What is the Structural Steel Market Size?

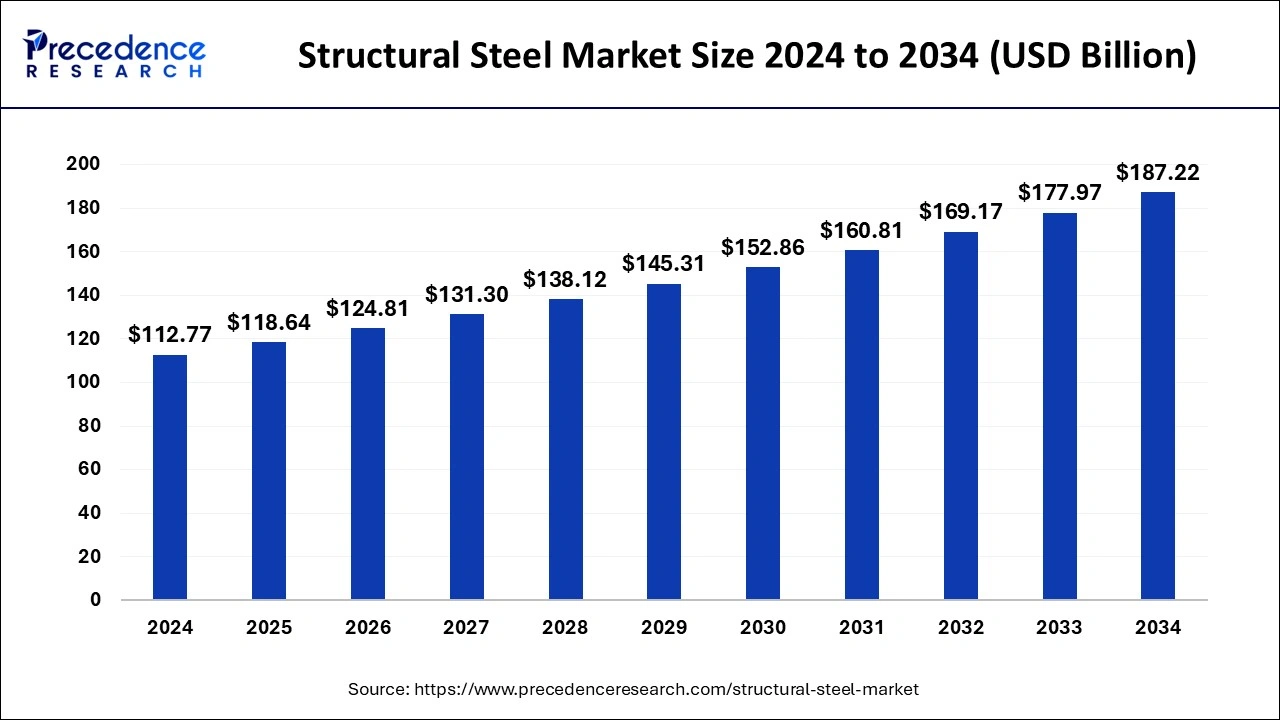

The global structural steel market size is valued at USD 118.64 billion in 2025 and is predicted to increase from USD 124.81 billion in 2026 to approximately USD 196.47 billion by 2035, expanding at a CAGR of 5.17% from 2026 to 2035.

Structural Steel Market Key Takeaways

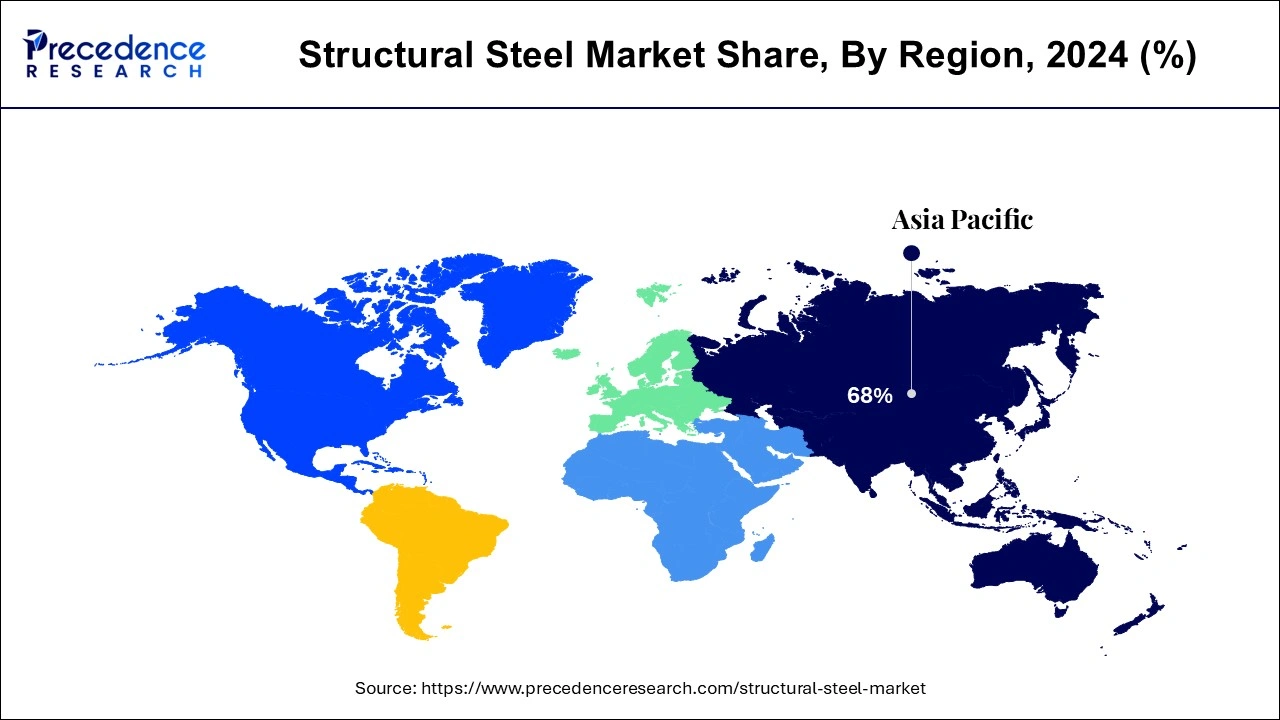

- Asia Pacific led the global market with the highest market share of 68% in 2025.

- North America is expected to grow fastest during the forecast period.

- By product type, the high-sectional steel segment captured the biggest market share in 2025.

- By application type, the non-residential segment dominated the market with the largest market share in 2025.

Market Overview

The structural steel market deals with the most commonly used building material across all areas of construction. Structural steel has various benefits over other materials, such as masonry, wood, and concrete, and it can be fabricated into various sizes and shapes. The rising advancement in engineering technology, strong growth of the construction industry, increasing industrialization in emerging countries, growing housing needs, increasing demand for sustainable construction materials, and strict regulations on carbon emissions and waste reduction in construction and energy conservation are anticipated to boost the growth of the market during the forecast period.

Structural Steel Market Growth Factors

- Increasing usage of structural steel in construction due to its recyclable nature fuels the market.

- Rising construction activities worldwide is expected to propel the market.

- Increasing industrialization, urbanization, and infrastructure development contribute to the market growth.

- Rising demand for sustainable materials further drives the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 124.81 Billion |

| Market Size in 2025 | USD 118.64 Billion |

| Market Size by 2035 | USD 196.47 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.17% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, the Middle East, and Africa |

Market Dynamics

Driver

Easy recyclability and increasing usage in construction

Structural steel is one of the most reused materials globally, as it is 100% recyclable. Carbon steel, high-strength low-alloy steel, high-treated carbon steel, and high-treated constructional alloy steel are among the several types of structural steel available in the market. Structural steel can get embrittled as a result of thermal deterioration and exhaustion, as well as corrosion damage when exposed to factors such as pressure, temperature, radiation, cyclic loads, and environment.

Structural steel is a shear-strength material. It has high strength, making it suitable for use in the construction of load-bearing structures. Unlike other building materials, steel parts will be small and lightweight regardless of the entire structure's size. Structural steel can be easily made and mass-produce in large quantities. The structural steel components can be manufactured off-site and then assembled on-site. This saves time and improves the overall construction process' efficiency.

Structural steel, known for its cost-effectiveness, is an extremely adaptable material. It can be molded into any shape without losing its qualities, making it a versatile choice for construction. Whether it's sheets or wires, structural steel can be designed to fit the project's needs. In comparison to other building materials, structural steel is relatively inexpensive. It's also a long-lasting material, with a well-maintained building expected to survive up to 30 years.

One of the primary factors driving the growth of the structural steel market is the increase in building and construction expenditure around the world. The structural steel market is expected to grow due to increased adoption of the product due to several benefits such as lightweight, elasticity, ease of fabrication, uniformity, toughness, high strength, and recyclability. Moreover, the increase in residential and non-residential construction projects boosts the market.

The structural steel market is also influenced by increased demand for flat products, such as cold and hot-rolled coil and stainless steel, in the manufacturing industry and its significant utilization in construction. Furthermore, rising consumer awareness, fast industrialization and urbanization, and rising high-sectional steel building construction all benefit the structural steel market's growth.

The demand for structural steel is expected to be driven by infrastructure developments in both developing and developed regions. One of the primary factors driving product demand is the increased housing needs resulting from global population growth.

Due to its great strength, structural steel is commonly utilized in industrial structures and buildings, which is useful for structural integrity and reducing the possible impact of repairs. Because of its high durability and outstanding strength-to-weight ratio, it is also ideal for constructing big bridges that can handle the weight of vehicles.

Restraint

Insufficient resistance to natural environments and the high cost of material

The insufficient resistance to natural environments to withstand the rigor of nature is the major factor restraining the market growth. This can create problems if it comes in contact with insects or animals and is exposed to extreme weather conditions, depending on where the steel structure is located. In addition, structural steel is more expensive than other construction materials, such as concrete and engineered wood, which limit its adoption in construction.

Opportunity

Rising demand for sustainable materials

Structural steel can be recycled and reused, which is a major advantage of using structural steel in construction. As a result, no new material can be required to build the structure and make it an environmentally friendly way to build buildings. Steel does not decompose when left in the ground for a long period of time, making it ideal for use in outdoor structures, including towers and bridges. This eco-friendly material is easy to fabricate and can be shaped into any desired shape and structure, enabling architects to design structures they can't with other materials. Moreover, key players are making efforts to boost the production of green steel products and stay competitive in the market. For instance,

- In September 2024, Mycron Steel Bhd is set to launch its own patented green steel products by 2025. The main motive behind this launch is to address the increasing demand for sustainable materials in the automotive and construction industries.

- In April 2023, Johnson Controls, a global leader in sustainable, healthy, and smart buildings, announced the launch of a program for recycling steel in collaboration with Nucor Corporation, a renowned steel recycler and producer in North America. Over 70% of Johnson Controls steel products in the U.S. are manufactured using recycled scrap materials.

Product Insights

Based on the product, the high sectional steel dominates the structural steel market during the forecast period. The high sectional steel is hot rolled long products. This type of structural steel is used in the construction of highways, buildings, bridges, and public utilities.

On the other hand, the light sectional steel is expected to grow at rapid pace during the forecast period. The increased product usage of light sectional steel will result from an increase in smart city projects sponsored by government and private entities funding.

Application Insights

The non-residential segment dominated the market with the highest market share in 2025. This is primarily due to the rising development of non-residential structures, such as commercial, industrial, and institutional buildings. Furthermore, the demand for structural steel is being driven by increased investments in the creation ofsmart cities and is likely to support market growth during the forecast period.

- For instance, in July 2024, non-residential construction is at a seasonally adjusted yearly rate of US$ 737.2 billion.

On the other hand, the residential segment is fastest growing segment in the structural steel market. Due to light weight and high strength qualities, structural steel is widely used in housing and residential constructions, reducing the foundation load and sub-structure expenses.

Regional Insights

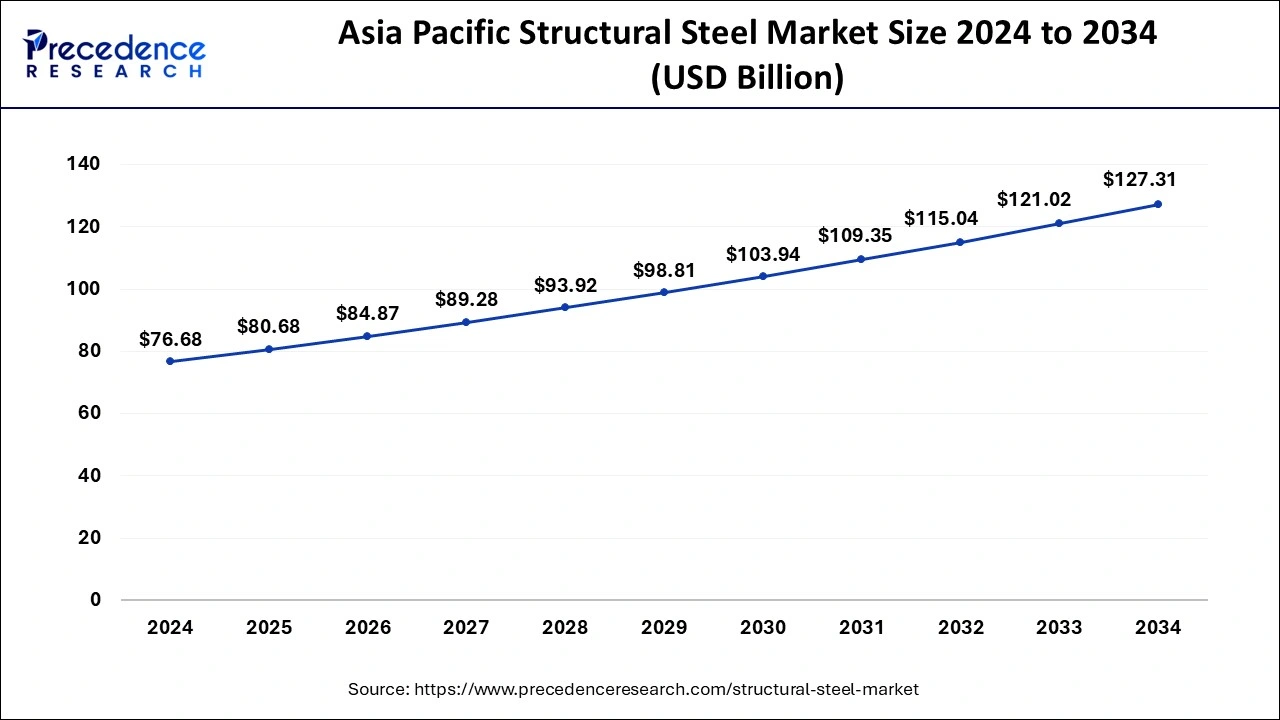

Asia Pacific Structural Steel Market Size and Growth 2026 to 2035

The Asia Pacific structural steel market size is estimated at USD 80.68 billion in 2025 and is predicted to be worth around USD 133.60 billion by 2035, at a CAGR of 5.20% from 2026 to 2035.

Asia Pacific dominated the market with the largest share in 2025. The Asia-Pacific's growing population is responsible for the expansion of the structural steel market in the region. The governments in Asian countries are developing housing policies and building smart cities in order to address the region's growing population. Moreover, the increased construction of non-residential buildings, such as commercial buildings for corporate and government offices, contributed to the regional market growth. Additionally, rapid urbanization and industrialization boosted the market in Asia Pacific.

The market in North America is expected to expand at the highest CAGR during the forecast period. The COVID-19 epidemic caused significant economic losses in North America, particularly in the U.S. and Mexico. However, during the second quarter of 2020, the building and construction business in this region recovered exponentially. The rising infrastructural development in the region is expected to be the major factor for regional market growth.

What are the Advancements in the Structural Steel Market in Europe?

Europe is experiencing significant growth in the market. This growth is due to the region's increasing emphasis on sustainability and green steel initiatives, coupled with the growing product demand from key sectors such as non-residential construction and automotive. The EU Green Deal and various other initiatives are encouraging reduced carbon emissions, thus increasing demand for innovative steel solutions. European nations are also seen investing in sustainable manufacturing methods.

Germany Structural Steel Market Trends: Germany shows significant growth, driven by a strong export market in the country and international collaborations to ensure an ongoing supply of high-quality steel. Moreover, stringent policies such as Germany's Climate Action Plan are pushing towards lower carbon emissions and pushing the adoption of green steel production.

What are the Key Trends in the Structural Steel Market in Latin America?

The Latin American market is witnessing substantial growth, driven by rapid infrastructure development and urbanization efforts. Construction remains the dominant demand driver for the region. Brazil and Mexico are leading players as regional supply chains seem to be strengthening. Producers are increasingly modernizing their operations to improve efficiency, reduce costs, and lower carbon emissions. Sustainability trends are also emerging, giving way to electric arc furnaces and low-carbon technologies.

Brazil Structural Steel Market Trends: The country's landscape is gradually shifting toward value-added and specialty steels as manufacturers continue to modernize their production processes in automotive and industrial applications. Regional producers are also focusing on capacity optimization and cost efficiency to remain afloat amid fluctuating raw material prices.

How is the Middle East and Africa Region Growing in the Structural Steel Market?

The Middle East and Africa's structural steel market is set to witness steady growth in the upcoming years. This growth is driven by increasing investments in infrastructure and construction projects in the region. It is also witnessing a surge in demand for structural steel due to urbanization and economic diversification efforts. Governments all over the region are increasingly implementing policies to help boost local manufacturing efforts, which are expected to boost GCC structural steel fabrication market growth and attract more foreign investments.

Saudi Arabia Structural Steel Market Trends: The country's market landscape has a strong focus on enhancing production capabilities and meeting international standards. As the region continues to develop its infrastructure, the demand for structural steel is anticipated to rise even more.

Value Chain Analysis of the Structural Steel Market

- Raw Material Selection

The steel materials are selected based on specific project design and material needs. When selecting steel grades and types, factors like load-bearing requirements, environmental considerations, and aesthetic criteria must be considered.

Key Players: BHP, Tata Steel, Nucor - Manufacturing Process

This stage deals with the cutting, drilling, welding, and bending of steel. Various bending processes, such as section bending, roll bending, plate bending, and tube bending, are performed to create the desired shape.

Key Players: BaoSteel, Hyundai, SSAB - Distribution Process

In this stage, the steel is delivered to the site and assembled as per the required design. Installation can be performed by using heavy-duty cranes.

Key Players: Ryerson, Olympic, Bechtel

Structural Steel Market Companies

- Baogang Group

- Gerdau S.A.

- Nippon Steel Corporation

- Tata Steel

- ArcelorMittal

- Evraz PLC

- JSW Steel

- POSCO

- SAIL

- Anshan Iron & Steel Group Corporation

Recent Developments

- In August 2024, Stecol International Private Limited (SIPL) launched a new product called Essar Structural. This launch enhanced its offerings for the infrastructure industry and helped India realize Prime Minister Narendra Modi's vision of 'AatmaNirbhar Bharat'. This new product contributed to the nation's increasing need for structural steel for the rising infrastructure developments in the country.

- In August 2022, APL Apollo launched next-gen steel building solutions for structural steel tubes.

- In September 2024, Grippon Infrastructures introduced JSW's advanced Magsure coating for steel structures. Magsure features a superior aluminum, magnesium, and zinc coating on cold-rolled steel and sets a new benchmark in the steel structure industry.

Segments Covered in the Report

By Product

- High sectional steel

- Light sectional steel

- Rebar

By Application

- Residential

- Non-Residential

- Industrial

- Commercial

- Institutional

- Offices

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content