Magnesium Market Size and Forecast 2025 to 2034

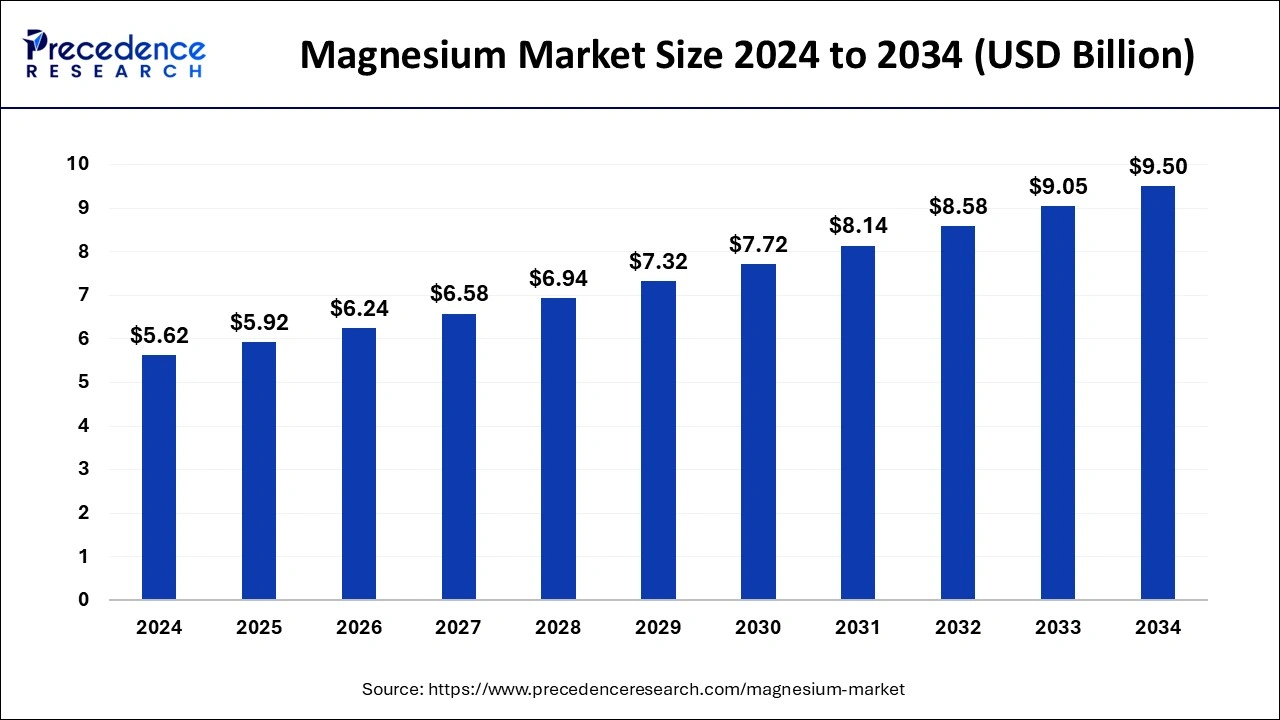

The global magnesium market size wwas estimated at USD 5.62 billion in 2024 and is predicted to increase from USD 5.92 billion in 2025 to approximately USD 9.50 billion by 2034, expanding at a CAGR of 5.39% from 2025 to 2034. The increase in product demand for various applications, such as die-casting and aluminum alloy for varied industrial purposes, is causing the global magnesium market to grow.

Magnesium MarketKey Takeaways

- The global magnesium market was valued at USD 5.62 billion in 2024.

- It is projected to reach USD 9.50 billion by 2034.

- The magnesium market is expected to grow at a CAGR of 5.39% from 2025 to 2034.

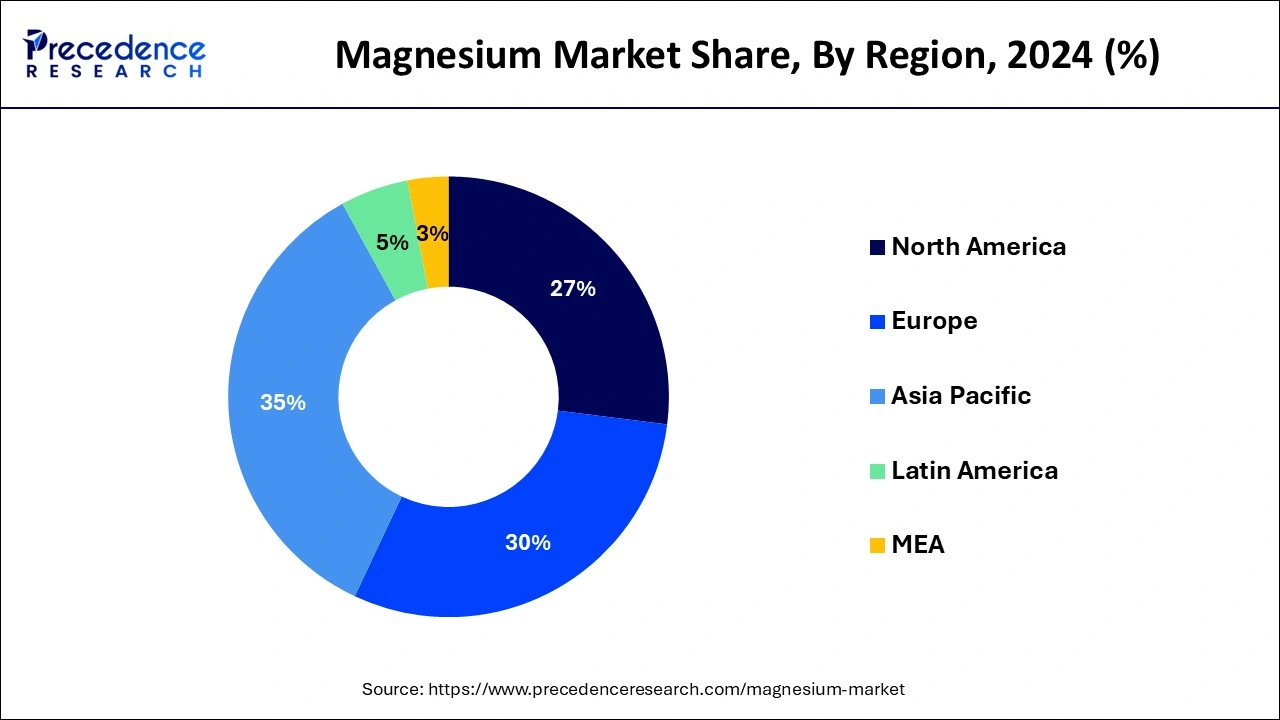

- Asia Pacific dominated the market with the largest market share of 35% in 2024.

- Europe is projected to witness significant growth in the market over the estimated period.

- By application, the aluminum alloying segment dominated the market in 2024.

- By application, the die casting segment is anticipated to witness substantial growth during the forecast period.

Asia PacificMagnesium Market Size and Growth 2025 to 2034

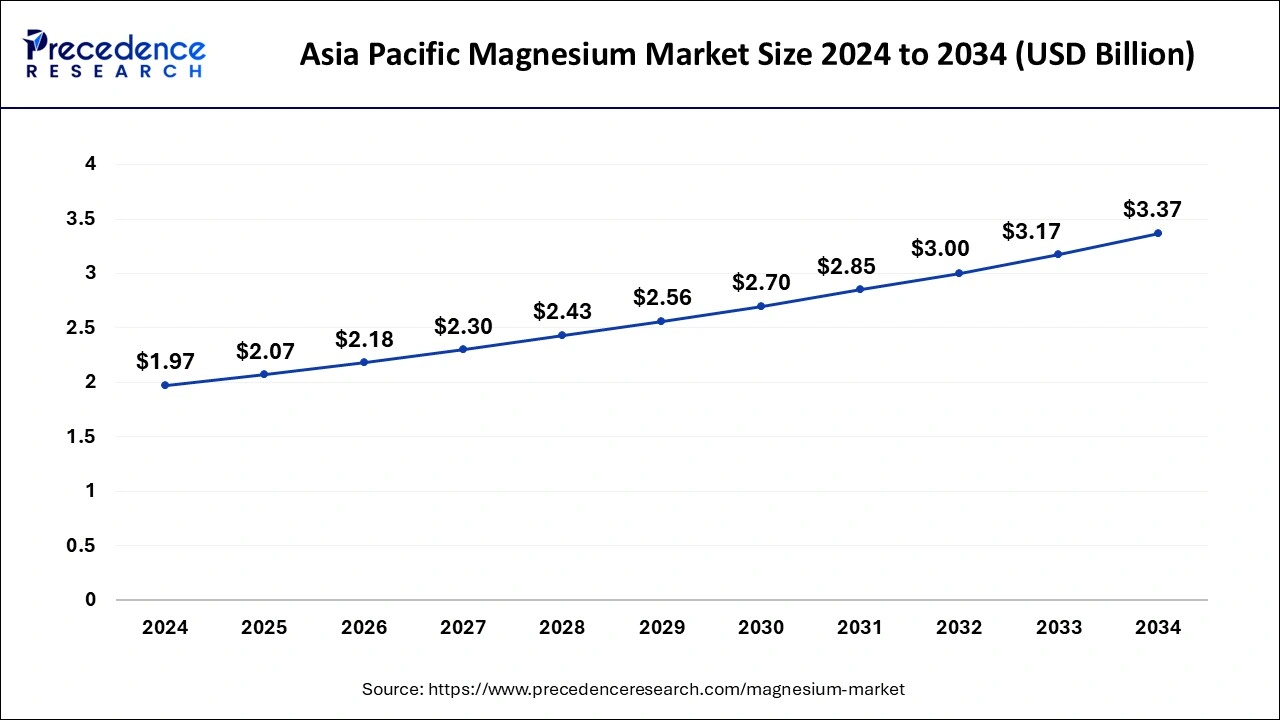

The Asia Pacific Magnesium market size was estimated at USD 1.97 billion in 2024 and is projected to surpass around USD 3.37 billion by 2034 at a CAGR of 5.52% from 2025 to 2034.

Asia Pacific dominated the global magnesium market in 2024, accounting for over the market revenue,and is expected to maintain its dominance in the forecast period. Countries like India and China have seen increased spending on electric automotive projects, while rapid growth in military aviation, aerospace, and space ventures is also driving magnesium market growth. Additionally, the importance of steel industries in countries like India and Japan is further contributing to the growth of the global market throughout the forecast period.

- The India Brand Equity Foundation (IBEF), in addition, forecasts that the Indian automotive industry will reach USD 300 billion by 2026. The report also stated that India's annual production of automobiles in FY22 was approximately 23 million units.

Europe is projected to witness significant growth in the magnesium market over the estimated period. Germany is the world's biggest consumer of aluminum casting, largely due to the automotive sector's high demand for aluminum parts. The increasing need for lightweight components, driven by fuel efficiency and aerodynamic advancements, is boosting the market for aluminum alloys, consequently increasing magnesium consumption.

As Europe's leading automobile producer, Germany boasts 41 assembly and engine production facilities. It dominates the European automotive market and manufactures one-third of all cars sold on the continent. It is a top manufacturing hub for the automotive industry, housing various manufacturers across different segments, including equipment producers, material and component suppliers, engine manufacturers, and system integrators. This will help the region to gain a foothold in the global magnesium market.

Market Overview

Magnesium possesses electromagnetic properties, high thermal heat capacity, and strength, making it suitable for various industrial applications. Its lightweight nature makes it particularly valuable in the automotive, aerospace, and electric vehicle sectors. Magnesium can store energy and is considered more stable than lithium-ion. It also plays a significant role in electronic devices like televisions and laptops.

Initiatives are promoting the alloying of aluminum and magnesium for beverage can manufacturing, contributing to rapid growth in the magnesium market share. Its electromagnetic screening property and heat conductivity make it ideal for such applications while also enhancing the strength of aluminum, which is widely used in these industries. The growing demand for lightweight components, especially in the automotive and aerospace sectors, is expected to drive market growth in the coming years.

Magnesium MarketGrowth Factors

- A rise in infrastructure and building projects is expected to fuel the market growth of the magnesium market in the future.

- Increasing the use of magnesium in the medical and healthcare industry further propels the magnesium market.

- Technological developments in the manufacturing of magnesium are boosting the growth of the market over the projected period.

- Growing urbanization and industrialization in emerging economies also contribute to the market expansion during the forecast period.

- The rise in utilization of magnesium in renewable energy technologies is one of the key factors for magnesium market growth.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.39% |

| Market Size in 2025 | USD 5.92 Billion |

| Market Size by 2034 | USD 9.50 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing need for alloy metals

In the magnesium market, the demand for magnesium for alloying with different metals is growing due to various applications of magnesium alloys. The lightest structural alloys are extensively used to be those made from magnesium.

Magnesium is also combined with other metals to enhance its physical properties. The elements used as alloys are copper, zinc, aluminum, manganese, and rare earth metals. This magnesium property, along with its physical property, is expected to boost the magnesium market shortly.

- In July 2023, Chinese scientists engineered supersized magnesium alloy auto parts that could see the development of cheaper, lighter cars. The two giant parts consisting of a car body and a battery box cover were derived from a single mold in one casting. Magnesium alloys are about 30 percent lighter than mainstream aluminum alloys and 70 percent lighter than steel. Lighter auto parts can lead to an increase in car range and effectively alleviate ‘range anxiety' for electric vehicles.

Enhanced manufacturing projects for aircraft spacecraft and missiles

Magnesium's ability to withstand harsh conditions makes it ideal for constructing ballistic missiles and spacecraft, which require lightweight materials capable of resisting electromagnetic waves encountered at close range. Additionally, growing environmental concerns regarding fuel emissions have led to increased efforts to reduce pollution worldwide. With the global atmospheric concentration of carbon dioxide reaching the highest in recent years, initiatives and expenditures toward electric vehicles and automotive alternatives are driving the demand for magnesium.

- The UK Armed Forces are set to invest $36.77 billion in military aircraft by 2029, further highlighting its relevance in aerospace and spacecraft industries due to increased government spending in these areas.

Restraint

Environmental policies about damage posed by magnesium mining

The construction process can be slowed down by metals' tendency to react with oxygen, causing damage to surface and under-surface areas. This poses challenges for industries like aerospace and automobiles, where efficiency is crucial. Additionally, environmental concerns surround magnesium mining, which can harm soil and biodiversity.

To mitigate these risks associated with mining activities, limitations have been imposed to protect ecosystems and indigenous species. Governmental policies and initiatives aimed at environmental protection are expected to limit the growth of the magnesium market.

Opportunity

Possible increase in the use of magnesium metals in electric vehicles

Products of the magnesium market are lightweight yet strong, making them increasingly favored for use in electric vehicles (EVs). Their use in EVs is expected to grow, enhancing the vehicles' overall range capacity and improving mileage per battery charge due to their lighter weight. As the EV market expands, various vehicle components such as brake pads, brake drums, driveshafts, and engine parts are likely to incorporate magnesium metal.

With consumers increasingly favoring vehicles with lower emissions, changes in emission policies and stricter regulations are expected to drive further growth in the magnesium market. Recent developments and government initiatives, such as France's tax reductions on electric trucks to promote their purchase and the goal of achieving carbon neutrality in the road freight industry by 2050, are likely to further boost demand for EVs in the coming years.

- In May 2023, Ipower Batteries Pvt Ltd announced that it would achieve a major milestone, which is being dubbed as revolutionizing the EV 2-wheeler industry in India. The company has developed India's first LMFP (Lithium Magnesium Iron Phosphate) batteries for the EV industry. These batteries have been named as Rugpro series by the company.

Application Insights

The aluminum alloying segment dominated the magnesium market in 2024. This is attributed to the property of Mg to enhance the strength of the alloy when mixed with other metals. These alloys are primarily used in the manufacturing of beverages. Other than this, they can be used in buildings, pressure vessels, and chemical tankers. Also, growing investments in the beverage industry are supporting the market growth further.

In the magnesium market, the die casting segment is anticipated to witness substantial growth during the forecast period. During a certain period, all manufacturing units and OEM plants were forced to stop production due to various reasons. As economies started recovering, the demand for die-cast parts in the automotive industry surged significantly, mainly because consumers preferred lightweight vehicles. This trend is expected to continue, fueling market growth.

- In August 2022, Wencan Group Co., Ltd. announced that it intends to build a production base of aluminum die-cast parts for New Energy Vehicles (NEVs) in Lu'an Economic and Technological Development Zone, Anhui Province.

Magnesium Market Companies

- U.S. Magnesium LLC

- Mag Specialties Inc.

- RIMA Group

- China Magnesium Corporation Ltd.

- Taiyuan Tongxiangyuan Fine Material Co., Ltd.

- POSCO Magnesium Corporation

- Norsk Hydro ASA

- Dead Sea Magnesium Ltd.

- Wenxi YinGuang Magnesium Industry (Group) Co., Ltd.

- Yinguang Magnesium Industry (Group) Co., Ltd.

- Shanxi Wenxi Hongfu Magnesium Co., Ltd.

- Taiyuan Yiwei Magnesium Co., Ltd.

- Shanxi Credit Magnesium Co., Ltd.

- Shanxi Fugu Tianyu Mineral Industry Co., Ltd.

- Shanxi Xinghua Magnesium Co., Ltd.

- Shanxi Yinguang Huasheng Magnesium Co., Ltd.

- Solikamsk Magnesium Works OAO (SMW)

- Timminco Limited

- Ningxia Hui-Ye Magnesium Marketing Group Co., Ltd.

- JSC Magnezit Group

Recent Developments

- In February 2023, Western Magnesium Corporation announced its plan to build a new production facility for magnesium metal with an initial annual capacity of 25,000 metric tons and a new research and development center in Nevada. With the help of this new production facility, the company aims to serve automotive, aerospace, airline, eco-friendly technology companies, and defense contractors through this expansion.

- In July 2022, Chongqing Boao Magnesium-Aluminum Metal Manufacturing Co. Ltd (a wholly owned subsidiary of RSM Group/ Nanjing Yunhai Special Metals Co. Ltd) announced the completion of a high-performance magnesium-aluminum alloy and deep processing project (Phase II project) located in Pingshan Industrial Park, Chongqing City. The new production facilities could have various workshops, including a magnesium particle production workshop with a 7,200 tons/year capacity.

- In January 2022, VSMPO-AVISMA Corporation (VSMPO) announced the extension of a long-term agreement with Barnes Aerospace (Barnes) until December 2026, with an approximate value of $35M. Under the amended contract, VSMPO intends to provide Barnes with an agreed-upon range of alloys and sizes of titanium mill products to support their commercial aircraft manufacturing programs.

- In April 2022, Western Magnesium Corporation announced a non-brokered private placement of USD 3,000,000 in principal amount of unsecured convertible notes.

Segments Covered in the Report

By Application

- Aluminum Alloying

- Die casting

- Desulfurization

- Metal Reduction

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting