What is the Fertilizer Market Size?

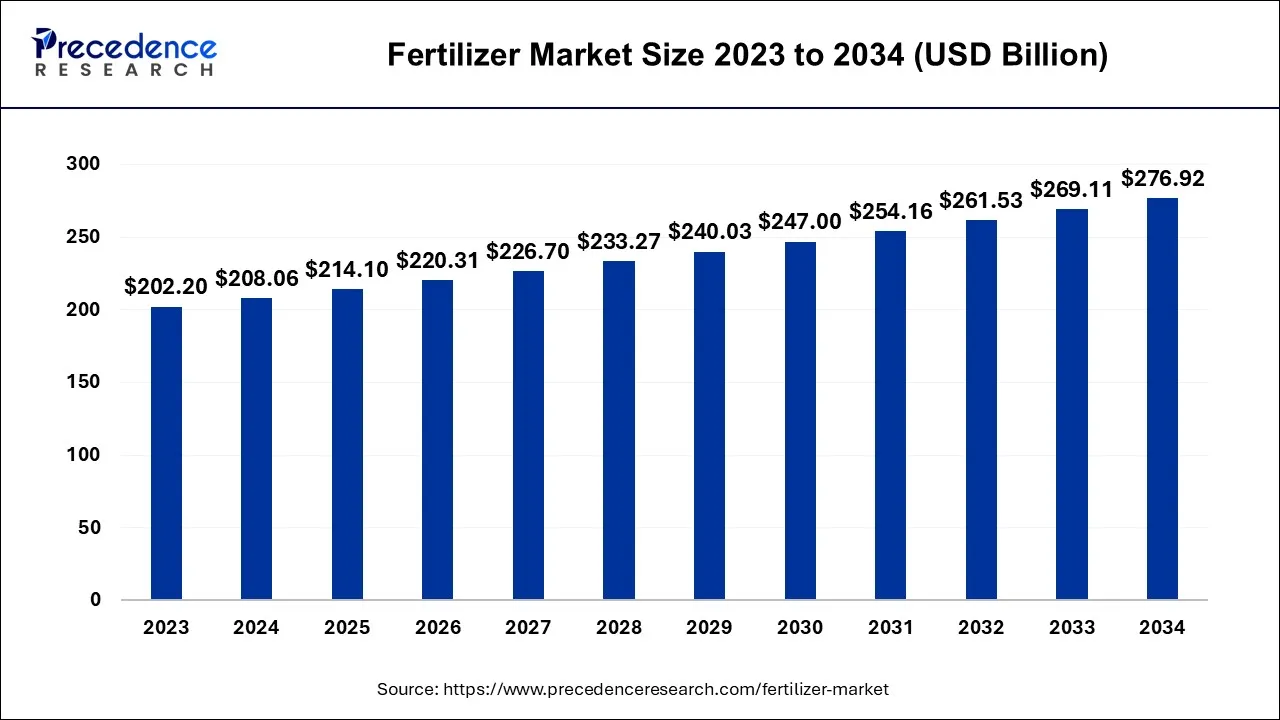

The global fertilizer market size is expected to be valued at USD 214.10 billion in 2025 and is predicted to increase from USD 220.31 billion in 2026 to approximately USD 276.92 billion by 2034, expanding at a CAGR of 2.9% over the forecast period from 2025 to 2034.

Fertilizer Market Key Takeaways

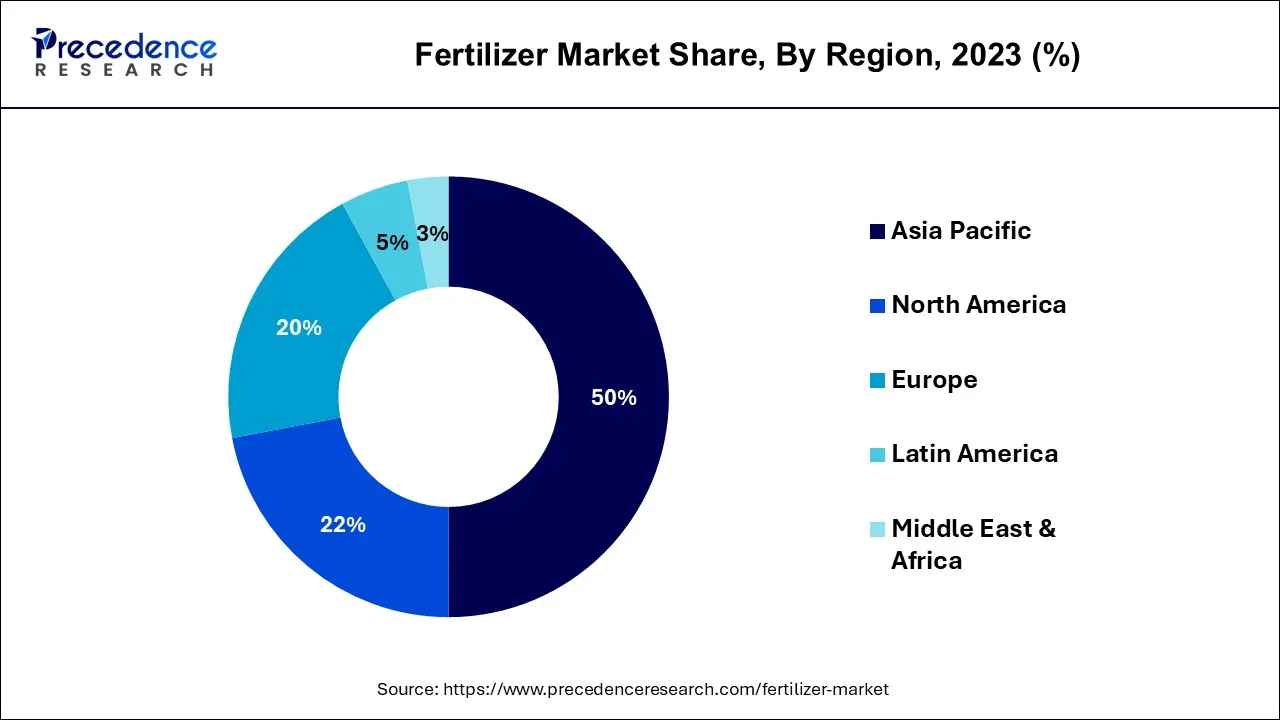

- The Asia-Pacific market led the global market with the highest market share of 50% in 2024.

- By form, the dry fertilizer segment has garnered 82.50% market share in 2024.

- By application, the agriculture segment accounted largest market share of 46.1% in 2024.

- By product, the organic segment accounted market share of around 94% in 2024.

AI in the Market

The fertilizer market is undergoing a radical transformation, thanks to artificial intelligence, which optimizes the entire process of production, distribution, and application. It not only makes the manufacturing processes more efficient but also reduces the amount of waste produced and, at the same time, maintains the quality of the products. AI enables companies to predict the future demand of their products and to organize their logistics in such a way that their cost management will be improved. In the agricultural sector, it studies the condition of the soil and weather to suggest the right amount of fertilizer to be used, which facilitates the process of reducing the environmental impact and rejuvenating the soil. AI is a tool that facilitates the process of making informed decisions that ultimately result in the dual benefit of sustainability and increased productivity.

Fertilizer Market Growth Factors

The growing population is emphasizing the expansion of agriculture sector. As per the United Nations, the worldwide population will surpass nine billion people by 2050. In addition, as per the Food and Agriculture Organization, more than 70% of the global population will live in cities by 2050. The farmers are being forced to use fertilizers to enhance their agricultural output due to loss of arable land across the globe. As a result, the growing population is expanding the global fertilizer market over the forecast period.

As the need for smart agriculture grows, different governments in emerging and established nations have taken steps to encourage farmers to convert their land to organic. For example, the European government has set aside 30% of its CAP policy's rural development budget to assist organic farming. The governmental activities that is likely to benefit the sales of organic fertilizers in the coming years to come include market findings, capacity growth, targeted subsidies, and research assistance for organic farming. Thus, the surge in demand for organic fertilizers is contributing towards the growth of global fertilizer market.

- The growth of global fertilizer market is also being driven by the expansion of various industries such as agriculture and horticulture.

- The government all around the world is highly investing for the development of global fertilizer market.

- The global fertilizer market is diversified with several fertilizer producers around the world. As fertilizers are such as crucial element for increasing crop yields, the key market players are forming strategic alliances and strategies such as partnership, product launch, joint venture, and collaboration to expand their regional presence and product portfolio. In addition, government is also collaborating with market players for expansion of the market all over the world.

- The increase in the global population has increased the demand for food, which in turn has encouraged farmers to apply fertilizers to achieve better crop yields.

- The urbanization process has caused the reduction of cultivable land, which in turn has made it necessary to use fertilizers for the limited soil to be productive as much as possible.

- Governments all over the world are putting this to the fore through taking initiatives such as implementing favorable policies, providing financial assistance, and establishing research programs, which will, in turn, promote the production of fertilizers and the spread of sustainable agricultural practices.

- There is a consumer trend towards organic food that is causing a rise in demand for fertilizers that are easy on the environment.

- The coming of new technologies, smart farming, and cooperation among producers are all aspects that are contributing to the widening of the market and the efficiency of production.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 214.10 Billion |

| Market Size in 2026 | USD 220.31 Billion |

| Market Size by 2034 | USD 276.92 Billion |

| Market Growth Rate from 20245 to 2034 | CAGR of 2.9% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Application, Product, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Global Population and increasing demand for food

The global human population has experienced a staggering increase, surging to over three times its size in the mid-twentieth century. According to United Nations, as of mid-November 2022, the estimated global population reached 8.0 billion, a significant leap from 2.5 billion in 1950. In just over a decade, the world population has grown by 1 billion people, and in just over two decades, it has skyrocketed by 2 billion. Projections indicate that the world's population is expected to continue to rise, with an estimated increase of nearly 2 billion individuals over the next 30 years, reaching 9.7 billion by 2050 and possibly peaking at nearly 10.4 billion in the mid-2080s.

As the world population continues to rise, there is a pressing need to increase agricultural productivity to meet the expanding demand for food. Fertilizers play a critical role in modern agriculture as they provide essential nutrients to crops, improve soil fertility, and enhance crop yields. Moreover, changing dietary patterns and the shift towards more protein-rich diets in emerging economies are fueling the demand for animal feed, which, in turn, is boosting the need for fertilizers used in forage and pasture production. Furthermore, the adoption of modern agricultural practices and technologies, such as precision agriculture techniques, is increasing the emphasis on using fertilizers for optimized crop production.

Rising Focus on sustainable agriculture and environmental concerns

Specialty fertilizers, including organic and bio-based fertilizers, are gaining popularity due to their eco-friendly nature, aligning with the increasing consumer demand for environmentally friendly and sustainable products. Moreover, government policies and subsidies that promote the use of fertilizers to increase agricultural productivity also impact the fertilizer market. Many governments worldwide provide subsidies or incentives to farmers, which accelerate demand for fertilizers and positively impact the market. Additionally, weather conditions and climate change, such as extreme weather events and changing weather patterns, disrupt agricultural production and result in increased demand for fertilizers to restore soil fertility and support crop growth.

Restraints

Environmental Constraints

The increasing global population and its demand for resources, energy, and food have detrimental effects on the environment. Overexploitation of natural resources, such as forests, fisheries, and water sources, lead to depletion and loss of biodiversity, disrupting delicate ecosystems and posing long-term sustainability challenges. Deforestation, driven by agricultural expansion, logging, and infrastructure development, contributes to habitat destruction, loss of carbon sinks, and climate change. Pollution from industrial and agricultural activities, including air and water pollution, degrades ecosystems, harm human health, and damage biodiversity. Climate change, caused by greenhouse gas emissions, has far-reaching consequences on weather patterns, sea-level rise, extreme weather events, and natural disasters, affecting agriculture, water resources, and vulnerable communities.

Social and Economic Constraints

Social and economic constraints impede progress and development. Socio-economic inequalities, including disparities in income, education, healthcare, and access to basic amenities, limit opportunities for certain groups and hinder social mobility. Poverty, particularly in developing countries, results in food insecurity, malnutrition, and inadequate access to clean water and sanitation. Unemployment, underemployment, and lack of economic opportunities leads to social unrest and undermining social cohesion and stability. Political instability, conflicts, and legal/regulatory barriers hinder governance, human rights, and rule of law, leading to social and economic constraints.

Opportunity

Sustainable and Green Technologies

The development and adoption of sustainable and green technologies present significant opportunities for addressing environmental, social, and economic challenges. Renewable energy technologies, such as solar, wind, and hydropower, offer alternatives to fossil fuels, reducing greenhouse gas emissions, mitigating climate change, and promoting sustainable energy production. Sustainable agricultural technologies, including precision farming, organic farming, and agroforestry, can improve soil health, enhance crop yields, reduce chemical inputs, and promote biodiversity. Circular economy practices, such as recycling, upcycling, and waste reduction, can contribute to resource conservation, reduce pollution, and create economic opportunities. Smart and green urban planning and infrastructure, such as green buildings, public transportation, and sustainable waste management, enhances quality of life, reduce carbon emissions, and improve resilience to climate change.

Form Insights

The dry fertilizer segment accounted largest market share in 2024. Dry fertilizers are solid fertilizers that come in granulated or powdered form, and are widely used in agriculture for field crops, such as grains, cereals, and oilseeds. One of the main factors driving the demand for dry fertilizers is their cost-effectiveness. Dry fertilizers are generally less expensive to produce, transport, and store compared to liquid fertilizers. They can be easily stored for longer periods without the need for special storage facilities, which results in cost savings for farmers and distributors. Additionally, dry fertilizers are easy to apply using various types of equipment, such as spreaders, seeders, and planters, making them convenient for farmers. The most significant advantage of a dry fertilizer is that it absorbs slowly in the soil. It is commonly used in large fields as it lasts longer than any other fertilizer. Furthermore, using a dry fertilizer rather than a liquid fertilizer, which gradually burns plants, has a much lower risk of harming plants and crops.

The liquid fertilizer segment is fastest growing segment of the fertilizer market in 2023. The surge in demand for high efficiency fertilizers, the convenience of use and administration of liquid fertilizers, and the acceptance of precision agriculture and irrigated agriculture are some of the drivers expected to propel the growth of the segment.

Product Insights

The organic segment garnered the largest revenue share in 2024. The organic fertilizers are mineral sources that are found in nature and include a moderate amount of plant needed nutrients. They are capable of resolving issues caused by synthetic fertilizers. They lessen the need for synthetic fertilizer applications to maintain soil fertility. They slowly release nutrients into the soil solution while maintaining nutritional balance for plant and crop growth.

The inorganic segment is fastest growing segment of the fertilizer market in 2023. The minerals and synthetic chemicals are used to make inorganic fertilizer. The petroleum is a popular source of inorganic nitrogen. Inorganic fertilizers are high in macronutrients such as potassium chloride, ammonium sulphate, and magnesium sulphate. Because the phosphorus, potassium, and nitrogen mix can provide quick treatment, some gardeners find inorganic fertilizer useful for rescuing starved plants. Inorganic fertilizers are chemically synthesized and typically contain essential nutrients in concentrated forms, such as nitrogen, phosphorus, and potassium, which are crucial for plant growth. They are widely used in modern agriculture and horticulture practices due to their effectiveness and availability in various formulations that cater to specific crop requirements. Inorganic fertilizers are commonly used in large-scale agricultural production which drives the growth of this segment. Moreover, inorganic fertilizers have a longer shelf life and can be stored for a longer period without losing their effectiveness, making them convenient for transportation, storage, and application. This allows for efficient distribution and use in various agricultural and horticultural practices. The growth of this segment is driven by the high demand for high-yielding and consistent crop production to meet global food demand.

Application Insights

The agriculture segment held the highest revenue share in 2024. The three essential plant nutrients, potassium, nitrogen, and phosphorus are found in most fertilizers used in agriculture. The certain micronutrients such as zinc are also present in some fertilizers and are required for plant growth. Natural fertilizers are materials that are put to the ground with the goal of improving soil properties. Fertilizers are primarily used in agriculture to enhance soil fertility and improve crop yields. Agriculture includes the cultivation of various field crops, such as grains, cereals, oilseeds, and fiber crops, as well as specialty crops, such as fruits, vegetables, and nuts. Fertilizers play a critical role in modern agriculture by providing essential nutrients to crops, promoting healthy plant growth, and maximizing crop productivity. Farmers extensively use fertilizers in agricultural practices to optimize crop production and achieve higher yields, contributing to the dominant demand for fertilizers in the agricultural sector.

The horticulture segment is the fastest growing segment of the fertilizer market in 2024. The fertilizers used for horticulture are very essential for the growth of plants. They provide large number of nutrients to the crops and results into rapid growth of plants. As a result, the growing importance of using fertilizers is driving the growth of the segment during the forecast period. Furthermore, Horticulture segment is expected to grow during the forecast period. Horticulture involves growing fruits, vegetables, flowers, and ornamental plants. These crops have specific nutrient requirements, and fertilizers are used to supplement them for healthy growth

Regional Insights

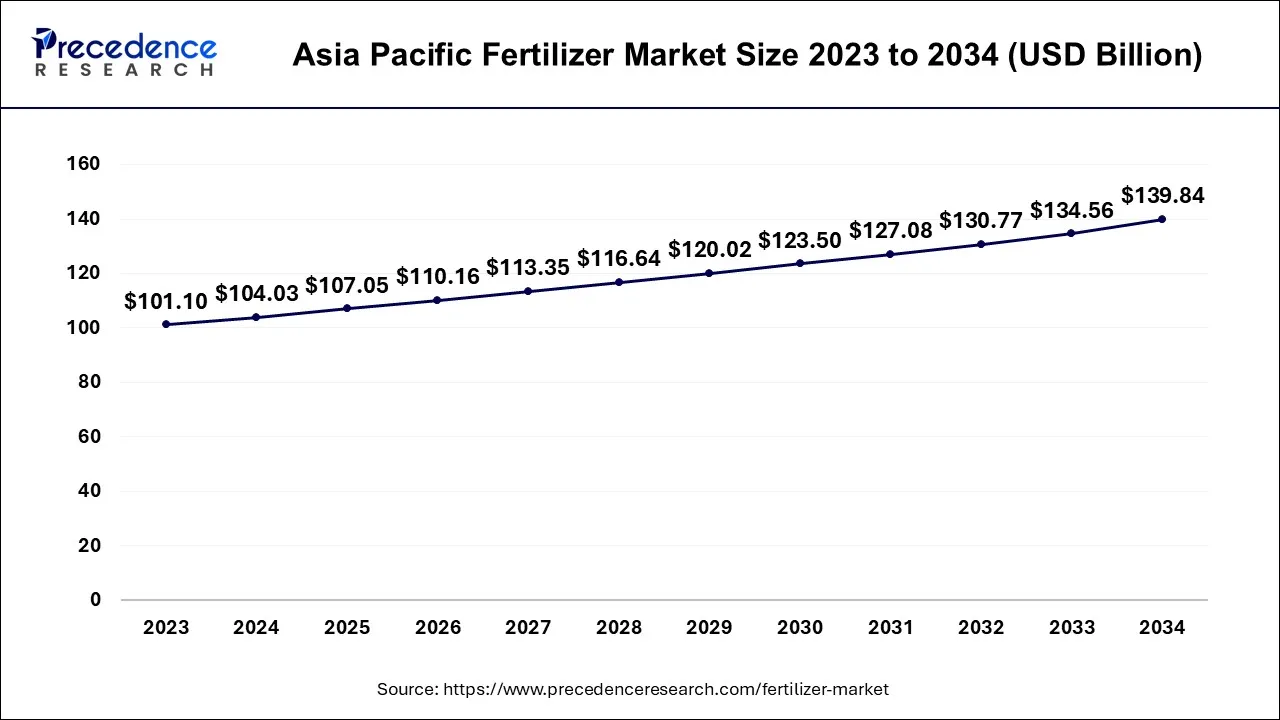

Asia Pacific Fertilizer Market Size and Growth 2025 to 2034

The Asia Pacific fertilizer market size is calculated at USD 107.05 billion in 2025 and is projected to be worth around USD 139.84 billion by 2034, poised to grow at a CAGR of 3% from 2025 to 2034.

Asia-Pacific dominated the fertilizer market in 2024.The Asia-Pacific region is considered as largest region in terms of rice production. The rice requires nitrogen while cultivation process. The rice production represented for 36% of total fertilizer consumption in Asia in 2017. In 2020, India has projected to export rice worth around US$ 4 billion. Oil palm fertilizer accounted 17% of overall fertilizer consumption and 50% of potash usage.

The region growth is driven by increasing demand for food due to population growth and changing dietary patterns. As the population continues to grow, there is a pressing need to increase agricultural productivity to meet the rising demand for food. Fertilizers play a crucial role in modern agriculture by providing essential nutrients to crops, improving soil fertility, and enhancing crop yields. In addition, the adoption of modern agricultural practices and technologies in Asia-Pacific, such as precision agriculture techniques, is driving the demand for fertilizers.

Precision agriculture involves using data-driven and technology-based approaches to optimize crop production, including the precise application of fertilizers based on crop needs, soil conditions, and weather patterns. This trend is leading to a higher demand for specialized and customized fertilizers tailored to the specific requirements of different crops, which further drives the fertilizer market in the region.

Middle East & Africa Fertilizer market is expected to grow at a CAGR of 4% from 2025 to 2034. Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the fertilizer market in Europe region. The growth of fertilizer market in Europe region is being driven by the surge in demand for organic products. In addition, rising disposable income are also driving the growth of Europe fertilizer market. Moreover, the technological advancements is creating demand for fertilizer in Europe region.

How is Asia-Pacific performing in the Fertilizer Market?

The Asia-Pacific region dominates the global fertilizer market due to a number of factors, like population increase, high food demand, and strong government support for agriculture. It is the very large-scale farming activities and the drive for self-sufficiency that keep the region's consumption of fertilizers very high. The region's adoption of modern farming practices, along with the use of organic fertilizers, further strengthens the market growth and its competitiveness against other regions.

China Fertilizer Market Trends

China's fertilizer market is getting bigger and bigger with government-backed agricultural modernization and also production on a larger scale. The growth is coming from the self-sufficiency goals, and the innovations in and demand for eco-friendly fertilizers. The integration of digital farming technologies along with efficient supply chains both sustains and strengthens the country's leadership in global fertilizer production.

How is North America leading in the Fertilizer Market?

The North American fertilizer market is characterized by the use of advanced farming systems, mechanization, and the high acceptance of precision agriculture. The regions' growth is influenced by the traits of efficiency, sustainability, and organic production. Research investments, along with the integration of technology, will lead to higher productivity, while the environmental consciousness among the farmers will facilitate the transition to balanced nutrient use and the adoption of eco-friendly fertilizers.

United States Fertilizer Market Trends

The U.S. market is driven by advanced agricultural practices, large areas of arable land, and the need for organic and precision farming solutions. There is a constant evolution in the game of fertilizer formulations and digital tools, which increases the productivity and thus the sustainability of the industry, making it possible to support the management of nutrients in a balanced manner and at the same time be good to the environment in different crop systems.

What are the driving factors of the Fertilizer Market in Europe?

Environmental regulations of a very high standard, and also the innovation in specialty and sustainable fertilizers, are the main forces driving the European fertilizer market at the fastest pace. The region advocates for efficient nutrient management and eco-friendly production processes. Partnerships between fertilizer producers and government agencies encourage the application of modern technologies, responsible fertilizer use, and the adoption of circular economy practices in the agricultural sector.

Russia Fertilizer Market Trends

Russia is in a strong position mainly because of its megascopic natural resources and modernization investments in fertilizers. The concentration on nitrogen fertilizers and the adoption of quality production technologies ensure that the country remains competitive. Through the promotion of sustainable agriculture and supporting the export market, government practices are underlining the country's presence in the global market for fertilizers even more.

Fertilizer Market Companies

- Haifa Group

- Nutrien Ltd.

- Yara International ASA

- CF Industries Holdings Inc.

- Syngenta AG

- Bunge Limited

- Israel Chemicals Ltd.

- Indian Farmers Fertilizer Cooperative Limited

- Sumitomo Chemical Co. Ltd

- Gemlik Fertilizer Inc.

Recent Developments

- Haifa Group added an extra 8,000 MTPA production capacity to its Controlled Release Fertilizer facility in France in 2019. The corporation was able to boost its production capacity by up to 24,000 MTPA due to this method.

- Yara purchased Finish colan in September 2021 to grow its organic fertilizer business, demonstrating the company's commitment to a larger position in the organic fertilizer industry.

- Vale CubataoFertilizantes Complex in Brazil was purchased for $255 million by Yara International ASA in 2018. The firm was able to improve its nitrogen production assets as well as its market position in the Brazilian fertilizer industry due to these tactics.

- Nutrien Ltd. purchased Ruralco Holdings Ltd. in Australia in September 2019. Nutrien would be able to provide considerable advantages to its stakeholders as well as improve the delivery of its services and products to Australian farmers as a result of this transaction.

- The Mosaic Company introduced the first DAP fertilizer in Saudi Arabia in 2017, through a joint venture. It supplied a fresh source of phosphate rock, allowing it to gain access to expanding agricultural markets, particularly in India.

- Yaralix, a smart agriculture technology released by Yara International ASA in March 2019, allows farmers to measure crop nitrogen needs using their cellphones. The technology comprised of a free to download app that used the smartphone camera to calculate nitrogen requirements for various crops in their early stages of development.

- In October 2025, the agriculture department and local sugar mills initiated a program to convert sugarcane trash into organic fertilizer, enhancing soil health and sustainable farming.

https://www.chinimandi.com - In September 2025, Refex Renewables Infrastructure is expanding into fertilizer manufacturing and trading after shareholders approved amendments to its Memorandum of Association during the 31st Annual General Meeting on September 18, 2025.

https://scanx.trade/stock-market-news

Value Chain Analysis:

- Harvesting and Post-Harvest Handling: The whole process starts with the collection of raw materials and the application of techniques to preserve their quality at the very beginning of processing so that losses can be minimized.

Key Players: Farmers/Producers, Farmer-Producer Organizations (FPOs), local aggregators/commission agents - Storage and Cold Chain Logistics: The product's integrity is guaranteed by the provision of the best environmental conditions throughout the storage and transportation process.

Key Players: Adani Agri Logistics, Snowman Logistics, DHL Supply Chain, Mahindra Logistics - Processing and Packaging: The raw inputs are turned into finished fertilizer products, and they are well-packaged for safety and market readiness.

Key Players: Nutrien, Yara International, The Mosaic Company, CF Industries Holdings, Coromandel International - Distribution to Wholesalers/Retailers: The packaged fertilizers are efficiently and quickly transported and supplied to the wholesale and retail markets, where the consumers can access them.

Key Players: IFFCO, KRIBHCO) - Export and Trade Compliance of Fertilizer: All the requirements related to regulations, documentation, and logistics for the international trade of fertilizers are met.

Key Players: Alibaba, IndiaMART, TradeIndia)

Segments Covered in the Report

By Form

- Dry

- Liquid

By Application

- Agriculture

- Grains and Cereals

- Oilseeds

- Fruits and Vegetables

- Others

- Horticulture

- Gardening

By Product

- Organic

- Plant-based fertilizers

- Animal-based fertilizers

- Mineral-based fertilizers

- Inorganic

- Nitrogen

- Urea

- Anhydrous ammonia

- Ammonium nitrate

- UAN solutions

- Ammonium sulfate

- Phosphorus

- Diammonium phosphate

- Monoammonium phosphate

- Triple superphosphate

- Ordinary superphosphate

- Ammonium polyphosphate

- Others

- Potassium

- Potassium chloride

- Potassium sulfate

- Potassium nitrate

- Nitrogen

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting