What is the Lignin-Based Resins Market Size?

The global lignin-based resins market size accounted for USD 512.05 million in 2024 and is predicted to increase from USD 539.34 million in 2025 to approximately USD 860.66 million by 2034, expanding at a CAGR of 5.33% from 2025 to 2034. The market is growing due to rising demand for eco-friendly and bio-based resins.

Lignin-Based Resins MarketKey Takeaways

- In terms of revenue, the global lignin-based resins market was valued at USD 512.05 million in 2024.

- It is projected to reach USD 860.66 million by 2034.

- The market is expected to grow at a CAGR of 5.33% from 2025 to 2034.

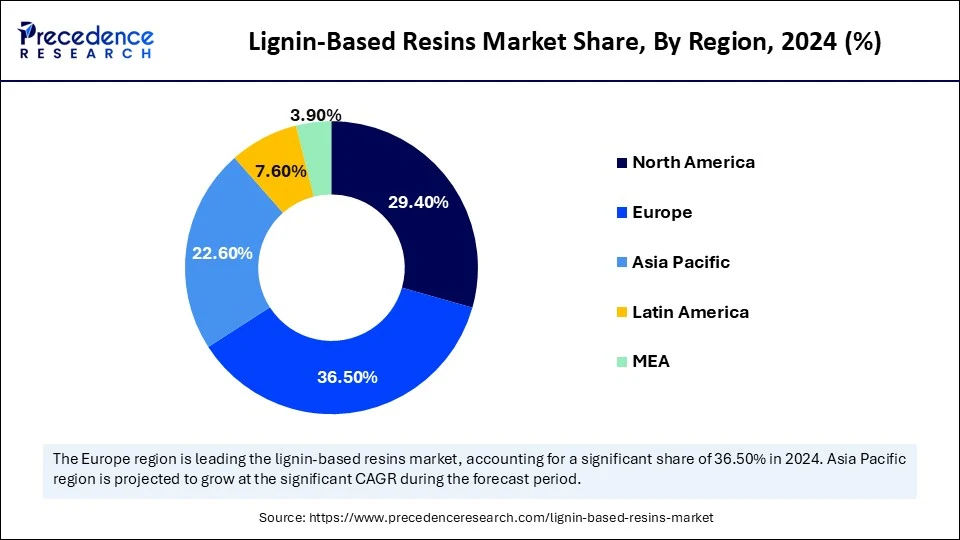

- Europe dominated the lignin-based resins market with the largest share of 36.50% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- By product type, the lignin–phenol–formaldehyde (LPF) resins segment dominated the market with 36.80% share in 2024.

- By product type, the polyurethane resins using lignin polyols segment is expected to grow at the highest CAGR of 9.80% over the forecast period.

- By source of lignin, the kraft lignin segment held a 39.50% market share in 2024.

- By source of lignin, the organosolv lignin segment is expected to grow at the highest CAGR of 9.50% over the forecast period.

- By application, the adhesives & binders segment dominated the market by holding 34.10% share in 2024.

- By application, the composites segment is expected to grow at the highest CAGR of 9.60% during the projected period.

- By end-use industry, the construction segment held a 28.70% market share in 2024.

- By end-use industry, the automotive segment is expected to grow at the highest CAGR of 9.90% during the forecast period.

How is AI revolutionizing the production of lignin-based resins?

The production of lignin-based resins is undergoing a revolution thanks to artificial intelligence (AI), which enhances the manufacturing process by making it more intelligent, efficient, and environmentally friendly. Algorithms driven by AI can evaluate enormous datasets to predict optimal resin formulations, optimize lignin extraction techniques, and reduce trial and error in R&D. The performance and consistency of resin are improved by using machine learning models to adjust processing parameters, such as pH, pressure, and temperature.AI-driven automation also ensures high product quality, reduces energy consumption, and increases operational efficiency while having the least possible negative environmental impact. Consequently, businesses are producing lignin-based resin with greater scalability, quicker innovation cycles, and lower costs.

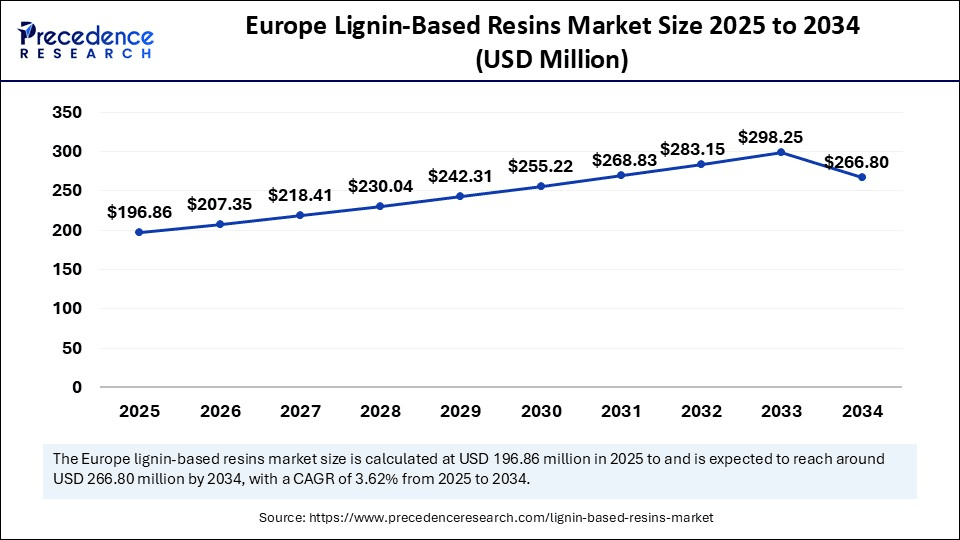

Europe Lignin-Based Resins Market Size and Growth 2025 to 2034

Europe lignin-based resins market size was exhibited at USD 186.90 million in 2024 and is projected to be worth around USD 266.80 million by 2034, growing at a CAGR of 3.62% from 2025 to 2034.

What made Europe the dominant region in the lignin-based resins market?

Europe dominated the lignin-based resins market by holding the largest share in 2024. This is mainly due to stringent environmental regulations, leading to a rapid shift of industries toward sustainable and bio-based materials. A mature paper and pulp industry ensures a steady supply of lignin in the region. There is a push toward carbon neutrality, which is boosting the adoption of bio-based materials, including lignin-derived resins, across the construction, automotive, and packaging industries. Public-private partnerships, funding initiatives under the green deal, and growing consumer preference for sustainable materials are likely to facilitate the long-term growth of the market. Additionally, rising environmental concerns and increasing production of bio-based products are expected to drive regional market growth.

Asia Pacific is expected to grow at the fastest rate in the coming years, driven by the need for affordable, environmentally friendly materials. Rapid industrialization and growing construction activities are likely to support regional market growth. There is a high demand for adhesives, coatings, and composites across various industries, driving market growth. Rising investments in bio-refinery technologies and government incentives for sustainable manufacturing further boost the market's growth. A plentiful supply of biomass and rising awareness of the benefits of green alternatives in high-volume industries, such as furniture and automobiles, are also advantages for the region. The demand for lignin-based substitutes is expected to increase rapidly in the coming years as industries seek to reduce their dependence on petroleum-based resins.

Market Overview

The lignin-based resins market refers to the production and use of resins derived from lignin, a natural, abundant polymer found in plant cell walls, primarily used as a sustainable and bio-based alternative to petroleum-derived phenolic, epoxy, and polyurethane resins. These resins are employed in adhesives, coatings, insulation, composites, and packaging due to their excellent binding properties, thermal stability, and environmental benefits. The market is driven by increased focus on green chemistry, circular bioeconomy, and stringent regulations on formaldehyde and VOC emissions.

What's driving the shift toward lignin-based resins?

This trend toward lignin-based resins is driven by the growing demand for environmentally friendly, sustainable alternatives to petroleum-based products. As a result of global efforts to reduce carbon emissions, stricter environmental regulations, and growing consumer awareness, industries are using lignin, a nontoxic renewable byproduct of the paper and pulp industries, as a green raw material. Lignin also shows promise as an adhesive and binding material, making it a suitable substitute in industries such as electronics, packaging, automotive, and construction. Its market adoption is accelerating due to technological advancements in processing and AI-based optimization, which will further enhance its performance and cost efficiency.

Lignin-Based Resins MarketGrowth Factors

- Demand for Eco-Friendly Materials: The growing shift toward sustainable and bio-based materials is boosting the adoption of lignin-based resins.

- Abundant Raw Material: Lignin is readily available as a byproduct of the paper industry, enhancing accessibility.

- Government Support:Incentives provided by the government, along with green policies, further promote bio resin development and support market growth.

- Tech Advancements: Innovations in extraction and modification techniques are boosting the production output of lignin-based resins.

- Expanding Applications: Lignin finds applications in various industries such as adhesives, coatings, and pharmaceuticals.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 860.66 Million |

| Market Size in 2025 | USD 539.34 Million |

| Market Size in 2024 | USD 512.05 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.33% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin Type, Lignin Source, Application, End-Use Industry, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Sustainability Trends

The use of renewable and biodegradable materials in manufacturing is rapidly increasing as environmental concerns gain international attention. Resins derived from lignin offer a bio-based alternative to conventional resins derived from petrochemicals, aligning with the objectives of the circular economy. Governments, businesses, and consumers are demanding greener supply chains. The biodegradability of lignin lessens the products' final environmental impact. Particularly appealing to the packaging, automotive, and construction industries is sustainable appeal. One major element propelling the market expansion of lignin-based resins is their environmentally friendly positioning.

Technology Advancements

The performance and quality of lignin-based resins are continually improving due to ongoing advancements in lignin extraction, purification, and resin formulation, thereby driving the growth of the lignin-based resins market. Utilizing AI and machine learning technologies in production processes helps maintain consistency and reduce product development cycles. Biotechnology advances are making it possible to functionalize lignin molecules in a customized way, improving their compatibility with various polymers. The range of high-performance applications for lignin resins is expanding due to these developments. Further reducing waste and operating costs can be achieved through automation and smart manufacturing. These developments are enhancing the commercial visibility of lignin-based resins across various industries.

Restraints

Technical Complexity in Processing

It is challenging to process lignin into reliable, high-quality resins due to its complex and variable chemical structure. Lignin needs extensive pretreatment and modification to increase its reactivity, in contrast to petroleum-based resins. The performance of the finished product is impacted when lignin from various sources (kraft, organosol, and soda) is inconsistent. Many manufacturers lack the specialized tools and knowledge that are required. This intricacy restricts its use in high-performance applications and slows down extensive commercialization.

Limited Industrial Grade Supply

Even with its abundance, there is still a shortage of high-purity refined lignin that can be used to make resin. Instead of being refined for use, a large portion of the lignin produced in the pulp and paper industry is burned for energy. In many places, the infrastructure needed for large-scale lignin valorization is still being developed. This makes it difficult for resin manufacturers to find raw materials of reliable quality. This gap in the supply chain limits growth and undermines consumer trust.

Opportunities

Expansion into High-Performance Applications

The rising use of lignin-based resins in high-performance applications, such as automotive composites, 3D printing, and aerospace-grade adhesives, creates immense opportunities in the lignin-based resins market. Ongoing advancements in lignin modification and extraction technologies are expanding the scope of applications. In harsh conditions, customized lignin-based resins can replace epoxy or phenol formaldehyde resins. Lignin resins can meet both performance and environmental goals as businesses seek strong, lightweight, and environmentally friendly substitutes. Future R&D could open these high-margin science companies.

Expansion into the Packaging Industry

The global packaging industry is undergoing a significant transformation due to the sustainability trend, creating opportunities for lignin-based adhesives and coatings. As businesses seek to reduce plastic waste and VOC emissions, the adoption of lignin resins increases as they provide biodegradable and non-toxic alternatives. Applications include corrugated board adhesives, eco-label coatings, and compostable laminates. Collaborations with FMCG and food brands can drive adoption. Green packaging is a high-volume, fast-growing segment where lignin resins can thrive.

Resin Type Insights

Why did the phenolic resins segment dominate the lignin-based resins market in 2024?

The phenolic resins segment dominated the market with a major revenue share in 2024. This is mainly due to their superior thermal stability, flame retardancy, and excellent bonding strength, which make them ideal for automotive, aerospace, and construction applications. Lignin is increasingly used as a sustainable alternative to phenol in these resins, reducing environmental impact while maintaining high performance. Established infrastructure, mature manufacturing processes, and regulatory support for bio-based materials further support segmental dominance. Major players are integrating lignin into phenolic resins to meet evolving eco-compliance norms.

The polyurethane resins segment is expected to grow at the fastest CAGR in the upcoming period, driven by their adaptability and demand in products adhesives, coatings, insulation, and cushioning. The use of lignin to replace petroleum-derived components is gaining popularity as industries prioritize bio-based polyols to reduce carbon emissions. Manufacturers and researchers are developing polyurethanes derived from lignin that are as strong and flexible as those derived from petroleum. The rising demand from the construction and automotive industries supports segmental growth.

Lignin Source Insights

How does the Kraft lignin segment dominate the lignin-based resins market?

The Kraft lignin segment held a 39.50% market share in 2024, due to its large-scale production, affordability, and consistent quality resulting from the well-established Kraft pulping process. It serves as an industrially viable feedstock for manufacturing resins, particularly phenolic types. Its high aromatic content allows for effective substitution in thermosetting formulations. Additionally, Kraft lignin benefits from a global supply chain and industrial familiarity, making it the most commercially adopted lignin resin.

The organosolv lignin segment is expected to grow at the highest CAGR of 9.50% over the forecast period. Because of its homogeneous molecular structure, low sulfur content, and high purity, which make it perfect for specialty and high-performance resin applications. Because organic solvents are used for extraction, the product is cleaner and simpler to chemically alter. Its expansion stems from the need for sophisticated composites, adhesives, and coatings where functionality and quality are essential. Organosolv lignin-based resins are attracting significant investment from startups and innovators in green materials.

Application Insights

What made adhesives & binders the dominant segment in the lignin-based resins market in 2024?

The adhesives & binders segment held the largest share of the market in 2024. This is mainly due to the increased demand for bio-based adhesives in various industries. Lignin-based resins offer a sustainable and non-toxic alternative to formaldehyde-laden conventional adhesives. These are widely used in furniture, packaging, and consumer goods industries due to their comparable strength and reduced environmental footprint. Increased consumer demand for eco-certified furniture and green construction materials further bolstered the segment. Governments are also encouraging the use of lignin-based binders through environmental subsidies and certifications.

The composites segment is expected to expand at the highest CAGR in the coming years due to the growing use in industries like construction, packaging, automotive, and aerospace. Lightweight, biodegradable, and reasonably priced lignin-based composites are a promising alternative to artificial fillers. Insulation boards, wall systems, door panels, and dashboards are a few examples of applications. To improve lifecycle sustainability and reduce reliance on petroleum, companies are promoting the incorporation of lignin into fiber-reinforced plastics. The commercialization of composite technologies based on lignin is being accelerated by regulatory pressure for environmentally friendly materials.

End-Use Industry Insights

Why did the furniture & wood segment dominate the lignin-based resins market in 2024?

The construction segment held a 28.70% market share in 2024. The dominance of the segment can be linked to the growing infrastructure investment, along with the stringent environmental regulations. Furthermore, lignin-based resins are utilized in concrete admixtures, as binders for particleboard, and as a component in phenolic resins for construction purposes.

The automotive segment is expected to grow at the highest CAGR of 9.90% during the forecast period. Driven by the industry's shift toward recyclable and lightweight parts. Automakers are using lignin-based materials to create environmentally friendly interior panels for insulation and dashboards. Automotive businesses are investing in bio-based substitutes that reduce carbon emissions and promote circularity, as sustainability emerges as a key differentiator in the marketplace. Collaborations between automakers and biopolymer companies are advancing the commercial use of lignin-derived resins in electric and hybrid vehicles.

Technology Insights

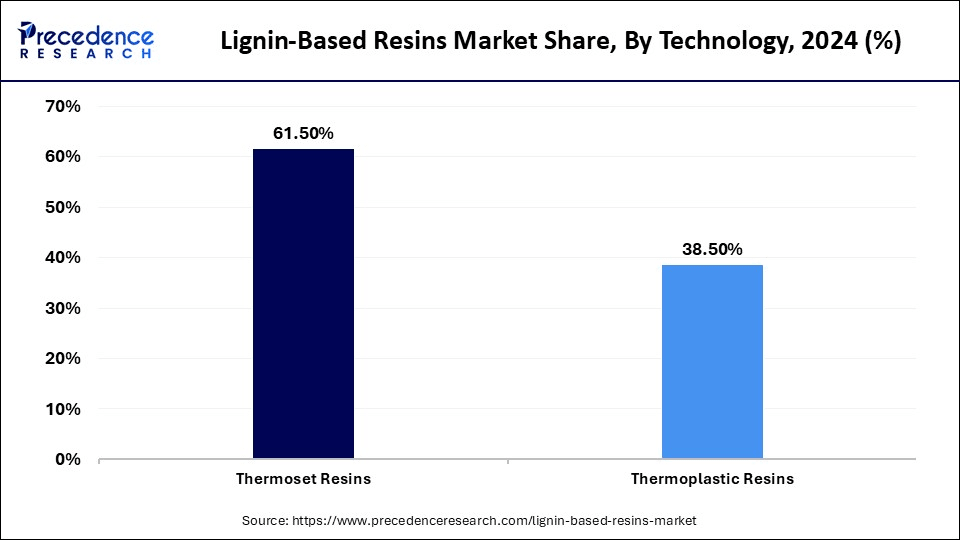

How does the thermoset resins segment dominate the lignin-based resins market?

The thermoset resins segment dominated the market with a major revenue share in 2024, as they offer structural integrity, high resistance to temperature and chemicals, and long-lasting durability. Their strong cross-linked polymer structure is ideal for the construction, electronics, and aerospace sectors. Lignin enhances the thermal stability and reduces the environmental impact of thermosets, making them more sustainable. Manufacturers prefer lignin-modified thermosets due to their superior performance, consistency, and compatibility with industrial processes. The growing green certification trend in high-performance industries is further bolstering their use.

The thermoplastic resins segment is expected to expand at the fastest rate over the projection period, driven by their versatility in terms of shape and design, low processing costs, and ability to be recycled. Thermoplastics blended with lignin are currently being used in consumer electronics packaging and medical applications. For dynamic design requirements, these resins are ideal because they can be reheated and remolded multiple times. Lignin's compatibility with PLA, PE, and PP matrices is being optimized through ongoing research, paving the way for wider industrial applications.

Product Type Insights

The lignin–phenol–formaldehyde (LPF) resins segment dominated the market with a 36.80% share in 2024. This is mainly due to their superior thermal stability, flame retardancy, and excellent bonding strength, which make them ideal for automotive, aerospace, and construction applications. Lignin is increasingly used as a sustainable alternative to phenol in these resins, reducing environmental impact while maintaining high performance. Established infrastructure, mature manufacturing processes, and regulatory support for bio-based materials further support segmental dominance. Major players are integrating lignin into phenolic resins to meet evolving eco-compliance norms.

The polyurethane resins using lignin polyols segment is expected to grow at the highest CAGR of 9.80% over the forecast period. Driven by their adaptability and demand for products such as adhesives, coatings, insulation, and cushioning. The use of lignin to replace petroleum-derived components is gaining popularity as industries prioritize bio-based polyols to reduce carbon emissions. Manufacturers and researchers are developing polyurethanes derived from lignin that are as strong and flexible as those derived from petroleum. The rising demand from the construction and automotive industries supports segmental growth.

Lignin-Based Resins Market Companies

- Domtar Corporation

- Stora Enso

- Borregaard ASA

- Nippon Paper Industries Co., Ltd.

- Domsjö Fabriker (part of Aditya Birla Group)

- The Nippon Synthetic Chemical Industry Co., Ltd. (NSCI)

- GreenValue Enterprises LLC

- Lignin Industries AB

- Tecnaro GmbH

- FPInnovations

- Valagro Group

- Fibenol

- Metsa Fibre

- UPM-Kymmene Corporation

- GranBio

- Suzano S.A.

- Prairie Tide Diversified Inc.

- LignoTech Florida (JV of Borregaard & Rayonier)

- Melodea Ltd.

- Sappi Ltd.

Recent Development

- In June 2025, Biorizon co-initiator VITO launched the Lingo Value Pilot Plant, Europe's first pilot facility to depolymerize lignin and convert it to bio-aromatics. LignoValue Pilot Plant completed its second large-scale delivery of depolymerized lignin. The plant is fully operational and delivers lignin-based materials for development of innovative bio-based products like epoxy resins.

(Source: https://www.biorizon.eu)

Segments Covered in the Report

By Product Type

- Lignin–Phenol–Formaldehyde (LPF) Resins

- Lignin–Urea–Formaldehyde (LUF) Resins

- Lignin–Melamine–Formaldehyde (LMF) Resins

- Epoxy Resins Modified with Lignin

- Polyurethane Resins Using Lignin Polyols

- Lignin–Acrylic Blended Resins

- Others (e.g., Lignin–Tannin Resins)

By Source of Lignin

- Kraft Lignin

- Organosolv Lignin

- Lignosulfonates

- Soda Lignin

- Hydrolysis Lignin

- Other Technical Lignins

By Application

- Adhesives & Binders

- Wood adhesives

- Particleboard/MDF/plywood binders

- Composites

- Automotive composites

- Building materials

- Coatings

- Industrial coatings

- Decorative coatings

- Foams and Insulation (Polyurethane foams)

- Plastics & Polymers

- Thermoplastic composites

- Bioplastics

- Paints & Varnishes

- Others

- 3D printing filaments

- Anti-corrosion materials

By End Use Industry

- Construction

- Furniture & Wood Products

- Automotive

- Packaging

- Textiles

- Electronics

- Industrial Manufacturing

- Agriculture

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content