What is the Aluminum Curtain Wall Market Size?

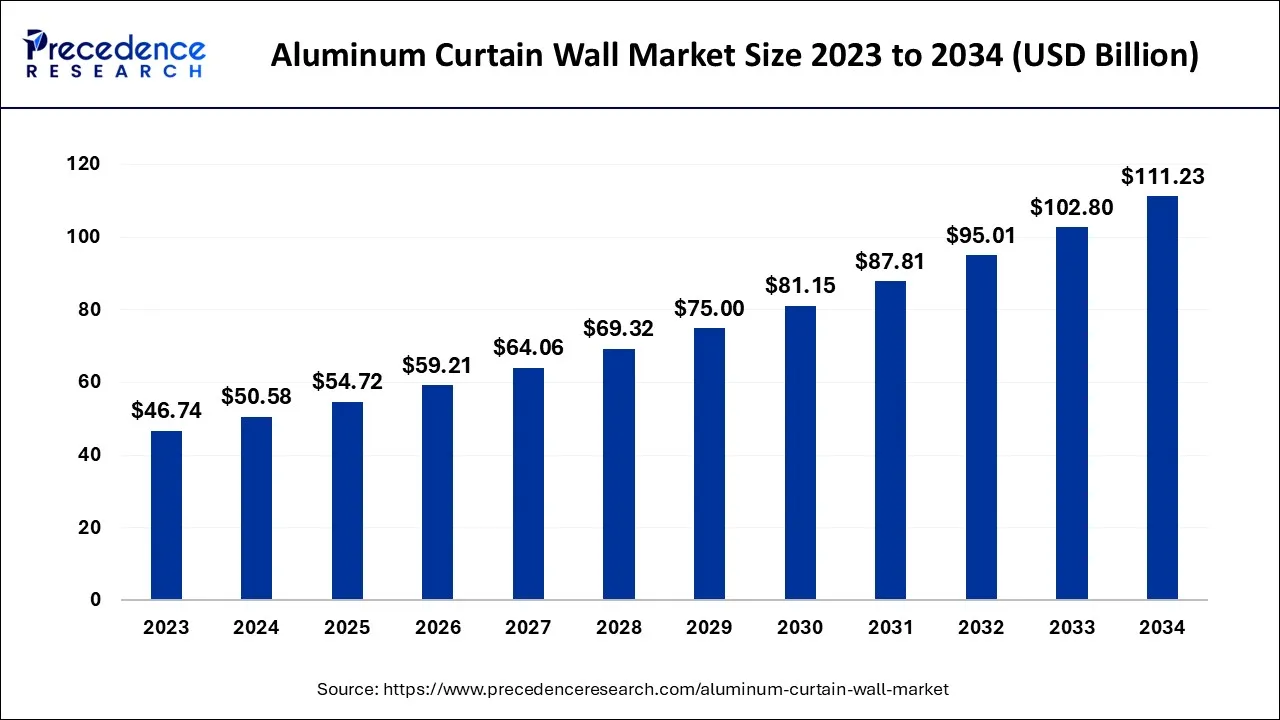

The global aluminum curtain wall market size is calculated at USD 54.72 billion in 2025 and is predicted to increase from USD 59.21 billion in 2026 to approximately USD 119.23 billion by 2035, expanding at a CAGR of 8.10% from 2026 to 2035.

Aluminum Curtain Wall Market Key Takeaways

- In terms of revenue, the aluminum curtain wall market is valued at USD 54.72 billion in 2025.

- It is projected to reach USD 119.23billion by 2035.

- The aluminum curtain wall market is expected to grow at a CAGR of 8.10% from 2026 to 2035.

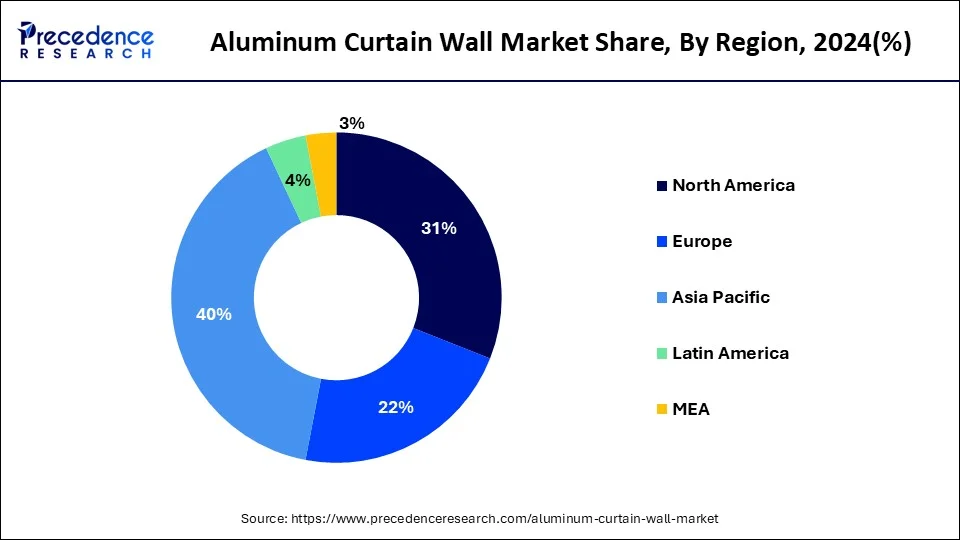

- Asia Pacific dominated the market and is predicted to grow at a CAGR of 11.50% from 2026 to 2035.

- North America is projected to grow at a CAGR of 6.7% from 2026 to 2035.

- By type, the unitized segment generated for more than 61% of the total market share in 2025.

- By type, the stick-built segment is growing at a remarkable CAGR.

- By application, the commercial segment dominate the market and it is projected to grow at a noteworthy CAGR.

- By application, the residential segment is expected to hold a significant market share from 2026 to 2035.

What is the Aluminum Curtain Wall?

Aluminum curtain walls are panels framed in a light-weight material that are utilized to wrap a building structure from the outside. The technique of aluminum curtain wall combines windows and framing to eventually create a single facade. The application of aluminum curtain walls enhances the energy efficiency of the building.

Aluminum curtain walls adequately address structural integrity, thermal insulation, condensation, weather tightness and fire safety. At the same time, the recent developments in the global aluminum curtain wall market are focused on addressing bomb blast resistance, sound transmission and hurricane-borne debris resistance. The advancements in aluminum curtain wall frames have brought an innovative function, acoustic insulation.

Acoustic insulation plays an essential role in structures installed at city-center commercial buildings by reducing sound penetration into the enclosed space. Aluminum curtain walls offer modern expression to the building structure. The modern and innovative aluminum curtain walls have high design freedom and can be customized accordingly.

The aluminum panels for curtain wall installment are placed with chemical, adhesive or mechanical bonding on the exterior part of the building. Aluminum curtain walls play the primary function of keeping water and air out of the building structure while enhancing the lifespan of the building. The rising trend of modernizing the building's exterior look is propelling the growth of the global aluminum curtain wall market.

How is AI Influencing the Aluminum Curtain Wall Industry?

AI and automation are transforming the curtain wall system market by improving design precision and decreasing project turnaround times. Advanced design software driven by AI allows the creation of highly customized facade solutions with improved structural performance, reducing material waste and human error. Automated fabrication, along with installation technologies streamline complex processes, enabling faster deployment while handling consistency in quality and safety standards across projects.

Aluminum Curtain Wall Market Growth Factors

The rising demand for improving the outer look of commercial buildings in order to maintain the aesthetic is observed as a significant driver for the growth of the global aluminum curtain wall market. The functional and visual comforts offered by the aluminum curtain wall systems are honored to be the major driving factors for the development of the market. Rising industrialization in developing countries is another factor to boost the aluminum curtain wall market growth.

Aluminum offers sustainability, which makes it an ideal element for curtain walls. Moreover, the rising construction activities are contributing to the demand for aluminum curtain wall systems. Aluminum curtain walls regulate the temperature of the building, and rising climate change concerns are boosting the demand for advanced solar screen-based aluminum curtain walls in the market.

Along with this, aluminum curtain walls effectively protect the building from adverse weather conditions such as heavy rains, humidity and penetration of excessive sunlight. The development of recyclable aluminum curtain wall frames is fueling the development of the global aluminum curtain wall market by offering lucrative opportunities to the market players.

However, the lack of professionals, designers and installers for the installation of aluminum curtain wall systems may hinder the growth of the global aluminum curtain wall market. Moreover, limited standard certification of the raw material acts as a restraining factor for the market's growth. Factors such as complexity in design, high installation and maintenance costs and risk of poor adhesion hamper the market's growth.

Market trends

- In May 2025, a Memorandum of Understanding (MoU) was signed by Emirates Extrusion Factory (EEF), which is a wholly owned subsidiary of Dubai Investments, and UCS Green Solutions Building and Construction Materials Trading (UCS), which is a provider of innovative façade and cladding solutions, to encourage and manufacture Green Curtain Wall System with Zero Material Wastage, enhancing the sustainable construction in the UAE. This strategic collaboration was signed by Ebrahim Mohammad Abdallah, Managing Director, UCS Green Solutions Building and Construction Materials Trading, and Sreekumar Brahmanandan, General Manager, Emirates Extrusion Factory, where it was formalized during the ‘Make it in the Emirates' forum.

- In February 2025, to distribute aluminum modular wall materials and activate sales, a business agreement was signed by Hansol HomeDeco, Okdong, which is a specialized aluminum manufacturer, as well as by an architectural design expert of Kookmin University, that is Professor Yoon Young-cheol. Furthermore, this agreement will help Hansol HomeDeco, launching furniture and construction products with the use of aluminum, expanding its business from a wood-centered focus to metal materials.

(Source: https://www.zawya.com/)

(Source: https://biz.chosun.com/)

Trade Analysis of Aluminium Curtain Wall Market

- The global buyers imported 48 shipments, which implies that the demand for facade and glazing solutions is increasing.

- There were 48 exporters and 51 verified foreign buyers with whom the trade activity occurred.

- The recorded growth of imports stood at 716 percent when compared to the previous year.

- Australia, Canada, and Japan became the major importing countries.

- Competitive manufacturing capabilities saw the dominance of Vietnam, Malaysia, and China in the global exports.

Trade intelligence tools allow buyers to determine the reliability of the suppliers and shipment reliability.

Market Outlook

- Industry Growth Overview: The steady aluminum curtain wall market growth is supported by the high-rise construction, urban development, and renovation activity.

- Sustainability Trends: The facade is being innovated regarding low-carbon aluminum, recyclable materials, energy-efficient glazing, and green codes.

- Global Expansion: The focus of Western Europe and North America is on refurbishment and energy-efficient retrofitting of commercial buildings.

- Major investors: Kawneer, Permasteelisa, Schuco International, YKK AP, Oldcastle BuildingEnvelope, and Reynaers Aluminium invest by way of the ongoing research.

- Startup Ecosystem: Startups develop intelligent facade, constructive modular buildings, software design tools, and sustainable coatings.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 54.72 Billion |

| Market Size in 2026 | USD 59.21 Billion |

| Market Size by 2035 | USD 119.23 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.10% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing manufacturing of customized aluminum curtain walls

Aluminum curtain walls offer design freedom, and the rising number of retrofitting of aged residential buildings has provoked the demand for customized aluminum curtain walls. According to the report published by Green Alliance Org., at least eleven million homes in the United Kingdom are suitable for retrofitting. Moreover, to meet the requirements for energy efficiency, many people are refurbishing homes/buildings.

Such buildings need custom-made curtain walls to enable the consumers' preferences and to add an excellent architectural signature to the building. Multiple large-scale manufacturing companies in the global aluminum curtain wall market are focusing on producing customized curtain walls to meet consumer requirements; this factor propels the market's growth.

Restraint

Lack of skilled professionals

The installation of aluminum curtain walls is a complex and time-consuming procedure, including sealing, fastening and other fixing steps. However, the installation process requires expertise in the field for proper planning, selection of materials and professional execution of the curtain wall system. Skilled professionals are needed for the installation due to the rapid innovation in the fastening process. Lack of qualified professionals for the procedure either results in denied or delayed installation of aluminum curtain walls or offers an uncertain product outcome. Thus, the shortage or lack of skilled and trained personnel in the field hampers the market's growth.

Opportunity

Rising construction of commercial buildings

The rising industrialization, especially in developing countries, demands the construction of commercial buildings to manage the operations of industries. For instance, industrialization in China is growing at a noticeable rate; the country currently holds 28.7% of global industrialization output. Commercial buildings have an enormous demand for curtain walls to wrap the building from the outside.

The rising construction of commercial buildings will increase the demand for aluminum curtain wall installation. Emerging economies in developing countries will boost construction activities, which will subsequently fuel the demand for aluminum curtain walls. The rising demand is expected to force the market players to develop advanced aluminum curtain wall frames to stay competitive in the market.

- According to the IBEF report 2024, FDI in construction development (townships, housing, built-up infrastructure, and construction development projects) and construction (infrastructure) activity sectors stood at USD 26.42 billion and USD 32.08 billion, respectively, between April 2000 and September 2023.

Segment Insights

Type Insights

The semi-unitized segment accounts for over 61% of the total market share. The unitized aluminum curtain wall frames are interlocking units, and the installation process for unitized curtain walls takes less time. The rising demand for aluminum curtain walls from high-rise buildings such as malls, business hubs and other commercial centers is observed to boost the growth of the unitized segment. The unitized segment offers the advantages of high quality and easy installation.

At the same time, the stick-built segment in the type of aluminum curtain walls is growing at a significant rate. The stick-built aluminum curtain wall structure is installed in pieces, and the stick-built aluminum curtain wall frames are lightweight and need low shipping costs. The segment's growth is attributed to the adventitious factor that allows onsite adjustments. However, the installation procedure for stick-built curtain walls takes time; this hampers the segment's growth.

Application Insights

The commercial segment leads the market, and it is expected to grow at a significant rate during the forecast period. The rising demand for commercial centers, including entertainment and shopping complexes and even business centers is supporting the growth of the commercial segment. Along with this, the rapidly growing industrialization is considered a significant factor in propelling the growth of the commercial segment. The rising construction activities in the commercial segment are driven by the growing tourism and hospitality businesses across the globe.

Moreover, the residential segment is projected to hold a significant market share during the forecast period. The growth of the residential segment is attributed to the rising construction of residential buildings, emerging economies in developing countries, and increasing disposable income in economically developed countries.

Regional Insights

What is the Asia Pacific Aluminum Curtain Wall Market Size?

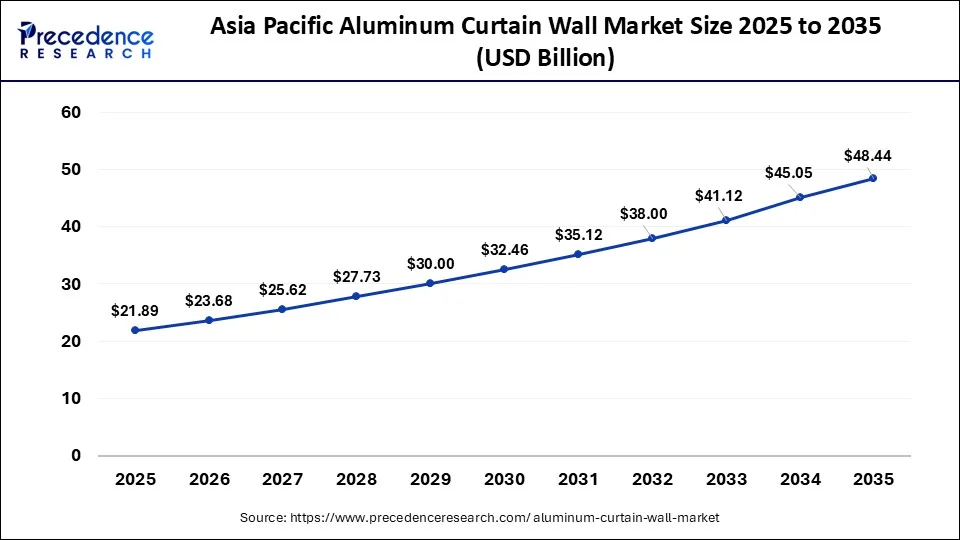

The Asia Pacific aluminum curtain wall market size was exhibited at USD 21.89 billion in 2025 and is projected to be worth around USD 48.44 billion by 2035, growing at a CAGR of 8.27% from 2026 to 2035.

Asia Pacific dominated the global aluminum curtain wall market and is expected to grow at a CAGR of 11.50% during the forecast period.The easy availability of aluminum in several countries of Asia Pacific has boosted the market's growth in the region. In 2021, India surpassed Russia in the production of aluminum. China and India are the most significant contributors to the aluminum curtain wall market development. Moreover, the rising construction activities in Japan for new commercial and industrial buildings are observed to boost the demand for aluminum curtain wall installation.

- China's aluminium production significantly increased, owing to the newer production capacity. According to the data recently published by the National Bureau of Statistics, China's aluminium output in the final month of 2024 rose month-on-month as well as year-on-year by 1.62% and 4.2%, respectively. China's aluminium output in December 2024 stood at 3.77 million tonnes, with daily production averaging 121,612 tonnes.

Another largest market for aluminum curtain walls, North America, is expected to grow at a CAGR of 6.7% during the projected timeframe.The rising allocation of budget construction projects in Canada by the private sector is projected to fuel the growth of the aluminum curtain wall market in North America. Rising corporate centers in Boston and New York are supplementing the market's growth for the region.

- According to the United States Census Bureau, Total U.S. construction spending reached USD 486 billion in Q1 2025, up 3% from USD 472 billion in Q1 2024. Private construction spending grew 2% year-over-year to USD 384 billion, with residential up 3% to USD 205 billion. Commercial public buildings (+44%) also recorded strong growth.

Dubai is emerging as a significant business hub. The rising construction for commercial buildings in Dubai is near gulf countries with growing demand for modernization of buildings, which will propel the growth of the aluminum curtain wall market in the Middle East. Moreover, the rising inclination towards utilizing low-cost metals in construction activities will increase the demand for aluminum curtain wall installation in Latin America.

Europe is expected to grow significantly in the aluminum curtain wall market during the forecast period. The demand for aluminum curtain walls is increasing in Europe due to growing urbanization and the shift to aesthetic aluminum solutions. At the same time, the presence of strict regulations on aluminum curtain walls is being utilized in buildings to improve their high energy performance. This, in turn, is increasing their production by various industries, leading to new collaborations. Moreover, the use of advanced technologies is also enhancing their development. Thus, their use to enhance the modern appearance of buildings is increasing. Hence, all these factors are promoting the market growth.

Italy Aluminum Curtain Wall Market Trends

Italy's market is driven by rising urbanization and an increase in sustainable construction practices. The requirement for energy-efficient, along with environmentally friendly, building envelopes, has propelled the acceptance of aluminum curtain walls, which provide superior thermal insulation and recyclability.

System-Wise Trends in the Aluminum Curtain Wall Market in Latin America

Latin America's market shows notable growth during the forecast period. It is driven by the rising adoption of sustainable construction practices is driving the usage of advanced aluminum facades. Further, rapid urbanization in Latin America necessitates modern, durable, and even aesthetically appealing building envelopes.

Brazil Aluminum Curtain Wall Market Trends

It is driven predominantly by increasing need from the commercial and even high-end residential construction sectors. Moreover, market maturity remains moderate, with ongoing structural drivers like urbanization, infrastructure modernization, and even sustainability initiatives fostering incremental need.

Role of Aluminum Curtain Wall in Commercial and Residential Buildings in MEA

MEA's market shows rapid growth during the forecast period. As MEA countries drive for green building standards, aluminum's 100% recyclability, along with its ability to significantly cut energy consumption, work with sustainable, eco-friendly, and cost-effective goals.

The UAE Aluminum Curtain Wall Market Trends

The UAE market is growing steadily as rapid urbanization and a booming construction sector drive demand for modern, high-performance building façades in major cities like Dubai and Abu Dhabi. Developers are increasingly adopting energy-efficient and sustainable solutions, with aluminum curtain walls valued for durability, thermal performance, and aesthetic appeal.

Value Chain Analysis for the Aluminum Curtain Wall Market

- Feedstock Procurement: It is mainly driving innovation in the pharmaceutical and even biologics sector by ensuring that drugs remain stable, safe, and effective until the point of use.

Key Players: Norsk Hydro ASA, Hindalco Industries Limited, Constellium, Kaiser Aluminum - Chemical Synthesis and Processing: It provides the aluminum curtain wall market with vital advancements in durability, aesthetic variety, and sustainability by improving the fundamental properties of the raw aluminum.

Key Players: Henkel AG & Co. KGaA, BASF SE / Chemetall GmbH, Atotech Deutschland GmbH - Compound Formulation and Blending: It addresses the growing need for high-performance, durable, and energy-efficient building facades.

Key Players: PPG Industries, AkzoNobel, Saint-Gobain

Aluminum Curtain Wall Market Companies

- EFCO Corporation: Offers tailor-made aluminum curtain wall structures, both stick-built and unitized systems of commercial buildings.

- Hansen Group Limited: Focuses on custom aluminum curtain walls and structurally glazed facade systems on complicated structures.

- Toro Group of Companies: Offers incorporated glazing solutions such as unitized curtain walls as well as window walls in high-rise developments.

- Alimicor Limited: Produces aluminum curtain wall systems with a focus on thermal efficiency, sustainability, and high-performance engineering facade.

Other Major Key Players

- Sanwa Tajima Corporation

- Technal

- Alutech

- HUECK Systems GmbH

Recent Developments

- In January 2025, Vedanta unveiled its company's INR 1 trillion aluminium refinery and smelter project will be set up in the Raygada district of Odisha. The INR 1 trillion investment in Odisha is to build a 6 MTPA alumina refinery and a 3 MTPA green aluminium plant. The first phase of the project is expected to be commissioned in the next three years.

- In January 2025, Kawneer announced a new product in its curtain wall framing product portfolio with the introduction of the 1600UT SS Curtain Wall System. Designed to meet the building and construction industry's thermal curtain wall needs.

- In November 2024, AluK India launched the W75U unitised curtain walling system. The W75U Unitised Curtain Walling System, an innovation that combines style with substance. It is engineered to tackle the harsh environmental challenges. W75U balances efficiency and aesthetics, built to meet the demands of architects who need efficiency without compromising aesthetic appeal.

- In October 2022,a proposal intended to facelift the Chadwick House, an iconic royal building on Warrington's Birchwood Park. The proposal aims to improve the appearance of the building along with its thermal performance. The proposed work for Chadwick House includes the replacement of existing curtain walls with a new double-glazed ppc aluminum curtain wall system.

- In October 2022, Overhead Door launched a new EverServe aluminum model for glass doors. The new mode by Overhead Door provides maximum light infiltration and eliminates the need for counterbalance. This model is considered to be a premier solution for commercial buildings.

- In June 2021, Washington-based Milgard Windows & Doors launched a new AX550 moving glass walls in custom sizes for both new construction and replacement purposes. The new AX550 features a modern aluminum frame with sightlines available in four colors. It also has a thermally broken aluminum design.

- In March 2021, the European market leader in aluminum solutions, Reynaers Aluminum, announced the opening of three new showrooms in Iasi, Cluj-Napoca and Timisoara. With the introduction of three new showrooms, the company aims to achieve a new strategy in architectural development. The company has extended its product portfolio with the latest range of accessories along with its original curtain walls, doors and windows.

- In December 2021, DMB Global Inc signed a definitive agreement to acquire a 60% controlling interest in Arcadia Inc, a leading supplier of architectural building products, including framing systems in the U.S. market. DMC planned to purchase a 60% interest in Arcadia for $285.2 million.

- In April 2022,a prominent manufacturer of aluminum composite panels in India, Alstone, launched a premium range of aluminum cladding solutions. This cladding solution by Alstone aims to change the exterior look of buildings.

- In June 2023,Western Window Systems unveiled new products that were added to its portfolio of windows and doors at the NAHB International Builder's Show 2023 in Las Vegas. The company launched innovative aluminum products to fulfil the demand of the architectural community.

Segments Covered in the Report

By Type

- Stick Built

- Semi-unitized

- Unitized

By Application

- Commercial

- Residential

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting