What is the Graphite Market Size?

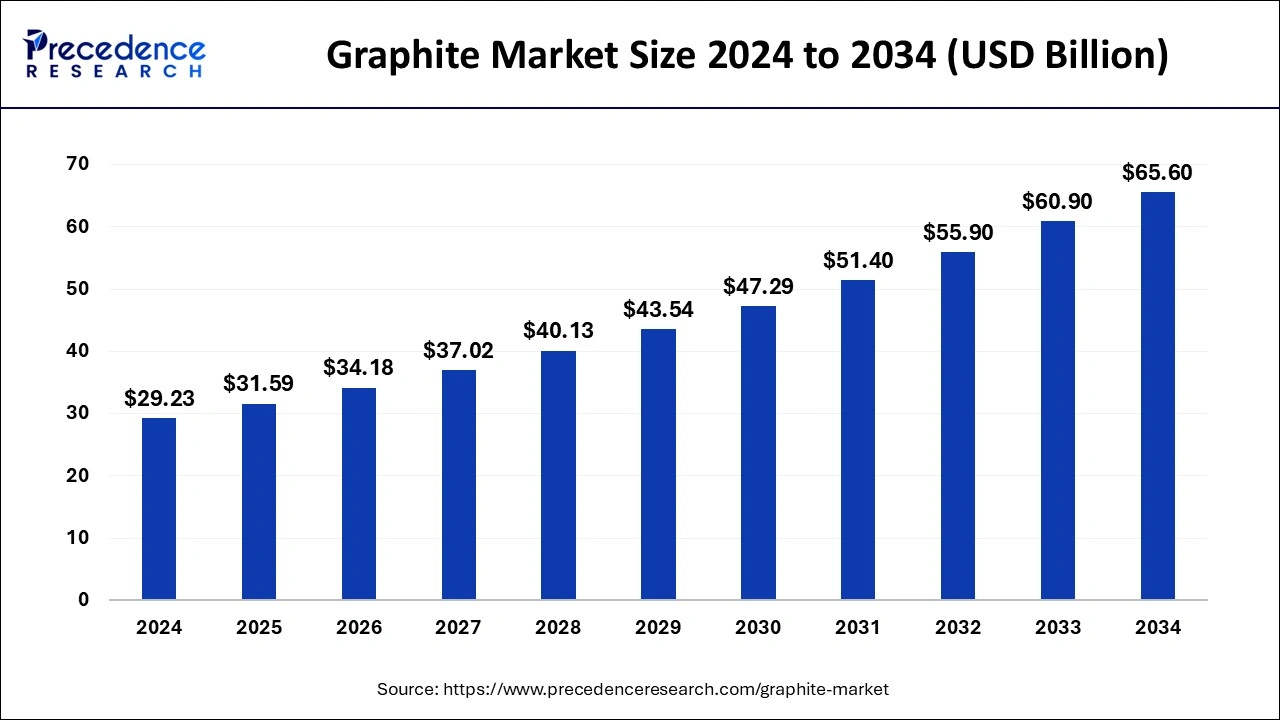

The global graphite market size was estimated at USD 31.59 billion in 2025 and is predicted to increase from USD 34.18 billion in 2026 to approximately USD 65.60 billion by 2034, expanding at a CAGR of 8.42% from 2025 to 2034.

Market Highlights

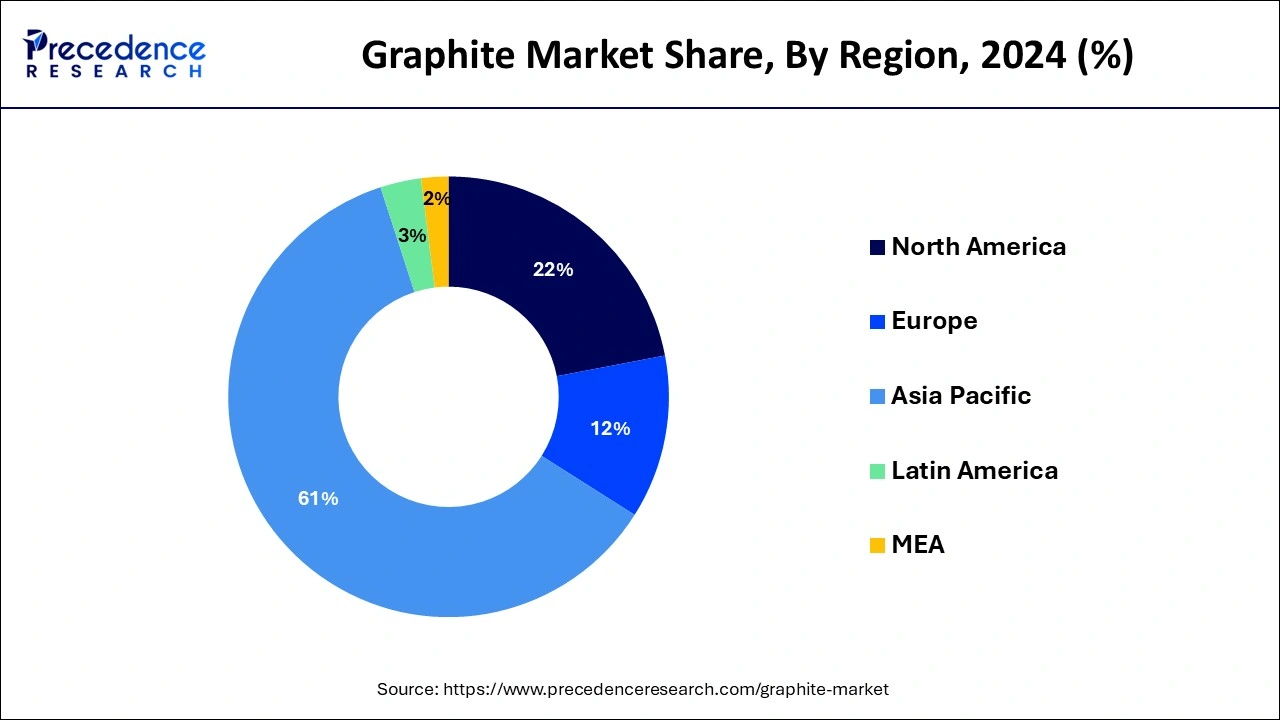

- Asia-Pacific contributed more than 61% of revenue share in 2024.

- North America is estimated to expand at the fastest CAGR between 2025 and 2034.

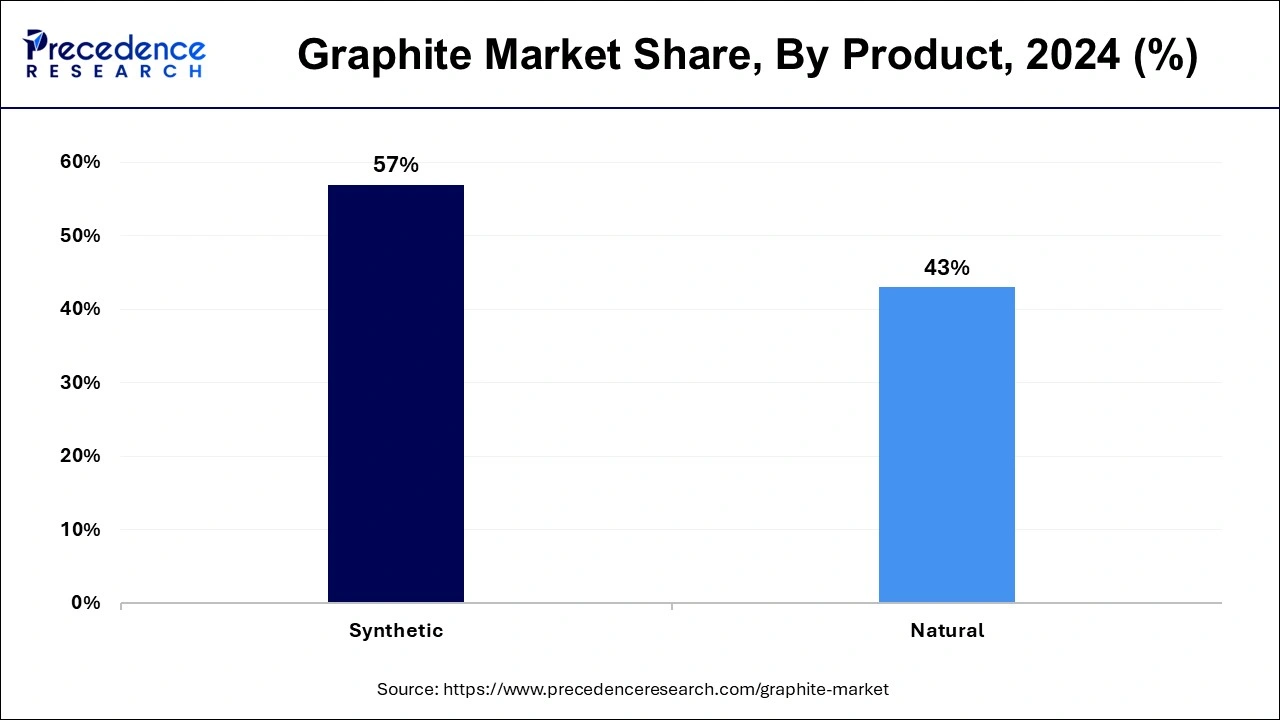

- By product, the synthetic segment has held the largest market share of 57% in 2024.

- By product, the personal care & cosmetics segment is anticipated to grow at a remarkable CAGR of 9.6% between 2025 and 2034.

- By application, the refractories segment generated over 29% of revenue share in 2024.

- By application, the virgin segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 31.59 Billion

- Market Size in 2026: USD 34.18 Billion

- Forecasted Market Size by 2034: USD 65.60 Billion

- CAGR (2025-2034): 8.54%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

Graphite is a specialized form of carbon characterized by its crystalline structure. Known for its slick and nonstick properties, it plays a vital role in various industries. With exceptional electrical conductivity and thermal stability, graphite is integral in the production of electrodes, batteries , and electrical components.

In metallurgy, it serves as a crucial element, acting as a refractory material in the creation of crucibles and molds for steel manufacturing. Beyond that, graphite's lightweight yet durable nature finds applications in the aerospace , automotive, and energy sectors. Its ability to withstand high temperatures and provide lubrication positions it as a fundamental material in industries ranging from machinery to cutting-edge technologies involving graphene-based materials.

Graphite Market Growth Factors

- The surge in popularity of electric vehicles and the need for efficient energy storage systems have notably elevated the use of graphite in lithium -ion batteries. Graphite plays a crucial role as a fundamental component in the anodes of these batteries, significantly contributing to the expansion of the graphite market.

- The metallurgical sector, particularly in steel production, emerges as a substantial consumer of graphite. With the global demand for steel on the upswing, the requirement for graphite as a refractory material in the creation of crucibles and molds for steel manufacturing is concurrently witnessing growth.

- Graphite's distinctive blend of lightness and strength positions it as an ideal material for applications in the aerospace and automotive sectors. Especially in the aerospace industry, graphite finds utility in components demanding a high strength-to-weight ratio, thereby playing a significant role in the overall market growth.

- Ongoing research and development in graphene, a derivative of graphite, have unlocked fresh opportunities across various industries. The exceptional properties of graphene, including high conductivity and strength, play a pivotal role in propelling the overall growth of the graphite market.

- Graphite's remarkable capacity to withstand high temperatures and provide effective lubrication makes it indispensable in industrial machinery. As industries progress technologically, there is a noticeable rise in demand for high-performance materials like graphite in manufacturing and machinery applications.

- The worldwide emphasis on renewable energy, encompassing wind and solar power, has spurred an increased demand for graphite in applications such as wind turbine components and solar panels. Graphite's commendable thermal stability and conductivity make it a fitting choice for these environmentally friendly technologies, thus fostering market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 31.59 Billion |

| Market Size in 2026 | USD 34.18 Billion |

| Market Size by 2034 | USD 65.60 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.42% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Surge in electric vehicle (EV) adoption

- According to the International Energy Agency (IEA), the global electric car stock surpassed 10 million in 2020, showcasing a substantial market for graphite in the battery sector.

- In February 2025, Epsilon announced its plan to invest INR 15,350 crore for EV battery materials and, testing facility in Karnataka. The company stated that it plans to invest INR 9,000 crore to set up a graphite anode manufacturing plant, INR 6,000 crore for a lithium iron phosphate (LFP) cathode manufacturing plant in Karnataka, and remaining it will invest INR 350 crore to build a battery materials and battery testing R&D and training center in the state.

According to the International Energy Agency, in 2024, global electric car sales soared by 35% year-on-year, increasing to almost 14 million new cars. While demand remained largely concentrated in China, Europe, and the United States, growth also picked up in some emerging markets such as Vietnam and Thailand, where electric cars accounted for 15% and 10%, respectively, of all cars sold.

The upsurge in the widespread adoption of electric vehicles (EVs) stands as a dynamic force driving the graphite market to new heights. This surge finds its roots in the essential role that graphite plays within the composition of lithium-ion batteries . As the automotive sector undergoes a transformative shift towards sustainable mobility, the demand for lithium-ion batteries has witnessed an unprecedented surge. Graphite, serving as a vital element in the anodes of these batteries, significantly contributes to their enhanced performance and augmented energy storage capabilities. Notably, data from the International Energy Agency highlights a significant milestone, with over 10 million electric cars navigating global roads in the year 2020.

This not only underscores the pivotal position of graphite in the automotive domain but also serves as a catalyst for innovations in battery technology, fostering a growing demand for graphite on the global stage. Positioned at the forefront, the graphite market is poised for sustained growth, driven by the ongoing electrification revolution in the rapidly expanding electric vehicle market.

Restraint

Limited graphite resources

The restricted availability of graphite resources significantly hinders market demand. Graphite being a finite resource implies that certain deposits may deplete over time, raising concerns about sustained availability. This scarcity affects industries, especially in sectors like electric vehicles and energy storage, where graphite is crucial. It not only increases production costs but also intensifies competition among industry players for access to these limited resources.

Moreover, the finite nature of graphite resources emphasizes the need for strategic resource management and exploration efforts to discover new deposits. Companies in the graphite market must navigate the challenge of balancing current demand with the imperative to secure a sustainable supply chain, emphasizing the importance of recycling initiatives and exploring alternative sources to mitigate the impact of resource limitations on market dynamics.

Opportunity

Innovations in lightweight materials for aerospace

Advancements in creating lighter materials for aerospace are opening significant doors for the graphite market. As the aerospace sector emphasizes fuel efficiency and improved performance, manufacturers are increasingly incorporating graphite-based composites in aircraft components. This integration helps reduce overall weight while enhancing structural integrity, aligning with the industry's goal of achieving better fuel economy and minimizing environmental impact.

Graphite's adaptability extends beyond traditional uses, with ongoing exploration into its potential for emerging technologies like additive manufacturing for aircraft parts. As the aerospace industry seeks innovative and sustainable solutions, graphite's distinct features position it as a preferred material, unlocking new opportunities for growth in an environment where weight savings and performance are paramount.

Segments Insights

Product Insights

The synthetic segment had the highest market share of 57% in 2024. The synthetic graphite segment in the graphite market refers to graphite produced through high-temperature processes using carbon-rich precursors. This method yields high-purity graphite with tailored properties for specific applications. A notable trend in the synthetic graphite sector is the growing demand for this variant in various industries, including electronics, aerospace, and energy storage. As industries seek enhanced performance and consistency, synthetic graphite becomes increasingly favored for its purity and customizable characteristics, reflecting a trend towards precision-engineered materials to meet evolving technological requirements.

The natural segment is anticipated to expand at a significant CAGR of 9.6% during the projected period. Within the graphite market, the natural graphite segment encompasses two key types: flake graphite and amorphous graphite, both sourced from natural deposits. Flake graphite, recognized for its crystalline structure, is commonly utilized in batteries and lubricants. On the other hand, amorphous graphite, distinguished by its non-crystalline form, finds applications in foundries and serves as a carbon additive. A noteworthy trend in this segment is the rising need for natural graphite, particularly in lithium-ion batteries, fueled by the expanding electric vehicle sector and the growing demand for renewable energy storage solutions.

Application Insights

The refractories segment has held a 29% revenue share in 2024. The refractories segment in the graphite market refers to the use of graphite in creating heat-resistant linings for high-temperature industrial processes, such as steel manufacturing. This application demands graphite's exceptional thermal stability. A notable trend in this segment is the increasing adoption of graphite-based refractories to enhance durability and performance in critical applications. As industries seek improved heat-resistant solutions, the refractories segment continues to witness growth, positioning graphite as a crucial material for applications requiring resistance to extreme temperatures in diverse manufacturing processes.

The lubricants segment is anticipated to expand the fastest over the projected period. In the graphite market, the lubricants segment involves using graphite as a crucial element in lubricating materials. Graphite's distinct qualities, especially its effectiveness and durability in providing lubrication, position it as a favored choice across various industries. A notable trend in this sector is the growing preference for graphite-based lubricants in situations with high temperatures, where traditional lubricants might fall short. As industries prioritize efficiency and longevity, the demand for graphite in lubricants underscores a rising trend, driven by its versatile and advantageous features in enhancing lubrication performance.

Regional Insights

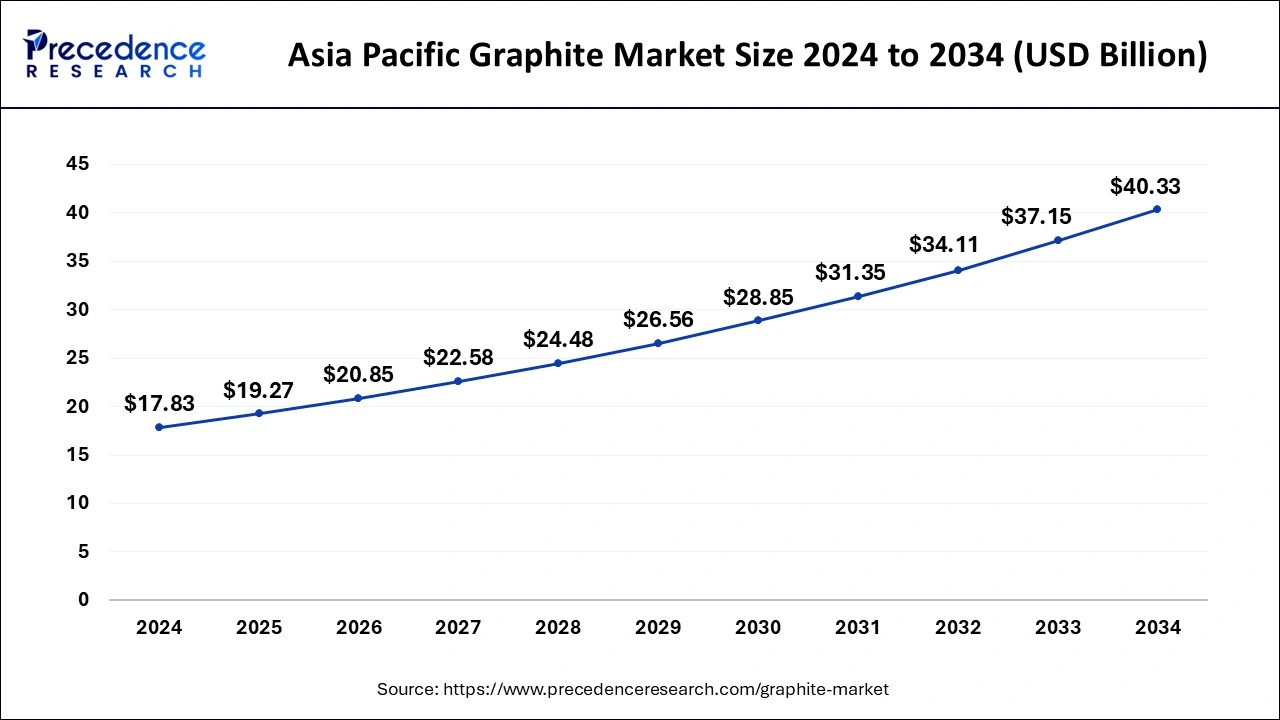

Asia PacificGraphite Market Size and Growth 2025 to 2034

The Asia Pacific graphite market size was evaluated at USD 19.27 billion in 2025 and is projected to be worth around USD 40.33 billion by 2034, growing at a CAGR of 8.50% from 2025 to 2034.

Asia-Pacific held the largest share of 61% in the graphite market due to a combination of factors. Asia-Pacific commands a significant share in the graphite market due to a confluence of factors. Rapid industrialization and urbanization in countries like China and India drive the demand for graphite in diverse applications, from steel production to electronics manufacturing. The region's robust automotive and energy storage sectors further contribute to graphite consumption. Additionally, favorable government policies, increased investments in infrastructure, and a growing emphasis on renewable energy solutions amplify the demand for graphite in the Asia-Pacific region, solidifying its dominant position in the global graphite market.

- Between January and October 2022, China experienced substantial growth in its iron and steel production capacities. Through capacity swaps, the country added 28.8 million metric tons per year (mt/year) of new pig iron production capacity and 23.1 million mt/year of new crude steel production capacity.

- In September 2024, POSCO Group, South Korea's steel and battery material conglomerate, announced its plan to invest in the world's second-largest graphite reserve, in Tanzania, with an aim to reduce graphite imports from China. South Korea is home to various global EV battery makers, including SK On Co., Samsung SDI Co., and LG Energy Solution Ltd., which heavily rely on the import of raw materials from China.

North America is poised for rapid growth in the graphite market due to increasing demand from key industries. The region's emphasis on electric vehicle production, coupled with advancements in battery technologies, propels graphite demand. Additionally, the growing aerospace sector's reliance on lightweight materials, where graphite plays a vital role, contributes to the market's expansion. The region's focus on renewable energy and sustainable practices further boosts graphite applications. With these factors aligning, North America stands as a promising market for graphite growth in the coming years.

- In January 2024, NMG announced the acquisition of 100% of Mason Resources' Lac Guéret Graphite Deposit/Uatnan Mining Project. The acquisition positions NMG as a leading graphite producer with 100% ownership in North America's two largest and most advanced projected natural graphite operations.

Meanwhile, Europe is witnessing significant growth in the graphite market due to several factors. The region's increased focus on electric vehicles , renewable energy, and aerospace applications has led to a surge in graphite demand. The push towards sustainability and the growing need for lightweight materials in manufacturing contribute to this growth. Additionally, innovations in graphite technologies, including graphene research, and a robust emphasis on environmental initiatives further propel the graphite market in Europe, creating a favorable landscape for its expansion in various industries.

Graphite Market Companies

- Syrah Resources Ltd.

- Imerys Graphite & Carbon

- Northern Graphite Corporation

- Mason Graphite Inc.

- Triton Minerals Ltd.

- SGL Carbon SE

- GrafTech International Ltd.

- Showa Denko K.K.

- Asbury Carbons

- Mersen S.A.

- Tokai Carbon Co. Ltd.

- Hexagon Resources Limited

- Alabama Graphite Corp.

- Graphex Mining Limited

- Black Rock Mining Limited

Recent Developments

- In October 2022, Imerys Graphite & Carbon initiated a significant project called the "EMILI Project" at its Beauvoir site in France's Allier départment. This landmark lithium exploitation project was designed to strengthen Imerys' standing as a market leader and expert in lithium-ion (Li-ion) battery components.

- In October 2022, Syrah Resources Ltd. made a significant announcement regarding its partnership with LG Energy Solution Ltd. in South Korea. Under the agreement, Syrah committed to supplying a crucial component for lithium-ion batteries, specifically graphite, to LG Energy Solution Ltd. The initial terms outlined the provision of 2 kilotons per annum of graphite to support LG Energy Solution Ltd.'s active anode material (AAM) starting in 2025.

- In March 2024, Syrah signed a binding offtake agreement with Posco Future M for natural graphite fines from Syrah's Balama Graphite Operations in Mozambique.

- In April 2025, Pobuzhzhia Development, part of BGV Group Management, unveiled its plan to develop a graphite deposit in the Kirovohrad region for battery production. Pobuzhzhia Development is developing BGV Graphite, a large-scale project in Ukraine's Kirovohrad region focused on the Balakhivka graphite deposit.

- In April 2025, NOVONIX announced its plan to invest USD 4.6 million to open a synthetic graphite manufacturing facility in Tennessee. NOVONIX has received approval to acquire land for its second mass production facility to meet the growing demand for synthetic graphite in the battery sector.

Segments Covered in the Report

By Product

- Synthetic

- Natural

By Application

- Refractories

- Foundries

- Batteries

- Friction Products

- Lubricants

- Others

By Reion

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting