What is the Automotive Aluminum Extrusion Market Size?

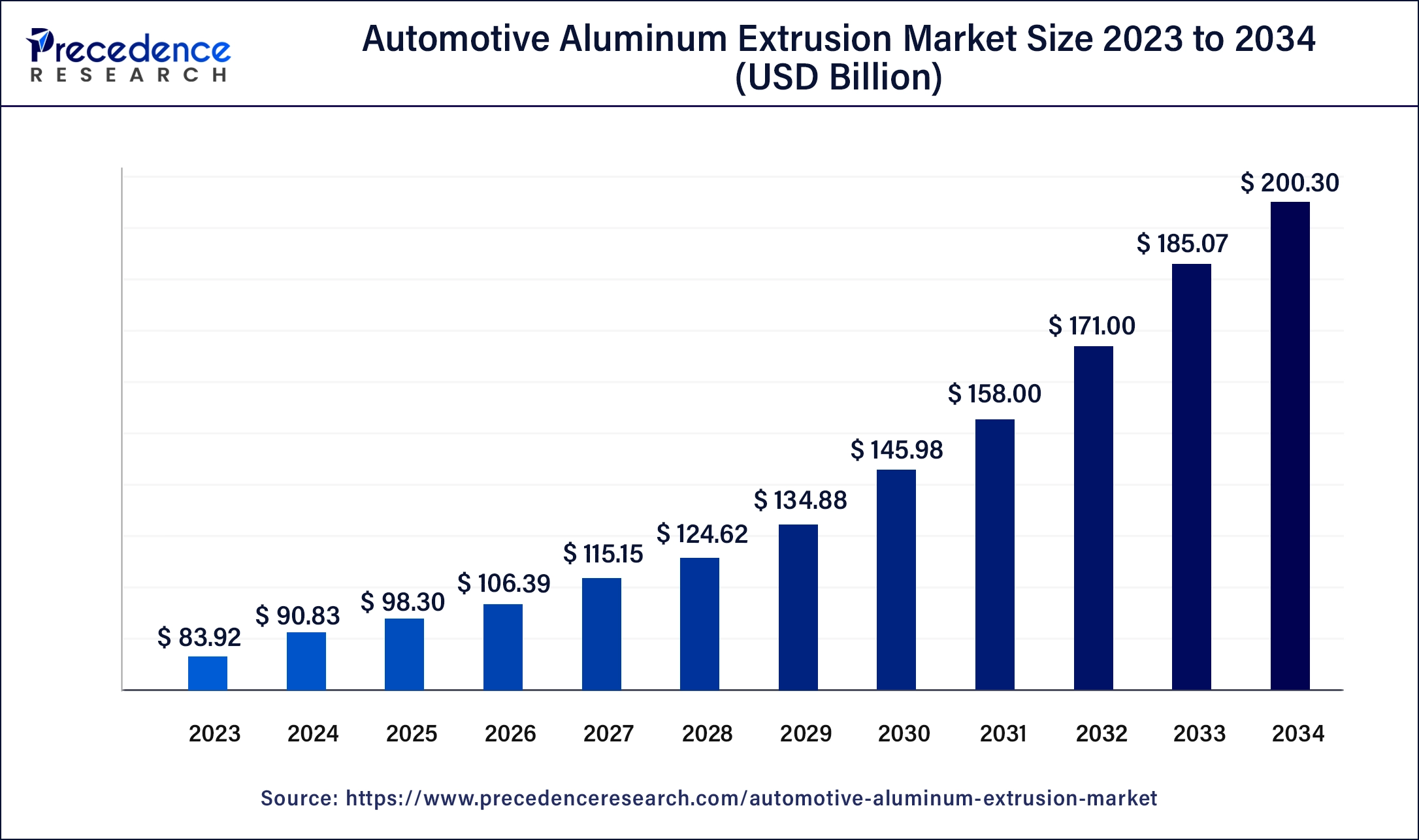

The global automotive aluminum extrusion market size is calculated at USD 98.30 billion in 2025 and is predicted to increase from USD 106.39 billion in 2026 to approximately USD 214.76 billion by 2035, expanding at a CAGR of 8.13% from 2026 to 2035.

Automotive Aluminum Extrusion Market Key Takeaways

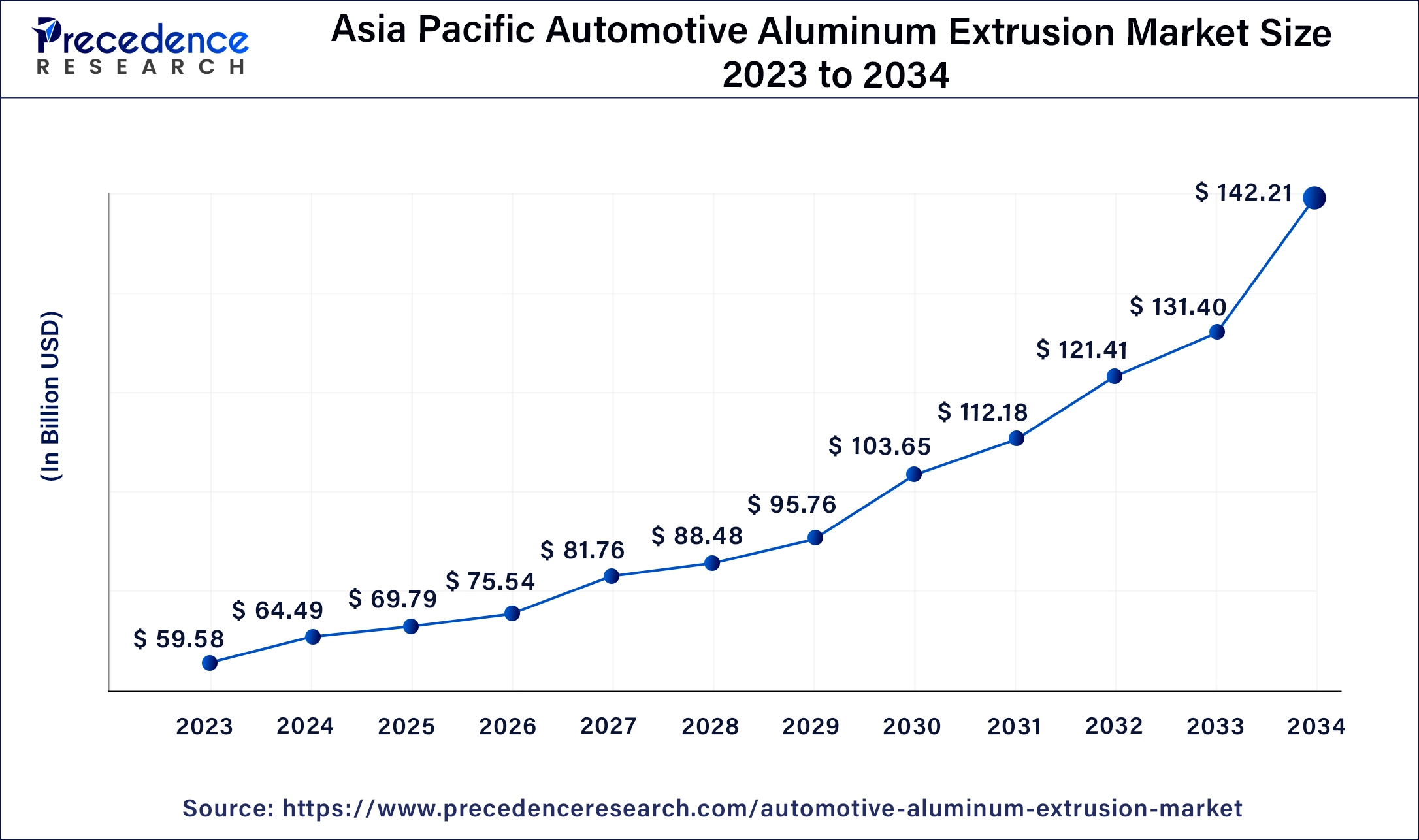

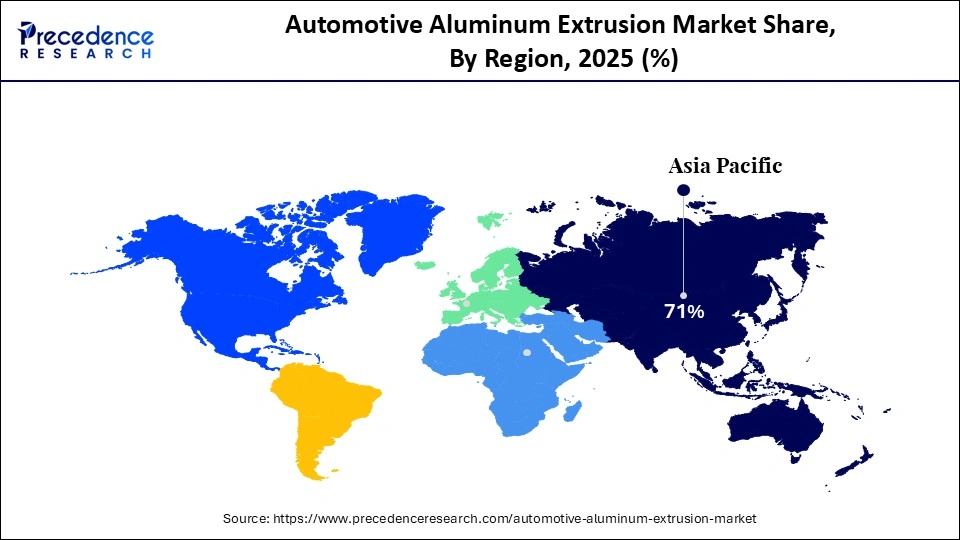

- Asia Pacific led the global market with the highest market share of 71% in 2025.

- By type, the sub-structure segment has held the highest market share in 2025.

- By vehicle, the utility vehicle segment captured the biggest market share in 2025.

How is AI contributing to the Automotive Aluminum Extrusion Market?

AI optimizes the aluminum extrusion production process mainly by defect detection through machine vision, predictive maintenance, digital twin technology, and real-time process optimization. It also significantly speeds up design innovation via generative modeling and material studies to create high-strength alloys. In addition to these, AI is very beneficial to the recycling aspect of the aluminum industry, as it employs optical sorting for better recycling and, likewise, energy-saving techniques in production. The technology fortifies supply chain management in terms of demand forecasting, logistics planning, and quality control, making light-weight metal automotive parts reliable, strong, and eco-friendly across the new era of EV-centered manufacturing.

Automotive Aluminum Extrusion Market Growth Factors

The expansion of the automotive aluminum extrusion market is being aided by revolutionary innovations in extrusion equipment. The demand for automotive aluminum extrusion has increased for the vehicles such as mini-compact vehicles, supermini vehicles, compact vehicles, mid-size vehicles, executive vehicles, luxury vehicles, utility vehicles, light commercial vehicles, heavy commercial vehicles, and buses & coaches.

The market for automotive aluminum extrusion is expected to develop due to an increase in demand for lightweight and robust extruded products in various types of industries. The weight of aluminum is less but is very strong metal as compared to others. These features of aluminum make it a perfect for huge structures and buildings that require additional strength while reducing weight. Aluminum objects have a good strength and rigidity, making them deform resistant.

Furthermore, extruded aluminum's superior corrosion resistance is projected to drive the demand automotive aluminum extrusion in electronics, electricals, and medical industries. Unlike steel and iron, extrusions become highly corrosion resistant after anodizing or powder coating due to a thick layer of aluminum oxide. As a result, the cost of maintenance of automotive aluminum extrusion is quite low. However, the automotive aluminum extrusion market's growth may be hampered by expensive initial setup costs and limited manufacturing efficiency.

The rise in government incentives to use aluminum extrusions in creating integrated photovoltaic systems is likely to promote the growth of the automotive aluminum market during the forecast period. Moreover, the surge in development in the construction and building industry is expected to boost the automotive aluminum extrusion market growth. On the other hand, the rising need for infrastructure development, residential, and commercial projects is expected to stifle the automotive aluminum extrusion market's expansion.

The global automotive aluminum extrusion market is expected to grow during the forecast period, owing to an increase in demand for lightweight automobiles as a result of severe emission standards being implemented around the world. As a result, the demand for aluminum extrusion in automotive applications is projected to rise. The rise in global demand for electric vehicles is expected to push the automotive aluminum extrusion market, as the usage of aluminum in electric vehicles extends their range.

The increased use of aluminum in vehicles due to improved fuel efficiency is expected to enhance the global market. Since few decades, the use of aluminum in the automobile industry has increased steadily. After steel, the aluminum is the second most commonly used material in automobiles.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 98.30 Billion |

| Market Size in 2026 | USD 106.39 Billion |

| Market Size by 2035 | USD 214.76 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.13% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Vehicle, Aluminum Grade, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Automotive Aluminum Extrusion Market Segment Insights

Type Insights

The sub-structure segment accounted largest revenue share in 2025. As the demand for lightweight automobiles is growing, leading vehicle manufacturers are turning to aluminum for sub-structure, which is expected to increase the global automotive aluminum extrusion market growth.

What Makes the Front Side Rail Segment a Key Growth Opportunity in the Automotive Aluminum Extrusion Market?

The front side rail segment is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rise in the demand for interior designing for the buildings and houses. The growth in building and construction industry is contributing towards growth of automotive aluminum extrusion market.

Vehicle Insights

The utility vehicle segment dominated the market in 2025. This is attributed to the increase in demand for sport utility vehicles (SUVs) and multi utility vehicles (MUVs).

How Is the Rising Demand for Compact Vehicles Creating New Market Opportunities?

The compact vehicles segment is estimated to be the most opportunistic segment during the forecast period. Compact vehicles have seen a significant increase in demand over the last decade, and they are quickly becoming a major sector for automobile and automotive manufacturers in the market.

Automotive Aluminum Extrusion Market Regional Insights

The Asia Pacific automotive aluminum extrusion market size is estimated at USD 69.79 billion in 2025 and is predicted to be worth around USD 153.55 billion by 2035, at a CAGR of 8.20% from 2026 to 2035.

Asia-Pacific region accounted largest revenue share in 2025. The growth in demand for electric vehicles in Asia-Pacific as a result of fairly strict emission regulations is expected to push the automotive aluminum extrusion market in the region. Furthermore, the rising demand for various commodities such as battery covers and structural components for electric vehicles may boost the Asia-Pacific automotive aluminum extrusion market growth.

The North America region is expected to grow at the highest CAGR over the forecast period 2026 to 2035. The presence of a significant automobile industry in the U.S. is the primary factor for the growth of the market. The growing popularity of electric vehicles across Canada and Mexico is expected to increase the North America region's automotive aluminum extraction market growth.

Automotive Aluminum Extrusion Market Companies

- Hindalco Industries Ltd.

- QALEX

- Arconic Corporation

- Constellium N.V.

- Norsk Hydro ASA

- Bonnell Aluminum

- China Zhongwang Holdings Ltd.

- ETEM Group

- EMERUS

- ST Extruded Products Germany GmbH

Automotive Aluminum Extrusion Market Segment Covered in Report

By Type

- Sub-structures

- Door Beam

- Bumpers

- Pillars

- Sub Frames

- Seat Back Bar

- Front Side Rail

- Space Frames

- Body Panels

- Others

By Vehicle

- Mini-compact

- Supermini

- Compact

- Mid-size

- Executive

- Luxury

- Utility Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Buses & Coaches

By Aluminum Grade

- 5000 Series

- 6000 Series

- 7000 Series

- Others

By Region

- North America

- Europe

- Asia-pacific

- Latin America

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting