What is the Hydrogen Generation Market Size?

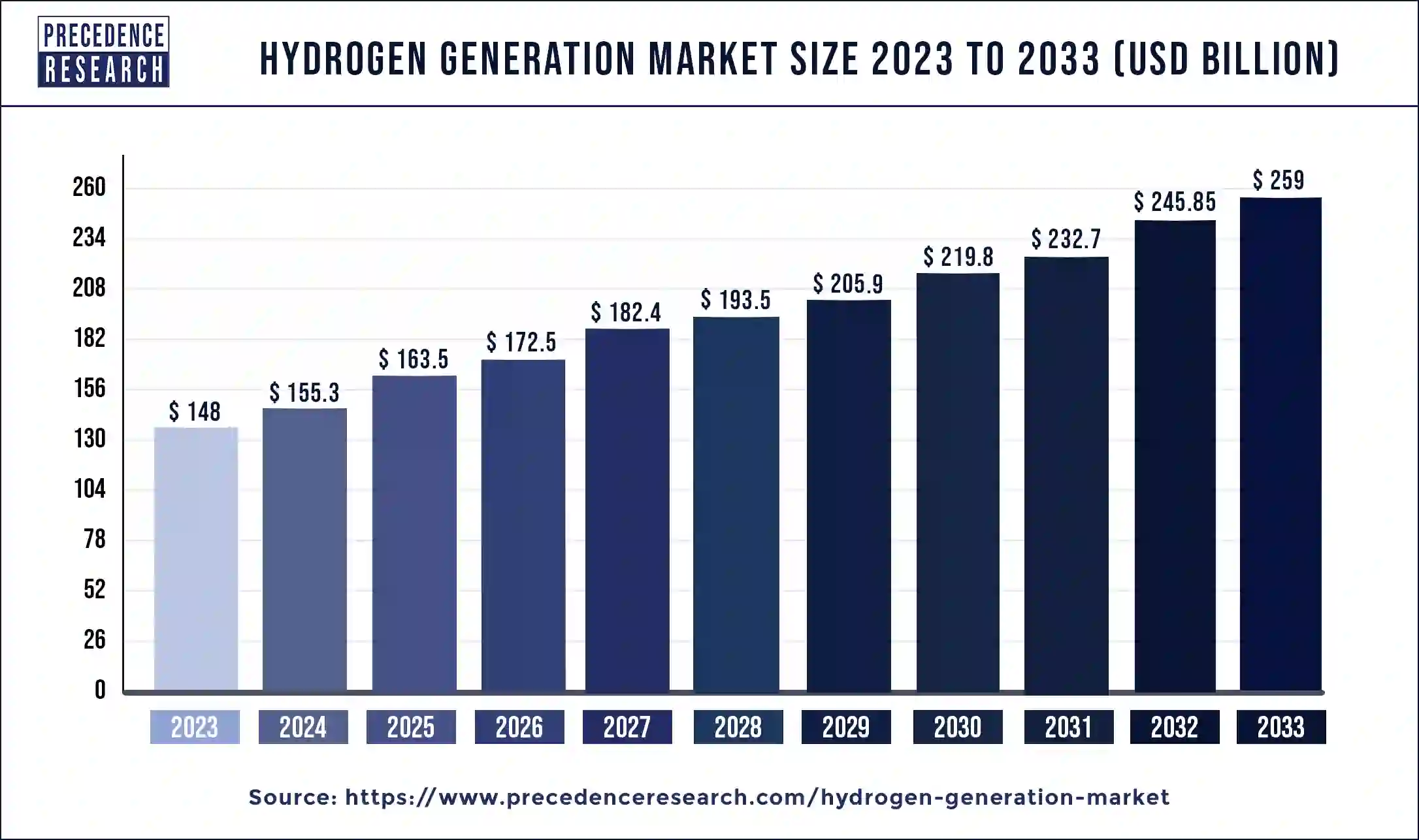

The global hydrogen generation market size is calculated at USD 163.5 billion in 2025 and is predicted to increase from USD 172.5 billion in 2026 to approximately USD xx billion by 2034, poised to grow at a noteworthy compound annual growth rate(CAGR) of 5.75% from 2024 to 2033.

Hydrogen generation has captured significant share in the green energy technology these days. Most of the nations have diverted their focus towards green hydrogen generation owing to their abundant presence in the earth's crust. However, majority of hydrogen produced today is from hydrocarbons i.e., natural gas and coal that are the main sources of carbon dioxide emission. As per an analysis conducted by Wood Mackenzie, China accounted for the highest global CO2 emissions that for 10,877 million tons of CO2 per year. This was followed by U.S. and India respectively in the highest CO2 emission rate per year.

Hydrogen Generation Market Key Takeaways

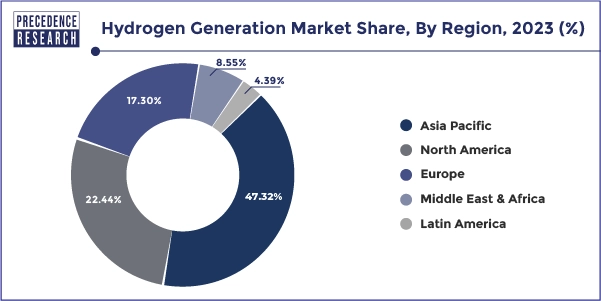

- North America hydrogen generation market size will reach USD 55.15 billion by 2033 and it is expanding at a CAGR of 5.20% from 2024 to 2033.

- Europe hydrogen generation market size is expected to hit around USD 42.2 billion by 2033 and it is growing at a CAGR of 5.12% from 2024 to 2033.

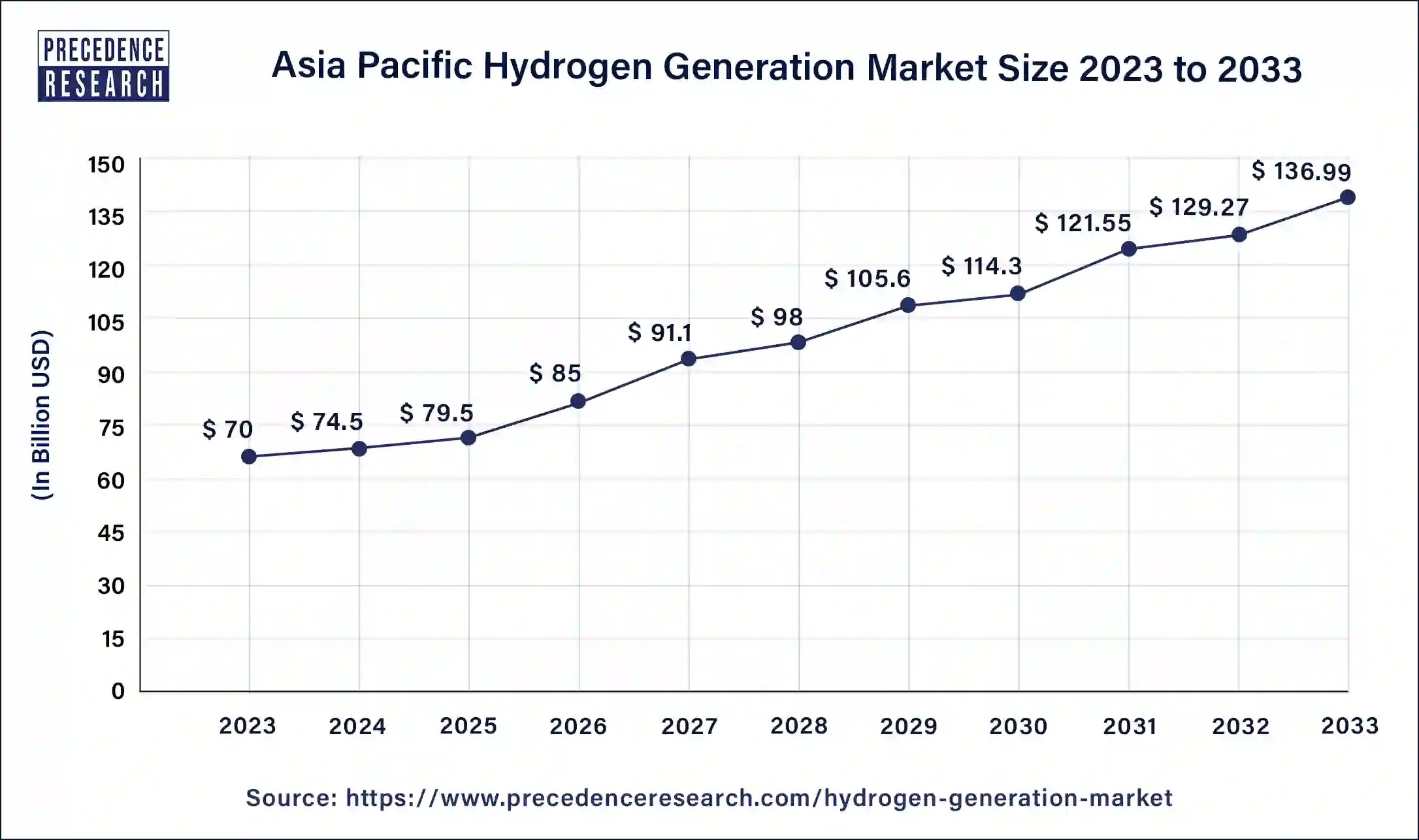

- Asia Pacific hydrogen generation market size is expected to surpass around USD 136.99 billion by 2033 and it is expanding at a CAGR of 6.94% from 2024 to 2033.

- Latin America hydrogen generation market size is predicted to hold USD 8.1 billion by 2033 and expanding at a CAGR of 2.22% from 2024 to 2033.

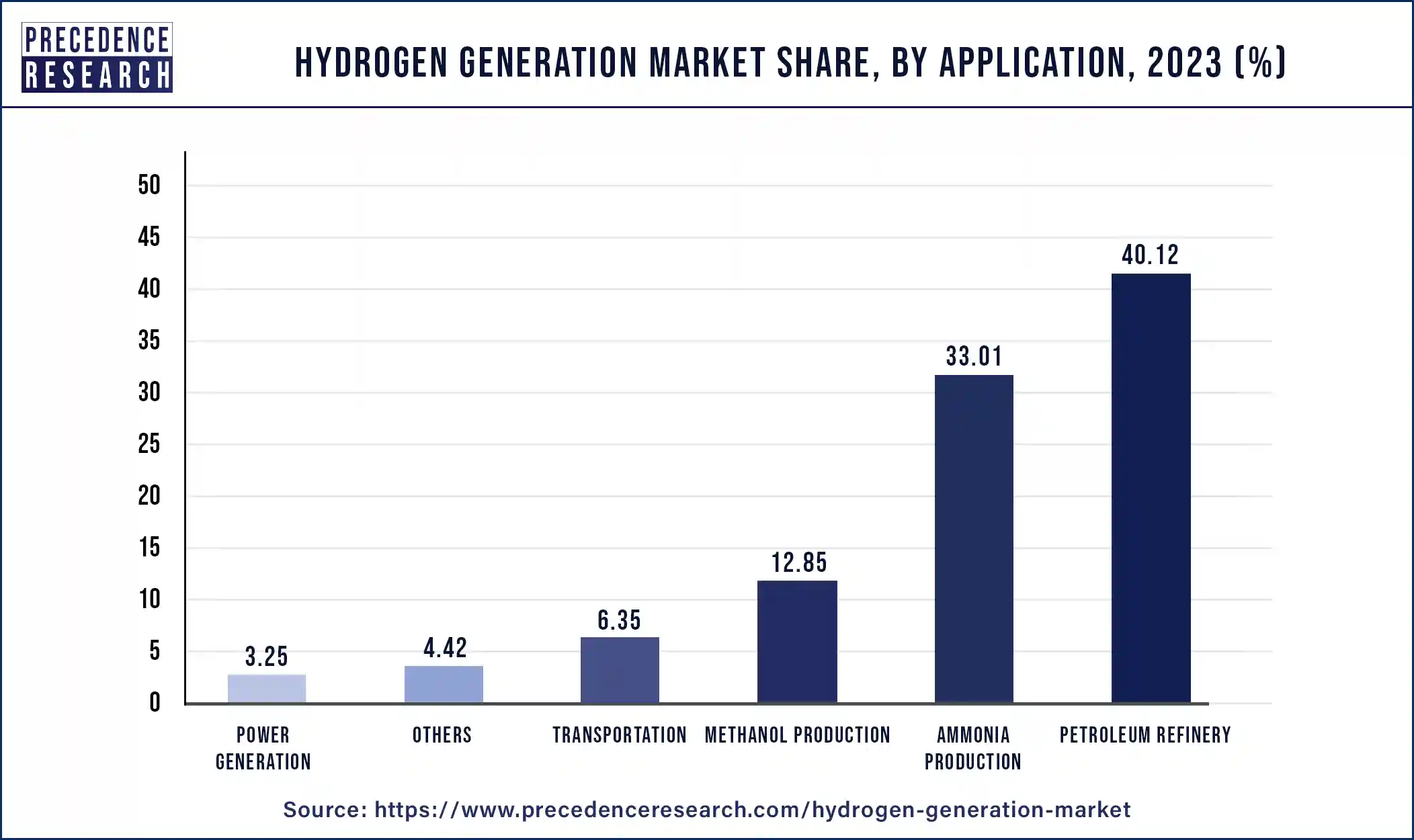

- By Application, the petroleum refinery segment has generated highest revenue share of around 40.12% in 2023.

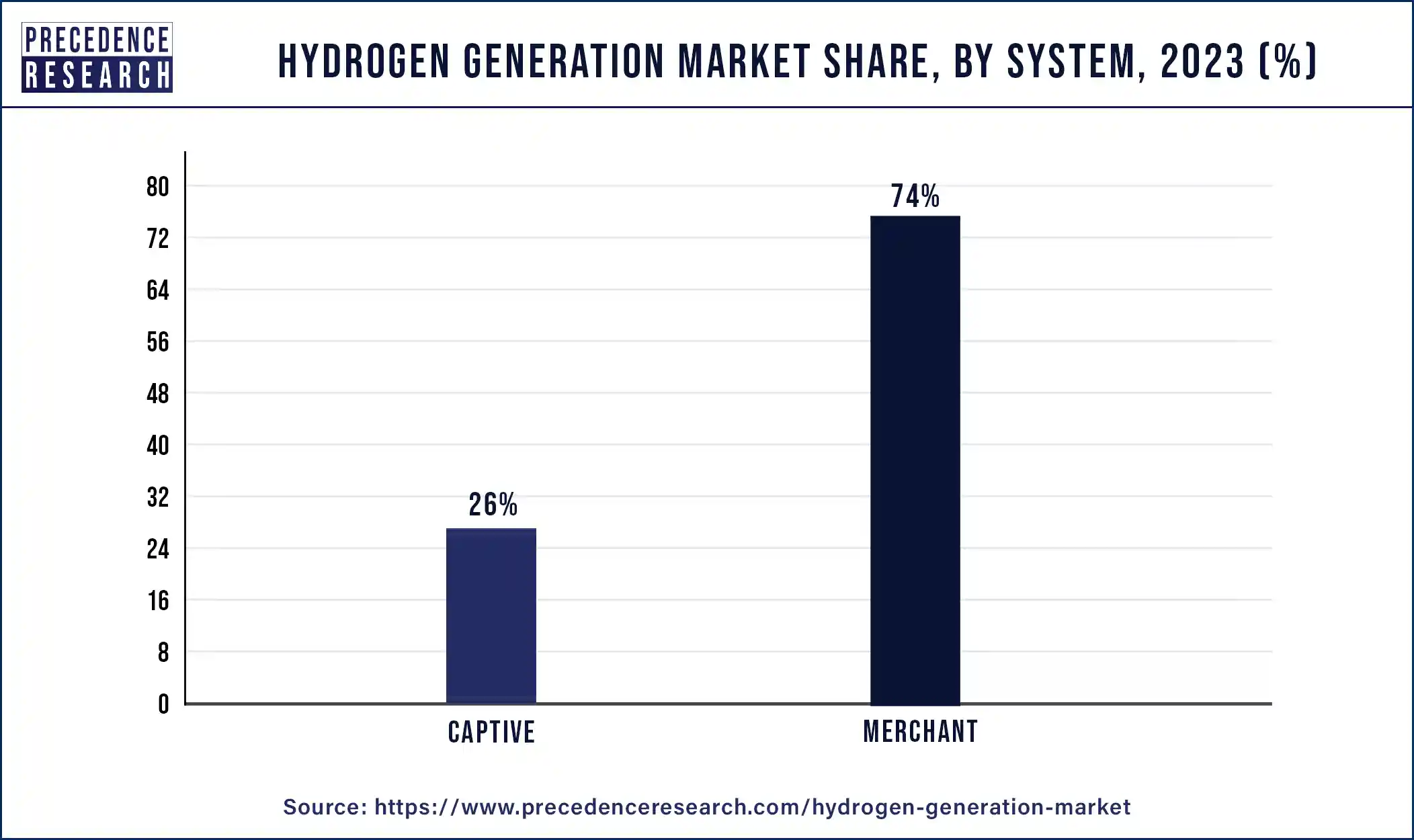

- By System, the merchant segment has accounted 74.02% revenue share in the year 2023.

- By Technology, the steam methane reforming segment has captured largest revenue share of 70.37% in 2023.

How AI is Revolutionizing Hydrogen Production for a Sustainable Future?

AI is significantly impacting the hydrogen generation market by enhancing efficiency and accelerating innovation in both electrolysis and steam methane reforming (SMR) processes. By leveraging machine learning and predictive analytics, AI is optimizing operational parameters, reducing energy consumption, and improving the overall efficiency of hydrogen production systems. In electrolysis, AI algorithms help better control variables such as temperature and pressure, leading to increased hydrogen output and lower operational costs. Furthermore, AI is aiding the development of smart grids for hydrogen distribution, thereby improving integration with renewable energy sources. As AI-driven technologies advance, they are expected to play a crucial role in scaling up green hydrogen production, making it more commercially viable and contributing to the global shift towards sustainable energy solutions.

Market Outlook

- Industry Growth Overview: The hydrogen generation industry is expected to experience significant growth between 2025 and 2035 due to global decarbonization goals and national hydrogen policies. The International Energy Agency (IEA) estimates that by 2030, low-emission hydrogen production is expected to reach 38 million tons, compared to less than 2 million tons currently. The expansion will mainly focus on green hydrogen projects utilizing renewable-powered electrolysis, particularly in Europe, the Middle East, Australia, and East Asia.

- Sustainability Trends: Sustainability is central to transforming hydrogen production from grey to green. Strict emission regulations and the growing integration of renewable energy are accelerating the shift towards zero-carbon production. According to the Hydrogen Council, the number of green hydrogen projects and renewable energy sourcing initiatives worldwide has increased by 30% in just one year.

- Global Expansion: The hydrogen ecosystem is being reshaped by global expansion efforts from companies and governments aiming to lead in hydrogen production hubs and export corridors. European firms like Air Liquide and Linde plc are constructing large-scale electrolysis and liquefaction plants in Germany, France, the Netherlands, Japan, and South Korea. They are also investing in import terminals and ports compatible with hydrogen to secure long-term supply chains.

- Major investors: Investment in hydrogen production is rapidly growing, supported by private equity funds and sovereign climate-focused vehicles. Large-scale manufacturing and storage of electrolysis are being financed by BlackRock, Brookfield Renewable, and Carlyle. Oil and gas giants like Shell, BP, and Equinor are adding hydrogen to their portfolios as a replacement for fossil fuels, using carbon credits and government incentives.

- Startup Ecosystem: The hydrogen startup ecosystem is rapidly evolving, focusing on innovations in electrolysers, hydrogen storage materials, and fuel cell integration. H2Pro (Israel), Sunfire (Germany), Enapter (Italy), and Ohmium (India) are among the first to develop new, cost-effective electrolyser designs. Universal Hydrogen and ZeroAvia are advancing aviation applications and making hydrogen a key driver of zero-emission mobility.

Hydrogen Generation Market Growth Factors

The rising global warming issues coupled with deteriorating climatic and environmental conditions due to the excess pollution have necessitated the development and adoption of clean and green energy. Therefore, the hydrogen is a source of clan and green energy and is expected to grow at a significant rate during the forecast period. Rising government initiatives to reduce carbon footprint is encouraging the production and consumption of hydrogen thereby boosting the hydrogen generation market across the globe. The demand for hydrogen has witnessed three-fold growth since 1975. The rising demand for the green energy across various industries is boosting the growth of the hydrogen generation market globally. At present natural gas is the main source of hydrogen generation followed by coal. Around 6% of the natural gas and 2% of the coal is used in the generation of hydrogen. Hydrogen is commonly used as an alternative to electric energy. The hydrogen fuel is extensively used in fuel cell devices. This is a major factor that propels the growth of the global hydrogen generation market.

Various developmental strategies such as partnerships and agreements are being adopted by the market players to manufacture hydrogen energy, using zero-emission technology. For instance, Brookfield Renewable Partners and Plug Power, Inc. entered into a partnership agreement to develop a hydrogen plant in the US. This plant aims at producing around 15 metric tons of liquid hydrogen daily using 100% renewable resources to reduce carbon footprint. These type of developmental strategies is expected to offer new growth avenues in the upcoming future and boost the growth of the global hydrogen generation market. Moreover, the government policies favoring the hydrogen generation has a crucial role to play in the development of the market. The government in developed and developing economies are coming forward with various policies that supports the reduction of carbon emission and encourages the adoption of clean energy. For instance, the US and India decided to include low carbon technology in their strategic energy collaboration.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 155.3 Billion |

| Market Size in 2026 | USD 155.3 Billion |

| Market Size by 2034 | USD 259 Billion |

| Growth Rate | CAGR of 5.75% from 2025 to 2034 |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, System Type, Application, Region |

Asia PacificHydrogen Generation Market Size from 2025 to 2034

The Asia Pacific hydrogen generation market size is accounted at USD xx billion in 2025 and predicted to increase from USD xx billion in 2026 to approximately USD xx billion by 2034, and expanding at a CAGR of 6.94% from 2024 to 2033.

Asia Pacific is the top consumer of the hydrogen power. The rapid growth of various industries in the various economies such as South Korea, China, Japan, and India showed a robust economic development that fostered the growth of the hydrogen generation market in this region. The attractive growth of the region is mainly attributed to the increasing demand for fuel cell powered electric vehicles in the region. Other than this, power generation through renewable energies is also booming in the region. China is the front-runner in the Asia Pacific region accounting for majority of revenue share in the year 2023. Major research activities and developments in the region targeting to reduce the cost of green hydrogen generation is the major factor behind the exponential growth of the region.

Asia Pacific is also estimated to be the fastest growing market owing to the rising demand for hydrogen for power generation in countries like China and India. Moreover, rising government initiatives in the nations like India, Japan, and Australia to promote clean and green energy is boosting the market growth.

China Hydrogen Generation Market Analysis

China has dominated the Asia-Pacific hydrogen generation market with its coal gasification-based grey hydrogen production. However, as the world's largest manufacturer of electrolyzers, China is poised to shift toward green hydrogen, in alignment with its 14th Five-Year Plan for Renewable Hydrogen. This transition is expected to drive large-scale industrial decarbonization and create significant export opportunities over the next decade. The expansion of electrolyzer manufacturing capacity, along with state incentives, is expected to play a critical role in fueling China's leadership in green hydrogen production and further strengthening its position in the global hydrogen market.

What Makes North America the Fastest-Growing Area in the Market?

North America is expected to expand at the fastest CAGR in the coming period. In recent years, hydrogen production in the region was primarily driven by steam methane reforming (SMR) and blue hydrogen (SMR + CCUS), using abundant natural gas feedstock and early-stage industrial demand in refining and chemicals. This legacy supply chain structure has historically met the majority of hydrogen demand in the United States. However, federal policy incentives and the DOE Hydrogen Hubs selection are creating commercial signals that favor electrolysis. As a result, green hydrogen is expected to increase its market share in the near future.

U.S. Hydrogen Generation Market Analysis

Hydrogen production in the U.S. has primarily been dominated by grey hydrogen through steam methane reforming (SMR), driven by abundant natural gas and a well-established refining infrastructure along the Gulf Coast. This segment has seen high industrial demand, particularly in refining, ammonia, and methanol production, which together accounted for the majority of U.S. hydrogen consumption. Moving forward, the U.S. market is expected to serve as a model for cost reduction through policy-driven scale-up and renewable hydrogen co-location solutions, paving the way for a more sustainable hydrogen economy.

Why is Europe Considered a Significantly Growing Area?

Europe is expected to grow at a significant rate in the coming years, supported by established incumbents and robust pipeline gas systems. Large-scale electrolysis-based renewable (green) hydrogen is set to become the dominant sub-segment by the 2030s, as green supply certification, cross-border import routes, and auction systems continue to evolve. Moreover, rapid policy actions under REPowerEU and the European Hydrogen Backbone vision are accelerating market growth and boosting the adoption of green hydrogen across the region.

Germany Hydrogen Generation Market Analysis

Germany has been a leader in hydrogen demand in Europe, primarily utilizing grey and blue hydrogen for refining, steel production, and ammonia manufacturing. The country's well-established industrial foundation and gas infrastructure have facilitated hydrogen consumption, though they have also hindered the transition to low-carbon hydrogen production. Looking ahead, Germany is set to shift towards green hydrogen through renewable-powered electrolysis as part of its National Hydrogen Strategy and the REPowerEU plan. By 2030, Germany aims to achieve 10 GW of electrolyzer capacity, marking a significant step toward decarbonizing its hydrogen sector.

Source: https://www.spglobal.com

How is the Opportunistic Rise of Latin America in the Hydrogen Generation Market?

Latin America is experiencing an opportunistic rise in the hydrogen generation market, driven by its vast renewable energy potential, particularly in solar and wind power. Small-scale, project-level experimentation with electrolyzers and industrial by-product hydrogen in the region has been modest compared to other areas. However, it is anticipated that developers will deploy GW-scale electrolyzers next to utility-scale PV and wind farms in order to leverage low renewable Levelized Cost of Electricity (LCOE), aiming to achieve sub-USD 2/kg hydrogen production costs in favorable locations.

Chile Hydrogen Generation Market Analysis

Chile has a historical background of small-scale hydrogen production and refining, with limited infrastructure. However, projects like Haru Oni in Punta Arenas, in partnership with Siemens Energy and Enel Green Power, are poised to enable large-scale production of green hydrogen and e-fuels. These initiatives are expected to transform Chile into a hydrogen superpower, positioning it as a key supplier to both Europe and Asia.

What Factors Support the Growth of the Middle East & Africa Hydrogen Generation Market?

The green hydrogen megaprojects announced in Saudi Arabia, the UAE, and Oman are expected to reshape the regional market. There is a rapid shift toward green ammonia production enabled by abundant solar energy and significant sovereign funding. Public-private partnerships and bundled EPC contracts are likely to accelerate construction timelines, with governments underwriting first-of-take risk or capital structures. Policy clarity on export certification and maritime logistics will be pivotal for securing an early-mover advantage.

Recently, production in the region was primarily focused on localized industrial hydrogen and small reformers, with capacity constrained by limited electrolyzer manufacturing and project financing. However, the development of export projects is expected to drive local industrial uptake, creating domestic anchor demand that will enhance project bankability and enable greater regional value capture.

Saudi Arabia Hydrogen Generation Market Analysis

Saudi Arabia's history in hydrogen generation has largely relied on grey hydrogen to support its extensive refining and petrochemical sectors. The country is now transitioning toward green hydrogen and ammonia production, with the NEOM Green Hydrogen Project positioned as one of the world's largest. Through Vision 2030 and its Hydrogen Strategy, Saudi Arabia aims to capture over 10% of the global hydrogen trade by the mid-2030s.

South Africa Hydrogen Generation Market Analysis

South Africa's hydrogen industry has historically relied on grey hydrogen and by-products from synthetic fuel production (e.g., Sasol). However, the future growth of the sector is expected to be driven by green hydrogen, supported by the Hydrogen Society Roadmap (HSRM) and partnerships with the European Union and Japan. The strategic availability of ports and renewable energy-rich regions like the Northern Cape will enhance South Africa's competitiveness in both local and export markets.

Market Drivers

Increasing focus towards clean hydrogen generation

Clean hydrogen production is a nascent market and offer enormous opportunities for development and growth. Increasing carbon footprint in the atmosphere significantly drives the clean hydrogen production in the recent as well as coming years.

Hydrogen is present in limited quantity as molecules in the Earth's atmosphere, yet is present abundantly in the form of atoms within different molecules (e.g., water, biomasses, and methane). Electrolysis, solar PV, and offshore wind energy are some of the renewable and green technologies used presently for hydrogen generation without including the cost of carbon emission. These technologies cost higher compared to hydrogen production through natural gas and coal; whereas technological development and innovations expected to commercialize these technologies for green & clean hydrogen generation by the year 2030.

As per analysis and forecast, breakthrough in technologies can upend the clean hydrogen generation technologies; although the relative costs are largely uncertain. Fuel switching towards blue and turquoise hydrogen production using sustainable biomethane possibly absorb the GHG emission from atmosphere and will be frequently used in transport sector as an alternate renewable fuel source. As a result, clean hydrogen production technology likely to propel the market growth for hydrogen generation in the upcoming years.

Government regulations for desulfurization and greenhouse gas emissions

Rising concern for air pollution has impelled governments of various regions to issue stringent emission regulations for passenger vehicles, light & heavy commercial vehicles, and other types of vehicles, as transportation mainly road transportation is the major contributor of air pollution in any country or region. In accordance to the same, the Environmental Protection Agency of United States, has issued revised GHG emission standards for passenger vehicles & light duty trucks that aim to significantly reduce the GHG emission along with reductions in other pollutants.

In addition, fuel gas desulphurization aids an advantage in reducing emissions and pollutants from the environment. The Clean Air Act amendments and related fuel regulations in the U.S. aim to reduce the sulfur content along with other harmful contents in the atmosphere. These all factors, anticipated to drive the market growth for hydrogen generation in the near future.

Market Restraints

High capital cost of hydrogen energy storage

Presently, hydrogen is most commonly stored as a gas or liquid in tanks for small scale mobile and stationary applications. Compression and cooling systems are required for transportation and storage of hydrogen. Storage tanks required for hydrogen storage should provide non-reactive media, low-temperature, and quick reversible adsorption/ desorption of hydrogen without the requirement of thermal energy.

On the other hand, storing hydrogen as ammonia requires thermal energy to decompose the molecules when hydrogen molecules are needed. Henceforth, large cost is associated with the hydrogen storage for the customized tanks. Apart from this, hydrogen storage is the key technological barrier to the development and widespread application of fuel cell technologies in stationary, transportation, and portable applications. This in turn, expected to further restrict the market growth in the coming years.

Market Opportunities

Development of green hydrogen production technologies

Mainly hydrogen produced today are through gasification of coal and steam reforming of natural gas that contribute approximately 95% of the total hydrogen production per year. Other methods for hydrogen generation are recently nascent and still under development process. These processes of hydrogen generation include electrolysis and carbon capture & storage (CCS) technologies. The hydrogen generated from CCS technology is known as blue hydrogen that capture and store carbon dioxide emitted during the production process. Secondly, hydrogen produced from electrolysis is known as green hydrogen as it uses renewable energy sources.

Green hydrogen and blue hydrogen are the most opportunistic and demanded technologies of hydrogen generation as they also fulfil emission standards as well as curb the rate of carbon dioxide emission in the atmosphere. Henceforth, these hydrogen technologies likely to prosper the growth of hydrogen generation market in the coming years.

Technology Insights

The steam methane reforming segment dominated the market with around 70.37% share in terms of revenue of the total market in 2023. This is attributable to the extensive use of the steam methane reforming technology in the hydrogen generation process across the globe. The rapidly growing demand for the hydrogen energy had resulted in the exponential growth of this segment across the globe. Hydrogen is a diverse product that is used across multiple industries, hence steam reforming gained popularity to meet the increasing demand of consumer across various verticals.

On the other hand, others is the fastest growing technology as it covers electrolysis of water. Presently, electrolysis of water has gained significant popularity owing to its clean and green hydrogen generation technology by emitting less or no CO2 in the atmosphere.

The coal gasification is projected to be the fastest-growing segment during the forecast period. Coal gasification is also a widely used technology just after the steam methane reforming technology. The abundant availability of coal in various nations like India has propelled the usage of coal in the hydrogen generation market in the past.

Hydrogen Generation Market Revenue (USD Billion) By Technology (2020-2023)

| Technology | 2020 | 2021 | 2022 | 2023 |

| Coal Gasification | 28.2 | 29.7 | 31.3 | 33 |

| Steam Methane Reforming | 92.1 | 95.7 | 99.6 | 104 |

| Others | 9.3 | 9.8 | 10.3 | 10.9 |

Application Insights

In 2023, the petroleum refinery segment dominated the market with around 40.12% share in terms of revenue of the total market. This is mainly due to its critical role in hydrocracking, desulfurization, and other refining processes that require large quantities of hydrogen. Hydrogen is essential in producing cleaner fuels and meeting environmental regulations for sulfur content in petroleum products. With the growing demand for refined products globally, refineries continue to be the largest consumers of hydrogen, driving significant market share. As a result, the established infrastructure and high hydrogen demand in the refining sector have been key factors in its dominance in the hydrogen generation market.

Ammonia application for hydrogen generation market accounted for nearly 33.01% in the year 2023. Out of total industrial application for hydrogen only 0.3 million tons of hydrogen demand was met with low-carbon hydrogen that was nearly 20% more than the year 2019. Among these renewable hydrogen generation, most of the demand was met through large-scale CCUS plants and small electrolysis units in the chemical subsector.

The future analysis for clean hydrogen demand for the ammonia production expected to rise exponentially owing to current pipeline projects in the sector that suggested to meet the 18% of overall hydrogen demand in the sector by the year 2030. Further, actions aim to meet projected Net Zero Emissions by 2050 Scenario for the ammonia production industry sector hydrogen demand.

On the other hand, power generation is projected to grow at the highest CAGR during forecast period from 2024 to 2033. This is attributed to the growing government initiatives regarding reducing the use of Sulphur fuels for the betterment of the environment. The others segment includes chemical industry, iron & steel industry, oil refining industry, and others. The others segment is expected to be the fastest-growing segment owing to the growing production and consumption of hydrogen in the chemical industry. In the chemical industry, hydrogen is obtained as a by-product and is consumed on the site and also supplied to other industries. Hence, the chemical industry is expected to witness a significant growth rate during the forecast period.

Hydrogen Generation Market Revenue (USD Billion) By Application (2020-2023)

| Application | 2020 | 2021 | 2022 | 2023 |

| Methanol Production | 16.4 | 17.2 | 18.1 | 19 |

| AmmoniaProduction | 42.6 | 44.5 | 46.6 | 48.8 |

| Ptrolium Refinary | 53 | 54.9 | 57 | 59.3 |

| Transportation | 7.8 | 8.3 | 9.4 | 10.1 |

| Power Generation | 4 | 4.3 | 4.5 | 4.8 |

| Others | 5.8 | 6 | 6.3 | 6.5 |

System Type Insights

The merchant hydrogen segment dominated the hydrogen generation market in 2023 due to its ability to supply hydrogen on demand to a wide range of industries without the need for significant capital investment in production facilities. This flexibility made it particularly attractive to smaller users and industries that don't require large, on-site hydrogen production. Additionally, the increasing industrial demand for hydrogen in sectors such as petrochemicals, refining, and steel production drove the growth of merchant hydrogen suppliers that could quickly meet these needs through established distribution networks. As industries increasingly sought cost-effective, scalable solutions, the merchant segment emerged as a preferred option, further solidifying its market dominance.

The captive segment is expected to grow rapidly over the forecast period due to increasing demand for self-sufficiency in hydrogen supply among large-scale industrial users, particularly in sectors such as refining, chemicals, and steel production. Captive hydrogen production allows companies to control their own supply chains, reduce dependency on external vendors, and ensure a consistent, reliable supply of hydrogen for critical processes. Additionally, as industries seek to optimize operational costs and meet increasingly stringent sustainability targets, the captive model offers a more cost-effective solution, especially when integrated with renewable energy sources such as wind or solar. This growing trend towards energy independence and cost control is driving the expansion of the captive hydrogen segment.

Hydrogen Generation Market Revenue (USD Billion) By System (2020-2023)

| Syatem | 2020 | 2021 | 2022 | 2023 |

| Merchant | 96.1 | 100.1 | 104.5 | 109.4 |

| Captive | 33.5 | 35 | 36.7 | 38.6 |

Key Companies & Market Share Insights

The global market for hydrogen generation is highly fragmented owing to the presence of large number of market players both on regional as well as global level. Analyzing future scope and application of hydrogen energy as a renewable energy along with the introduction to green hydrogen generation has diversified the scope and opportunities int eh global hydrogen generation market. Several players are investing prominently in the strengthening their foothold on the global scale by adopting numerous inorganic growth strategies such as merger & acquisition, strategic alliance, collaboration, joint venture, regional expansion, and product development.

In addition, large number of players believe in collaborating with electric vehicle manufacturers or with power distribution companies to secure their future growth prospects after analyzing the significant growth of hydrogen in power generation and transportation. Hydrogen fuel cell vehicles are the emerging vehicle type that has gained prominent momentum across several developing as well as developed countries such as China, Japan, Germany, USA, UK, and many others. Hence, hydrogen generation is highly competitive and fragmented market that offers numerous future growth opportunities to the market players.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

- In March 2021, Brookfield Renewable Partners and Plug Power, Inc. entered into a partnership agreement to develop a hydrogen plant in the US. This plant aims at producing around 15 metric tons of liquid hydrogen daily using 100% renewable resources to reduce carbon footprint.

The various developmental strategies like partnerships, joint ventures, and agreements fosters market growth and offers lucrative growth opportunities to the market players.

Hydrogen Generation Market Revenue (USD Billion) Analysis by Manufacturer (2016-2020)

| Top Manufacturer | 2016 | 2018 | 2020 |

| Linde plc | 2120.7 | 2296.2 | 2502.9 |

| Air Liquide International S.A. | 2339.6 | 2513.4 | 2752.6 |

| Hydrogenics | 41.3 | 44.0 | 45.1 |

| Inox | 1037.3 | 1088.8 | 1175.1 |

| Air Products and Chemicals, Inc. | 3376.8 | 4018.5 | 3985.2 |

Hydrogen Horizons 2035: The Global Race to Build, Power, and Scale the Next Energy Revolution

- As of 2024, China leads in hydrogen production capacity with over 33 million tons annually, primarily from coal gasification, but is investing heavily in green hydrogen hubs in Inner Mongolia and Gansu

- Global hydrogen demand reached 97 million tons (Mt) in 2023, marking a steady 2.5% year-on-year increase, according to the International Energy Agency (IEA). While demand continues to rise, low-emission hydrogen (green and blue) accounted for less than 1 Mt, highlighting the immense untapped potential within the Hydrogen Generation Market.

- The IEA's 2024 Global Hydrogen Review projects that if all announced projects are realized, low-emission hydrogen capacity could reach nearly 49 Mt per annum by 2030. This exponential growth directly strengthens the Hydrogen Generation Market, driving investment in electrolyzers, storage infrastructure, and renewable energy integration.

- The European Union, under its REPowerEU plan, aims to produce 10 Mt of renewable hydrogen domestically by 2030 and import another 10 Mt, as stated by the European Commission (EC). The expansion of hydrogen hubs in Spain, Germany, and the Netherlands is not only increasing capacity but also fostering a robust intra-European Hydrogen Generation Market through interconnected pipelines and electrolyzer clusters.

- Reported ranges place grey/blue hydrogen roughly between USD 1.2–2.4/kg (depending on feedstock and capture for blue), while renewable hydrogen estimates cluster near ~USD 4–6/kg under current market conditions and typical renewable power prices. These ranges explain why early green-H2 uptake has focused on high-value, hard-to-abate uses.

- The U.S. Hydrogen Shot / DOE target aims to reduce the cost of clean hydrogen to USD 1/kg by 2030 (80% reduction from 2020 baseline), creating a clear market signal for private investment and manufacturing scale-up if achieved.

- The current LCOH ranges explain why green hydrogen penetration is highest in markets where end-product value is high or emissions are costly (refining, ammonia, methanol, some steel routes). Achieving ~USD 2/kg materially opens hydrogen for wider industrial use; ~USD 1/kg becomes a game-changer for commoditized energy and transport sectors.

- Announced new hydrogen pipeline projects could reach ~37,000–40,000 km by 2035, with the vast majority concentrated in Europe and China, but only a small share (≈2–6%) has reached FID or construction, leaving a large delivery gap between ambition and built reality.

Source

- https://medium.com/@jayant111294/ch11-scary-domination-of-chinas-green-hydrogen-industry-ec4edab3159d#:~:text=Green%20Hydrogen%20Industry!-,Jayant%20Mundhra,So%2C%20let's%20dive%20in!

- https://www.iea.org/reports/global-hydrogen-review-2024/hydrogen-demand

- https://www.iea.org/reports/global-hydrogen-review-2024/hydrogen-production#:~:text=Highlights,in%20the%20last%2012%20months.

- https://energy.ec.europa.eu/topics/eus-energy-system/hydrogen_en

- https://www.sciencedirect.com/science/article/pii/S2590174525004519

- https://www.energy.gov/eere/fuelcells/hydrogen-production-pathways#:~:text=The%20U.S.%20Department%20of%20Energy,are%20expected%20to%20become%20viable.

- https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2024/Jul/IRENA_Green_hydrogen_strategy_design_2024.pdf?utm_source=chatgpt.com

- https://www.iea.org/reports/global-hydrogen-review-2025/trade-and-infrastructure#:~:text=In%20Germany%2C%20work%20began%20on,emissions%20hydrogen%2Dbased%20fuel%20bunkering.

Top Vendors in the Hydrogen Generation Market & Their Offerings

- Linde plc: Linde is a global leader in industrial gases, providing hydrogen production, distribution, and storage solutions through technologies like SMR and electrolysis, contributing to the growth of both grey and green hydrogen industies.

- Air Liquide International S.A.: Air Liquide specializes in the production of industrial gases, including hydrogen, with a strong focus on green hydrogen generation via electrolysis, and provides infrastructure for hydrogen storage and distribution.

- Hydrogenics: Now a part of Cummins, Hydrogenics is known for its hydrogen electrolyzers and fuel cell technologies, driving the development of green hydrogen and clean energy solutions for various industries.

- Inox: Inox is a significant player in hydrogen production, storage, and distribution, offering advanced gas cylinder technologies and compression systems for safe hydrogen transport, particularly in the industrial and commercial sectors.

- Messer Group GmbH: Messer Group provides hydrogen for industrial applications like refining, chemical production, and metal processing, and is involved in the infrastructure for hydrogen transport and storage.

- Air Products and Chemicals, Inc.: Air Products is a key supplier of hydrogen production technologies, focusing on SMR and electrolysis, as well as large-scale hydrogen infrastructure projects for both industrial and green hydrogen applications.

- Weldstar, Inc.: Weldstar offers hydrogen supply solutions and equipment for welding, cutting, and metalworking, serving as a critical part of the hydrogen value chain for industrial applications.

- Praxair, Inc.: Now a part of Linde plc, Praxair provides hydrogen solutions for a range of industries, from chemical production to refining, and is also involved in the expansion of green hydrogen infrastructure.

- McPhy: McPhy is dedicated to green hydrogen production through electrolysis, offering innovative solutions for hydrogen generation and storage to help decarbonize industries and support renewable energy integration.

- LNI Swissgas: LNI Swissgas specializes in hydrogen metering and analyzing solutions, providing critical instrumentation for ensuring the quality and safety of hydrogen production and transportation systems.

Key Strategies Adopted by Players

Some of the basic growth strategies adopted by the market players include merger & acquisition, investment for technology development towards clean hydrogen generation.

- Merger & Acquisition: Merger & acquisition is the key strategy adopted by the market players in the global hydrogen generation to strengthen their foothold on the global scale. For instance, in September 2019, Cummins Inc. announced to complete the acquisition of Hydrogenics Corporation, a fuel cell and hydrogen production technology provider. The acquisition will help Cummins to increase its capability for innovation and development in the hydrogen generation sector.

- Technology Investment: Several market players in the global hydrogen generation market are focusing significantly towards the technology enhancement and development to foster the demand for green and clean hydrogen generation methods. For example, ONGC has invested significantly in the research & development of electrolytic hydrogen generation process to decrease its overall production cost. In addition, December 2021, Woodside, an oil & gas supplier, announced to invest USD 7 billion in the low carbon energy by the year 2030.

Recent Developments

- In October 2025, Ingeteam launched the INGECON H2 Megalyzer, a modular rectifier system tailored for renewable hydrogen plants. Revealed during World Hydrogen Week 2025, the Megalyzer boosts power conversion efficiency and scalability, reinforcing Ingeteam's leadership in hydrogen infrastructure solutions.

- In October 2025, ITM introduced the ALPHA 50, a 50 MW full-scope green hydrogen plant that sets new standards for modularity and cost efficiency. Fully skid-mounted and standardized, the plant integrates redundancy to ensure maximum uptime, showcasing ITM's cutting-edge electrolyzer technology.

- In May 2025, Samsung E&A, in collaboration with Nel Hydrogen, rolled out CompassH2, a next-generation green hydrogen production platform. Designed to deliver world-leading performance and cost competitiveness, the system was unveiled at the World Hydrogen Summit 2025, aiming to redefine global LCOH benchmarks.

Source:

- https://fuelcellsworks.com/2025/10/08/hydrogen-energy/ingeteam-launches-new-hydrogen-power-conversion-solution-at-world-hydrogen-week-2025

- https://itm-power.com/news/launch-of-alpha-50-a-new-global-standard-for-execution-at-scale

- https://www.samsungena.com/en/newsroom/news/view?idx=15707

Hydrogen Generation Market – Value Chain Analysis

- Raw Material Sourcing

The hydrogen production process starts with sourcing essential feedstocks such as natural gas, coal, biomass, and water. These raw materials form the foundation for grey, blue, and green hydrogen production methods. The availability, cost, and carbon footprint of these inputs significantly impact the economics of hydrogen generation.

Key Players: ExxonMobil, Shell, BP, Chevron, TotalEnergies, Air Liquide, and Linde plc. - Hydrogen Production

This stage involves converting raw materials into hydrogen using various technologies such as steam methane reforming (SMR), partial oxidation, coal gasification, electrolysis, and biomass gasification. Increasing emphasis is on green hydrogen produced through water electrolysis powered by renewable energy.

Key Players: Nel ASA, Plug Power, ITM Power, Siemens Energy, Cummins Inc., Thyssenkrupp Nucera, Bloom Energy. - Carbon Capture, Utilization & Storage (CCUS) Integration

For blue hydrogen production, CCUS systems capture and store COâ‚‚ emissions from hydrogen plants to lower the carbon footprint. This step is essential for making hydrogen production more sustainable while utilizing existing fossil-based assets.

Key Players: Aker Carbon Capture, Schlumberger, Mitsubishi Heavy Industries, Air Products, Equinor, Occidental Petroleum (Oxy). - Hydrogen Storage, Compression & Transportation

Hydrogen is stored and transported in various forms, including compressed, liquefied, or as chemical carriers like ammonia or LOHC. The infrastructure comprises pipelines, storage tanks, and refueling stations, which require specialized materials and engineering because of hydrogen's low density and high reactivity.

Key Players: Air Liquide, Linde, Chart Industries, Hexagon Purus, Kawasaki Heavy Industries, H2 Mobility, and Air Products. - End-Use Applications & Distribution

The final stage links hydrogen supply to end-use industries, such as transportation (fuel cell vehicles), power generation, industrial heating, ammonia production, and refining. Hydrogen distribution networks and partnerships between producers and consumers are quickly evolving under national hydrogen strategies.

Key Players: Toyota Motor Corporation, Hyundai Motor Company, Cummins Inc., Ballard Power Systems, Siemens Energy, ENGIE, Iberdrola.

Segments Covered in the Report

By Technology

- Coal Gasification

- Steam Methane Reforming

- Partial Oxidation (POX)

- Electrolysis

- Others

By Application

- Methanol Production

- Ammonia Production

- Petroleum Refinery

- Transportation

- Power Generation

- Others

By Type

- Blue Hydrogen

- Gray Hydrogen

- Green Hydrogen

By System Type

- Merchant

- Captive

By Source

- Natural Gas

- Coal

- Biomass

- Water

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content