What is the Calcium Carbonate Market Size?

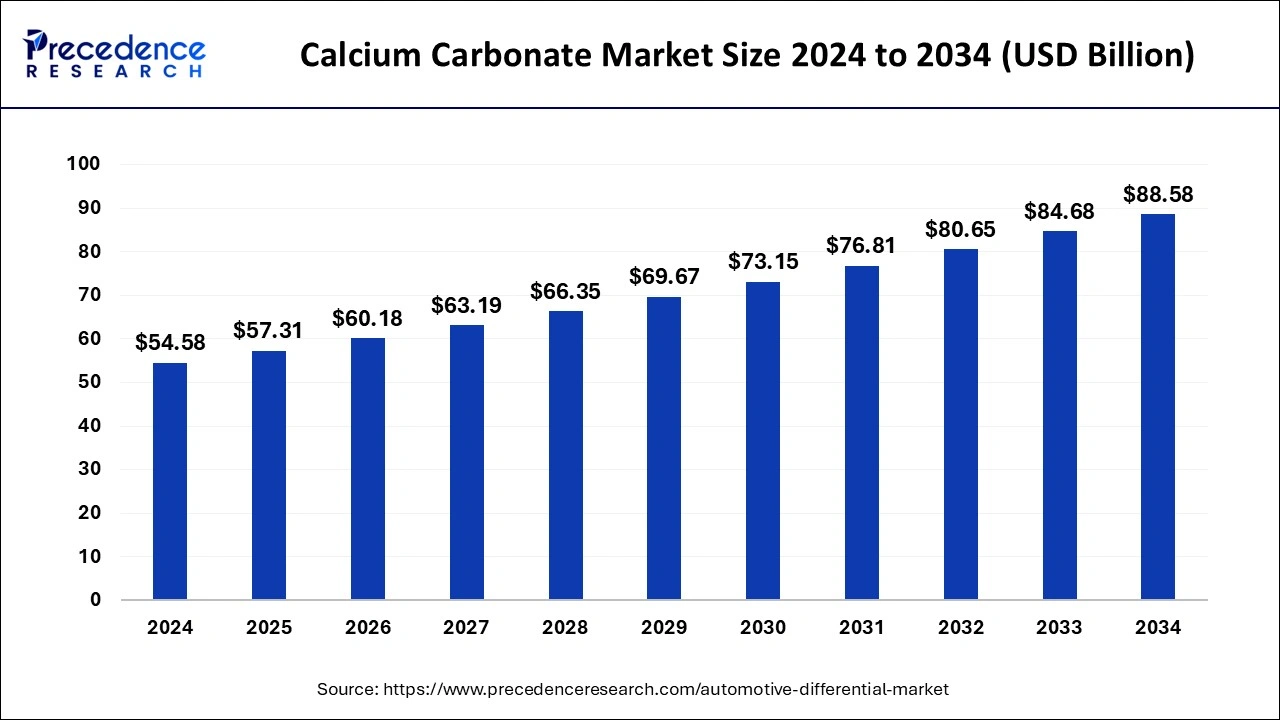

The global calcium carbonate market size is calculated at USD 57.31 billion in 2025 and is predicted to increase from USD 60.18 billion in 2026 to approximately USD 92.57 billion by 2035, expanding at a CAGR of 4.91% from 2026 to 2035.

Calcium Carbonate Market Key Takeaways

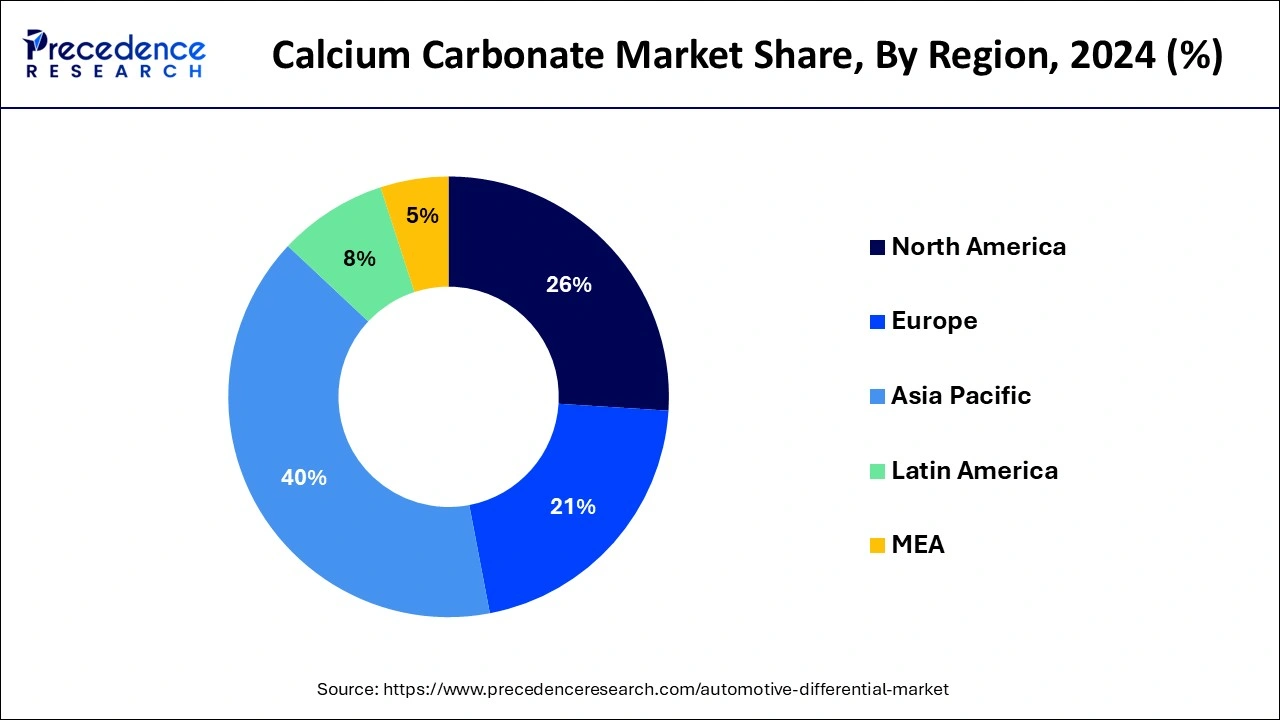

- Asia Pacific led the global market with the highest market share of 40% in 2025.

- By type, the ground calcium carbonate segment has held the largest market share of 71% in 2025.

- By end user, the plastic segment captured the biggest revenue share in 2025.

Market Overview

Calcium carbonate is a substance compound addressed by the synthetic recipe CaCO3. It is assessed that around 4% of the world's outside layer is comprised of calcium carbonate. It is found normally as minerals and rocks, some of which incorporate calcite, limestone, chalk, marble, and aragonite. Calcium carbonate is utilized either in its normally happening state or in the unadulterated structure. Unadulterated calcium carbonate is extricated from normal sources by different strategies like mining and quarrying. As of now, calcium carbonate utilized is generally utilized for different capabilities, including as a mineral filler, brightening specialist, and an alkalizing specialist.

Trends in Calcium Carbonate in 2025

- Expansion of Nano Calcium Carbonate Application

Due to its improved qualities including a larger surface area and greater reactivity nano-calcium carbonate or nano-CaCO3 is being used more and more. Plastics paints coatings and cosmetics all make extensive use of it. While nano-CaCO? improves abrasion resistance UV protection and rheological qualities in paints and coatings it also increases mechanical strength impact resistance and thermal stability in plastics. Because of its affordability and environmental friendliness, it is a popular choice in sectors like automotive construction and packaging where there is a need for high-performance materials.

- Rising Demand in Plastic Industry

Because calcium carbonate is an inexpensive filler that improves the durability and rigidity of products its demand in the plastics industry is growing. Its use in polypropylene and PVC specifically is growing for use in electronics construction and automobiles. Calcium carbonate plays a critical role in lowering overall production costs and enhancing the mechanical qualities of plastics including strength flexibility and heat resistance. It is anticipated that this industry will continue to grow due to the growing demand for sustainable solutions and lightweight materials

Calcium Carbonate Market Growth Factors

Expanding interest in paper from bundling applications and cleanliness-related items like tissue paper is a significant development driver for the market. Nonetheless, the item request saw a decrease in 2020 inferable from the episode of the Covid. The pandemic caused far and wide closures across the globe, which essentially affected the economy overall in the main portion of 2020. No sweat in limitations in the final part of the year, organizations are investing additional amounts of energy to continue their tasks, which is a positive sign for market development.

The U.S. has been a conspicuous objective for the item considering popularity from enterprises including paints and coatings, glues and sealants, and paper producing. Paper is the biggest application section of the market and the U.S. is among the world's biggest paper producers. In spite of the pandemic that significantly affected the nation's economy, the interest for calcium carbonate keeps on enduring, particularly in the paper creation area attributable to a developing accentuation on tidiness.

The market for calcium carbonate has been hampered by store network precariousness, a log jam in natural substance creation, exchange development easing back, and a decrease in development, vehicle, and paint and coatings request because of the COVID-19 pandemic. Calcium carbonate request is tied straightforwardly to various enterprises that are seeing business vulnerability, for example, car, plastics, paper, and building and development.

A drop in paper utilization from corporate workplaces, schools, and colleges, and the paper and printing enterprises has hampered the development of the paper business. Nonetheless, new application classes including cleanliness paper items, food bundling, clinical specialty sheets, and folded bundling have given open doors to the business, which is driving up the interest for calcium carbonate, consequently lessening the pandemic's effect on some degree.

As per the American Forest and Paper Association, the U.S. paper and wood items industry kept elevated degrees of tissue creation in February and March 2020. The U.S. factories created around 700 kilotons of tissue in March. Factors like lockdown and additional cleanliness concerns prompted alarm purchasing and storing of tissues and other cleaning items, in this way helping the market development.

Regardless of the interest for calcium carbonate in the paper portion, the market saw a plunge in2023attributable to confined transportation, a stop in assembling tasks for unnecessary businesses, and the closure of mines across different locales. A few market players detailed negative deals and benefits for the main portion of2023.

For example, LafargeHolcim, a coordinated player on the lookout, revealed a 14% benefit fall in Q1 of 2020 as the pandemic made building locales shut down around the world. The organization mines limestone produces calcium carbonate and uses it to fabricate concrete, which is additionally taken care of the development business. The organization needed to stop its mining exercises in March 2020 in Meghalaya, India because of lockdown; nonetheless, the tasks continued following two or three months as mining exercises were permitted by the state government with the requirement of social separating standards and appropriate cleanliness conditions.

Market Outlook

- Industry Growth Overview: The calcium carbonate market is poised for rapid expansion between 2025 and 2034. This is mainly due to rising demand across industries such as construction, plastics, paints, and paper, driven by its versatility, cost-effectiveness, and functional properties. Manufacturers are focusing on scaling production to meet growing demand across various industries. Most producers are investing in particle-size control and purity improvements. The core of innovation is in the specialty grades for pharmaceuticals, food, and high-performance polymers.

- Major Investors: Major investors in the market include global mineral processing companies, chemical manufacturers, and suppliers of construction materials. To ensure a steady supply of raw materials, these investors are expanding both quarry operations and processing facilities. They are also investing in technological upgrades and energy-efficient production methods.

- Global Expansion: The market is growing worldwide due to its extensive use as a filler and functional additive in construction, plastics, paints, and paper, driven by increasing industrialization and urbanization. Emerging regions present opportunities for growth through expanding infrastructure projects, rising manufacturing activities, and the adoption of high-purity and specialty grades for advanced applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 57.31 Billion |

| Market Size in 2026 | USD 60.18 Billion |

| Market Size by 2035 | USD 92.57Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.91% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Increasing interest from paper and plastic businesses in APAC

- Calcium carbonate is a basic unrefined substance for paper and plastics. The interest for paper is expanding in APAC as advanced change is moderately sluggish. The financial development saw in the non-industrial nations of APAC has prompted an expansion in the utilization of paper bundling. China, India, and South Asian nations are the biggest buyers of paper in the district. Also, the development of the online business industry in India and China has prompted an expansion in the interest for layered bundling arrangements. Paper bundling is likewise utilized in ventures like food, medical services, schooling and writing material, and individual consideration. This multitude of elements are expanding the interest for paper in the locale.

- The plastic business in APAC is likewise developing at a quick rate. The district is seeing a popularity for plastics for different applications in bundling, car, development, electrical and gadgets, and different enterprises. The rising utilization of plastics in these businesses for various purposes, like diminishing costs in bundling and development enterprises, lessening weight in car parts, and as a cover in electronic items, is driving the interest for calcium carbonate in APAC.

Key market challenges

Declining paper industry because of expanding digitization

- The paper business has been seriously impacted by expanding digitalization and electronic distributing. The worldwide paper industry has diminished throughout recent years because of the shift to paperless correspondence and computerized media across most created economies. The interest for newsprint paper has additionally seriously declined as of late because of oversupply issues.

- The rising utilization of computerized media is continuously supplanting paper, in this manner hampering the market for office paper and newsprint paper, which is contracting by around 5% each year. As calcium carbonate is broadly utilized as a filler recorded as a hard copy and printing paper, newsprint endlessly paper bundling applications, the rising digitalization acts a test for the market.

Market Opportunities

- Potential applications - Right now, calcium carbonate is significantly utilized in the paper, plastic, paints and coatings and cements and sealants enterprises. What's more, there are a few possible uses of nano calcium carbonate. Nano calcium carbonate has drawn in interest among analysts, particularly for helpful applications. Calcium carbonate-based materials have biodegradable and biocompatible properties, which are ideal as a savvy transporter to convey qualities, proteins, and medications. Studies are being directed to carry out these nanoparticles in helpful applications, including as an antibacterial specialist, for quality conveyance to target disease cells, and for malignant growth drug conveyance. These potential applications present different open doors for the development of the calcium carbonate market from here on out.

Segment Insights

The ground calcium carbonate ruled the item type fragment, representing over 71% in 2025. Ground calcium carbonate is normally utilized as a modern mineral. It is utilized in paints and coatings, paper and plastic fillers. GCC additionally tracks down application in concrete and can be changed over into calcium oxide and calcium hydroxide. It builds the pH in soils or water and can be utilized to kill ignition fumes. Subsequently, different favorable properties of GCC drive the development of item type segment. Precipitated calcium carbonate (PCC) is expected to enlist the highest CAGR of more than 4.5%. The different state of PCC permits them to go about as a utilitarian added substance in glues, sealants, elastic, plastic, inks, paper, drug, and nutraceutical, helping the development of this portion.

Plastic to be the quickest developing end-use industry of calcium carbonate over the forecast period. This is because of the rising interest for calcium carbonate-supported polypropylene from the auto business and the capacity of calcium carbonate to upgrade the properties of plastics and help in better intensity dissemination. Additionally, the rising utilization of plastics in different end-use ventures like bundling, building and development, and electrical and hardware has expanded the interest for plastics. These elements add to the development of the calcium carbonate market in the plastic business. The plastics application segment is growing at a CAGR of 6.6% between 2025 to 2034. The ongoing pandemic has constrained makers to increase their creation to take special care of the rising shopper needs. For example, in August 2020, Celulosa Argentina declared an expansion in its development of paper bundling by 30%. The organization's emphasis was on the food business as the interest flooded in this area. With the development of the web-based business area and the developing utilization of tissue papers, the paper application fragment is expected to keep up with its lead over the estimate period. The paints and coatings portion hit as the second-biggest application section in 2024. The item is utilized in a few applications in the paints and coatings area. It goes about as a specialist for decreasing or upgrading shine, as an extender, and as an added substance for expanding thickness. In spite of many purposes, the item request was influenced in this application portion in 2023 inferable from an end in the assembling tasks, which upset the whole presentation and store network of the paints and coatings industry. Albeit the creation has continued effortlessly in limitations, the rising instances of COVID-19 and activities at negligible limit are still matters of worry for the market players. Certain organizations have taken on techniques to adapt to this situation. For example, Asian Paints, a main player in Asia, has sent off another scope of items in the wellbeing and cleanliness section. The organization is running a "Protected Painting Campaign" to help its deals. Moreover, the organization has started a "San Assure" administration for disinfecting homes, working environments, and shops. Such drives are expected to build the interest for paints and coatings, accordingly prompting market development.Type Insights

End User Insights

Regional Insights

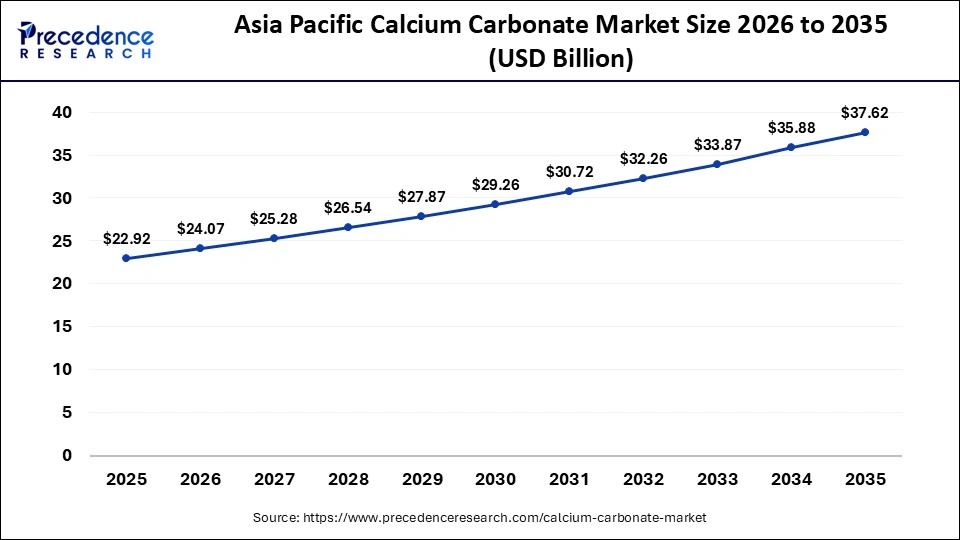

The Asia Pacific calcium carbonate market size is exhibited at USD 22.92 billion in 2025 and is projected to be worth around USD 37.62 billion by 2035, growing at a CAGR of 5.08% from 2026 to 2035.

APAC to overwhelm the calcium carbonate market during the estimate time frame. The development in the APAC locale can be credited to the developing interest for calcium carbonate from different end-use businesses like paper, plastic, glues and sealants, and paints and coatings. In any case, because of the pandemic, the assembling tasks and production network have been monstrously affected. Aside from China, any remaining significant Asian nations have detailed negative GDP development for the second quarter of 2024.

Economies are investing additional amounts of energy for the legitimate working of activities in various areas by keeping up with fundamental conventions expected during the pandemic. As the tasks continue, certain ventures have announced positive news; for example, auto deals in India went up in the beyond two months. What's more, the interest for paints and coatings and vehicles is expected to increment, which, thusly, will increase the interest for calcium carbonate.

India Calcium Carbonate Market Analysis

The market in India is growing due to the rapid expansion of industries such as construction, plastics, and automotive, which use calcium carbonate as a key ingredient in paints, coatings, adhesives, and rubber. India is actively promoting calcium supplementation for children through government-led nutrition programs and large-scale health initiatives. Additionally, the increasing demand for high-quality materials in the manufacturing sector, along with rising infrastructure development and urbanization, is driving its consumption.

North America held the second position in 2024. However, the area has been seriously affected by the pandemic, the end-use businesses of the market have started their activities at negligible limit considering the ascent in purchaser interest. Businesses including clinical, bundling and DIY are helping the interest for items, for example, cements and paper, which is a positive sign for the market.

U.S. Calcium Carbonate Market Analysis

The U.S. held the biggest income share in the North American market in 2023 and is supposed to keep up with its lead over the figure period. Taking into account the item interest in the nation, organizations are participated in supporting their creation limits and growing their presence in the country. For example, in March 2020, Anglo Pacific Group PLC declared going into a supporting concurrence with Incoa Performance Minerals LLC for subsidizing the development of a calcium carbonate-related framework in the Dominican Republic.

Europe is considered a significant region in the calcium carbonate market due to its well-established industrial base, particularly in the paper, plastics, and construction sectors, where calcium carbonate is widely used as a filler and coating material. The region also has a strong demand for high-quality, ultra-fine grades of calcium carbonate, driven by stringent environmental and product performance standards. Additionally, Europe is home to several key producers and consumers of calcium carbonate, and the market is supported by technological advancements in extraction and processing methods.

France Calcium Carbonate Market Analysis

In France, the market is expanding due to increasing demand for high-quality, ultrafine grades, driven by the growing need for sustainable materials in industries like paper, plastics, and paints. Additionally, there is a growing emphasis on environmentally friendly, natural calcium carbonate sourced from local quarries, as well as on innovations in manufacturing processes to reduce carbon emissions and enhance product performance.

Latin America's lead in the calcium carbonate market is driven primarily by its abundant natural reserves of high-quality limestone, which provide a cost-effective raw material for production. Additionally, the growing demand in key industries like paper, paints, plastics, and construction, along with expanding infrastructure projects, has fueled market growth. The rise of sustainable and eco-friendly product trends also supports the adoption of calcium carbonate as a natural filler and coating material, further boosting the region's market position.

Several key factors are driving the growth of the calcium carbonate market in the Middle East & Africa (MEA). First, the region's abundant limestone reserves provide a cost-effective and reliable source of raw material for production. Second, ongoing industrialization and infrastructure development, especially in sectors like construction, plastics, paints, and paper, are increasing demand for high-quality calcium carbonate. Third, strategic investments and initiatives in sustainable manufacturing practices are driving the adoption of eco-friendly, locally sourced products. Additionally, collaborations between industry players and academic institutions, like the Emirates Calcium Carbonate Factory's partnership with the American University of Sharjah, are fostering research and innovation, further accelerating market growth.

Saudi Arabia Calcium Carbonate Market Analysis

The Saudi Water Authority adopted advanced technology to produce calcium carbonate with 97% purity, marking the launch of the world's first high-purity calcium carbonate production project. Saudi Arabia attracted $32 billion in mining investments, which will support the Kingdom's projects in iron, aluminum, phosphate, and copper.

Calcium Carbonate Market Companies

- AGSCO Corp.: AGSCO supplies high-quality ground and precipitated calcium carbonate products for applications in plastics, rubber, paints, and coatings.

- Carmeuse: Carmeuse produces a wide range of calcium carbonate products, including agricultural lime, industrial minerals, and specialty carbonates for various industrial uses.

- Blue Mountain Minerals: Blue Mountain Minerals offers natural calcium carbonate products for construction, paper, plastics, and agricultural applications.

- Carmeuse Lime & Stone Company: Carmeuse Lime & Stone manufactures and distributes calcium carbonate and lime products for industrial, environmental, and agricultural sectors.

- GCCP Resources: GCCP Resources provides calcium carbonate minerals for applications in plastics, paints, adhesives, and other industrial sectors.

Other Major Key Players

- GLC Minerals, LLC

- Greer Limestone Company

- Gulshan Polyols Ltd.

- ILC Resources

- Imerys

- J.M. Huber Corp.

- LafargeHolcim

- Midwest Calcium Carbonates

- Mineral Technologies

- Mississippi Lime

- Mountain Materials, Inc.

- NALC, LLC

- Omya

- Parchem Fine & Specialty Chemicals

- The National Lime & Stone Company

- United States Lime & Minerals, Inc.

Recent Developments

- On 25 February 2024, Omya introduced its Omyaloop product line, comprising 100% recycled calcium carbonate, certified by Bureau Veritas. Designed to enhance sustainability in polymer applications, Omyaloop products are tailored for use in polyethylene (PE) and polypropylene (PP) recycling processes. These solutions aim to reduce carbon footprints and support circular economy initiatives in industries like automotive, PVC flooring, and packaging.

- On 5 April 2024, Minerals Technologies Inc. (MTI) entered into long-term agreements with major paper companies in China and India to build and operate on-site precipitated calcium carbonate (PCC) satellite plants. These facilities, with a combined capacity exceeding 180,000 metric tons per year, aim to enhance paper quality and sustainability. Notably, the Rajahmundry plant in India will deploy MTI's patented New Yield LO PCC technology, repurposing waste streams from pulping processes into valuable PCC products.

- On 2 June 2024, GCCP resources introduced a new line of high-purity calcium carbonate products tailored for the food and pharmaceutical sectors. These products meet stringent quality standards, ensuring safety and efficacy in applications such as dietary supplements, antacids, and food fortification. The launch aligns with the growing demand for calcium-enriched products driven by health-conscious consumers.

Segments Covered in the Report

By Product Type

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

By End Use

- Paper

- Plastic

- Paints & Coatings

- Adhesives & Sealants

- Others (rubber, environment, pharmaceutical, cosmetic, food, oil & gas, and others)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting