Hydrogen Internal Combustion Engines Market Size and Forecast 2025 to 2034

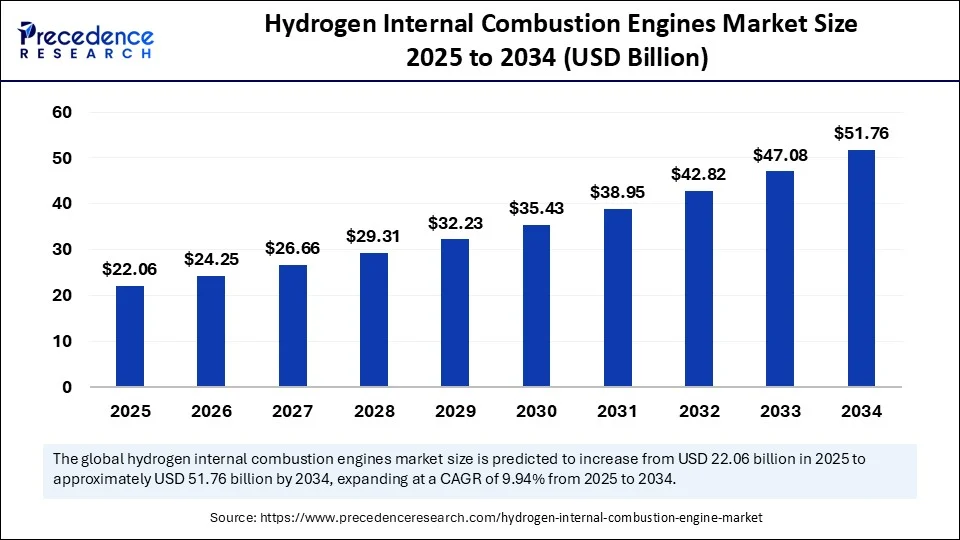

The global hydrogen internal combustion engines market size accounted for USD 20.06 billion in 2024 and is predicted to increase from USD 22.06 billion in 2025 to approximately USD 51.76 billion by 2034, expanding at a CAGR of 9.94% from 2025 to 2034. The market growth is attributed to the strong emphasis of the automotive industry to reduce carbon emissions, driven by environmental concerns.

Hydrogen Internal Combustion Engines Market Key Takeaways

- In terms of revenue, the global hydrogen internal combustion engines market was valued at USD 20.06 billion in 2024.

- It is projected to reach USD 51.76 billion by 2034.

- The market is expected to grow at a CAGR of 9.94% from 2025 to 2034.

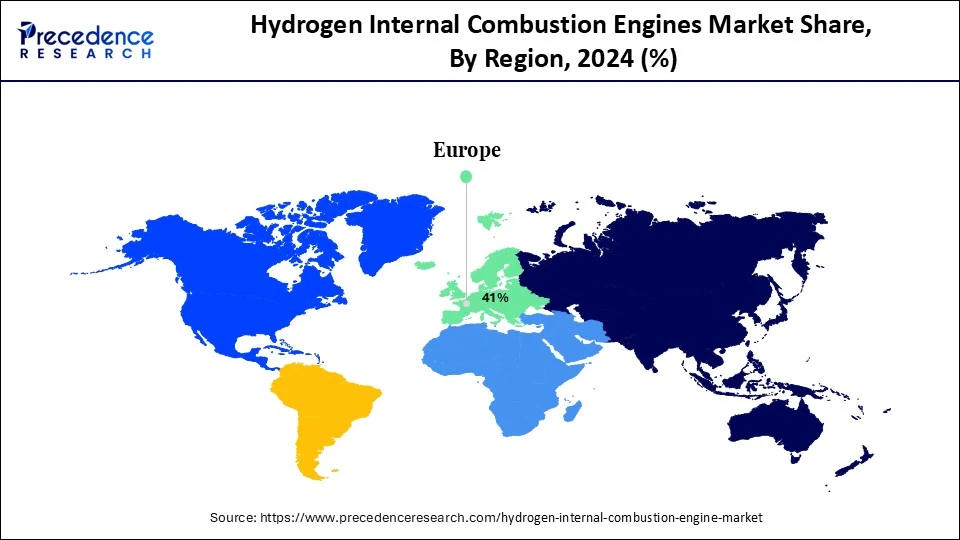

- Europe dominated the hydrogen internal combustion engines market with the largest market share of 41% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By power output, the 100–300 kW segment captured the biggest market share of 43% share in 2024.

- By power output, the 300kW segment is expected to expand at the fastest CAGR in the coming years.

- By vehicle type, the commercial vehicles segment contributed the highest market share of 49% in 2024.

- By vehicle type, the off-highway vehicles segment is expected to grow at the fastest CAGR during the projection period.

- By fuel type, the green hydrogen segment generated the major market share of 56% in 2024 and is expected to sustain the position during the forecast period.

- By ignition type, the compression Ignition with hydrogen-diesel dual-fuel segment held the highest market share of 38% in 2024.

- By ignition type, the direct hydrogen injection segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By end-use industry, the transportation and logistics segment accounted for significant market share of 46% in 2024.

- By end-use industry, the construction and mining segment is expected to grow at the fastest CAGR in the coming years.

Impact of AI on the Hydrogen Internal Combustion Engines Market

The integration of artificial intelligence in hydrogen internal combustion engines is poised to optimize efficiency, performance, and emission reductions. AI and machine learning are extensively used to optimize combustion processes during design, manufacturing, and implementation, enhancing fuel efficiency and reducing emissions. AI can be used to monitor and control the performance of H2-ICEs in real-time. AI-powered sensors can optimize engine parameters such as fuel injection, ignition timing, and air-fuel ratio to maximize efficiency and minimize emissions. AI can also detect and diagnose engine problems, enabling proactive maintenance and preventing costly repairs. This timely maintenance ensures smooth engine functioning, optimizing energy use and performance.

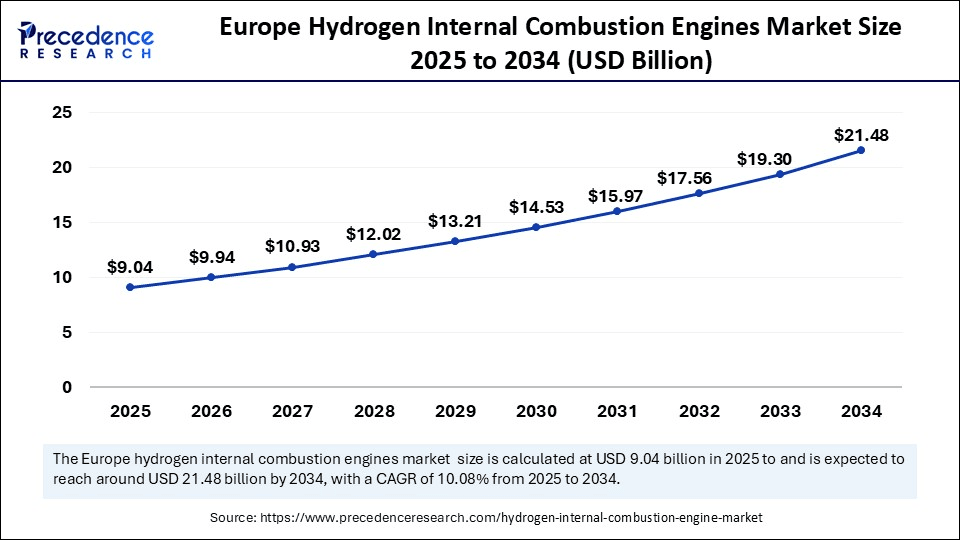

Europe Hydrogen Internal Combustion Engines Market Size and Growth 2025 to 2034

The Europe hydrogen internal combustion engines market size is exhibited at USD 9.04 billion in 2025 and is projected to be worth around USD 21.48 billion by 2034, growing at a CAGR of 10.08% from 2025 to 2034.

Why did Europe dominate the hydrogen internal combustion engines market?

Europe dominated the market with a major share of 41% in 2024. This is due to robust government backing and stringent regulations against carbon emissions. The EU is committed to green hydrogen production and carbon emission reduction. Automobile manufacturers in the region are adopting hydrogen-based alternatives for heavy-duty vehicles. Germany and the UK have launched national hydrogen strategies to boost production. Significant investments are being made in hydrogen refueling networks and hydrogen production and refueling stations across the European region. Companies are considering H2 ICE technology for various industrial applications, supporting market growth. Moreover, the rising investments in hydrogen production, storage, and distribution infrastructure support market growth.

North America Hydrogen Internal Combustion Engines Market Trends

North America is expected to grow at a steady rate in tge coming years. North American government is actively promoting cleaner energy solutions, driving the adoption of hydrogen-based energy as an impactful option against traditional fossil fuels. They have set emission reduction targets and are pushing for hydrogen internal combustion engines in vehicles, providing incentives, and investing in hydrogen production and refueling infrastructure.

The region's robust automotive and aerospace industries are significantly adopting hydrogen internal combustion engines, driving market growth. Moreover, stringent emission regulations in the region are pushing for cleaner transportation solutions, boosting the growth of the market.

Asia Pacific Hydrogen Internal Combustion Engines Market Trends

Asis Pacific is expected to grow at the fastest rate in the coming years. This is mainly due to growing awareness of climate change and the need to reduce greenhouse gas emissions. Research and development have helped to provide technology at affordable prices, which is significantly contributing to the market growth. Long-range transportation demand in the Asia Pacific region is continuously increasing due to the major factors, such as the expansion of e-commerce, which requires significant infrastructure for transportation solutions. Hydrogen combustion engines are one of the suitable options available for long-range transportation in commercial fleets and heavy vehicles. Moreover, the growing need to reduce greenhouse gas emissions and rising integration with renewable energy creates immense opportunities in the market.

Market Overview

The Hydrogen Internal Combustion Engines (H2-ICE) Market refers to the segment of the automotive and industrial engine market that uses hydrogen gas as fuel in modified internal combustion engines (ICEs). Unlike fuel cells, H2-ICEs operate similarly to traditional gasoline/diesel engines but emit near-zero COâ‚‚ when using green hydrogen. These engines offer a cost-effective transitional solution to decarbonize sectors such as trucks, buses, off-highway vehicles, and marine transport, especially where fuel cell electrification or battery storage is less feasible due to infrastructure or load requirements. The market is poised for substantial growth due to technological advancements, government support, and expanding infrastructure. Cost reductions in green hydrogen production further support market expansion.

Hydrogen Internal Combustion Engines Market Growth Factors

- Rising concerns over climate change are driving the demand for clean energy alternatives, boosting the market growth.

- Governments around the world are promoting cleaner fuel and incentivizing hydrogen-powered vehicles to reduce greenhouse gas emissions, boosting the growth of the market.

- Ongoing R&D in hydrogen combustion technology improves engine efficiency and performance, enhancing H2 ICE reliability.

- The rising focus on converting existing engines to hydrogen combustion engines to reduce emissions is expected to boost market growth.

- Advancements in hydrogen production and storage technologies are accelerating the adoption of H2 ICEs. Hydrogen ICE is ideal for commercial vehicles and public transport due to its reliability, long range, and high power.

- Hydrogen-powered passenger cars are gaining popularity due to their convenience, efficiency, and sustainable transportation alternative, contributing to market growth.

- Rising government investments in hydrogen refueling infrastructure is expected to support the growth of the hydrogen internal combustion engines market.

- Many leading automobile manufacturers are making significant investments in the research and development of hydrogen internal combustion engines and technology, contributing to market growth.

- Many countries have adopted national hydrogen strategies and initiatives to ensure the implementation of hydrogen technology and infrastructure development, boosting market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 51.76 Billion |

| Market Size in 2025 | USD 22.06 Billion |

| Market Size in 2024 | USD 20.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.94% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Power Output, Vehicle Type, Fuel Type, Ignition Type, End Use Industry, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Environmental Concerns and Government Support

The rapidly growing climate change issue is leading to very strict government regulations and a strong demand for sustainable and clean energy transportation solutions. On a global level, governments are actively working to reduce the greenhouse gas emissions caused by vehicles running on fossil fuels, which is a primary contributor to air pollution and further exacerbates global warming, increasing the Earth's temperature.

H2 ICE technology emerges as a promising solution for clean energy transportation systems. Hydrogen internal combustion engines release only water vapor and heat as byproducts during combustion. Governments are actively pushing clean energy transportation solutions by providing various incentives and increasing awareness among the general public, thereby accelerating the adoption of hydrogen-based transportation. Governments are continuously taking various actions, including making massive investments in the required infrastructure development for hydrogen production, hydrogen refueling stations, and imposing stringent regulations on fossil fuel vehicle sales through heavy tariffs.

Restraint

High initial Capital Requirement for the Establishment of Hydrogen Production and Refueling Infrastructure

One of the key restraints in the hydrogen internal combustion engines market is the high initial capital required for the establishment of hydrogen production facilities and refueling stations. The large-scale production of green hydrogen is still limited and expensive. This creates barriers and discourages new entrants from entering the market. Storing and transporting hydrogen safely and efficiently is a challenge due to its low energy density. Building a widespread hydrogen distribution network requires substantial investment and coordination. All these factors lead to the increased costs of H2 ICEs, limiting their adoption, particularly in price-sensitive markets.

Opportunity

Immense Potential in Transportation and Power Generation

The increasing demand for zero-emission vehicles creates immense opportunities for H2-ICEs. The potential for use in heavy-duty vehicles (trucks, buses) and off-road applications (construction, mining) is particularly promising. Shift toward clean energy resources also open up new growth avenues. H2-ICEs can be integrated with renewable energy sources (solar, wind) for hydrogen production, creating a sustainable energy ecosystem. The key reason behind the potential of hydrogen internal combustion engines is that they use the existing infrastructure developed for conventional internal combustion engines, which does not require massive investments in completely new infrastructure, making H2 ICE technology extremely popular now.

Various clean energy technologies are available, such as fuel cell technology, but compared to these, the development time and resources required for H2 ICE technology are relatively low, making it a better renewable energy alternative at a reasonable cost. H2 ICE Technology has a wide range of applications, such as trucks, buses, and power generation, where this technology is proving highly efficient, leading to massive potential in the upcoming times.

Power Output Insights

Why does the 100-300 kW segment dominate the hydrogen internal combustion engines market in 2024?

The 100-300 kW segment dominated the market with the largest share of 43% in 2024. This is mainly due to the increased demand from the automotive and power generation industries. 100-300 kW H2 ICEs are particularly suitable for commercial vehicles and decentralized power generation. They are well-suited for distributed power in places like telecom towers, water treatment plants, agricultural processing, and small-scale manufacturing. These engines are often compact and easy to integrate with fuel storage and power electronics, making them perfect for on-site or off-grid energy solutions.

The modular design of these engines allows for easy deployment based on changing needs, eliminating the need for extra resources. Heavy-duty trucks benefit greatly from the 100-300 kW range, increasing their demand in the transportation sector and for public transport vehicles like buses. Many manufacturers have successfully converted existing spark ignition engines to run on hydrogen within this power range, making it a straightforward transition for this segment.

The 300-kW segment is expected to grow at the fastest rate during the forecast period. The growth of this segment is driven by its balance of power and efficiency, along with its versatile applications. It strikes a perfect balance, offering an optimal mix of power and cost. Commercial vehicles, medium-duty applications, logistics, and industrial transport are all heavily utilizing 300 kW hydrogen internal combustion engines. Automobile manufacturers like Toyota and Hyundai are also developing advanced technologies for these engines, contributing to the segment's growth.

Vehicle Type Insights

Why did the commercial vehicles segment dominate the market in 2024?

The commercial vehicles segment dominated the hydrogen internal combustion engines market with the biggest market share of 49% in 2024. The dominance of this segment is primarily attributed to the suitability of commercial vehicles for long-distance and government support for sustainable transport. H2 ICE technology offers an excellent balance of range and refueling time, making it a popular choice for long-haul and heavy-duty commercial vehicles, where electric vehicles face challenges with power, distance, and charging times.To meet carbon neutrality goals, governments around the world have imposed stringent regulations on the automotive and transportation industries to reduce emissions, boosting the adoption of H2 ICEs. Governments are promoting the use of commercial vehicles that run on clean energy, which can significantly lower CO2 emissions. Although still in its early stages, the development of hydrogen refueling infrastructure is steadily progressing, making refueling more accessible for commercial vehicles at various hubs and logistics centers.

The off-highway vehicles segment is expected to grow at the fastest CAGR during the forecast period. The need for heavy-duty engines in industries like construction and agriculture can be met by hydrogen internal combustion engines, which are capable of handling heavy loads and demanding operations. Electric vehicles face limitations in these heavy-duty functions, a constraint that hydrogen-based vehicles address by offering powerful performance with clean energy and zero emissions. Rapid urbanization and infrastructure projects are driving demand for heavy-duty vehicles in construction. The increasing use of machinery in agriculture is also fueling demand. The rising government support, including incentives and subsidies, for hydrogen-based vehicles in agriculture further supports segmental growth.

Fuel Type Insights

What made green hydrogen the dominant segment in the hydrogen internal combustion engines market in 2024?

The green hydrogen segment dominated the market with a major revenue share of 56% in 2024. The segment is expected to sustain its position during the projection period. The growth of the segment is attributed to the increasing efforts by governments toward carbon neutrality. Green hydrogen is produced using renewable energy through electrolysis, releasing only water vapor when combusted in H2 ICE. This supports government goals for carbon neutrality and reduced emissions.Green hydrogen production has a minimal carbon footprint compared to methods like thermal methane reforming. Advancements in electrolysis technology are lowering production costs, making green hydrogen accessible to a broader consumer base. Governments are offering incentives and subsidies for green hydrogen production and infrastructure development, driving the growth of the segment.

Ignition Type Insights

How does the compression ignition with hydrogen diesel dual fuel segment dominate the market in 2024?

The compression ignition with hydrogen diesel dual fuel segment dominated the market with significant market share of 38% in 2024. The dominance of the segment stems from its ability to utilize existing diesel engine infrastructure and its potential for better thermal efficiency when hydrogen is used as a secondary fuel. CI engines, which use compression heat to ignite the fuel-air mixture, can run on hydrogen alongside diesel, offering a pathway to reduce carbon emissions while using existing engine technology.Many industries using diesel engines for heavy-duty transport are converting these engines to a dual-fuel CI configuration, providing a smoother transition to hydrogen without needing new setups or investments. When hydrogen is added as a secondary fuel in CI engines, it improves combustion efficiency and reduces overall fuel consumption. Using dual fuel with hydrogen significantly reduces emissions compared to pure diesel.

A dual-fuel strategy, where diesel initiates combustion and hydrogen are the primary fuel, provides a better combustion process and optimizes emissions across various engine loads. The direct hydrogen injection segment is witnessing the fastest growth in the market. The growth of this segment is driven by its ability to achieve high power output and improve efficiency. The H2 ICE provides better control in the combustion process while generating higher power output and better efficiency compared to PFI. There is less pumping work in direct injection compared to PFI, where hydrogen needs to be inducted into the cylinder, resulting in lower demand on boosting systems.

End Use Industry Insights

Why did the transportation & logistics segment dominate the market in 2024?

The transportation andlogistics segment dominated the hydrogen internal combustion engines market with major market share of 46% in 2024. Hydrogen-powered engines are highly suitable for the transportation & logistics sector. They are widely used in heavy-duty vehicles, including on-road and off-road vehicles for construction and agriculture. The faster refueling times of hydrogen ICE make them ideal for heavy-duty vehicles, avoiding downtime. This segment's dominance is also reinforced due to strict government emission reduction regulations and net-zero emission goals.

The construction & mining segment is expected to grow at the fastest rate. This is primarily due to the increased demand for zero-emission solutions in these sectors. The suitability of H2 ICEs for heavy-duty vehicles is leading to a faster adoption of these engines. Stringent government regulations on construction activities, considering their environmental impact, can be addressed with hydrogen-based vehicles, reducing emissions on construction sites. Stringent emission regulations drive the adoption of cleaner alternatives like hydrogen internal combustion engines in construction and mining.

Hydrogen Internal Combustion Engines Market Companies

- Cummins Inc.

- Rolls-Royce plc (MTU Engines)

- Toyota Motor Corporation

- MAN Truck & Bus (Volkswagen Group)

- Deutz AG

- Yamaha Motor Co., Ltd.

- Caterpillar Inc.

- JCB

- Hyundai Motor Company

- Punch Hydrocells (Belgium)

Recent Developments

- In June 2025, in an agreement to decarbonize shipping, joint venture partners JPNHâ‚‚YDRO and BeHydro, together with DAIHATSU INFINEARTH and Mizuno Marine, entered into a strategic partnership to introduce BEH2YDRO INFINEARTH hydrogen engines in Japan. The objective behind this partnership is to increase the deployment of hydrogen fuel and 100% hydrogen in Japan's port and coastal areas, contributing to the country's zero-emission goals.

(Source: https://fuelcellsworks.com) - In January 2025, Cummins Inc. announced the launch of its new turbocharger designed specifically for hydrogen internal combustion engines (H2 ICE). This advancement in turbocharging technology marks a significant milestone for heavy-duty commercial on-highway applications in Europe.

(Source: https://fuelcellsworks.com) - In December 2024, HORIBA India launched its first Hydrogen Internal Combustion Engine (H2-ICE) test bed facility at the HORIBA India Technical Center in Chakan, Pune. The new facility is designed to test hydrogen-fuel-based ICEs, paving the way for advancements in energy efficiency and sustainability.

(Source: https://www.autocarpro.in)

Segments covered in the report

By Power Output

- <100 kW

- 100–300 kW

- 300 kW

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Heavy-duty Trucks

- Buses

- Delivery Vans

- Off-Highway Vehicles

- Agriculture

- Construction

- Mining

- Marine & Locomotive

- Power Generators (Stationary)

By Fuel Type

- Green Hydrogen

- Blue Hydrogen

- Grey Hydrogen

By Ignition Type

- Spark Ignition (SI)

- Compression Ignition with Hydrogen-Diesel Dual-Fuel

- Direct Hydrogen Injection

By End Use Industry

- Transportation & Logistics

- Agriculture

- Construction & Mining

- Marine

- Power Generation

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting