What is Structural Insulated Panels (SIPs) Market Size?

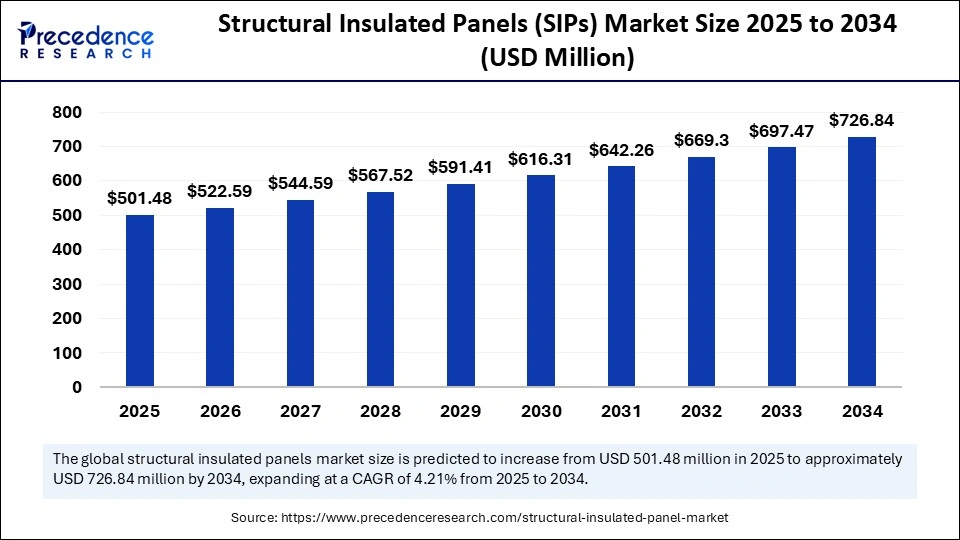

The global structural insulated panels (SIPs) market size is calculated at USD 501.48 million in 2025 and is predicted to increase from USD 522.59 million in 2026 to approximately USD 755.41 million by 2035, expanding at a CAGR of 4.18% from 2026 to 2035.

Market Highlights

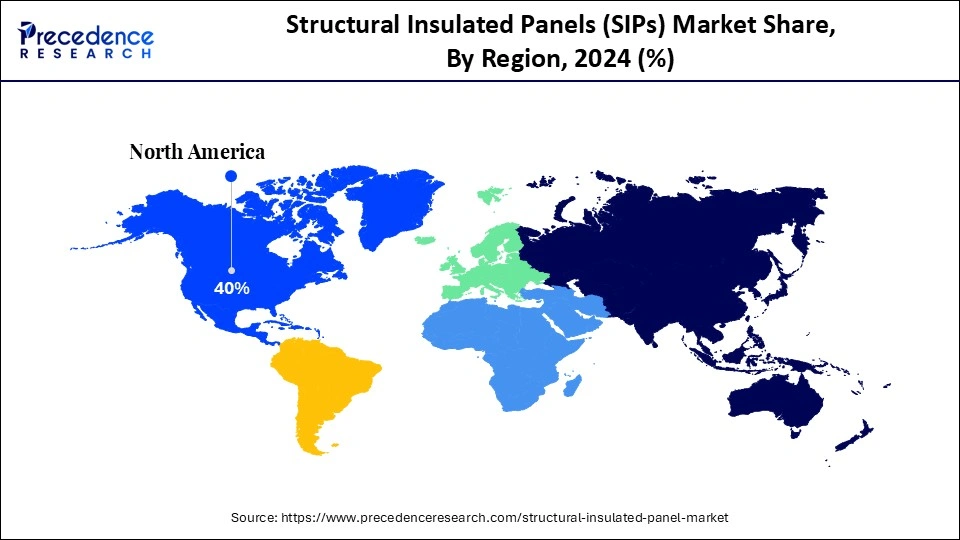

- North America dominated structural insulated panels (SIPs) market share with the largest market share of 40% in 2025.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2026-2035.

- By product type, the EPS (expanded polystyrene) panels segment led market in 2025.

- By product type, the PUR/PIR (Polyurethane/Polyisocyanurate) panels segment is expected to witness the fastest CAGR during the foreseeable period.

- By facing material, the OSB (oriented standard board) segment held the biggest market share in 2025.

- By facing material, the cement board segment is expected to witness the fastest CAGR during the foreseeable period.

- By application, the walls segment contributed the highest market share in 2025.

- By application, the roofs segment is expected to witness the fastest CAGR during the foreseeable period.

- By distribution channel, the direct sales segment generated the major market share in 2025.

- By distribution channel, the indirect sales segment is expected to grow at the fastest CAGR during the foreseeable period.

Market Overview

Structural insulated panels (SIPs) are high-performance building panels composed of an insulating foam core sandwiched between two structural facings, typically oriented strand boards (OSB) or similar materials. They are widely used in residential, commercial, and industrial construction due to their superior thermal performance, energy efficiency, structural integrity, and speed of installation. SIPs contribute to sustainable building practices by reducing energy consumption and carbon footprint, making them a preferred choice in green construction.

What is the structural insulated panels (SIPs) market?

The integration of artificial intelligence in structural insulated panels can optimize their manufacturing, design, and deployment with the help of automated designs,predictive maintenance, and increased accuracy, which is crucial for safe and cost-effective buildings while aligning with regulations. By considering factors like wind, potential seismic activity, and temperature changes, AI can predict the perfect configuration for optimal structural insulated panels among various designs. AI can support potential cost savings at an initial stage of panel designing, leading to a shift from traditional methods to a more performance-based design. Also, AI can help find the best possible methods and location to incorporate structural insulator panels to reduce costs by minimizing waste, further expanding the market's reach globally.

What Are the Key Trends in the Structural Insulated Panels (SIPs) Market?

- Sustainable Building Construction: A significant trend that the structural insulated panels (SIPs) market is witnessing includes energy-efficient methods and eco-friendly practices to build sustainable infrastructure. Structural insulated panels provide excellent thermal insulation, reducing energy consumption, which leads to lower rates of heating/cooling costs, which is crucial to meet net-zero and energy-efficient building standards. Structural insulated panels provide various benefits, like minimized air leakage and enhanced indoor air quality by reducing pollutants and dust particles, which can cause various allergies.

- Increasing Rate Of Urbanization: Another trend for the market growth is the increasing rate of urbanization across the globe due to emerging economies' investments in modern infrastructure with an eco-friendly approach. Residential construction is a major consumer of structural insulated panels due to its unparalleled offerings and safety. Also, structural insulated panels can be easily integrated with smart systems with controlled ventilation, further supporting building functionality.

Market Outlook

- Industry Growth Overview: The structural insulated panels (SIPs) market is growing, driven by the rising demand for energy-efficient and sustainable buildings in the residential and commercial sectors, the requirement for disaster-resistant structures, and the faster construction times that SIPs provide.

- Global Expansion: The structural insulated panels (SIPs) market is experiencing global expansion, as growing government incentives for green building, reduced construction times due to quick assembly, and the SIPs' greater thermal performance. North America is a dominant market with promising government regulations and green building standards.

- Major investors: Major investors in the structural insulated panels (SIPs) market are significantly the large, established manufacturing organizations themselves, operating and increasing their presence across major regions

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 501.48 Million |

| Market Size in 2026 | USD 522.59 Million |

| Market Size by 2035 | USD 755.41 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Facing Material, Application, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Energy-efficient buildings

A major driving factor for the structural insulated panels (SIPs) market is increasing demand for energy efficiency and sustainability, which can be achieved through structural insulated panels that offer excellent insulation by reducing heat transfer from outside areas to inside rooms and further reducing energy require for heating or cooling rooms, resulting in lesser energy consumption. Also, favorable standards for green building and government regulations encouraging the use of sustainable building materials to reduce carbon footprints in the construction industry. Structural insulated panels are fabricated in a maintained factory space to accurate specifications, leading to minimization of on-site labor and time required for construction.

Restraint

Sensitivity to the moisture in the air

Despite having several benefits, the structural insulated panels (SIPs) market is witnessing some drawbacks, like high sensitivity to humidity in the air, limitations in materials that can be used for the construction of insulated panels, with high initial investments. The oriented strand board utilized in the structural insulated panels is highly prone to damage by moisture due to its humidity-sensitive nature. Hence, it requires to seal carefully sealing to prevent it from rot, cracks, and degradation for its longer lifespan. Also, materials that are used to construct structural insulated panels have a limited lifespan, which may require thorough renovations after many decades.

Opportunity

Automation in the production process of structural insulated panels

The significant opportunity that structural insulated panels hold is the potential for automation in the production process of structural insulated panels. Specialized computer-aided designs and computer-aided manufacturing can be possible due to the integration of automation. CAD software enables designers to generate digital house kits from structural insulated panels and perform calculations to ensure optimal material usage and performance. These CAD design files can automatically convert into an instructive protocol for CNC machinery and ensure precise cutting of panels, reducing human error further.

Further, sensors and AI-based systems can monitor the process for defects and offer insights about it to troubleshoot the emerging issues. The automation in structural insulated panels has several benefits, like enhanced speed, productivity, superior quality with consistency, minimized operational costs, increased workplace safety, with flexibility in terms of programming that can be changed accordingly.

Segment Insights

Product Type Insights

How EPS products are helpful in expanding the structural insulated panels (SIPs) market?

The EPS (expanded polystyrene) panels segment held the largest market share in 2024. EPS is an insulated material that is cost-friendly as compared to other insulators, making it an affordable alternative for builders and developers by offering good R-value and efficient thermal performance, which contributes to energy savings in building construction. It is lightweight in nature and easy to handle, which further simplifies the process of construction and reduces extra labor costs with less installation time. Lower water absorption rate of EPS helps to restrict the possibility of degradation due to humidity in the air.

The PUR/PIR (Polyurethane/Polyisocyanurate) panels segment is expected to witness the fastest CAGR during the foreseeable period. The PUR/PIR panels are highly appealing due to their unparalleled thermal resistance, which causes substantial energy savings and minimizes carbon footprints for buildings, aligning with the environmental regulations for climate protection to reduce carbon emissions. PIR foams further offer fire resistance also which is a crucial factor to build any construction, and makes them an ideal option for various constructions such as commercial, industrial, and residential.

Facing Material Insights

Why is OSB preferred in the structural insulated panels (SIPs) market?

The OSB (oriented standard board) segment held the largest market share in 2024, as this material is inexpensive in comparison with other facing materials is a plus point. It is derived from underutilized species of wood, making it highly affordable. It has incomparable load-bearing capabilities, which have been tested rigorously for structural applications. Many builders are familiar with OSB material due to its widespread use. Also, the growing shift towards modular and prefabricated construction requires easily transportable and lightweight materials like OSB.

The cement board segment is expected to witness the fastest CAGR during the foreseeable period. Cement boards offer excellent barriers for harmful UV radiation, temperature changes, and humidity, preventing deterioration to extending the lifespan of the buildings. They are ideal for partition and structural frameworks due to their fire-resistant nature and further provide protection against damage caused by water and pest infestation, which is eco-friendly and the best solution for efficient buildings.

Application Insights

Which application leads the structural insulated panels (SIPs) market?

The walls segment held the largest market share in 2024. Structural insulated panels used in the wall create an airtight barrier, which reduces heat transfer and enhances building thermal performance, leading to significant energy savings and a comfortable indoor space. Also, rapid on-site assembly is possible due to the prefabricated nature of structural insulated panels, extensively cutting down on extra labor and construction time, translating to overall low cost for the whole project. Moreover, increasing demand for smart residential and commercial spaces is further accelerating the market's growth.

The roofs segment is expected to witness the fastest CAGR during the foreseeable period. The segment is expanding due to the global shift towards energy efficiency and eco-friendly building construction, making insulated roofing an attractive option. Structural insulated panels roofs are self-spanning, which eliminates the need for rafters. Also, technological advancements in building-integrated photovoltaics provide direct integration of solar panels to the roof, further saving on extra expenses.

Distribution Channel Insights

How do direct sales channels contribute to the growth of the structural insulated panels (SIPs) market?

The direct sales segment held the largest market share in 2024 due to a couple of factors, like increasing demand for customized structural insulated panels to continue with expected aesthetic looks of buildings, with technical expertise, high control over the installation process, and the growing residential sector, with the possibility of a higher profit margin. By directly connecting with customers, manufacturers of structural insulated panels can gain higher profit by eliminating the need for retailers and distributors is fueling the segment's growth.

The indirect sales segment is expected to witness the fastest CAGR during the foreseeable period. By depending on indirect sales channels, manufacturers can focus on their core activities to increase performance and high-quality production of panels. Manufacturers can further expand their network without heavily investing in their independent sales force, which can reach various businesses, leading to a higher turnover annually.

Regional Insights

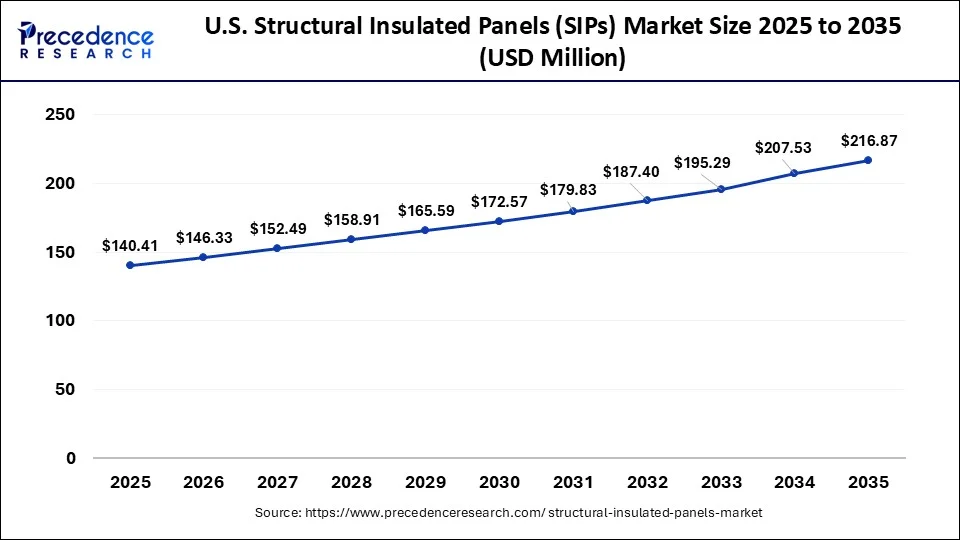

What is theU.S. Structural Insulated Panels (SIPs) Market Size?

The U.S. structural insulated panels (SIPs) market size is evaluated at USD 140.41 million in 2025 and is projected to be worth around USD 216.87 million by 2035, growing at a CAGR of 4.44% from 2026 to 2035.

U.S.: Increasing demand for Energy-efficient construction

In the U.S. strong demand for energy-efficient housing, government incentives for green building, and a well-recognized construction sector. The country has strict energy codes, a massive cold storage and logistics sector, and increasing consumer awareness of the benefits of SIPs, all of which drive acceptance in both residential and commercial projects.

What factors aid in the expansion of North America's structural insulated panels (SIPs) market?

North America held the largest market share in 2024. The region is expanding due to various factors such as green building initiatives by leading countries like the U.S. and Canada, favorable policies for energy-efficient construction, increasing construction activity, along with active presence of key manufacturers in the region. The well-developed cold chain and logistics sector in North America is another significant factor that supports the market's growth.

A thriving construction market is another key driver of the region, which creates a substantial demand for high-performing insulated materials like structural insulated panels that further minimize energy consumption and emission of greenhouse gases. Moreover, North America has significant manufacturers of structural insulated panels contributing to the market growth positively.

How does growing awareness of sustainability fuel the Asia Pacific market?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2026-2035. The increasing awareness about sustainability in the construction sector to reduce carbon emissions for environmental protection fuels the recyclability and resource-efficient manufacturing for structural insulated panels in the region. Governments in the leading nations are adopting various technologies and energy-efficient methods to support growing urbanization, and smart city projects are a plus point for the market growth.

Structural insulated panels are prefabricated, which makes them easily adjustable and ready to install, reducing overall expenses and construction time. This capability is attracting various consumers in Asia Pacific and encourages them to adopt structural insulated panels for a higher profit margin. All these factors are collectively contributing to the expansion of the Asia Pacific structural insulation market on a global scale.

China: Growing Government support

China offers significant state aid to production sectors, including materials relevant to SIPs. This includes substantial government grants, tax concessions, and below-market-rate loans that lower production expenses for producers. Increasing urbanization and population growth have led to a massive boom in commercial and residential construction.

Europe: Stringent energy efficiency regulations

Europe is experiencing significant growth in the market, as European governments and organizations have a strong commitment to green building practices and reducing overall energy use, which aligns directly with the sustainability goals that SIPs help achieve. SIPs offer a highly effective building covering with lower thermal bridging and reduced air leakage, making them a standard service for projects where energy efficiency is a top priority.

UK: Technological Advancements

The UK's dominance in structural insulated panels (SIPs) is driven by the requirement for energy efficiency, quicker construction times, and regulatory initiatives to meet housing and carbon-lowering targets. The design of SIPs comprises continuous insulation, which removes thermal bridging and lowers cold spots, causing more consistent indoor temperatures year-round, which drives the growth of the market.

What are the Advancements in the Structural Insulated Panels Market in Latin America?

Latin America is expected to witness substantial growth in the market throughout the forecasted years. This growth is driven by the rising adoption of sustainable technologies, supportive government incentives, and the need for energy-efficient housing and construction activities. With factors such as growing urbanization and an increasing preference for advanced construction systems, the market is expected to see increased use across various residential, commercial, and even industrial applications.

Brazil Structural Insulated Panels Market Trends: The country is expanding due to the growing demand for energy-efficient and sustainable building solutions. There is also rising awareness about carbon footprints and energy conservation, which is boosting demand for SIP-based projects.

How is the Middle East and Africa growing in the Structural Insulated Panels Market?

The Middle East and Africa are expected to witness steady growth in the market and are expected to maintain this growth trajectory in the upcoming years as well. This growth and development are driven by rapid urbanization, industrialization, and infrastructure development across the region. The region is also witnessing an increasing demand for energy-efficient and sustainable building materials. Government initiatives promoting green construction and building codes are also gaining traction, boosting market growth.

Saudi Arabia Structural Insulated Panels Market Trends: The country's expanding construction sector, coupled with the rising disposable incomes, has led to increased investments in modern infrastructure. Overall, economic growth, environmental policies, and infrastructure development propel this market forward.

Value Chain Analysis

- Raw Material Sourcing: This is the initial yet crucial stage of the structural insulated panels (SIPs) market and its expansion, where raw materials like sheath availability, core insulation material decide pricing of the whole process.

Key players- Aditya Birla Group, India, Kingspan Group, and Shandong Qigong Environmental Protection Technology Co.

- Maintenance and After-Sales Service: This stage focuses on offering technical facilities to their users and ensuring consistent performance with durability while solving issues instantly to build trust among consumers.

Key players- Formance, DSS industries, diligent enterprises.

- Distribution Network Management: This stage involves the efficient distribution of structural insulated panels from manufacturing plants to the required destination locations across various geographic regions.

Key players- Kingspan Group, Nohara Holdings, Inc., Bondor.

Top Vendors in the Structural Insulated Panels (SIPs) Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Kingspan Group |

Ireland |

Strong focus on sustainability and innovation |

Kingspan provides aesthetic flexibility with a vast range of insulated metal panels, insulated roof panels, architectural wall panels, and facade systems. |

|

Metl-Span (Nucor) |

Texas |

Superior thermal efficiency and sustainability |

Metl-Span is an industry-leading manufacturer of insulated metal wall & roof panels for a variety of applications. |

|

PFB Corporation |

Canada |

Sustainable construction practices |

In December 2024, the Plasti-Fab and Insulspan divisions of PFB Corporation, which included its structural insulated panel operations |

|

Alubel S.p.A |

Italy |

Construction general |

The company is focused on the growing demand for its products, driven by market trends like energy-efficient construction, the expansion of cold storage facilities. |

|

Rautaruukki Corporation (SSAB) |

Sweden |

Expertise in steel-based building products |

Ruukki Construction offered complete steel-based roofing and wall solutions for buildings. |

Structural Insulated Panels (SIPs) Market Companies

- Kingspan Group

- Metl-Span (Nucor)

- PFB Corporation

- Alubel S.p.A

- Rautaruukki Corporation (SSAB)

- Owens Corning

- SIPA (Structural Insulated Panel Association Members)

- Hemsec Manufacturing Ltd

- Isopan S.p.A

- Premier SIPs

- Extreme Panel Technologies, Inc.

- EconCore N.V.

- Innova Eco Building System

- Foard Panel Inc.

- MBC Timber Frame

Recent Developments

- In September 2025, Nucor Corporation unveiled plans to invest in a state-of-the-art manufacturing facility dedicated to producing structural insulated panels. This investment is expected to bolster Nucor's production capacity and reduce operational costs, thereby enhancing its market competitiveness. By expanding its manufacturing capabilities, Nucor aims to meet the rising demand for high-performance building materials, which could significantly impact its market share.

(Source:https://www.ainvest.com ) - In December 2024, AWIP collaboratively launched FASSADE with Bellara to offer a versatile solution for a wide range of single skin metal panels. Bellara Steel Siding products can be integrated into the system and can be easily attached using hat channels fastened through the tongue and groove joint.

(Source: https://www.buildingenclosureonline.com) - In May 2024, Mayor Steve Rotheram officially launched a press machine at Hemsec's structural insulated panel manufacturing hub. This machine is a paradigm of state-of-the-art. This groundbreaking technology is positioned to drive crucial innovation in the construction sector and a fabric-first approach to achieving a net-zero built environment, particularly in the area of social and affordable housing.

(Source: https://hemsec.com)

Segments Covered in the Report

By Product Type

- EPS (Expanded Polystyrene) Panels

- PUR/PIR (Polyurethane/Polyisocyanurate) Panels

- Glass Wool Panels

- Other Panels (XPS, Phenolic, etc.)

By Facing Material

- OSB (Oriented Strand Board)

- Cement Board

- Gypsum Board

- Metal Sheets

- Others

By Application

- Walls

- Roofs

- Floors

By End-Use Industry

- Residential

- Commercial

- Industrial

By Distribution Channel

- Direct Sales (Manufacturers to Builders/Contractors)

- Indirect Sales (Distributors, Dealers, Retailers)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content