What is Aluminum Die Casting Market Size?

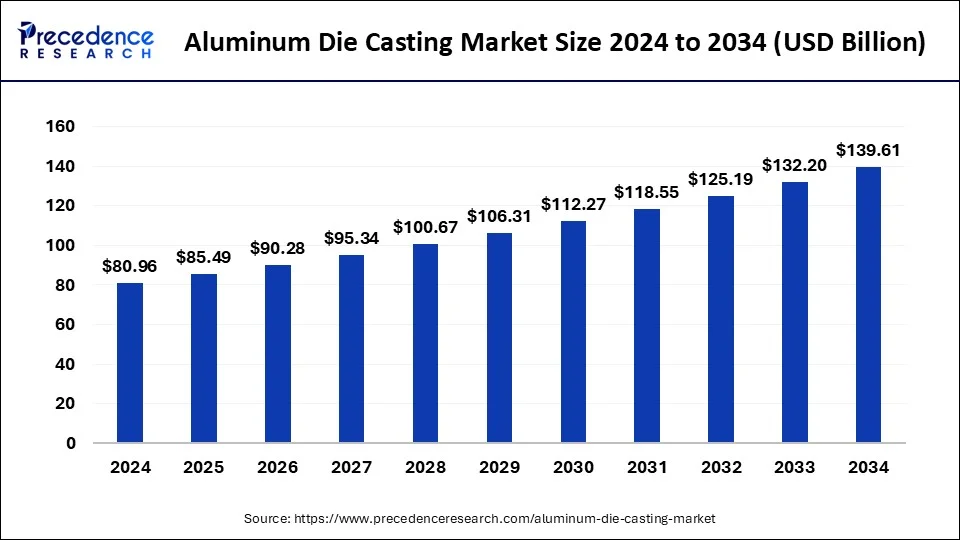

The global aluminum die casting market size reached USD 85.49 billion in 2025, estimated at USD 90.28 billion in 2026, and is predicted to be worth around USD 146.75 billion by 2035, expanding at a CAGR of 5.55% from 2026 to 2035

Market Highlights

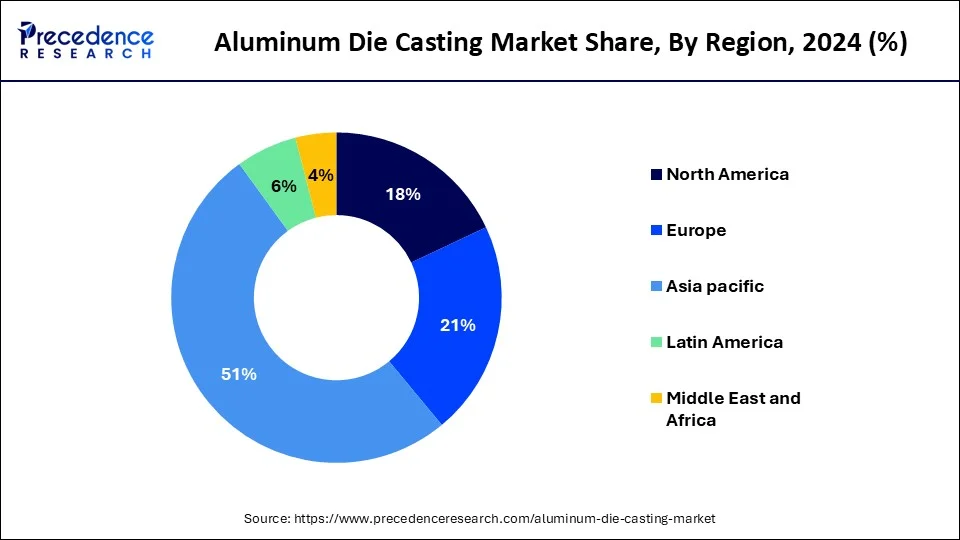

- Asia Pacific led the global market with the highest market share of 51% in 2025.

- By region, North America is expected to grow at the fastest rate during the forecast period.

- By production process, the pressure die casting segment led the market with the largest share in 2025.

- By application, the transportation segment accounted for the highest market share in 2025.

What is the Aluminum Die Casting?

The aluminum die casting market deals with the process of making complex aluminum parts using a specific die, die casting machine, metal, and a furnace. Aluminum die casting is a method of producing aluminum products in desired shapes by pouring molten metal into a mound of the appropriate shape and size, yielding a finished product that meets the requirements. The output product of aluminum die casting is obtained by pouring metals under high pressure or injecting metal into the mound cavity. When extreme precision, complicated pieces, and precise details are required, the aluminum die casting process is preferred.

The qualities of aluminum, such as resistance to corrosion, increase the feasibility of aluminum die casting products for a variety of applications. The automobile industry is a major user of aluminum die casting products, and the industry's continued growth in manufacturing and sales may provide prospects for the aluminum die casting market to expand.

The aluminum alloys are melted in the furnace and then injected into the dies. Alloy 380.0 is widely used for dying casting and can cast aluminum alloys 413, 390, and 360. They also act as a metal surface coating that displays excellent corrosion resistance. The increasing usage of aluminum in several applications, such as telecommunication and transportation, is estimated to drive market growth. A rising preference for lightweight castings and high strength is also a major driving factor. Manufacturers are required to adhere to the regulations to reduce harmful emissions and enhance fuel efficiency in the transportation industry, which is further expected to drive the growth of the aluminum die casting market.

How is AI contributing to the Aluminum Die Casting Industry?

Artificial intelligence transforms die casting into a data-driven process by allowing live optimization of parameters, predicting defects, developing digital twins, inspection, predictive maintenance, and energy optimization. It minimizes scrap, maintains consistency, enhances the life of tools, and contributes to sustainable manufacturing on the basis of recycled aluminum feed.

Aluminum Die Casting Market Growth Factors

- The aluminum die casting market's growth is being supported by increased demand for automobiles and consumer products.

- The military and defense sector's growing investment in lightweight weapon systems is a major driver of the market growth.

- In addition, rising usage in the building and construction, electronics, and mining industries has aided market expansion.

- The rising growth in the substitution of aluminum for iron and steel in the automotive industry and the rising production of vehicles are further anticipated to drive the growth of the aluminum die casting market.

Market Outlook

- Industry Growth Overview: The demand for electric vehicles, lightweighting, and aerospace growth steps up the usage of aluminum die cast in the world.

- Sustainability Trends: The use of recycled aluminum and energy-efficient melting transforms the cost structures and environmental performance.

- Major investors: Rock Island Capital, NEMAK, Ryobi Limited, Castings Acquisition Company, and automotive OEMs fuel growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 85.49 Billion |

| Market Size in 2026 | USD 90.28 Billion |

| Market Size by 2035 | USD 146.75 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 5.55% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Production Process, Application, and region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Market Dynamics

Drivers

Increasing demand for automobiles and consumer goods

The aluminum die casting market's growth is being supported by increased demand for automobiles and consumer products. The rising usage of aluminum die casting for various purposes and acceptance of high-strength and lightweight castings, notably in the auto sector, are among the primary drivers driving the market's expansion. Furthermore, a growth in the substitution of aluminum for iron and steel in the automotive sector, as well as increased funding in this sector, propel the market during the forecast period.

Furthermore, the automotive industry's need for lightweight materials has been significantly influenced by the swift implementation of stringent government regulations. These regulations aim to lower emissions and improve fuel efficiency, and the market is responding by increasingly using highly accurate machines and gadgets to improve the quality and durability of aluminum casts for various applications as casting technology advances.

Rising use in construction applications

Aluminum castings are extensively used in construction applications. Aluminum die castings are popular in various construction applications due to their enhanced properties, such as being lightweight and high-strength. Aluminum casting is commonly used for gazed structures and window structures ranging from shop fronts to large roof superstructures for other shopping centers. They are also used for cast door handling, curtain walling, siding, and roofing. In addition, aluminum die casting is environmentally friendly, peel-resistant, scratch-resistant, and lightweight. These major factors are driving the growth of the aluminum die casting market during the forecast period.

Restraints

Availability of alternative materials

As there are numerous reasons that can cause the aluminum die casting market to grow, there are also some factors that can limit the market growth. One of the most significant disadvantages of aluminum die casting is the entrapment of gases in the aluminum due to permeability, which can cause product deformation and damage. Furthermore, the aluminum die casting method is not ideal for the design of large parts, making it unsuitable for large parts.

However, the increasing substitution of aluminum alloys with magnesium, as well as the economic crisis in developed countries, is among the key factors restraining the growth of aluminum die casting market during the forecast period. In addition, fluctuations in raw material prices and easy availability of substitutes are further restraining the growth of the aluminum die casting market.

Opportunity

Internet of Things and Industry 4.0

The Internet of Things and Industry 4.0 are transforming the manufacturing industry. By leveraging these technologies, companies can improve product quality, reduce costs, and enhance productivity. IoT technology can monitor every step of the aluminum die casting procedure, from melting the metal to cooling the mold. IoT sensors help to collect information on variables such as humidity, temperature, and pressure. This data may be studied in real-time and enable producers to detect defects immediately and alter the procedure to ensure constant quality. In addition, with the help of Industry 4.0 technologies, automation of the aluminum die-cast tooling process is possible. Robotics can be utilized to complete this since they can be trained to carry out activities such as extracting the final piece from the mold and pouring molten metal into a mold. Furthermore, Industry 4.0 and IoT innovations can enhance the aluminum die casting tooling procedures, resulting in cost savings for manufacturers, enhanced quality of products, and higher productivity, which are further expected to drive the growth of the aluminum die casting market in the coming years.

Segment Insights

Production Process Insights

The pressure die casting segment led the market with the largest share in 2025. The process's notable advantages, such as fast cavity filling, flawless surface finish, high mechanical capabilities, and lower dimension tolerance, contributed to the segment's dominance. This process is more cost-effective and versatile than others. Moreover, reduced material waste and high precision associated with this process further boost its demand, particularly in the automotive industry.

On the other hand, the others segment is estimated to be the most opportunistic segment during the forecast period. Vacuum and squeeze die casting are two other methods of die casting. These methods are used to cast solar sensors and turbine blades. The rising usage of solar devices contributes to segmental growth.

Application Insights

The transportation segment accounted for the largest market share in 2025. This is mainly due to the rising demand for lightweight vehicles. Moreover, aluminum die casting is corrosion-resistant and possesses a high strength-to-weight ratio, allowing manufacturers in the transportation industry to design lightweight components, which significantly improves vehicles' fuel efficiency.

On the other hand, the industrial segment is expected to expand at the highest CAGR during the forecast period. Agriculture, mining, and construction equipment all fall under this category. Aluminum cast products are used in the components of the above-mentioned machinery. Rising industrialization further contributes to segmental growth.

Regional Insights

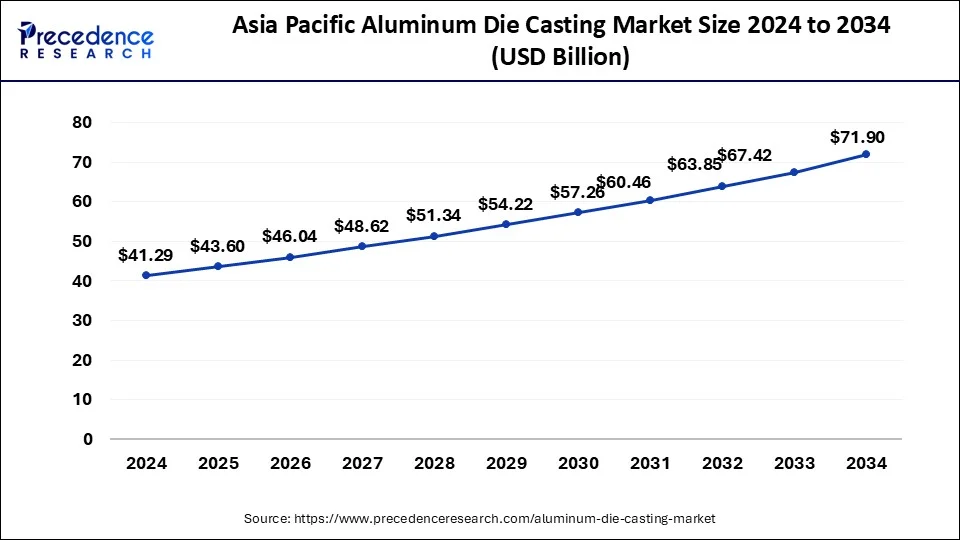

Asia Pacific Aluminum Die Casting Market Size and Growth 2026 to 2035

The Asia Pacific aluminum die casting market size was estimated at USD 43.60 billion in 2025 and is anticipated to reach around USD 75.77 billion by 2035, at a CAGR of 5.68% from 2026 to 2035

Asia Pacific dominated the aluminum die casting market with the largest share in 2025. The market growth in the region is driven by the increasing presence of skilled labor, low labor costs, and the easy availability of raw materials, which makes it the leading region for manufacturers to build production facilities. China accounted for a major market share in 2023 and is one of the largest manufacturing hubs across the globe. Moreover, the rising industrialization in the region contributed to the regional market expansion.

- In March 2024, India launched an anti-dumping probe into the import of aluminum foil from China. The aim behind this launch was to protect its domestic aluminum industry.

North America is expected to grow at the fastest rate during the forecast period. The abundant skilled labor at a low cost distinguishes the region, making it the most attractive location for firms seeking to establish industrial facilities. Moreover, the region is known for innovative technologies in manufacturing processes. Thus, the rising technological advances in aluminum die casting production methods and the increasing demand from the automotive industry further propel the market in the region.

What Are the Driving Factors of the Aluminum Die Casting Market in Europe?

Europe is expected to grow at a remarkable rate during the forecast period. Europe focuses on high-quality aluminum casting, which is motivated by the stringent environmental requirements and the need to lighten cars. Vacuum-assisted and semi-solid casting have been adopted by the automakers. The demand is dominated by the high-integrity parts, which are largely needed in the electric mobility and aerospace industry, with the help of the sustainability-oriented manufacturing and the material transitions based on the regulations.

Germany Aluminum Die Casting Market Trends:

Germany is a source of the high demand for advanced high-pressure die casting, which assists in the manufacture of vehicle structural parts that are electric-powered. The green aluminum is expedited by the sustainability rules. Foundries engage in acquisitions in order to increase their vacuum and squeeze casting capabilities, and have continued to lead the high-integrity, low-carbon, precision aluminum production.

China Aluminum Die Casting Market Trends:

China is ahead in the mass production of aluminum casting, with the use of giga-casting and vertically integrated electric vehicle supply chains. The manufacturers engage in heavy investment in automation, AI-based monitoring, and high-pressure die casting to enhance accuracy, reduce dependence on labor, and speed up the production of structural components.

U.S. Aluminum Die Casting Market Trends:

The U.S. concentrates on localized growth of aluminum castings with the help of reshoring efforts. Recycled aluminum is motivated by sustainability. The use of digital twins, smart factories, and simulation tools in industry enhances yield, quality control, and responsiveness to the automotive and aerospace manufacturing ecosystem.

Value Chain Analysis of the Aluminum Die Casting Market

- Raw Material Sourcing: This is the process of obtaining aluminum and alloying materials supplied by the suppliers of the company, whose quality and continuity in production shall be ensured.

Key Players: Hindalco Industries, NALCO, CMR Green, Vedanta Aluminium - Component Manufacturing:Smelting of aluminum, injection, vulcanizing, clipping, and creating finished or semi-finished die-casted components.

Key players: Endurance Technologies, Rockman Industries, Sandhar Technologies, Ryobi Die Casting - Vehicle Assembly and Integration: Using aluminum die-cast components in vehicle systems in the assembly process with structural and functional components.

Key players: Samvardhana Motherson Group, Martinrea International, Bosch - Testing and Quality Control:A check of cast parts and assemblies to determine the accuracy of dimensions, mechanical performance, and defect-free quality.

Key Players: etwerk, SGS, TUV Rheinland - Distribution to Dealers and OEMs: These involve management of logistics, warehousing, and transportation of the finished aluminum components to dealers and OEMs.

Key players: Tata Motors, Toyota, General Motors, Ford, Mahindra

Top Aluminum Die Casting Market Companies and their Offerings

- GF Casting Solutions: Manufactures lightweight aluminum and magnesium die-cast parts through high-pressure processes to be used in automotive, aerospace, and commercial vehicles all over the world.

- Dynacast Deutschland GmbH: Focuses on accurate aluminum die casting by multi-slide and hot-chamber technologies, providing multi-operation secondary processes integrated into the components.

- Consolidated Metco Inc. (ConMet): Aluminum die-cast products used by heavy-duty trucks and commercial vehicles are manufactured with a focus on durability, reduction of weight, and the efficiency of operations.

Other Aluminum Die Casting Market Companies

- MartinreaHonsel Germany GmbH

- Shiloh Industries Inc.

- Alcoa Corporation

- Alcast Technologies Ltd.

- Gibbs Die Casting Corporation

- Ryobi Die Casting Dalian Co.

- Walbro LLC

Recent Developments

- In November 2025, Roots Cast Private Ltd launched low-carbon aluminium castings, enhancing its sustainability efforts. Volvo Penta will source parts made from these new eco-friendly castings, reinforcing their commitment to green manufacturing.(Source: https://www.motorindiaonline.in)

- In September 2025, Golden Aluminum Inc. (GAI) partnered with SMS group to launch the nexcast aluminium strip at its Fort Lupton facility. This cutting-edge continuous casting line produces high-alloy aluminium grades, converting molten aluminium into hot-rolled 36-inch coils. It replaces a 40-year-old block caster previously used at the plant.

- In August 2024, the core company of the UBE Group's machinery business, UBE Machinery Corporation, Ltd., launched a die casting technology, a newly developed die casting machine for giga casting that uses aluminum alloy to integrally mold body structure parts for battery electric vehicles (BEVs).

- In October 2023, Alloy Enterprises announced the launch of its aluminum cold plate component. The aim behind this launch was to expand its production facilities.

Segments Covered in the Report

By Production Process

- Pressure Die Casting

- High Pressure Die Casting

- Low Pressure Die Casting

- Others

By Application

- Transportation

- Industrial

- Building & Construction

- Telecommunication

- Consumer Durables

- Energy

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting