Zero Emission Trucks Market Size and Forecast 2025 to 2034

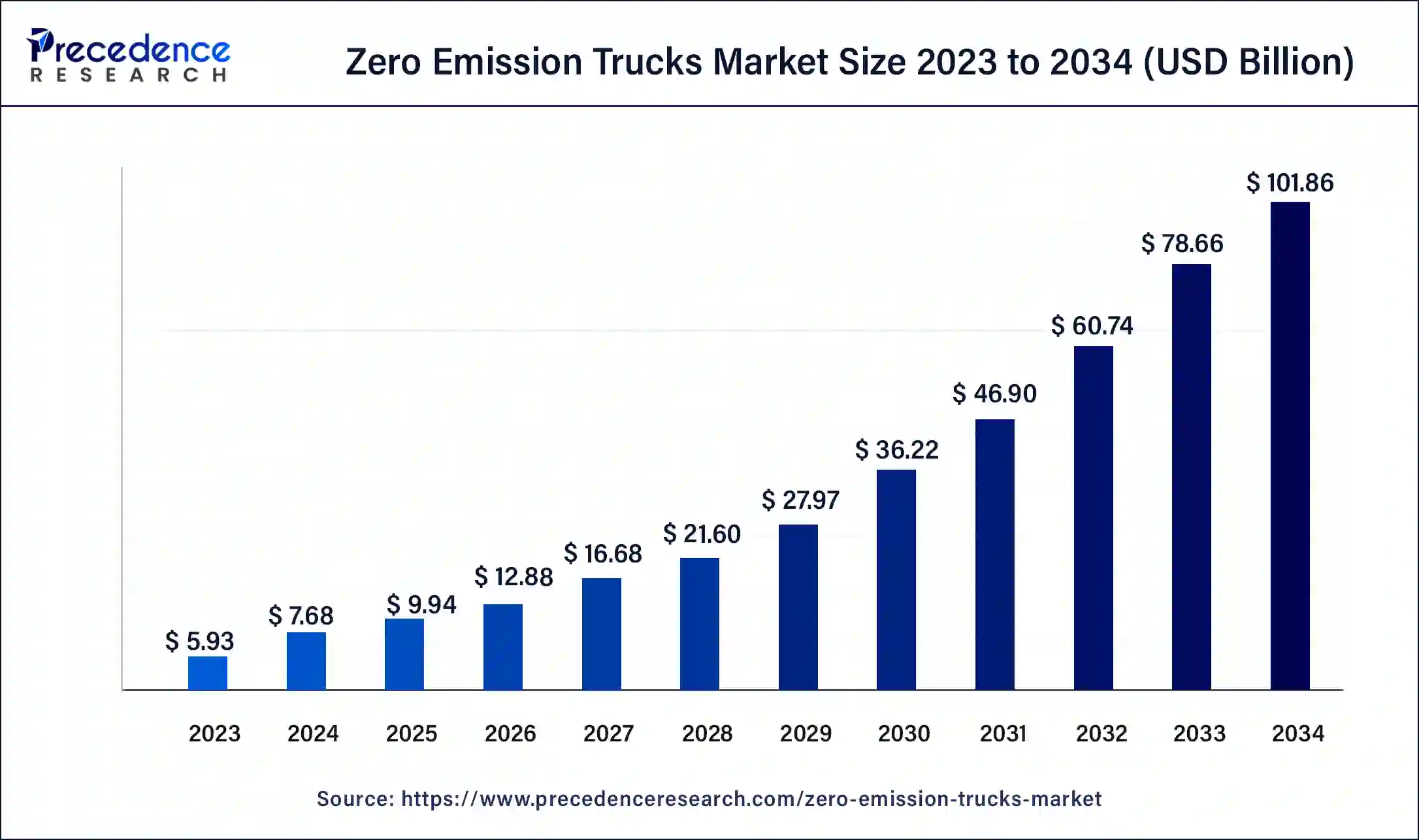

The global zero emission trucks market size accounted at USD 7.68 billion in 2024 and is expected to be worth around USD 101.86 billion by 2034, at a CAGR of 29.50% from 2025 to 2034. The zero emission trucks market is driven by the emergence of policies aimed at reducing greenhouse gas emissions.

Zero Emission Trucks Market Key Takeaways

- The global zero emission trucks market was valued at USD 7.68 billion in 2024.

- It is projected to reach USD 101.86 billion by 2034.

- The zero emission trucks market is expected to grow at a CAGR of 29.50% from 2025 to 20

- North America is projected to hold a significant share in the market during the forecast period.

- Asia Pacific is expected to witness a significant expansion during the projected timeframe.

- By vehicle type, the electric light-duty trucks segment dominated the zero emission trucks market in 2024.

- By vehicle type, the electric medium-duty trucks segment is observed to expand at the fastest rate during the forecast period.

- By source, the battery electric trucks segment dominated the market in 2024.

- By source, the hybrid electric trucks segment is observed to witness the fastest expansion over the forecast period.

- By application, the logistics and transportation segment dominated the market in 2024.

Market Overview

Being one of the most emerging trends in the automotive industry, the zero emission trucks market focuses on the development, manufacturing, and deployment of trucks that produce no tailpipe emissions during operation. Zero-emission trucks are designed to run on alternative fuels or power sources that do not release greenhouse gases or other pollutants into the atmosphere.

The primary goal of zero-emission trucks is to address environmental concerns, particularly related to air quality and climate change. Traditional trucks, especially those powered by internal combustion engines running on fossil fuels, emit pollutants such as carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter. Zero-emission trucks aim to mitigate these environmental impacts by using cleaner and more sustainable energy sources.

Zero Emission Trucks Market Data and Statistics

- According to the recent report published by NITI Aayog, the adoption of zero emission trucks in India can reduce trucking carbon emission by 46% by 2050.

- During the G20 summit in India, the World Economic Forum announced to create India's first zero emission road freight cluster where businesses will employ over 550 zero emission trucks in the upcoming 2 years.

- Nikola Corporation, a leader in the world of zero-emissions transportation, energy supply, and infrastructure solutions, produced and distributed 35 Class 8 Nikola hydrogen fuel cell electric cars (FCEVs) in 2023.

- Stated by International Energy Agency, in 2022, 60,000 medium to heavy-duty electric trucks were sold worldwide.

- Nissan Motor Corp, a Japanese automobile giant, announced a USD 17.6 billion investment directed towards expanding their offerings of battery-powered vehicles over a five-year period. As a major player in the zero emission trucks market, some of Nissan's other noteworthy achievements include shifting to heavy-duty, battery electric trucks for last-mile deliveries of new vehicles in the Los Angeles region. This crossover will be supported with appropriate charging infrastructure in accordance with Nissaqn's goals for achieving carbon neutrality across its operations by 2050.

- The largest express delivery corporation in the world, FedEx, has set a target to convert 50% of its pickup and delivery vehicle acquisitions worldwide to electric power by 2025, and to 100% by 2030.

- According to TrendForce, the average selling price of electric vehicle batteries dropped by 6-10% in December 2023. Moreover, Goldaman Sachs predicted the prices of EV battery will fall 40% by 2025. The cost reduction factor is observed to make the production of zero emission trucks even more economically viable in the upcoming period.

Zero Emission Trucks Market Growth Factors

- Several effective environmental policies aimed at reducing pollution and promoting sustainable transportation modes act as supplement for the zero emission trucks market to grow.

- Ongoing advancements in battery technology, electric drivetrains, and energy storage systems are improving the efficiency and range of zero-emission trucks, making them more attractive to buyers.

- Increasing awareness about environmental issues and the desire for sustainable transportation options among consumers and businesses contribute to the growing demand for zero-emission trucks.

- Collaborations between public and private entities can help address challenges related to infrastructure development, policy advocacy, and technology standardization while promoting the acceptance of zero emission trucks.

- The global trend towards electrification in various industries, including transportation, creates a favorable environment for the growth of the zero-emission trucks market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 29.50% |

| Market Size in 2024 | USD 7.68 Billion |

| Market Size in 2025 | USD 9.94 Billion |

| Market Size by 2034 | USD 101.86 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Vehicle Type, By Source, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Government initiatives for sustainable mobility

Governments around the world are setting ambitious emission reduction targets to combat climate change. In response to international agreements and commitments, governments are actively promoting the use of zero-emission vehicles, including electric trucks, to achieve these targets. Many governments offer financial incentives, tax credits, grants, and subsidies to promote the purchase and adoption of zero-emission trucks. These incentives help offset the initial higher costs of electric vehicles, making them more attractive to businesses and individuals. Thereby, such initiatives are observed to support the market's growth by acting as a growth factor for the market.

- In September 2023, under the theme of Sustainable Transport, China's president stated willingness to promote global transportation cooperation with the perspective of sustainable transportation development.

- By supporting the Global Memorandum of Understanding on Zero-Emission Medium- and Heavy-Duty Vehicles (Global MOU), the one India subnational government declared a renewed commitment to zero-emission transportation. The goal of the Global MOU is to have 100% of new trucks and buses sold with zero emissions by 2040.

- The European Green Deal aims to reduce 90% greenhouse gas emissions by 2050. The European Commission is financing for approximately 1 million public charging stations that will be needed for 13 million zero emission vehicles that are expected to be on European roads.

Restraint

Lack of charging infrastructure

The limited availability of charging stations creates concerns among potential buyers about the range and reliability of zero-emission trucks. Range anxiety, or the fear of running out of battery power without access to charging, can deter fleet operators and individual consumers from adopting electric trucks. The absence of a robust charging network acts as a barrier to widespread market adoption. Fleet operators and businesses may be hesitant to invest in zero-emission trucks if they perceive challenges in maintaining their vehicles' operational readiness due to insufficient charging options.

Opportunity

Emphasis on reducing logistics cost

Zero-emission trucks, especially electric ones, generally have lower operating costs compared to traditional internal combustion engine vehicles. With fewer moving parts, reduced maintenance requirements, and lower fuel costs, businesses can realize significant operational cost savings over the life cycle of the vehicle.

- The Indian government has launched ‘Gati-Shakti' initiative to focus on the reduction of logistics cost by integrating technologies while expecting a robust growth of logistics industry in the country.

Many urban areas are implementing stringent emission standards and access restrictions. Zero-emission trucks, meeting these standards, ensure continued access to urban centers, preventing potential fines or delays associated with non-compliance. Adopting zero-emission vehicles is consistent with long-term environmental objectives. Companies that project an image of environmental consciousness could benefit from a competitive advantage as stakeholders and customers value sustainable practices increasingly.

Zero Emission Trucks Market Competitive landscape

Ashok Leyland:

Renowned for its proficiency in truck manufacture, Ashok Leyland is a major player in the commercial vehicle manufacturing sector. The company achieved greater price realisations and its highest-ever LCV volumes of over 67,000 units in FY23. Leveraging decades of experience in the commercial vehicle industry, Ashok Leyland brings a deep understanding of fleet requirements and logistics to its electric truck offerings.

In June 2023, Ashok Leyland announced that its forthcoming electric compact trucks will be produced at its Hosur production complex's LCV (light commercial vehicle) facility. The Hinduja brand has previously stated that, as part of its larger objectives to increase the LCV volumes through new product rollouts, it will be introducing two new electric small trucks: the electric Dost and the electric Bada Dost.

Nikola Corporation

NIKOLA Corporation is a prominent player in the electric truck manufacturing industry, known for its innovative approach to zero-emission transportation solutions. NIKOLA's product portfolio includes a range of electric trucks, with a notable emphasis on fuel cell-powered vehicles. NIKOLA is investing in the development of a hydrogen fueling network, aiming to overcome infrastructure challenges associated with fuel cell technology.

The goal of Nikola's hydrogen fuel network is to increase the output of trucks that emit no emissions. Nikola stated in February 2023 that it was in the process of negotiating an investment deal with Fortescue Future Industries, a branch of Fortescue Metals Group Ltd., an Australian iron ore firm, for the project. The initial volume of hydrogen production is expected to be about 30 metric tonnes per day by the end of 2024.

Vehicle Type Insights

The electric light-duty vehicles segment held the largest share of the market in 2024. The demand for last-mile delivery services has increased as a result of the growth of e-commerce and rising urbanization. For this, electric light-duty vehicles are a good fit since they are efficient, agile, and have a smaller environmental effect in urban areas.

Electric light-duty trucks are becoming increasingly common in fleets as a result of corporate environmental efforts. Electric light-duty trucks are a desirable option for companies that provide local deliveries and services because of their adaptability, reduced operating costs, and favourable brand image linked with environmentally friendly operations.

- In December 2023, major automaker in India, Mahindra & Mahindra announced to produce a range of light-duty electric trucks for commercial purposes. The new truck by Mahindra & Mahindra is set to compete with leading electric vehicles by Tata and Ashok Leyland.

The electric medium-duty vehicles segment is observed to expand at the fastest rate during the forecast period. Delivery vans and light trucks are examples of electric medium-duty vehicles that are more widely accessible on the market than some of their heavy-duty equivalents. Due to its availability, companies may quickly and with minimal disturbance add electric medium-duty vehicles to their fleets.

Source Insights

The battery electric trucks segment held the largest share of the zero emission trucks market in2024. Battery electric technology has matured significantly in recent years, leading to advancements in battery efficiency, energy density, and overall performance. This maturity has positioned battery electric trucks as reliable and viable alternatives to traditional combustion engines.

- In an effort to increase the efficiency of deliveries, Isuzu Motors of Japan said that it will start a new company in 2023 centred on electric vehicles that use changeable batteries. Isuzu plans to install similar amenities at petrol stations and depots owned by logistics companies all around Japan.

The hybrid electric trucks segment is observed to witness the fastest rate of growth during the forecast period. Compared to fully electric cars, hybrid electric trucks have a longer range since they integrate conventional internal combustion engines with electric power. Due to its versatility, hybrid electric trucks can be used for a range of tasks, such as long-haul freight, regional transit, and urban delivery. Their versatility renders them appropriate for an extensive array of sectors and applications.

- In 2024, Ford intends to treble the number of hybrid F-150 pickup trucks it produces. This move will accelerate the automaker's shift to gas-electric powertrains as a precaution against American truck purchasers' reluctance to switch to all-electric vehicles. The hybrid powertrain will be available for the same price as a truck with a six-cylinder combustion engine starting in the 2024 model year.

Application Insights

The logistics and transportation segment held the dominating share of the market in2024. Vehicles used for logistics and transportation, particularly delivery vans and goods trucks, frequently travel great distances and burn a lot of gasoline. Significant reductions in greenhouse gas emissions may result from the segment's adoption of zero-emission cars. Many cities are implementing restrictions on the entry of vehicles with high emissions into urban areas. This encourages logistics and transportation companies to invest in zero-emission vehicles to ensure continued access to these critical locations.

Many logistics and transportation companies have set ambitious sustainability goals and commitments to reduce their carbon footprint. Adopting zero-emission vehicles is a tangible way for these companies to achieve their environmental objectives.

- To further electrify its e-commerce logistics in the nation, Amazon India teamed up with Eicher Motors and Buses in August 2023. Up to 1,000 electric trucks with different payload capacities will be used by Amazon in its delivery operations over the course of the next five years.

Regional Insights

North America is expected to have a significant market share throughout the forecast period. The market for zero-emission trucks is growing as a result of state-level incentives, stricter emission standards, and supportive infrastructure development. Some states in North America, like California, have been especially proactive in implementing policies to reduce greenhouse gas emissions and improve air quality. The adoption of zero-emission trucks is often accelerated by large corporations with extensive logistics and transportation needs.

Many North American companies, especially those with sustainability goals and commitments, have incorporated electric trucks into their fleets. The United States is home to some of the world's largest automotive manufacturers. The involvement of major automakers in producing and promoting electric trucks has significantly influenced the market dynamics. Technological innovation, particularly the development of electric vehicle technologies, has been centred in the United States. New and competitive electric vehicle options have been made possible by the existence of state-of-the-art research and development centers.

North America zero emission trucks market: Government initiatives

- The Canadian government has taken significant steps towards rising the availability of electric vehicles by finalizing its new Electric Vehicle Availability Standard. The minister of environment and climate change, these standards aim to ensure a non-stop supply of zero emission vehicles in the country to meet the national target of zero emission vehicle sales by 2035.

- The United States federal government in 2022 initiated supporting the adoption of zero emission vehicles especially for commercial sector with its Inflation Reduction Act 2022. The legislation aims to offer tax credits on every purchase of electric commercial vehicle up to 30%.

Asia Pacific is observed to witness the fastest rate of growth in the zero emission trucks market during the forecast period. High population density and rapid urbanization in many Asia Pacific countries contribute to increased concerns about air quality and pollution. Governments are motivated to address these challenges by promoting environmentally friendly transportation solutions, such as zero-emission vehicles. The region has experienced significant economic growth, leading to an expanding middle class.

This demographic shift has increased the demand for personal vehicles, and there is a growing awareness of the environmental impact of traditional vehicles, driving interest in zero-emission alternatives. Asia Pacific countries, particularly China, have made significant strides in advancing battery technology. The development of high-performance and cost-effective batteries has played a crucial role in making electric trucks more accessible and appealing to consumers.

Asia Pacific zero emission trucks market: Government initiatives

- India has initiated Electric Mobility Mission to mark the beginning of EV transition in the country. The government of India has also introduced FAME and FAME II to promote the adoption of electric vehicles by offering multiple incentives and tax exemptions.

- Under the Union Budget 2022, Indian government offered interventions where national and state governments can introduce special EV tariff to offer lower electricity prices for charging electric trucks.

- The government of China has allowed battery swappable electric vehicles to be eligible for subsidies. In addition, local governments such as the Jiangsu provincial government are in process of standardising batteries for swapping purposes.

Zero Emission Trucks Market Companies

Recent Developments

- In December 2023, the Middle East's first all-electric, zero-emission ready-mix truck was unveiled by CEMEX. The truck can carry a full load of concrete and is fully functional, according to the manufacturer. It has a 350kWh battery that is state-of-the-art and can run the device for an average workday on a single charge. In order to find, test, learn from, and scale the long-term solutions required for hybrid and zero-emission vehicles to be widely available, CEMEX is working with manufacturers and partners.

- In September 2023, Alfa Laval and Scan Global Logistics announced the launch of their first electric scania truck as part of zero emissions partnership. The zero-emission truck is manufactured in close collaboration with Scania, which will operate a designated lane between Alfa Laval's manufacturing sites in Sweden along with SGL in Denmark.

Segments Covered in the Report

By Vehicle Type

- Electric Light-Duty Trucks

- Electric Medium-Duty Trucks

- Electric Heavy-Duty Trucks

By Source

- Battery Electric Trucks (BEVs)

- Hydrogen Fuel Cell Electric Trucks

- Hybrid Electric Trucks

By Application

- Last Mile Delivery

- Logistics and Transportation

- Construction

- Waste Management

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting