depend on these coatings to make their products have a longer life as well as have lower failure rates.

The medical devices & implants segment is expected to grow substantially in the fluoroalkyl-based coatings market, driven by the increasing demand for better biocompatibility, strength, and functionality in healthcare applications. They reduce friction between medical instruments and tissues, improve patient comfort, and help procedures become more precise. They can be applied to different substrates, such as metals, silicones, and polymers, so their usage increases across a variety of medical areas. The increased demand of the medical industry for performance and reliability of the coating materials is leading to the massive growth of this segment.

End-use Industry Insights

What Factors Led the Electronics & Electrical Segment to Secure a 27% Share in 2024?

The electronics & electrical segment has captured a 27% revenue share in 2024 owing to the electronics industry that remains innovative and shows requirement for more resistant materialsThey support the growth in demand for high-performance insulation, thermal stability, as well as dielectric protection in the consumer electronics, telecommunication, and automotive electronics markets. The fastest increase in production of electric vehicles, intelligent devices, and 5G cellular networks influences the use of these coatings. There is also the demand towards miniaturization and increased life cycle of devices, which aids in the growth of the market.

The healthcare & medical segment is expected to grow substantially in the fluoroalkyl-based coatings market. The use of such coatings can be used to ensure longer life and the increased performance of medical devices, implants, and equipment because they can be used to give low-friction surfaces that lower wear and patient discomfort during use.

They are chemically resistant and do not attract contamination or cause biofilm, which enhances sterility and minimizes infection risk. The applications of the fluoroalkyl-based coatings on different substrates of medical use, i.e., metals, polymers, and silicones, extend their applicability in surgical equipment, catheters, diagnostic equipment, and implant parts.

Fluoroalkyl-based Coatings Market Companies

- Daikin Industries, Ltd.

- The Chemours Company

- 3M Company

- AGC Inc. (Asahi Glass Company)

- Solvay S.A.

- H.B. Fuller Company

- PPG Industries, Inc.

- BASF SE

- W.L. Gore & Associates, Inc.

- Arkema S.A.

- Akzo Nobel N.V.

- Momentive Performance Materials Inc.

- Aculon, Inc.

- Nanophase Technologies Corporation

- DuPont de Nemours, Inc.

- Nippon Paint Holdings Co., Ltd.

- SABIC (for advanced substrate coatings)

- Sika AG

- Shanghai 3F New Material Co., Ltd.

- NanoSlic Smart Coatings

Recent Developments

- In May 2025, PPG Industries, Inc. announced the launch of ENVIROLUXE Plus powder coatings that contain no PTFE fluoropolymer and use recycled plastic. The coatings were developed to deliver a reduced carbon footprint while maintaining performance, which aligns with PPG's sustainability focus. Environmental concerns with fluorocarbon brands such as 'oil and water repellent' also have effects on manufacturers in user markets included including the architectural and industrial markets.

(Source:https://investor.ppg.com)

- In March 2024, Archroma planned to enter the market with Cartaseal OGB F10, a water-based and easily recyclable oil and grease barrier coating that is intended to replace fluorochemicals and polyethylene use in packaging and paper applications, including food and non-food paper goods, while being FDA and BfR compliant and offering increased sustainability.

(Source: https://www.archroma.com)

- In July 2024, NOF Metal Coatings is expected to enter the market with a PFAS-free PLUS topcoat series that will meet global OEM needs while having improved tribological characteristics, silver appearance, and fluorescent readability to replace PTFE-based coatings preceding prospective European regulatory approvals for PFAS use.

(Source: https://www.ipcm.it)

Market segment Covered in the Report

By Product Type

- Fluoroalkylsilane Coatings

- Mono-functional silanes

- Multi-functional silanes

- Fluoropolymer-based Coatings

- PTFE (Polytetrafluoroethylene)

- PVDF (Polyvinylidene Fluoride)

- FEP (Fluorinated Ethylene Propylene)

- PFA (Perfluoroalkoxy)

- Perfluorinated Compounds (PFCs)

- PFOS-based

- PFOA-based

- Short-Chain Fluoroalkyl Coatings (C6 and below)

- Long-Chain Fluoroalkyl Coatings (C8 and above – being phased out)

- Eco-friendly/Bio-based Fluoroalkyl Coatings

By Substrate Compatibility

- Metals

- Glass & Ceramics

- Plastics & Polymers

- Textiles & Fabrics

- Concrete & Masonry

- Composites (Carbon Fiber, FRP, etc.)

By Technology

- Solvent-based Coatings

- Water-based Coatings

- Powder Coatings

- UV-cured Coatings

Nano-coatings / Self-assembled Monolayers (SAMs)

By Function / Performance Attribute

- Hydrophobic & Oleophobic Coatings

- Anti-corrosion Coatings

- Anti-fingerprint Coatings

- Anti-fouling / Marine Coatings

- Anti-icing Coatings

- Low Surface Energy / Release Coatings

- Dielectric / Electrical Insulation Coatings

By Application

- Electronics & Semiconductors

- Display screens

- Printed circuit boards

- MEMS devices

- Aerospace & Defense

- Aircraft exterior coatings

- Radar components

- Automotive

- Windshields

- Sensor housings

- Engine components

- Building & Construction

- Facades

- Glass panels

- Concrete structures

- Healthcare & Medical Devices

- Surgical tools

- Implants

- Labware

- Energy Sector

- Solar panels

- Wind turbine blades

- Textiles & Leather

- Outdoor wear

- Upholstery

- Marine

- Ship hulls

- Offshore structures

- Consumer Goods

- Eyewear

- Cookware

- Touchscreens

By End-use Industry

- Electronics & Electrical

- Aerospace & Defense

- Automotive & Transportation

- Construction & Architecture

- Medical & Healthcare

- Oil & Gas / Energy

- Consumer Products

- Textile & Apparel

- Marine

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting