What is the Aluminum Alloys Market Size?

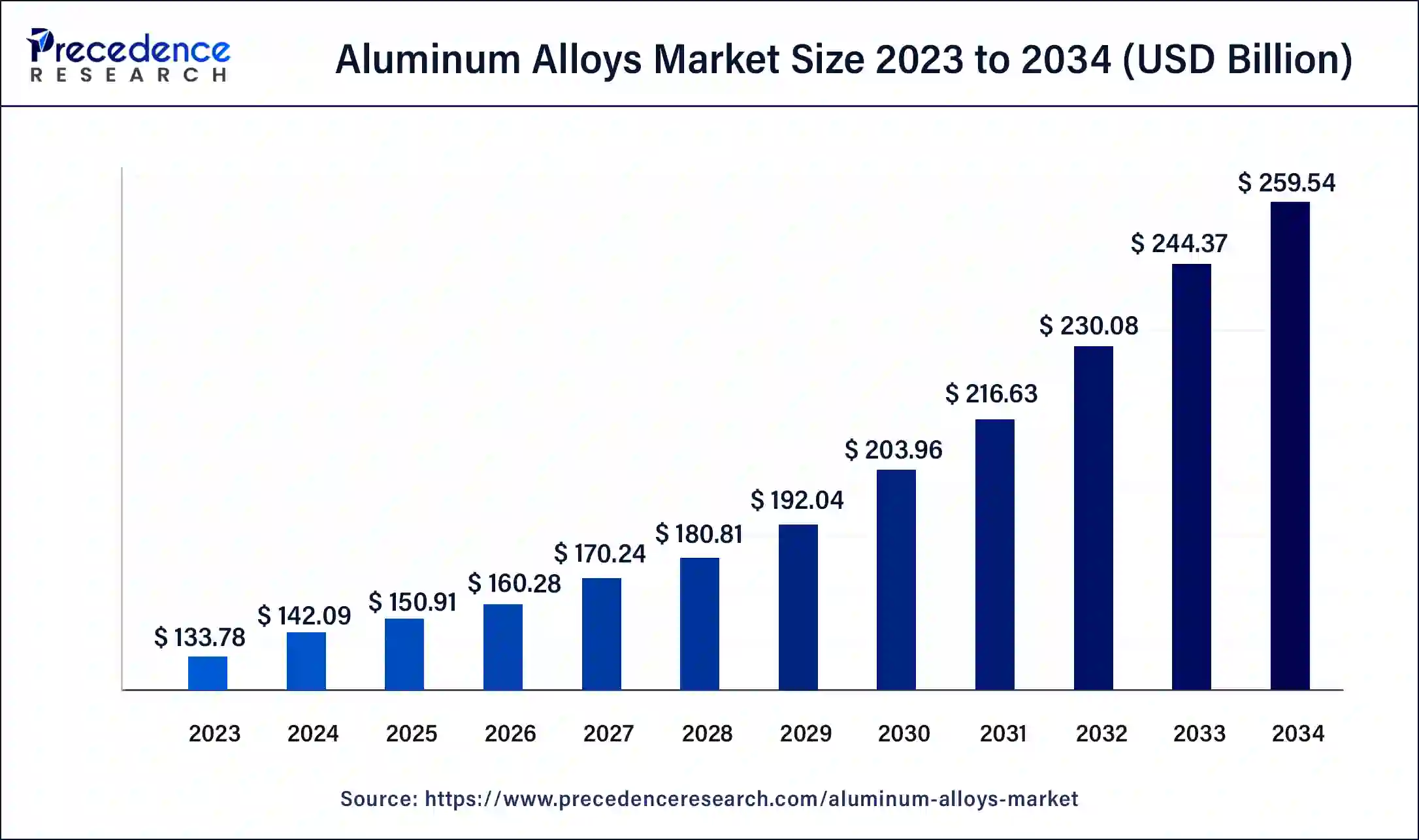

The global aluminum alloys market size is estimated at USD 150.91 billion in 2025 and is predicted to increase from USD160.28billion in 2026 to approximately USD 259.54 billion by 2034, expanding at a CAGR of 6.21% from 2025 to 2034. The aluminum alloys market growth is attributed to the increasing demand for lightweight, high-strength materials across the automotive, aerospace, and construction industries

Aluminum Alloys Market Key Takeaways

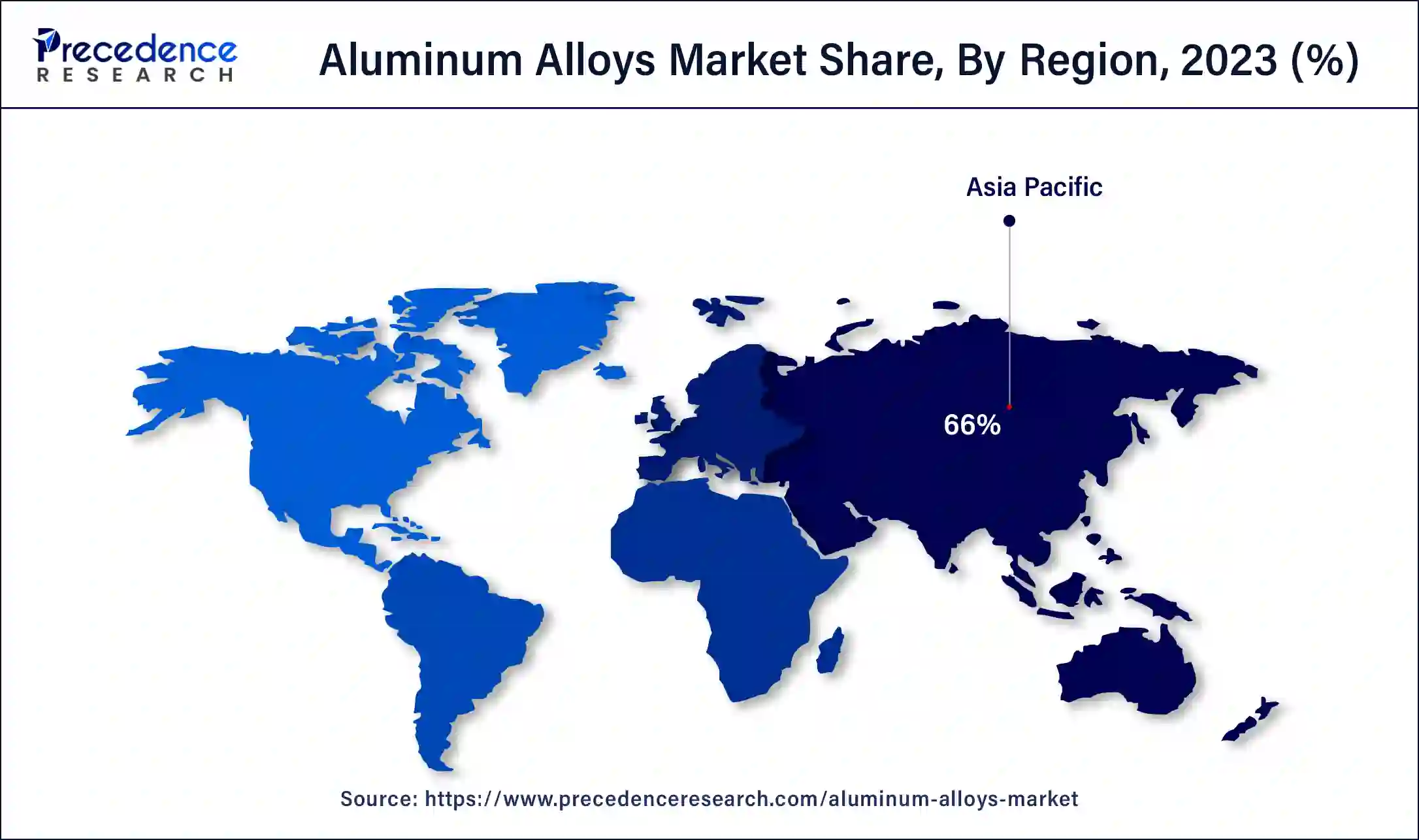

- Asia Pacific dominated the global aluminum alloys market with the largest market share of 66% in 2024.

- North America is projected to host the fastest-growing market in the coming years.

- By end-user, the automotive & transportation segment contributed the biggest market share of 27% in 2024.

- By end-user, the construction segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

AI, 3D Printing, and Aluminum Innovation

Recent advances in 3D printing and AI automation in the manufacturing industries have extended the development of lighter and more sophisticated aluminum alloys. These advancements facilitate production mode and cut down material and energy use of the product, hence improving the quality of the product. The need for continuously improving manufacturing technologies is expected to support the growth of the aluminum alloys market due to increasing demand for advanced high-performance and green materials. Such continuous advancement in technology is expected to contribute towards the growth of the market and innovation in aluminum alloy technology.

- An analysis of the U.S. Department of Energy conducted in 2023 estimates that manufacturing incorporates AI and IoT annually by 15%, an indication of the industry's transformation to an enhanced and sustainable model.

Impact of Artificial Intelligence on the Aluminum Alloys Market

AI helps to increase the productivity of manufacturing processes in the aluminum alloys market by improving the material's characteristics, minimizing the usage of additional materials, and assessing the probable composition of alloys with given performance characteristics. AI is combined with analytics facilitating the manufacturing industries to predict demand patterns and thus optimize supply. This results in a reduction of costs and time taken to deliver products. In addition, the use of artificial intelligence in the fabrication of alloys eradicates one hundred percent human error, which affects the quality of the end product.

Market Outlook

- Industry Growth Overview:

The aluminum alloys market is growing, driven by the increased application of aluminum alloys in electric vehicles to counterbalance battery weight, a strong sector presence, and the increasing demand for secondary, recycled aluminum as it is affordable and environment-friendly nature. - Global Expansion:

The aluminum alloys market is increasing worldwide, driven by growing demand from sectors such as construction, electric vehicles (EVs), and renewable energy, which are increasing their applications of the lightweight and durable metal. Asia Pacific is dominant in the market due to increasing demand for lightweight materials, a modern manufacturing base, and a focus on driving effectiveness. - Major investors:

Major investors are a combination of many worldwide aluminum corporations and strategic spending firms involved in manufacturing, recycling, and advanced alloy development. It includes Alcoa Corporation, China Hongqiao Group, Emirates Global Aluminium (EGA), Hindalco Industries Limited, and many others.

Aluminum Alloys Market Growth Factors

- Urbanization and infrastructure development in emerging markets are anticipated to increase the need for aluminum alloys.

- Technological advancements in recycling processes are projected to improve the sustainability of aluminum alloys.

- Rising demand for lightweight materials across various industries is expected to drive aluminum alloys market growth.

- Increased investment in green building technologies is likely to drive the use of aluminum alloys in construction projects.

- Increased adoption of aluminum alloys in renewable energy applications is anticipated to boost market expansion.

- Growing automotive safety standards are likely to enhance the use of aluminum alloys in vehicle design.

- Expansion of the aerospace sector is expected to fuel demand for high-strength aluminum alloys.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 259.54 Billion |

| Market Size in 2026 | USD 160.28 Billion |

| Market Size in 2025 | USD 150.91 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.21% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing demand from the automotive industry

Growing demand for lightweight materials in the automotive industry is anticipated to drive the aluminum alloys market. Automotive companies are using aluminum alloy parts, as they are light, hence improving fuel efficiency and reducing pollution. Aluminum alloys enable high strength-to-weight ratios and high durability to seal against corrosion, thus being used for engine parts, body frames, and structural parts.

The further shift towards environmentally friendly and highly energy-efficient vehicles will create demand for aluminum alloys over the next years. The U.S. Department of Energy also points out that the use of lightweight materials such as aluminum helps increase the fuel economy of vehicles by as much as one-fifth. Furthermore, the growing global car sales are observed.

The International Energy Agency IEA pointed out that electric vehicle sales increased by 60% in 2022 to stress increasing EV adoption across the world.

Restraint

Hamper competition from alternative materials

Competition from alternative materials is likely to hamper the aluminum alloys market growth. High-strength plastic and advanced composites, especially in the automotive and aerospace industries, are anticipated to decrease the utilization of aluminum alloys. These alternative materials provide comparable or even superior strength-to-weight ratios and corrosion strength. Carbon fiber composites are being increasingly used in applications where shedding mass is highly appropriate.

Carbon fiber composites are 50% lighter and stronger than aluminum. Thus, the U.S. Department of Energy states their use in high-performance vehicles and airplanes. Additionally, these alternatives, entailing innovation in material science and cost control, are expected to lead to a lowered application of aluminum alloys, especially in the areas where performance and cost are critical factors.

- The European Aviation Safety Agency (EASA) reveals that in a decade, civil aircraft manufacturers have greatly increased the use of lightweight materials such as composites by 35%.

Opportunity

Spurring technological advancements in manufacturing

Spurring technological advancements in manufacturing processes are likely to create immense opportunities for the players competing in the aluminum alloys market. Technological advancements, including 3D printing and the specificity of automation, produce innovations that allow the provision of a blend of alloys appropriate to certain industries. These technologies contribute to faster production and help decrease the wastage of material, thus improving the quality of the finished products.

IoT facilitates monitoring systems integration in alloy production plants to enhance the efficiency of processes that consequently lead to productivity gain and reduced cost for manufacturers in the aluminum alloys market. The growth of industries manufacturing complex products is expected to enhance the sales of aluminum alloys due to the introduction of new products.

- Airborn from Norsk Hydro Aluminum was launched in September 2023 with a new aluminum alloy for 3D-printed parts and part designs for the automotive & aerospace industries.

Segment Insights

End-user Insights

The automotive & transportation segment held a dominant presence in the aluminum alloys market in 2024 due to the increased demand for lightweight materials, increasing fuel efficiency and thereby curbing emissions. The trend towards EVs and the general tightening of greenhouse emission standards are behind the push to lighten vehicles while reducing the amount of material used in their construction. Aluminum alloys have the ability to support high strength, corrosion resistance, and good energy-absorbing properties, making them suitable for use in the manufacture of vehicular parts like engine blocks, body panels, and wheels. Additionally, the automotive industry, with sustainability and performance demand for aluminum alloys.

- As reported by the International Organization of Motor Vehicle Manufacturers (OICA), automotive production has remained high worldwide, and the production of EVs is likely to rise 10% by 2025.

- According to the European Aluminium Association, the use of aluminum reduces vehicle weight by up to 30%, therefore decreasing CO2 emissions considerably.

The construction segment is expected to grow at the fastest rate in the aluminum alloys market during the forecast period of 2024 to 2034. Rising levels of construction and infrastructure in APAC & the Middle East are expected to propel the demand for aluminum alloys in buildings & structures. The lightweight metallic alloys that are gaining the popularity of construction engineers are aluminum, as they are highly durable and immune to corrosion and erosion. The International Building Code has also included provisions for the use of sustainable materials in construction, and since aluminum is a material that is recyclable and has the least impact on the environment, it has received a boost in usage. Furthermore, the growing demand for sustainable and replicable metal building materials further boosts the market.

- The United Nations report projects that by 2050, 68% of the global population will be living in urban areas.

- In July 2023, the U.S. Green Building Council (USGBC) included aluminum among the materials that positively impact green building practices since it increases the rating of LEED projects.

Regional Insights

Asia Pacific Aluminum Alloys Market Size and Growth 2025 to 2034

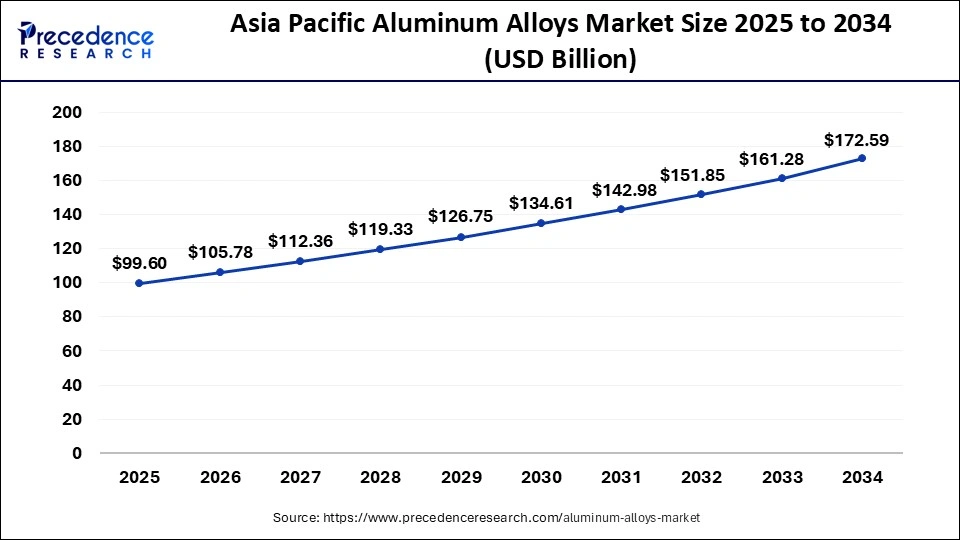

The Asia Pacific aluminum alloys market size is evaluated at USD99.60 billion in 2025 and is predicted to attain around USD 172.59 billion by 2034, at a CAGR of 6.29% from 2025 to 2034.

Asia Pacific dominated the globalaluminum alloys market in 2024 due to the increasing industrialization, urbanization, and infrastructural development. In countries such as China and India, industries, including road bridges and tall buildings, have made significant investments in infrastructure development, resulting in increased use of aluminum alloys.

Growing innovation in production

The automotive industry of Asia Pacific is one of the largest in the world, creating demand for aluminum in vehicle construction to conform to new emission standards. Moreover, extensive use of technological improvements and environment-friendly measures are expected to create a higher demand for aluminum alloys in the region in the future.

- The aluminum business of Asia Pacific consumed approximately 60% of the total metal consumed in the world in 2023, according to a survey by the International Aluminum Institute.

- The Asian Development Bank (ADB) noted the fact that regional infrastructure spending would likely cross from USD 4.7 trillion in 2017 to USD 7 trillion by 2025 which increasing aluminum consumption.

China: Increasing government policies and subsidies

The Chinese government has prioritized the heavy industry, including aluminum, through strategic planning, regulatory grants, tax incentives, and below-market loans. Aluminum production is highly energy-intensive, specifically the electrolysis process. China's rich domestic coal reserves and the applications of captive power plants in coal-rich provinces provided a secure and affordable electricity supply.

North America: Rising government support to chemical industry

North America is projected to host the fastest-growing aluminum alloys market in the coming years, owing to the presence of the large car industry and the aircraftmanufacturing industries, which are leading consumers of aluminum alloys. The United States has experienced a rise in the production ofelectric vehiclesand aerospace engineering, thus escalating demand for light and strong materials.

- According to the Aluminum Association, aluminum demand in automotive uses has increased by about 25% over the last five years.

- As cited by the U.S. Department of Energy in its July 2023 report, aluminum also continues to be used in EVs as original equipment manufacturers strive to optimize power density and trim mass.

Increased demand for aluminum alloys is estimated by the Biden Administration's infrastructure plan, which encompasses sustainable transportation as well as green infrastructure, among others. The U.S. Environmental Protection Agency (EPA) also underscores the fact that aluminum plays a part in the reduction of vehicle emissions, and the improvement of fuel efficiency supports the U.S. environmental policy. Additionally, the technological development of aluminum alloy products and environmental consciousness.

U.S.: Robust Research and Development (R&D)

The U.S. was the world's largest manufacturer of main aluminum, and it increased in the production and application of specialized, high-strength aluminum alloys, significant for the aerospace and defense fields. The U.S. has a strong R&D ability with the goal of improving alloy compositions, advancing novel manufacturing processes.

Europe: Continuous Innovation

Europe is significantly growing in the market as this region has maintained a focus on R&D to develop next-generation alloys tailored for specific high-performance uses and developed manufacturing technology. Europe has a well-recognized and comprehensive aluminum value chain, from bauxite refining to a broad network of semi-fabrication and recycling plants in different countries, which drives the growth of the market.

UK: Technological advancements

The UK has the second-largest national aerospace sector worldwide and an important defense sector. The UK's automotive sector, particularly in vehicle manufacturing and R&D for electric vehicles (EVs), drives demand for lightweight aluminum components to improve drive effectiveness and performance.

Aluminum Alloys Market- Value Chain Analysis

Raw Material Sourcing:

Aluminum alloy raw materials are sourced from bauxite ore, and exact alloys are created by adding other elements such as silicon, copper, magnesium, manganese, and zinc to the molten aluminum.

- Key Players: China Hongqiao Group and Alcoa Corporation

Package Design and Prototyping:

Use of aluminum alloy, multipurpose materials, and specialized manufacturing technology to quickly create functional, durable, and high-fidelity prototypes for different applications.

- Key Players: Rio Tinto and Norsk Hydro ASA

Recycling and Waste Management:

The process of recycling aluminum alloys contributes sorting and collection, cleaning and pre-treatment, melting, shredding, and casting.

- Key Players: Aluminum Corporation of China and Hindalco Industries

Top Vendors in the Aluminum Alloys Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Japan |

Advanced manufacturing capabilities and global sales network. |

In March 2025, UACJ Corporation earned ASI Performance Standard V3 Certification for the manufacture of custom aluminium extruded shapes at UACJ Automotive Whitehall Industries, Guanajuato, Mexico. |

|

|

RusAL |

Russia |

Vertical integration |

In June 2025, RUSAL starts commercial production of new low-carbon foundry Alloys for the automotive industry. |

|

Press Metal |

Malaysia |

Strong Financial Performance |

In March 2024, Press Metal inks a multi-year low-carbon aluminum supply deal with Novelis Korea. |

|

Novelis |

United States |

World's Largest Recycler |

In June 2025, Novelis Inc. and The Future Is NEUTRAL, the first 360° circular economy enterprise in the automotive world, announced their collaboration on a circular end-of-life recycling solution. |

|

National Aluminum Company Limited |

India |

Integrated operations |

In November 2025, NALCO recently started producing Flat Rolled Aluminium Products through the continuous caster route. Rolled Products, in certain limited widths and thicknesses, are being produced and sold in the Domestic market in India. |

Other Major Key Players

- Hydro

- Hindalco

- Aluminum Corporation of China

- AluminIum Bahrain B.S.C. (Alba)

- Alcoa Corporation

Recent Developments

- In October 2024, Norsk Hydro ASA, a leading aluminum producer, announced the launch of its new aluminum alloy designed specifically for electric vehicles (EVs). This alloy boasts improved energy absorption and durability while maintaining a lightweight profile, making it ideal for modern EV applications.

- In August 2024, Alcoa Corporation unveiled its latest aluminum alloy product tailored for aerospace applications. The new alloy offers enhanced strength and fatigue resistance, addressing the high-performance requirements of modern aircraft.

Segments Covered in the Report

By End-user

- Construction

- Packaging

- Consumer Durables

- Automotive & Transportation

- Electronics

- Machinery & Equipment

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting