High Temperature Coatings Market Size and Forecast 2025 to 2034

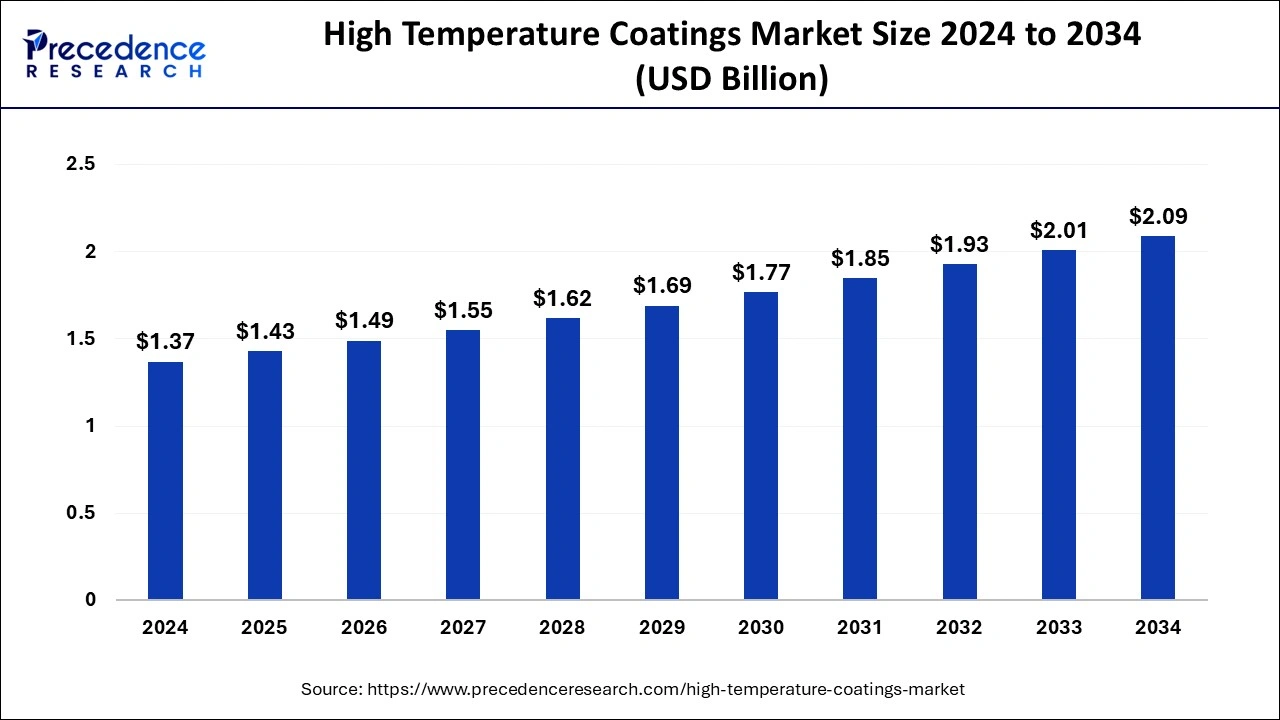

The global high temperature coatings market size was estimated at USD 1.37 billion in 2024 and is predicted to increase from USD 1.43 billion in 2025 to approximately USD 2.09 billion by 2034, expanding at a CAGR of 4.31% from 2025 to 2034

High Temperature Coatings MarketKey Takeaways

- In terms of revenue, the global high temperature coatings market was valued at USD 1.37 billion in 2024.

- It is projected to reach USD 2.09 billion by 2034.

- The market is expected to grow at a CAGR of 4.31% from 2025 to 2034.

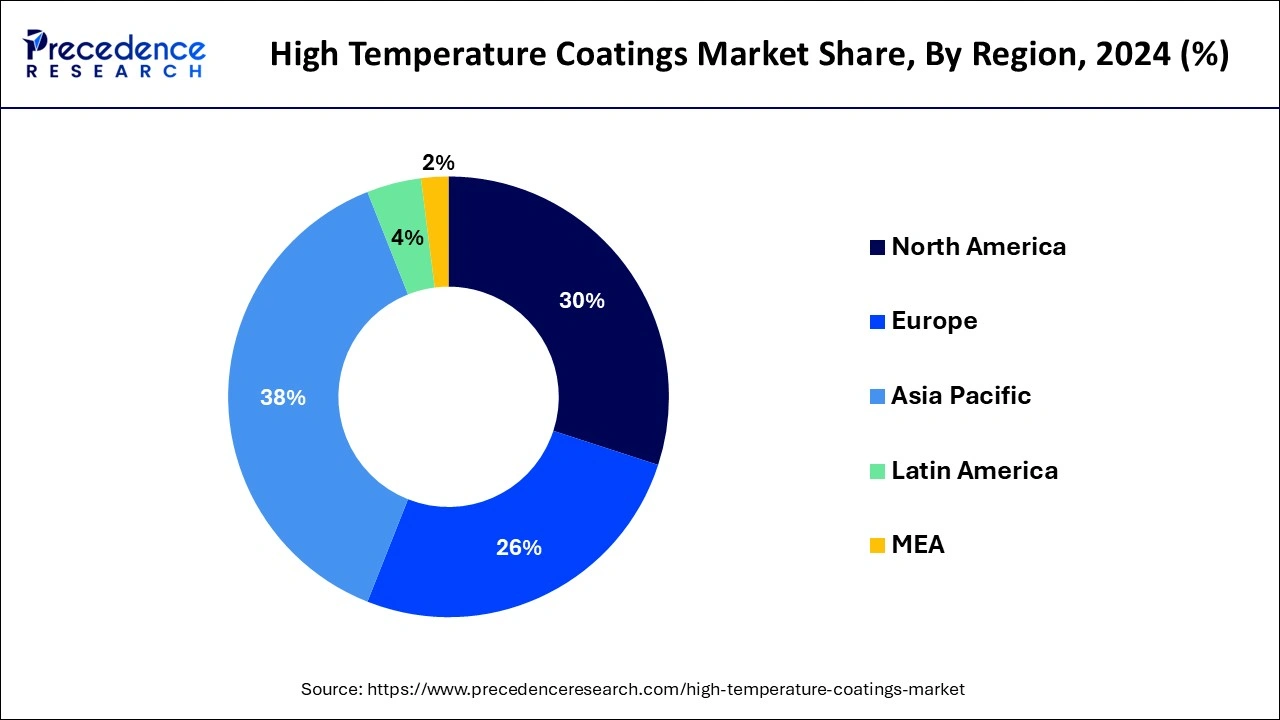

- Asia Pacific led the market with the biggest market share of 38% in 2024.

- North America is expected to witness the fastest rate of growth in the high-temperature coatings market during the forecast period.

- By resin, the acrylic segment held the largest share of the market in 2024.

- By resin, the epoxy segment is expected to grow at a significant rate during the forecast period.

- By technology, the dispersion/water-based segment held the largest share of the market in 2024.

- By technology, the powder-based segment is expected to grow at a notable CAGR.

- By application, the energy and power segment dominated the market with the largest share in 2024.

- By application, the metal processing segment is expected to grow at a CAGR.

Asia Pacific High Temperature Coatings Market Size and Forecast 2025 to 2034

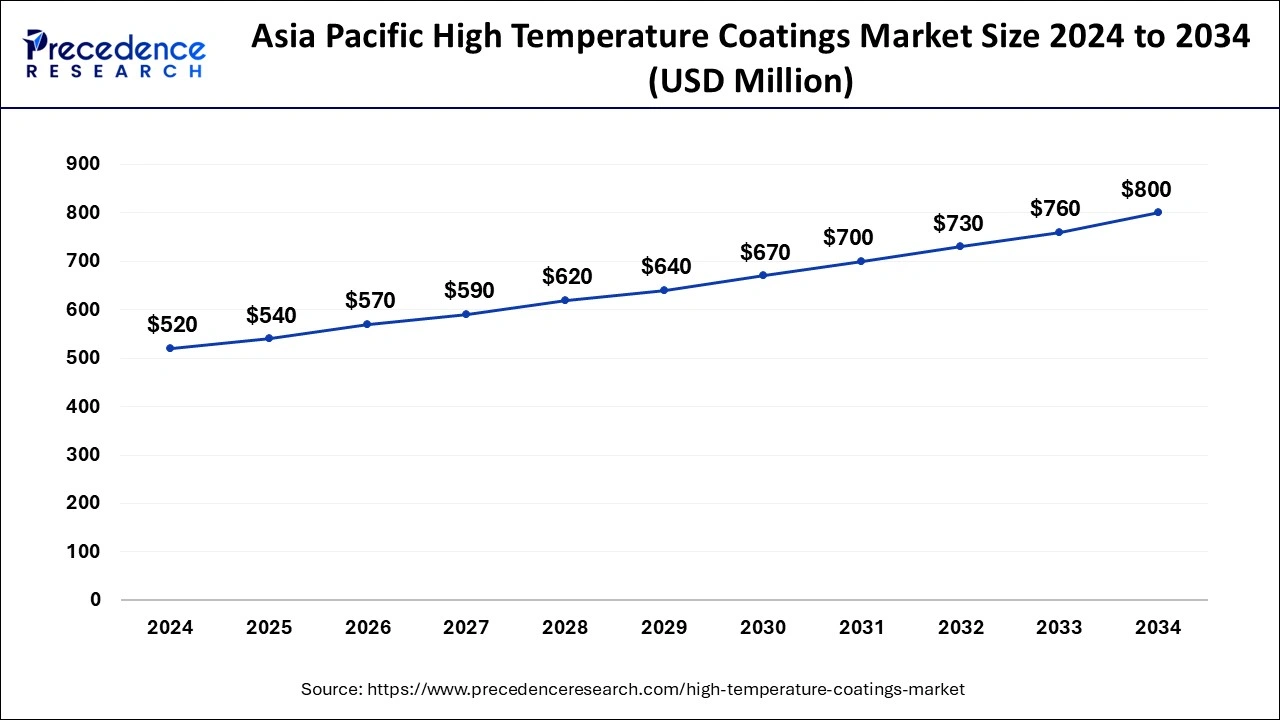

The Asia-Pacific high-temperature coatings market size was valued at USD 520 million in 2024 and is expected to reach around USD 800 million in 2034, expanding at a CAGR of 4.40% from 2025 to 2034.

Asia Pacific has the largest market share of 38% in 2024, increasing manufacturing activities, and the presence of key sectors such as automotive, aerospace, energy, and electronics. APAC countries, including China, India, Japan, South Korea, and others, contribute significantly to the demand for high-temperature coatings.

- In July 2023, HeatCure launched its heat management solutions in India that helps in blocking heat gain from glass windows, facades and doors. Its coating products deliver protection against ultraviolet (UV) and infrared (IR) rays, forming energy-efficient and comfortable indoor environments.

Additionally, the rapid industrialization in countries like China and India, coupled with a booming manufacturing sector, fuels the demand for high-temperature coatings. Industries such as steel, petrochemicals, and electronics drive the need for coatings that can withstand elevated temperatures.

North America is poised for rapid growth in the high-temperature coatings market driven by their widespread use in industrial applications. Industries such as oil and gas, power generation, and metal processing rely on these coatings to protect critical components from extreme temperatures and harsh environmental conditions. Moreover, North America has stringent environmental regulations, and there is an increasing emphasis on adopting coatings that meet environmental standards, including low volatile organic compound (VOC) formulations. This has led to the development of eco-friendly high-temperature coatings in the region.

Meanwhile, Europe is growing at a notable rate in the high temperature coatings market. High-temperature coatings find extensive applications in various industries across Europe, including power generation, metal processing, and petrochemicals. These coatings are used to protect critical components exposed to elevated temperatures. The automotive and aerospace industries are significant consumers of high-temperature coatings in Europe. These coatings are used to protect engine components, exhaust systems, and other parts subjected to extreme temperatures.

Market Overview

The high-temperature coatings market refers to a specialized segment of the coatings industry that addresses the need for protective coatings capable of withstanding extreme temperatures and harsh environmental conditions. These coatings are designed to provide a durable and resilient layer on surfaces exposed to elevated temperatures, offering protection against corrosion, oxidation, and other forms of degradation. Furthermore, the high-temperature coatings market is driven by various factors such as the increasing demand from industries such as automotive, aerospace, and industrial manufacturing, where components are subjected to extreme temperatures during operation. These coatings play a crucial role in enhancing the longevity and performance of materials and equipment in high-temperature environments, contributing to the overall efficiency and safety of industrial processes.

High Temperature Coatings Market Data and Statistics

- In May 2023, Akzo Nobel N.V. launched a novel bisphenol-free internal coating that provide can makers and coil coaters with a sustainable alternative as they quicken their transition away from bisphenol-based coatings for beverage can. AkzoNobel's product launch aligns with the increasing need for alternative coatings and helps the industry's efforts to comply with the evolving regulatory landscape. This innovative BPA-NI (Bisphenol A non-intent) coating, does not use BPA or bisphenol-based epoxies in its manufacturing process. It complies with both EU regulations and Food and Drug Administration (FDA).

High Temperature Coatings Market Growth Factors

- As industrial activities and infrastructure development continue globally, there is a growing demand for high-temperature coatings to protect critical components and structures exposed to elevated temperatures. Industries such as petrochemical, power generation, and manufacturing rely on these coatings to enhance equipment durability and reliability.

- The automotive and aerospace sectors are major consumers of high-temperature coatings. As these industries advance technologically, the need for coatings that can withstand extreme temperatures in exhaust systems, engine components, and aircraft parts becomes critical. High-temperature coatings contribute to increased efficiency and performance in these applications.

- Increasing environmental regulations drive the adoption of high-temperature coatings that provide corrosion protection and prevent emissions from industrial equipment. These coatings help industries comply with environmental standards by reducing the environmental impact of high-temperature processes.

- Ongoing research and development efforts lead to innovations in coating technologies. Advanced formulations incorporating nanotechnology, ceramic materials, and other high performance additives enhance the heat resistance and durability of high-temperature coatings, expanding their application possibilities.

- The growth of the energy sector, particularly in power generation and renewable energy projects, contributes to the demand for high-temperature coatings. Coatings are crucial for protecting components in power plants, including turbines and exhaust systems, as well as in solar and geothermal applications.

- Industries prioritize operational efficiency, and high-temperature coatings play a role in achieving this by extending the lifespan of equipment and reducing maintenance costs. Coated components are less prone to corrosion and wear, leading to improved overall system reliability.

- Rising investments in the aerospace sector, including both civil and defense applications, drive the demand for high-temperature coatings. These coatings are essential for protecting critical aircraft components from extreme temperatures and environmental conditions.

- The globalization of industries and market expansion efforts by coating manufacturers contribute to the overall growth of the high-temperature coatings market. Increasing industrialization in emerging economies further amplifies the demand for these specialized coatings.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.96 Billion |

| Market Size in 2024 | USD 1.37 Billion |

| Market Size in 2025 | USD 1.43 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 2.09% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

High Temperature Coatings Market Dynamics

Driver

Increasing environmental regulations and sustainability goals

- In June 2023, PPG Industries, Inc. launched electrocoat (e-coat) products known as ENVIRO-PRIME EPIC 200R coatings that deliver lower temperature curing related to alternative technologies. These coatings offer customers sustainability advantages by reducing CO2 releases during the manufacturing process and decreasing energy consumption.

The high-temperature coatings market is experiencing a significant upswing due to the escalating emphasis on environmental regulations and sustainability goals across industries. As governments worldwide intensify efforts to mitigate environmental impact, stringent regulations necessitate the adoption of coatings that contribute to eco-friendly practices. High-temperature coatings play a pivotal role in this context by providing corrosion protection and thermal resistance to equipment, extending their lifespan and minimizing the need for frequent replacements.

By preventing premature deterioration of industrial components exposed to extreme temperatures, these coatings align with sustainability objectives, reducing overall resource consumption and waste generation. Industries facing strict emission standards, such as automotive, power generation, and manufacturing, are increasingly turning to high-temperature coatings to comply with environmental regulations. Additionally, the coatings' ability to enhance energy efficiency and reduce the environmental footprint of industrial processes positions them as vital elements in achieving sustainability goals. As a result, the high-temperature coatings market is not only driven by performance requirements but also by a growing awareness of the importance of environmentally responsible practices, making these coatings a key contributor to sustainable and responsible industrial operations.

Restraint

Limited durability in extreme conditions

The high-temperature coatings market faces a potential constraint with the challenge of limited durability in extreme conditions. While these coatings are designed to withstand elevated temperatures and harsh environments, certain extreme conditions prevalent in certain industrial processes may surpass the capabilities of existing formulations. Industries involved in highly corrosive or mechanically aggressive operations may encounter scenarios where the durability of high-temperature coatings becomes a limiting factor. The demanding conditions, such as exposure to aggressive chemicals, extreme mechanical stress, or a combination of both, may accelerate degradation and compromise the protective properties of these coatings over time.

In applications where equipment is subjected to exceptionally severe conditions, the need for frequent recoating or maintenance interventions may arise, leading to increased operational costs and downtime. This limitation may influence industries to explore alternative solutions, such as refractory materials or other protective technologies, potentially diverting demand away from traditional high-temperature coatings. Consequently, addressing the challenge of limited durability in extreme conditions through continuous research and development efforts will be crucial for sustaining and expanding the market, ensuring that high-temperature coatings remain reliable and effective across a broad spectrum of industrial applications.

Opportunity

Development of hybrid and composite materials

The high-temperature coatings market is poised for expansion as a result of the ongoing development of hybrid and composite materials. The evolution of materials with a combination of unique properties, including enhanced strength, heat resistance, and reduced weight, presents a promising opportunity for innovation in high-temperature coatings. These advanced materials offer a balanced approach to addressing the demanding requirements of industries operating in extreme conditions. By incorporating hybrid and composite materials into high-temperature coatings, manufacturers can tailor formulations to meet specific application needs, offering superior performance compared to traditional coatings.

The advent of hybrid materials, combining elements like ceramics, polymers, and metals, provides an avenue for creating coatings with improved thermal stability and durability. Additionally, composite materials, featuring a blend of different constituents, enable the formulation of coatings that offer a synergistic combination of heat resistance and mechanical strength. Industries such as aerospace, automotive, and energy, which demand high-performance coatings for components exposed to elevated temperatures, can benefit significantly from these advancements.

Resin Insights

The acrylic segment dominated the high-temperature coatings market in 2024. the segment is observed to continue the trend throughout the forecast period. Acrylic coatings provide a balance of durability, flexibility, and weather resistance. They are often used in architectural applications, such as high-temperature paints for buildings and structures.

On the other hand, the epoxy is expected to grow at a significant rate throughout the forecast period. Epoxy coatings are widely used for their excellent adhesion, chemical resistance, and thermal stability. They find applications in industries such as aerospace, automotive, and electronics, where durability and corrosion resistance are critical.

Technology Insights

The dispersion/water-based segment held the dominating share of the high- temperature coatings market in 2024. Dispersion or water-based high-temperature coatings use water as a carrier for the resin and other components. This technology is considered more environmentally friendly compared to solvent-based coatings, as it typically has lower VOC content. Water-based coatings are commonly used in applications where environmental and health considerations are paramount. They offer good adhesion and durability while being less prone to emitting harmful substances.

On the other hand, the powder-based segment is expected to generate a notable revenue share in the market. Powder-based high-temperature coatings involve the application of a dry powder to a substrate, followed by a curing process. The coating adheres to the surface electrostatically and is then cured in an oven. Powder coatings are known for their durability, resistance to chemicals, and environmental advantages, as they often contain little to no VOCs. Powder-based technology is prevalent in industries such as automotive, appliances, and metal finishing.

Application Insights

The energy & power segment held the dominating share of the high-temperature coatings market in 2024. High-temperature coatings are crucial in the energy and power sector for protecting components such as turbines, boilers, and exhaust systems from extreme temperatures and corrosive environments in power plants.

- In March 2023, UK Atomic Energy Authority announced that its partnership with the U.S. Department of Energy's Oak Ridge National Laboratory to launch a $3 million fusion energy materials project. In this partnership, industries will study for five-year to examine behavior of materials for fusion power and will place entirely new materials into the ORNL High Flux Isotope Reactor, including new high-temperature steels, permeation barrier coatings and welded materials.

On the other hand, the metal processing segment is expected to generate a notable revenue share in the market. Industries involved in metal processing, including foundries and metal manufacturing, use high-temperature coatings to protect equipment exposed to elevated temperatures during various processes.

High Temperature Coatings Market Companies

- Aremco

- Belzona International Ltd.

- Chemco International Ltd

- Hempel A/S

- Valspar

- Carboline Company

- Axalta Coating Systems, LLC

- Jotun

- BASF SE

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Weilburger Coatings GmbH

- GENERAL MAGNAPLATE CORPORATION

Recent Developments

- In June 2023, Sherwin-Williams announced launch of its Heat-Flex CUI-mitigation coatings that features Heat-Flex ACE (Advanced CUI Epoxy), an ultra-high-solids epoxy novolac with a specialized chemical development for effective CUI (corrosion under insulation) mitigation. According to the company, this advanced coating formulation exceeds other alternatives in minimizing CUI-associated risks.

- In March 2022, PPG Asian Paints and MG Motor India launched a ULTRAX Degreaser technology to reduce their CO2 emissions by 1500 tons per year. The companies also announced that it will conserves energy through low-temperature phosphate (VERSABOND) and high throw low cure cathodic electro coating paint.

- In October 2022, Dow launched its new SiLASTIC SST-2650 recyclable silicone self-sealing tire solution that is utilized in Bridgestone's newly released B-SEALS, a recyclable tire sealant technology. In addition, it will increase energy consumption and environmental impact during production due to the difficult high temperature application process and need for extensive laser cleaning of the tire surface prior to coating.

Segments Covered in the Report

By Resin

- Epoxy

- Silicone

- Polyethersulfone

- Polyester

- Acrylic

- Alkyd

- Others

By Technology

- Solvent Based

- Dispersion/Water Based

- Powder Based

By Application

- Energy & Power

- Metal Processing

- Cookware

- Stoves and Grills

- Marine

- Automotive

- Coil Coating

- Aerospace

- Building & Construction

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting