What is the Automotive Wheel Market Size?

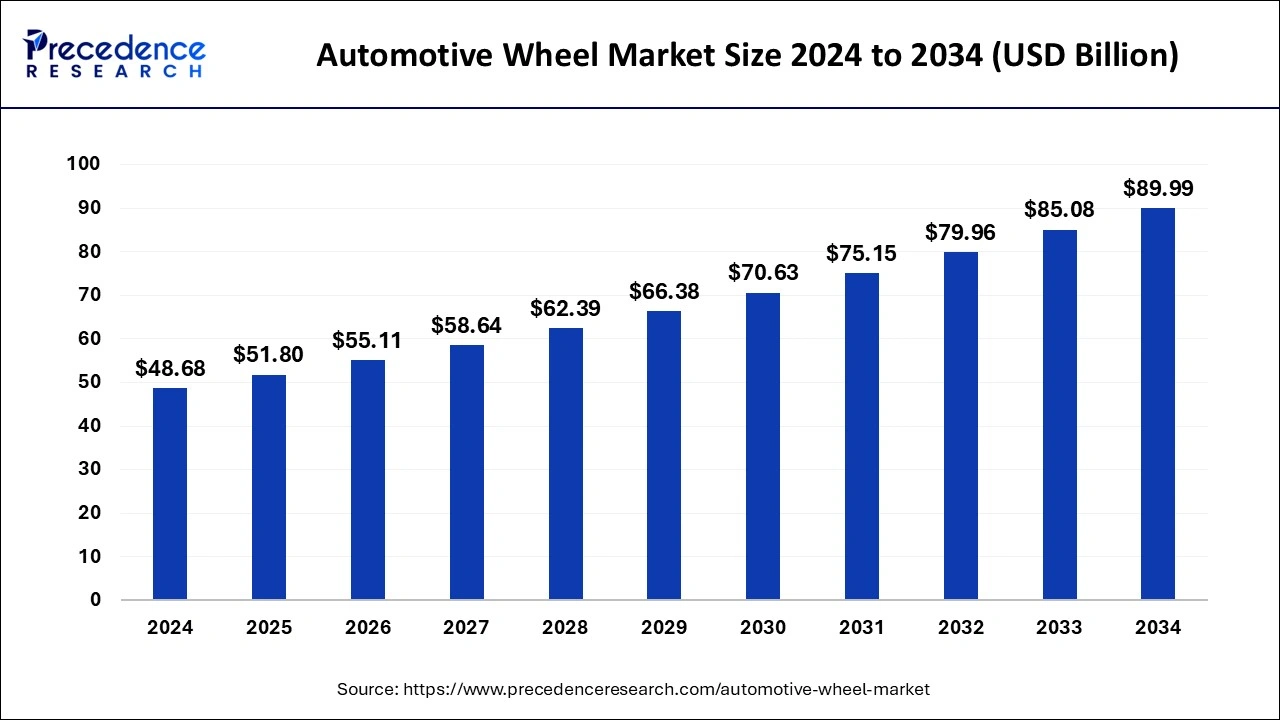

The global automotive wheel market is accounted at USD 51.80 billion in 2025 and predicted to increase from USD 55.11 billion in 2026 to approximately USD 94.90 billion by 2035, representing a CAGR of 6.24% from 2026 to 2035. The significant features of wheels including robust construction, lower cost, less maintenance, and high production raise their adoption in the automotive wheel industries and accelerate the growth of the automotive wheel market.

Automotive Wheel Market Key Takeaways

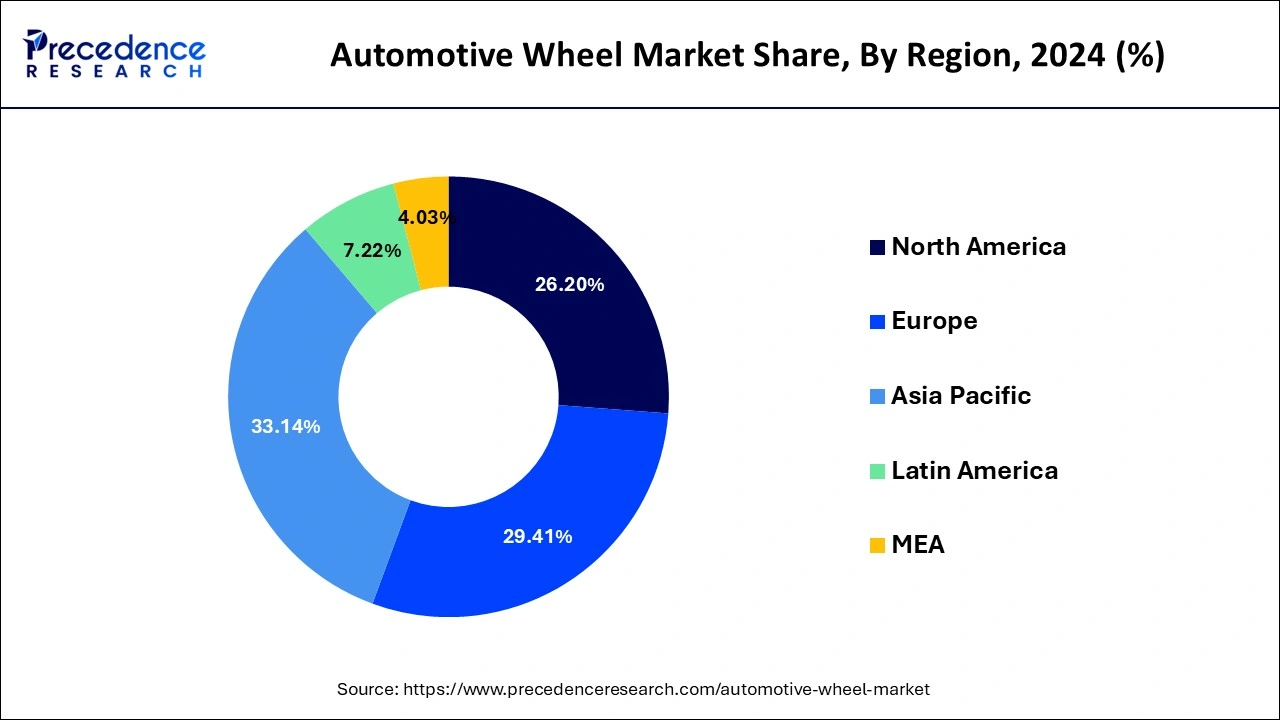

- Asia Pacific led the global market with the highest market share of 33.14% in 2025.

- By material type, the aluminum segment has held the largest market share in 2025.

- By material type, the alloy segment is expected to grow at a remarkable CAGR during the forecast period.

- By vehicle type, the passenger vehicles segment captured the biggest revenue share in 2025.

- By vehicle type, the heavy commercial vehicle segment is expected to expand at the fastest CAGR over the projected period.

Role of Artificial Intelligence in the Automotive Sector

Artificial intelligence and generative AI have great potential to revolutionize the automotive industries and the automotive market by addressing and fulfilling the needs of customers. Generative artificial intelligence can harness a huge amount of data to provide useful insights into customer behavior. It can analyze vast amounts of data including browsing history, purchase patterns, and social media activity to create dynamic customer profiles that help to drive targeted marketing efforts. GenAI can transform a huge amount of data into personalized narratives. It also allows brands to organize personalized marketing campaigns for potential customers.

Market Overview

Automotive wheels are used on vehicles, including lorries, passenger automobiles, and motorbikes. They improve the vehicle's performance, traction, and overall ride quality. Lightweight metals and aerodynamics enhance fuel efficiency, while diverse wheel designs accommodate different driving situations and aesthetics.

Automotive Wheel Market Growth Factors

- The automotive wheel market is growing due to increased automobile production and a trend of vehicle weight reduction. The automotive wheel market is propelled by the need for lightweight wheels to reduce vehicle weight and improve fuel efficiency.

- Technological advancements and product developments in design and material have boosted the industry's growth. Furthermore, rising consumer expenditure on vehicles and rising population increase the automotive wheel market growth.

- The increase in middle-class people's disposable income is driving the demand for the automotive wheel in the market. Furthermore, the rising demand for vehicles from nations such as Germany, China, the U.S., and India is driving the growth of the automotive wheel market.

- The manufacturing costs, on the other hand, will continue to be a huge obstacle to market profitability and economic viability, as will technological developments to boost performance while decreasing vehicle weight for better fuel efficiency.

Market Outlook:

- Industry Growth Overview: The automotive wheels industry is currently witnessing a consistent upward curve caused by the increase in overall production numbers of automobiles and light trucks, along with increasing demand for lightweight components compared to conventional design, and finally, the continuing rise of electric vehicles (EVs), which will lead to an acceleration of the growth of the automotive supply chain of organisations based on a global basis.

- Sustainability Trends: The shift toward sustainability is being embraced by wheel manufacturers who have created initiatives aimed at reducing their negative impact through the incorporation of recycled aluminium (aluminium), energy-efficient forging techniques, and coating systems.

- Global Expansion: The global expansion of the wheel manufacturer community will continue to be facilitated through the implementation of a global strategy that consists of localising Original Equipment Manufacturers (OEM) as well as establishing regional hubs in emerging markets. This strategy will improve operational efficiencies, reduce logistical costs, and shorten timelines based on automotive industry requirements.

- Startup Ecosystem: The startup ecosystem is bringing new opportunities to the wheel manufacturing industry through innovative wheel design concepts that offer performance-enhancing solutions via smart technology, machine learning techniques, and layer additive manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 51.80 Billion |

| Market Size by 2035 | USD 94.90 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.24% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material, and By Vehicle, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing growth in automotive

As global vehicle production grows, the need for automotive wheels rises correspondingly. With emerging markets such as Asia-Pacific and Latin America experiencing a surge in automotive sales, producers are producing more vehicles to meet consumer demand. The growth of both passenger and commercial vehicles has contributed to a steady increase in the automotive wheel market.

Restraint

Raw material price volatility

The volatility in raw materials poses significant challenges in the industry, and price hikes in vital components of manufacturing wheels such as aluminum, steel, can affect producers' profitability. The price fluctuations are considered by several factors, such as disruptions in timely supply and demand, trade regulations, and inflation, which add up to high production expenses and unstable economic conditions. Thus, it hinders automotive wheel market growth and compels manufacturers to face the challenges of high competition and increased production costs.

Opportunity

Development of advanced materials and technology

Advanced materials such as high-strength steel, forged aluminum, and composite materials provide improved strength and resistance to corrosion, creating the wheels more durable and capable of handling the stresses of road conditions, harsh temperatures, and impacts. More strength improves safety by providing better shock absorption and reducing the risk of wheel failure.

Material Type Insights

The aluminum segment dominated the market with a revenue share in 2025. With the future commercialization of the wheels, the segment is likely to be driven by the increasing application of diverse material types in dynamic environments.

The alloy segment is estimated to be the most opportunistic segment during the forecast period. The shape and performance of alloy wheels are the main factors for their adoption. The manufacturers are focusing on the lightweight construction of wheels because the automotive industry is primarily focused on energy savings.

Vehicle Type Insights

The passenger vehicles segment dominated the global automotive wheel market in 2025, in terms of revenue. This is attributed to the increased demand for passenger vehicle wheels, the segment is experiencing significant expansion. The carbon fiber composites are now used in passenger vehicle wheels to provide a combination of high strength and light weight qualities.

The heavy commercial vehicle segment is estimated to be the most opportunistic segment during the forecast period. This is due to the surge in demand for advanced features of heavy commercial vehicles in the automotive wheel market during the forecast period.

Key Companies & Market Share Insights

Many key market players are investing extensively to expand their reach in order to offer their products to original equipment manufacturers (OEMs), as well as to place their manufacturing units near OEM facilities in order to better understand OEM requirements and the regional market. The various developmental strategies such as business expansion, investments, new product launches, acquisition, partnerships, joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players of automotive wheel. The automotive wheel market is also fragmented into many local and regional market players. In March 2020, the Zhejiang Jinfei Kaida invested for project of manufacturing aluminum wheel. To increase their market reach and position, the automotive wheel manufactures are focusing on improving their product portfolio by launching new products in the automotive wheel market during the forecast period.

Regional Insights

Asia Pacific Automotive Wheel Market Size and Growth 2026 to 2035

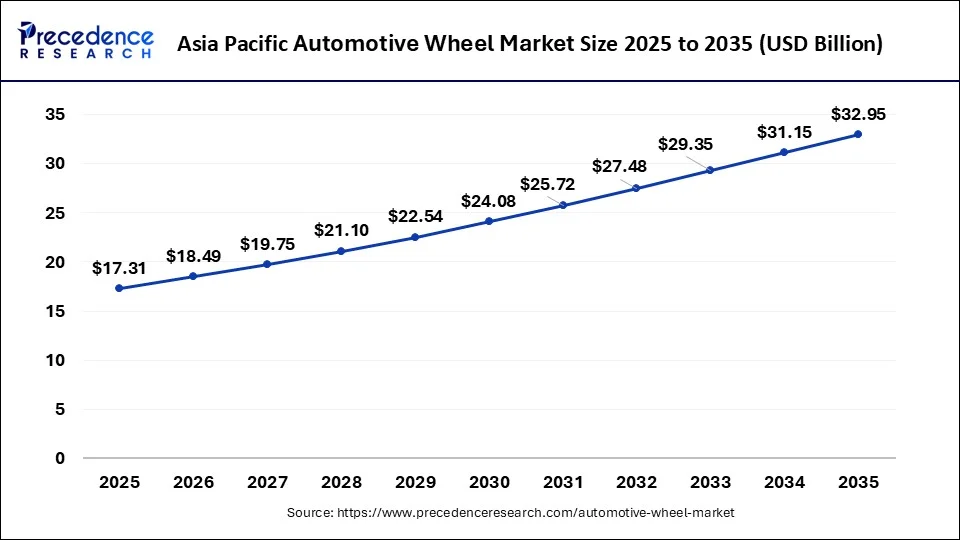

The Asia Pacific automotive wheel market size is estimated at USD 17.31 billion in 2025 and is predicted to be worth around USD 32.95 billion by 2035, at a CAGR of 6.65% from 2026 to 2035.

Asia-Pacific segment dominated the global automotive wheel market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. The market's expansion can be attributable to growing passenger vehicle production and demand. Furthermore, the growing need for fuel efficiency and vehicle performance, as well as the increased spending power of customers in developing countries, are propelling this market in Asia-Pacific.

- In July 2024, Musashi Seimitsu Industry Co., Ltd. and the president of Japan announced that their project entitled “Industrial Cooperation Program in the Global South through Technology Transfer from Japan 2024” was selected to promote the expansion of e-mobility in the Republic of Kenya. This project is committed to accelerating the deployment and adoption of two-wheel e-mobility.

Europe is estimated to be the most opportunistic segment during the forecast period. The automotive wheel market in Europe is expected to grow due to the rising demand for improved fuel economy in automobiles across the region. The automotive wheel market in Europe is expected to be propelled by the presence of original equipment manufacturers (OEM) across Europe with advanced material composition research and development initiatives.

- In December 2024, the Federal Ministry for Economic Affairs and Climate Protection of Germany introduced a package of measures to strengthen the car industries and accelerate the competitive edge of the German and European car industries over their American and Chinese competitors.

Value Chain Analysis of the Automotive Wheel Market:

- Sourcing for Raw Materials and Developing Alloys: Instead of creating wheels from raw materials (aluminium, steel, magnesium, and carbon fibre composite), a wheel manufacturer purchases the necessary raw materials through their suppliers. The suppliers must also consider the requirements of each of their customers.

Key Players: Alcoa Corporation (Aluminium), Rio Tinto (Aluminium), and Norsk Hydro (Steel). - Manufacturing the Wheel and Precision Engineering: The manufacturing process includes the methods used to create wheels. The techniques commonly used to manufacture wheels are casting, forging, machining, and surface finishing. The implementation of automation and artificial intelligence systems for defect detection will significantly improve a manufacturer's yield and the level of uniformity in the quality of their products, and thus increase their overall profit.

Key Players: Ronal Group, Superior Industries, and Enkei Corporation. - Distribution, OEMs, and Aftermarket: The distribution of finished wheels, how OEMs incorporate finished wheels into their vehicles, and the aftermarket distribution channels.

Key Players: Maxion Wheels, Borbet GmbH, and Accuride Corporation.

Automotive Wheel Market Companies

- Euromax Wheel

- Prime Wheel Corporation

- Aluminum Wheel Co. Ltd

- Superior Industries International Inc.

- Foshan Nanhai Zhongnan

- Enkei Corporation

- Ronal Group

- BBS GmbH

- Center Motor Wheel of America Inc.

- Topy Industries Ltd.

Latest Announcements by Industry Leaders

- In April 2024, Jake Dingle, CEO of Carbon Revolution announced that the company was honored by prestigious global auto industry awards for innovation and recognized as a tier 1 supplier of lightweight carbon fiber wheels, and with its collaboration with General Motors.

- In October 2024, José Muñoz, president and global CEO of Hyundai and Genesis Motor Company of North America announced that he had received the Visionary Leader Award in the Reuters Events 2024 Automotive D.R.I.V.E. Honours. He also reported that the company is fortunate to work under the leadership of Hyundai's Executive Chair who is committed to delivering goods and services safely, conveniently, and sustainably.

Recent Developments

- In May 2024, the Ronal Group announced that it plans to launch a new sporty wheel with Y-spokes and Ronal R75 from its design line.

- In May 2024, the Ronal Group reported that the company plans to incorporate a monobloc forged wheel into its range with the Ronal RF1 Forged which will be established based on experience and technical know-how from motorsport.

Segments Covered in the Report

By Material Type

- Alloy

- Steel

- Aluminum

- Carbon Fiber

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By End User

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- MEA

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting