What is the Electric Bus Market Size?

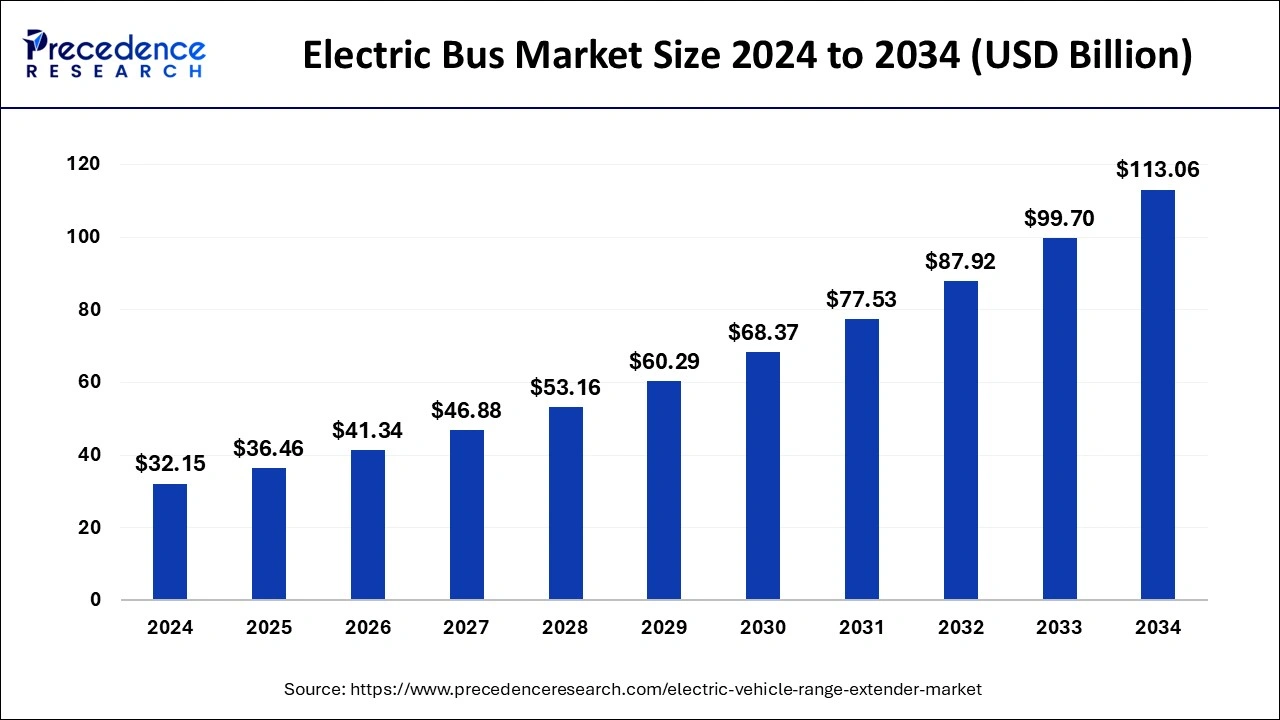

The global electric bus market size is accounted at USD 36.46 billion in 2025 and predicted to increase from USD 41.34 billion in 2026 to approximately USD 113.06 billion by 2034, representing a CAGR of 13.40% from 2025 to 2034.

Electric Bus Market Key Takeaways

- By vehicle, the BEV segment has captured a revenue share of 86% in 2024.

- The FCEV segment is expected to register a lucrative CAGR of 15.1% in terms of volume over the forecast period.

- By application, the intracity segment has held a revenue share of 86% in 2024.

- The intercity segment is expanding at a CAGR of 15.6% between 2025 to 2034.

- By end-use, the public segment has held a revenue share of around 81% in 2024.

- The private segment is growing at a CAGR of 11.8% from 2025 to 2034.

- By battery, the lithium iron phosphate battery segment has accounted revenue share of 90.5% in 2024.

- The lithium nickel manganese cobalt oxide segment is poised to grow at a CAGR of 14.7% over the forecast period.

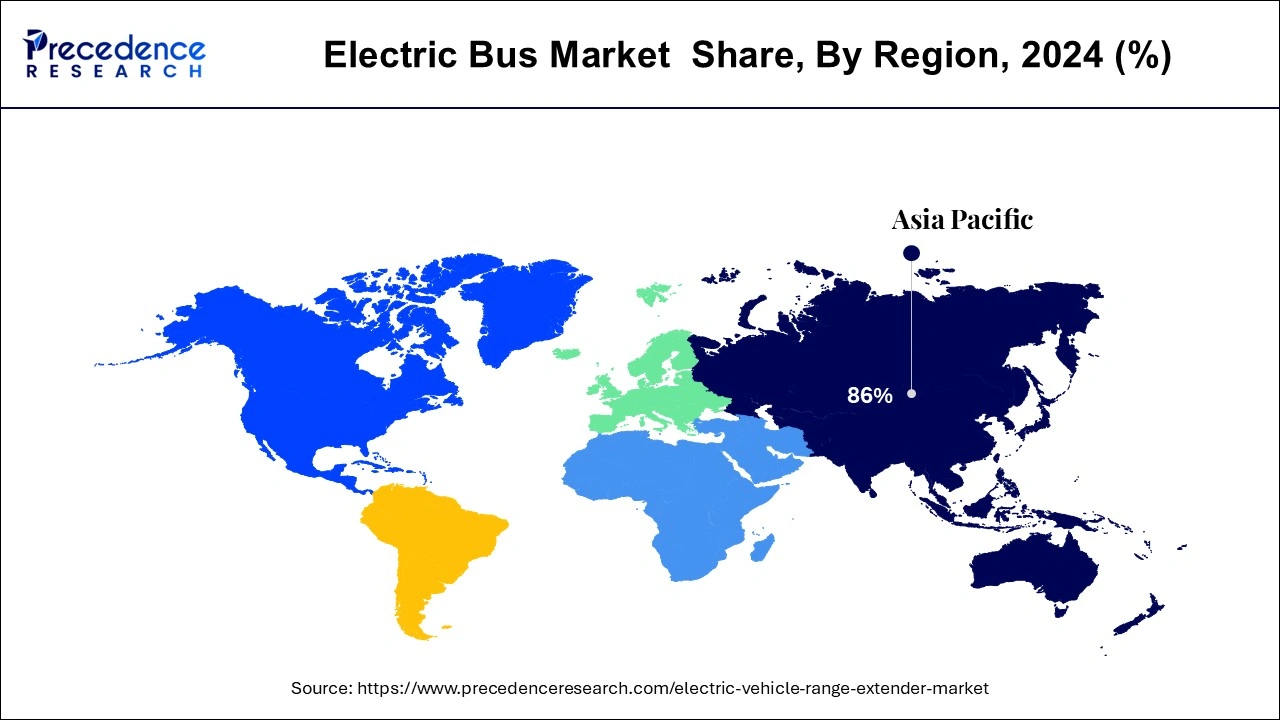

- Asia Pacific market has accounted Highest revenue share of 85.7% in 2024.

Market Size and Forecast

- Market Size in 2025: USD 36.46 Billion

- Market Size in 2026: USD 41.34 Billion

- Forecasted Market Size by 2034: USD 113.06 Billion

- CAGR (2025-2034): 13.40%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Smart Transit: How AI is revolutionizing the Electric Bus Market

Artificial intelligence is changing the electric bus market, enhancing performance, maintenance, and operational efficiency. AI analysis carries out battery management, forecasts energy consumption, and monitors the health of cells. Route optimization tools maximize opportunities for fleet operators to consider traffic, demand, and weather conditions for efficient scheduling. Predictive maintenance determines early signs of wear, which increases downtime and cost. Safety is another parameter enhanced with AI through Advanced Driver Assistance Features, while intelligent charging algorithms work to optimize load and cost by coordinating irrigation with renewable energy sources. Overall, these technologies enhance reliability, reduce ownership costs, and thus make electric bus fleets a more sustainable and profitable venture.

Electric Bus Market Growth Factors

The electric bus is a vehicle that do not require internal combustion engine. The electric buses are considered as environmentally friendly. The electric bus does not emit any kind of toxic gases in the environment. As a result, the growing environmental concerns are driving the growth of the global electric bus market. In addition, the electric bus also helps in saving of fuel and gasoline. The use of electric bus benefits end user in each and every way. The surge in government initiatives is also driving the expansion of the electric bus market. The government of established and emerging nations is mainly investing in the development of electric bus. The electric bus also helps end users to save time of their passengers. Due to ongoing trend of clean energy, the major countries have started using electric bus on a large scale. The electric bus is also helping government in reduction of noise pollution levels. Moreover, the utilization of solar powered electric bus charging stations is creating growth prospects for the electric bus market expansion.

The highly populated regions require good vehicles for public transportation. The electric bus is changing the face of public transportation in a different way. The electric bus helps in reduction of pollution which is helping in the reduction of global warming. The utilization of electric buses has helped government in saving costs. The launch of self-driving electric bus is boosting the growth and development of the global electric bus market. One of the prominent factors that drive the growth of the global electric bus market is technological developments. The new and advanced features deployed in the electric bus are creating lucrative opportunities for the growth of the electric bus market. The electric buses are largely used in the developed regions. Additionally, the electric bus manufacturers are adding additional features to the bus such as additional seating capacity and lane keep assist system. The lane keep assist technology will help drivers to drive efficiently by reducing the chances of accidents. The electric bus is also helping in the reduction of road accidents. Thus, all of these factors are propelling the growth of the global electric bus market.

Globally, there has been a significant increase in the electrification of public transportation. This has resulted into low maintenance expenses for using electric buses. In addition, the government is significantly investing in the development of charging infrastructure in all developed regions. Moreover, the research and development expenditure in battery technology is also increasing. The electric bus is considered as environmentally friendly option all over the globe. In the developing regions such as Latin America and Asia-Pacific, there is surge in demand for environmentally friendly transportation and mobility solutions. Furthermore, the transportation companies are shifting their focus to sustainable energy. Thus, this has created significant demand for electric bus since few years. As a result, all of these aforementioned factors are driving the expansion and development of the global electric bus market over the projected period.

- Government Support and Policy Initiatives: Favorable regulations and incentives encouraging the adoption of electric buses for the electrification of public transport have hence fast-tracked electric-bus adoption across the globe.

- Increasing Environmental Awareness: The pollution disquiet and the dread of greenhouse emissions are pushing governments and operators toward sustainable and zero-emission transportation choices.

- Technological Advancements: Continuous improvement in battery efficiency and energy density, and charging infrastructure are in more performance and less operational constraints.

- Urbanization and Demand for Public Transport: Rapid growth of urban centers and high population density are providing the demand for environmental and economic mass transit solution-e-buses.

- Cost Efficiency and Energy Saving: Electric buses act as a source of cost efficiency, i.e., savings on energy costs, maintenance costs, and reduced downtime.

Electric Bus Market Outlook

- Industry Growth Overview: The electric bus market is poised for rapid expansion from 2025 to 2034, driven by strong government policies, a global push for sustainable urban mobility, and quick advances in battery technology. This growth will be evident in intercity and intracity transport, airport shuttles, and private fleet operations.

- Sustainability Trends: Sustainability remains a key market driver, with electric buses providing zero tailpipe emissions and less noise pollution compared to traditional diesel buses. Trends include developing energy-efficient designs, focusing on the circular battery economy through recycling and second-life applications, and integrating these fleets with renewable energy sources for charging.

- Major Investors: Significant investment is flowing from venture capital, private equity, and major automotive and tech corporations such as Volvo, BYD, Tata Motors, and Microsoft. These investors are drawn by the strong policy-driven demand, high growth potential, and the alignment with global ESG goals. Innovative financing models are de-risking investments.

- Startup Ecosystem: The startup ecosystem is thriving, focusing on innovations in battery technology (solid-state and sodium-ion batteries), smart charging infrastructure, and AI-driven fleet management systems. Emerging firms are attracting considerable funding by offering scalable, cost-effective solutions and new business models like RaaS for private operators.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 36.46 Billion |

| Market Size in 2026 | USD 41.34 Billion |

| Market Size by 2034 | USD 113.06 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.40% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Propulsion, Consumer Segment, Application, Length of Bus Type, Vehicle Range, Battery Capacity, Power Output, Battery Type, Component, Seating Capacity, Level of Autonomy, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Opportunity

Government Initiatives Accelerate Growth Opportunities for Electric Bus Industry

One key opportunity that is defining the electric bus market is strong government support through policy initiatives, like in May 2025, the PM e-Drive Scheme in India's urban and intercity transport. The Union government recently also approved 4,500 electric buses for Bengaluru, and this is a clear sign of the scale of investment and commitment towards green mobility.

(Source: https://energy.economictimes.indiatimes.com)

By 2030, electric buses are expected to account for 25% of the total share (STATED POLICIES SCENARIO), sharply increased from just under 6% in 2024. The projections for electric buses show that even in intercity transport, where electric coaches had less than 10% market share in 2024, by 2030 electric buses will account for around 75% of all bus segments market share. The surge in electric buses due to funding, a supportive infrastructure, and emissions targets provide a substantial growth opportunity for manufacturers and service providers.

(Source: https://www.iea.org)

Propulsion Insights

The fuel cell electric bus (FCEB) segment is expected to grow at a CAGR of 19.10% during the forecast period. The FCEB segment is playing an elevating role in the electric public transportation as a zero-emission option instead of diesel. It eliminates operations, accelerates refueling. The FCEB's potential to provide similar routes as diesel buses, with the absence of local emissions and less noise, makes it the most approachable option.

With massive investment, technological advancement, and legislative help in hydrogen fuel cells are leveraging their approval globally. The FCEB is a suitable and flexible option for routes where BEBs find it difficult to serve. The segment is dedicatedly support largely to supporting emission reduction. Recently, China has begun research and development into the FCEB technology to contribute further to the global electric bus.

Battery type Insights

The lithium-ion battery segment held the largest share of 86.40% in the 2024 global electric bus market. The battery is the heart, the foundation of the global electric bus. The segment is emerging with the capability and strength to operate. It improves and accelerates the vehicle's performance. The key development targets on enhancing safety, lifespan, cost, and energy density against challenges such as faster degradation and limited range.

For example, the Chinese manufacturers such as YUTONG, KINGLONG, and CRRC use LFP batteries the most in the common part of lithium-ion battery for their projects. Whereas NMC is a popular choice in commercial vehicle and car applications. Also, NCA provides prominent highest energy in a lighter package and a smaller one, which refers to longer ranges for global electric buses.

The solid-state battery segment is expected to grow at a CAGR of 28.30% during the forecast period. The SSBs segment brings transitional advantages for global electric buses, involving higher energy density, safety, and quick charging, giving it a longer lifespan. The partnership and R&D investment in SSBs will lead to approval worldwide. The development of this segment identifies hurdles to the deployment of electric vehicles.

Bus size/length Insights

The 9-12 meters (standard/city buses) segment held the largest share of 49.60% in the 2024 global electric bus market. The standard/city electric buses are the epicenter of global electrification, with their perfect balance of capacity and suitability for the urban setting. It contributes largely by controlling local noise and pollution, alongside reducing fuel prices for transit agencies.

The development is pinned by the aim of the standard/city buses on enhancing charging technologies, meeting driver/passenger comfort. The spacious factor is emerging, so the growth of this segment is also accelerating with the demand for comfort with the rising population, including working, daily, business, and travel individuals.

The >12 meters segment is expected to grow at a CAGR of 11.70% during the forecast period. The > 12-meter electric bus is convenient and suitable for medium distances and urban areas. Development is leveraged by prioritizing technological advancement and electrification in charging and batteries. Furthermore, the passenger capacity needed in the particular cities is the key area for the development of this segment.

Application Insights

The intra-city (urban transit) segment held the largest share of 57.80% in the 2024 global electric bus market. The electric buses play a vital role in intra-city public transport by controlling noise pollution and reducing carbon emissions. The key development depends on improvement and enhancement in battery technology and the discovery of strong charging infrastructure, and financial support via incentives from the financial and government institutions.

A popular example of global intra-city (urban transit) is Shenzhen, China. They transformed to an electric bus fleet completely faster. With this quick transition, the region became a leader in the global electric bus industry. BYD, a known electric bus manufacturer, supported the change dedicatedly.

The airport shuttle segment is expected to grow at a CAGR of 12.60% during the forecast period. The airport shuttle (electric) promotes sustainability by controlling emissions, optimizing over time operation, and mitigating airport traffic congestion by enabling a seamless option for private vehicles. Their development is supported by enhancements in battery technology, government regulations, and attentiveness to passenger-oriented factors such as their convenience with necessary trendy innovations like wifi and smart tracking.

Charging type/infrastructure Insights

The depot charging (slow/overnight) segment held the largest share of 62.30% in the 2024 global electric bus market. The depot charging is vital for the deployment of e-buses. It immensely supports the overnight operations with the responsibility for full charging. The segment is equipped for overcoming the high load of electricity with the help of smart grid management and connection unifying with sustainable sources.

The development targets the power-fueled infrastructure planning involving DNO and substation connections. For smooth, disruptive travel without any delay, depot charging is the popular choice for e-buses to accelerate the growth of electric buses. The depot charging includes public transit agencies such as the Cape Town project that use this type of charging mainly for electric buses, such as BYD B12s.

The opportunity charging (fast, en route) segment is expected to grow at a CAGR of 13.50% during the forecast period. This segment is pivotal for the growth of the global electric bus. With its fastest, en-route methods, such as inductive charging or pantograph charging, opportunity charging allows compact batteries to elevate operational range. These technologies promote minimal use of expensive, large batteries. The key trend is a shift in zero-emission fleets to achieve the environmental goal.

Bus body type Insights

The low-floor bus segment held the largest share of 44.90% in the 2024 global electric bus market. The low-floor bus is designed for the passengers' convenience and ease in physical comfort while getting in and out. The stepless and flat surface enhances boarding for passengers, mainly disabled and senior individuals. The major development is supported by improved battery technology and sustainability initiatives.

The segment is emerging with the growing demand for pollution-free and comfortable spacious travelling. The Karsan e-JEST minibus for different low-floor electric models and for urban use is popular in cities such as Brisbane, Australia. Whereas the Volvo 8900 electric is engineered for the European intercity services and cities.

The articulated bus segment is expected to grow at a CAGR of 10.80% during the forecast period. The articulated bus is steadily fueling growth due to its massive capacity and lower emission potential in cities seeking a zero-emission high-density transport solution. The articulated electric buses are the major component of the modern transit reach, further boosted by technology and policy incentives. This comfort unification in the smart city infrastructure, like Brazil's popular bi-articulated electric bus, is in use and exponentially contributing to the growth of articulated electric buses.

Battery capacity Insights

The 201-350 kWh segment held the largest share of 41.70% in the 2024 global electric bus market. The battery capacity measures the overall performance of the electric bus. This 201-350 kWh range offers moderate to long range operations in an intra-city model that precisely balances the operational and cost requirements for daily use. This battery size is a prominent part of the market with compact capacity for intercity routes, with highly driven by charging infrastructure advancement.

The >350 kWh segment is expected to grow at a CAGR of 12.90% during the forecast period. The>350 kWh battery in global electric buses marks a larger capacity, providing a prominent range. The size battery can allow an electric bus to travel various kilometers at a single charge. Its capacity promotes operational flexibility and increased range that rapidly bolsters growth in the global electric bus industry.

Ownership model Insights

The fleet-owned by transit agencies segment held the largest share of 63.40% in the 2024 global electric bus market. The segment is consistently revolutionizing globally, with the increased use of electric buses, with 60% of municipal bus sales expected by 2030. Their development represents substantial growth in China and advancement in charging and battery technologies. The leading companies, such as BYD, are initiating a transition with the supply of electric buses and unified systems.

The battery-as-a-service (Baas) segment is expected to grow at a CAGR of 14.80% during the forecast period. The Baas reduces vehicle cost and lowers electric buses, enabling operators to hire batteries rather than chasing electric buses. This makes EVs available and cuts upfront cost. The Baas model contributes largely to the circular economy via battery recycling and focuses on quick uptime for fleets through battery swapping stations.

Regional Insights

Asia Pacific Electric Bus Market Size and Growth 2025 to 2034

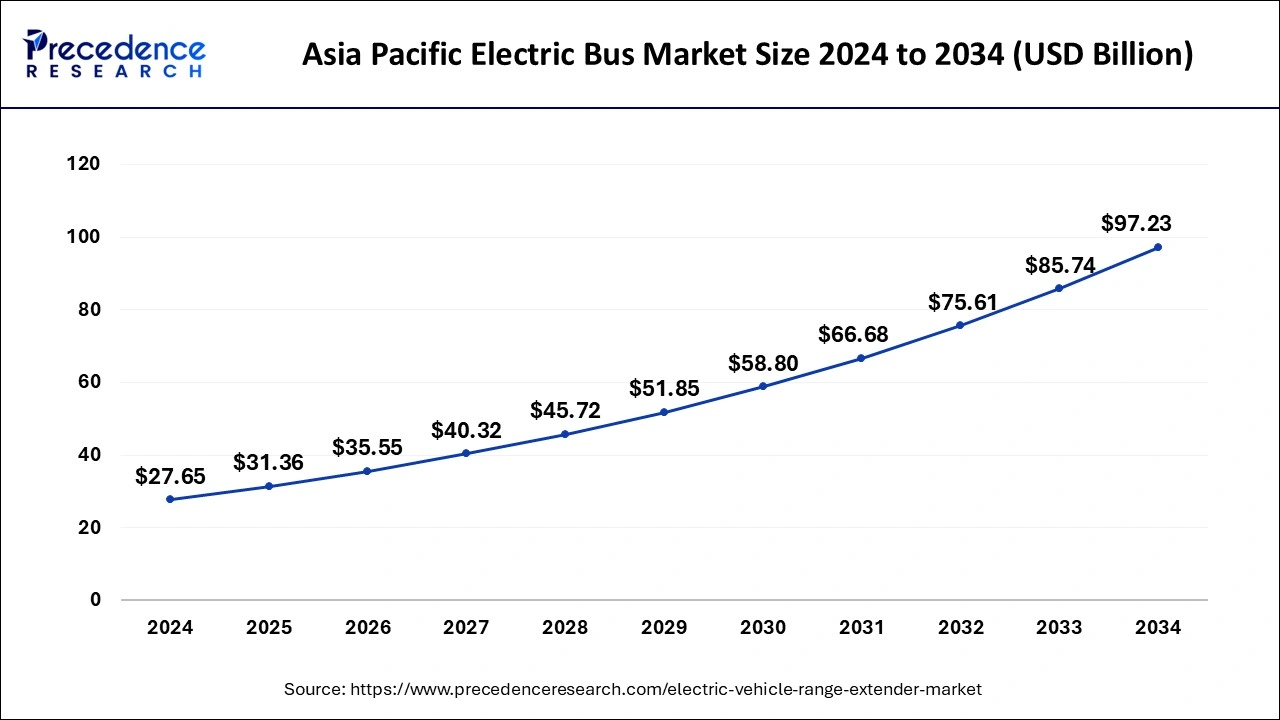

The Asia Pacific electric bus market size is estimated at USD 31.36 billion in 2025 and is predicted to be worth around USD 97.23 billion by 2034, at a CAGR of 13.60% from 2025 to 2034.

Asia-Pacific dominated the electric bus market in 2024 with highest revenue share of 86%. The China dominates the electric bus market in Asia-Pacific region. The Asia-Pacific region comprises of large number of market players operating in electric bus market. The electric bus market is growing in developing and developed countries such as China, Japan, South Korea, and India. In addition, the Asia-Pacific region has vast number of original equipment manufacturers (OEMs). Furthermore, the factors such as favorable government regulations regarding electric buses and the expansion of the electric vehicle infrastructure are propelling the growth of the electric bus market in the Asia-Pacific region during the forecast period.

China continues to dominate the electric bus market throughout the Asia Pacific region, with robust government policy support, massive investment in EV infrastructure, and rapid urbanization on the supply side fully operational. With the continued rollout of programs such as the “New Energy Vehicle” (NEV) program and generous subsidies, the country accounts for nearly all electric bus deployment in the world. Large suppliers such as BYD and Yutong lead in scale and innovation. In addition to the production and adoption of electric buses, China's move to replace conventional diesel buses and improve urban air pollution (expedited by COVID-19) in cities has made China the centre of electric bus production in the Asia Pacific.

North America is expected to develop at the fastest rate during the forecast period, due to increasing research and development investments in the development of electric buses. The major market players of the region are collaborating with government to increase their market share in the region. This is also helping them to increase their geographical presence in developed and developing nations. In addition, the growing number of infrastructural development projects is also driving the expansion the electric bus market in the region.

The United States is a leader of the electric bus market in North America as a result of growing environmental awareness, federal funding programs, and commitments to reduce public transport emissions. Government funding initiatives such as the Bipartisan Infrastructure Law and Federal Transit Administration Grants have catalyzed adoption of electric buses in recent years. Cities, such as Los Angeles and New York, have committed to fully electrifying their public systems within a decade. Additionally, infrastructure improvements and U.S.-based manufacturers (e.g., Proterra, Lion Electric, etc.) as well as international joint ventures with other global transportation providers signals that the U.S. is on the forefront of enabling a cleaner and more sustainable transit ecosystem.

Europe is expected to grow significantly in the electric bus market during the forecast period. The demand as well as the use of electric buses in Europe are increasing for reducing the environment pollution. This, in turn, is supported by the government policies as well as investments. Thus, this, promotes the market growth.

The use of electric buses in the UK is increasing, due to increasing awareness about air pollution. At the same time, the investment by the government is also encouraging the development process of these buses with additional safety features.

In Germany, the demand for the use of electric buses is increasing due to their affordability as well as efficiency. Furthermore, to reduce the pollution, different polices laid down by the government are encouraging their use as well.

How is the Opportunistic Rise of Latin America in the Electric Bus Market?

Latin America is experiencing robust growth in the market, primarily driven by high urbanization rates, heavy reliance on public transport, and strong public policies aimed at reducing emissions. The region presents a significant investment opportunity. Countries like Chile, Colombia, Brazil, and Mexico are leading the charge, with Santiago and Bogotá. The market is primarily shaped by public procurement and the strong presence of Chinese manufacturers, though local production is growing, supported by international partnerships and initiatives such as the ZEBRA accelerator program.

Brazil Electric Bus Market Trends

Brazil is poised to lead Latin America's electric bus market, supported by an electricity grid powered by over 80% renewable sources. The market's expansion is driven by ambitious federal initiatives such as the BNDES financing for fleet purchases, the New Growth Acceleration Program, and the MOVER program, which together allocate significant funds for the transition. Key drivers include the need to cut urban air pollution in major cities like São Paulo and Rio de Janeiro, along with government mandates to replace diesel fleets.

Smart Mobility in the Middle East and Africa to Fuel Transport Modernization

The MEA region is quickly gaining ground in the electric bus market, fueled by national sustainability targets, rising environmental awareness, and a desire to modernize public transportation systems. The Middle East, especially the UAE and Saudi Arabia, is speeding up adoption through major investments in smart cities and advanced charging networks. Meanwhile, parts of Africa are focusing on using AI-powered mobile solutions to address primary healthcare gaps. Overall growth is driven by government incentives, lower battery costs, and a strong move toward sustainable mobility options.

Saudi Arabia Electric Bus Market Trends

Saudi Arabia is leading the market in the MEA, aiming to diversify its economy and become a global leader in low-carbon energy solutions. The government has ordered that all new public transport buses must be electric and has allocated substantial funds for public transportation projects. Major cities like Riyadh and Jeddah are leading the way in deploying electric buses and developing smart transportation systems that use AI for route optimization and predictive maintenance.

Key Government Initiatives Supporting the Electric Bus Market

|

Country |

Key Government Initiatives |

|

India |

PM e-Bus Sewa (10,000 buses), PM E-DRIVE, Payment Security Mechanism, PLI schemes for manufacturing. |

|

China |

Subsidies, national mandates for the full electrification of public transport by 2035, and massive investment in charging infrastructure. |

|

EU |

EU Clean Vehicles Directive (setting procurement targets), national grants (e.g., Germany's purchase subsidies), UK's ZEBRA program. |

|

U.S. |

Federal Transit Administration's Low/No Emission Program, EPA Clean School Bus Program (grants/rebates), and Bipartisan Infrastructure Law funding. |

Value Chain Analysis

Raw Material and Component Sourcing

This stage involves procuring essential materials for battery production, including lithium, nickel, cobalt, and rare-earth metals, as well as electric drivetrains, control systems, and lightweight chassis materials. Strategic partnerships with battery suppliers and electronics manufacturers ensure quality and cost efficiency across the supply chain.

Manufacturing and Assembly

In this stage, manufacturers integrate battery systems, motors, software, and vehicle bodies to produce fully functional electric buses. Advanced automation, modular design, and in-house R&D play key roles in optimizing energy efficiency, safety, and performance.

Distribution and After-Sales Services

Once produced, electric buses are distributed through OEM networks, government contracts, and fleet operators. After-sales services such as battery maintenance, charging infrastructure support, and software updates ensure long-term operational efficiency and customer satisfaction.

Electric Bus Market Companies

- Tata Motors: Develops and manufactures a wide range of fully electric and hybrid buses under its “Starbus EV” series, widely adopted in Indian public transport fleets.

- Daimler AG: Produces the Mercedes-Benz eCitaro and other electric bus models designed for zero-emission urban mobility across Europe.

- Geely Automobile Holdings Ltd.: Through its subsidiary, Farizon and partnerships with other EV brands, Geely designs and supplies electric buses for China's growing public transport electrification.

MAN SE: Manufactures the MAN Lion's City E electric bus series, focusing on sustainable, low-noise urban transport solutions in Europe. - Scania AB: Offers fully electric and hybrid buses featuring modular battery systems optimized for city operations and sustainable transit networks.

- AB Volvo: Leads with its Volvo 7900 Electric and Electric Articulated buses, providing zero-emission public transport solutions across global markets.

- Workhorse Group Inc.: Specializes in electric commercial vehicles and mid-sized buses, supporting fleet electrification in North America.

- BYD Company Ltd.: One of the world's largest electric bus manufacturers, offering a full range of battery-electric buses deployed in over 70 countries.

- Dongfeng Motor Company: Produces electric and hybrid buses powered by in-house battery and drivetrain technologies for China's public transit modernization.

- PACCAR Inc.: Through its subsidiaries like DAF and Peterbilt, develops electric commercial and transit vehicles, contributing indirectly to electric bus innovation and infrastructure.

Recent developments

- In May 2025, low-floor buses provided by a subsidiary of Olectra Greentech, that is Evey Trans Private Limited, were announced to have reached Puducherry on 26th May 2025. Furthermore, their main goal is to strengthen the public transport sector with electric vehicles.

- In May 2025, a fresh colour scheme was approved by the Delhi Transport Department, for improving the identity and visibility of Delhi Electric Vehicle Interconnector (DEVI) buses, which were recently launched. Dark orange and yellow are the colors in which these buses will be painted.

- In May 2025, a milestone was achieved by GreenCell Mobility due to its order of over 1,200 electric buses to enhance the electric public transport in India, with the help of the PM E-Bus Sewa Scheme. Their main objective is to achieve sustainable, zero-emission solutions by transforming urban mobility.

(Source: https://www.msn.com)

Segments Covered in the Report

By Propulsion Type (Revenue: US$ Bn and Volume: No. of Units)

- Battery Electric Bus (BEV)

- Plug-in Hybrid Electric Bus (PHEV)

- Fuel Cell Electric Bus (FCEB / Hydrogen)

- Trolley Electric Bus (Overhead Catenary Line Powered)

- Hybrid Electric Bus (HEV)

By Battery Type

- Lithium-Ion Battery

- LFP (Lithium Iron Phosphate)

- NMC (Nickel Manganese Cobalt)

- NCA (Nickel Cobalt Aluminum)

- Solid-State Battery

- Lead-Acid Battery

- Ultracapacitor + Battery Hybrid Systems

By Bus Size / Length

- < 6 meters (Mini/Short Buses)

- 6–8 meters (Midi Buses)

- 9–12 meters (Standard/City Buses)

- > 12 meters

By Application

- Intra-City (Urban Transit)

- Inter-City (Suburban, Long-Distance Transit)

- School Transportation

- Airport Shuttle

- Tourism / Sightseeing Bus

- Corporate Staff Transport

- Last-Mile Shuttle Services

By Charging Type / Infrastructure

- Depot Charging (Slow/Overnight)

- Opportunity Charging (Fast, En Route)

- Pantograph Charging

- Inductive Charging (Wireless)

- Swappable Battery Systems

- Hydrogen Refueling Infrastructure (for FCEBs)

By Bus Body Type

- Low-Floor Bus

- High-Floor Bus

- Double-Decker Bus

- Articulated Bus

- Coach / Long-Haul Bus

By Battery Capacity

- < 100 kWh

- 100–200 kWh

- 201–350 kWh

- > 350 kWh

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content