What is Car Rental Market Size?

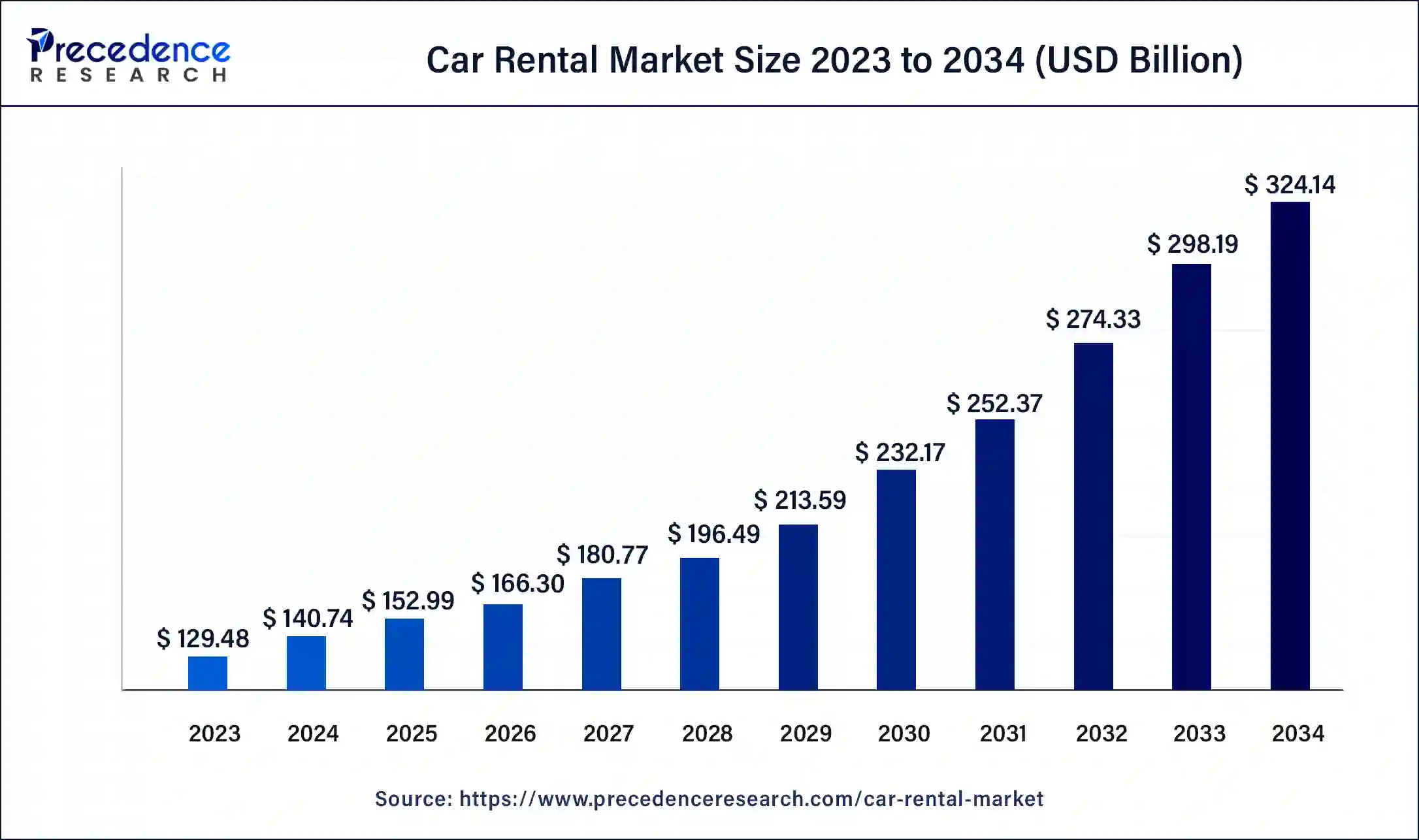

The global car rental market size is estimated at USD 152.99 billion in 2025 and is predicted to increase from USD 166.30 billion in 2026 to approximately USD 348.69 billion by 2035, expanding at a CAGR of 8.59% from 2026 to 2035

Market Highlights

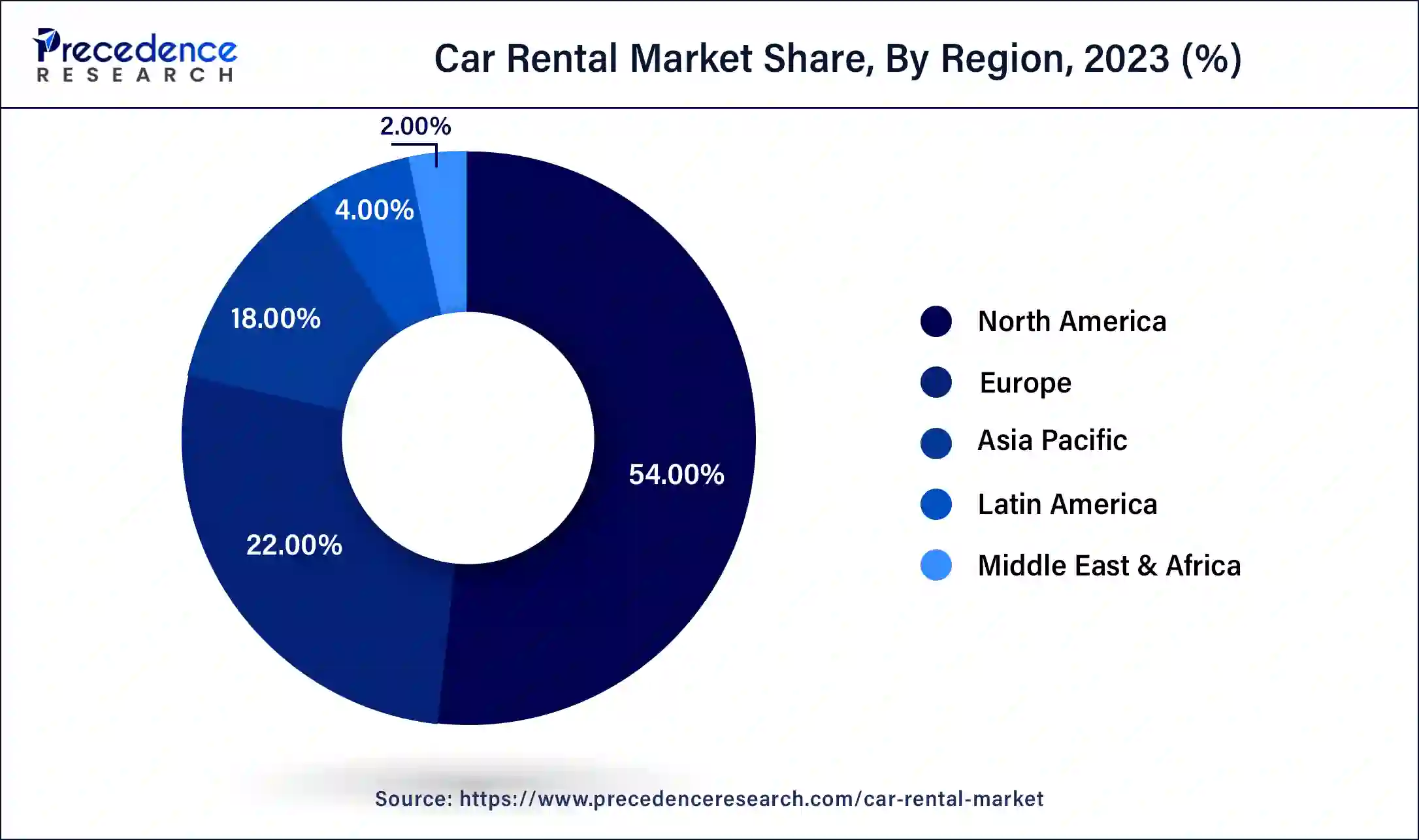

- The North America region has captured a market share of around 54% in 2025.

- By vehicle type, the economy cars segment held a market share of around 35% in 2025.

- The executive cars segment is expected to grow at a CAGR of 5.8% from 2026 to 2035

- By application, the airport transport segment accounted for 43% of the total revenue share in 2025.

- The local usage segment is registering growth at a CAGR of 6.8% between 2026 to 2035

Car Rental Market Growth Factors

The technology plays vital role for the growth and development of car rental market. The increased adoption of car rental software by key market players is driving the growth of the market. Moreover, the business of car rental service is quite profitable, where venture capitalists and angel investors are funding the startups to start their own car rental services. The startups such as Turo, Getaround, Zoomcar, Zipcar, Socar, and Kovi are the new market players in the car rental market. The increased in internet penetration will create lucrative opportunities for the growth of the car rental market.

The digitalization of developing and underdeveloped regions is also helping the market to grow at a rapid pace. Furthermore, the digital technologies have also helped market players to collect, store, and analyze passenger data to build long-term relationship with its customers. However, the rise in low-cost public transportation may hamper the growth of car rental market. The government of developed regions is implementing policies for the growth of public transport industry. These government policies include a greater number of public buses and low-cost tickets. Thus, the increase in government activities and initiatives for the development of public transport infrastructure will restrict the growth of car rental market.

The factors such as rise in trend of on-demand transportation services and low rate of car ownership among millennials propel the growth of car rental market. Moreover, the adoption of car rental management technology will provide growth opportunities for car rental market players. However, the low rate of internet penetration in developing regions is hampering the growth of the market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 152.99Billion |

| Market Size in 2026 | USD 166.30 billion |

| Market Size by 2035 | USD 348.69 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.59% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Vehicle, By Application, and By Rental Duration, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Vehicle Type Insights

Based on the vehicle type, the economy cars segment accounted for 35% of revenue share in 2024. The economy cars are very efficient in terms of fuel consumption. Most of the market players prefer economy cars for car rental services, owing to low maintenance and procurement costs. Also, economy cars are compact in nature and provide enough comfort to the passengers.The executive cars segment is expected to hit 5.8% of CAGR during the forecast period. Executive cars are larger than economy cars but smaller than luxury cars. The regions such as Asia-Pacific and Latin America are flourishing with the strong economic growth, which also helps key market players to provide better transportation services. This factor is driving the growth of the executive cars segment.

Application Type Insights

The airport transport segment has garnered a 43% revenue share in 2025. The increase in number of airports in developing regions is contributing towards the growth of airport transport segment. The increase in urbanization has also helped to increase the demand for the car rental services. The rise in upper middle-class group is also contributing for the growth of the market. As a result, the surge in demand for airport car rental services is creating lucrative opportunities for the growth of the segment.The local usage segment is projected to reach 6.8% of CAGR during the forecast period. The demand for local cars and taxis has increased over the time period. The short trips and tours require car rental services for the local usage.

Rental Duration Insights

Based on the rental duration, the short-term segment dominated the global car rental market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. The short-term duration rental cars are used for short trips, tours, and journeys. This type of rental duration car is also applicable for the local usage, airport transportation, and short distance outstation journeys.On the other hand, the long-term is estimated to be the most opportunistic segment during the forecast period. The rental cars are used for long-term trips and journeys. It is mostly used for the outstation trips. The car rental service for long-term duration is also gaining traction for the family trips.

Regional Insights

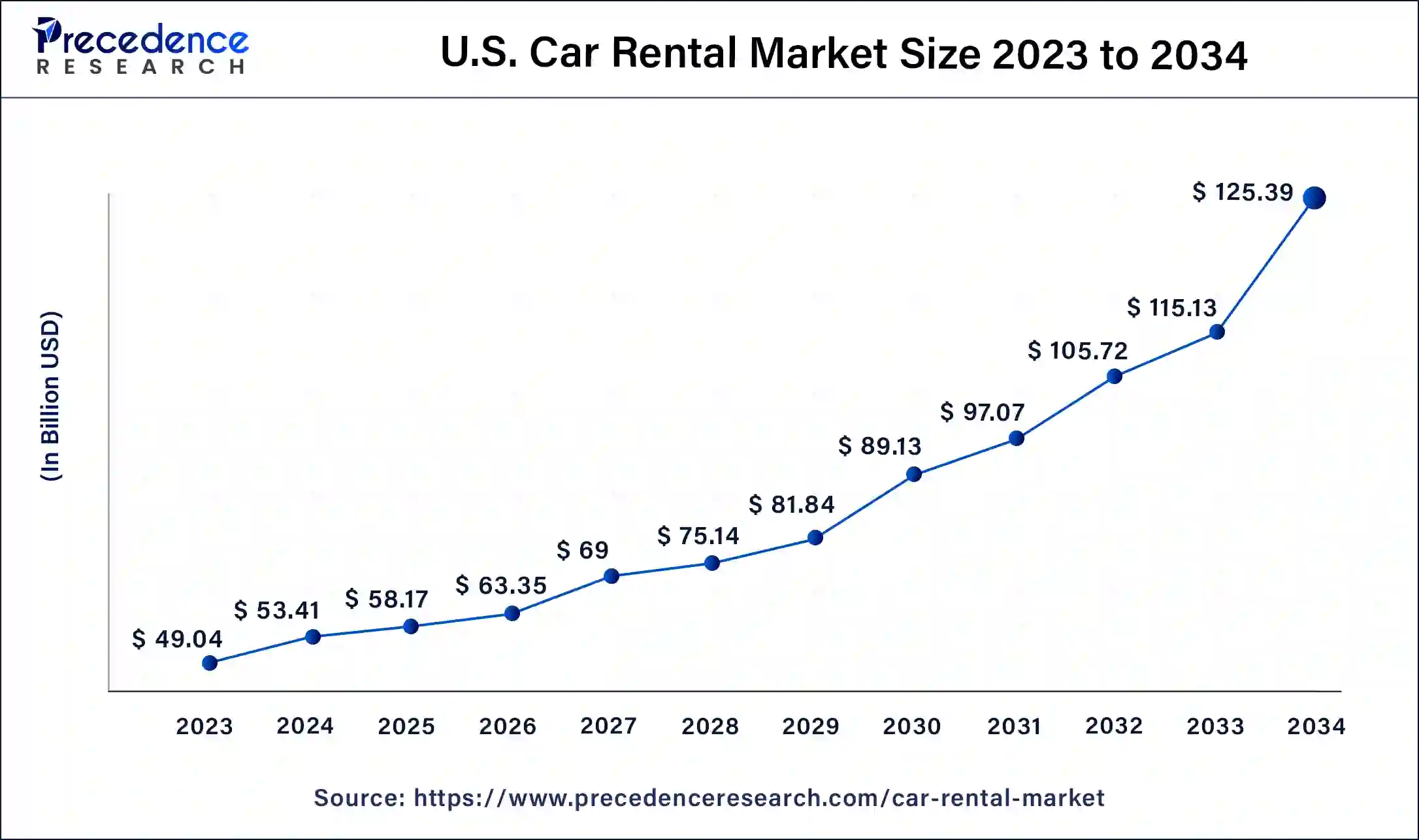

U.S. Car Rental Market Size and Growth 2026 to 2035

The U.S. car rental market size is estimated at USD 58.17 billion in 2025 and is predicted to be worth around USD 135.08 billion by 2035, at a CAGR of 7.98% from 2026 to 2035.

Based on the region, the North America region held 54% revenue share in 2024. The surge in number of leisure and business tours across the North America region is boosting the growth of market. The trips to North American cities such as New York, Los Angeles, Chicago, San Francisco, and Las Vegas are also paving way for the growth of the car rental market.

The U.S. is major contributor to the car rental market in North America. The market growth is driven by re-emergence of travel and tourism for both domestic and international tourism, flexibility offered by rental car service providers, growing use of online booking platforms offering a cost-effective and convenient option for travellers, rising popularity of electric vehicles (EVs), implementation of advance technological solutions such as self-serving kiosks and increased demand of rental cars in popular tourist destinations such as Florida, California, Las Vegas and New York.

- For instance, in March 2025, SIXT USA, a part of Sixt SE- a globally leading premium mobility services company, opened its newest U.S. rental car branch in Hollywood, Florida at the iconic Seminole Hard Rock Hotel & Casino. The newly launched branch will offer exceptional service for both hotel guests and area travellers by providing direct acces to SIXT's top-tier fleet.

What Makes Asia Pacific the Fastest-Growing Region in the Car Rental Market?

The Asia-Pacific is expected to grow at a CAGR of 8.4% during the forecast period. The rise in consumer spending for tourism and traveling combined with rising disposable income is driving the growth of car rental market in the Asia-Pacific region during the forecast period. The market players such as Uber, Avis, Ola, Hertz, Didi Chuxing, Sixt, Zoomcar, Europcar, GrabTaxi, Hailo, Line Taxi, and Blue Bird are offering car rental services in the Asia-Pacific region.

- For instance, in April 2025, Go Wheelo, a leading two-wheeler rental aggregation platform in India, expanded its service offerings with the launch of its new vertical for car rentals with the aim of providing smart, sustainable and accessible travel options for everyone.

China Car Rental Market Trends

China is a major contributor to the car rental market. The growing business travel and rapid growth in the tourism industry increase demand for car rentals. The rising disposable incomes and strong government support for domestic tourism help in the market growth. The growing infrastructure development, like scenic routes & highways, helps market growth.The ongoing technological advancements, like mobile apps and online platforms, increase the adoption of car rentals. The rising traffic congestion problems and rapid urbanization drive the overall growth of the market.

- In May 2025, Baidu, Apollo, and CAR Inc. launched an autonomous car rental service in China. The service is available in the second quarter of the year and provides users with driverless vehicles for flexible travel to tourist spots & cultural landmarks. It supports various users like international tourists, individuals with disabilities, the elderly, and unlicensed drivers.

How is India growing in the car rental market?

India is growing in the car rental market. The well-established tourism landscape, including offbeat & popular destinations, increases demand for rental cars. The growing improvements in the infrastructure of roads, like highways, and growing tourism help in the market growth. The higher disposable incomes and increased middle-class population fuel demand for car rentals.

The growing expansion of the hospitality & tourism sector and the growing preference for domestic travel increase demand for car rentals. The growing preference for personalised travel & road trips and increasing demand for luxury cars by foreign tourists, millennials, and Gen Z drives the overall growth of the market.

- In December 2024, Zoomcar launched Zoomcar Cabs rental service with drivers. The customer can select a car category like hatchback, sedan, and others. The customer needs to add a pickup location and have full control of their destination, stops, and route.

How is the Opportunistic Rise of Europe in the Car Rental Market?

Europe is growing in the car rental market. The growing business-related & leisure tourism and travel in the region increases demand for rental cars. The growing traffic congestions and urban population in various cities helps in the market growth. The growing disposable incomes increase the adoption of rental cars. The availability of mobile applications and online booking platforms drives the market growth.

UK Car Rental Market Analysis

In the UK, the market is growing due to a surge in both business and leisure travel, rising disposable incomes, and increasing urbanization. The adoption of digital booking platforms and mobile apps makes rentals more convenient and cost-effective. Additionally, traffic congestion in major cities encourages people to rent cars instead of owning them, boosting market growth.

Top Companies Operating in the Market & Their Offerings

- Enterprise Holdings Inc.

Enterprise Holdings operates Enterprise Rent-A-Car, National, and Alamo brands, offering a wide vehicle selection, flexible rental terms, local airport and neighborhood pick-ups, roadside assistance, loyalty programs, and customer-focused services for business and leisure travelers globally. - The Hertz Corporation

Hertz provides car and truck rentals worldwide with economy to premium vehicles, digital reservations, Hertz Gold Plus Rewards, roadside support, and optional protections, serving business, leisure, and long-term renters through airports and city locations. - Toyota Rent a Car

Toyota Rent a Car offers reliable Toyota vehicles for daily, weekly, and long term rentals, emphasizing fuel efficiency and safety, with convenient booking, customer support, and options suitable for family, business, and tourism travel needs. - Sixt SE

Sixt SE delivers premium car rentals across global markets with a modern fleet including luxury, sports, and electric vehicles, online/mobile reservations, corporate solutions, loyalty benefits, and flexible pickup/drop off at airports and city hubs. - Alamo Rent a Car LLC

Alamo focuses on affordable, family friendly car rentals with straightforward pricing, online check in, unlimited mileage (in many markets), airport locations, and deals tailored to leisure travelers and vacationers. - Carzonrent India Pvt Ltd

Carzonrent India offers self-drive and chauffeur-driven rentals, corporate mobility, airport transfers, and subscription models with varied vehicles, 24/7 support, digital booking, and customized plans for business and tourism travel. - Localiza

Localiza provides extensive car rental and fleet management in Latin America, with diverse vehicles, online/mobile booking, loyalty perks, flexible terms, airport and city locations, and tailored solutions for business, tourism, and everyday use.

Car Rental Market Companies

- Avis Budget Group

- Europecar

- Enterprise Holdings Inc.

- The Hertz Corporation

- Toyota Rent-a-Car

- Sixt SE

- Alamo Rent-a-Car LLC

- Carzonrent India Pvt Ltd

- Localiza

- ANI Technologies Pvt. Ltd

Companies Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting different marketing strategies, such as investments, partnerships, and mergers & acquisitions. The companies are also spending on the development of improved products. Moreover, they are also focusing on competitive pricing.

- In March 2021, the Uber Technologies Inc. entered into partnership with car a rental company called CarTrawler to launch car rental service called Uber Rent.

The various developmental strategies such as partnerships, new product launches, acquisition, joint venture, R&D investments, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Recent Developments

- In April 2025, SelfDrive Mobility, a leading mobility tech company, launched car rental services offering Zero Deposit across daily, weekly and monthly rental plans providing a flexible and cost-effective solution to traditional leasing. The service is launched in five key markets, including Qatar, Bahrain, the Kingdom of Saudi Arabia, the UAE and the UK with the aim of simplifying and improving customer rental experience.

- In April 2025, Dollar Car Rental UAE launched a digital-first travel solution at the Arabian Travel Market (ATM) 2025 with new customer-centric offerings which align with the future of global tourism and are set to revolutionize mobility services.

- In February 2025, Poppy Mobility, a leading car-sharing and rental operator in Belgium, announced the launch of its remote-driving technology for delivering rental cars in collaboration with Ush, a developer of autonomous and remote-controlled vehicle solutions. Requests for rental vehicle can be done via the Poppy app by users, which will then remotely be driven to the user's real-time location by Ush's remote driving operator.

Segments Covered in the Report

By Vehicle Type

- Luxury Cars

- Economy Cars

- SUVs

- Executive Cars

- MUVs

By Application Type

- Local Usage

- Outstation

- Airport Transport

- Others

By Rental Duration

- Long-term

- Short-term

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content