Electrical Insulation Materials Market Size and Forecast 2025 to 2034

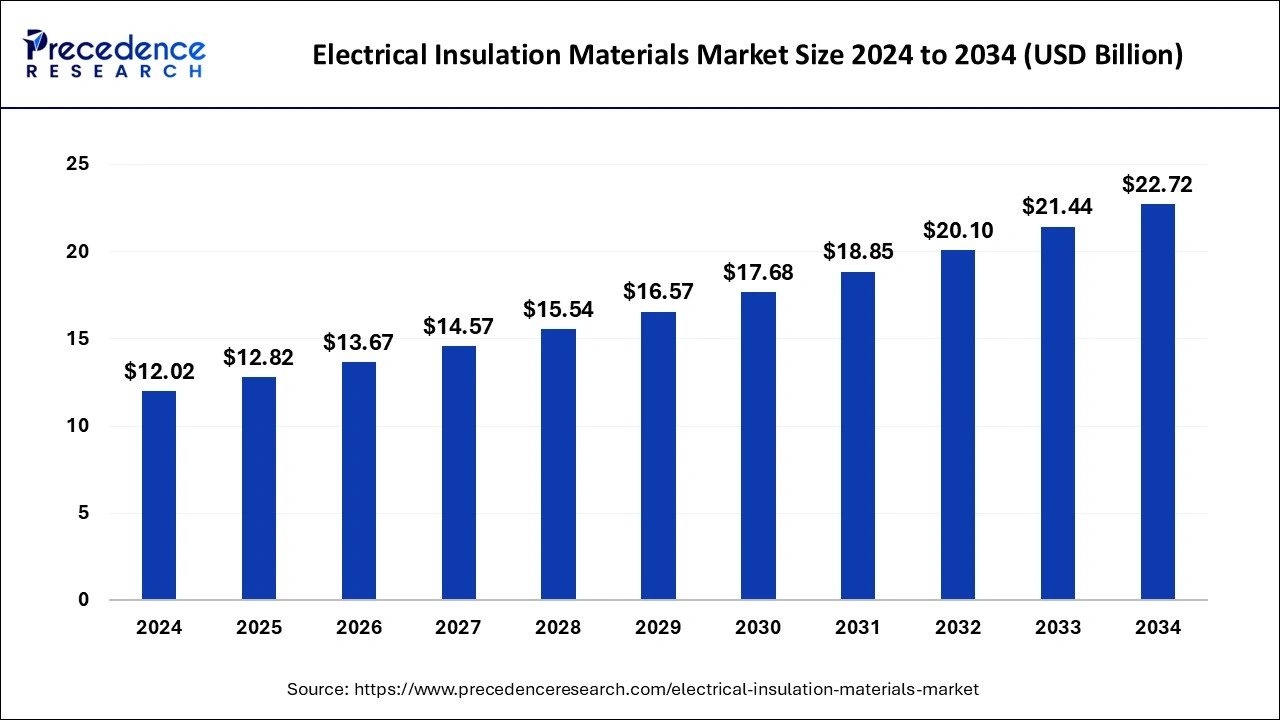

The global electrical insulation materials market size was valued at USD 12.02 billion in 2024 and is anticipated to reach around USD 22.72 billion by 2034, growing at a CAGR of 6.57% from 2025 to 2034. The expansion of power-producing industries and the rise in global electricity consumption are major growth factors in the electrical insulation materials market.

Electrical Insulation Materials Market Key Takeaways

- The global electrical insulation materials market was valued at USD 12.02 billion in 2024.

- It is projected to reach USD 22.72 billion by 2034.

- The electrical insulation materials market is expected to grow at a CAGR of 6.57% from 2025 to 2034.

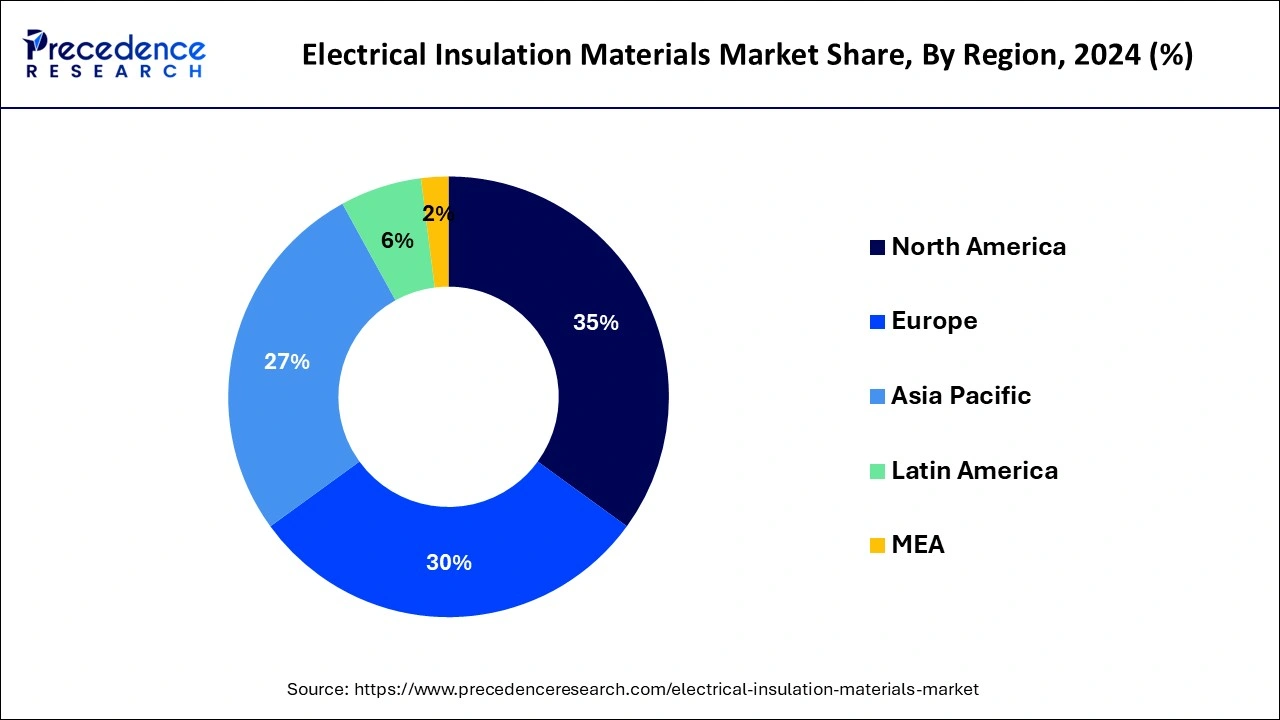

- North America led the market with the biggest market share of 35% in 2024.

- Asia Pacific is expected to show notable growth in the global market during the projected period.

- By type, in 2023, the thermoplastic segment has contributed more than 34% of market share in 2024.

- By application, the power transformers segment has recorded more than 27% of market share in 2024.

- By application, the electrical motors and generators segment is expected to show notable growth during the projected period.

How does AI impact the Electrical Insulation Materials Market?

AI technologies are revolutionizing the electrical insulation materials market. Integrating AI technologies in the manufacturing processes of insulation materials significantly enhances the quality of materials by improving the quality control process. AI-driven technologies automate manufacturing processes and reduce errors, enhancing production efficiency. AI also helps in developing better insulation materials that meet stringent regulations.

U.S. Electrical Insulation Materials Market Size and Growth 2025 to 2034

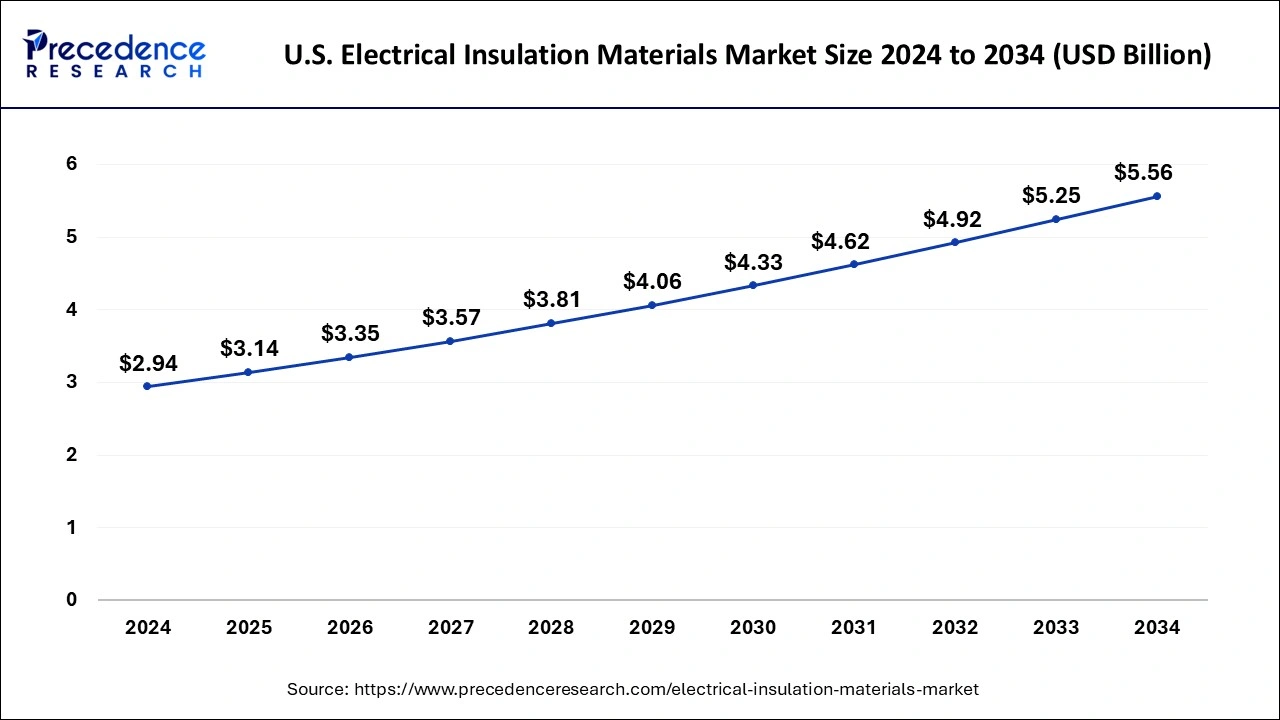

The U.S. electrical insulation materials market size was estimated at USD 2.94 billion in 2024 and is projected to surpass around USD 5.56 billion by 2034 at a CAGR of 6.60% from 2025 to 2034.

Considering North America, the U.S. was estimated to be the largest contributor to the electrical insulation materials market in 2024. The United States is ready to witness growing infrastructure investments, with a focus on innovating its old electrical grids and expanding its energy resources. These will also fuel the demand for advanced electrical insulation materials. Moreover, the rising emphasis on energy efficiency combined with the market's rising focus on environment-friendly insulation solutions can drive market growth.

The U.S. is at the forefront of the electrical insulation material market in North America, driven by its high electrical infrastructure capacity and grid modernization. As stated by the U.S. Department of Energy, funding under the Bipartisan Infrastructure bill will be utilized for the grid upgrades that exceed USD 13 billion. Companies such as DuPont and 3M are pouring money into high-performance insulating polymers to meet the future needs of the renewable energy and Electric Vehicle markets. UL Standards & Engagement is also developing and updating insulation safety standards.

Asia Pacific is expected to show notable growth in the global market during the projected period. The region's growth is fueled by rapid urban development, rising energy usage, and the expansion of electrical infrastructure. Increased demand for high-voltage equipment, renewable energy initiatives, and advancements in technology are driving market growth. Moreover, strict safety standards and the requirement for dependable power distribution systems are also contributing to the demand for effective electrical insulation materials in the region.

China is a major player in the Asia Pacific electrical insulation market, propelled by rapid urbanization and plans for significant expansion of the power grid as part of its 14th Five-Year Plan. State Grid Corporation of China is investing heavily in the construction of ultra-high-voltage transmission networks and creating a growing demand for high-performance insulation materials. Companies such as Sinoma and Zhejiang Rongtai are ramping up production of epoxy resins and mica-based insulator products to serve the domestic electrical insulation market and help meet export opportunities.

Market Overview

Electrical insulation materials are barriers for electric current, stopping it from flowing where it shouldn't and ensuring electrical systems work safely and efficiently. These materials have special qualities like being strong against electricity, not conducting electricity well, and staying stable even at high temperatures. They're important because they keep wires and parts separate, preventing problems like short circuits or leaks. Plus, they can handle changes in temperature, exposure to chemicals or water, and physical stress.

Electrical insulation materials are crucial in many areas, from transmitting power to electronics, cars, and planes, making sure electricity works reliably, and protecting people and equipment from electrical dangers. Surge protection devices are also important, they're guards that shield electrical setups from sudden changes in voltage, and they use insulation materials to do their job. Most of the materials used in these devices are also common in household applications.

Electrical Insulation Materials Market Growth Factors

- With the increasing electricity demand across the globe, the need for electrical insulation is rising, which boosts the growth of the market.

- Shifting consumer preference toward electric vehicles, which require electrical insulation materials, fuels the market growth.

- Governments are investing in developing transformers, towers, and electric poles to meet the overall energy demand, which contributes to market expansion.

- The rapid expansion of powerhouses in emerging countries further drives market growth.

- The rising production and adoption of electronic devices positively impact the market.

- The increasing demand for energy-efficient devices further propels the growth of the market

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.57% |

| Global Market Size in 2025 | USD 12.82 Billion |

| Global Market Size by 2034 | USD 22.72 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising interest in electric cars

Electrical insulation materials play a crucial role in electric vehicles (EVs) by shielding electronic parts and reducing electrical conductivity. The demand for EVs is rising due to the focus on fuel efficiency, emissions targets, and shifting consumer preferences toward sustainability. These materials are essential as they prevent electricity from leaking out of power lines, thereby averting potentially catastrophic electric shocks. This creates a steady demand for the electrical insulation materials market.

Each year, electric shocks cause nearly 1,000 fatalities in the United States alone, leading to severe conditions like brain paralysis and heart muscle failure. Also, increased government investment in electric infrastructure construction, such as poles, towers, switches, and transformers, is driving the growth of the electrical insulation materials market.

- In March 2024, BMW launched the iX xDrive50 in India, priced at Rs 1.39 crore, ex-showroom. The new all-electric iX xDrive50 will be available at all BMW showrooms and sold in India as CBUs. It has a range of 635 km and can be charged in 35 minutes.

Restraint

Stringent government regulations

The growth of the electrical insulation materials market is impeded due to strict environmental regulations and sustainability concerns. Industries are focusing more on adopting environmentally friendly practices and materials as general awareness related to environmental issues intensifies. This shift leads to the limited use of insulation materials, which contain hazardous chemicals and have a negative ecological impact globally during generation, use, or disposal.

Materials used for electrical insulation production include ceramics, mica, cellulose, and others. Some of them are crude oil-based products; hence, their high cost can also affect the manufacturing of electrical insulators, which can hamper the growth of the electrical insulation materials market.

Opportunity

Rapid urbanizations

The electrical insulation materials market is experiencing growth due to rapid urbanization and the expansion of construction industries. North America and Europe are expected to see increased demand for re-insulation, which boosts market growth globally. The expansion of transmission and distribution networks is also driving market growth, as these networks facilitate the smooth flow of electricity through various devices like generators and transformers.

Another significant factor contributing to the growth of the electrical insulation materials market is the rise in production and adoption of protection devices. Moreover, the expansion of power generation sectors and the growing use of electricity worldwide are also fueling demand for electrical insulation materials.

Type Insights

The thermoplastic segment dominated the electrical insulation materials market share in 2023 and is expected to continue this dominance over the forecast period. These materials can be molded into different shapes and extruded into films and fibers. This is because of the physical properties of these materials, such as low melting point, moldable, flexible, strong, recyclable, and durable. Examples of thermoplastic materials are polyesters, polyvinyl chloride, polyamides, polyethylene, and polystyrene.

- In November 2023, Audia Elastomers, a global supplier of innovative elastomer materials, launched its OP line of thermoplastic elastomers (TPEs) based on marine waste plastics. The OP line of elastomer materials includes products with up to 45% marine waste and 70% total recycled material content in a wide range of hardness from 35 Shore A to 95 Shore A.

Application Insights

The power transformers segment dominated the electrical insulation materials market in 2024 and is predicted to grow at a lucrative pace over the forecast period. This is attributed to rising infrastructural spending, increasing investment by market players in the expansion of transmission, and growing electricity demand. Additionally, the increase in focus on renewable electric power generation and the replacement of current old power transformers are some major factors anticipated to fuel segment growth over the forecast period.

- In February 2023, one of the leading players in the manufacturing and supply of power conditioning equipment and power transformers, Servokon, is all set to exhibit its energy prowess by showcasing a power transformer with a massive capacity of 16,000 KVA at Elecrama 2023.

- In May 2022, Krempel GmbH announced that Nomex 910, which DuPont previously developed, will now be produced and sold by Krempel. The product is a unique insulating material comprised of high-quality electrical grade cellulose pulp and web-like binders that can be used as interlayer insulation in liquid-immersed transformers for distribution and small power transformers.

In the electrical insulation materials market, the electrical motors and generators segment is expected to show notable growth during the projected period. The rise in supply and demand for electricity is augmenting the segment's growth. Also, the improved efficiency and inexpensive services provided by electric generators are boosting the segment's growth further during the forecast period.

Electrical Insulation Materials Market Companies

- 3M Company (U.S.)

- Nitto Denko Corporation (Japan)

- Achem Technology Corporation (Taiwan)

- Tesa SE (Germany)

- Intertape Polymer Group Inc. (Canada)

- Scapa Group plc (UK)

- Avery Dennison Corporation (U.S.)

- Shurtape Technologies, LLC (U.S.)

- HellermannTyton Group PLC (UK)

- Teraoka Seisakusho Co., Ltd. (Japan)

- Shanghai Yongguan Adhesive Products Corp., Ltd. (China)

- Coroplast Fritz Müller GmbH & Co. KG (Germany)

- Advance Tapes International Ltd. (UK)

- Shanghai Huaxiang Adhesive Products Co., Ltd. (China)

- Guangzhou Broadya Adhesive Products Co., Ltd. (China)

- PPM Industries S.p.A. (Italy)

- Pro Tapes & Specialties, Inc. (U.S.)

Recent Developments

- In April 2025, Fonon Technologies, a marketing and systems integration provider of state-of-the-art laser technologies for material processing and defense infrastructures, launched its advanced wire processing system – the DTWP-6010. It is a fully automated laser-powered machine for optimized wire harness board assembly that strips, marks, and cuts wires of various gauges, setting a new standard for efficiency and reliability in critical applications. (Source: https://www.businesswire.com)

- In January 2025, V-Marc India Limited, a leading manufacturer of wires and cables in India, announced its expansion plans in Kerala. Known for its embrace of technology and innovation through the launch of new products, Flexi-TUF eB-HFFR Wires and eB+ Power Cables, developed through extensive research and powered by electron beam (eBeam) technology. ( Source: https://www.apnnews.com)

- In September 2024, Asahi Kasei launched a new material solution grade of LASTAN™ flame-retardant nonwoven fabric for enhanced EV battery safety. A flame-retardant and highly flexible nonwoven fabric, LASTAN™ is an outstanding alternative to conventional materials for thermal runaway protection. It can be utilized in top covers, busbar protection sleeves, and other applications within the EV battery pack. (Source: https://www.asahi-kasei.com)

- In December 2024, Sumitomo Electric launched ultra-thin insulated powder magnetic cores for high-performance axial flux motors. The powder magnetic cores have an ultra-thin, high-voltage insulation coating of 40 μm thickness and 5 kV insulation resistance. They are formed and heat-treated to exhibit good soft magnetic properties and a high degree of three-dimensional shape freedom. (Source: https://www.metal-am.com)

- In September 2023, Avery Dennison Performance Tapes unveiled the Volt Tough range of electrical insulation tape products. This high-end range of electrically insulative, single-sided filmic tapes is designed to address the challenges of insufficient electrical insulation in EV battery packs.

- In May 2023, Solvay announced the launch of KetaSpire KT-857, a new polyetheretherketone (PEEK) extrusion compound designed specifically for copper magnet wire insulation in electric motors.

Segments Covered in the Report

By Type

- Thermoplastic

- Thermosets

- Epoxy Resin

- Silicone Rubber

- Polyimide

- Ceramics

- Fiberglass

- Mica

- Others

By Application

- Power Transformers

- Distribution Transformers

- Electrical motors and Generators

- Wires and Cables

- Switchgear

- Batteries

- Circuit Breakers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting