What is the Soda Ash Market Size?

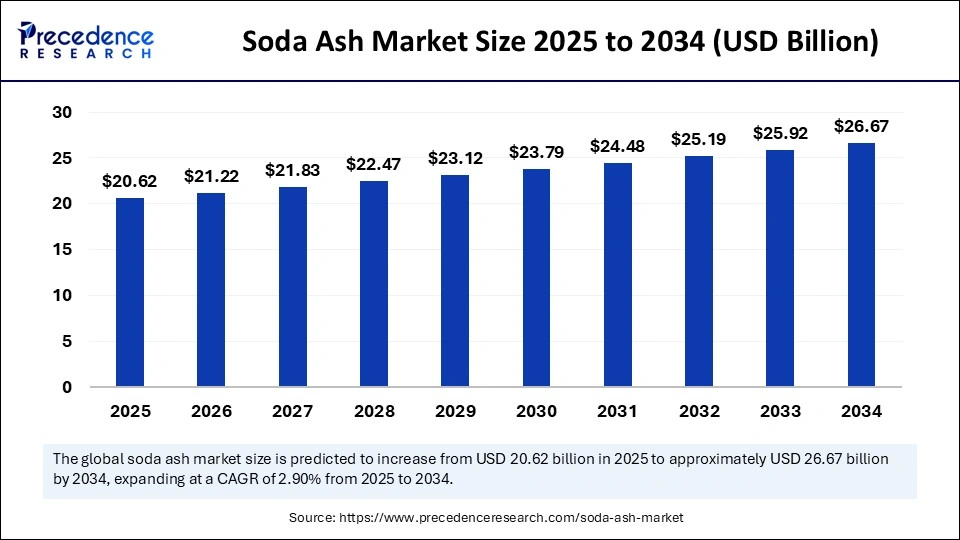

The global soda ash market size is accounted at USD 20.62 billion in 2025 and predicted to increase from USD 21.22 billion in 2026 to approximately USD 27.42 billion by 2035, expanding at a CAGR of 2.90% from 2026 to 2035. The growth of the market is driven by increasing demand for glass products from the automotive and construction sectors.

Soda Ash Market Key Takeaways

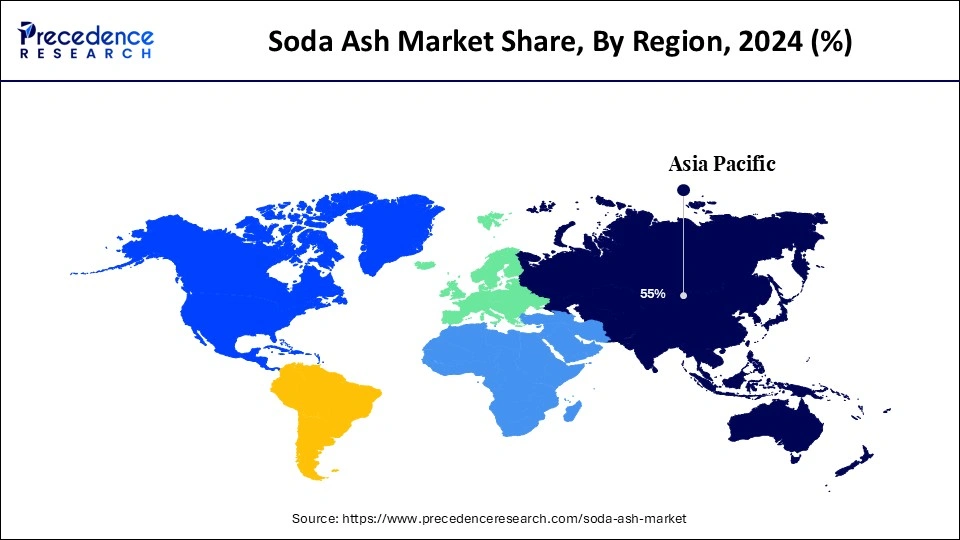

- Asia Pacific dominated the soda ash market with the largest share of 55% in 2025.

- North America is expected to grow at the fastest rate between 2026 and 2035.

- By type, the synthetic segment led the market in 2025.

- By type, the natural segment is expected to grow at a significant rate in the coming years.

- By application, the glass segment held the biggest market share of 48% in 2025.

- By applications, the chemicals segment is projected to grow at a notable rate during the forecast period.

Role of AI in Soda Ash Production

Integrating artificial intelligence AI technologies into soda ash production significantly improves the quality and production volumes. AI-driven tools analyze data in real time from production processes to identify anomalies. AI-based technologies also detect areas of improvement, reducing the risks of downtime and optimizing operations. AI algorithms also improve the quality control process by adjusting parameters, ensuring the production of high-quality soda ash. In addition, AI technologies analyze market trends and predict future demand for soda ash, enabling manufacturers to adjust production and manage inventory levels accordingly.

Market Overview

Soda ash is broadly used in various industries, such as textiles, detergents, and glass. Soda ash is an important chemical reagent for diverse industrial processes, such as manufacturing. It is also used to make sodium percarbonate, sodium silicates, sodium phosphates, and sodium bicarbonate. Soda ash is utilized to control the alkalinity of the water and adjust the pH in water treatment. It increases acidic water pH and also reduces corrosiveness. It helps eliminate impurities and heavy metals, enhancing the quality and safety of drinking water. It also plays a significant role in the production of aluminum, increasing purity for better results.

Soda Ash Market Growth Factors

- The rising demand for soda ash from the pharmaceutical industry is boosting the growth of the market. It is used as a buffering and pH-adjusting agent in various pharmaceutical formulations, enhancing the stability and effectiveness of drugs.

- With the increasing electric vehicle production, the demand for batteries is rising. This significantly boosts the need for soda ash, as it plays a key role in the production of lithium-ion batteries to create lithium carbonate, a key component for cathodes. Soda ash plays a significant role in refining lithium compounds, ensuring the high purity of electric vehicle EV batteries.

- The growing need for soda ash in water treatment further boosts the growth of the market. Soda ash is used to stabilize acidic water so that it can be consumed without harm.

- The rising demand for glass products is expected to boost the growth of the market in the coming years. The demand for soda ash is increasing annually by 5%, driven by the domestic solar glass sector. Soda ash is used in the production of solar glass because of its valued characteristics, along with a high melting point and noteworthy alkalinity.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 27.42 Billion |

| Market Size in 2025 | USD 20.62 Billion |

| Market Size in 2026 | USD 21.22 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 2.90% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and the Middle East & Africa |

Market Dynamics

Drivers

Growing Use of Soda Ash in Environmental Protection Efforts

The growing use of soda ash in environmental protection efforts is a key factor driving the growth of the soda ash market. Soda ash is increasingly utilized to reduce air pollution by removing sulfur dioxide and other harmful chemicals from industrial flue gases, including those emitted by shipping and other industries. Furthermore, its application in water treatment plays a significant role in precipitating hazardous contaminants, such as arsenic and radium, thereby improving water quality and safeguarding public health. These environment-friendly applications not only reduce the environmental footprint of different industries but also open novel opportunity streams, positioning soda ash as a significant component in industrial practices.

Restraint

Fluctuations in Energy Prices

Fluctuations in energy prices significantly affect the production of soda ash. Production of soda ash is an energy-intensive process. There are two primary production processes: the natural Trona-based and Solvay processes. Both methods require huge amounts of energy. As energy prices rise, energy consumption has become a serious challenge for soda ash manufacturers, reducing profitability and creating challenges in the soda ash market.

Opportunity

Integration of Carbon Capture and Utilization (CCU)

The integration of carbon capture and utilization (CCU) technologies in soda ash manufacturing creates significant opportunities in the market. With increasing environmental regulations and regulatory pressures to reduce CO2 emissions, CCU offers a promising solution by capturing carbon emissions from production processes and converting them into valuable byproducts. Applications such as mineral carbonation enable the use of captured CO2 to produce sustainable building materials, while other processes convert CO2 into chemicals like methanol, creating new revenue streams. This shift toward emission-to-product innovation helps manufacturers reduce their carbon footprint, opening up new avenues for the growth of the soda ash market.

Type Insights

The synthetic segment led the soda ash market with the largest share in 2025. This is mainly due to the increased adoption of synthetic soda ash in glass production. Synthetic soda ash can be produced using two methods: the Solvay or Hou processes. These processes offer control over quality, resulting in more consistent products. Synthetic soda ash has a higher purity, making it suitable for demanding applications.

The natural segment is expected to grow at a significant rate in the coming years. Natural soda ash production is cost-effective as it requires less water and energy than synthetic soda ash. Natural soda ash production is considered environmentally friendly, as it emits small greenhouse gases. It is widely used in the production of detergent and cleaning products.

Application Insights

The glass segment dominated the soda ash market with the largest share in 2025, as soda ash is a significant compound in glass manufacturing. It is used as a fluxing agent to lower the melting point of silica. The rapid expansion of the glass industry and the increased use of glass products in the automotive and construction sectors bolstered the growth of the segment. The alkalinity of soda ash helps achieve the desired shape of glass products, making it indispensable in glass production.

The chemicals segment is projected to grow at a notable rate during the forecast period. Soda ash is used to produce chemicals containing sodium phosphates, sodium silicate, and sodium bicarbonate. It is also used in making pigments, dyes, and pharmaceuticals, and in manufacturing paper, soaps, and detergents. Soda ash is used as a softener for hard water, containing calcium and magnesium ions that are precipitated.

Regional Insights

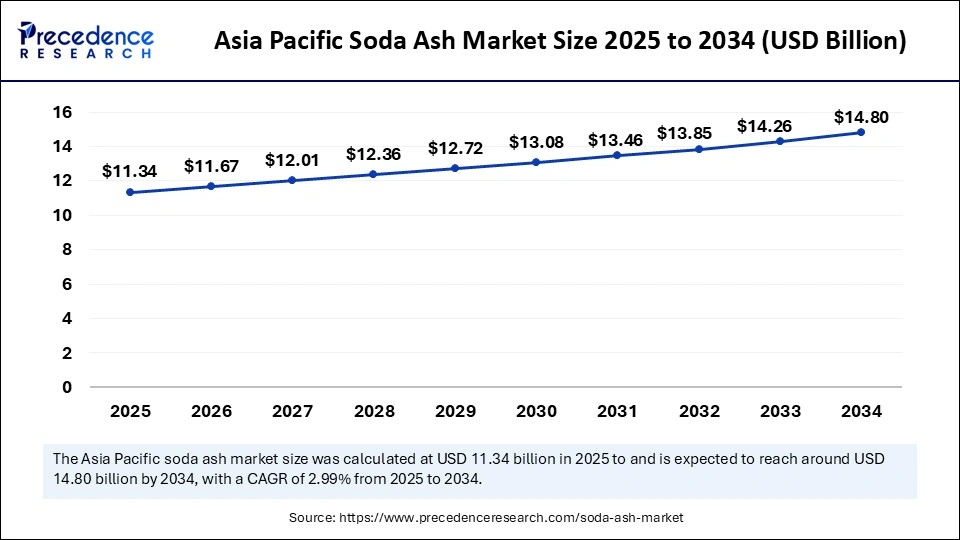

Asia Pacific Soda Ash Market Size and Growth 2026 to 2035

The Asia Pacific soda ash market size is evaluated at USD 11.34 billion in 2025 and is projected to be worth around USD 15.25 billion by 2035, growing at a CAGR of 3.01% from 2026 to 2035.

Asia Pacific registered dominance in the soda ash market by capturing a considerable share in 2025. The growth of the market in the region is driven by rapid industrialization, driving the demand for soda ash in industries like chemicals, glass, and detergent. Advancements in chemical manufacturing processes and the increased adoption of sustainable manufacturing practices further boosted the demand for soda ash. Governments in the region are investing in infrastructure projects, boosting the demand for high-quality glass products, in which soda ash is important.

China is a major contributor to the market. In China, the construction sector is witnessing rapid growth due to the growing urbanization and ongoing infrastructure development. As infrastructure development increases, so does the demand for glass. Moreover, China is endowed with vast natural resources, including limestone and soda ash, which are vital ingredients in glass production. China has made significant investments in enhancing manufacturing capabilities, enabling its glass industry to produce a variety of glass products in different sizes, shapes, and thicknesses, further propelling the market's growth.

India also plays an important role in the Asia Pacific soda ash market. With a strong emphasis on sustainable practices, the demand for natural soda ash is increasing in various industrial processes. The rapid expansion of the automotive sector, with the rising vehicle production, is boosting the demand for glass. The chemicals industry is rapidly growing in India, which further supports market growth as soda ash is essential in chemical production.

North America is expected to witness the fastest growth in the coming years. The growth of the market in the region is attributed to the abundant availability of natural resources. The growth of the glass manufacturing industry further supports market growth. There is a high demand for flat glass in the construction industry. The rising construction of high-rise buildings is boosting the demand for glass, contributing to regional market growth.

The U.S. is projected to have a stronghold on the North American soda ash market. The U.S., particularly Wyoming, is home to the world's largest trona deposit, which is a significant source of soda ash. This mineral accounts for about 90% of the soda ash produced in the U.S. In addition, the U.S. is the world's largest exporter of soda ash. The rising water treatment activities in the country further bolster the growth of the market.

What are the Advancements in the Soda Ash Market in Europe?

Europe is witnessing a significant amount of growth in the soda ash market. This growth is driven by the region's stringent environmental regulations and a shift towards sustainable production methods. The EU Green Deal and various other national policies help to promote the use of eco-friendly materials, thus enhancing demand for soda ash in various applications, including glass and detergents. Countries like Germany and the UK are leading players.

Germany Soda Ash Market Trends: The region's landscape is driven by innovation and collaboration among companies to develop sustainable solutions. Investments in research and development are gaining traction as companies strive to meet the growing demand. There is also a high focus on reducing carbon emissions and enhancing energy efficiency.

What are the Key Trends in the Soda Ash Market in Latin America?

Latin America is set to witness substantial growth in the upcoming years. This growth is due to its wide-ranging applications, such as chemical, soaps and detergents, water treatment, and various other end-user industries. The increasing usage of soda ash in the manufacturing process of various glass and glass products is expected to boost market growth. Moreover, a flourishing construction industry in the region will drive the market growth even more.

Mexico Soda Ash Market Trends: Mexico dominated the Latin American soda ash market due to the rising construction activities in this country. Since soda ash acts as the most common material of choice in the construction industry to increase the efficiency of products, there is a potential growth in the market.

How is the Middle East and Africa Region Growing in the Soda Ash Market?

The Middle East and Africa are expected to witness steady growth in the market. This growth is driven by the region's rich natural resources and increasing investments that are being made in industrialization. Countries like South Africa and Saudi Arabia are players, with government initiatives aimed at boosting local production. The region is also witnessing a high focus on enhancing production capabilities and adopting sustainable practices, which is propelling the region's growth.

Saudi Arabia Soda Ash Market Trends: As the demand for soda ash continues to rise, Saudi Arabia is poised to become a key player in the global market, leveraging its resource advantages and strategic initiatives. There is increasing interest in high-purity and specialty soda ash grades to meet the quality requirements of advanced industrial applications.

Soda Ash Market-Value Chain Analysis

- Raw Material Sourcing

The process begins with brine preparation, where saltwater is purified and dechlorinated. Limestone, a key ingredient, is crushed to a specific granularity. Ammonia is then injected into the brine under controlled conditions to make ammoniated brine.

Key Players: GHCL, Genesis, Solvay - Manufacturing Process

This stage deals with carbonation, precipitation, filtration, and drying stages. After that, it undergoes calcination and is chilled, then graded based on the size of the particle.

Key Players: Nirma, Tata, Ciner Group - Quality Checks

This stage deals with everything from flow control to waste control and pollution management. Even a minor misalignment in the distribution of particle size or thermal control can impact the quality of products.

Key Players: DCW, NSG Group, Brenntag

Soda Ash Market Companies

- Tata Chemicals Ltd.

- Ciner Group

- NIRMA

- Solvay

- DCW Ltd.

- Shandong Haihua Group Co., Ltd.

- Genesis Energy, L.P.

- Kushal Chemicals

- Angel Chemicals Private Limited

- Radhe Enterprise

- Tuticorin Alkali Chemicals and Fertilizers Limited (TFL)

Recent Developments

- In March 2025, WE Soda Ltd announced that it had acquired Genesis Alkali, the largest US-based producer of natural soda ash, from Genesis Energy LP in an all-cash transaction that was completed at an implied enterprise value of USD 1.425 billion, inclusive of working capital at closing. The acquisition established WE Soda as the world's largest producer of soda ash, increasing total production capacity to approximately 9.5 million metric tonnes per year.

- In January 2025, Sisecam takes a significant step toward global leadership in the soda ash industry by acquiring all shares of its partner, Ciner Group, in the U.S. soda investments and operations. Moreover, the company has taken another significant step by acquiring all shares of Ciner Group, in Sisecam Chemicals Resources LLC and Pacific Soda LLC in the U.S. With this agreement, Sisecam's ownership in Pacific Soda LLC has increased to 100%.

- In December 2023, Solvay and ENOWA partnered to establish the world's first carbon-neutral soda ash plant in NEOM, Saudi Arabia, before 2030. This partnership creates the way for a novel global benchmark, intensifying competitiveness, circularity, and carbon neutrality.

Segments Covered in the Report

By Type

- Natural

- Synthetic

By Application

- Glass

- Chemicals

- Soap & Detergents

- Alumina & Mining

- Others

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting