What is Flat Steel Market Size?

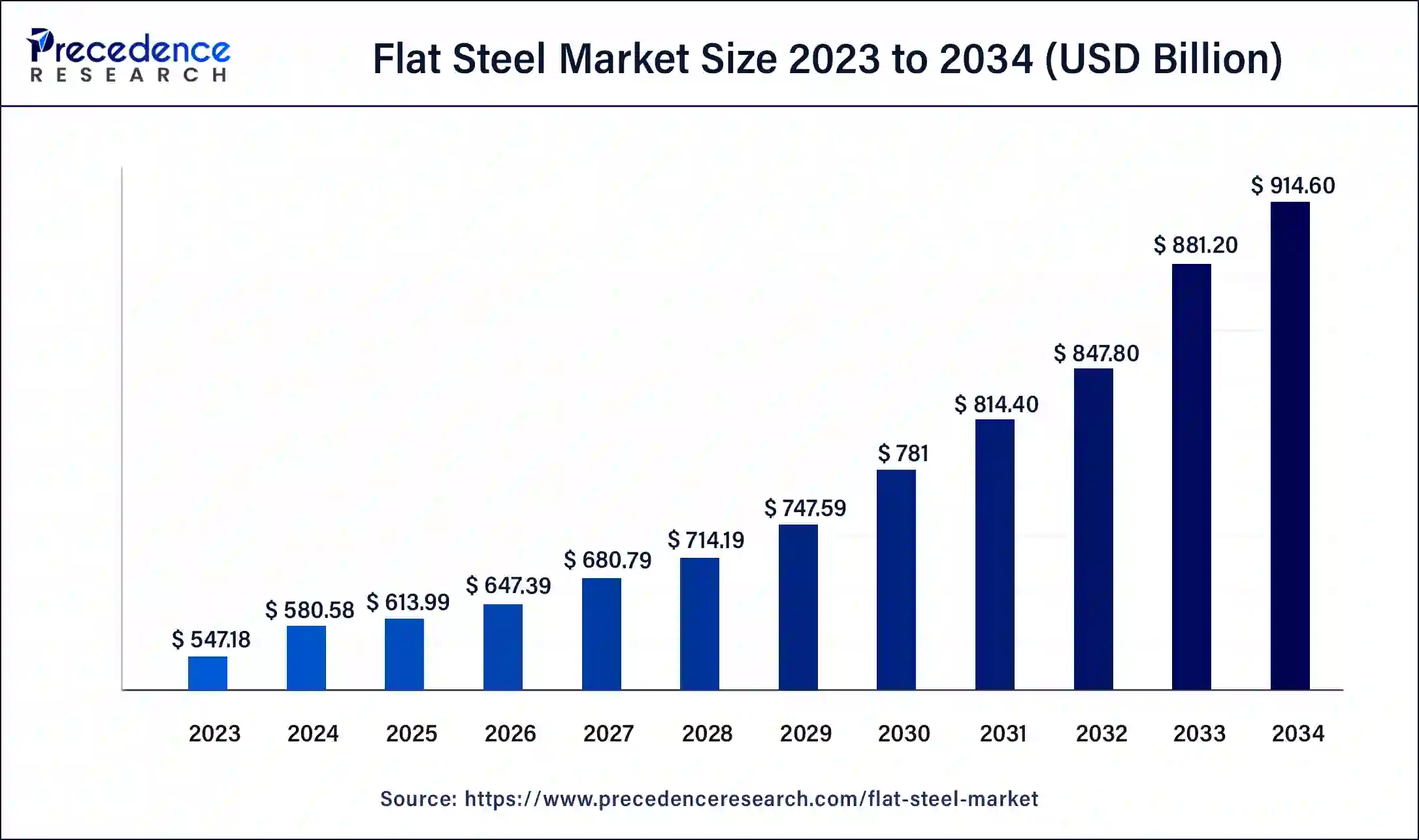

The global flat steel market size is calculated at USD 613.99 billion in 2025 and is expected to reach around USD 948 billion by 2035, expanding at a CAGR of 4.44% from 2026 to 2035

Market Highlights

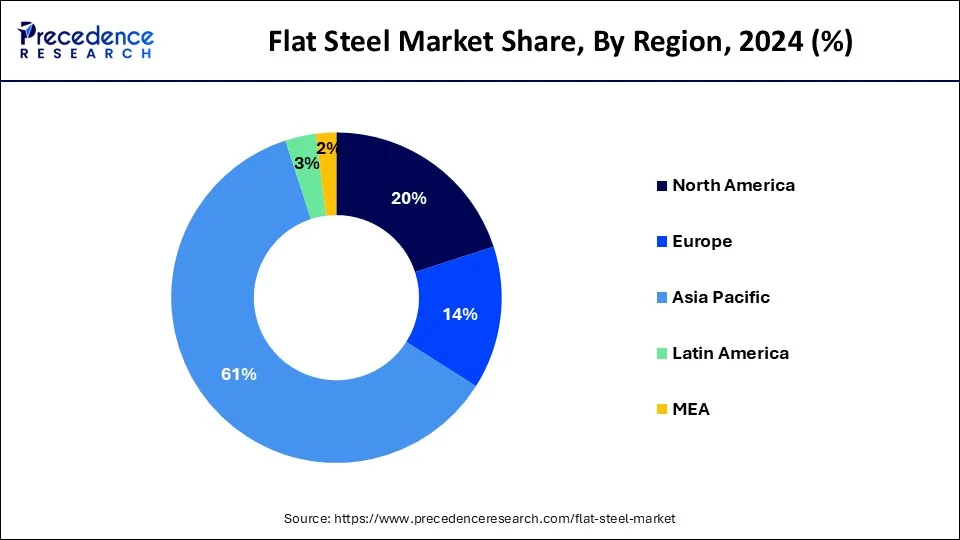

- Asia Pacific contributed more than 61% of revenue share in 2025.

- By type, the hot rolled coil (HRC) segment held the largest segment of the flat steel market in 2025.

- By type, the cold rolled coil (CRC) segment is expected to grow at a significant rate during the forecast period.

- By application, the construction segment is expected to hold the dominating share of the market during the forecast period.

- By application, the energy segment is expected to grow at a notable rate.

Flat Steel Market Overview: Exploring Market Trends

Flat steel refers to a class of steel products characterized by their flat and thin shapes, typically in the form of sheets or strips. These sheets exhibit a rectangular cross-section and are produced through processes such as hot rolling or cold rolling. Flat steel finds extensive use in various industries, including construction, automotive manufacturing, appliances, shipbuilding, and infrastructure projects.

Its versatility stems from its ability to be easily manipulated and formed into different shapes, making it a crucial material for constructing buildings, manufacturing vehicles, and creating diverse consumer goods. The flat steel market is influenced by factors such as economic conditions, infrastructure development, and technological advancements, reflecting its integral role in supporting the global industrial and construction sectors.

Flat Steel Market Data and Statistics

- India is the world's second-largest producer of crude steel, with an output of 125.32 MT of crude steel and finished steel production of 121.29 MT in FY23.

- As announced in May 2023, INOX Air Products will invest Rs. 1,300 crore (US$ 157.5 million) to set up two air separation units having a capacity of 1,800 tons a day each at Tata Steel's plant in Dhenkanal, Odisha.

- On July 20, 2023, Mr. Jyotiraditya M. Scindia, the Union Minister of Steel, and Mr. Nishimura Yasutoshi, the Minister of Economy, Trade, and Industry of Japan, convened in New Delhi for a bilateral meeting. The focus of their discussions centered on fostering collaboration in the steel sector and addressing concerns related to decarbonization.

- AMNS India, a significant player in the industry, is gearing up for a substantial investment of US$ 7.4 billion. This investment aims to augment capacity across both upstream and downstream operations, with a particular emphasis on enhancing iron ore capabilities.

- In a strategic move, JSW Steel and JFE Steel inked an agreement in May 2023 to establish a joint venture (JV) company. This JV, set to operate in Vijaynagar, Karnataka, is geared towards manufacturing the complete spectrum of cold-rolled grain-oriented electrical steel (CRGO) products.

- April 2023 marked a milestone for AMNS India, a collaborative venture between ArcelorMittal and Nippon Steel. The National Company Law Tribunal (NCLT) in India granted approval for AMNS India to acquire Indian Steel Corporation, further consolidating its position in the market.

- Tata Steel, in the same month, disclosed its partnership with A&B Global Mining (ABGM) to explore new business avenues. This collaboration extends to mine technical services, with a focus on leveraging each other's strengths for projects in the mining and metals, including the steel value chain.

- A significant development under the Production Linked Incentive (PLI) Scheme for Specialty Steel was the selection of 67 applications from 30 companies. This move is expected to attract a committed investment of Rs. 42,500 crore (US$ 5.19 billion), leading to a downstream capacity addition of 26 million tonnes and the potential generation of 70,000 jobs.

Steel export and import data for the top 10 countries in the world:

| Country | Exports (Million Tonnes) | Imports (Million Tonnes) | Trade Balance (Million Tonnes) |

| China | 62.2 | 55.3 | 6.9 |

| Japan | 35.1 | 19.2 | 15.9 |

| India | 11.2 | 8.3 | 2.9 |

| South Korea | 33.6 | 26.2 | 7.4 |

| Russia | 35.9 | 7.8 | 28.1 |

| United States | 10.1 | 23.9 | -13.8 |

| Germany | 24.1 | 21.4 | 2.7 |

| Italy | 21.3 | 15.8 | 5.5 |

| Turkey | 16.2 | 12.1 | 4.1 |

| France | 14.9 | 12.8 | 2.1 |

Flat Steel Market Growth Factors

- The increasing integration of genomics into healthcare practices fuels the demand for flat steel. Applications such as clinical diagnostics, oncology, and pharmacogenomics drive market growth. As genomic information becomes more central to disease understanding and treatment strategies, the need for consumables in laboratories and clinical settings continues to rise.

- A significant driver for market expansion is the ongoing reduction in the cost of DNA sequencing. The achievement of the "$1000 genome" milestone and continuous efforts to lower sequencing expenses make genomic analysis more accessible. The declining costs stimulate increased adoption of sequencing technologies, consequently boosting the demand for consumables.

- The paradigm shift toward personalized medicine, tailoring treatments based on individual genetic profiles, fuels the demand for flat steel. The ability to identify genetic markers and variations crucial for personalized treatment strategies propels the use of sequencing technologies in clinical practice. As personalized medicine gains prominence, the market for consumables is propelled by the increasing need for accurate and comprehensive genomic data.

Flat Steel Market Outlook: The Road Ahead

- Industry Growth Overview: The growing demand from the construction and automotive sectors is responsible for the market growth.

- Major Investors: Large institutional asset management firms and private equity firms are the major investors in the market.

- Startup Ecosystem: The startup ecosystems are focusing on technological advancements to develop novel coating technologies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 613.99 Billion |

| Market Size in 2026 | USD 647.39 Billion |

| Market Size by 2035 | USD 948 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.44% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Infrastructure Investments

- The American Society of Civil Engineers estimated that the United States needed to invest trillions of dollars in infrastructure over the next decade.

Infrastructure investments play a crucial role in fueling the demand for the flat steel market. As both government bodies and private enterprises allocate funds towards extensive construction ventures like bridges, highways, and commercial structures, the necessity for flat steel escalates. The adaptability and structural reliability of flat steel make it a fundamental material in these projects. Whether in roofing, flooring, or support structures for buildings, flat steel proves indispensable. Additionally, the transportation sector, including bridges and roads, heavily relies on flat steel due to its resilience and ability to bear substantial loads.

The upswing in infrastructure investments not only triggers an immediate surge in flat steel demand but also initiates a prolonged domino effect. As new infrastructure projects come to fruition, they catalyze economic activities, instigating a continuous cycle of construction and development initiatives. This symbiotic relationship leads to an enduring and expanding need for flat steel, positioning it as a primary beneficiary of heightened infrastructure investments, both at the national and global levels.

Restraint

Data analysis challenges

Trade disputes and tariffs impose significant restraints on the flat steel market by disrupting the global supply chain and influencing market dynamics. When tariffs are imposed on steel imports or exports, it often leads to increased costs for manufacturers, impacting their competitiveness. The imposition of tariffs can result in a complex web of retaliatory measures and countermeasures, creating uncertainty for flat steel producers and consumers alike. Trade disputes, especially between major economies, can lead to reduced international trade and market fragmentation. This fragmentation can disrupt established supply chains, making it challenging for flat steel manufacturers to source raw materials and distribute products efficiently.

Moreover, the threat of protectionist measures can dampen investor confidence and hinder long-term strategic planning for flat steel companies. The flat steel market's growth is intricately tied to global economic cooperation, and trade disputes introduce volatility and obstacles that can hinder market expansion and stability.

Opportunity

E-commerce and warehousing growth

- According to the U.S. Census Bureau, e-commerce sales in the United States reached $196.7 billion in the second quarter of 2021, underscoring the robust expansion of the online retail sector.

With the rise of online retail, the demand for robust and efficient logistics infrastructure, including storage and distribution centers, has soared. flat steel plays a pivotal role in constructing these facilities, offering structural support and durability essential for the safe storage and handling of goods. As e-commerce continues to thrive globally, the need for expansive and well-equipped warehousing facilities is expected to persist, creating a sustained demand for flat steel. Moreover, the trend towards automated warehouses and smart logistics centers further amplifies the requirements for durable and versatile flat steel products, positioning the industry at the forefront of supporting the evolving landscape of modern commerce.

Segment Insights

Type Insights

The hot rolled coil (HRC) segment dominated the flat steel market in 2025. the segment is observed to continue the trend throughout the forecast period. Hot Rolled Coil (HRC) is a type of flat steel produced through the hot rolling process, involving heating steel and then pressing it between rollers to achieve the desired thickness. Renowned for its malleability and durability, HRC finds extensive application in construction and automotive manufacturing. Within the flat steel market, there is a growing trend towards increased demand for HRC due to its versatility and strength. This reflects the ongoing preference for HRC in manufacturing processes where flexibility and robustness are critical factors.

The cold rolled coil (CRC) segment is expected to grow at a significant rate throughout the forecast period. Cold Rolled Coil (CRC) in the flat steel market refers to flat steel products that undergo a cold rolling process, enhancing surface finish and dimensional accuracy.

- In 2021, global automotive production reached approximately 77 million units, highlighting the significance of CRC in meeting the stringent quality standards of the automotive industry.

The CRC segment is characterized by its smooth and uniform surface, making it ideal for applications requiring precision. The CRC market has seen increasing demand, driven by its use in automotive manufacturing. In 2021, global automotive production reached approximately 77 million units, highlighting the significance of CRC in meeting the stringent quality standards of the automotive industry.

Application Insights

The construction segment is observed to hold the dominating share of the flat steel market during the forecast period. In the flat steel market, the construction segment pertains to the application of flat steel in various construction facets, including building structures and infrastructure. With the global construction sector expanding, the demand for flat steel remains robust. Flat steel's versatility in roofing, flooring, and structural components positions it as a crucial material, aligning with the escalating construction activities worldwide and underscoring its significance in shaping modern architectural landscapes.

The energy segment is expected to generate a notable revenue share in the market. In the flat steel market, the energy segment involves using flat steel in applications related to the energy sector. This includes constructing wind turbines, transmission towers, and components for oil and gas infrastructure. With a rising global emphasis on renewable energy, especially wind power, there's a growing demand for flat steel in building sturdy wind towers. As the energy industry shifts towards sustainable practices, the role of flat steel in supporting renewable energy infrastructure represents a notable and expanding market trend.

Regional Insights

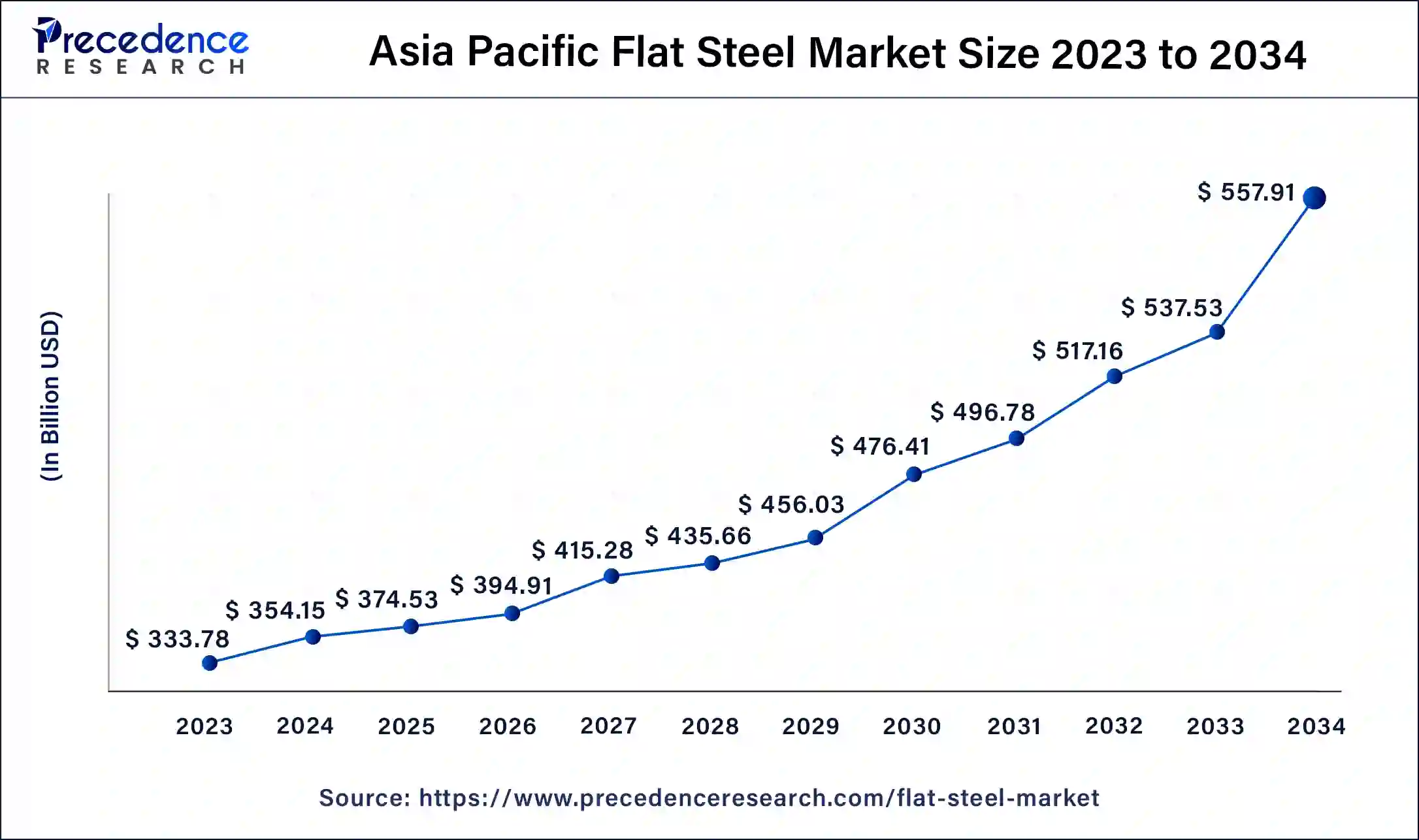

Asia Pacific Flat Steel Market Size 2026 to 2035

The Asia Pacific flat steel market size is valued at USD 374.53 billion in 2025 and is expected to reach around USD 578.28 billion by 2035, growing at a CAGR of 4.44% from 2026 to 2035

Asia Pacific Driven by Rapid Industrialization

Asia Pacific has held the largest revenue share of 61% in 2025. Asia-Pacific stands as a dominant force in the flat steel market, driven by vigorous industrial growth, swift urban expansion, and substantial infrastructure initiatives.

- According to the World Steel Association, China, a key player in the region, is the world's largest producer and consumer of steel.

The area's prominence is further propelled by heightened construction and flourishing automotive manufacturing. India, a key contributor, is also experiencing a significant upsurge in infrastructure endeavors. With these factors in play, Asia-Pacific retains a leading position in the global flat steel market, wielding considerable influence on demand patterns and industry trajectories.

Expanding Construction Sector Drives Europe

Meanwhile, Europe's notable growth in the flat steel market can be attributed to robust demand from the construction and automotive sectors. The recovery of these industries post-pandemic, coupled with increased infrastructure investments, fuels the demand for flat steel. Moreover, the region's commitment to sustainable practices aligns with the material's recyclability and eco-friendly features. Favorable economic conditions, technological advancements, and a focus on energy-efficient applications contribute to Europe's prominence in the expanding flat steel market.

Growing Construction Activities Boost North America

North America is poised for rapid growth in the flat steel market due to several factors. The region is experiencing a resurgence in construction activities, including infrastructure development and residential projects. Additionally, the recovering automotive industry, coupled with advancements in technology and a focus on lightweight materials, is driving increased demand for flat steel in vehicle manufacturing. The region's commitment to renewable energy projects, such as wind power, further contributes to the growing need for flat steel in the energy sector. These combined factors position North America as a key player in the expanding flat steel market.

Expanding Infrastructure Propels India

The expanding infrastructure in India is increasing the demand for flat steel. The government investments are also increasing their support in the development of smart cities, metros, and roads. The growing use of electric vehicles is also increasing their demand, which is increasing their production.

Robust Manufacturing Sector Fuels the UK

Due to the presence of robust manufacturing and the automotive sector, the demand for flat steel is increasing. Moreover, the infrastructure development is also increasing its use, which is backed by government support. Due to stringent regulations, the companies are adopting greener production methods for their development.

Increasing Vehicle Ownership Stimulates the U.S.

The increasing vehicle ownership in the U.S. is increasing the demand for flat steel. The growing infrastructure projects and residential constructions are also increasing their use. The companies are therefore increasing their production and shifting towards sustainability trends.

Rapid Industrialization Facilitates South America

Europe is expected to grow significantly in the flat steel market during the forecast period, due to rapid industrialization. There is an increasing demand for flat steel in various sectors, along with expanding infrastructure. The companies are therefore developing hot and cold rolled sheets.

Brazilian Flat Steel Market on the Rise

Brazil's flat steel market is expanding robustly, propelled by growing domestic demand from the automotive, construction, and appliance sectors. Strategic investments in infrastructure and manufacturing capacity are key growth drivers, with market size increasing steadily. This upward trajectory reflects a buoyant industrial landscape and strong recovery in key economic segments.

Flat Steel Market Regulatory Landscape: Global Regulations

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

United States |

U.S. Environmental Protection Agency (EPA), |

Clean Air Act (CAA)– New Source Performance Standards (NSPS), National Emission Standards (NESHAP), |

Air emissions from steel mills (PM, SOâ‚‚, NOx), |

Flat steel production involves high-temperature processes (rolling, annealing) with emissions and wastewater; permits and controls are required. OSHA mandates machine guarding, hazard communication, and silica exposure limits. |

|

European Union |

European Chemicals Agency (ECHA), |

Industrial Emissions Directive (IED), |

BAT (Best Available Techniques) for steel plants, |

EU IED requires steel plants to use BAT to control emissions/effluents; REACH governs substances used in coatings/roll oils. EU ETS places a carbon price on COâ‚‚ emissions from steelmaking. |

|

China |

Ministry of Ecology and Environment (MEE), |

Air and Water Pollution Prevention and Control Laws, |

Pollution discharge limits, |

China's regulatory regime emphasizes strict enforcement of air/water emission limits and solid waste disposal; recent campaigns target steel mill emissions, especially in key industrial zones. |

|

India |

Ministry of Environment, Forest and Climate Change (MoEFCC), |

Air (Prevention and Control of Pollution) Act, |

Permit requirements for emissions & effluent, |

Steel plants must obtain environmental clearances and comply with emission/effluent standards; hazardous waste rules govern contaminated slag, sludges, and spent chemicals. |

|

Latin America (Brazil & Mexico) |

Brazil:IBAMA / Ministry of Mines & Energy |

National air & water quality laws, |

Emissions caps |

Brazil's steel sector must comply with air quality permits and effluent limits; Mexico's regulators enforce industrial emissions and hazardous waste management. |

|

Middle East & Africa |

UAE:Ministry of Climate Change & Environment (MOCCAE) |

National environmental protection laws, |

Air & water emission controls, |

Frameworks in many countries reference international best practices (GHS, ISO) and require environmental permits for large steel plants; worker safety and emissions monitoring are focal areas. |

Value Chain Analysis

- Feedstock Procurement

The feedstock procurement for the flat steel involves the procurement of the iron ore, coking coal, and limestone from the major global mining companies.

Key players: ArcelorMittal, Tata Steel Limited. - Quality Testing and Certification

A series of mechanical and chemical analyses is involved in the quality testing and certification of the flat steel.

Key players: ArcelorMittal, Nippon Steel Corporation. - Regulatory Compliance and Safety Monitoring

Adherence to compliance with environmental, health, and safety regulations is involved in the regulatory compliance and safety monitoring of the flat steel.

Key players: ArcelorMittal, Nippon Steel Corporation.

Flat Steel Market Giants: Key Players' Offering

- ArcelorMittal: The company provides hot and cold rolled coils, coated products, etc.

- Nippon Steel Corporation: Hot and cold rolled sheets, coated steel sheets, stainless steel flat, etc, are provided by the company.

- POSCO: The company offers hot and cold rolled coils, electrical steel, galvanized products, and stainless steel sheets.

- Tata Steel Limited: Hot rolled, cold rolled, colour-coated, corrugated, and galvanized sheets and tubes are provided by the company.

- JFE Steel Corporation: The company provides hot and cold rolled sheets, galvanized sheets, and electric steel sheets

Recent Development

- In June 2023, Tata Steel Limited inked a memorandum of understanding with Germany's SMS group, marking a collaborative effort in advancing decarbonized steel manufacturing. The partnership entails further technical discussions and a Joint Industrial Demonstration of SMS group's EASyMelt technology, illustrating a shared commitment to sustainable steel production.

- In February 2023, Nippon Steel strategically aligned with Teck Resources Limited, securing royalty interests and equity in Elk Valley Resources Ltd. This move aims to fortify Nippon Steel's carbon-neutral objectives by ensuring a stable supply of high-quality steelmaking coal, contributing to a sustainable and lucrative consolidated portfolio.

- ArcelorMittal's successful acquisition of Companhia Siderúrgica do Pecém ('CSP') in Brazil for an estimated USD 2.2 billion in enterprise value, announced in March 2023, signifies a significant stride. The deal not only unlocks financial and operational synergies but also positions ArcelorMittal for future growth opportunities, potentially expanding primary steelmaking capacity.

- March 2023 witnessed JFE Steel's innovation as it enhanced the fatigue resistance of its AFD (anti-fatigue-damage) steel, introducing a thin-walled variant. This development opens up diverse applications, particularly in structural components like bridges, promising durability and reduced maintenance costs for long-term steel constructions.

- In May 2023, JFE Steel Corporation and JSW Steel Limited laid the groundwork for a joint venture to manufacture grain-oriented electrical steel sheets (GOES) in India. With a focus on supporting India's growing economy through supplying GOES for green energy network projects, this collaboration aligns with sustainable initiatives.

- In January 2022, the collaboration between POSCO and the Adani Group embarked on exploring commercial synergies, including the prospect of establishing an environmentally friendly integrated steel mill in Mundra, Gujarat, alongside other business endeavors.

- In July 2022, the strategic partnership between BP p.l.c. and ThyssenKrupp Steel took shape to facilitate the decarbonization of steel production. Their collaboration involves the supply of renewable power and low-carbon hydrogen, with a commitment to advocating policies in Europe conducive to the advancement of low-carbon hydrogen and green steel.

Segments Covered in the Report

By Type

- Hot Rolled Coil (HRC)

- Cold Rolled Coil (CRC)

- Sheets

- Others

By Application

- Construction

- Automotive & Transportation

- Mechanical Equipment

- Energy

- Packaging

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting