What is the Flat Glass Market Size?

The global flat glass market size is valued at USD 325.89 billion in 2025 and is predicted to increase from USD 340.98 billion in 2026 to approximately USD 510.78 billion by 2035, expanding at a CAGR of 4.60% from 2026 to 2035. The flat glass market is driven by the expansion in construction and infrastructure activities globally, mainly due to rapid urbanization in emerging economies.

Flat Glass Market Key Takeaways

- The tempered glass market is expected to reach at a CAGR of over 8.8%.

- The laminated glass market is poised to reach at a CAGR of 8.9% from 2026 to 2035.

- The North America flat glass market is projected to hit at a CAGR of over 7.8% between 2026 to 2035.

- The Europe flat glass market is growing at a CAGR over 6.9% from 2026 to 2035.

- The Germany flat glass market is poised to reach at a CAGR of 6.3% from 2026 to 2035.

Key AI Integration in the Flat Glass Industry

Artificial Intelligence (AI) is rapidly integrating into the flat glass industry, mainly to optimize manufacturing processes, improve quality control, and even facilitate the development of smart glass products. This integration is boosted by the demand for increased efficiency, sustainability, along competitiveness amid labor shortages and even growing energy expenses.

By determining data from sensors together with historical performance, AI can forecast equipment failures before they occur. This allows proactive maintenance scheduling, reducing costly downtime and even extending the lifespan of machinery.

Flat Glass Market Market Outlook

- Industry Growth Overview: The flat glass market is growing, driven by rising demand for energy-efficient and smart glass, and regulatory support for renewable energy. Quick urbanization and infrastructure advancement in evolving economies are increasing the demand for flat glass in residential and commercial constructions for windows.

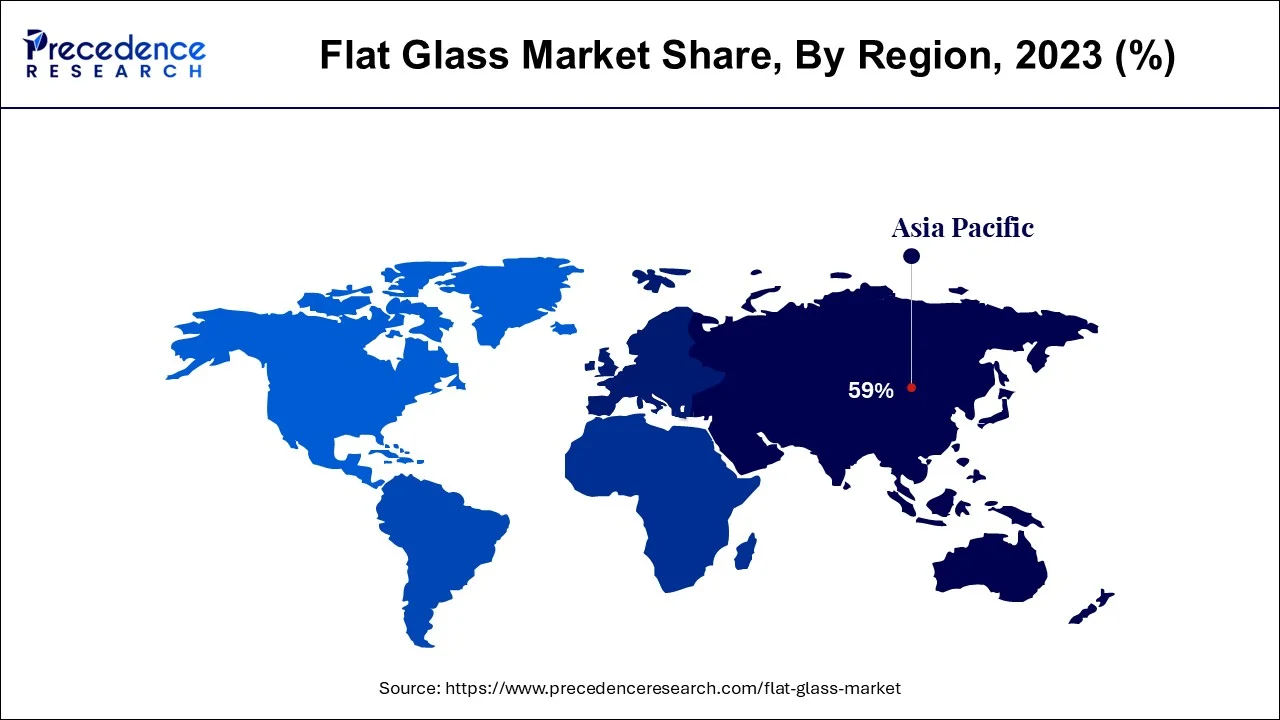

- Global Expansion:The flat glass market is experiencing global expansion, as the expansion of the automotive, construction, and solar energy sectors. Asia Pacific dominated the market due to massive infrastructural advancement, including residential and non-residential buildings.

- Major investors:The major investors in the flat glass market generally include a combination of founding families/insiders, massive institutional asset management organizations, and public retail investors who hold shares in publicly traded organizations.

Flat Glass Market Key Trends:

- Smart/Switchable Glass: increasing demand for energy-efficient commercial/public buildings with improved privacy/control of public occupancy through electrochromic/thermochromic flat glass.

- Carbon-neutral Manufacturing: manufacturers utilizing lower-carbon melting processes, hydrogen fuels, and more recycled cullet to comply with new/stricter emission levels by reducing environmental impact.

- Integrated Solar Glass: as more solar installations are going up, so is demand for materials that provide high light transmission for photovoltaic modules.

- Advanced Functional Coatings: increasing growth for low-e, anti-reflective, self-cleaning, and acoustic coatings is allowing value-added applications to be grown across many different types of architecture and for automotive glazing.

- Automation/Industry 4.0 Growth: use of automation to increase production yield rates of flat glass while lowering the production costs through artificial intelligence quality/control systems reviewing production process; predictive furnace maintenance and use of digital twin technology will further increase yield rates.

Global Overview of the Flat Glass Trade

- The volume of Global Flat Glass trade recorded more than 3300 shipments of imports during the past year, with a 50% increase in growth over the previous year.

- The highest importers of flat glass were Bulgaria, Turkey, and the U.S., while the highest exporters were China, Turkey, and the U.S.

- An estimated 800+ exporters to global trade have been reported, and 1100+ active importers are currently importing flat glass, indicating a wide range of demand for flat glass across multiple borders.

Flat Glass Market Growth Factors

Rising penetration of solar energy installations along with supportive government regulations are likely to propel the industry value for flat glass during the upcoming years. Solar energy is the fastest growing renewable energy across the globe with countries racing for asserting their dominance in the burgeoning market. As per the statistics revealed by the Global Change Data Lab, the total installed capacity for solar energy across the world in the year 2019 was 580.76 GW and the capacity grew to 707.50 GW by the year 2020. According to the Solar Energy Industries Association (SEIA), solar energy has registered an annual growth rate of 42% in the last decade and the this is anticipated to grow further during the forecast period.

The accelerating growth of solar energy is prominently supported by the growing demand for electricity coupled with reducing cost of solar installations. For instance, average-sized residential system price has fallen from a pre-incentive price of US$ 40,000 in the year 2010 to US$ 20,000 by the year 2020. Hence, the increasing solar energy demand is intent to propel the market for flat glass during the upcoming years.

Apart from drastic rise solar energy installation, rising penetration of glass architecture in non-residential and residential applications in another major factor that drives the growth of flat glass market over the analysis timeframe. Building & construction sector is one of the major end-user sectors in the global flat glass market. This is mainly because of various developments in the architecture segment.

Market Scope

| Market Scope | Details |

| Market Size in 2025 | USD 325.89 billion |

| Market Size in 2026 | USD 340.98 billion |

| Market Size by 2035 | USD 510.78 billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.60% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segmental Insights

Product Insights

The insulated product captured the majority of market revenue share of approximately half of the total market revenue in the year 2024 and projected to maintain the same trend over the forecast period.

This is mainly attributed to the increasing demand of the insulated product from applications that include storefronts, curtain walls, non-vision locations, overhead glazing, and commercial & operable windows. This growing demand of the insulated product has compelled its manufacturers to increase their production capacity. For instance, in February 2020, Pilkington IGP, announced to expand its manufacturing capacity in Ostroleka, Poland to cater the increasing demand for the product particularly in building and construction industry.

Application Insights

The architectural segment held the largest revenue share in the year 2024 and the segment estimated register a steady growth over the forthcoming period. This is mainly attributed to the rise in infrastructure developments and increasing construction activities because of rising population as well as rapid urbanization especially in the developing countries.

However, automotive segment witness slow growth in the global flat glass market because of declining sales and production of passenger vehicles across the globe. For instance, the global sale of automobiles witnesses a continuous decline owing to rising trend for shared mobility in order to curb the rate of pollution. Nonetheless, rising demand for electric vehicles along with rising cases of road accidents are likely to propel the market growth in the automotive segment.

Regional Insights

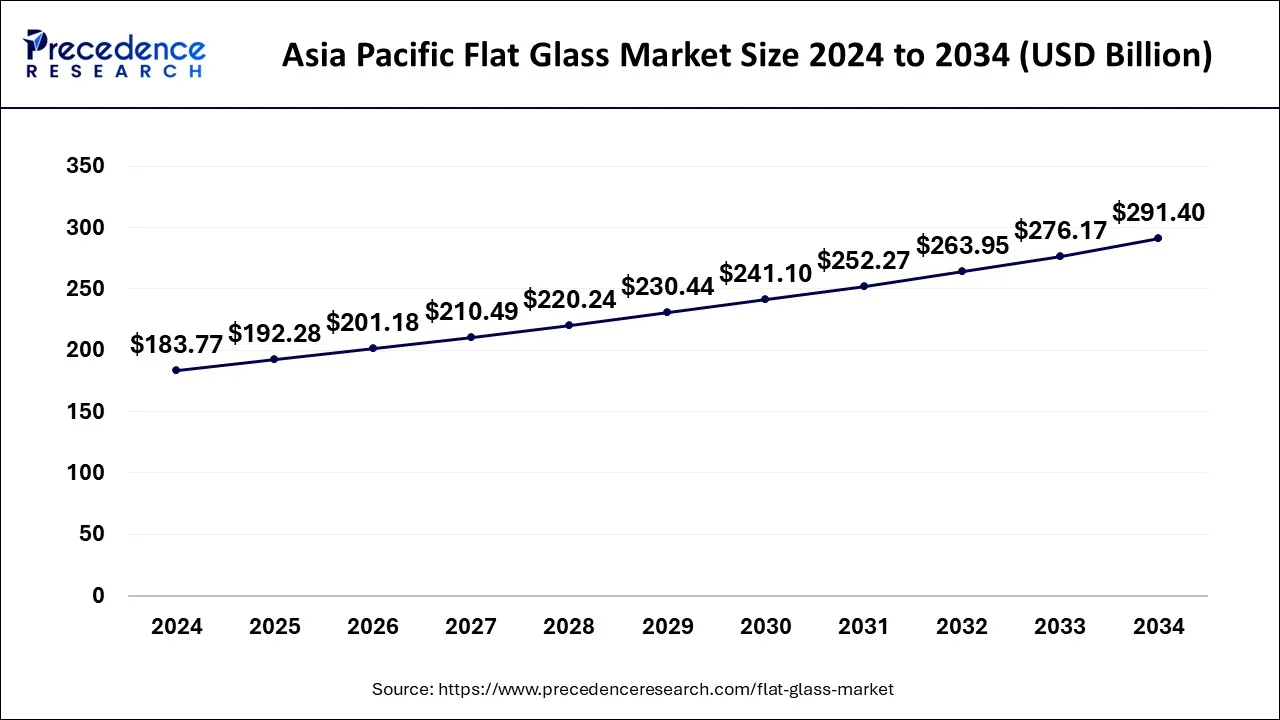

What is the Asia Pacific Flat Glass Market Size?

The Asia Pacific flat glass market size is exhibited at USD 192.28 billion in 2025 and is expected to be worth around USD 304.62 billion by 2035, rising at a CAGR of 4.71% from 2026 to 2035.

The Asia Pacific leads the global flat glass market and accounted for more than 59% of revenue share in the year 2025. This is primarily because of rapid infrastructural development in the developing nations across the Asia Pacific.

Increasing investment in advanced infrastructure

Asian Development Bank has quoted that the Asia Pacific region needs to invest US$ 1.7 trillion per year on its infrastructure till 2034 in order to retain its growth momentum. In terms of sectors, power sector accounted for nearly 56% of the total infrastructure investment, transport 32%, water & sanitation 3%, and telecommunications accounted for 9%. Among all Asian nations, Southeast Asia is the most emerging region because of rapid development in the manufacturing, automotive, construction, and various other industries.

China: Rapid urbanization and infrastructure development

China has a massive domestic demand from fast urbanization, infrastructure projects, and a massive automotive sector, as well as government initiatives that promote large-scale construction and energy-efficient materials. An increasing middle class with rising disposable incomes also drives demand for premium and aesthetically pleasing glass products.

Government regulations and green building

North America is the fastest-growing market in market as significant spending in residential, commercial, and infrastructure projects creates massive demand for flat glass in facades, windows, and partitions. Stringent regulations and regulatory programs, like LEED certification, encourage the application of energy-efficient products such as low-E and insulated glass. This focus on sustainability is a major driver for the market.

U.S.: Technological advancements

In the U.S., growing manufacturing of vehicles, specifically electric and advanced models, drives the demand for specialized flat glass, such as lightweight and smart glass services for windshields, windows, and sunroofs. There is a robust emphasis on research and development to produce advanced, high-performance flat glass, which drives the growth of the market.

Europe: Technological advancements

Europe is experiencing substantial growth in the market due to the region is a leader in emerging and adopting novel technologies, like vacuum-insulated units, smart glass, and coated glass, to meet market requirements for energy conservation and performance. The European construction area's push for sustainability directly drives the market for high-performance architectural glazing, as mandated by construction codes in countries such as Germany, France, and the UK.

UK: Technological Advancements

In the UK growing use of flat glass in modern architectural enterprises for commercial buildings, plus facades, windows, and interior partitions, drives market growth. Initiatives such as the Smart Export Guarantee (SEG) have increased demand for dedicated, high-value flat glass applied in solar panels, driving a shift toward sustainability.

Latin America's Clear Outlook: Emerging Growth Shapes the Flat Glass Market

Latin America's flat glass market is experiencing emerging growth driven by rising construction activity, expanding urbanization, and increasing investments in infrastructure development. Growing demand from the residential and commercial building sectors, along with the adoption of energy-efficient and solar-control glass, is supporting market expansion. Additionally, the recovery of the automotive industry and the gradual shift toward sustainable building materials are creating new opportunities for flat glass manufacturers across the region.

Brazil Flat Glass Market Trends

Brazil's market is witnessing steady growth, supported by rising construction activity, infrastructure modernization, and gradual recovery in the automotive sector. Increasing demand for energy-efficient, tempered, and laminated glass in residential and commercial buildings is driving product innovation and capacity utilization. Additionally, growing adoption of solar control and low-emissivity glass, aligned with sustainability goals and energy-saving regulations, is enhancing market prospects.

Value Chain Analysis – Flat Glass Market

Raw Material

The raw materials for flat glass involve silica sand, soda ash, and limestone, along with other additives such as dolomite and recycled glass.

- Key Players: AGC Inc. and Saint-Gobain

Chemical Synthesis and Processing

Flat glass is produced application of the float glass process, where a particular combination of raw materials (predominantly silica sand, soda ash, and limestone) is melted in a furnace and then floated onto a bath of molten tin to form a flawlessly flat and uniform sheet.

- Key Players:Nippon Sheet Glass (NSG) Co., Ltd.

Compound Formulation and Blending:

Flat glass is significantly a soda-lime-silica glass with a particular chemical composition and an exact, automated blending process to confirm quality and uniformity.

- Key Players: Guardian Industries and Fuyao Glass Industry Group

Top Vendors in the Flat Glass Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Japan |

Extensive R&D capabilities |

Central Glass Ltd. continues to offer a variety of architectural flat glass products. |

|

|

Japan |

Strong foundation in Innovation |

In October 2025, AGC Glass Europe and SOLAR MATERIALS announced a strategic partnership to advance PV flat glass circularity. |

|

|

Cevital Group |

Algeria |

Extensive diversification |

Cevital Group strengthens its presence in France through the launch of new industrial projects. |

|

Euroglas |

Ujazd Poland |

Innovative glass solutions |

Euroglas serves the construction market in the Benelux countries with tailor-made glass. |

|

China Glass Holding Ltd. |

China |

Strong research and development capabilities for innovation |

The industry is focusing on innovations such as energy-efficient and smart glass. |

Other Major Key Players

- Fuyao Glass Industry Group Co., Ltd.

- Xinyi Glass Holdings

- Nippon Sheet Glass Co., Ltd.

- Guardian Industries

- ?i?ecam Group

- Saint-Gobain

- Vitro

Recent Developments in the Flat Glass Industry

- In October 2023, Vitro declared that it had signed an additional contract with First Solar to offer high-tech glass front sheets for the solar panels, which First Solar manufactures in North America. Vitro will now invest nearly USD 180 million in adapting its current facilities to meet the requirements of the new contract expansion. (Source: vitroglazings.com)

- On August 13, 2025, Saint-Gobain began construction of its 7th float glass line and associated insulation production lines in Oragadam, Chennai. The production line aims to boost local capacity (1,000 tonnes/day) while integrating advanced digital controls and energy-efficient technologies to enhance operational performance. (https://www.glassonweb.com)

Segments Covered in the Report

By Product Type

- Tempered

- Basic

- Insulated

- Laminated

- Others

By Technology

- Float Glass

- Sheet Glass

- Rolled Glass

By Raw Material

- Sand

- Soda Ash

- Recycled Glass

- Dolomite

- Limestone

- Others

By End-Use

- Safety and Security

- Solar Control

- Others

By Type

- Fabricated

- Non-Fabricated

By Application

- Construction

- New

- Refurbishment

- Interior

- Automotive

- OEM

- Aftermarket

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting