What is the Sodium Tripolyphosphate (STPP) Market Size?

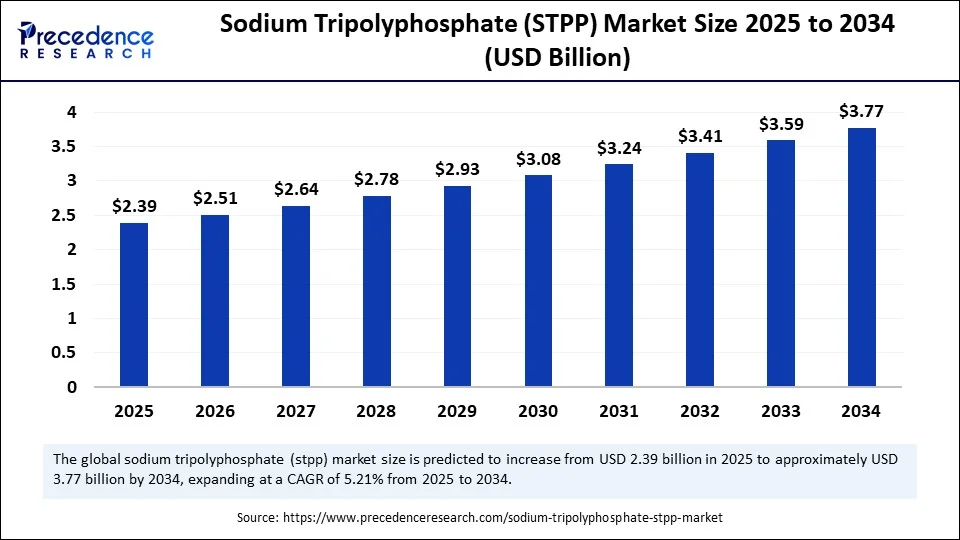

The global sodium tripolyphosphate (STPP) market size is calculated at USD 2.39 billion in 2025 and is predicted to increase from USD 2.51 billion in 2026 to approximately USD 3.77 billion by 2034, expanding at a CAGR of 5.21% from 2025 to 2034. The market for sodium tripolyphosphate is growing due to rising demand in the detergents, water treatment, and food processing industries.

Market Highlights

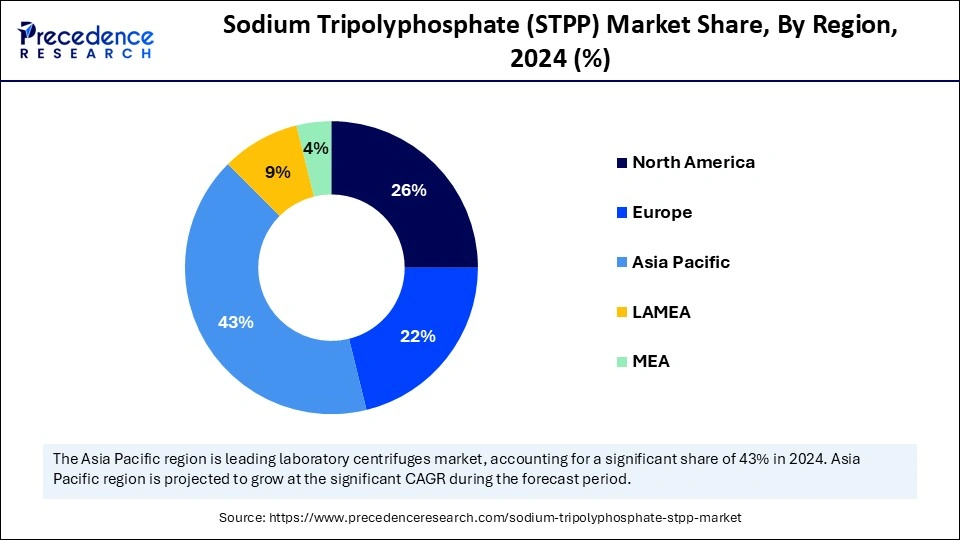

- The Asia Pacific accounted for the largest market share of 43 in 2024.

- The North America is expected to grow at the highest CAGR between 2025 and 2034.

- By application, the detergents segment contributed the largest market share 2024.

- By application, the food industry segment is growing at a notable CAGR between 2025 and 2034.

- By end user industry, the food and beverage segment contributed the biggest market share in 2024.

- By end user industry, the agriculture segment will grow at a notable CAGR between 2025 and 2034.

- By product form, the powdered STPP segment contributed the largest market share in 2024.

- By product form, the liquid STPP segment is growig at a notable CAGR between 2025 and 2034.

- By distribution channel, the direct sales segment generated the highest share in 2024.

- By distribution channel, the distributors segment is growing at the fastest CAGR between 2025 and 2034.

- By grade, the industrial grade STPP segment held the highest market share in 2024.

- By grade, the food-grade STPP segment is growing at a solid CAGR between 2025 and 2034.

Market Overview

The Unsung Hero of Cleanliness and Preservation

The sodium tripolyphosphate (STPP) market is experiencing rapid growth because it is widely used in food preservation, water treatment systems and household and industrial detergents. Demand is rising as global industrialization increases the need for effective sequestrants, scale inhibitors and stabilizing agents across multiple end-use sectors. Growth in processed and convenience foods is also strengthening the market, since STPP helps maintain texture, moisture retention and shelf stability in meat, seafood and bakery products.

The shift toward more eco-friendly cleaning formulations is prompting detergent manufacturers to optimise phosphate levels while still relying on STPP for performance in hard-water environments. As producers develop more specialized grades and application-specific formulations, sodium tripolyphosphate is becoming a critical multifunctional ingredient across food processing, chemical manufacturing and water treatment industries.

Case Study: InnovaChem AI Platform Boosts STPP Production Efficiency

In 2025, InnovaChem Technologiess breakthroughs reshaped the sodium tripolyphosphate (STPP) market with its AI-powered SmartReact Optimization Suite, which useddigital twin simulations to monitor reactions in real time and automatically adjust production parameters. The system reduced energy consumption by 18%, minimized off-spec batches, increased yields, and improved equipment reliability through predictive maintenance, helping STPP manufacturers meet strict quality standards while cutting costs and advancing sustainable, next-generation phosphate production.

Sodium Tripolyphosphate (STPP) Market Outlook

The demand for sodium tripolyphosphate (STPP) in detergents, water treatment, and processed food applications is driving the markets steady growth on a global scale. Market adoption is driven by growth in the household and industrial cleaning industries, as well as by rising urbanization. STPPs ability to improve product performance in a variety of industries makes it a vital growth engine.

By maximizing the use of STPP and blending it with biodegradable ingredients, manufacturers are increasingly concentrating on environmentally friendly formulations. The development of low-phosphate, environmentally safe substitutes is encouraged by regulatory pressure on phosphates in wastewater, ensuring sustainability without sacrificing functionality.

New businesses are using STPP in creative ways, such as food preservation technologies, sophisticated water treatment solutions, and specialty cleaning products. In the chemical and consumer goods industries, these startups are advancing specialized applications, driving research and development, and opening the door to strategic partnerships.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.39 Billion |

| Market Size in 2026 | USD 2.51 Billion |

| Market Size by 2034 | USD 3.77 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.21% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application-Based, End-User Industry, Product Form, Distribution Channel, Grade, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emerging Opportunities in Sodium Tripolyphosphate (STPP) Market

| Opportunity Area | Description & Impact | Application |

| Eco-friendly Detergents | Biodegradable, low-phosphate detergents are driving higher demand | Laundry, dishwashing, and industrial cleaning |

| Water Treatment | Softening & wastewater management solutions are gaining traction | Municipal & industrial water treatment |

| Food Processing & Preservation | Retains moisture, improves texture in processed foods | Frozen foods, canned products, and ready-to-eat meals |

| Specialty Industrial Uses | Enhances quality in textiles, ceramics, and metal finishing | Textiles, ceramics, and metal treatment |

| Startup Innovations | Startup Innovations | Specialty cleaners, advanced food processing, and eco-friendly water treatment |

Sodium Tripolyphosphate (STPP) Market Segmental Insights

Application-Based Insights

Detergents: The detergents segment led the sodium tripolyphosphate (STPP) market, driven by their crucial role as potent builders that enhance stain removal, water softening, and cleaning effectiveness. Sodium tripolyphosphate continues to hold the largest market share in this sector, despite global growth in household and industrial detergent consumption. Its leadership is further reinforced by its affordability and compatibility with various formulations.

Food Industry: The food industry is growing rapidly as food-grade STPP becomes better known for its use as a stabilizer, preservative, and moisture-retention agent in processed foods. Growth in this category is being accelerated by rising consumer demand for packaged and convenience foods. Adoption is further boosted by increased global attention to product safety and longer shelf life.

Ceramics and Glass: Ceramics and glass production are seeing notable growth in the market for sodium tripolyphosphate, where the compound crucially serves as a dispersing agent and processing aid. Although smaller, this segment remains relevant as the ceramics, construction materials, and specialty glass manufacturing sectors expand. Its ability to improve material uniformity and optimize production efficiency makes it a key supporting application.

End-User Industry Insights

Food and Beverage: The food & beverage segment dominated the market because processed meats, seafood, dairy, and baked goods all contain this compound. This is the top end-user segment due to its many uses in enhancing product stability, prolonging shelf life, and improving texture. The segments dominance is further reinforced by the packaged food industrys continuous global market expansion.

Agriculture: The agriculture sector is the fastest-growing, as fertilizers and nutrient-management products increasingly use STPP. Its use in agricultural formulations is increasing due to the drive for increased crop yields and improved farming techniques. Demand is further fueled by growing interest in improved soil conditioning and micronutrient delivery systems.

Product Form Insights

Powdered STTP: The powdered STPP segment led the market due to its high solubility, ease of blending, and extensive use in food formulations, industrial processing, and detergents. It is the preferred form in all major industries due to its handling advantages and stability. Its adaptability and reliable performance in large-scale production are additional reasons why manufacturers prefer it.

Liquid STPP: This segment is growing rapidly as industries explore more convenient, ready-to-use formulations, especially in water treatment, industrial cleaners, and specialty chemical processes. Its increasing adoption reflects a shift toward flexible application formats. The growing need for precise dosing and rapid dispersion in certain processes further supports its rise.

Granular STPP: This segment is a notable application area appreciated for its easy dosing, controlled release, and suitability for applications requiring precise material flow. Despite being smaller than powdered STPP, it is still very useful in both industrial and agricultural applications. It is well-suited to specific applications due to its enhanced handling and reduced dust production.

Distribution Channel Insights

Direct Sales: Direct sales dominate the distribution landscape, with major detergent manufacturers, food processors, and industrial users purchasing sodium tripolyphosphate directly from producers for assured quality, bulk pricing, and long-term supply stability. This channel also strengthens supplier–buyer relationships and supports customized product specifications.

Distributors: Distributors are growing rapidly as small- and mid-sized end users increasingly rely on outside vendors for competitive pricing, regional availability, and flexible order quantities. Their extensive networks allow manufacturers to better penetrate the market and deliver goods more quickly.

Grade Insights

Industrial Grade STPP: The segment led the market during 2024 due to its widespread use in detergents, ceramics, water treatment, and other manufacturing processes. It is the most widely used grade due to its affordability and wide suitability. This market is further strengthened by the demand for bulk industrial chemicals in emerging economies.

Food-grade STPP: This segment is growing fastest, stimulated by growing food processing operations and consumer demand in international markets for packaged, preserved, and texture-enhanced foods. Growing safety certifications and regulatory approvals are hastening its market acceptance.

Sodium Tripolyphosphate (STPP) Market Regional Insights

Asia Pacific dominated the sodium tripolyphosphate (STPP) market because the region hosts very large detergent production bases, rapidly expanding food processing industries and strong industrial activity across China, India and Southeast Asia. Manufacturers in these countries benefit from abundant raw materials, competitive production costs and well-developed chemical supply chains, which support high-volume STPP output for both domestic use and export.

Rapid industrialization has also increased demand for water treatment chemicals, cleaning products and processing aids, all of which rely heavily on STPP for performance and stability. In addition, the regions growing middle-class population continues to drive consumption of packaged foods, personal care items and household detergents, further strengthening demand across multiple STPP applications.

India Sodium Tripolyphosphate (STPP) Market

India is growing in the market because the detergent industry, which remains the biggest consumer, has strong demand. While the nations booming ceramics and tile industry supports consistent industrial demand, growing packaged food production is increasing the use of food-grade STPP. India remains one of Asias fastest-growing STPP markets, driven by rapid urbanization and rising household consumption.

North America is growing rapidly in the sodium tripolyphosphate (STPP) market because industries in the region increasingly rely on advanced specialty chemical formulations for detergents, food processing and industrial cleaning. Investments in modern water treatment infrastructure are rising as municipalities and private operators focus on improving scale control, corrosion prevention and overall water quality, which reinforces regional demand for STPP-based additives.

The food sector is also adopting new processing technologies that require reliable moisture-retention and texture-stabilisation agents, creating additional opportunities for STPP suppliers. As environmentally friendly industrial processes gain wider adoption and manufacturers prioritise higher efficiency and lower waste, demand for high-performance, well-regulated chemical inputs continues to strengthen across the region.

The U.S. is growing, backed by sophisticated food processing, a robust market for specialty detergents, and expanding water treatment applications. Food-grade STPP is widely used in frozen and processed foods, while industrial-grade STPP is used as a cleaning agent and in ceramics. Demand is consistently high due to the nations emphasis on effective formulations and quality standards.

The Middle Eastern region is experiencing steady growth in the sodium tripolyphosphate (STPP) market because water treatment facilities, food processors and detergent manufacturers are increasing their use of performance additives to meet rising operational and quality standards. Demand is also being supported by the expansion of modern household cleaning practices, particularly in urban areas where consumers prefer high-efficiency detergents and multi-purpose cleaning agents that rely on STPP for stability and effectiveness.

Industrial sectors are investing more in specialised cleaning chemicals to maintain equipment reliability and hygiene in manufacturing plants, which further strengthens regional consumption. In addition, many countries in the region are placing greater emphasis on improving industrial efficiency, recycling water and raising overall water quality, leading operators to adopt STPP as part of their treatment formulations. Overall, the market is growing consistently due to a strong shift toward high-performance, professionally formulated cleaning and processing products.

UAE Sodium Tripolyphosphate (STPP) Market

UAE is growing as demand increases from food processing facilities, the hospitality sector, and the detergent industry. The demand for high-purity STPP is increasing due to the nations sophisticated water treatment infrastructure and widespread use of high-end cleaning supplies. Expanding the market is further supported by strong logistics capabilities and a preference for premium chemical ingredients. Additionally, the UAEs sustainability initiative promotes controlled phosphate use and cleaner production.

Sodium Tripolyphosphate (STPP) Market Companies

A key division of the Aditya Birla Group, producing chlor-alkali, phosphates, sulphites, and advanced materials for industrial and agricultural applications. The company serves global markets with a strong focus on sustainability and large-scale chemical manufacturing.

A global fertilizer producer with significant operations in nitrogen, phosphate, and potash. EuroChem also supplies industrial phosphate chemicals used in food, water treatment, and manufacturing.

Part of the Aditya Birla Group, engaged in chemicals, textiles, and advanced materials. Grasim is a major producer of chlor-alkali chemicals, epoxy resins, and other industrial inputs.

A Chinese producer specializing in phosphate-based fine chemicals and fertilizers. The company operates integrated mining and processing facilities supporting agriculture and industrial applications.

An Israeli multinational known for specialty fertilizers and industrial phosphates. Haifa supplies high-purity phosphate salts for food, industrial, and agricultural markets.

One of Chinas largest phosphate chemical companies, involved in mining, processing, and fine chemical production. Its portfolio includes industrial phosphates, food-grade phosphates, and speciality chemicals.

A leading North American manufacturer of specialty phosphates used in food, pharmaceuticals, and industrial markets. Innophos is known for high-purity formulations and customized functional additives.

A global minerals and specialty chemicals company producing essential phosphates, potash, and bromine. ICL serves agricultural, industrial, and food industries with advanced chemical solutions.

One of the worlds largest producers of phosphate and potash fertilizers. Mosaic operates integrated mining-to-production facilities to supply the global agriculture and industrial phosphate markets.

A major Russian integrated producer of high-grade phosphate rock and mineral fertilizers. PhosAgro is one of the worlds largest suppliers of phosphate-based crop nutrients and technical phosphates.

Recent Developments

- In August 2024, Prayon acquired Natural Enrichment Industries (NEI) in the U.S., reinforcing its position in the high-value phosphate salts market. Through this acquisition, Prayon expands its production footprint with NEIs sites in Illinois, complementing its Georgia plant and widening its capacity to serve both technical and food applications(Source:https://www.prayon.com)

- In November 2024, PhosAgro announced a record RUB 75 billion investment 2024 to expand its phosphate-chemical production. The investment is targeted at scaling up phosphate rock processing, sulfuric acid, and other critical inputs to ramp up production of agrochemicals, including sodium tripolyphosphate.(Source: https://www.phosagro.com)

Sodium Tripolyphosphate (STPP) MarketSegments Covered in the Report

By Application-Based

- Food Industry

- Detergents

- Ceramics and Glass

- Textiles

By End-User Industry

- Agriculture

- Food and Beverage

By Product Form

- Granular STPP

- Powdered STPP

- Liquid STPP

By Distribution Channel

- Direct Sales

- Distributors

By Grade

- Food Grade STPP

- Industrial Grade STPP

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting