What is the Insulation Market Size?

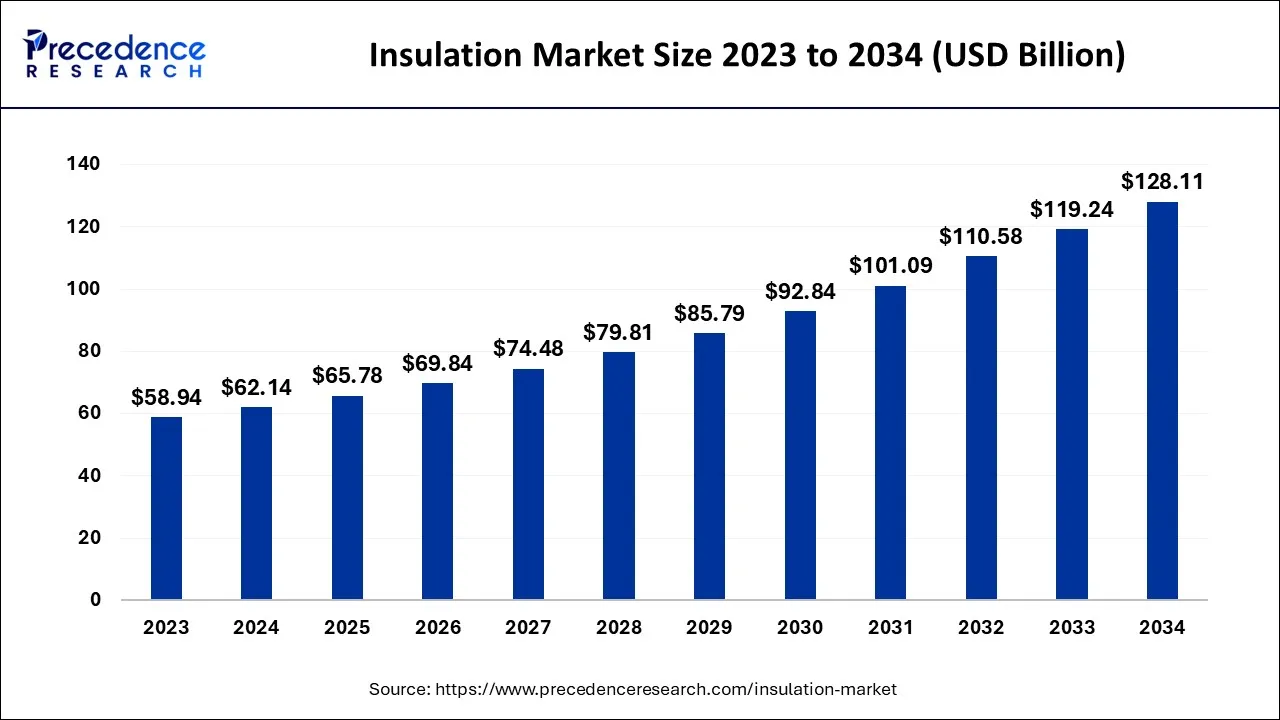

The global insulation market size is accounted at USD 65.78 billion in 2025 and predicted to increase from USD 69.84 billion in 2026 to approximately USD 128.11 billion by 2034, expanding at a CAGR of 7.70% from 2025 to 2034. The market is driven by favorable regulations in a majority of regions and increasing consumer awareness, leading to energy conservation.

Insulation Market Key Takeaways

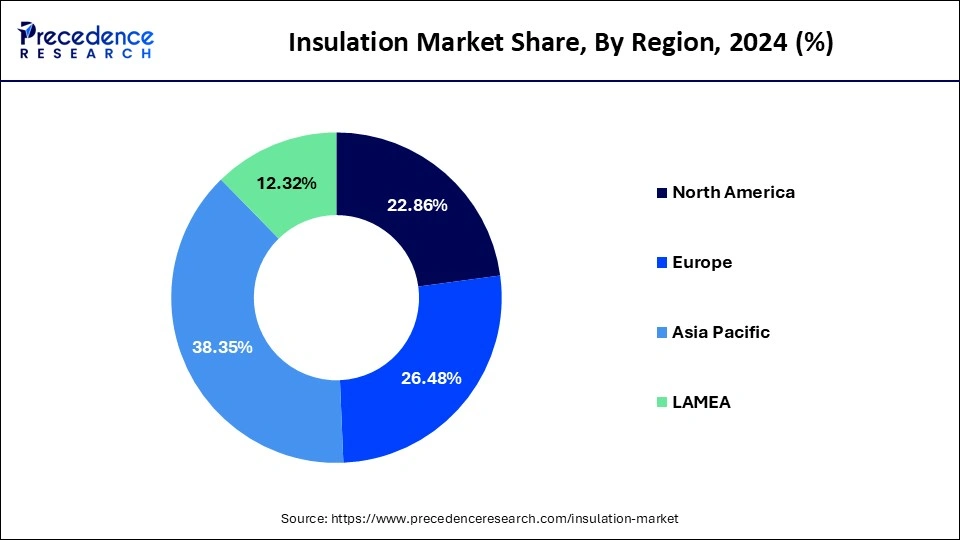

- The Asia Pacific region led the global market with the highest market share of 38.35% in 2024.

- North America is expected to grow fastest during the forecast period.

- By insulation type, the thermal insulation segment dominated the market with a share of 64.80% in 2024.

- By material type, the expanded polystyrene (EPS) segment generated high revenue share in 2024.

- By end-use type, the building and construction segment registered a maximum market share in 2024.

What is the Role of the AI in the Insulation Market?

Artificial intelligence (AI) based insulation is important due to it can enhance energy efficiency, reduce greenhouse gas emissions, and save money on energy bills. AI techniques like neural networks and machine learning, allows precise fault prediction, real time monitoring, and adaptive control, significantly improving grid reliability. AI technology and tools are used by firms in the construction and mechanical insulation to manage their internal operations and projects more easily, efficiently and cost effectively.

Innovative AI technology offers advanced solutions for improving thermal insulation in many industries. Ai based insulations designed for architects, engineers, and construction professionals, this platform provides the real time data analysis, predictive modeling and energy efficiency recommendations. Enhance sustainability, improve insulation performance, and reduce energy costs with innovative tools.

The Invisible Shield Powering the World's Efficiency Revolution

The insulation market is entering a pivotal era where efficiency, climate adaptation, and building modernization converge. Demand is being fuelled not only by construction and industrial applications but also by global mandates for energy conservation and carbon reduction. Insulation once viewed as a passive structural component, is now recognized as a strategic enabler of operational savings, thermal resilience, and long-term infrastructure sustainability. The market is expanding across materials such as mineral wool, fibreglass, polyurethane foams, cellulose, aerogels, and advanced bio-based alternatives, each fulfilling unique performance niches in residential, commercial, transportation, and industrial sectors.

Insulation Market Growth Factors

- The growing demand for insulation there has been a growth in the demand for solutions that are helpful in saving energy.

- There has been a growth in the demand for the products that provide insulation in the vehicles which will be helpful in improving the performance of the engines.

- The growing demand for the installation of insulation in various commercial infrastructures contributed to propel the market growth.

- The increasing number of people moving from rural to urban regions and the massive growth in the global population are expected to enhance market growth.

Market Trends

- The need for adequate housing and commercial spaces

- A rising number of people migrating from rural to urban regions

- Development of robust infrastructure

- Increasing investment in the construction sector

Market Outlook

- Industry Outlook: Industry dynamics are shifting toward consolidation and capability expansion. Manufacturers are aligning with sustainability targets, optimizing supply chains, and integrating digital tools to enhance product traceability and lifecycle monitoring. The market is witnessing deeper collaborations between material scientists, construction firms, and energy consultants to develop insulation solutions tailored for net-zero buildings.

- Major Investments: Significant capital is flowing into digitalized production lines, advanced extrusion technologies, expanded capacity for mineral wool and polyurethane foams, and specialized plants for aerogel-infused composites. Investments are also accelerating in green-chemistry initiatives particularly low-GWP blowing agents and renewable feedstocks for foam production. Several global players are reorienting corporate strategies toward net-zero commitments, allocating budgets for decarbonizing manufacturing operations and integrating renewable energy into insulation production units. Additionally, large construction conglomerates are investing in insulation-centric prefabrication facilities to cater to rapid-build and sustainable housing programs.

- Startups Shaping the Future: The startup landscape is vibrant, with innovators developing unconventional material science breakthroughs. Entrepreneurs are pioneering:

- Bio-based insulation from hemp, mushroom mycelium, seaweed, and recycled textiles.

- Aerogel nanocomposites providing extreme thermal resistance in ultrathin layers.

- Recyclable and modular insulation panels enabling easy end-of-life recovery.

- Smart insulation systems integrating sensors to track temperature, humidity, and thermal decay.

- COâ‚‚-derived foams, converting captured emissions into high-value building materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 65.78 Billion |

| Market Size in 2026 | USD 69.84 Billion |

| Market Size by 2034 | USD 128.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.70% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Insulation Type, Material Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing construction and residential industry

The increasing installation of environmentally friendly, recyclable, and efficient materials and increasing emphasis on reducing energy consumption are increasing the market growth. The rising demand for new homes and Increasing customer expenditure have a positive impact on the market demand. In addition, the expansion of the construction industry combined with a rise in energy-efficient innovation further drives the market growth.

Domestic players are expected to compete with international ones, due to the need for a stronger customer relationship in this industry. Manufacturers are supposed to develop robust distribution networks to increase their profits. Furthermore, by decreasing the heating and cooling loads in the building industry, the use of EPS, plastic foam, and glass wool can reduce the overall energy consumption further contributing to propelling the market growth.

Restraint

High Cost and Environmental Concerns

Crude oil is the major raw material for the majority of insulating products. Political uncertainty in these regions has a significant impact on crude oil supply and pricing globally since Middle Eastern countries produce most of the world's crude oil. In addition, the high cost of crude oil is affecting the market demand and further restraining the growth of the insulation market.

Opportunity

Increasing demand for insulation services from developing nations

The high demand from emerging countries will drive the market's growth. The market is growing rapidly in growing markets such as India, Mexico, South Korea, Indonesia, Turkey, Russia, and China. Considerations such as government regulations, low transportation costs, cheap labor, and the availability of land have made manufacturing plants and automobile manufacturers in these countries.

Due to the increasing demand for insulation in the construction and refrigerator sectors, the market is growing rapidly in India. In addition, EPS provides improved high-performance insulation, precision, durability, and moisture resistance. Thus, the growth of the construction industry in developing markets is further anticipated to enhance the growth of the insulation market.

Insulation Type Insights

The thermal insulation segment held a dominant presence in the insulation market in 2024.

- In March 2025, the Heat-Flex Advanced Energy Barrier (AEB) which tackles corrosion under insulation (CUI) was launched by Sharwin-Williams. The new coating replaces the bulky mineral-based insulation traditionally used on storage tanks, process vessels and piping to retain process heat. (Source: Sherwin-Williams launches new insulative coating - Oil Review Middle East)

The acoustic insulation segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- In May 2025, to develop test and launch a suite of new impact sound insulation floor systems designed to reduce sound transmission Saint-Gobain Weber and REGUPOL collaborated with CMS Danskin Acoustics. The new ‘Weber floor acoustic system' can be used to meet challenging acoustics targets across both new construction and refurbishment projects, including commercial, residential, healthcare, and leisure schemes. (Source:Weber and CMS Danskin Acoustics launch new acoustic floor systems incorporating REGUPOL)

Insulation Market Revenue, By Insulation Type 2022-2024 (USD Million)

| By Insulation Type | 2022 | 2023 | 2024 |

| Thermal Insulation | 36,429.32 | 38,022.94 | 40,263.85 |

| Acoustic Insulation | 20,091.14 | 20,917.84 | 21,876.39 |

Material Type Insights

The expanded polystyrene (EPS) segment accounted for a considerable share of the insulation market in 2024.

- In April 2025, the launch of the industry's first biodegradable EPS QPMC pallet shipper was announced by Thermo Safe. The cutting-edge solution offers a breakthrough in sustainable thermal packaging, performing high performance with environmental responsibility, making it a game changer for the life sciences and healthcare logistics industries. (Source: ThermoSafe launches biodegradable EPS QPMC pallet shipper)

The aerogel segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- In June 2025, the full-scale commercial production of its proprietary fiber-enhanced aerogel insulation for electric vehicle (EV) battery fire protection was announced by Irving-based Alkegen, a supplier of battery cell spacers. (Source: Irving-Based Alkegen Launches Full Production of EV Battery Fire Protection ‘Aerogels' » Dallas Innovates)

End-use Insights

The building and construction segment led the market.

- In April 2025, the addition of OPTIM-R E to its OPTIM-R Series vacuum insulation panels was announced by Kingspan Insulation North America. OPTIM-R E is a rigid vacuum insulation panel with a fumed silica core encased and sealed in a thin, gas-tight envelope.

(Source: Kingspan Launches OPTIM-R E, Encapsulated Vacuum Insulation Panel | Roofing Contractor)

The transportation segment is set to experience the fastest rate of the market growth from 2025 to 2034.

- In June 2022, a new international air freight transport service using environmentally friendly isothermal packaging produced by EMBALL'ISO was launched by Nippon Express Co., Ltd, a group company of Nippon Express Holdings, Inc., a first Japanese logistics company to collaborate with EMBALL'ISO, a French company with a proven track record in vaccine transport. (source: https://www.nipponexpress-holdings.com)

Insulation Market Revenue, By Material Type 2022-2024 (USD Million)

| By End User | 2022 | 2023 | 2024 |

| Building and Construction | 20,361.40 | 21,259.37 | 22,470.10 |

| HVAC and OEM | 9,389.07 | 9,817.18 | 10,358.91 |

| Transportation | 13,585.42 | 14,198.75 | 15,083.54 |

| Appliances | 5,596.06 | 5,784.36 | 6,078.75 |

| Othes (Furniture, Packaging, etc.) | 7,588.53 | 7,881.13 | 8,148.94 |

Regional Insights

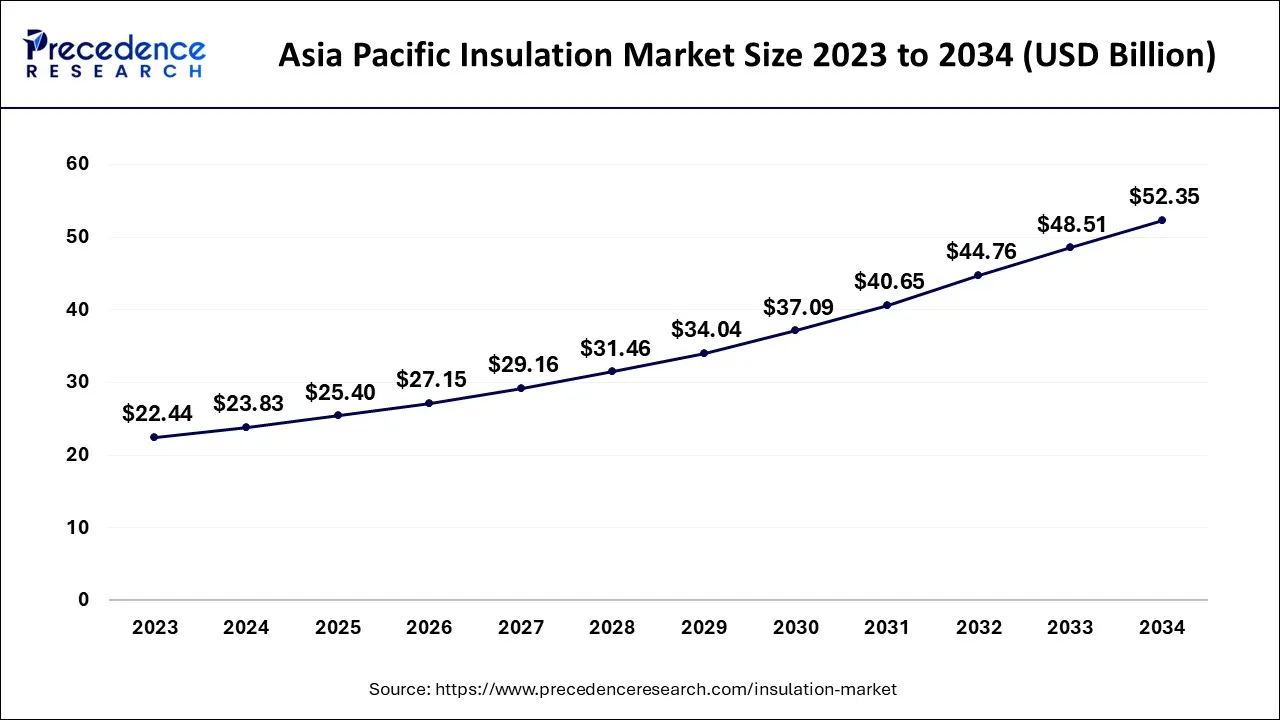

Asia Pacific Insulation Market Size and Growth 2025 to 2034

The Asia Pacific insulation market size is exhibited at USD 25.40 billion in 2025 and is projected to be worth around USD 52.35 billion by 2034, growing at a CAGR of 8.40% from 2025 to 2034.

Asia Pacific is dominated the insulation market in 2024. In countries like China and India due to increased oil production, there has been a significant use ofinsulation materials. There has been increased use of insulation to prevent energy wastage and an increasing demand for insulation in refurbishing and renovation applications.

North America is expected to grow fastest during the forecast period.The North American region also has a great demand for insulation materials. The market in the North American region is influenced by the demand for oil and gas, metal and mining, power, and manufacturing industries where the temperature of operation is high. Due to rapid industrialization and the presence of major manufacturers of insulation material European market is also expected to have a significant revenue share during the forecast period. There is a growth in the insulation materials market across various regions in the globe due to the maintenance and repair work in the infrastructure. The market in Africa in the Middle East region is also expected to grow as there are many petrochemical industries located in these regions.

Asia Pacific dominated the global insulation market in 2024.

- In April 2025, for showcasing innovative home-comfort solutions, a leading advanced insulation product and service provider in India, NEO partners with Roof India Exhibition Mumbai.

North America projected to host the fastest growing market in the coming years.

- In June 2025, a full-scale commercial production of proprietary fiber enhanced AlkeGel Aerogel Insulation to boost EV battery safety was announced by Alkegen, a global leader in advanced battery materials.

How Europe is Notably Catching the Steps?

Europe is leading the charge in the global insulation market, driven by ambitious climate goals, stringent regulations, and a growing emphasis on energy efficiency. The region's commitment to achieving climate neutrality by 2050 necessitates a comprehensive approach to building performance, resulting in significant investments in insulation solutions across various countries. The European Union has established regulations such as the Energy Performance of Buildings Directive (EPBD) and the Climate Law to promote energy-efficient construction practices. These regulations are compelling building owners and developers to upgrade existing structures with advanced insulation materials.

Germany Insulation Market Trends:

As one of Europe's largest markets for insulation, Germany is at the forefront of energy-efficient building practices. The country offers various incentives for retrofitting buildings with high-performance insulation materials, including mineral wool and cellulose. Germany is also a leader in the development of innovative insulation technology, such as aerogel composites and sustainable building materials. France is pushing for extensive energy renovations, targeting a reduction in energy consumption across its building stock. Initiatives like the French Energy Transition Law promote the use of eco-friendly insulation materials such as bio-based solutions derived from agricultural waste. The country's commitment to transitioning toward low-emission housing continues to drive investment in insulation technologies.

| Country | Regulatory body | Key regulations | Focus areas | Notable note |

| Germany | Fedral ministry for housing, Urban Development and building. | energy saving ordinance building energy act. | thermal performance, fire safety, and energy efficiency in building envelopes. | Germany enforces some of the strictest U-value limits in Europe. |

| France | Ministry for ecologist transition; CBSTB. | RE2020 energy regulations. | Low-carbon construction | Strong push towards carbon-neutral building materials. |

| U.K. | Department for levelling up, housing and communities. | Building and regulations | energy conversion, fire performance, retrofit standards. | Post-genfell reforms have tightened façade insulation ruels and expanded compliance adults. |

| Italy | Ministry if infrastructure and transport; UNI standards. | national energy performance law. | thermal insulation in renovation. Seismic-resilient. | emphasis on climate-zone tailoring and eco-efficiency. |

Market Value Chain Analysis

- Raw Material Sourcing: Raw material sourcing hinges on accessibility, sustainability, and quality assurance. Mineral wool manufacturers depend on basalt, slag, and other industrial by-products; polymer-based insulation relies on petrochemical derivatives, additives, and blowing agents; cellulose insulation draws from recycled paper streams; and bio-based materials rely on agricultural inputs or microbial growth cycles. Supply chains are undergoing transformation to minimize carbon footprints, adopt renewable feedstocks, and ensure compliance with environmental standards. Ethical sourcing, certification schemes, and supplier transparency frameworks are becoming central differentiators for manufacturers.

- Technological Advancements: Technology is reshaping insulation with remarkable sophistication. Advances include, arogel-enhanced composites delivering unmatched thermal conductivity reductions, phase-change materials (PCM) integrating thermal storage into insulation layers. Smart and sensor-enabled insulation for real-time energy monitoring. Digital twin modelling, AI-based building envelope simulations, and automated inspection tools are further enhancing the accuracy and efficiency of insulation deployment.

Top Vendors in Insulation Market

- GAF: A significant competitor in the insulation market, often mentioned alongside other major players like Knauf Insulation and Johns Manville.

- Saint-Gobain: A French company with a long history and a strong presence in building and construction products.

- Recticel: A Belgian company that produces insulation boards, such as Eurothane GP, made from rigid polyisocyanurate (PIR) foam.

- Kingspan Group: An Irish company that is a key player in the technical insulation market.

- URSA: Another competitor in the insulation market, frequently listed alongside other major brands like GAF and Rockwool.

- Rockwool Group: A Danish company known for its stone wool insulation products, with a significant global market presence.

- Knauf Insulation: A prominent company in the insulation market with a significant presence in the US.

Johns Manville: A US-based company that is a leading manufacturer of insulation and building materials.

RecentDevelopments

- In August 2025, the Microcell technology for efficient window system's insulation was launched by Promix Solutions. The insulation characteristics of window systems are largely defined by the function of thermal break profiles, which make a thermal barrier for heat transfer between parts like window frames.

(Source: Promix Solutions launches Microcell Technology for efficient window systems' insulation - Interplas Insights) - In April 2025, the launch of groundbreaking insulation, designed to provide unprecedented weight to warmth comfort and performance for outdoor lifestyle enthusiasts was announced by FOLI AEROGEL, a leading innovator in Aerogel Insulation Technology.

(Source: Foli Aerogel launches lightweight insulation for outdoors - Fibre2Fashion)

Segments Covered in the Report

By Insulation Type

- Thermal Insulation

- Acoustic Insulation

By Material Type

- Glass Wool

- Mineral Wool

- Expanded polystyrene (EPS)

- Extruded polystyrene foam insulation (XPS)

- Calcium-Magnesium-Silicate (CMS) Fibers

- Calcium Silicate

- Polyurethane

- Aerogel

- Others (Cellulose, Phenolic Foam, etc.)

By End User

- Building and Construction

- HVAC and OEM

- Transportation

- Appliances

- Others (Furniture, Packaging, etc.)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting