Sodium Sulfide Market Size and Forecast 2025 to 2034

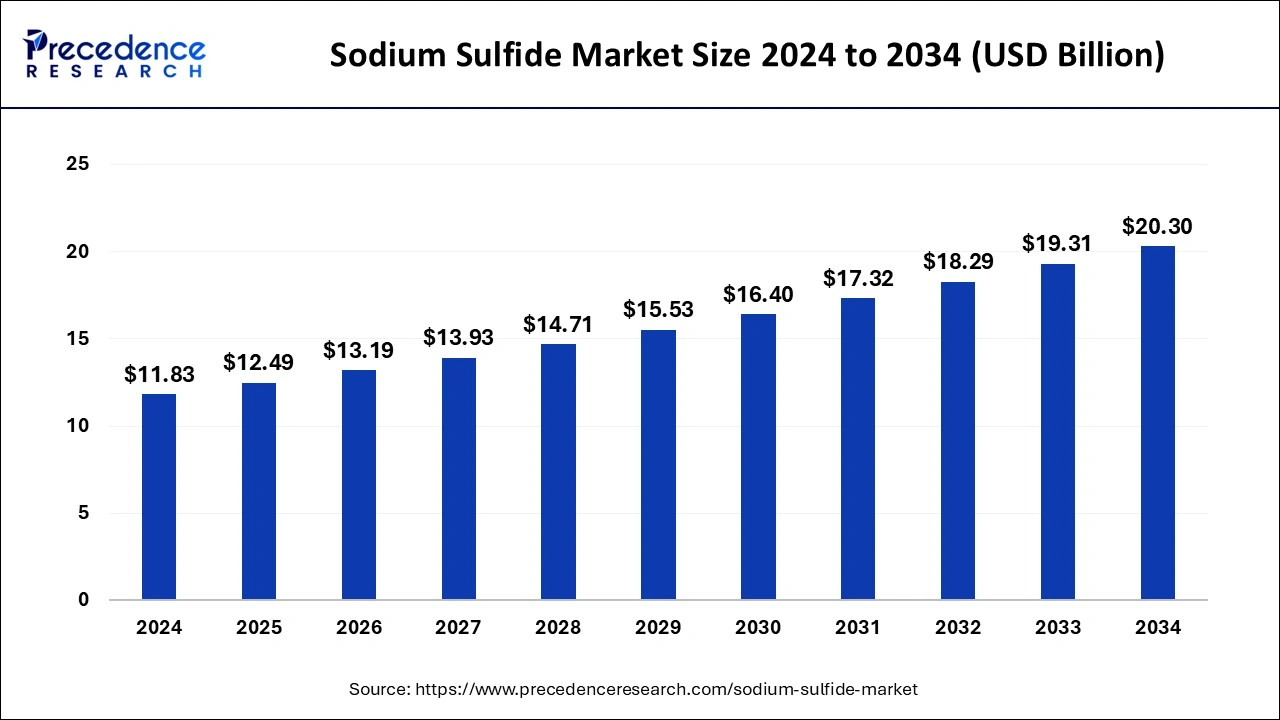

The global sodium sulfide market size accounted for USD 11.83 billion in 2024 and is predicted to increase from USD 12.49 billion in 2025 to approximately USD 20.30 billion by 2034, expanding at a CAGR of 5.55% from 2025 to 2034.

Sodium Sulfide MarketKey Takeaways

- The global sodium sulfide market was valued at USD 11.83 billion in 2024.

- It is projected to reach USD 20.30 billion by 2034.

- The sodium sulfide market is expected to grow at a CAGR of 5.55% from 2025 to 2034.

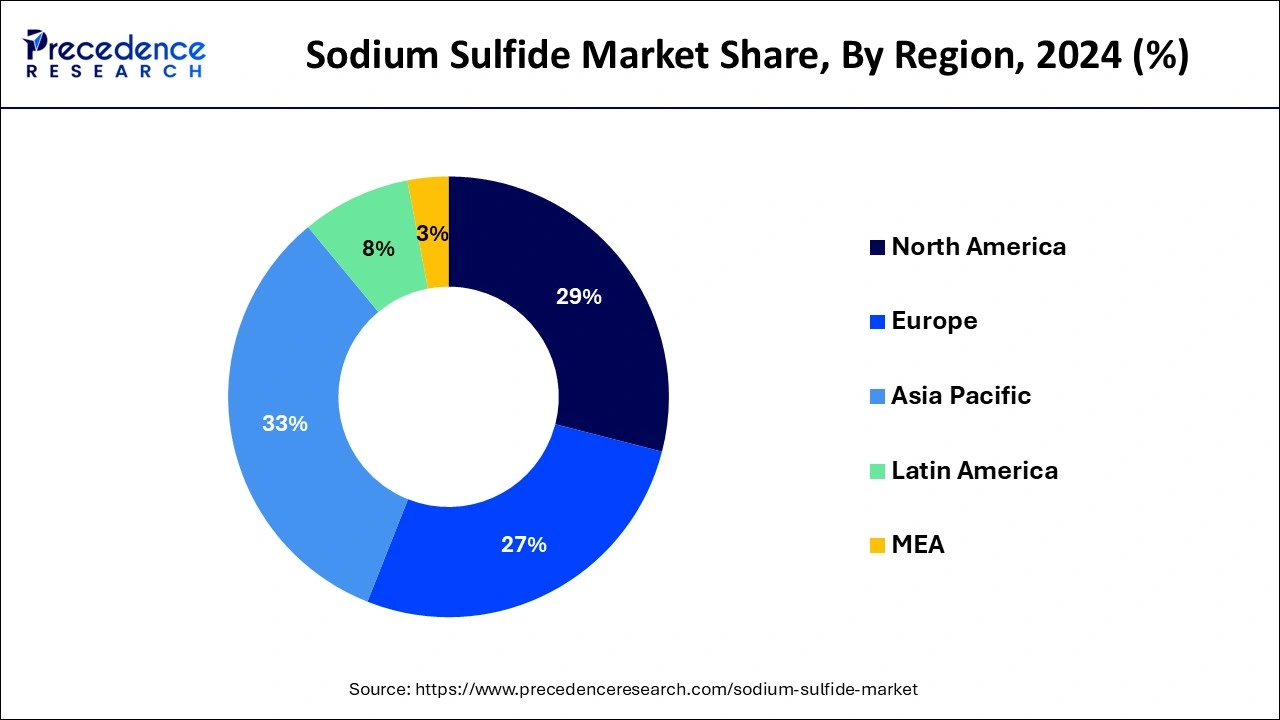

- Asia Pacific contributed 33% of market share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By product type, the crystal sodium sulfide segment held the largest market share of 35% in 2024.

- By product type, the low ferric sodium sulfide segment is anticipated to grow at a remarkable CAGR of 7.6% between 2025 and 2034.

- By application, the textile segment generated over 25% of market share in 2024.

- By application, the water treatment segment is expected to expand at the fastest CAGR over the projected period.

Asia PacificSodium Sulfide Market Size and Growth 2025 to 2034

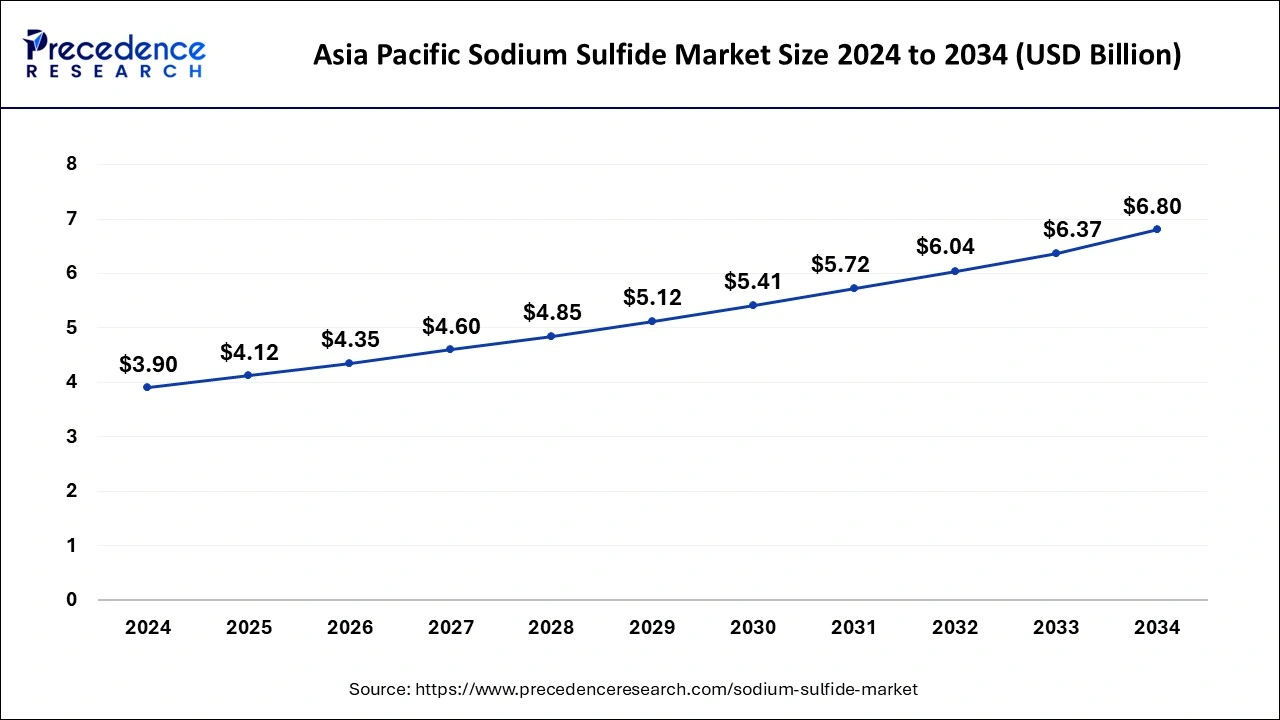

The Asia Pacific sodium sulfide market size was exhibited at USD 3.90 billion in 2024 and is projected to be worth around USD 6.80 billion by 2034, growing at a CAGR of 5.72% from 2025 to 2034.

Asia-Pacific holds a share of 33% in the sodium sulfide market due to rapid industrialization and urbanization in countries like China and India. These nations are significant producers and consumers of textiles, leather, and paper products, where sodium sulfide finds extensive application. Moreover, stringent environmental regulations in the region favor the adoption of eco-friendly chemicals like sodium sulfide in industrial processes. The increasing demand for metals and minerals in sectors like mining further boosts the usage of sodium sulfide, consolidating Asia-Pacific's dominance in the market.

The North America region is witnessing rapid growth in the sodium sulfide marketdue to several factors. Increasing industrial activities, particularly in sectors like textiles, leather processing, and mining, are driving up the demand for sodium sulfide. Additionally, stringent environmental regulations necessitating the use of eco-friendly chemicals further boost its adoption. Moreover, advancements in production technologies and infrastructure development contribute to the expansion of the market. These combined factors create a favorable environment for the growth of the sodium sulfide market in North America.

Meanwhile, Europe is experiencing notable growth in the sodium sulfide market due to several factors. Stringent environmental regulations are driving industries to adopt eco-friendly chemicals like sodium sulfide for various applications, including leather processing and water treatment. Additionally, the region's expanding textile industry and increasing investments in infrastructure projects are boosting demand for sodium sulfide. Moreover, ongoing research and development efforts are exploring innovative applications of sodium sulfide in healthcare, further contributing to its market growth across Europe.

Market Overview

Sodium sulfide is a chemical compound made up of sodium (Na) and sulfur (S). It appears as a colorless or yellow solid and is often dissolved in water, forming a clear, yellowish solution. This compound is commonly used in various industrial processes, such as in the production of paper, textiles, and leather. It is also utilized in the mining industry for ore processing and as a precursor to other chemicals. In simpler terms, sodium sulfide is a substance made by combining sodium and sulfur. It looks like a white or yellowish powder and can be mixed with water to make a clear, yellow liquid. Industries use it to make things like paper, clothes, and leather. It's also used in mining to help extract metals from rocks and in making other chemicals.

Sodium Sulfide Market Data and Statistics

- According to the African Development Bank, the estimated GDP growth for the country in 2020 stands at 2.5%, signaling a favorable outlook.

- In 2020, Mudassir & Brothers, a Nigerian textile trading company headquartered in Kano, is slated to establish a textile manufacturing facility valued at over USD 50 million. The state Governor has earmarked 22.5 hectares of land for the company, which is expected to create more than 10,000 jobs. Additionally, the company plans to introduce cotton harvest bags, aiming to minimize polypropylene contamination.

Sodium Sulfide MarketGrowth Factors

- Sodium sulfide finds extensive usage in various industries such as pulp and paper, textiles, leather, and mining. The growing demand for these end products globally is a significant driver for the sodium sulfide market. For instance, in the leather industry, sodium sulfide is used for dehairing and tanning processes, contributing to its increasing demand.

- With the rise in global industrialization and infrastructure development, there's an increasing demand for metals and minerals, driving the growth of the mining sector. Sodium sulfide is crucial in the extraction of certain metals like copper, zinc, and lead from ores. As mining activities expand, so does the demand for sodium sulfide.

- Environmental regulations mandating the use of eco-friendly chemicals in various industrial processes are propelling the demand for sodium sulfide. As it is considered less harmful compared to some alternative chemicals, industries are increasingly adopting sodium sulfide, driving its market growth.

- Continuous technological advancements in the manufacturing processes of sodium sulfide are leading to enhanced production efficiencies and cost-effectiveness. Improved production techniques are enabling manufacturers to meet the increasing demand for sodium sulfide, thereby driving market growth.

- The Asia-Pacific region, particularly China and India, is witnessing rapid industrialization and urbanization, leading to increased demand for sodium sulfide across various industries. China, being a significant producer and consumer of textiles and leather products, accounts for a substantial portion of the global sodium sulfide market.

- Researchers are exploring new applications of sodium sulfide in sectors such as healthcare, agriculture, and water treatment. For instance, it is being investigated for its potential in hydrogen sulfide therapy for various medical conditions. The exploration of these novel applications opens up new avenues for market growth and expansion.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.55% |

| Market Size in 2024 | USD 11.83 Billion |

| Market Size in 2025 | USD 12.49 Billion |

| Market Size by 2034 | USD 20.30 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing usage in leather processing

The rising usage of sodium sulfide in leather processing plays a crucial role in boosting market demand. In leather production, sodium sulfide is primarily utilized for the dehairing and tanning processes. When animal hides are prepared for leather, they need to be stripped of hair and treated to become durable and usable. Sodium sulfide is a key chemical used in this process due to its ability to efficiently remove hair and soften the hides, making them suitable for various leather products like shoes, bags, and jackets.

As the demand for leather goods continues to increase globally, particularly in fashion and accessory industries, so does the need for sodium sulfide. Manufacturers rely on this chemical to meet the growing demand for processed leather efficiently. Therefore, the expanding leather industry acts as a significant driver for the sodium sulfide market, propelling its growth as it remains an indispensable component in the production of high-quality leather goods.

Restraint

Health hazards associated with handling sodium sulfide

Health hazards linked with handling sodium sulfide pose a notable restraint on the market demand. Sodium sulfide is a corrosive substance that can cause skin and eye irritation upon contact. Moreover, inhalation of its fumes may lead to respiratory issues and discomfort. These health risks necessitate stringent safety measures and protective gear for workers involved in handling sodium sulfide during manufacturing, transportation, and industrial processes. Companies often incur additional expenses for implementing safety protocols and providing training to mitigate these risks, which can impact their bottom line.

Furthermore, concerns about worker safety and potential liabilities may deter some industries from using sodium sulfide altogether, opting for alternative chemicals or processes instead. This reluctance could limit the market demand for sodium sulfide, particularly in regions with strict occupational health and safety regulations. Overall, the health hazards associated with handling sodium sulfide not only affect worker well-being but also contribute to market constraints by increasing operational costs and potentially reducing its adoption in various industrial applications.

Opportunity

Development of innovative applications in healthcare

The development of innovative applications in healthcare is opening up new opportunities in the sodium sulfide market. Researchers are exploring the potential use of sodium sulfide in healthcare for its ability to release hydrogen sulfide, which has shown promising therapeutic effects. Hydrogen sulfide is being studied for its potential to improve cardiovascular health, reduce inflammation, and even play a role in cancer treatment. As these research efforts progress, the demand for sodium sulfide as a precursor for hydrogen sulfide generation is expected to increase, creating new avenues for market growth.

Additionally, sodium sulfide is being investigated for its antimicrobial properties, which could make it useful in disinfection and wound care products. As healthcare facilities seek more effective and sustainable solutions for infection control, sodium sulfide-based formulations may gain traction in the market. Thus, the development of innovative applications in healthcare not only expands the potential uses of sodium sulfide but also drives demand for this chemical in the medical sector, contributing to its overall market growth.

Product Type Insights

The crystal sodium sulfide segment held the highest market share of 35% in 2024. Crystal sodium sulfide is a type of sodium sulfide characterized by its solid crystalline form. In the sodium sulfide market, the crystal segment refers to products that are manufactured and supplied in solid crystalline state. This segment has witnessed steady growth due to its stability, purity, and ease of handling compared to other forms of sodium sulfide. Additionally, advancements in manufacturing processes have led to improved crystal sodium sulfide products with enhanced quality and performance, further driving the segment's popularity.

The low ferric sodium sulfide segment is anticipated to witness rapid growth at a significant CAGR of 7.6% during the projected period. The low ferric sodium sulfide segment refers to a type of sodium sulfide with reduced iron content, typically less than a certain threshold level. This product variant is favored in industries where iron contamination is undesirable, such as in textile and paper manufacturing. In the sodium sulfide market, the demand for low ferric sodium sulfide is witnessing an upward trend due to increasing quality requirements in end products and the preference for cleaner and more efficient chemical processes.

Application Insights

The textile segment has held a 25% market share in 2024. In the sodium sulfide market, the textile segment refers to the use of sodium sulfide in the textile industry for processes such as dyeing and printing of fabrics. Trends in this segment include the increasing demand for sodium sulfide due to the growth of the textile industry globally. As textile manufacturers aim to meet consumer demand for a wide range of colored and patterned fabrics, the need for sodium sulfide as a key dyeing agent continues to rise.

The water treatment segment is anticipated to witness rapid growth over the projected period. In the sodium sulfide market, the water treatment segment refers to the use of sodium sulfide in purifying and treating water for various industrial and municipal purposes. This includes removing impurities, neutralizing acidity, and eliminating contaminants like heavy metals. Trends indicate a growing emphasis on wastewater recycling and treatment due to increasing environmental concerns and regulatory requirements. Sodium sulfide's effectiveness in precipitating and removing pollutants from water makes it a key component in modern water treatment processes, driving its demand in this segment.

Recent Developments

- In June 2023, Solvay has declared the signing of a definitive agreement to purchase ICS Industries, a prominent manufacturer of sodium sulfide and other specialized chemicals. The acquisition is anticipated to be finalized in the third quarter of 2023.

- In July 2023, PPG Industries has revealed an expansion of its sodium sulfide production capacity at its facility in China. The expansion project is slated for completion in the first quarter of 2024.

- In August 2023, ISSC (IRSS) has announced the signing of a new contract to provide sodium sulfide to a major customer in the pulp and paper sector. The contract spans a duration of three years.

- August 2023, the government of China has disclosed its intention to invest in the development of additional sodium sulfide production capabilities. This investment is aimed at meeting the escalating demand for sodium sulfide within China.

Sodium Sulfide Market Companies

- Solvay

- PPG Industries

- ISSC (IRSS)

- BASF SE

- AkzoNobel

- Chevron Phillips Chemical Company LLC

- Tessenderlo Group

- Chemtrade Logistics Income Fund

- LANXESS

- Merck KGaA

- Henan Haofei Chemical Co., Ltd.

- Nafine Chemical Industry Group Co., Ltd.

- Sichuan Shenhong Chemical Industry Co., Ltd.

- Sinopec Corp.

- ISALTIS

Segments Covered in the Report

By Product Type

- Anhydrous Sodium Sulfide

- Crystal Sodium Sulfide

- Low Ferric Sodium Sulfide

By Application

- Paper & Pulp

- Water Treatment

- Textile

- Tanneries

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting