Hydrogen Market Size and Forecast 2025 to 2034

The global hydrogen market size accounted at USD 262.13 billion in 2024 and is projected to reach around USD 556.56 billion by 2034, growing at a CAGR of 7.82% from 2025 to 2034. The hydrogen market is driven by the growing demand for clean energy sources.

Hydrogen Market Key Takeaways

- In terms of revenue, the hydrogen market is valued at $282.63 billion in 2025.

- It is projected to reach $556.56 billion by 2034.

- The hydrogen market is expected to grow at a CAGR of 7.82% from 2025 to 2034.

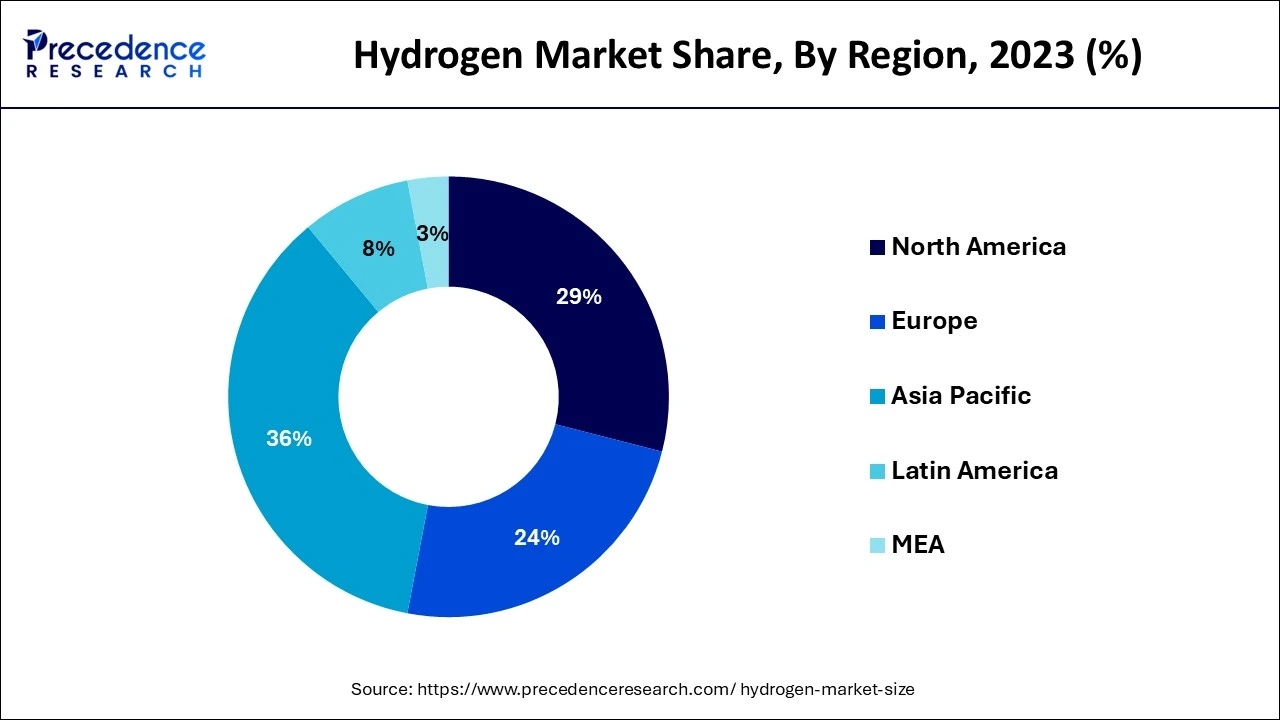

- Asia Pacific dominated the hydrogen market and recorded the highest market share of 36% in 2024.

- North America is observed to be the fastest growing in the market during the forecast period.

- By sector, the gray hydrogen sub-segment dominated the hydrogen market in 2024.

- By application, the chemical & refinery segment dominated the hydrogen market in 2024.

How is AI Being Implemented in Hydrogen Industry?

By optimizing operational conditions (such as temperature, pressure, and input energy), cutting expenses, and raising yields, artificial intelligence (AI) helps increase the efficiency of electrolyzers used in the manufacture of hydrogen. By detecting inefficiencies in the hydrogen supply chain, from production to consumption, AI-driven analysis can assist in lowering overall production and operating costs. To make the process cleaner and more sustainable, it helps integrate carbon capture technology with hydrogen production, primarily blue hydrogen (hydrogen produced from natural gas with carbon capture).

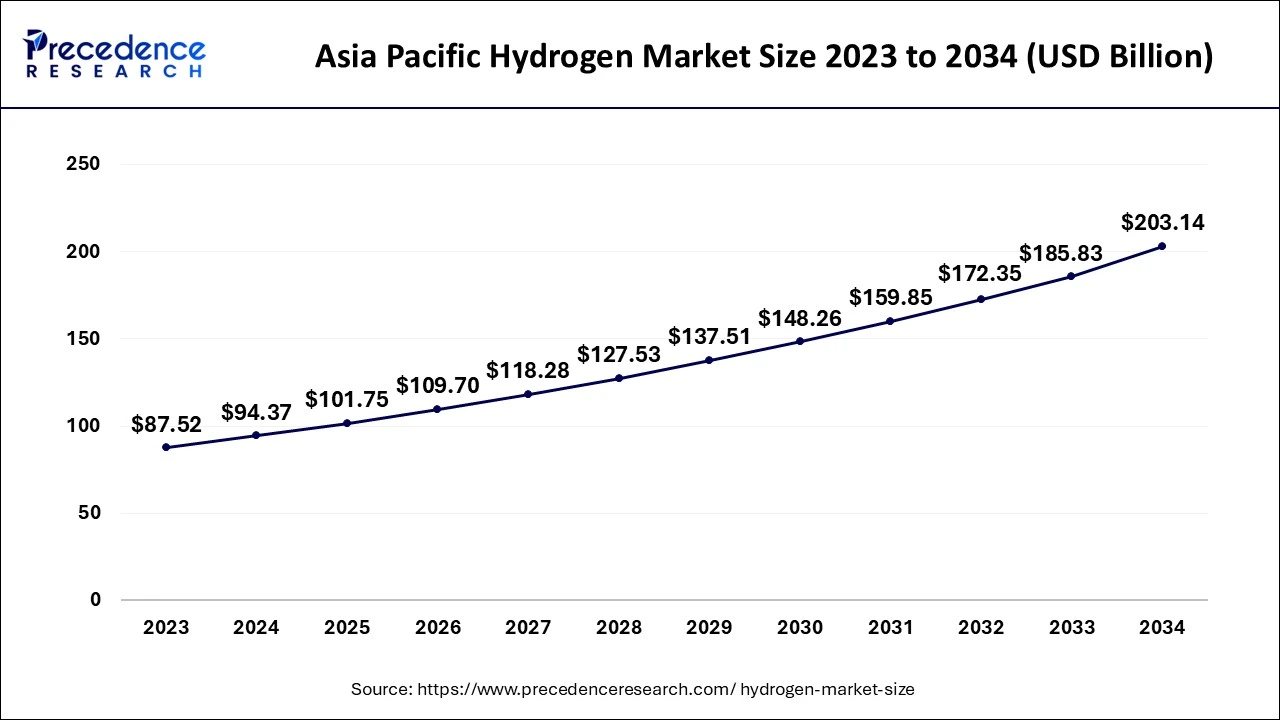

Asia Pacific Hydrogen Market Size and Growth 2025 to 2034

The Asia Pacific hydrogen market size was exhibited at USD 94.37 billion in 2024 and is projected to be worth around USD 203.14 billion by 2034, growing at a CAGR of 7.97% from 2025 to 2034.

Asia Pacific dominated the global green hydrogen market with the largest share in 2024. Favourable policies and initiatives by governments in the region are promoting the adoption of clean energy solutions like green hydrogen. Abundance of renewable energy resources such as solar, hydro ad wind is contributing to cost-effective production of green hydrogen through electrolysis. Additionally, growing focus on reducing carbon emissions, advancements in electrolyzer technology, rising investments in renewable energy infrastructure for energy security as well as increased collaborations between local and international companies for deploying large-scale green hydrogen projects is bolstering the region's market growth. Regional players, like Australia, Japan and South Korea are highly focused on adoption of green hydrogen.

- For instance, in May 2025, India's Ministry of New and Renewable Energy launched the Green Hydrogen Certification Scheme (GHCI) for certifying green hydrogen production through a transparent and credible framework. The scheme focuses on encouraging domestic production and export of green hydrogen to meet India's climate and sustainability goals.

- In July 2024, China unveiled a trading platform for net-zero hydrogen and its derivatives. This step drives China to the latest in the global hydrogen industry while simultaneously addressing the shipping sector's hefty carbon footprint.

- Japan's government has exposed a plan to work with the private sector to develop a next-generation passenger aircraft. By improving the participation of multiple companies and aiding in creating technology standards, Japan hopes to avoid the pitfalls that doomed Mitsubishi Heavy Industries' SpaceJet.

Governments in North America have viewed hydrogen as a vital part of their clean energy plans due to their aggressive decarbonization goals and pledges to cut greenhouse gas (GHG) emissions. Hydrogen is a flexible way to cut emissions, especially in areas like power generation, heavy industry, and long-distance transportation that are challenging to electrify. Transportation, especially heavy-duty vehicles like trucks, buses, and trains, uses more hydrogen fuel cells. For example, California has taken the lead in establishing hydrogen refueling stations and policies that support hydrogen fuel cell vehicles. Demand is further increased by the aviation and maritime industries' exploration of hydrogen as a zero-emission fuel.

- The U.S. National Clean Hydrogen Strategy and Roadmap provides advancement for clean hydrogen to contribute to national decarbonization goals across multiple fields. It provides a snapshot of the United States' hydrogen production, storage, transport, and use.

Market Overview

Green hydrogen, or hydrogen derived from renewable resources, is a clean fuel that only releases water in fuel cells. It plays a crucial role in assisting nations and businesses in achieving their decarbonization goals and cutting greenhouse gas emissions, which is essential for addressing climate change. Numerous resources, including nuclear power, renewable energy sources, and natural gas, can be used to create it domestically. This variety of production techniques improves countries' energy security, lessening reliance on imported fossil fuels.

Global investments in hydrogen projects are surging, with countries like Germany, Japan, and Australia committing billions to develop hydrogen infrastructure. For example, the European Union has announced plans to invest over €400 billion in hydrogen technologies by 2030.

Many governments are implementing hydrogen strategies. The U.S. Department of Energy launched the Hydrogen Shot initiative, targeting a significant reduction in the cost of clean hydrogen production. Countries like Japan are enhancing their hydrogen roadmaps, focusing on domestic production and international partnerships.

Hydrogen Market Growth Factors

- The need for hydrogen, a clean and adaptable fuel, is driven by the global transition to renewable energy sources and the mounting push to lower carbon emissions.

- Electric vehicles that use hydrogen fuel cells are a viable substitute for battery-powered vehicles, particularly heavy-duty and long-distance driving.

- Many industrial processes, like the manufacturing of ammonia, steel, and refinement, need hydrogen. Hydrogen will become increasingly in demand as industry works to reduce carbon footprints.

- To encourage the development and uptake of hydrogen technology, governments everywhere are putting laws into place and offering incentives. Tax credits, infrastructure, and R&D expenditures are all included in this.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 556.56 Billion |

| Market Size in 2024 | USD 262.13 Billion |

| Market Size in 2025 | USD 282.63 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sector, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Focus on Decarbonization from Industries

Many industries, especially those reliant on fossil fuels, face pressure to reduce their carbon footprint. Hydrogen, particularly green hydrogen produced from renewable energy sources, is viewed as a viable solution for decarbonizing various sectors, including transportation, manufacturing, and energy. The transportation sector is also a major contributor to greenhouse gas emissions. Hydrogen fuel cell vehicles (FCVs) offer a clean alternative, emitting only water vapor. Companies like Toyota and Hyundai have developed hydrogen FCVs, and infrastructure projects are underway to expand hydrogen refueling stations, facilitating broader adoption.

Restraints

Lack of infrastructure

Green hydrogen production depends on electrolysis, necessitating large capital expenditures in production facilities. Because there are now so few electrolysis facilities, green hydrogen is more expensive than hydrogen from fossil sources. A vast network of hydrogen filling stations is necessary to use hydrogen in transportation, including fuel-cell vehicles (FCVs). The widespread use of hydrogen-powered cars is now hampered by the scarcity of these stations, particularly when contrasted with the extensive networks of charging stations for gasoline or electric vehicles.

Storage and transportation challenges

The volumetric energy density of hydrogen is lower than that of traditional fuels. This creates problems for compact storage since a lot of hydrogen is needed to store the same quantity of energy. Another approach is to transport compressed hydrogen in tubes or cylinders; however, this method is less effective for considerable amounts because the cylinders need to be heavy and take up space. There are additional difficulties in handling and delivering these high-pressure containers logistically.

Opportunity

Adoption hydrogen technologies

Technological improvements in electrolysis, such as alkaline electrolysis and proton exchange membrane (PEM), have made hydrogen more economically feasible by drastically lowering the cost of creating green hydrogen. With longer ranges and faster refueling than battery electric vehicles (BEVs), hydrogen is becoming a competitive fuel for heavy-duty vehicles (buses, lorries, trains) and maritime applications. Subsidies, grants, and tax breaks for research and development are just a few of the policies and incentives numerous governments are implementing to support hydrogen technologies.

Value Chain Stage Insights

The hydrogen production segment dominated the market with 45.20% market share in 2024. The dominance of the segment can be attributed to the innovations in hydrogen production technologies and the increasing role of hydrogen in decarbonization efforts. Also, Hydrogen is considered a promising solution for energy storage, especially for maintaining the intermittency of renewable energy sources.

The hydrogen refuelling infrastructure segment is expected to grow at the highest CAGR of 12.80% in 2024. The dominance of the segment can be credited to the increasing demand for zero-emission vehicles along with the ongoing development of cost-effective hydrogen production and storage technologies. Moreover, incentive programs such as tax credits and tax breaks are being provided to optimise the purchase and use of FCEVs, impacting positive segment growth.

Technology Insights

The production technologies segment dominated the market with a 63.50% market share in 2024. The dominance of the segment can be credited to the advancements in electrolysis and renewable energy technologies, and the rising need for cleaner energy sources. Ongoing investments in hydrogen infrastructure, such as transportation and storage facilities, are important for facilitating the widespread use of hydrogen.

The fuel cell technologies segment is expected to grow at the highest CAGR of 13.60% over the forecast period. The growth of the segment can be linked to the growth in stationary power applications and the growing utilisation of fuel cell electric vehicles (FCEVs). Furthermore, governments across the globe are implementing policies to support hydrogen infrastructure and fuel cell adoption, such as subsidies, incentives, and investments in research and development.

End-Use Industry Insights

The industrial manufacturing segment held a 52.70% market share in 2024. The dominance of the segment is owed to the rising demand for cleaner fuels, coupled with innovations in hydrogen production technologies. Moreover, Hydrogen plays an essential role in various industrial processes, such as methanol synthesis, ammonia production, and metal refining.

The transportation segment is expected to grow at the highest CAGR of 14.30% in 2024. The dominance of the segment is due to the growing demand to minimize carbon emissions and ongoing developments in hydrogen fuel cell technology. The transportation sector, especially public transport and heavy-duty vehicles, is rapidly exploring hydrogen fuel cell technology as a clean energy substitute.

Hydrogen Market Companies

- Linde plc

- Chevron Corporation

- Saudi Arabian Oil Co.,

- Worthington Industries

- INOX India Limited

- Hexagon Purus

- NPROXX

- Cryolor

- Pragma Industries

- BayoTech

- Luxfer Gas Cylinders

- Chart Industries

- Weldship Corporation

Recent Developments

- In May 2025, China began production at its first green hydrogen project at Daye Green Power's $476m facility in Hubei province, which uses electrolysers supplied by Sungrow Hydrogen. The project initiated in the 27MW facility in the city of Daye is the first in China which stores hydrogen in an underground cavern and employs both 5MW alkaline electrolysers and a 2MW PEM machine.

- In May 2025, MT Group in collaboration with Vilnius City Municipality and Vilnius Heat Networks, the largest supplier of centralized heat in Lithunia has signed an engineering, procurement and construction (EPC) contract for building a 3MW green hydrogen plant in Vilnius, Lithuania. The project is scheduled to start up in the first half of 2026 is anticipated to produce up to 3.45 million metres of green hydrogen annually for replacing diesel-fuelled public transport buses in the city.

- In May 2025, UAE's clean energy company, Masdar signed a non-binding Letter of Intent (LOI) with OMV, Austria's integrated energy firm for jointly exploring the development of green hydrogen, synthetic sustainable aviation fuel (eSAF) and other eco-friendly projects.

- In September 2023, Honda unveiled its first V engine, the new Honda Marine BF350, at the Genoa Boat Show.

- In October 2023, Atlas Copco acquired William G Frank Medical Gas Testing and Consulting. The business contributes to New England customers' medical and laboratory gas services, including inspections, consulting, equipment sales, parts supply, and training.

- The Bosch Group increased its sales and earnings in 2023 and is successfully implementing its growth strategy despite a challenging environment.

- In January 2023, ECL disclosed hydrogen-powered data center modules.

Segments Covered in the Report

By Value Chain Stage

- Hydrogen Production

- Green Hydrogen

- Alkaline Electrolysis

- PEM Electrolysis

- Solid Oxide Electrolysis

- Blue Hydrogen (SMR + Carbon Capture)

- Grey Hydrogen (SMR without CCS)

- Turquoise Hydrogen (Methane Pyrolysis)

- Biomass Gasification

- Photoelectrochemical and Biological Methods (emerging)

- Green Hydrogen

- Hydrogen Storage

- Physical Storage

- Compressed Hydrogen (Type I–IV cylinders)

- Liquid Hydrogen (Cryogenic storage)

- Material-based Storage

- Metal Hydrides

- Chemical Hydrides

- Carbon-based storage

- Geological Storage

- Salt Caverns

- Depleted Oil & Gas Fields

- Aquifers (under evaluation)

- Physical Storage

-  Hydrogen Transportation & Distribution

- Pipeline

- Dedicated Hydrogen Pipelines

- Natural Gas Blending Pipelines

- Road Transport

- Tube Trailers (high-pressure gas transport)

- Cryogenic Liquid Hydrogen Trucks

- Rail Transport

- Maritime Transport

- LOHC (Liquid Organic Hydrogen Carrier)

- Ammonia as Carrier

- Liquid Hydrogen Shipping

- Pipeline

- Hydrogen Refueling Infrastructure

- Refueling Station Types

- Permanent (Fixed) Stations

- Mobile/Temporary Stations

- Refueling Station Types

- By Capacity

- <500 kg/day

- 500–1,000 kg/day

- 1,000 kg/day

- Components

- Dispensers

- Compressors

- Storage Vessels

- Cooling Units

- Safety & Control Systems

- Hydrogen Applications

- Mobility

- Passenger Cars

- Buses

- Trucks (HDV)

- Rail (Hydrogen Trains)

- Ships & Ferries

- Aircraft (short-range, prototype)

- Industrial

- Steel Production (DRI process)

- Ammonia & Fertilizer Production

- Refining & Petrochemical Processes

- Electronics Manufacturing

- Power & Utilities

- Stationary Fuel Cells

- Peaking Power Plants

- Grid-Scale Hydrogen Storage (Power-to-Gas)

- Residential & Commercial

- Hydrogen for Heating

- CHP Systems (Combined Heat and Power)

- Mobility

By Technology:

- Production Technologies

- PEM Electrolyzers

- Alkaline Electrolyzers

- Solid Oxide Electrolyzers

- SMR with/without CCS

- Autothermal Reforming (ATR)

- Pyrolysis (Methane)

- Biomass Gasification

- Fuel Cell Technologies

- Proton Exchange Membrane (PEMFC)

- Solid Oxide Fuel Cells (SOFC)

- Alkaline Fuel Cells (AFC)

- Direct Methanol Fuel Cells (DMFC)

By End-Use Industry:

- Transportation

- Automotive

- Rail

- Aviation

- Maritime

- Industrial Manufacturing

- Chemicals

- Steel

- Glass

- Electronics

- Utilities & Energy Storage

- Peak Shaving

- Seasonal Storage

- Grid Balancing

- Residential & Commercial

- Heating Systems

- Microgrids

- Building Energy Supply

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting