What is the Aluminum Casting Market Size?

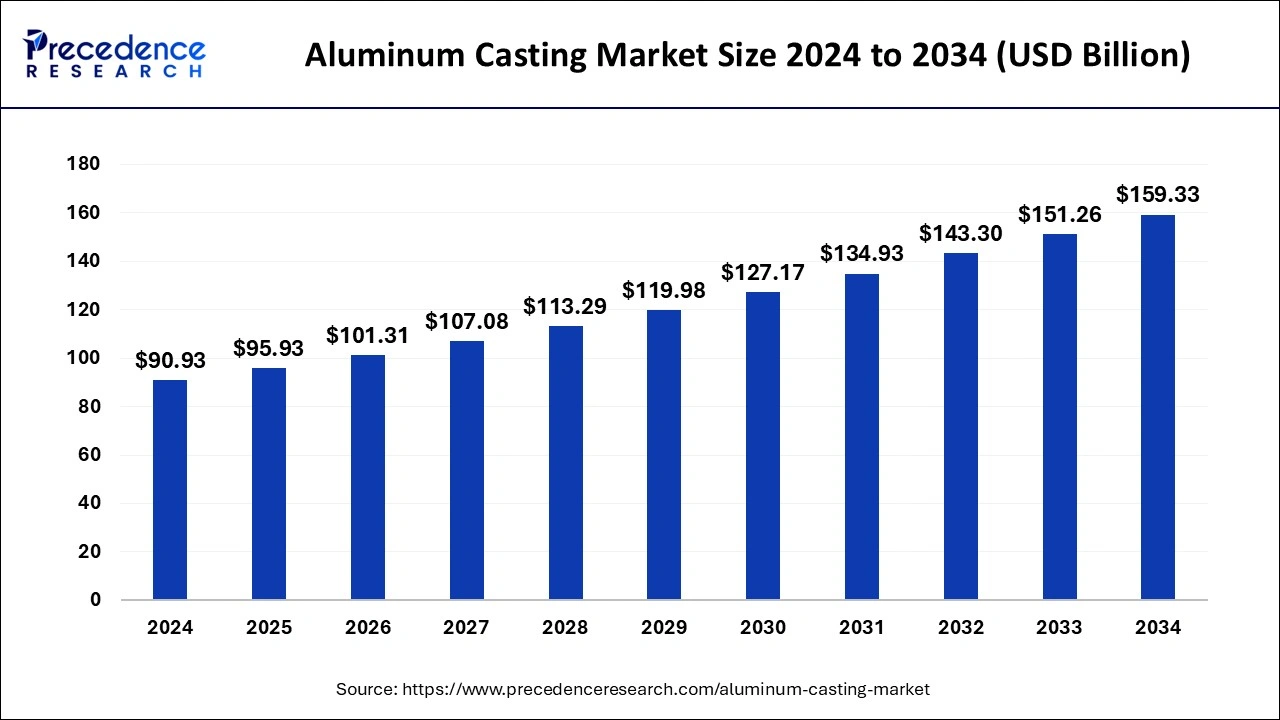

The global aluminum casting market size surpassed USD 95.93 billion in 2025 and is predicted to increase from USD 101.31 billion in 2026 to approximately USD 167.33 billion by 2035, poised to grow at a CAGR of 5.72% during the forecast period from 2026 to 2035.

Market Highlights

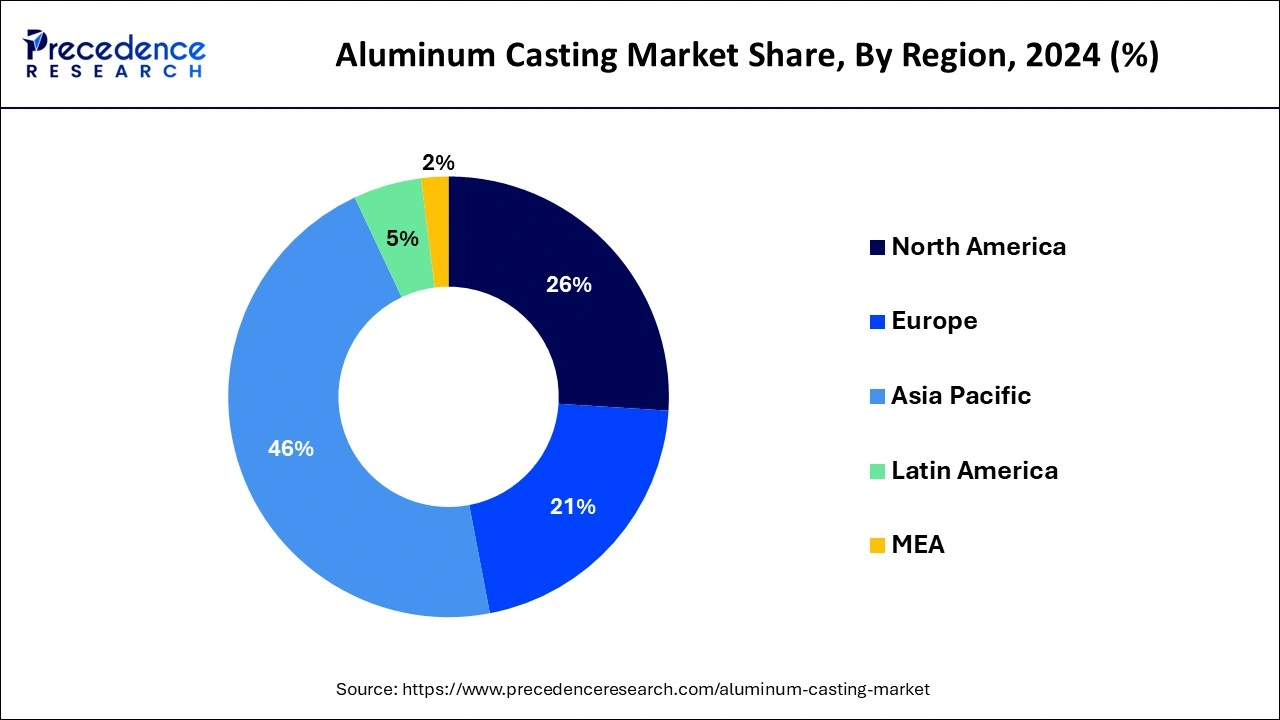

- Asia Pacific has generated more than 46% of revenue share in 2025.

- By Processes, the die-casting segment has captured more than 51% of the revenue share in 2025.

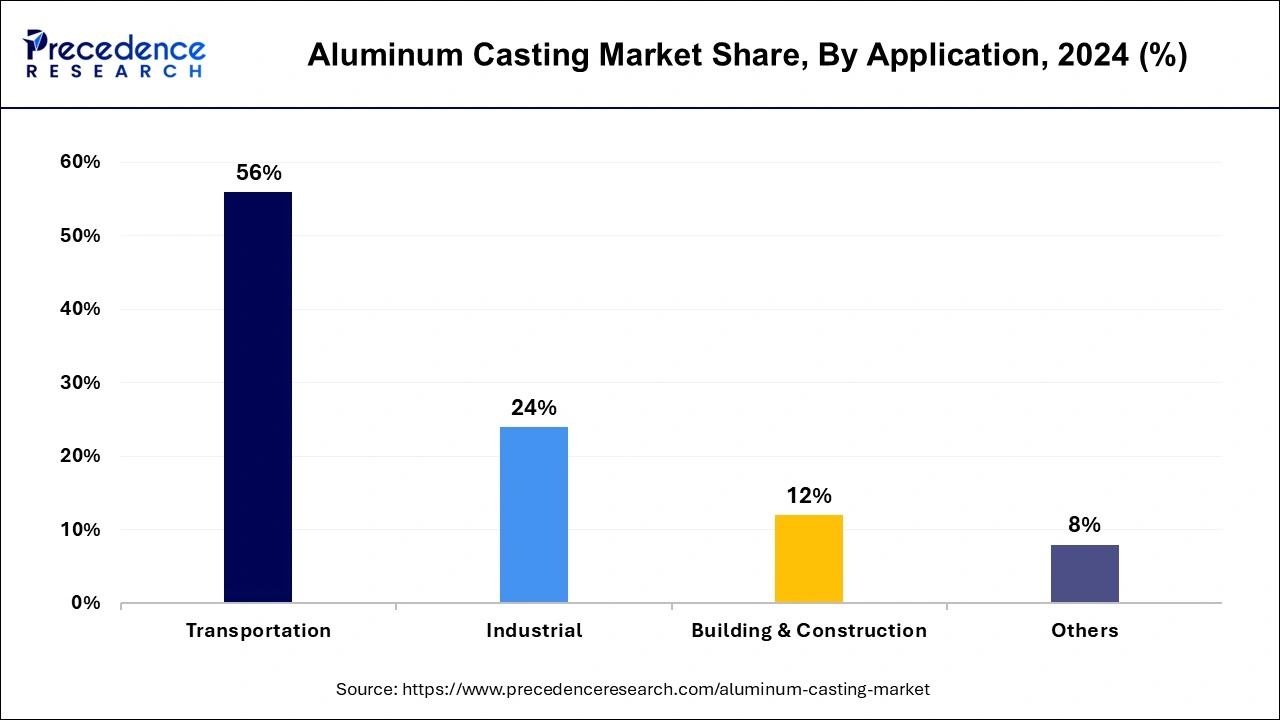

- By Application, the transportation segment has contributed more than 56% of revenue share in 2025.

Market Size and Forecast

- Market Size in 2025: USD 95.93 Billion

- Market Size in 2026: USD 101.31 Billion

- Forecasted Market Size by 2035: USD 167.33Billion

- CAGR (2026 to 2035): 5.72%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The process of shaping molten aluminum under intense pressure into a cavity of a die is known as aluminum casting. The model is precisely manufactured to have the desired shape, size, quality, and finish surface. These have the best surface finishing, are the lightest of all die-cast metals, and can operate at the greatest temperature.

Aluminum Casting Market Growth Factor

In the upcoming years, the market is likely to be driven by the rising use of aluminum in cars due to its high strength and lightweight properties. Each year, a light car uses between 30 and 40 percent of aluminum; this number is expected to rise to 70 percent in the upcoming years as a result of strict international rules aimed at lowering gasoline emissions. The Federal Reserve Bank of St. Louis reports that in May 2019, there were 17.385 million lightweight cars sold worldwide. Thus, it is expected that rising environmental pollution, shifting customer habits and rising disposable incomes will increase demand for lightweight cars and consequently increase aluminum casting demand.

In the United States, rising demand for general utility and sports utility cars is expected to fuel product demand. For instance, the U.S. is expected to have more than 90 popular SUV types by 2023, according to the car research company LMC car. Additionally, the country's automakers are coming under more and more pressure to adhere to the regulation standards for the environmental effect of cars. Due to rising greenhouse gas emissions, which are expected to boost market development, passenger cars must achieve a fuel economy goal of 54.5 miles per gallon by 2026, according to Corporate Average Fuel Economy (CAFE).

The range of heavy-duty machinery that aluminum casting can be used for is expanding to include farming, building, mining, and other types of machinery. These emerging countries, like India and Brazil, have a high demand for updating equipment to achieve higher levels of output and efficiency, which is primarily responsible for the rise in these kinds of machinery. India is one of the biggest producers of tractors, harvesters, and other agricultural machinery. The country's tractor purchases are anticipated to increase by nearly 8.0% between 2018 and 2022, driving the industry.

On the other hand, factors like expensive aluminum casting equipment and high expenditures for technical developments in aluminum casting are likely to restrain market expansion. Furthermore, stringent regulations and standards established by the European Atmosphere Agency and the U.S. Environmental Protection Agency (EPA) regarding harmful emissions into the atmosphere during the casting process are probably going to impede market development in the upcoming years.

- In the upcoming years, the market demand will be driven by the rising use of aluminum in cars due to its high strength and lightweight properties.

- The market is anticipated to expand further due to the rising demand for sport utility vehicles and general utility vehicles.

Market Outlook

What Factors are Fueling the Future of the Aluminum Casting Sector?

- Industry Growth Overview: The desire for lightweight vehicles, electric vehicles, and new infrastructure developments is driving demand for aluminum castings. As aluminum castings offer many advantages, such as strength, corrosion resistance, and the ability to be designed into one part vs. multiple castings, the increase in the usage of aluminum castings continues.

- Sustainability Trends: Due to increasing carbon neutrality requirements and other regulations across the globe, manufacturers are implementing a more sustainable manufacturing process. This includes using recycled aluminum, utilizing low-emission smelting methods, and implementing closed-loop processes throughout their operations.

- Global Expansion: Capacity expansions are occurring in the high-growth regions of Asia, South America, and Central and Eastern Europe. As major original equipment manufacturers (OEMs) continue to move manufacturing to emerging countries, there will be an increase in the demand for low-cost aluminum castings in both the transportation and industrial industries.

- Startups: Startups are using advanced technology to develop AI-based casting simulation software, cutting-edge alloys, and integrating into additive manufacturing systems, which will reduce waste, improve the accuracy of the final cast, and accelerate the overall product development process.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 95.93 Billion |

| Market Size in 2026 | USD 101.31 Billion |

| Market Size by 2035 | USD 167.33Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.72% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Processes, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased desire for luxury goods and cars

The rise in demand for consumer goods and automobiles is contributing to the development of the aluminum die-casting industry. Additionally, a significant factor in the market's expansion is the military and defense industry's increasing investment in light-weight weaponry. The market has also grown as a result of increasing utilization in the technology, mining, and building and construction sectors. Changing environmental regulations and metal market price volatility, however, are anticipated to impede market expansion.

One of the main factors propelling the growth of the aluminum die casting market is the increasing use of aluminum, die casting for a variety of applications, and acceptance of high strength and light weight castings, particularly in the car industry. Additionally, during the projection period, there will be lucrative possibilities for the development of the aluminum die casting market due to an increase in the substitution of aluminum for iron and steel in the automotive and automobile sectors, as well as higher financing in these industries.

Key Market Challenges

Favorable magnesium metals

- Among the major factors impeding the development of the aluminum die casting market over the projection period are the rising use of magnesium alloys in place of aluminum alloys and the economic crisis in developed nations.

Opportunities

Increasing regulations die casting demand

During the forecast period of 2025 to 2034, the market participants will have additional lucrative opportunities thanks to the favorable steps taken by the government in conjunction with environmental laws to boost demand for aluminum die castings. New rules and policies are made by the European Commission and other federal government bodies, such as the Eco-product Certification Scheme. (ECS). Low or no harmful VOC emissions are guaranteed by these rules, as well as a green and sustainable atmosphere. The use of light or decreased vehicle weight is also mandated by these rules in order to lower vehicle emissions. The application of cutting-edge, low-pollution covering technology will also continue to be supported by governmental laws in the US and Western Europe, particularly those that deal with air pollution.

Segments Insights

Process Insights

Due to the expanding demand for aluminum casting goods in the automotive industry, the die-casting category held the biggest revenue share of over 51% in 2024. Several car components, including engines, cylinders, gears, and flywheels, which are used in high-end vehicles and mass-produced vehicles, are made using the die-casting process. This is due to elements like the cheap cost of die casting and stringent CO2 pollution laws being established globally.

Pressure die casting and other types of aluminum die casting are further divided into segments. Pressure die casting's distinctive qualities, such as its smooth surface finish, ease of cavity filling, powerful mechanical properties, and closer measurement accuracy, are anticipated to support market development, particularly in the automobile industry. Vacuum die casting and compression die casting fall under the other group.

The production of numerous cast goods using a single mold structure made of materials that can endure high temperatures, such as cast iron and die steel, is known as permanent mold casting. Permanent mold casting produces a better-completed part with a high degree of dimensional tolerance, which qualifies it for use in the production of racing and leisure vehicle components.

Over the next few years, there will likely be an increase in demand for durable model casting, particularly in the United States. The number of new registrations for motorcycles with a capacity of 600cc or less rose from 58.3 thousand units in 2013 to 63.4 thousand units in 2017, according to statistics released by the U.S. International Trade Commission (USITC) in 2018. As a result, producers of metal permanent mold casting are likely to have plenty of chances in the near future due to the motorbike industry's consistent demand.

Application Insights

The largest revenue portion in 2025 more than 56% was accounted for by the transportation application sector. The expansion is ascribed to the rising worldwide demand for lightweight cars and airplanes. One of the most profitable markets for lightweight vehicles is the sports car market. The demand for sports cars continues to be driven by the appeal of athletic events, rallies, and races in North America and Europe, which also increases the demand for aluminum casting.

As aluminum-cast goods are used in the production of jet or aircraft engines, rising aviation demand also contributes to the transportation sector's development. According to 2018 research by Airbus, over the next ten years there will likely be a desire for nearly 39,000 new aircraft. Rising demand for new airplanes will probably increase the need for new jet engines, which will help the industry expand.

Construction machinery is expected to experience significant growth in the industrial application sector over the next few years due to the worldwide commitment to infrastructure development. Over the past ten years, Asia Pacific has seen a rise in Chinese construction machinery producers in this market, including XCMG and Sany. This is likely to lead to steady demand for aluminum casting goods.

Due to the rising use of aluminum casting goods in homes, the building and construction sector is predicted to experience a CAGR of 3.3% in terms of volume from 2022 to 2030. Numerous products, including awnings, door knobs, windows, and curtain walls, can be made from aluminum casting. The market is expected to be driven in the coming years by the increasing substitution of iron and steel due to shifting customer tastes and the advantages of aluminum, such as its lightweight and visual appeal.

Regional Insights

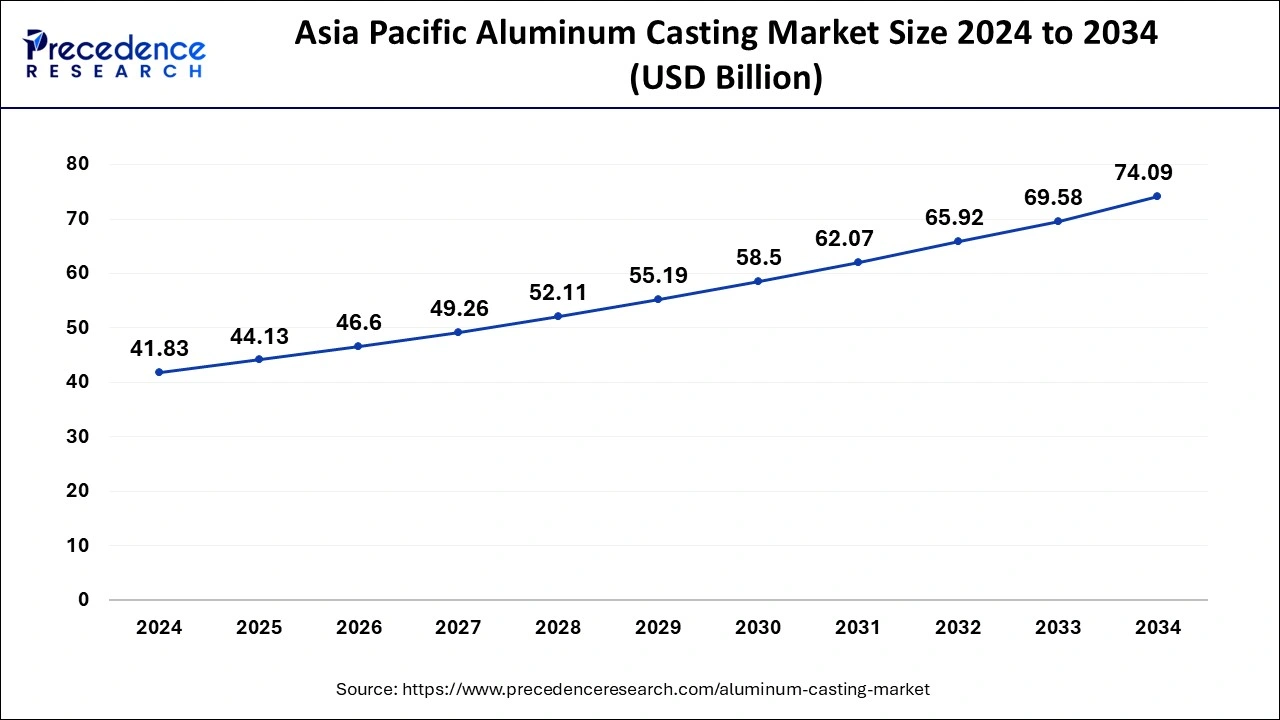

What is the Asia Pacific Aluminum Casting Market Size?

The Asia Pacific aluminum casting market size is estimated at USD 44.13 billion in 2025 and is projected to surpass around USD 78.03 billion by 2035 at a CAGR of 5.87% from 2026 to 2035.

With the largest revenue share of over 46% in 2025, the Asia Pacific area led the world due to China and India's quickly growing manufacturing industries. Due to the cheap cost of labor and government policy support, such as 100% FDI permitted under the automatic route for car components, automakers are moving or increasing their manufacturing sites in these countries. As of December 2018, Continental, an automaker with headquarters in Germany, had spent USD 25.65 million in establishing a premium surface materials plant in Pune, India, with a 5 million square meter manufacturing capability.

Because of the North American Free Trade Agreement, it is expected that over the next few years, demand for lightweight cars in North America will increase at a healthy rate. (NAFTA). It was stated that the goal of 54.5 mpg fuel economy would be attained in two stages by 2025. This is requiring automakers to reduce the weight of the vehicle chassis by 25%, which will likely increase demand for aluminum casting in the upcoming years.

Because of the North American Free Trade Agreement, it is expected that over the next few years, demand for lightweight cars in North America will increase at a healthy rate. (NAFTA). It was stated that the goal of 54.5 mpg fuel economy would be attained in two stages by 2025. This is requiring automakers to reduce the weight of the vehicle chassis by 25%, which will likely increase demand for aluminum casting in the upcoming years.

Growing product demand for farm machinery is expected to boost the market in Russia. Over the past five years, the nation's farming production has increased by more than 20%. Thus, the country's steadily expanding agricultural sector is likely to increase the demand for effective agricultural machinery, which will favorably impact the demand for aluminum casting over the future years.

Europe: Innovations in Engineering-Driven Aluminum Casting

Aluminum casting for lightweight products (automotive, aerospace, and renewable energy) is moving toward high-precision types of castings in Europe. The European legal framework offers support for lightweight materials, environmental sustainability, and decarbonization. Consequently, there is a rapid adoption of advanced aluminum casting technologies.

Germany Aluminum Casting Market Trends

Germany has become the fastest-growing market for aluminum castings in Europe due to the growth of electric vehicle production and its advanced manufacturing infrastructure. The automotive industry's focus on lightweighting and electrification is a major driver, increasing use of aluminum castings in EV powertrains, chassis parts, and heat-dissipating components.

Latin America: Infrastructure Supported Demand for Castings

The demand for aluminum castings in Latin America is being driven by the growth of the construction industry, manufacturers of industrial equipment, and the increasing number of automotive assembly operations through the improvement of aluminum recycling networks.

Brazil Aluminum Casting Market Trends

Brazil will continue to experience significant growth driven by an expanding base of automotive production as well as continued investments in its industrial manufacturing capabilities. The automotive industry's shift towards fuel efficiency and electrification is boosting the use of aluminum castings for engine parts, structural components, and EV applications.

Middle East & Africa (MEA): Pathways to Industrial Diversification

The MEA region has experienced increasing demand for aluminum castings from the energy, transportation, and construction sectors due to government efforts to diversify their economies beyond oil and support domestic manufacturing hubs.

The UAE Aluminum Casting Market Trends

The UAE is the most rapidly growing market in the MEA region because of its strong base of aluminum production and ongoing industrial diversification efforts. Sustainability and circular economy initiatives are boosting the use of recycled aluminum and energy-efficient processes, aligning with strict EU environmental regulations and corporate decarbonization goals.

Value Chain Analysis of the Aluminum Casting Market

- Procurement of raw materials and alloy development: The Value Chain begins with the procurement of primary and secondary aluminum, alloying elements, and flux materials. The cost volatility of bauxite and recycled aluminum has a direct impact on margins.

Key Players: Rio Tinto, Alcoa Corp, Norsk Hydro. - Manufacturing & casting process: The manufacturing process consists of die casting, sand casting, and permanent mold casting, and automation/Industry 4.0 implementation is improving yield and reducing defects.

Key Players: Nemak, Ryobi Die Casting, Endurance Technologies. - Machining, finishing, and integration with end-use companies: Operations post-casting, such as heat treatment, CNC machining, surface finishing, and quality inspection, meet OEM standards.

Key Players: Dynacast, Gibbs Die Casting, Martinrea International.

Aluminum Casting MarketCompanies

- Walbro

- Alcoa Corporation

- Consolidated Metco, Inc.

- BUVO Castings

- RDW Wolf, GmbH

- Georg Fischer Ltd.

- Dynacast

- GIBBS

- Ryobi Limited

- Martinrea Honsel Germany GmbH

- Bodine Aluminum

- Alcast Technologies

- Endurance Technologies Limited

- Aluminum Corporation of China Limited

Recent Developments

- Tesla stated in September 2020 that it would install metal casting equipment for the manufacture of frames at a German factory to increase its EV output.

Segments Covered in the Report

By Processes

- Die Casting

- Pressure Die Casting

- Others

- Permanent Mold Casting

- Others

By Application

- Transportation

- Industrial

- Building & Construction

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting