What is the Busbar Market Size?

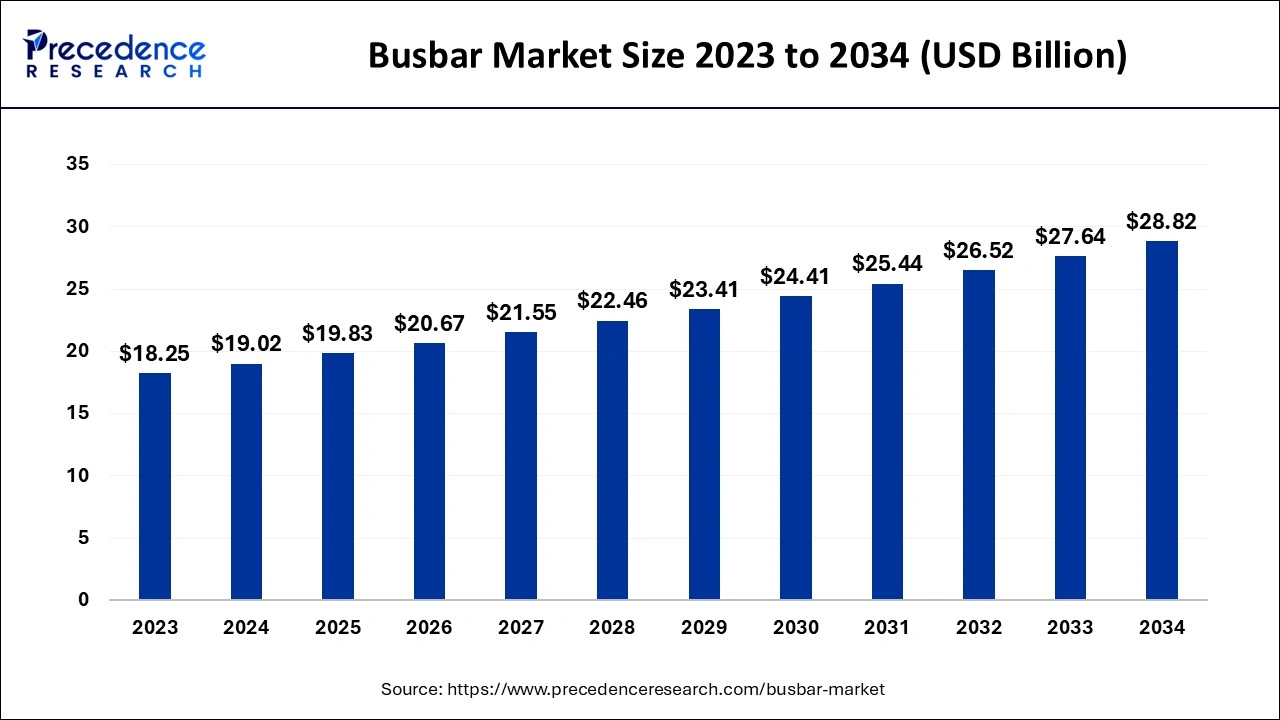

The global busbar market size is valued at USD 19.83 billion in 2025 and is predicted to increase from USD 20.67 billion in 2026 to approximately USD 28.82 billion by 2034, expanding at a CAGR of 4.24% from 2025 to 2034. The rising demand for power generation and distribution in economically developing countries is driving the growth of the busbar market.

Busbar Market Key Takeaways

- In terms of revenue, the global busbar market was valued at USD 19.02 billion in 2024.

- It is projected to reach USD 28.82 billion by 2034.

- The market is expected to grow at a CAGR of 4.24% from 2025 to 2034.

- Asia Pacific dominated the busbar market in 2024.

- North America expects the fastest growth in the market during the forecast period.

- By material, the copper segment led the market in 2024.

- By material, the aluminum segment is predicted to witness significant growth in the market over the forecast period.

- By application, the industrial segment accounted for the largest growth in the market in 2024.

- By application, the commercial segment experienced substantial growth in the busbar market during the predicted period.

- By conductor material, the copper busbars segment dominated the market with a 62.80% share in 2024.

- By conductor material, the aluminum busbars segment is expected to grow at the highest CAGR of 6.90% over the forecast period.

- By application, the switchgear segment dominated the market with 26.70% share in 2024.

- By application, the UPS & data center power distribution segment is expected to grow at the highest CAGR of 8.10% over the forecast period.

- By end-user industry, the utilities segment held a 37.90% market share in 2024.

- By end-user industry, the renewables segment is expected to grow at the highest CAGR of 8.30% during the projected period.

- By sales channel type, the OEMs segment dominated the market with a 68.40% share in 2024.

- By sales channels type, the battery manufacturers segment is expected to grow at the highest CAGR of 7.60% during the study period.

How Can AI Impact the Busbar Market?

The integration of AI into electric or power supply management streamlines operational efficiency. It helps reduce utility and consumer costs and computational time and ensures reliability in the power supply system. Artificial intelligence resolves frequency system frequency changes, minimizes fault rate, and maintains voltage profile. It also helps reduce total electricity costs.

- In July 2024, Vertiv launched the Trinergy, next-generation uninterruptible power supply (UPS) for supporting high capacity and availability power demand driven by high-performance computing (HPC) and artificial intelligence (AI) applications.

Market Overview

The busbar is the electric device; it is the conductor or group of conductors that helps in efficiently distributing the power in the different electrical devices. The busbar is a metallic device with high conductivity. Busbar plays an important role in the central link for multiple electric connections. It streamlines the power distribution process with affordability and easy adaptability. The busbar can be found in different metals and in different sizes, depending on the process and operations. The rising industrialization and digitization across the industries are driving the expansion of the busbar market.

Busbar Market Growth Factors

- Rising industrial infrastructure: The increasing economic stability in the various regional countries accelerates the industrial infrastructure that drives the higher demand for efficient power distribution and supply that drives the demand for the busbar market.

- The rise in electricity demand: The increasing population and the rising disposable income are driving the demand for increased electricity, which causes the high-quality power distribution and supply medium that drives the growth of the market.

- Infrastructural development: The rapid growth in urbanization and the development of commercial and residential infrastructure in economically developed and developing countries drive the demand for efficient and effective power supply sources, which is driving the expansion of the market.

Market Concentration & Characteristics

The busbar market possesses a mix of characteristics, such as increasing demand for both aluminum and copper busbars, along with the presence of major market players across the globe. Furthermore, the choice between aluminum and copper busbars relies on factors such as cost, performance needs, and application requirements. Busbars are extensively used in distribution boards, transformers, and power distribution and transmission systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 28.82 Billion |

| Market Size in 2025 | USD 19.83 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.24% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

The rise in infrastructural development

The economic development in many countries that drive the infrastructural development, such as the increasing number of residential, commercial, and industrial infrastructure, is driving the demand for high-end power supply management or systems that can conduct electricity efficiently in the different electrical appliances. Additionally, the rising cases of replacement of old wiring and connectivity are driving the demand for the busbar market.

- In December 2024, a U.S.-based microinverter producer, Enphase Energy, launched a residential power control product that it says can support larger solar PV and energy storage systems without needing to upgrade the home electricity panel. The busbar power control software analyses and manages the power of residential solar panels and batteries.

Restraint

High prices

The increased and fluctuating prices of raw materials like copper, aluminum, and other conductive materials are limiting production and elevating production costs, which makes the system higher in cost and restrains the growth of the busbar market.

Opportunity

Technological advancements in the busbar

The significant advancement in busbar technologies that help improve performance and sustainability drives future opportunities for market expansion. The integration of the smart grid into the busbar is one of the significant advancements in the technology. The smart busbar includes sensors in it for providing real time insights on temperature, current flow, and other critical parameters. With the integration of IoT into the busbar, the electric system becomes more responsive and adaptive to changing conditions. Additionally, the diversion of people towards sustainability is driving the adoption of co-friendly material for manufacturing busbars, which also contributed to the growth of the market.

- In October 2024, Sunlite Recycling Industries Ltd, a leading manufacturer of copper products, announced a strategic forward integration and expansion into new product lines. The company's stock price has shown positive movement following this news.

Conductor Material Insights

The copper busbars segment dominated the market with a 62.80% share in 2024. The wide adoption of the copper busbar from various end-use industries, such as hospitals, manufacturing industries, data centers, and others, is due to several industries driving the demand for the segment. The copper busbar includes several benefits, such as increased efficiency, durability, cost-effectiveness, and flexibility. It requires lower maintenance, weather resistance, and compact designs, making it more convenient to use. The high-quality busbar is corrosion-resistant and plays an important role in the electrical flow of different electric appliances. The copper busbar can be found in different spaces, such as flat, hollow, round, custom-shaped busbars, and others. The flow of electricity depends highly on the shape of the busbar.

The aluminum busbars segment is expected to grow at the highest CAGR of 6.90% over the forecast period. There is an increased use of aluminum busbars in different industries and applications. These can be used in transformers, electric panel boards, and distribution boards. Aluminum has a larger surface area and lower conductivity than copper; they are economically affordable and lighter in weight. It is cost-effective, used in multiple applications in different electrical panels, easy to install and transport by weight, and provides great heat exchange and efficient thermal dissipation.

Application Insights

The industrial segment accounted for the largest growth in the busbar market in 2024. The busbar is used in different industrial applications, such as power distribution. It efficiently distributes the power to each of the electrical devices in the industry. The busbar plays an important role in distributing power to industrial machinery such as motors and other things. It provides power to the renewable energy system, data centers, electrolysis processes, and others.

The commercial segment saw substantial growth in the busbar market during the predicted period. The rising economic growth drives the rise in urbanization and drives the demand for efficient electric supply and distribution devices that drive the demand for the busbar in commercial applications. The rising commercial infrastructure, such as the rising construction of commercial buildings such as corporate offices, malls, hospitals, restaurants, schools, and others, is creating the demand for an electric supply system that helps in the seamless distribution of electricity for effective operations.

The switchgear segment dominated the market with a 26.70% share in 2024. The dominance of the segment can be attributed to the growing energy demand, along with the need for a more efficient power distribution network globally. Also, initiatives to support smart grids and energy efficiency create lucrative opportunities for busbars to switch gears further.

The UPS & data center power distribution segment is expected to grow at the highest CAGR of 8.10% over the forecast period. The growth of the segment can be credited to the surge in sustainability goals, rising power densities, and ongoing adoption of the smart grid. Furthermore, the rising adoption of modular energy-efficient UPS systems can improve data center resilience and reliability.

End-Use Industry Insights

The utilities segment held a 37.90% market share in 2024. The dominance of the segment can be linked to the ongoing expansion and modernization of the aging power infrastructure, coupled with the need for smooth, efficient distribution in renewable energy integration projects. Utilities have to ensure a consistent power supply, particularly in critical infrastructure.

The renewables segment is expected to grow at the highest CAGR of 8.30% during the projected period. The growth of the segment can be driven by the rapid integration of renewable energy sources such as wind and solar into the grid, which requires efficient and flexible power distribution solutions that busbars offer.

Sales Channel Type Insights

The OEMs segment dominated the market with a 68.40% share in 2024. The dominance of the segment is owing to the growing demand for electricity across commercial, residential, and industrial sectors across the globe. Moreover, technological advancements are leading to more modular, compact, and flexible busbar designs to improve energy efficiency.

The battery manufacturers segment is expected to grow at the highest CAGR of 7.60% during the study period. The growth of the segment is due to the increasing need for energy storage systems (ESS) and innovations in material science for better busbar performance. Busbars enhance system performance and reliability by increasing capacitance and minimizing inductance, which is necessary for battery systems.

Regional Insights

Asia Pacific dominated the busbar market in 2024. The growth of the market is attributed to the rising infrastructural development and the rise in the demand for electric supply. The rapidly growing residential, industrial, and commercial infrastructure is anticipated to increase demand for effective electric distribution and supply, which are contributing to the increased demand for the busbar. Additionally, the rising population and the economic stability in the regional countries are driving the demand for electric applications, and the rising presence of the factories is collectively driving the growth of the busbar market in the region.

- India is the third largest consumer and producer of electricity globally, with a 442.85 GW installed power capacity as of April 30, 2024. The power consumption in India in FY23 accounted for a 9.5% growth to 1,503.65 billion units owing to the rapidly growing population and rising per capita usage.

- India's installed capacity of renewable energy accounted for 203.19 GW, representing 45.5% of the overall installed power capacity.

- The power generation industry in India had the highest growth rate in the last 30 years in FY23. The highest power demand in the nation increased to 249.85 GW in June 2024.

North America expects the fastest growth in the market during the forecast period. The growth of the market is attributed to the rising presence of the factories and the commercial applications. Regional countries like the United States and Canada are the most economically stable countries with increased commercial and industrial infrastructure development, which are anticipated to drive the demand for the busbar for the efficient supply and distribution of energy. Additionally, the ongoing technological advancement in electricity and electric appliances is accelerating the growth of the busbar market across the region. The total generation of electricity from utility-scale generators in the U.S. is 4,178 billion kilowatt-hours (kWh).

- In the United States, approximately 60% of the utility-scale electricity generation is produced from fossil fuel, including natural gas, coal, and petroleum, 21% from renewable energy, and 19% from nuclear energy.

Busbar Market Companies

- Siemens AG

- Connectivity

- Mersen

- Schneider Electric

- Rogers Corporation

- Legrand S.A.

- Eaton Corporation plc

- CHINT Group

- Friedhelm Loh Group

- ABB

Latest Announcements by the Industry Leaders

- Siemens got the agreement to acquire the Trayer Engineering Corporation (Trayer), a California-based leader in designing and manufacturing medium voltage secondary distribution switchgear suitable for below-ground and outdoor applications.

- Rogers Corporation signed a lease on a factory in Monterrey, Mexico, for the manufacturing of advanced busbar and engineering services. Rogers' advanced ROLINX busbars provide power distribution solutions to a number of applications in renewable energy, electric and hybrid-electric vehicles (EV/HEV), mass transit, and industrial markets.

- In November 2024, Eaton launched the new xEnergy Elite low voltage motor control and power distribution center with a capacity of up to 7,500 A and 690 VAC design to provide enhanced flexibility and uptime with maintenance cost savings and for industries with critical applications such as mining.

Recent Developments

- In April 2025, LONGi Green Energy Technology, a global leader in solar innovation, unveiled the upgraded Hi-MO 9 module powered by its HPBC 2.0 technology in Anhui, China. The latest iteration achieves a groundbreaking 24.8% conversion efficiency and a maximum power output of 670W, outperforming mainstream TOPCon modules by 40W in mass production.

- In September 2024, a Japanese technology company, Asahi Kasei, launched a new material solution for enhanced EV battery safety. A flame-retardant and highly flexible nonwoven fabric, LASTAN™ is an outstanding alternative to conventional materials for thermal runaway protection. It can be used in top covers, busbar protection sleeves, and other applications within the EV battery pack.

Segments Covered in the Report

By Conductor Material

- Copper Busbars

- Aluminum Busbars

- Brass Busbars

- Other Alloys

By Power Rating

- Low Power

- Medium Power

- High Power

By Insulation Type

- Laminated Busbars

- Insulation Material

- Kapton

- Tedlar

- Mylar

- Epoxy Powder Coating

- Tonnex

- Polyester Film

- PVF Films

- Polyester Resin

- Heat-Resistant Fiber

- Polyimide Film

- Insulation Material

- Bare Busbars

- Powder-Coated Busbars

- Insulated Busbars

- Air Insulated Busbars

- Sandwich Insulated Busbars

By Type (Construction/Design)

- Single Conductor Busbars

- Multi Conductor Busbars

- Solid Busbars

- Flexible Busbars

- Busbar Trunking Systems/Busways

- Rigid Busbars

- Hybrid Busbars

- Molded Busbars

- Stamped Busbars

By Application

- Switchgear

- Panel Boards

- Distribution Boards

- Substations

- Transmission Substations

- Distribution Substations

- Collector Substations (Renewables)

- Industrial Substations

- Bus Ducts / Bus Trunking Systems

- Transformers

- Battery Banks / Energy Storage Systems (BESS)

- UPS and Data Center Power Distribution

- Others

By End-Use Industry

- Utilities

- Power Generation (e.g., Thermal Power Plants, Nuclear Power Plants, Hydroelectric Power Plants)

- Transmission & Distribution Networks (e.g., Grid Infrastructure, Substations, Switchyards)

- Substations (e.g., Step-up Substations, Step-down Substations, Switching Substations)

- Smart Grid Infrastructure

- Rural Electrification Projects

- Industrial

- Manufacturing (e.g., Automotive Manufacturing, Electronics Manufacturing, Heavy Machinery Manufacturing,

- Consumer Goods Manufacturing)

- Metals & Mining

- Chemicals & Petroleum (e.g., Refineries, Petrochemical Plants, Fertilizer Plants)

- Industrial Automation (e.g., Robotics, Automated Assembly Lines)

- Data Centers

- Pulp & Paper

- Food & Beverage Processing

- Textile Industry

- Pharmaceuticals

- Cement Industry

- Oil & Gas (e.g., Onshore, Offshore, Pipelines)

- Defense & Aerospace (Manufacturing Facilities)

- Commercial

- Business Centers & Office Spaces

- Shopping Complexes & Retail Facilities

- Hospitals & Healthcare Facilities

- Educational Institutions (e.g., Universities, Schools)

- Hotels & Hospitality

- Sports Arenas & Entertainment Venues

- Public Buildings (e.g., Government Offices, Convention Centers)

- Banking & Financial Institutions

- IT Parks & Commercial Complexes

- Residential

- Single-Family Homes

- Multi-Family Dwellings (e.g., Apartments, Condominiums)

- High-Rise Buildings

- Automotive/Transportation

- Electric Vehicles (EVs)

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles (FCEV)

- EV Charging Infrastructure

- Railways & Metros (e.g., Locomotives, Signalling Systems, Traction Substations)

- Ports & Airports (e.g., Ground Power Units, Terminal Buildings)

- Marine & Shipbuilding

- Electric Vehicles (EVs)

- Renewables

- Solar Power (e.g., Solar Farms, Rooftop Solar Installations)

- Wind Power (e.g., Onshore Wind Farms, Offshore Wind Farms)

- Hydroelectric Power Plants

- Geothermal Power Plants

- Battery Energy Storage Systems (BESS)

- Microgrids

- Hybrid Renewable Energy Systems

- Telecom

- Telecommunication Towers

- Data Centers (shared with Industrial, but specifically focusing on telecom infrastructure)

- Communication Hubs

- Broadcasting Stations

By Sales Channel Type (Specific to EV Busbars, but can be broadly applied)

- Battery Manufacturers

- OEMs

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting