Electrical Steel Market Size and Forecast 2025 to 2034

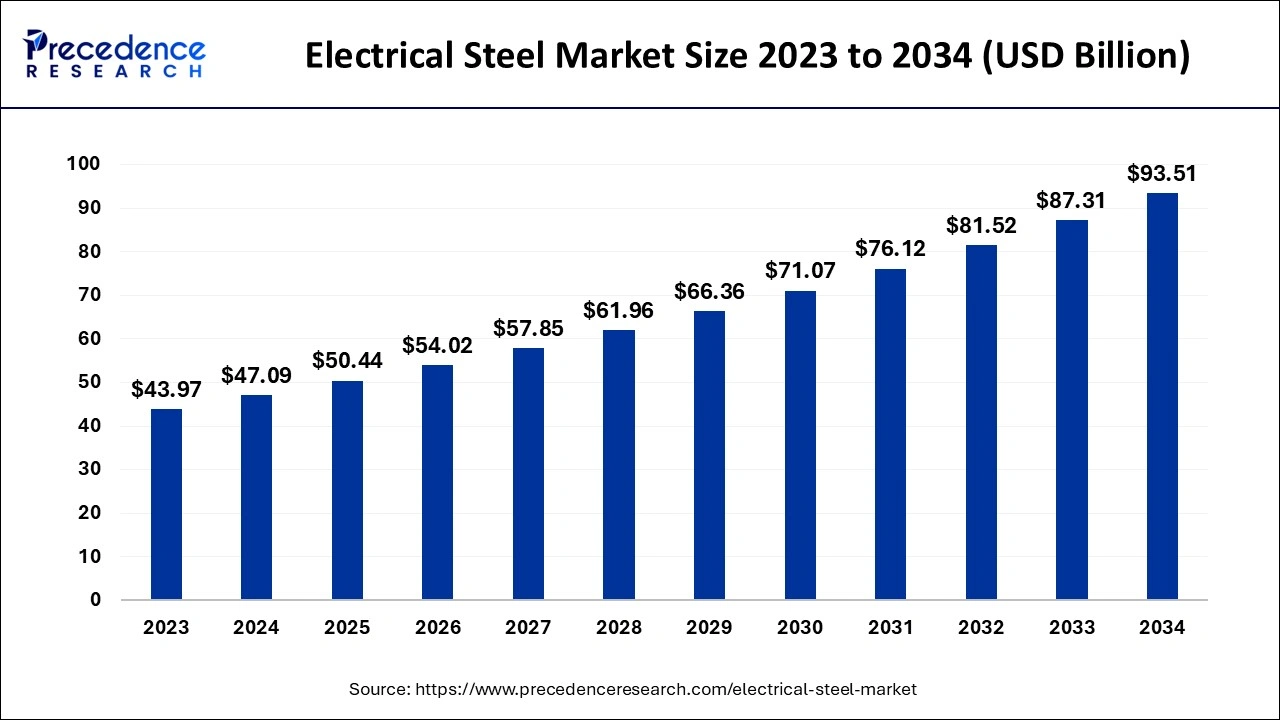

The global electrical steel market size is estimated at USD 47.09 billion in 2024, and is projected to hit around USD 50.44 billion by 2025, and is anticipated to reach around USD 93.51 billion by 2034, expanding at a CAGR of 7.10% from 2025 to 2034.

Electrical Steel Market Key Takeaways

- In terms of revenue, the market is valued at $50.44 billion in 2025.

- It is projected to reach $93.51 billion by 2034.

- The market is expected to grow at a CAGR of 7.10% from 2025 to 2034.

- By product, the non-grain oriented electrical steel (NGOES) segment has held the largest market share of more than 71% in 2024.

- By application, the transformer segment accounted for 53% of the overall market share in 2024.

- By end user, the energy segment has held a market share of 34% in 2024.

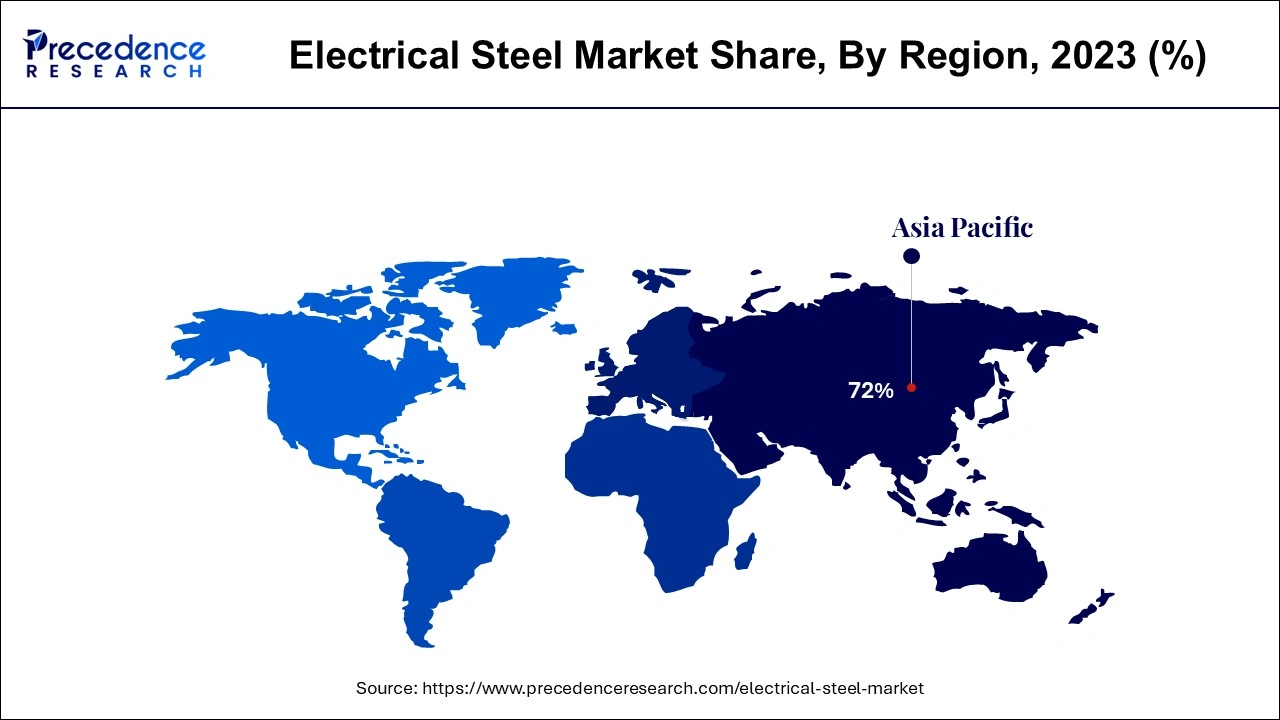

- By region, Asia Pacific region has contributed a revenue share of over 72% in 2024.

- North America region has held a market share of 9% in 2024.

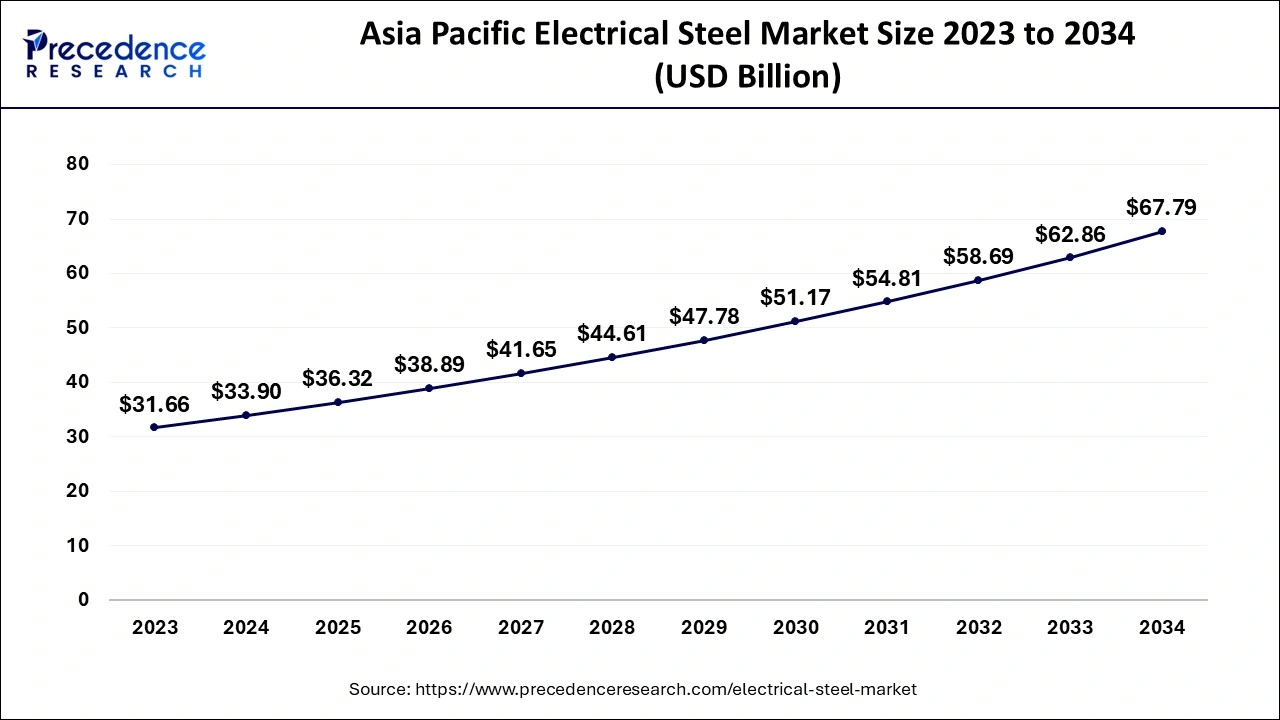

Asia Pacific Electrical Steel Market Size and Growth 2025 to 2034

The Asia Pacific electrical steel market size is evaluated at USD 36.32 billion in 2025 and is predicted to be worth around USD 67.79 billion by 2034, rising at a CAGR of 7.17% from 2025 to 2034.

The Asia Pacific market is anticipated to have the fastest growth in terms of volume and in terms of revenue when it comes to the electrical steel market. The reasons for the growth of the electrical steel market in this region is the existence of the largest market for power Transformers. There is a great demand for power Transformers in many nations like China India in Indonesia in the Asia Pacific region. China is one of the largest manufacturers of the power Transformers across the globe. India is also expected to have a growth at a considerable rate due to various factors like growing demand for renewable energy sector, increased demand for energy and increase in the population and urbanization.

The European electrical steel market also holds a significant share in the overall industry and it is expected to see a substantial growth in the future. due to the proliferating automotive and manufacturing sectors in the European region the demand for this product is expected to grow. Germany dominates the domestic automotive market in the European region as it has leading automotive producers. Due to an increased emphasis on electrification of the vehicles the demand for automotive motors will boost this region's market growth.

What Are the Key Trends in the North American Electrical Steel Market?

The North American electrical steel market is expected to witness significant growth over the forecast period. The machinery and automotive sectors are major contributors to demand, as electrical steel is essential for manufacturing power generators, electric motors, and transformers. Also, investments in infrastructure enhancements and modernization projects throughout North America, from smart grids to renewable energy integration, are expected to propel the market.

The expansion of the automotive sector and the market for electric and hybrid vehicles is increasing demand for intricate electrical steel grades utilized in motors and generators, propelling growth. The application of electrical steel in the U.S. machinery sector is extensive, primarily serving to manufacture transformers, motors, and industrial equipment, leading to considerable consumption of electrical steel.

Market Overview

The pandemic had affected the electric steel market negatively. The disrupted operations of the manufacturing plants, halt in the infrastructure projects and the decline in the automobile production during the lock down had affected the market growth majorly. The demand for electricity across many nations had dropped during the lockdown. Electrical steel is the ferromagnetic material which has different quantities of silicon. It helps in reducing the dissipation of heat and therefore it is used across many industries. Dissipation of heat leads to energy wastage so there is an increased application of electrical steel in devices.

Increased focus of the governments on energy efficiency is promoting the product growth. In order to support the power generation in many countries like India, UAE, China Governments are coming up with initiatives which are foreseen to bolster the demand for this product. Due to the replacement of old transformers and advancements in transmission lines due to the trend of smart transformers there shall be rampant growth in the demand for this product. Electrical steel is able to provide higher efficiency and it is extremely sustainable. Under the sustainable development program of the United Nations the vendors of the electrical steel market shall have a lot of benefits in terms of revenues.

Key factors influencing future market trends

- Increase Demand for Electricity: Rising demand for electricity through rapid industrialization, population, and urbanization processes is highlighting the need for energy-saving electrical equipment. Electrical steel can perform high magnitudes and enhance the efficiency of the generator and transformer.

- Manufacturing potentiality: standardization of electrical steel will enable the countries to be on equal terms concerning international standards that will ensure that their economies become competitive, and consequently, it will lead to the proliferation of energy-efficient electrical components in the established markets.

Electrical Steel Market Growth Factors

Electrical steel is a soft magnetic material which has improved electrical properties and varied applications in electric motors, solenoids, generators, small relays and other. Electrical steel is also known as lamination steel or Transformers steel. It helps in reducing the dissipation of heat. Due to the presence of silicon in the electrical steel there is an increased resistivity and improved permeability. Due to these factors there's an increase in the demand for the generation of energy and transmission with the use of electrical steel. Increasing popularity of profoundly efficient, elite execution and low emission vehicles along with the regulations by the government regarding the vehicle discharge is driving the growth of electric vehicles.

- The electric vehicle is lightweight and helps in meeting the security principles. These factors provide new opportunities for the growth of this market.

- Increased per capita income in the developing regions like India Mexico and China will support the development of this product.

- Increase in the usage of electric cars across Europe is expected to helping the growth of the market during the forecast period.

Pictures of electrical industry and the electronics industry are making an effective utilization of electrical steel as it is able to provide abrasion resistance, improved durability, strength and vibration control. It also helps in reducing the production cost and improves the quality of the product. Owing to all of these reasons the electrical steel market is expected to grow during the forecast period.

Electrical Steel Market Trends

- Rising demand for high magnetic strength sheets in the rapidly growing electric vehicle (EV) market owing to its ability for enhancing the quality of steel lamination in motors and stators.

- Increased emphasis on reducing CO2 emissions with the development of innovative production methods for manufacturing sustainable and eco-friendly electrical steel.

- Continuous advancements in developing innovative products and manufacturing processes such as Spatially Optimized Diffusion Alloying (SODA) technology for improving the properties of electrical steel.

- Surging investments in renewable energy sources like solar and wind power are driving the demand for electrical steel which is a key material in generators of wind turbines and in transformers facilitating the efficient transmission of power and supply from renewable energy plants.

- Development of advanced and effective coatings providing insulation and tension like for grain-oriented electrical steel (GOES). The coatings improve the efficiency of electrical devices by reducing power loss and magnetostriction.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 93.51 Billion |

| Market Size in 2025 | USD 50.44 Billion |

| Market Size in 2024 | USD 47.09 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.10% |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-User, and Region |

| Region Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Type Insights

The grain oriented electrical steel segment is expected to have the fastest growth during the forecast period. there is a growth of electrical Transformers due to various factors like the upgradation of existing grid networks, initiatives for the smart grid development and increase in the demand for these electrical Transformers.

The rapid increase in the demand for electrical transformers will boost the adoption of grain oriented electrical steel during the forecast period. This segment is expected to grow at a CAGR of 4.6% in terms of volume. The demand for non-grain oriented electrical steel shell grow as there is an increasing demand for electric vehicles across varied nations the use of non-oriented electrical steel helps in building efficient hybrid electric vehicles which provides a better driving range and good performance.

Application Insights

The motor segment is anticipated to have the largest growth rate during the forecast period. In recent years the motor segment has shown a good growth in terms of volume. In the projection. The demand for electric motors shall increase as there is an increase in the penetration of electric vehicles across many developed and developing nations around the globe. Growing awareness regarding the usage of electrical steel and the benefits of his use are creating demand which is providing opportunities for electrical steel manufacturers.

Europe and North America are the regions that have maximum number of electrical vehicles on road as compared to the other developing nations. This happens to be the most important factor for the growth of this segment in Europe as well as North America. The supporting policies in this region are helping in the growth of the market. The grain oriented electric steel industry has great demand as it provides excellent power and permeability features. The grain oriented electrical steel is extensively used in large power Transformers and this is expected to support the growth of this segment.

Electrical Steel Market Top Companies

- ArcelorMittal (Luxembourg)

- Voestalpine AG (Austria)

- TATA Steel Limited (India)

- Thyssenkrupp AG (Germany

- JFE Steel Corporation (Japan)

- Baosteel (China)

- Nippon Steel & Sumitomo Metal Corporation (Japan)

- United States Steel Corporation (United States)

- POSCO (South Korea)

- SAIL India

Companies positive info

- Benxi Steel Group Co., Ltd. and Shougang Group have made large inroads into China's expanding electrical steel market with the support of the government and large investments in production capacity. The two companies can now meet the expected rising demand for premium electrical steel in China, as applications grow and demand rises for premium electrical steel, especially for power generation and transmission.

- Tata Steel, NIPPON STEEL CORPORATION, and Baosteel Group Corporation will maintain their leadership positions in the Asian markets based on their advanced capabilities and facilities to serve the global demand. These companies are also expanding production and investment in research and development to be able to meet the rising demand from the EV market.

Market Developments

- In February 2025, ArcelorMittal, a globally leading steel producer, announced investment of $1.2 billion into a cutting-edge facility at Mobile County, Alabama. The new plant will manufacture non-grain-oriented electrical steel (NOES) which is a key material utilized in renewable energy production, electric vehicle (EV motors) and industrial applications with an estimated capacity of producing up to 150,000 metric tons of NOES per year, subject to product mix.

- In January 2025, Jsquare Electrical Steel Nashik Private Limited, a wholly owned subsidiary of JSW Steel successfully completed Rs. 4,158 crore acquisition of thyssenkrupp Electrical Steel India Private Limited (tkES India). The acquisition focuses on production of granular electrical steel (GOES) with the goal of meeting the medium and long-term demand for GOES in India.

- In January 2025, Steel Authority of India Limited (SAIL), the state-owned steelmaker and John Cockerill India (JCIL), a technology firm, announced plans for investing around $692 million for setting up a downstream plant producing cold-rolled grain-oriented (CRGO) and cold-rolled non-oriented (CRNO) electrical steel. The new manufacturing plant scheduled for completion in 2027-2029, seeks to achieve 1.5 million tons of production volume annually.

- JFE Steel Corporation signed a memorandum of understanding in May 2021 to conduct a feasibility study with JSW Steel Limited (JSW). This memorandum of Understanding will be able to establish a grain oriented electrical steel sheet manufacturing and sales joint-venture company in India.

- In November 2020, Nippon Steel announced plans to invest nearly US $1 billion to expand its electrical steel sheet facilities at two different plants located in Japan., This will be completed by the year 2023 with manufacturing capacity expected to increase by approximately 40%.

Segments Covered in the Report

By Type

- Grain-oriented

- Non-grain-oriented

- Fully-Processed

- Semi-Processed

By Application

- Transformers

- Transmission

- Portable

- Distribution

- Motors

- 1hp - 100hp

- 101hp - 200hp

- 201hp - 500hp

- 501hp - 1000hp

- Above 1000hp

- Inductors

- Others

By End-User

- Energy

- Automotive

- Household Appliances

- Manufacturing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content