What is Aircraft Engine Market Size?

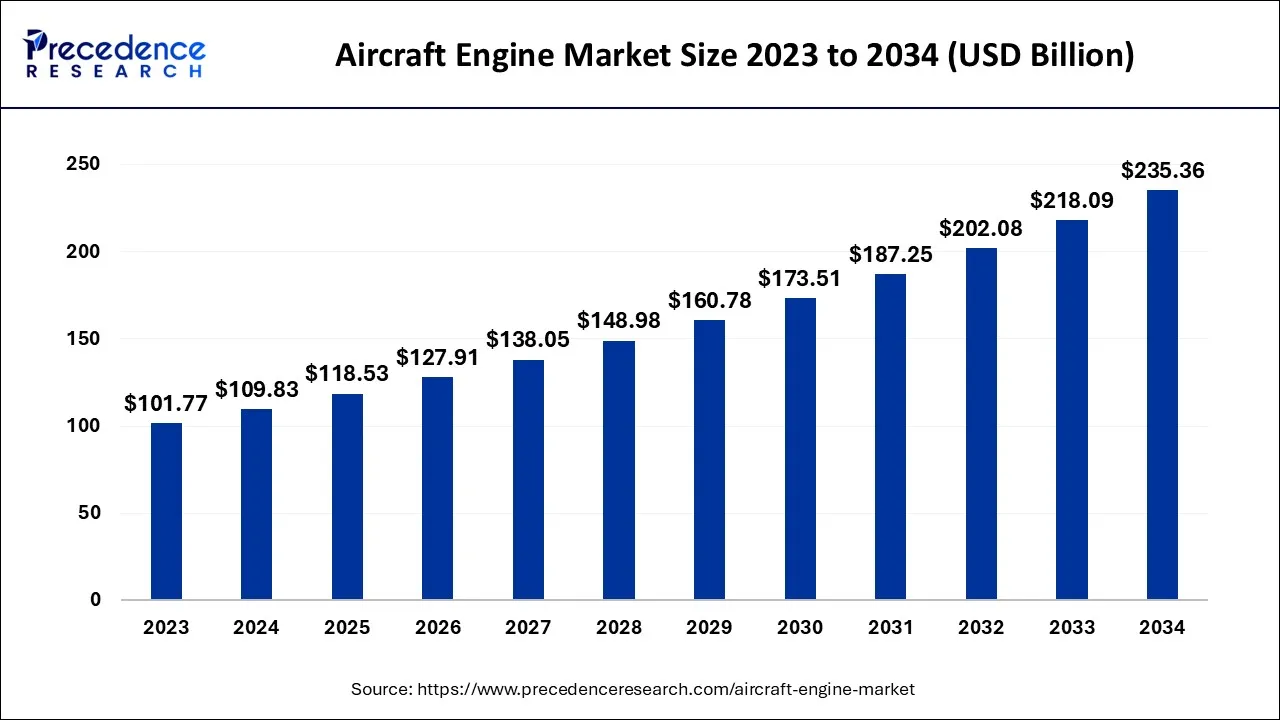

The global aircraft engine market size is expected to be valued at USD 118.53 billion in 2025 and is anticipated to reach around USD 251.79 billion by 2035, expanding at a CAGR of 7.83% over the forecast period from 2026 to 2035.

Market Highlights

- Asia Pacific is expected to expand at the largest CAGR over the forecast period

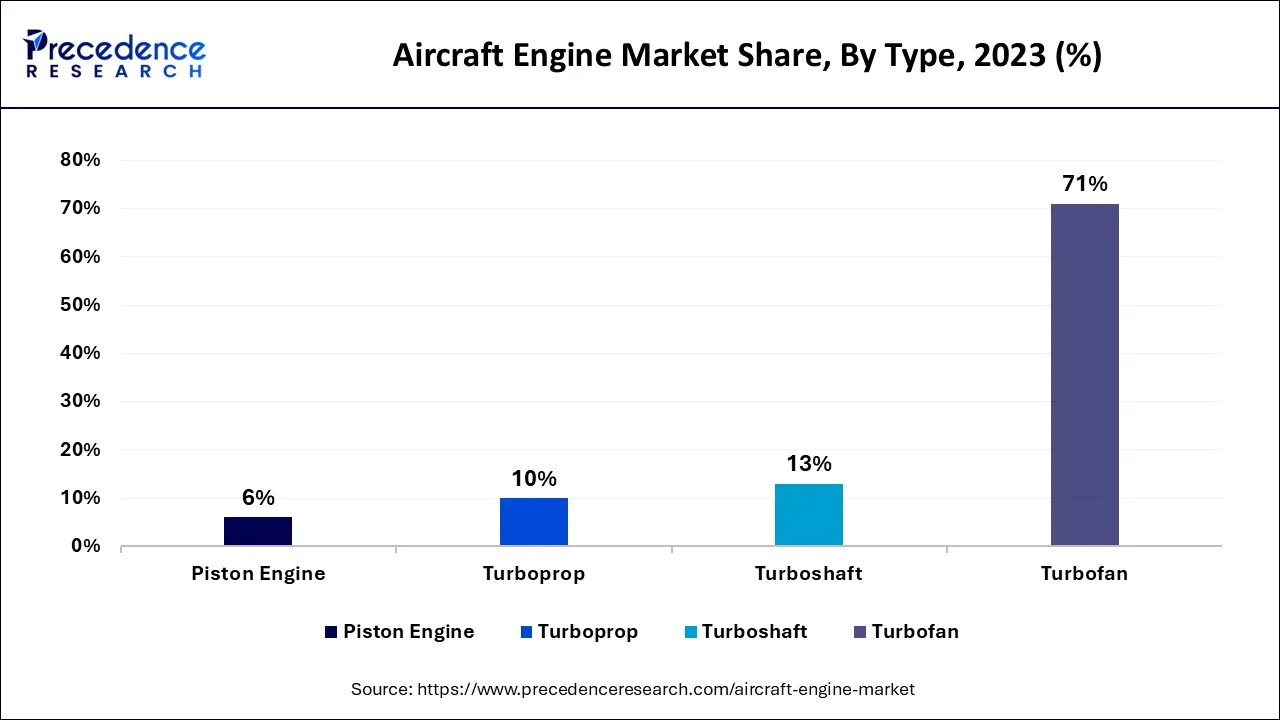

- By Type, the turbofan engine recorded revenue share of 71% in 2025

- By Component, the fixed-wing segment is projected to lead the market between2026 to 2035

- By Technology, the conventional segment is predicted to capture a maximum market between 2026 to 2035

Market Overview

The component of the drive mechanism that produces mechanical power is an aircraft engine. A fan compresses the air inside an aircraft motor as it is drawn in from the front through a channel, mixed with fuel, and ignited. The air is then quickly and powerfully released from the back of the aircraft, which moves it forward. All aircraft are propelled by some form of mechanical engine, except a few hybrid or solar-powered models. A range of aircraft engines is offered for various aircraft end-uses, including passenger, cargo, military, and aviation applications.

The factor beneath the entire framework is provided by aircraft engines, which are items connected to the aircraft's impetus framework. These engines are in charge of the aircraft's display and are directly related to the operating effectiveness of the engine in terms of speed, impetus, push, and flying. The development of the overall Aircraft Engine Market in the upcoming years will be significantly impacted by the enormous interest in the advancement of a proficient aircraft engine. General Electric, Rolls-Royce, and Pratt & Whitney are the industry leaders.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 118.53 Billion |

| Market Size in 2026 | USD 127.91 Billion |

| Market Size by 2035 | USD 251.79 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.83% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Component, Platform, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing air passenger traffic

Over the forecast period, it is anticipated that rising aviation passenger traffic will fuel the expansion of the aircraft engine market. Following a two-month pause until the reopening of domestic airline facilities in a graded fashion, carriers flew more than 70 lakh passengers during the period, increasing total air passenger traffic by 19% in 2020. Numerous airlines are updating their fleets with new aircraft to satisfy the demand for more seats in the air, which increases the need for new engines. According to the International Air Transport Association (IATA), there could be 8.2 billion travelers worldwide in 2037. As a result, the market for aircraft engines is expanding as more people travel by flight.

Restraints

High maintenance cost

The forecasted development of the aircraft engine market is anticipated to be constrained by the high maintenance costs of aircraft engines. Cleaning and drying jet engine parts, inspecting the interiors and exteriors, disassembling the engine, repairing and replacing any damaged parts, and finally reassembly and testing the engine are all steps in the maintenance of aviation engines. Multiple tools are used to support skilled inspectors throughout the process, and other innovative techniques, like robots, can be used for maintenance. Refurbishing a small jet motor can cost between $200,000 and $300,000. Bigger engines will cost $3 million. As a result, the market for aircraft engines is constrained by the high expense of engine maintenance.

Opportunities

Integration of the 3D-printed parts

A major trend gaining traction in the aircraft engine market is the incorporation of 3D-printed components. To save money on fuel and materials, businesses are increasingly using 3D printing technology in aircraft engines and 3D printing-based manufacturing for the aviation industry. The first 777X jet, powered by twin GE9X engines, was completed by the American multinational aerospace behemoth Boeing, according to a January 2020 announcement from GE Aviation. Over 300 3D-printed parts can be found in the GE9X motors. The GE9X engine, which General Electric (GE) claims are 10% more fuel effective than the GE90 engine, was made possible by 3D printing. Thus, the integration of 3D-printed parts in an aircraft engine is expected to offer a lucrative opportunity for the growth of the aircraft engine market.

Segment Insights

Type Insights

Based on the type, the global aircraft engine market is segmented into turboprop, turbofan, turboshaft and piston engines. The turbofan engine is expected to capture the largest market share over the forecast period due to its high fuel efficiency, which allows it to produce more thrust with almost the same quantity of fuel as the core. On the other hand, the turboprop segment is expected to grow at a substantial rate during the forecast period.

The turboprop engine was developed to operate more efficiently than the turbojet engine by adding the propelling function. The original goal of the turbojet motor was to fly at extremely high speeds and altitudes while performing better and more efficiently. Although their early climb and takeoff performance were not particularly good, when propellers were added to these turbojet engines, they were able to provide much better performance at medium speed and height as well. In conclusion, a turboprop engine blends the efficiency features of a turbojet and a propeller engine, in turn, driving the segment growth over the forecast period.

Platform Insights

Based on the platform, the market is bifurcated into fixed-wing, rotary-wing and unmanned aerial vehicles. The fixed-wing segment is expected to dominate the market during the forecast period. A fixed-wing aircraft do not use wings to generate lift, so it has forward propulsion and is heavier than other kinds of aircraft. Fixed-wing aircraft generate lift using forward velocity. A fixed-wing aircraft's wings are not always stationary, and the pilot is not needed to fly the plane constantly. Simple instances of unmanned fixed-wing aircraft include kites and gliders, whereas manned fixed-wing aircraft include seaplanes and aeroplanes.

The fuselage, fixed wings, vertical and horizontal stabilizers, motor, and associated components are among the major components of a fixed-wing aircraft. An aeroplane without a tail or distinguishable fuselage is said to have flying wings. Blended wing bodies produce more lift and less friction when the wings are integrated into the body.

Technology Insights

Based on the technology, the market is segmented into conventional and hybrid. The conventional segment is expected to capture a significant market share over the forecast period. The primary participants in the market for conventional aircraft engines are currently the key players in the market for aircraft engines. However, many new players are bringing in novel developments to provide aircraft engines that give operators more efficiency and are more dependable than the current aircraft engines in response to the growing demand for more functionality from atypical aircraft engines. In the vast majority of airplanes, the engines are either gas turbines or pistons. Turbofan, turboprop, turboshaft, and others are some of the common kinds of aircraft engines. These conventional aircraft engines are used in a broad range of aircraft, including military aircraft, helicopters, wide-body and narrow-body commercial aircraft, and UAVs. As a result, the demand for conventional aircraft engines will increase along with the demand for commercial and defense aircraft in the aviation sector.

Regional Insights

The Asia Pacific is expected to grow at the fastest rate over the forecast period. The growth in the region is attributed to the strong demand for domestic air travel in emerging economies such as India and China. For instance, IATA (International Air Transport Association) estimates that in 2022, air traffic in India will be 85.7% higher than in 2019. While domestic ASK (Available Seat Kilometers) rose 30.1% from the prior year, the nation's RPKs (Revenue Passenger Kilometers) increased by 48.8% from 2021. Similarly, The DGCA, India's aviation regulator, recently disclosed that 123.2 million people in India traveled in 2022. This was a 47% increase over the 2021 traveler's totals. Vistara and IndiGo exceeded 2019 levels.

In contrast, Vistara flew 11.35 million passengers last year, a substantial increase over the 7.44 million it carried in 2019. IndiGo carried nearly 68 million passengers, a million more than it did in 2019. In addition, countries are increasing their investments to strengthen their aerial capabilities by buying cutting-edge aircraft and replacing their outdated aircraft as a result of geopolitical tensions in the area. By 2035, the Indian Air Force hopes to fill the gap between the number of squadrons it currently has and the necessary number by purchasing 450 fighter jets for use on the country's northern and western frontiers. These fleet modernization plans will probably increase demand in the upcoming years for cutting-edge, lightweight, fuel-efficient motors.

North America is expected to grow at a significant rate over the forecast period. The growth in this region is attributable to the presence of major players such as GE Aviation and Honeywell International Inc. Moreover, the growing defense investments are the major factor that penetrates the market expansion in the region. The total amount spent on the US defense in 2021 increased by 2.9% to USD 801 billion. The US spent USD 801 billion, or roughly 38% of all military expenditures globally, on its military in 2021, according to the Stockholm International Peace Research Institute. (SIPRI).

A further increase of 5.6% from the budget projections for 2021 was seen in the updated budget estimates for 2022, which came to a total of USD 782 billion. For the purchase of aircraft for the Air Force, the budget sets aside about USD 15.7 billion. A budget of approximately USD 169.5 billion has also been asked by the Air Force for FY 2023, of which USD 18.5 billion will be used to buy aircraft. Thus, the aforementioned facts support the market growth in the region.

Why Is the European Aircraft Engine Market Experiencing Notable Growth?

The European market has experienced high growth due to the strong demand from both the commercial and military aviation sectors. Europe has significant aircraft manufacturers, including Airbus, Rolls-Royce, and Safran, who constantly invest in technology of engine efficiency, including lightweight materials, fuel-efficient turbofan engines, and hybrid-electric propulsion. The replacement and upgrade of the existing engines are being caused by the increasing air traffic, the growth of the low-cost carriers, and the growth in aircraft deliveries on the continent.

Moreover, there are stringent environmental policies and carbon-cutting measures that are accelerating the development of next-generation low-emission aircraft engines.

Why Is the MEA Aircraft Engine Market Gaining Momentum?

The Middle East & Africa market is on the rise because of the fast growth of commercial air transport, the growing volume of air passenger traffic, and the increasing number of aircraft modernization initiatives. The GCC countries' airlines, including Emirates, Qatar Airways, and Etihad, are also investing in high-thrust fuel-efficient engines to accommodate the long-haul flights and improve their reliability in operations. The strategic positioning of the region as a point of transit around the world leads to an increase in passenger flights and cargo flights, which requires advanced engine technologies.

Moreover, a growing demand for aircraft engines is also caused by such factors as growing defense spending and the modernization of military fleets. With the airline traffic yet to recover after the pandemic, MEA will experience consistent growth in the market.

Why Is the Latin American Aircraft Engine Market Emerging Rapidly?

The Latin American market is growing fast because of the growing commercial aviation, the development of regional connectivity, as well as the modernization of the old aircraft. Growth in new aircraft deliveries in countries like Brazil, Mexico, and Colombia is also increasing, especially in the regional and low-cost airlines, thus creating demand for advanced fuel-efficient engines.

The increased cargo and logistics industry also underpins the engine needs of freight airplanes. Increasing state efforts to enhance air transport infrastructure, economic recovery, and urbanization are driving fleet growth and renewals, meaning that Latin America is slowly emerging as a booming market in the world aircraft engine industry.

Value Chain Analysis-Aircraft Engine Market

- Raw Material Sourcing: The high-performance metals such as titanium, nickel alloys, and composites are procured to supply engine parts that require strength, high heat resistance, and longevity.

Key players: Allegheny Technologies, Carpenter Technology, Special Metals Corporation, Arconic. - Testing and Certification: Engines undergo rigorous testing before their certification by aviation authorities like EASA and FAA, which also test them on performance, safety, emissions, and reliability.

Key players: Rolls-Royce, GE Aviation, Honeywell Aerospace, Pratt & Whitney. - Maintenance, Repair & Overhaul (MRO): MRO services ensure that the engines are durable, dependable, and up to the safety standards by undertaking inspection, repair, and replacement of the parts.

Key players: Lufthansa Technik, StandardAero, ST Engineering Aerospace, GE Aviation Services.

Aircraft Engine Market Companies

- Rolls-Royce Holding PLC

- IHI Corp.

- Mitsubishi Heavy Industries Aero Engines Ltd

- Raytheon Technologies Corporation

- Honeywell International Inc.

- Rostec

- MTU Aero Engines AG

- Safran SA

- Textron Inc.

- Williams International Co. LLC

- General Electric Company

Recent Developments

- In April 2024, Rolls-Royce reported that IndiGo ordered 60 Trent XWB-84 engines, which became their first contract with the Indian airline. The transaction involved TotalCare service of engine health and maintenance by Rolls-Royce to boost the growth of the IndiGo fleet, especially on long-distance flights. (Source:https://www.rolls-royce.com)

- In June 2024, Safran Helicopter Engines and MTU Aero Engines established a 50/50 joint venture, EURA. The project is expected to reduce the industrial and technological gap in aerospace in Europe by implementing joint industrial and technological projects that will encompass different countries. (Source:https://www.safran-group.com)

- In November 2022, with the first flight of a modern aero engine powered by hydrogen, Rolls-Royce and easyJet officially announced they had achieved a new aviation milestone. The ground test was performed using green hydrogen produced by wind and tidal power on a prototype demonstrator. It is a crucial proof point in both Rolls-Royce and easyJet's decarbonization strategies and represents a significant move towards demonstrating that hydrogen could be a zero-carbon aviation fuel in the future.

- In October 2022, 4AIR, LLC has been named as the supplier of environmental offsets for its clients by GE Honda Aero Engines (GE Honda). The new partnership with 4AIR gives HF120 customers access to extensive sustainability programs that reduce their environmental effects from flight emissions.

- In July 2022, to flight test, CFM's cutting-edge open fan engine design, Airbus and CFM International, a 50/50 joint venture between GE and Safran Aircraft Engines, are working together. As a component of CFM's Revolutionary Innovation for Sustainable Engine (RISE) demonstration program, the Flight Test Demonstrator seeks to advance and quicken the development of advanced propulsion technologies on board an Airbus A380. The Airbus Flight Test facility in Toulouse, France will host the flight test campaign during the second part of this decade. At GE Aviation's Flight Test Operations facility in Victorville, California, USA, CFM will conduct engine ground tests and flight test validation before the A380 test missions.

- In June 2022, the United Aircraft Corporation (UAC), a division of the Rostec State Corporation, merged with Sukhoi, a Russian manufacturer of civil and military aircraft, and Russian Aircraft Corporation (MiG), a Russian aerospace and defense business. The merger seeks to increase UAC's financial potential, enhance the effectiveness of the managerial and administrative staff, lower non-production expenses, and lighten debt loads. The Russian company Rostec State Corporation helps the country's makers and developers of industrial products.

Segments Covered in the Report

By Type

- Turboprop

- Turbofan

- Turboshaft

- Piston Engine

By Component

- Compressor

- Turbine

- Gearbox

- Exhaust System

- Fuel System

- Others

By Platform

- Fixed Wing Aircraft

- Rotary Wing Aircraft

- Unmanned Ariel Vehicles

By Technology

- Conventional

- Hybrid

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content