What is the Automotive Electronics Market Size?

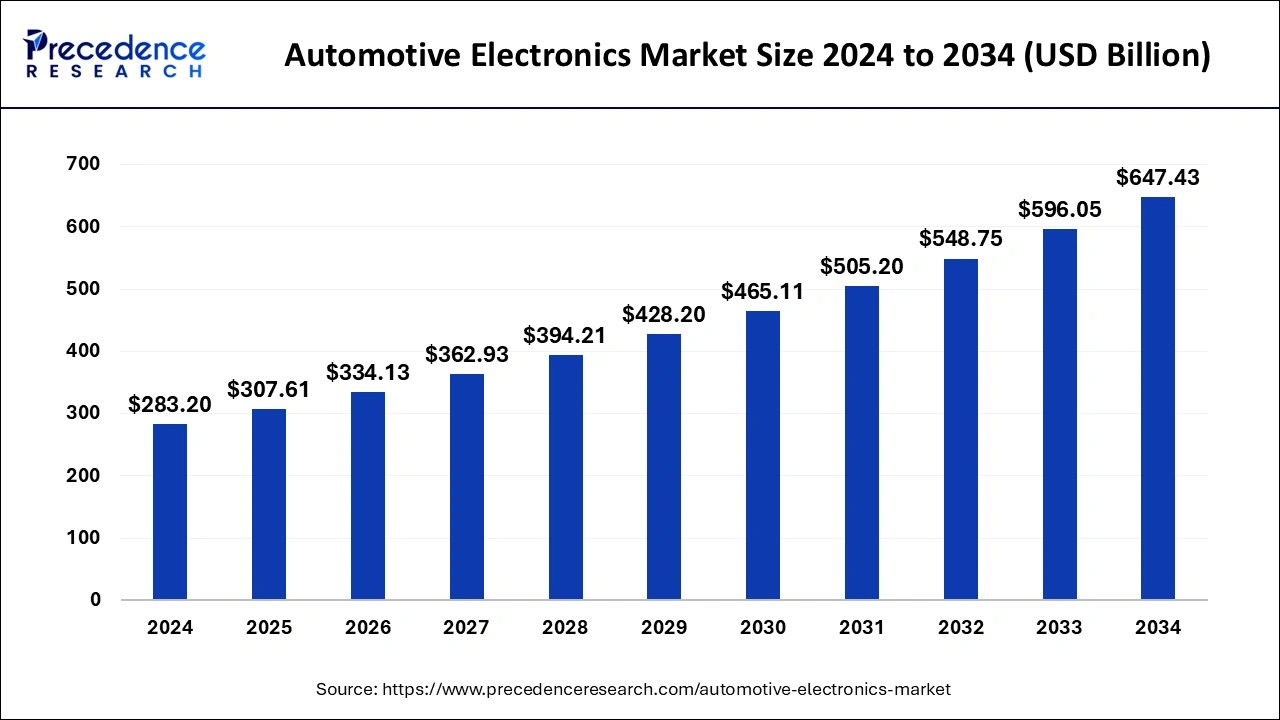

The global automotive electronics market size is accounted at USD 307.61 billion in 2025 and predicted to increase from USD 334.13 billion in 2026 to approximately USD 647.43 billion by 2034, expanding at a CAGR of 8.62% from 2025 to 2034. The global automotive electronic market is attributed to the increasing implementation and integration of advanced safety systems such as automatic emergency lane departure warnings, parking assistance systems, airbags, and braking to decrease road accidents.

Automotive Electronics Market Key Takeaways

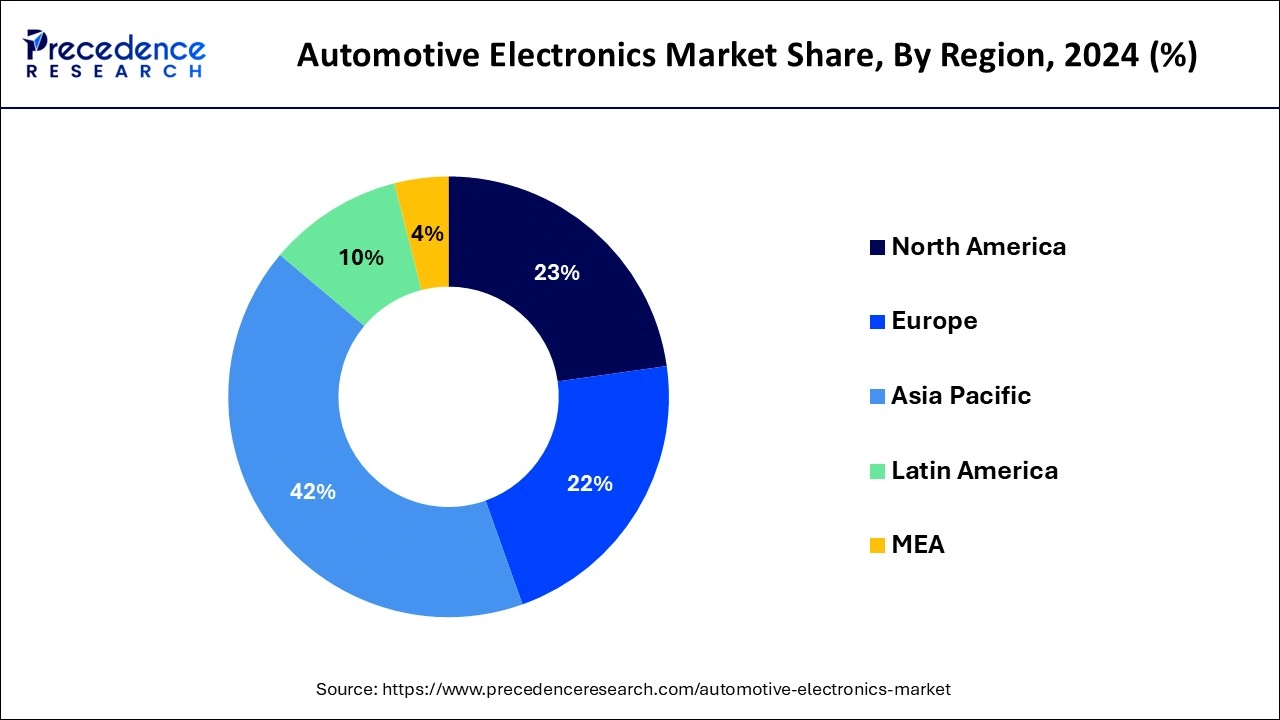

- Asia Pacific led the automotive electronics market with the largest market share of 42% in 2024.

- North America is projected to expand at a CAGR of 8.82% during the forecast period.

- By component, the current carrying devices segment has held a major market share of 42% in 2024.

- By component, the sensors segment is expected to grow at a notable CAGR during the forecast period.

- By application, the safety systems segment accounted for the biggest market share in 2024.

- By application, the advanced driver assistance system (ADAS) segment is growing at a significant CAGR over the forecast period.

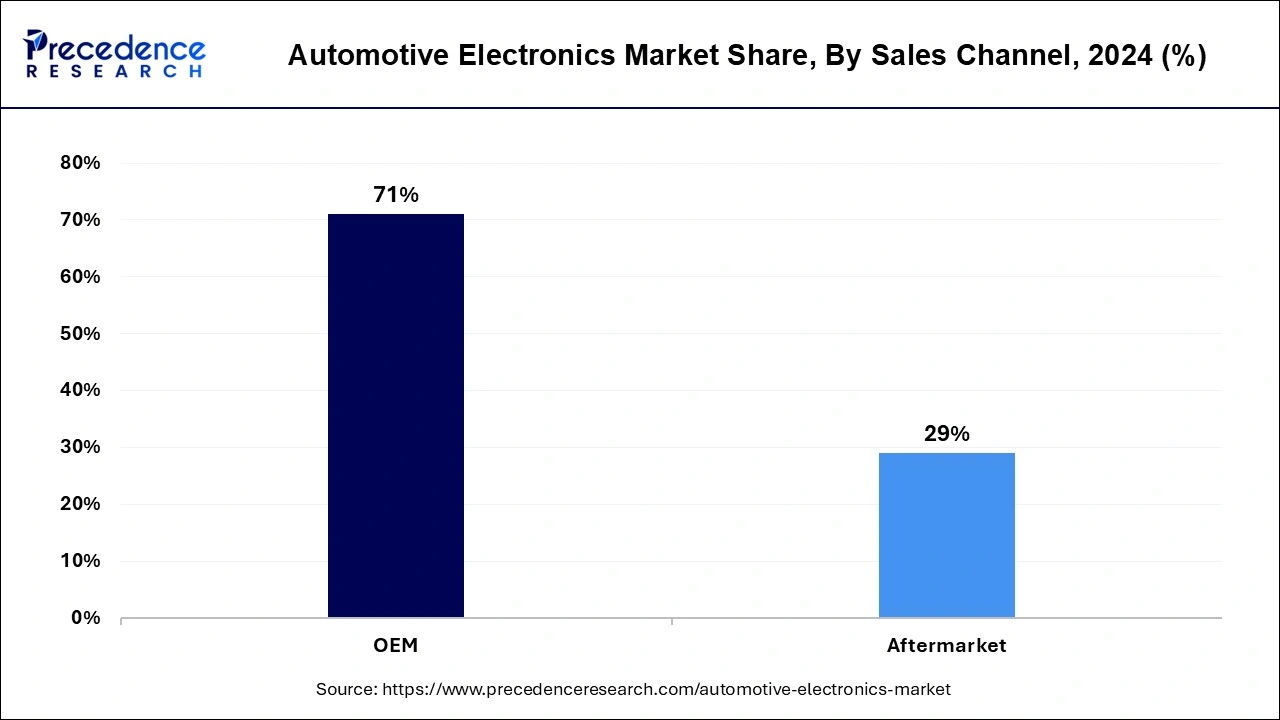

- By sales channel, the OEM segment contributed the highest market share of 71% in 2024.

- By sales channel, the aftermarket segment is expected to grow at a notable CAGR over the forecast period.

How Can AI Revolutionize the Automotive Electronics Market?

Artificial intelligence is a major and necessary trend in technology. There are various ways in which AI is being integrated into how they operate on the road and how vehicles are built. AI in cars aims to provide drivers, increase fuel efficiency, and improve with enhanced connectivity features. In addition, AI is applied in cars in various ways, such as robots that use AI to quickly assemble cars, driver-assistance systems that activate under certain scenarios, and sensors that help automotive vehicles navigate their surroundings. AI-based infotainment systems allow in-vehicle configurations such as mirror and seat settings tailored to the driver's needs and preferences. In addition, to prevent road accidents, AI solutions offer drivers real-time information on potential hazards, which is expected to drive the demand for the automotive electronics market in the coming years.

Automotive Electronics: Driving Innovation and Enhanced Vehicle Functionality

Automotive electronics are customized electronics designed for use in vehicles. These types of electronics can be exposed to, and are thus rated at, more severe temperature ranges when compared with regular electronics. Over the last decade, vehicle sensor improvements have led to pioneering autonomous driving mechanism that permits better visibility and consciousness. The special cutting-edge features in the modern vehicles include adaptive cruise control, park assistance, lane-keep support, traffic-sign identification and pedestrian recognition among others. Multiple features presented by original equipment manufacturers (OEMs) such as mechanized emergency braking organization, lane departure warning and airbag system among others have suggestively reduced road accidents across the world. Automotive electronics along with the existence of connected features and comprehensive computing technologies are improving automobile competences. These developments have been probable due to the substantial progress of electronic component in recently manufactured vehicles.

Automotive Electronics Market Growth Factors

- Rising adoption and incorporation of automotive electronics in recent vehicles to carry improved comfort and safety boosts the growth of automotive electronics industry

- The escalating automotive production right away influences the revenue sales and volume of electronic components

- Increasing focus of automotive manufacturers on increasing safety of vehicles

- Growing popularity of Driver-Assisted technology.

- Launch of electric vehicles

Market Outlook

- Industry Growth Overview- The market is experiencing strong growth driven by rising adoption of advanced driver-assistance systems (ADAS), electric and hybrid vehicles, and connected car technologies. Technological advancements in sensors, infotainment, and vehicle safety are further boosting industry expansion.

- Global Expansion- The automotive electronics market is expanding globally due to increasing demand for electric and connected vehicles, adoption of advanced driver-assistance systems (ADAS), and growing investments in R&D. Technological innovations and supportive automotive infrastructure are driving growth across major regions.

- Startup Ecosystem- The startup ecosystem in automotive electronics is thriving, with companies innovating in electric vehicle components, ADAS, sensors, and connected car technologies. Strong venture capital funding, collaborations with OEMs, and rising demand for smart mobility solutions are driving rapid growth.

Market Scope

| Report Highlights | Details |

| Market Size in 2026 | USD 334.13 Billion |

| Market Size in 2025 | USD 307.61 Billion |

| Market Size by 2034 | USD 647.43 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.62% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Sales Channel, Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Future of Automotive Electronics

Increasing speed of modernization in the automotive electronics industry is expected to pave the way for customers to better exploit their time in transportation to enjoy innovative services. As a result, customers will have additional time to participate in personal activities. Thus, an electronically smart automobile will consist of enhanced features. It is more relaxed, secure, and energy efficient. New reports and investigation on smart cars assert that higher than 65% of new cars will consist of smart technology by the end of 2022. As per a report published by BI Intelligence, around 94 million smart cars will be shipped by the end of 2022. And, approximately 82% of all cars transported by 2022 will be equipped with connected technology. This would result in a CAGR of nearly 35% from the present 21 million connected automobiles.

Significant Market Trends

Component Insights

The current carrying devices segment has held a major market share of 42% in 2024.

The current-carrying devices segment dominated the global automotive electronics market due to high cost of components including connectors and wiring harness. Furthermore, government initiatives comprising Make in India and influences such as fewer labor costs and intensifying disposable income in evolving economies have led to an upsurge in the production of passenger cars and light commercial vehicles.

Sales Channel Insights

The OEM segment contributed the highest market share of 71% in 2024.

The original equipment manufacturer or OEM segment occupied the leading market portion in 2024, as most of the electronic components are incorporated while the vehicle manufacturing phase. As electronic components provided by the OEMs are extremely durable OEM market is projected to develop at a momentous growth rate during years to come.

Application Insights

Safety Systems led different application segments and reported more than 24% market share in terms of revenue in 2024. Some of the prominent driving forces for the market growth include government guidelines that aim to minimalize road accidents and loss of passenger lives, rising requirement for transportation management systems, specially in the logistic industry.

Regional Insights

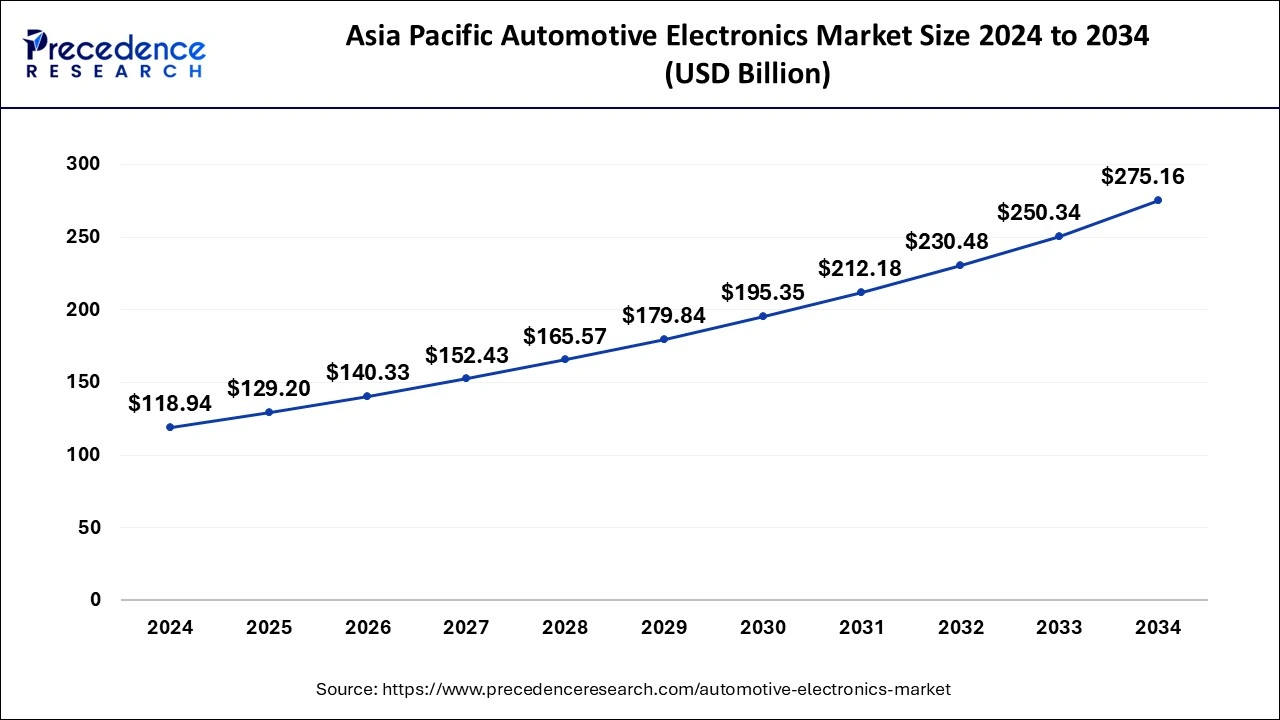

Asia Pacific Automotive Electronics Market Size and Growth 2025 to 2034

The Asia Pacific automotive electronics market size is evaluated at USD 129.20 billion in 2025 and is predicted to be worth around USD 275.16 billion by 2034, rising at a CAGR of 8.74% from 2025 to 2034.

Asia Pacific dominated the automotive electronics marketwith the largest market share of 42% in 2024.

The market growth in the region is driven by increasing consumer awareness of safety features in emerging countries, increasing purchasing power of consumers, and increasing demand for advanced electronics in vehicles. By implementing modern manufacturing technology, automotive manufacturers in the region intend to enhance their production volume.

North America is expected to grow fastest during the forecast period. The automotive electronics market growth in the region is attributed to the increasing number of automotive electronics companies that are implementing collaboration and partnership initiatives to increase their demographic presence.

U.S. Automotive Electronics Market Trends

The market in the U.S. is anticipated to grow fastest during the forecast period. The market growth in the U.S. is attributed to the increasing consumer preference towards connected cars increasing demand for electric vehicles and rising government funding and regulations. Various vehicles in the U.S. are tailored with Internet access and the ability to communicate devices, such as cars, smartphones, and infrastructure. In addition, connected cars need sophisticated electronic systems to enable connectivity, which is further driving the growth of the automotive electronics market in the U.S.

China Automotive Electronics Market Trends

China is the fastest growing country in the automotive industry and is expected to grow the fastest during the forecast period across the globe. Government regulation, subsidies, and incentives enhancing NEVs have led to an increase in the demand for electric cars which is expected to propel the growth of the automotive electronics market. In addition, China has been heavily investing in autonomous driving technology and is experiencing growth in AI technologies, radar systems, LiDAR, and sensors.

India Automotive Electronics Market Trends

The market growth in the country is attributed to the rapid advancements in technology for the development of innovative and new automotive electronics products, such as advanced driver assistance systems (ADAS), navigation systems, and infotainment systems.

Europe Accelerates Automotive Innovation Through Advanced Electronics

Europe's market is growing due to increasing adoption of advanced driver-assistance systems (ADAS), rising demand for electric and hybrid vehicles, and growing emphasis on vehicle safety and connectivity. Stringent government regulations on emissions and road safety are encouraging manufacturers to integrate sophisticated electronics. Additionally, technological advancements in sensors, infotainment systems, and autonomous driving features, coupled with strong automotive manufacturing infrastructure, are driving the expansion of automotive electronics across the region.

Driving Innovation: Growth of Automotive Electronics in the UK

The UK market is growing due to increasing demand for connected and smart vehicles, rising adoption of electric and hybrid cars, and government initiatives promoting road safety and emission reduction. Advanced driver-assistance systems (ADAS), infotainment technologies, and autonomous driving features are driving electronics integration. Additionally, strong automotive R&D infrastructure, collaborations between OEMs and technology providers, and consumer preference for safer, high-tech vehicles are further fueling the growth of automotive electronics in the UK.

Value Chain Analysis

Vehicle Assembly and Integration

- Vehicle assembly and integration in automotive electronics involves connecting electronic control units (ECUs), sensors, and high-speed networks.

- These components are incorporated into the vehicle's electrical/electronic (E/E) architecture.

- Proper integration is essential for enhancing safety, performance, and enabling advanced vehicle features.

Testing and Quality Control

- Testing and quality control in automotive electronics ensure components and systems are safe and reliable.

- Includes verification for compliance with industry regulations and standards.

- Conducted through environmental, electrical, and functional testing to guarantee performance and durability.

Aftermarket Services and Spare Parts

- Aftermarket services and spare parts for automotive electronics provide third-party components, repair, and diagnostic solutions.

- Serve as alternatives to Original Equipment Manufacturer (OEM) parts for maintenance, upgrades, and repairs.

- The aftermarket industry is diverse, offering everything from raw materials to finished parts and advanced diagnostic solutions for both conventional and electric vehicles.

Top Vendors and their Offerings

- Hella GmbH & Co. KGaA- Provides automotive lighting solutions, sensors, and electronic control units (ECUs) for safety, driver assistance, and energy-efficient systems.

- Altera (Intel)- Supplies programmable logic devices (FPGAs) and system-on-chip solutions for vehicle networking, infotainment, and advanced driver-assistance systems (ADAS).

- Broadcom Ltd- Offers automotive semiconductors, connectivity solutions, and networking chips for in-vehicle communication and safety systems.

- Infineon Technologies- Provides microcontrollers, power semiconductors, sensors, and safety solutions for electric vehicles, ADAS, and vehicle networking.

- Panasonic Corporation- Supplies automotive batteries, infotainment systems, sensors, and electronic components supporting electric and connected vehicles.

Automotive Electronics Market Companies

Due to prevalent electronics systems in automobile operations, manufacturers have been able to enhance the driving performance, riders' and driver's comfort and fuel efficiency. Number of electronics components is increasingly growing with time due to need to recover everything from fuel effectiveness and driver security. As a consequence, more mechanisms are getting converted from mechanical systems to electronic ones.

Prominent market participants are emphasizing on tactics such as novel product launch, business development, collaborations and acquisition to withstand the strong market rivalry. Leading competitors contending in global automotive electronics market are as follows:

- Hitachi Automotive Systems, Ltd

- Microchip Technology, Inc

- NXP Semiconductors N.V

- Texas Instruments Incorporated

In order to better recognize the current status of acceptance of automotive electronics, and policies adopted by the foremost countries, Precedence Research predicted the future evolution of the Automotive Electronics market. This research study offers qualitative and quantitative insights on Automotive Electronics market and assessment of market size and growth trend for potential market segments.

Latest Announcements by Market Leaders

- In September 2024, to advance vehicle safety and performance through innovative solutions in automotive electronics, Supratik Roy joined Marelli UM Electronics Systems as Chief Operations Officer. They had a distinguished career in the automotive electronics market.

Recent Developments

- In June 2024, a global leader of health and performance monitoring solutions for advanced electronics, protean Tecs announced the launch of RTSM (Real-Time Safety Monitoring), a deep data application for failure prevention and fault detection in mission-critical automotive applications.

- In November 2024, the first SOC for automotive fusion was launched by Renesas Electronics on the 3nm process, which is designed to save critical space on computer boards for car OEMs and improve performance with lower power. It serves advanced driver assistance systems on single-chip gateway applications and in-vehicle infotainment.

Major Market Segments Covered

By Type

- Sensors

- Electronic Control Unit

- Current Carrying Devices

By Sales Channel

- OEM

- Aftermarket

By Application

- Body Electronics

- ADAS

- Infotainment

- Safety Systems

- Powertrain Electronics

By Geography

- North America

-

- U.S.

- Canada

-

- Europe

-

- Germany

- France

- United Kingdom

- Rest of Europe

-

- Asia Pacific

-

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

-

- Latin America

-

- Brazil

- Rest of Latin America

-

- Middle East & Africa (MEA)

-

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

-

Get a Sample

Get a Sample

Table Of Content

Table Of Content