What is the Zero Emission Vehicle (ZEV) Market Size?

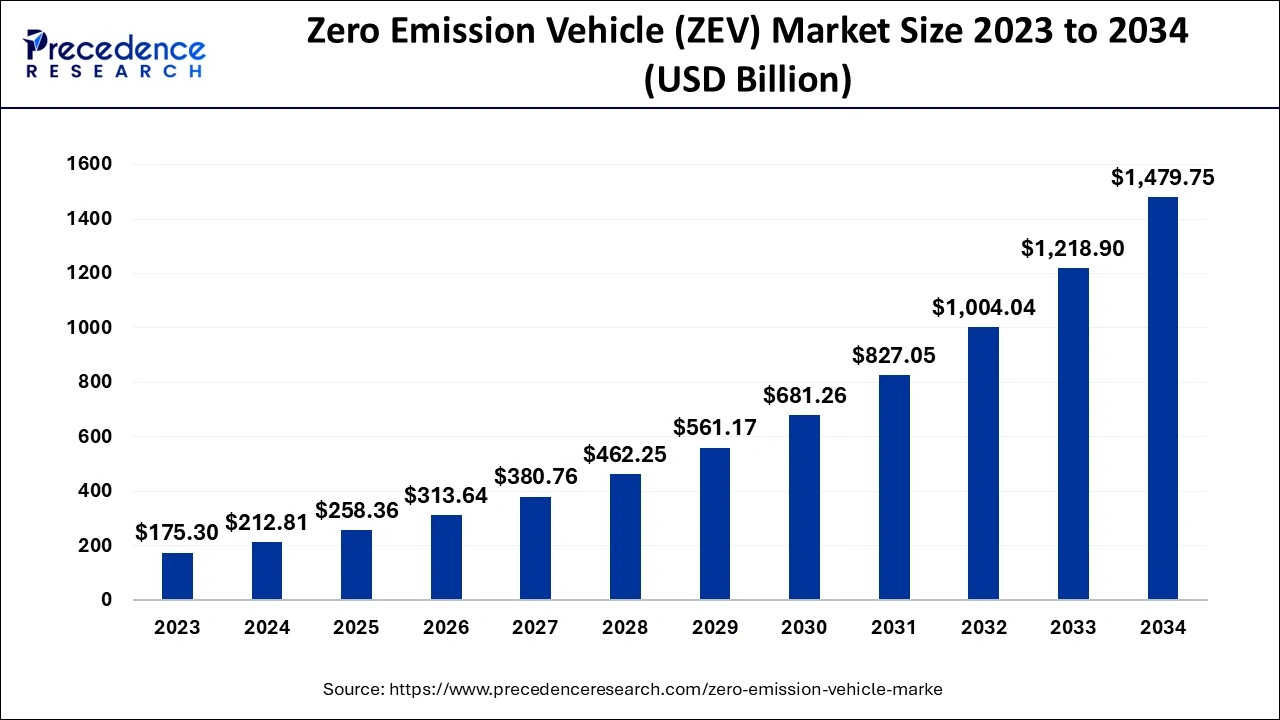

The global zero emission vehicle (ZEV) market size is calculated at USD 258.36 billion in 2025 and is predicted to increase from USD 313.64 billion in 2026 to approximately USD 1,709.94 billion by 2035, expanding at a CAGR of 20.8% from 2026 to 2035.

Zero Emission Vehicle (ZEV) Market Key Takeaways

- On the basis of vehicle type, the fuel cell electric vehicle (FCEV) segment dominated the market in 2025.

- On the basis of vehicle type, the battery electric vehicle (BEV) segment is the fastest-growing segment from 2026 to 2035.

- On the basis of application, the commercial vehicle segment dominated the market in 2025.

- On the basis of application, the passenger vehicle segment is the fastest-growing segment from 2026 to 2035.

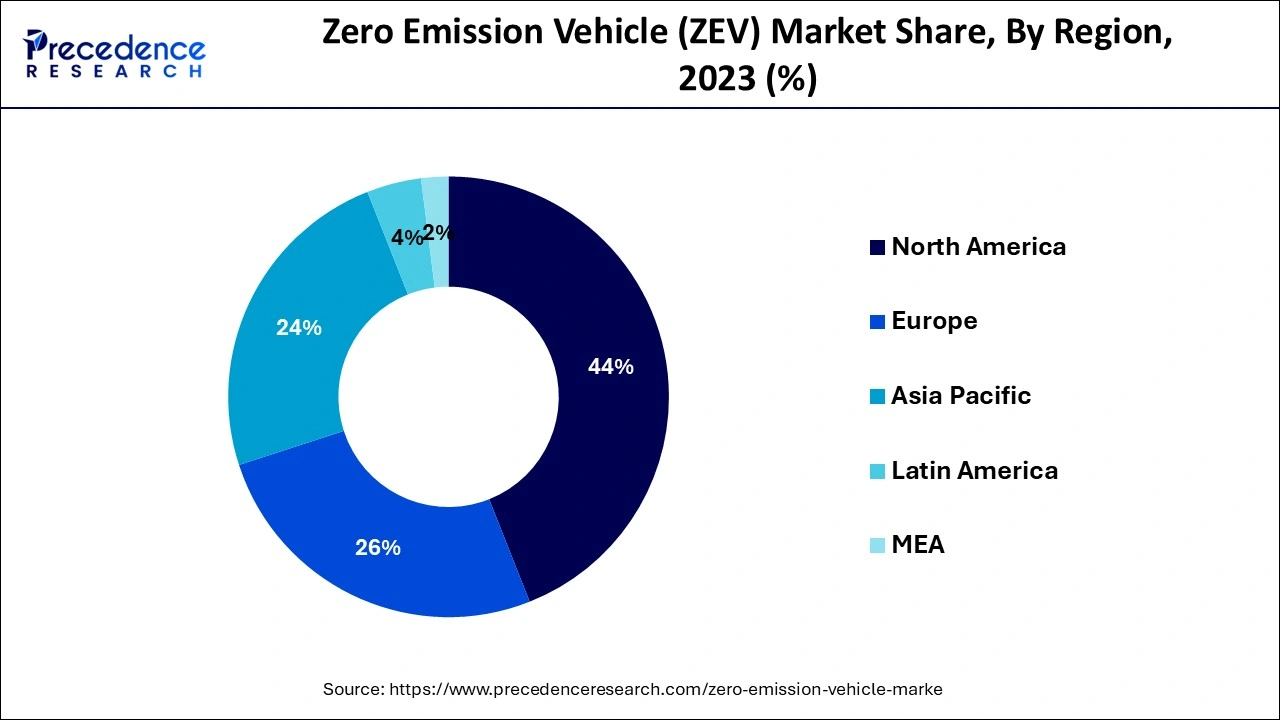

- On the basis of geography, the North America region dominated the market in 2025.

- On the basis of geography, the Asia-Pacific region is expected to develop the fastest from 2026 to 2035

Zero Emission Vehicle (ZEV) Market Growth Factors

Vehicles that generate no pollutants through their exhaust are known as zero emission vehicles (ZEV). Vehicles that run on different types of fuels such as diesel, compressed natural gas (CNG), and gasoline produce a variety of pollutants from their tailpipes including carbon monoxide, particulates, and hydrocarbons. The pollutants emitted by gasoline-powered automobiles cause health problems like asthma and respiratory disorders, as well as environmental problems like global warming. Zero emission vehicle (ZEV) have lower emissions than traditional vehicles and run on alternative energy sources such as natural gas, battery electricity, and solar power. The zero emission vehicle (ZEV) market is still in its development phase, but it is predicted to grow at a rapid rate in the coming years.

Due to the need to meet future energy demands, the zero emission vehicle (ZEV) market has seen substantial growth. The necessity for environmentally friendly transportation is a major driver of zero emission vehicle (ZEV) demand. The zero emission vehicle (ZEV) market is emerging as an important sector of the automotive industry, representing a road to greater energy efficiency as well as lower emissions of pollutants and other greenhouse gases. The increasing environmental concerns, as well as favorable government initiatives, are some of the primary drivers of the zero emission vehicle (ZEV) market expansion. The zero emission vehicle (ZEV) market growth is also projected to be fueled by rising energy costs and competition among emerging energy efficiency technologies.

Government incentives and growing consumer awareness are driving the global zero emission vehicle (ZEV) market. Global warming is currently a source of concern, as it threatens both humanity and the environment. The rise in temperature is largely due to an increase in pollution levels, with vehicles being a major source of pollution. To prevent the rise in global temperature, governments are creating global collaborations and enacting severe emission standards. As zero emission vehicle (ZEV) do not use fossil fuel and generate no pollution, they are projected to remove pollution caused by fuel-powered vehicles. As a result, governments are supporting these vehicles by providing substantial subsidies and exemptions for zero emission vehicle (ZEV).

Consumers are preferring zero emission vehicle (ZEV) as a result of increased awareness of zero emission vehicle (ZEV) and global warming. In addition, rising gasoline prices, falling zero emission vehicle (ZEV) pricing, increased zero emission vehicle (ZEV) capacity and rising per capita income are all boosting demand for zero emission vehicle (ZEV) around the world. The lack of infrastructure facilities is a major impediment for the zero emission vehicle (ZEV) market.

Consumers are adopting battery electric vehicles (BEV) at a rapid rate around the world, due to government subsidies and improved knowledge about the products. To power electric motors, a battery electric vehicles (BEV) use a battery, usually a lithium-ion battery. As compressed air is used to push the vehicle, air-propelled vehicles are a popular means of transportation. Although the technology is still in the early stages of development, is projected to provide prospects for the zero emission vehicle (ZEV) market in the upcoming years.

Market Outlook

- Industry Growth Overview: As long as governments impose stricter emission standards and the general public continues to demand cleaner forms of transportation, the ZEV (zero-emission vehicle) industry will continue to grow rapidly. The increased use of technology, a decrease in the cost of batteries, and an expansion in the availability of charging stations will continue to drive growth across the world.

- Sustainability Trends: The sustainability movement has been focused on, Recycle batteries, installation of charging stations powered by renewable energy, and downstream manufacturing models that promote circularity. The automotive industry has committed to implementing carbon neutral production, reducing lifecycle emissions, and developing vehicles that are sustainable.

- Global Expansion: Emerging markets are focusing on the establishment of ZEV infrastructure, creating opportunities for global automotive manufacturers to enter the market and form partnerships. Trade agreements between countries implementing electric vehicle (EV) incentives will further increase global market penetration.

- Startup Ecosystem: Startups focused on EV component production, charging technology, fleet electrification, and battery development are evolving ZEVs and the way they are manufactured. Startups have added competitiveness to the industry by developing a more agile business model and frequent cycles of technological advancement.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 258.36 Billion |

| Market Size in 2026 | USD 313.64 Billion |

| Market Size by 2035 | USD 1,709.94 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 20.8% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type,Application,Price,Vehicle Drive Type,Top Speed,Source of Power |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Zero Emission Vehicle (ZEV) Market Dynamics

Drivers

Rise in demand for efficient vehicles

Since gasoline is a fossil fuel, it is not a renewable energy source and will be depleted in the future. To support sustainable development, it is critical to develop and use alternative fuel sources. This necessitates the use of zero emission vehicle (ZEV), which do not require gasoline and are less expensive than conventional vehicles. An electric vehicle converts more than half of the grid's electrical energy to power at the wheels, whereas a gas-powered vehicle only converts about 17–21% of the energy stored in gasoline. The recent increase in the price of gasoline and diesel has increased demand for fuel-efficient vehicles. Thus, the rise in demand for efficient vehicles is driving the growth of the zero emission vehicle (ZEV) market during the forecast period.

Restraints

High cost of production

Zero emission vehicle (ZEV) are preferable to conventional vehicles, though they are more expensive. The lack of charging infrastructure associated with the development of zero emission vehicle (ZEV)has proven to be a barrier to market growth. Similarly, manufacturers require a substantial amount of capital and assets, which may stifle market expansion. The cost of batteries is expected to fall in the coming years as a result of increased production of zero emission vehicle (ZEV) batteries in large quantities and technological advancements. As a result, the production of zero emission vehicle (ZEV) necessitates a significant investment, is restricting the market growth.

Opportunities

Technological advancements

Automobile manufacturers are focusing on the development of improved zero emission vehicle (ZEV) systems that are expected to emit fewer pollutants while costing less. The companies have also begun developing smaller engines for use in automobiles, as smaller engines help meet pollution standards.The compactness and low cost of these engines add another dimension to their utility. As a result, the future development of advanced gasoline direct injection systems opens up numerous opportunities for market players.

Challenges

Lack of charging infrastructure

The lack of infrastructure to support the growth of zero emission vehicle (ZEV) has proven to be a market barrier. Many countries around the world have a scarcity of zero emission vehicle (ZEV) charging stations. As a result, public zero emission vehicle (ZEV) charging becomes less accessible, lowering market demand for zero emission vehicle (ZEV). Despite the fact that many governments are attempting to establish charging infrastructure for zero emission vehicle (ZEV), most countries have not been able to develop an adequate number of charging stations. Thus, this factor is a major challenge for the zero emission vehicle (ZEV) market growth.

Segment Insights

Vehicle Type Insights

The fuel cell electric vehicle (FCEV) segment dominated the zero emission vehicle (ZEV) market in 2025. The segment is growing as consumers become more aware of the benefits of good air quality and the negative effects of automobile emissions. The fuel cell electric vehicle (FCEV) segment will grow due to rising government initiatives and investments to improve the infrastructure for electric vehicle charging outlets.

The battery electric vehicle (BEV) segment is a fastest growing segment from 2023 to 2032. The electric vehicle battery (EVB) is growing due to rising demand for environmentally friendly mobility solutions to reduce pollution levels and the availability of tax refunds. The battery electric vehicle (BEV) segment will grow as a result of government programs and schemes that encourage the adoption of sustainable mobility solutions in order to reduce car pollution.

Application Insights

The commercial vehicle segment dominated the zero emission vehicle (ZEV) market in 2025. The zero emission vehicle (ZEV) is used as a commercial vehicle. Commercial vehicles are four-wheeled cargo vehicles. The mass difference between small vehicles and heavy trucks is measured in tons. Buses and coaches are used to transport passengers with more than eight seats plus the driver's seat and a maximum mass greater than light vehicles. Various governments are also developing and securing commercial vehicles on the road. In the world of commercial vehicles, technological advancements are continually being made, and some of these technologies are soon becoming required.

The passenger vehicle segment is the fastest growing segment during the forecast period. The zero emission vehicle (ZEV) is used as a passenger vehicle. Passenger vehicles are the most frequent means of transportation in industrialized countries, and their numbers are growing in underdeveloped countries as per capita income rises. Due to increased leisure and travel activities around the world, demand for special utility vehicles has risen in recent years. Small automobiles are also developing at a rapid rate, owing to the fact that they encounter less traffic than large passenger vehicles on the road. All these factors are boosting the growth of the zero emission vehicle (ZEV) market during the forecast period.

Regional Insights

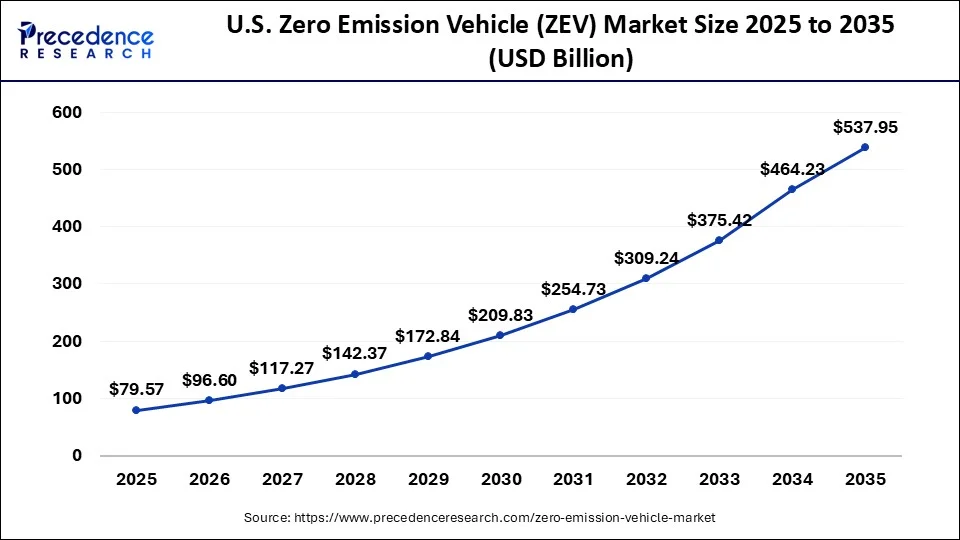

The global zero emission vehicle (ZEV) market size accounted for USD 79.57 billion in 2025 and is expected to be worth around USD 537.95 billion by 2035, growing at a CAGR of 21.06% from 2026 to 2035.

North America dominated the market due to strong government support through incentives, tax credits, and strict emission regulations that accelerate ZEV adoption. The region also benefits from the presence of leading electric vehicle manufacturers, advanced R&D capabilities, and a well-developed charging and hydrogen refueling infrastructure. Additionally, high consumer awareness, strong purchasing power, and corporate commitments to sustainability further reinforce North America's leadership in the ZEV market.

U.S. Zero Emission Vehicle (ZEV) Market Trends

The U.S. market is expanding due to rising environmental awareness, government incentives, and stringent emission regulations. Rising fuel prices, growing consumer preference for sustainable transportation, and falling EV costs are driving adoption. Additionally, technological advancements in battery electric vehicles (BEVs), expanding charging infrastructure, and higher per capita income are further accelerating market growth, positioning the U.S. as a key player in the global ZEV transition.

Asia-Pacific is expected to develop at the fastest rate during the forecast period. The Asia-Pacific region is heavily populated, with the bulk of residents falling into the middle class. They are the largest purchasers of zero emission vehicle (ZEV). As a result, the volume of zero emission vehicle (ZEV) sales in this region is likely to continue to climb. Customers are being pushed to choose zero emission vehicles (ZEV) due to rising gasoline prices. \

India Zero Emission Vehicle (ZEV) Market Trends

The Indian market is expanding due to rising government support through subsidies, tax incentives, and favorable policies promoting electric mobility. Growing environmental concerns, urban air pollution, and high fuel costs are driving consumer adoption. Additionally, improvements in charging infrastructure, rising awareness of sustainable transportation, and advances in battery technology are boosting demand for battery electric vehicles (BEVs) and other ZEVs across India's urban and semi-urban markets.

The European Union, together with aggressive climate change initiatives, will continue to lead globally as a market leader for ZEV adoption in 2025 and beyond through developed EV ecosystems and strong OEM presence. The European Union has set the Fit for 55 targets to achieve a 50% reduction in greenhouse gas emissions by 2030 and to meet numerous similar 2030 goals across all modes of transportation via EV infrastructure/charging networks and the phase-out of internal combustion engines.

UK Zero Emission Vehicle (ZEV) Market Trends

The UK market is expanding due to strict government regulations on vehicle emissions, ambitious carbon-reduction targets, and financial incentives for electric vehicle (EV) adoption. Rising environmental awareness, rising fuel costs, and advances in battery technology are further driving consumer interest. Additionally, expanding EV charging infrastructure, increased availability of electric and hybrid models, and supportive policies for sustainable transportation are contributing to the steady growth of the UK ZEV market.

Latin America is on the verge of becoming an important player within the Zero-Emission Vehicle market. Urban air pollution and other environmental issues have led Latin American governments to create significant policies that encourage Electric Vehicle Adoption by investing in charging infrastructure, offering financial incentives, and promoting Renewable Energy use to support electric mobility. Additionally, the transition to electric vehicles is accelerating as more ride-share services and commercial fleets transition to EVs.

The Middle East & Africa (MEA) presents significant opportunities in the market due to growing government interest in renewable energy and sustainable transportation, particularly in countries like the UAE and South Africa. There is potential for large-scale investment in EV infrastructure, including charging networks and battery manufacturing, driven by urbanization and rising fuel costs. Additionally, partnerships with global EV manufacturers and adoption of incentives can accelerate market growth, creating opportunities in fleet electrification, public transport, and renewable-powered mobility solutions.

Value Chain Analysis

- Battery Manufacturing and Component Development: As battery suppliers grow in numbers, they are focused on increasing the energy density and reducing the cost of battery materials while scaling-up their manufacturing capabilities in gigafactory settings to keep up with an increasing demand for electric vehicles (EVs).

- Charging Infrastructure Development: Fast-charging stations, smart chargers, and renewable power chargers are being deployed rapidly throughout the country by both public and private entities to support the deployment of zero-emission vehicles (ZEVs) on a national scale.

- Commercial Production and Distribution of Vehicles: Leading automakers such as Tesla, BYD, and Nissan are rapidly scaling their assembly operations, improving their software capabilities, and working with dealerships to ensure the availability of ZEVs to customers across a wide geographic area.

Zero Emission Vehicle (ZEV) Market Top Companies & their Offerings

- Chevrolet: Offers electric vehicles like the Bolt EV and Bolt EUV, focusing on affordable zero-emission mobility, advanced safety features, and expanding electric vehicle platforms.

- Toyota: Develops hybrid, plug-in hybrid, hydrogen fuel cell, and battery electric vehicles, emphasizing fuel efficiency, reliability, and sustainable transportation technologies.

- BYD:Manufactures battery electric vehicles, electric buses, and energy storage solutions, leveraging in-house battery technology to support large-scale zero-emission transportation.

- Tesla: Designs and produces premium battery electric vehicles, autonomous driving software, energy storage systems, and fast-charging infrastructure through its Supercharger network.

- Nissan:Produces electric vehicles such as the Nissan LEAF and Ariya, focusing on mass-market affordability, efficiency, and practical zero-emission mobility solutions.

Other Major Companies

Key Developments

Mergers and acquisitions, partnerships, new product development, business expansions, collaborations, supply contracts, agreements, and contracts are some of the important marketing strategies used by the major market players to maintain their market position. BMW, for instance, debuted the BMW X5 plug-in hybrid electric vehicle in 2016.

Segments Covered in the Report

By Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Application

- Commercial Vehicle

- Passenger Vehicle

- Two Wheelers

By Price

- Mid-Priced

- Luxury

By Vehicle Drive Type

- Front Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

By Top Speed

- Less Than 100 MPH

- 100 to 125 MPH

- More Than 125 MPH

By Source of Power

- Gasoline

- Diesel

- CNG

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content