What is the Transformers Market Size?

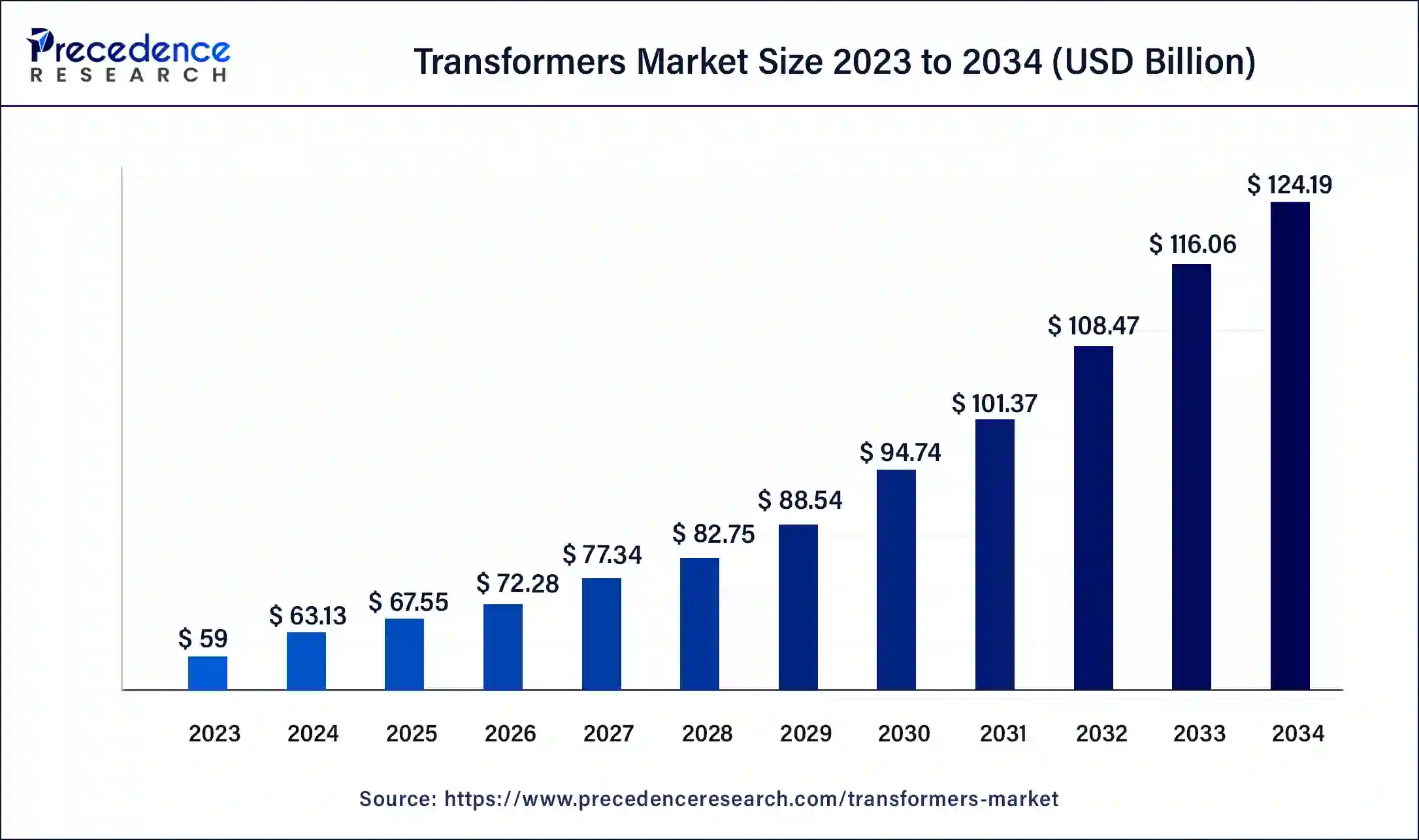

The global transformers market size accounted for USD 67.55 billion in 2025and is predicted to increase from USD 72.28 billion in 2026 to approximately USD 131.96 billion by 2035, expanding at a CAGR of 6.93% from 2026 to 2035.

Transformers Market Key Takeaways

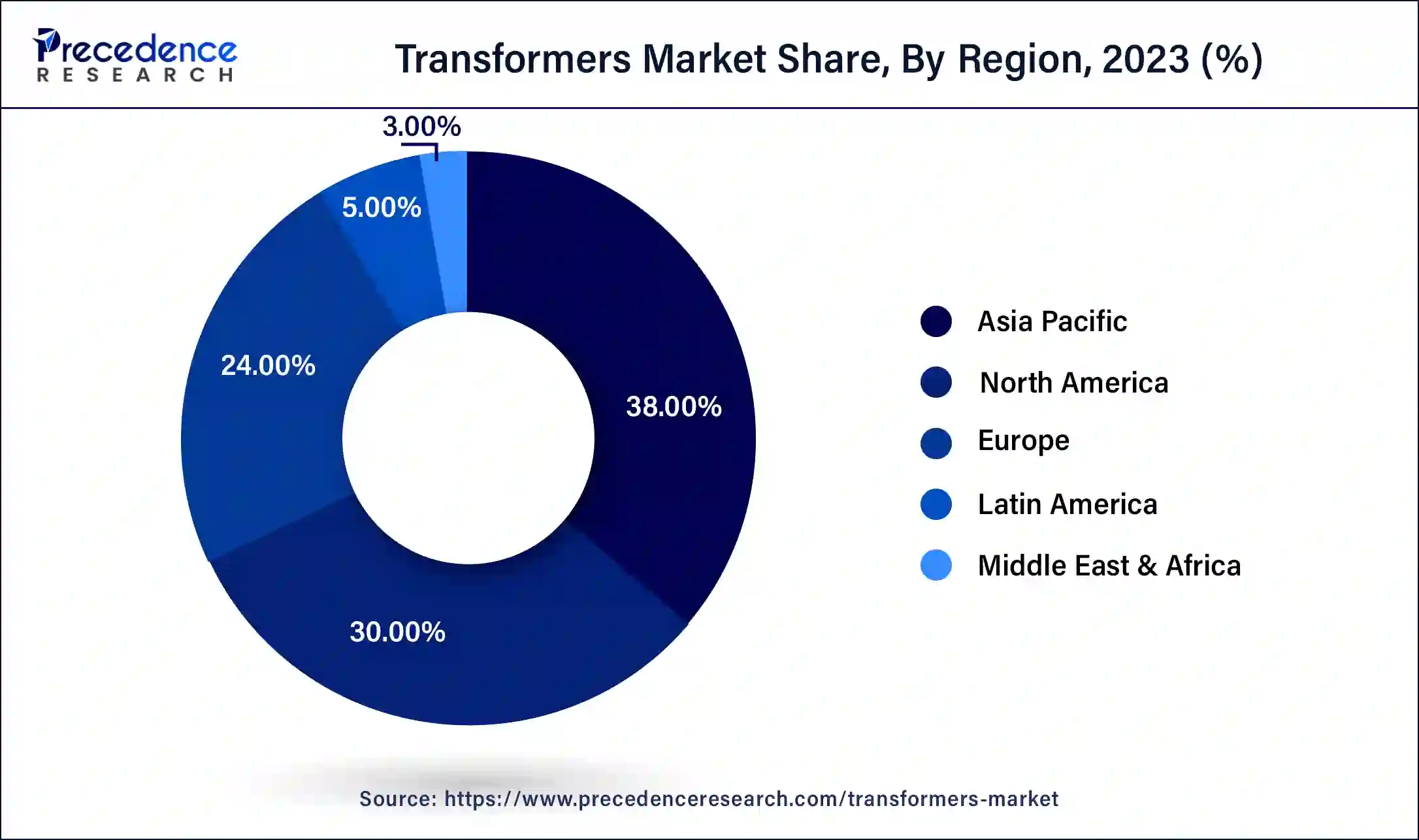

- Asia Pacific led the global market with the highest market share of 38% in 2025.

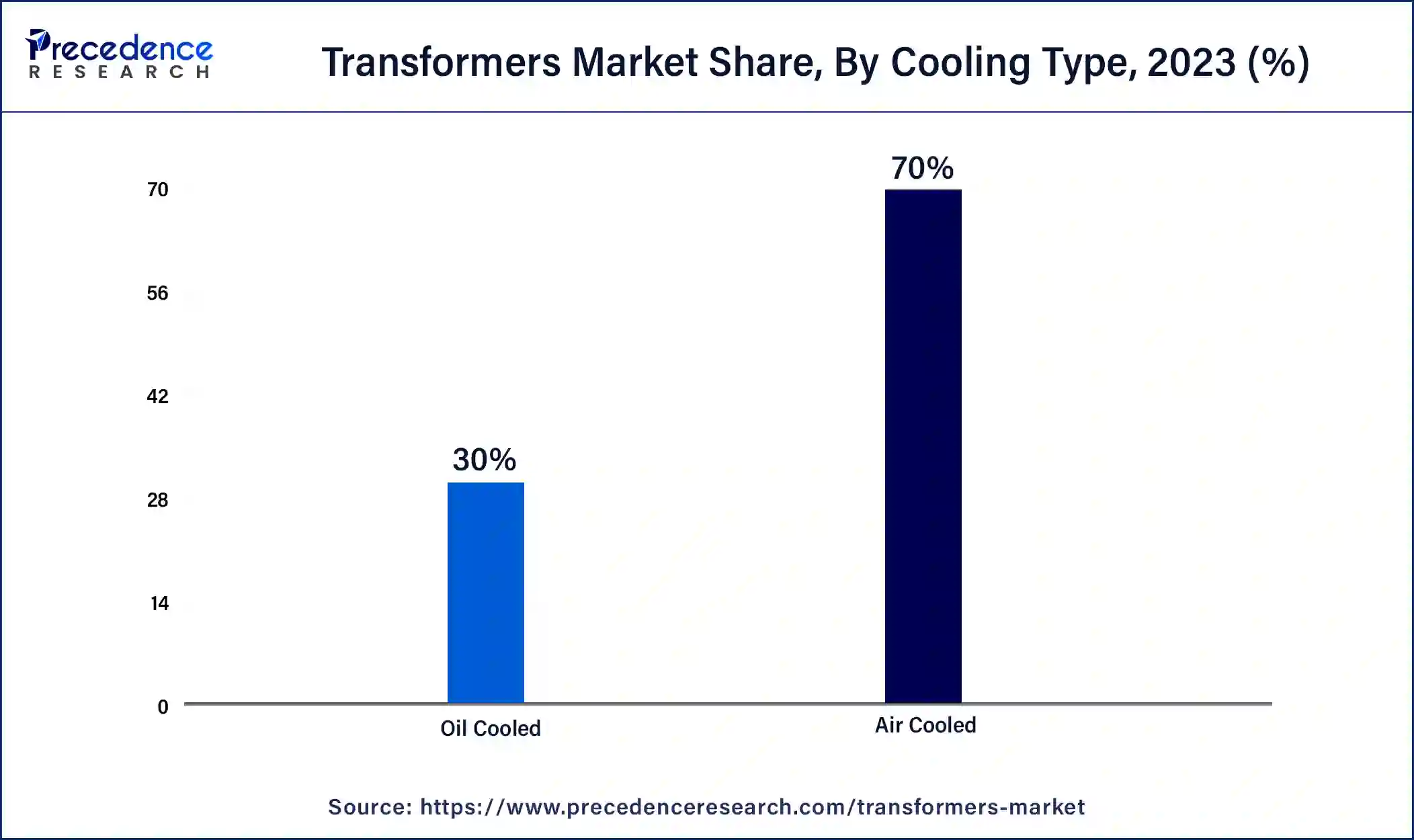

- By Cooling Type, the air cooled segment contributed more than 70% of the market share in 2025.

- By Type, the power transformers segment is expected to hold the largest market share from 2026 to 2035.

- By Phase, the three phase segment transformer is expected to grow at a significant rate from 2026 to 2035.

- By Application, the industrial segment is expected to dominate the market from 2026 to 2035.

Market Overview

The transformer market encompasses power and distribution transformers, which has experienced a significant growth in recent years with the increasing demand for electricity across various industries and regions. Transformers are essential components in power generation, enabling efficient transmission, distribution and regulation of electrical energy. Their ability to modify voltage levels ensures the reliable delivery of electricity to end-users. Transformers play a crucial role in power generation by facilitating the efficient transmission and distribution of electrical energy. These devices enable the conversion of voltage levels, allowing electricity to be transmitted over long distances with minimal losses.

According to Indian Electrical and Electronics Manufacturers Association statistics, the output of distribution transformers has climbed by 7% while the production of power transformers has only increased by 2%.

According to the International Energy Agency, the amount of wind-generated power reached more than 2 100 TWh in 2022, an all-time high rise of 265 TWh (up 14%). After solar PV, this technology saw the second-highest increase among all forms of renewable energy. However, the average annual generation growth rate has to rise to roughly 17% to keep up with the Net Zero Emissions by 2050 Scenario, which anticipates over 7,400 TWh of wind power output in 2030.

According to the India Brand Equity Foundation, India had 168.4 GW of installed renewable energy capacity (including hydro) as of January 31, 2023, making up 40.9% of the nation's total installed power capacity. Estimates place solar energy's contribution at 63.3 GW, followed by wind energy 41.9 GW, biomass energy's 10.2 GW, small hydropowers 4.92 GW, waste-to-energy's 0.52 GW, and hydropower's 46.85 GW.

Transformers Market Growth Factors

The global transformers market is observed to be accelerated with the rising power consumption and increasing industrialization across the globe. As economies strive for energy efficiency and reduced carbon emissions, upgrading and expanding power infrastructure becomes crucial. Emerging economies are witnessing rising investments in power generation and transmission, further boosting the transformer market.

Moreover, government programs for upgrading the current power grids and installing strong and superior power transformers will benefit the market in the upcoming years. Innovation in transformer design and technology, such as smart gridsand digital monitoring systems, is enhancing operational efficiency and reliability. The advent of electric vehicles and charging infrastructure is also spurring demand for transformers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 67.55 Billion |

| Market Size in 2026 | USD 72.28 Billion |

| Market Size by 2035 | USD 131.96 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.93% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Power Rating, By Cooling Type, By Insulation, By Phase, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Integration of renewable energy

The global shift towards renewable energy sources, such as wind and solar power, requires efficient grid integration. Transformers play a crucial role in stepping up or stepping down the voltage to match the requirements of the grid and consumers, enabling the integration of renewable energy into the existing power systems. For instance, according to a recent report from International Energy Agency, in comparison to investments in oil exploration and production, which total USD 370 billion, the investment in solar energy is expected to reach USD 380 billion in 2023. Thus, the integration of renewable energy is expected to propel market growth over the forecast period.

Restraint

High initial cost

Transformers, especially high-voltage and specialized transformers, can be expensive to manufacture and install. The initial investment required for the procurement, installation, and maintenance of transformers can deter some organizations and regions from adopting or upgrading their transformer infrastructure. Power transformer prices vary widely depending on factors like BIL rating, MVA rating, core design, required assured losses, tank design, and others. Thus, the high initial cost of high-voltage transformers is expected to hamper the market growth over the forecast period.

Opportunity

Growing collaboration activities

The increasing collaboration in the transformers industry is one of the major factors that is observed to provide enormous potential for market growth during the forecast period. In May 2023, the Tel Aviv, Israel-based VRT Power Ltd.'s North American brand got acquired by Northern Transformer Corporation. Leading utility clients highly respect VRT Power's best-in-class technology for low noise, customized solutions, small footprints and proven dependability. The acquisition allows Northern Transformer to immediately benefit its customers and is precisely in line with the corporate goal. Thereby, such collaboration and other business activities present definite opportunities for the market to grow.

Segment Insights

Type Insights

Based on the type, the global transformer market is segmented into distribution transformers, power transformers,s and others. The power transformers segment is expected to hold the largest market share over the forecast period. The segment growth is attributed to the benefits of power transformers including stable power supply, reduced energy losses and enhanced grid performance. Power transformers enable the conversion of voltage levels, allowing electricity to be transmitted over long distances at high voltages to minimize energy losses and then distributed at lower, safer voltages to end-users. Moreover, by stepping up voltage for long-distance transmission, power transformers reduce energy losses due to resistance in power lines, making the overall transmission process more efficient. Additionally, power transformers help maintain grid stability by regulating voltage levels and managing fluctuations in power supply and demand, preventing voltage sags, surges, and blackouts. Thereby, driving the segment growth during the forecast period.

On the other hand, the distribution transformer segment is expected to witness the fastest rate of growth during the forecast period. Distribution transformers step down high-voltage electricity from transmission lines to lower, safer voltage levels suitable for homes, businesses, and industries. This ensures that end-users receive a consistent and stable power supply. In addition, distribution transformers help balance the load across different sections of the electrical grid. By distributing power effectively, they prevent overloads and minimize the risk of blackouts. Thereby, driving the segment expansion.

Cooling Type Insights

Based on the cooling type, the global transformers market is segmented into air-cooled and oil-cooled.

The air-cooled transformer is expected to grow at the fastest rate over the forecast period. An air-cooled transformer, also known as a dry-type transformer, is a type of electrical transformer that uses air as the cooling medium to dissipate heat generated during operation. Unlike liquid-immersed transformers that use oil or other liquids for cooling, air-cooled transformers utilize natural convection and forced air circulation to keep the transformer's temperature within acceptable limits.

Phase Insights

Based on the phase, the global transformers market is segmented into three phases and a single phase. The three-phase segment transformer is expected to grow at a significant rate over the forecast period due to a variety of uses, including powering heavy loads, transferring power across electrical grids for power generation, and expanding use in the transmission and distribution industry. Three-phase transformers are more cost-effective for supporting huge loads and massive power distribution than single phase transformers. Thus, all these factors are expected to drive the segment expansion.

Application Insights

Based on the application, the global transformers market is segmented into utility, industrial and commercial and residential. The industrial segment is expected to dominate the market over the forecast period. The development of smart transformers, which gives market participants an advantage in the competitive landscape, is related to the expansion of transformer use in the industry. Furthermore, the market participants are being forced to invest resources in research and development to create eco-friendly transformers by the massive investments made globally in energy production, industrialization, and urbanization.

Regional Insights

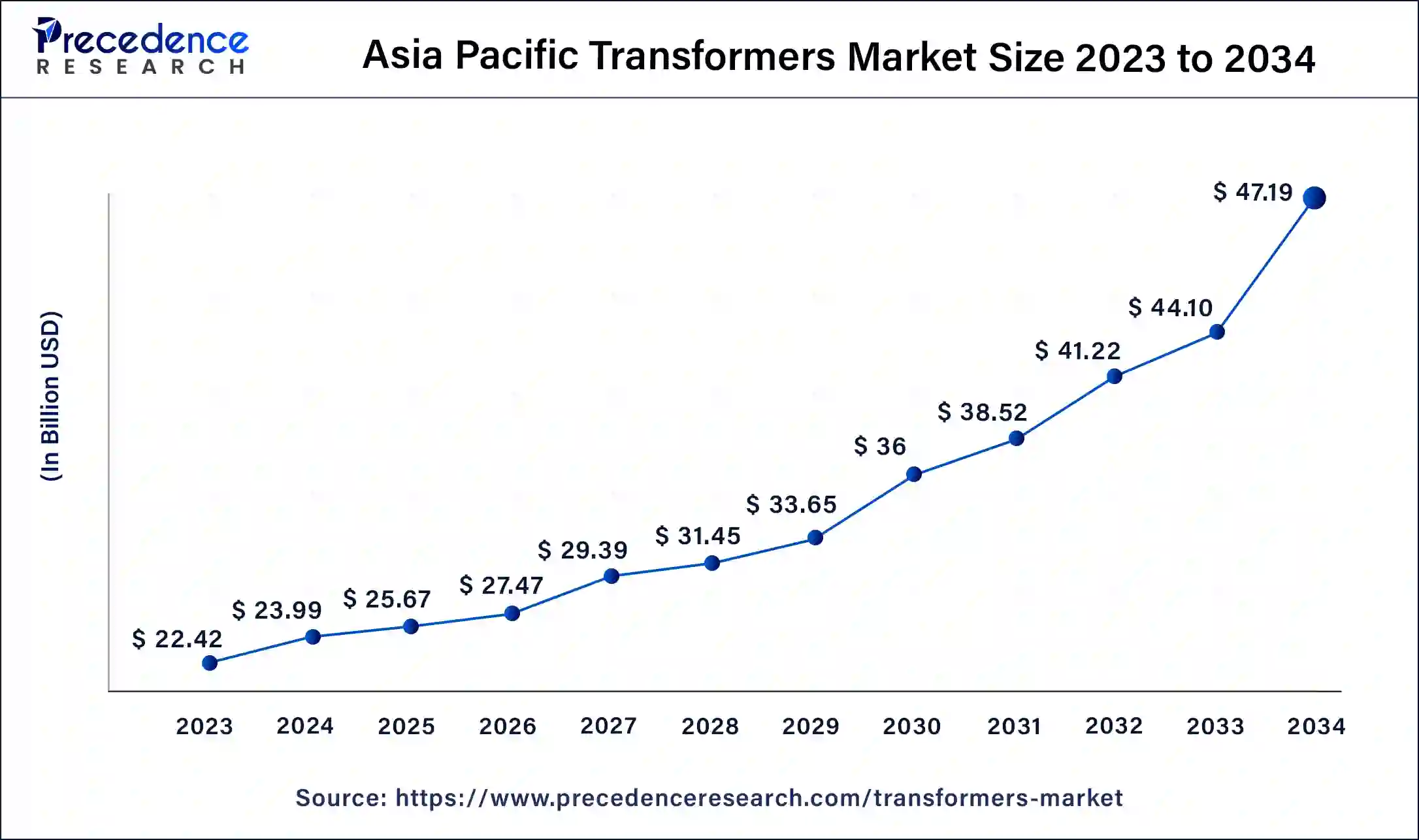

What is the Asia Pacific Transformers Market Size?

The Asia Pacific transformers market size is estimated at USD 25.67 billion in 2025 and is predicted to be worth around USD 50.14 billion by 2035, at a CAGR of 6.92% from 2026 to 2035.

Asia Pacific is expected to dominate the market over the forecast period.Countries such as China, India, Japan, South Korea, and Southeast Asian countries have experienced significant economic growth in recent years, leading to increased energy consumption and the need for advanced power infrastructure. For instance, according to government data, India's electricity consumption increased annually by 9.5% to 1503.65 billion units in 2022–23, mostly as a result of rising demand brought on by increased economic activity.

Moreover, urbanization and industrial growth in countries like China and India have led to a surge in electricity demand. Transformers are crucial for distributing power to growing urban centers and industrial complexes. According to the data given by United Nations, India is expected to have 675 million urban residents by 2035, which is the second-highest number after China. Thus, this is expected to drive market growth in the region during the forecast period.

India Transformers Market Analysis

India is one of the major contributors to the market in Asia Pacific. This is mainly due to the rapid expansion of power generation and distribution infrastructure, rising electricity demand, and government initiatives promoting renewable energy. A rising number of solar, wind, and hydro projects, modernization of grid networks, and replacement of aging transformers are also driving the market.

North America is expected to hold a significant market share over the forecast period.The market growth is attributed to renewable energy integration in the region. The region is witnessing a significant shift toward renewable energy sources, including wind, solar, and hydroelectric power. This transition necessitates the integration of these sources into the grid using transformers for power conversion and distribution. For instance, according to the Solar Energy Industries Association, nearly $35 billion in private investment was contributed by the solar sector to the American economy in 2022.

U.S. Transformers Market Analysis

The market in the U.S. is expanding due to rising electricity demand, large-scale grid modernization programs, and increasing integration of renewable energy sources. Growing investments in transmission and distribution infrastructure, replacement of aging power assets, expansion of electric vehicle charging networks, and supportive government funding for resilient and smart grids are further driving market growth.

Why is Europe Considered a Notably Growing Region in the Transformers Market?

Europe is expected to grow at a notable rate in the market due to increasing investments in renewable energy, smart grid projects, and the modernization of aging power infrastructure. Supportive government policies, rising electricity demand, and the integration of advanced transformer technologies for efficient energy transmission and distribution are further fueling market expansion across the region.

UK Transformers Market Analysis

The market in the UK is growing due to the shift toward decentralized energy systems, including microgrids and offshore wind farms. Increasing adoption of smart transformers for real-time monitoring, predictive maintenance, and energy optimization, along with investments in electrification of transport and industrial sectors, is driving market expansion.

Value Chain Analysis

- Raw Material Procurement

This stage involves sourcing essential materials such as electrical steel, copper, aluminum, insulating oils, and core laminations required for transformer manufacturing.

Key Players: Nippon Steel, Jindal Steel & Power, and General Cable. - Component Manufacturing

At this stage, transformer components such as cores, windings, bushings, tap changers, and insulation systems are fabricated.

Key Players: ABB, Siemens, Schneider Electric, and Toshiba. - Transformer Assembly & Testing

This stage involves assembling components into finished transformers and conducting rigorous testing for safety, efficiency, and compliance with international standards.

Key Players: GE Grid Solutions, Hitachi Energy, and Eaton. - Distribution & Logistics

Transformers are delivered to end-users through distributors, direct contracts, and logistics partners.

Key Players: Rexel, Grainger, and local regional distributors.

Transformers Market Companies

- GE Company: Provides power and distribution transformers, grid automation solutions, and advanced energy management systems, enabling reliable electricity transmission, renewable integration, and smart grid optimization globally.

- Hyundai Heavy Industries Co. Ltd.: Manufactures high-voltage and distribution transformers, electrical equipment, and power solutions, supporting industrial, utility, and renewable energy sectors with reliable and efficient energy infrastructure.

- ABB Ltd.: Offers power and distribution transformers, grid automation, and digital solutions, ensuring efficient electricity transmission, renewable energy integration, and smart grid management worldwide.

- Mitsubishi Electric Corporation: Supplies power transformers, smart grid solutions, and renewable energy integration systems, enhancing electricity reliability, operational efficiency, and sustainable energy distribution globally.

- Alstom SA: Provides transformers and power equipment for energy generation, transmission, and distribution, supporting industrial, renewable, and utility sectors with advanced electrical solutions.

- Bharat Heavy Electricals Limited (BHEL): Offers power and distribution transformers, grid solutions, and renewable energy integration equipment, supporting India's energy infrastructure, industrial growth, and smart grid development.

Other Major Key Players

- Siemens Energy

- Toshiba Corp.

- Hyosung Power & Industrial Systems Performance Group

- Crompton Greaves Ltd.

Recent Developments

- In March 2025, Hitachi Energy announced a $250 million investment by 2027 to increase global production of essential transformer components.

(Source: www.hitachienergy.com ) - In February 2025, Eaton Corporation invested $340 million to establish a new three-phase transformer manufacturing plant in Jonesville, South Carolina.

(Source: www.eaton.com ) - In February 2023, Telawne unveiled its Internet of Things (IoT)-based smart transformers, which are designed to deliver the best power quality. Furthermore, these transformers help utilities cut maintenance costs.

- In January 2023, with the introduction of the Distribution Transformer Monitor (DTM), INCON, Franklin Electric stated the extension of its range of Power Grid Monitoring products. The DTM offers high-value, low-voltage pad mount transformers, mission critical and traditional pole top transformers with accurate performance monitoring.

Segments Covered in the Report

By Type

- Distribution Transformer

- Power Transformer

- Others

By Power Rating

- Small

- Medium

- Large

By Cooling Type

- Air Cooled

- Oil Cooled

By Insulation

- Dry

- Liquid Immersed

By Phase

- Three Phase

- Single Phase

By Application

- Utility

- Industrial

- Commercial and Residential

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting