What is the High Performance Fibers Market Size?

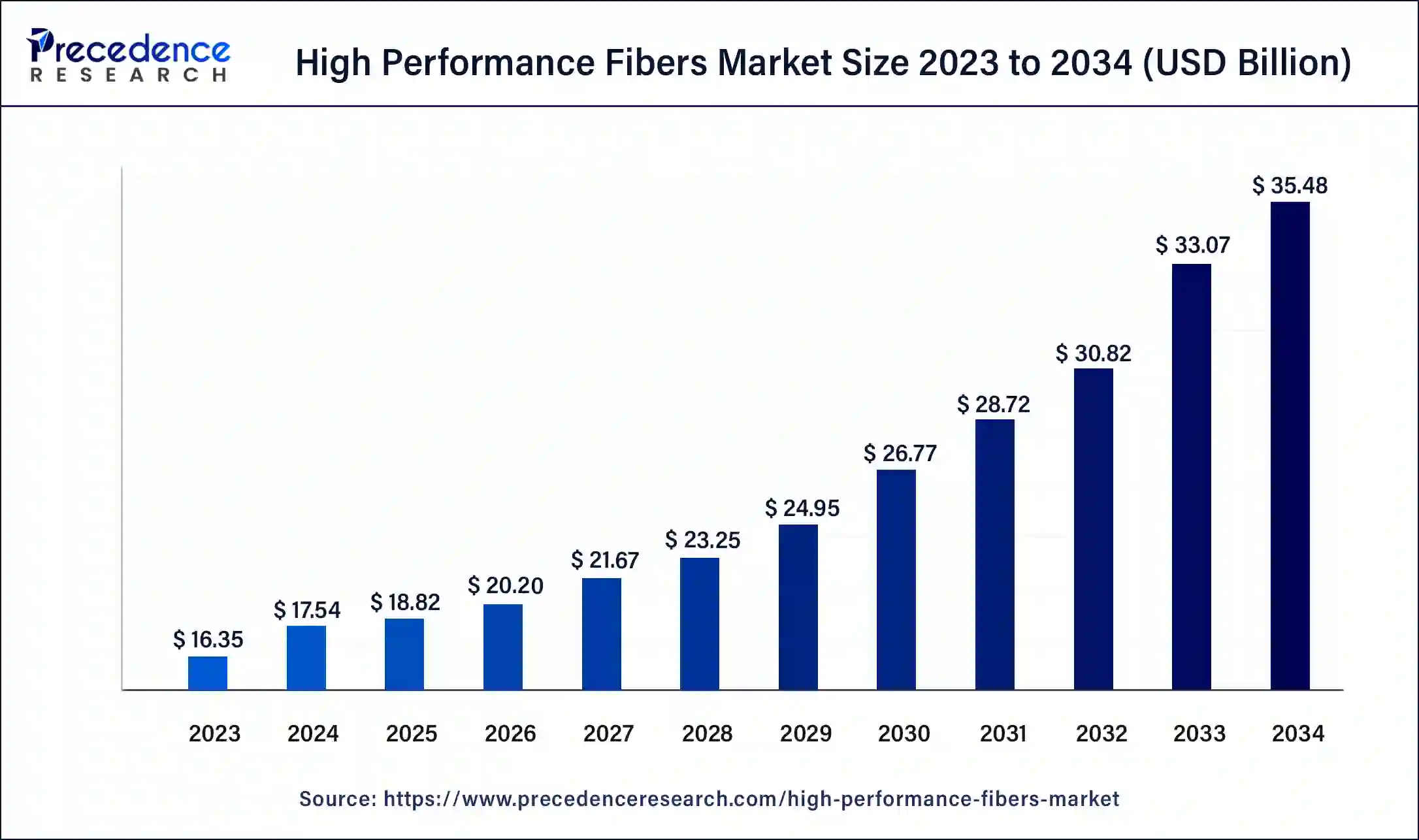

The global high performance fibers market size is valued at USD 18.82 billion in 2025 and is predicted to increase from USD 20.20 billion in 2026 to approximately USD 35.48 billion by 2034, expanding at a CAGR of 7.29% from 2024 to 2034. The high-performance fibers market is driven by the growing need across a range of applications for lightweight materials with exceptional strength.

High Performance Fibers Market Key Takeaways

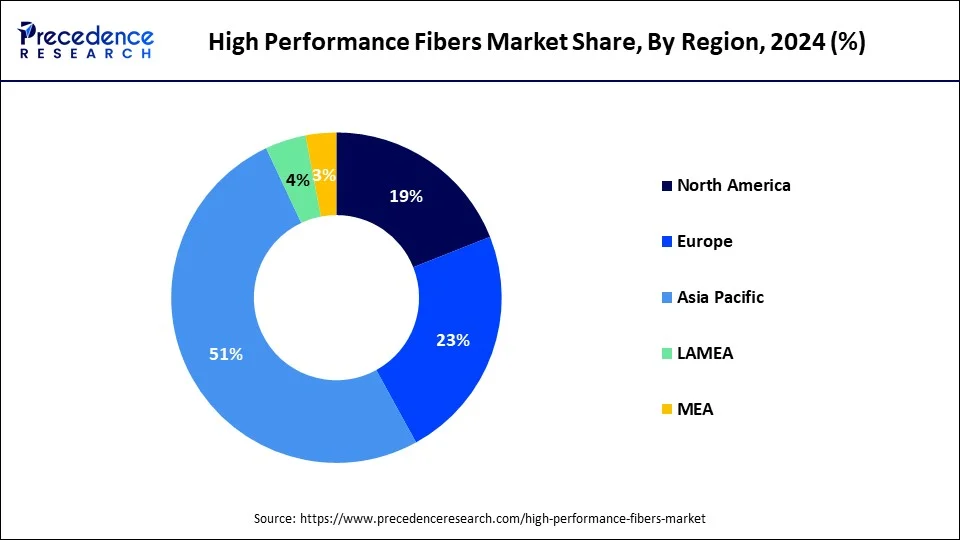

- Asia Pacific had dominated in the high-performance fibers market in 2024 with revenue share of 43.6%.

- North America shows a significant growth in the market during the forecast period.

- By product, the polybenzimidazole (PBI) segment is observed to be the fastest growing in the high-performance fibers market in 2024.

- By product, the carbon fiber segment has accounted market share of 36% in 2024.

- By application, the aerospace & defense segment dominated the high-performance fibers market with market share of 45% in 2024.

- By application, the automotive segment shows significant growth in the high-performance fibers market during the forecast period.

What is the High Performance Fibers Market?

Specialized applications requiring superior strength, stiffness, heat resistance, or chemical resistance are why high-performance fibers are developed. In this market, aramid, carbon, polyethylene, glass, and others are some of the major high-performance fibers. The high performance fibers market is experiencing exponential growth with the rising development of sustainable solutions in the industry. Integration of cutting-edge technologies and innovation of new structures create significant opportunities for the market to grow.

How is AI Contributing to the High Performance Fibers Market?

AI has a revolutionary impact on the market for high performance fibers by facilitating the whole process that includes material design, manufacturing precision, quality control, and predictive maintenance. It further helps in making the production process green by using resources in the most efficient way, and at the same time, it is the main driver of innovation in smart textiles, which leads to the creation of fiber-based solutions that are both intelligent and environmentally friendly across various industries.

High Performance Fibers Market Trends

- In April 2024, the biotech startup CARBIOS, creating and implementing biological solutions to transform the plastic and textile life cycles, released its financial and operational results for the fiscal year 2024.

- In October 2023, Magna unveiled the EcoSphere product line. By combining the company's cutting-edge 100% Melt Recyclable Foam and Trim technology with mono-material polyethylene terephthalate (PET), this industry-first solution eliminates the need to dispose of seating foam pads and trim covers in landfills. Foam, structures, trim padding, and sustainable trim materials make up Magna's new EcoSphere product line.

- In October 2023, with a strength of 1,160 kilopounds per square inch (Ksi), Toray Industries, Inc. announced the development of TORAYCA T1200 carbon fiber, the strongest strength in the world. This innovative product will help us reduce our environmental impact by making carbon-fiber-reinforced plastic components lighter. Additionally, this fiber creates a new performance frontier for applications that prioritize strength. Applications for it could be found in consumer goods, defense, aerostructures, and alternative energy.

What are the factors driving High Performance Fibers Market?

- Increased demand in aerospace and defense- High-performance fibers are becoming increasingly used in aerospace and defense for their light weight and superior strength properties, which are very important for improving fuel efficiency, level of protection, and overall structural performance.

- Growth in renewable energy- Wind turbine blades and other renewable energy components are using high-performance fibers for increased durability and to reduce weight to help support the global move toward sustainable energy solutions.

Automotive industry growth- Automakers are using more high-performance fibers to meet stringent fuel efficiency and emissions standards, and they use the fibers because of their light weight and strong performance to assist in improving vehicle performance and safety. - Advancements in Fiber Technology- Various technologies to improve the production of fibers are continuing to improve the strength, heat resistance, and versatility of fibers and expand application opportunities in demand across industries such as electronics, sports gear and equipment, and industrial manufacturing.

- Greater utilization in protective wear- Growing safety regulations and hazards in the workplace are driving up demand for protective clothing made from high-performance fibers, especially in more dangerous industries, like mining, oil and gas, and construction.

High Performance Fibers Market Growth Factors

- For a variety of uses, high-performance fibers provide exceptional strength and protection.

- Investigation and development of novel fiber varieties and enhanced production techniques.

Market Outlook

- Industry Growth Overview: The market is showing a steady increase in sales supported by the aerospace, automotive, and defense industries that seek strong and at the same time light materials.

- Sustainability Trends: The main area is gradually establishing the use of sustainable and recyclable materials, making it possible to use fibers in cars to lower and thus reduce carbon emissions through less energy consumption.

- Global Expansion: Asia-Pacific is the most rapidly growing market, owing to the fast pace of industrialization; major companies from the USA and Europe are also settling there.

- Major Investors: The big companies are corporations like DuPont, Toray Industries, Teijin, Mitsubishi Chemical, and Solvay that are investing a lot in research and development.

- Startup Ecosystem: No major startup ecosystem was reported; however, the established global chemical and material science corporations continue to dominate the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 35.48 Billion |

| Market Size in 2025 | USD 18.82 Billion |

| Market Size in 2026 | USD 20.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.29% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Growing focus on sustainable fiber development

Consumer attitudes are shifting in favor of ecologically friendly items. Products that are both high-performing and made responsibly are becoming increasingly in demand. To meet this demand, producers have been forced to give the creation of sustainable fibers top priority. Businesses are using sustainable fibers as a major differentiator for their products in the marketplace. A wide range of people are drawn to eco-conscious branding, including customers who care about the environment and companies trying to boost their sustainability credentials. This drives the growth of the high-performance fibers market.

Advancements in manufacturing processes

Automation and sophisticated control systems have increased the accuracy and consistency of fiber production processes. This guarantees homogeneity in the fiber qualities for high reliability and performance applications. Real-time monitoring and feedback systems are integrated to enable quick manufacturing adjustments, lowering faults and raising overall product quality.

High-performance fibers are guaranteed to meet strict quality standards due to improved testing and characterization methods. Techniques like scanning electron microscopy (SEM) and atomic force microscopy (AFM) offer in-depth knowledge of the characteristics and structure of fibers. Creating global standards and certification procedures guarantees that fibers fulfill the necessary performance standards for specific uses. Adherence to these guidelines is essential for gaining market acceptance and maintaining competitiveness.

Restraint

Issues surrounding the recycling and disposal of high-performance fibers

Complex polymers and cutting-edge materials are frequently used to create high-performance fibers. Its intricacy adds difficulty to the recycling process. These materials are typically unsuitable for traditional recycling techniques, which makes it challenging to decompose and reprocess the fibers. High-performance fiber disposal done incorrectly can have serious adverse effects on the environment. These fibers can linger in the atmosphere for extended periods and are frequently non-biodegradable, which adds to pollution. The expenses and complications involved with disposing of non-biodegradable items are rising due to the tightening of environmental restrictions. This limits the growth of the high-performance fibers market.

Opportunity

Development of bio-based and sustainable high-temperature fibers

The development of bio-based and sustainable fibers is greatly aided by the pressing need to minimize carbon footprints and the public's increased awareness of environmental issues. Traditional high-performance fibers, such as those derived from petrochemicals, have difficulties in recycling and are derived from non-renewable resources, contributing to environmental damage. Because bio-based fibers are made from renewable resources like plants and biopolymers, they have a smaller negative influence on the environment. Sustainable fibers can be made recyclable or biodegradable, encouraging a circular economy and lowering waste. Rising customer aversion to eco-friendly items may propel the market need for high-temperature bio-based fibers. This opens an opportunity for the growth of the high-performance fibers market.

The rising popularity of aramid fibers owing to their durability and recyclability

The development of bio-based and sustainable fibers is greatly aided by the pressing need to minimize carbon footprints and the public's increased awareness of environmental issues. Traditional high-performance fibers, such those derived from petrochemicals, have difficulties in recycling and are derived from non-renewable resources, contributing to environmental damage. Because bio-based fibers are made from renewable resources like plants and biopolymers, they have a smaller negative influence on the environment. Sustainable fibers can be made recyclable or biodegradable, encouraging a circular economy and lowering waste. Rising customer aversion to eco-friendly items may propel the market need for high-temperature bio-based fibers. This opens an opportunity for the growth of the high-performance fibers market.

Product Insights

The polybenzimidazole (PBI) segment is observed to be the fastest growing in the high-performance fibers market in 2023. PBI is increasingly demanding protective gear for industrial workers, firefighters, and military personnel. PBI is crucial in these industries due to its resilience to flames and capacity to retain its integrity in extreme heat. Materials that exhibit dependable performance in harsh environments are essential to the aerospace and defense industries. PBI fibers have high strength and thermal stability, which makes them a popular choice for insulation and heat shielding in aircraft components.

PBI is becoming the material of choice for insulating components in electronic devices due to the downsizing of these devices and the demand for materials that can survive extreme temperatures and severe conditions.

The carbon fiber segment shows a significant growth in the high-performance fibers market during the forecast period. Because carbon fiber composites give design engineers better materials, they alter the production process and the characteristics of the final product. Because of their high stiffness, high tensile strength, high chemical resistance, low weight, high-temperature tolerance, and low thermal expansion, they have become increasingly popular in various industries.

Carbon fiber is twice as stiff as steel, weighs less, and is more essential. Therefore, it can be used to maximize part performance and is especially helpful in the construction, military, aerospace, automobile, and other industries. When other materials in a design have poor performance or higher lifecycle costs, carbon fiber might be used in their stead.

Application Insights

The aerospace & defense segment dominated the high-performance fibers market in 2024. Lightweight aircraft and defense vehicles are essential for increased maneuverability and fuel efficiency. High-performance fibers can save a lot of weight because they are significantly lighter than conventional materials like metals. For example, aircraft constructions substantially use carbon fiber composites, which reduce weight without sacrificing strength or performance. High-performance fibers are crucial in defense applications because they absorb and distribute energy to improve protection against bullets, shrapnel, and other dangers in personal protective equipment (PPE) like helmets, vests, and other gear. Since they are so durable and impact-resistant, armored materials like Kevlar are widely used in body armor.

The automotive segment shows significant growth in the high performance fibers market during the forecast period. A key tactic for increasing fuel economy is lightening the car's weight. Compared to traditional materials like steel and aluminum, high-performance fibers are substantially lighter while still providing the required strength and durability. In addition to using less gasoline, lightweight cars perform better in handling, braking, and acceleration. Because of these improved qualities, high-performance fibers are a material of choice for automakers.

Regional Insights

Asia Pacific High Performance Fibers Market Size and Growth 2025 to 2034

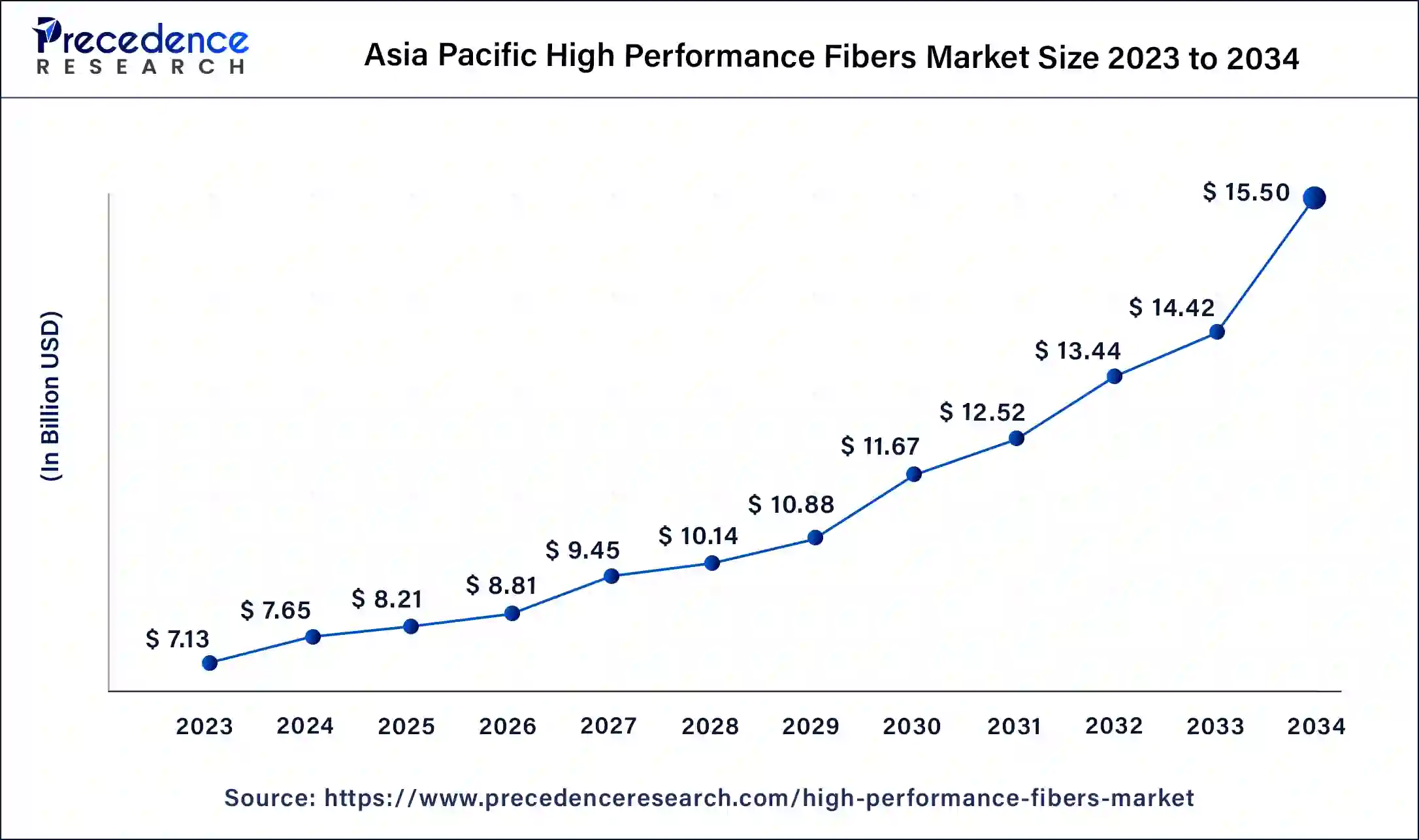

The Asia Pacific high performance fibers market size is exhibited at USD 8.21 billion in 2025 and is projected to be worth around USD 15.50 billion by 2034, poised to grow at a CAGR of 7.31% from 2025 to 2034.

Asia Pacific dominated in the high-performance fibers market in 2024. The area makes significant R&D investments to create cutting-edge fiber technologies. The nations of South Korea and Japan are renowned for their advances in material sciences and nanotechnology. Strong linkages between academic institutions and industrial participants foster ongoing innovation and advancements in fiber characteristics and applications. The area's governments support manufacturing and applying high-performance fibers by offering subsidies and other rewards. This assistance keeps regional producers competitive in the international market.

How is Asia-Pacific Leading in the High Performance Fibers Market?

This area is the largest in the world market, and it is the result of fast industrial development and the use of cutting-edge technology. The regional production capabilities and the high-performance fibers, along with the growing demand from various industries, make the market more competitive and increase its presence.

The strong industrial ecosystem and the commitment to advanced materials are the backbone of the Chinese market's growth. The demand for high-performance fibers in the automotive, defense, and industrial sectors is the main factor for the market growth; meanwhile, the innovative manufacturing techniques are playing a supportive role.

North America shows significant growth in the high-performance fibers market during the forecast period. North America, in particular the US and Canada, has a developed industrial infrastructure that facilitates the research and manufacturing of high-performance fibers. Many top industries and research centers that invest significantly in innovation and technical developments are in the region. New and improved high-performance fibers with improved qualities, such as higher tensile strength, better thermal stability, and more resistance to chemicals and abrasion, have been developed due to ongoing materials science research and development.

How is North America Performing in the High Performance Fibers Market?

The market's growth is partly attributed to the well-established aerospace and defense industries and the increasing use of high-performance materials in automotive and protective applications. The continuous flow of new ideas and the powerful industrial base create a strong demand for these products and ultimately lead to the growth of the market as a whole.

The technological superiority of the country, along with its research programs, helps to bring high-performance fibers into the advanced applications area. The United States has a strong position in the global supply chain thanks to its focus on innovation and eco-friendliness.

What are the Driving Factors of the High Performance Fibers Market in Europe?

Europe is the region where the most stringent safety regulations, technological innovation, and the use of advanced composites have the biggest impact on market growth. The focus on wind and solar energy, combined with the use of biodegradable materials, makes the region the leader in sustainable development.

The skilled workforce and the high-tech machines of the German engineering and manufacturing industry are the main factors driving the adoption of the new fibers. The country's efforts to be light in terms of material use and to produce sustainably are attracting many industrial sectors and leading to growth.

Value Chain Analysis

- Feedstock Procurement: The procurement of raw materials such as petrochemicals and specialized polymers for fiber-making.

Key Players: Reliance Industries, ExxonMobil, SABIC, and Mitsubishi Chemical - Chemical Synthesis and Processing: The conversion of feedstocks into polymers and fibers possessing specific physical attributes.

Key players: DuPont, Teijin Limited, and Toray Industries - Compound Formulation and Blending: The mixing of fibers and/or additives that results in upgraded performance and quality of the material.

Key players: BASF, Solvay, and Honeywell International - Quality Testing and Certification: The process of verifying fibers according to the specified criteria of strength, heat-resistance, and durability.

Key players: BASF, Solvay, and Honeywell International - Packaging and Labelling of High-Performance Fibers: Fibers are packed with care, and their safe and efficient delivery is ensured by the labeling.

Key Players: Toray or Teijin

High Performance Fibers Market Companies

- Toray Industries, Inc.

- Dupont

- Kolon Industries, Inc.

- Huvis Corp.

- Teijin Limited

- Toyobo Co. Ltd

- DSM

- Kermel S.A.

Recent Developments

- In March 2025, Thermore launches Ecodown Fibers Sync , an ultra-soft, clump-resistant insulation made from 100 per cent recycled PET bottles. Ecodown Fibers Sync is the power of dual-performance fibers, carefully engineered to offer exceptional ultra-lofty softness and resilience. Combining high performance and sustainable design, it offers flexibility for both technical and fashion outerwear.

(Source: https://www.fibre2fashion.com) - In March 2025, Industrial Summit Technology (I.S.T.) launched IMIDETEX, an advanced polyimide fiber engineered to redefine composite applications. With exceptional properties such as high tensile strength (3.0 GPa), a continuous use temperature exceeding 250°C, and an ultra-low water absorption rate (<0.9%), IMIDETEX stands out as a super fiber for the most demanding environments.

(Source: https://www.textileworld.com) - In March 2025, Hyper Photonix, in collaboration with its group company SiPhx Inc. (Japan), has developed an 800G optical transceiver that can be directly connected to FUJIKURA multi-core fiber (MCF) with 2 duplex LC connectors. Multi-core fiber (MCF), by integrating multiple cores within a single cladding, helps address the limitations of single core fibers.

(Source: https://www.businesswire.com) - In May 2024, the manufacturer of insulating wood composites TimberHP and Saint-Gobain announced a collaborative relationship allowing CertainTeed to distribute TimberHP's wood fiber insulation products throughout North America, including as the exclusive distribution partner in Canada. CertainTeed Inc. is a subsidiary of Saint-Gobain that specializes in building products.

Segments Covered in the Report

By Product

- Carbon Fiber

- Polybenzimidazole (PBI)

- Aramid Fiber

- M5/PIPD

- Polybenzoxazole (PBO)

- Glass Fiber

- High Strength Polyethylene

- Others

By Application

- Electronics & Telecommunication

- Textile

- Aerospace & Defense

- Construction & Building

- Automotive

- Sporting Goods

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting