Performance Additives Market Size and Forecast 2025 to 2034

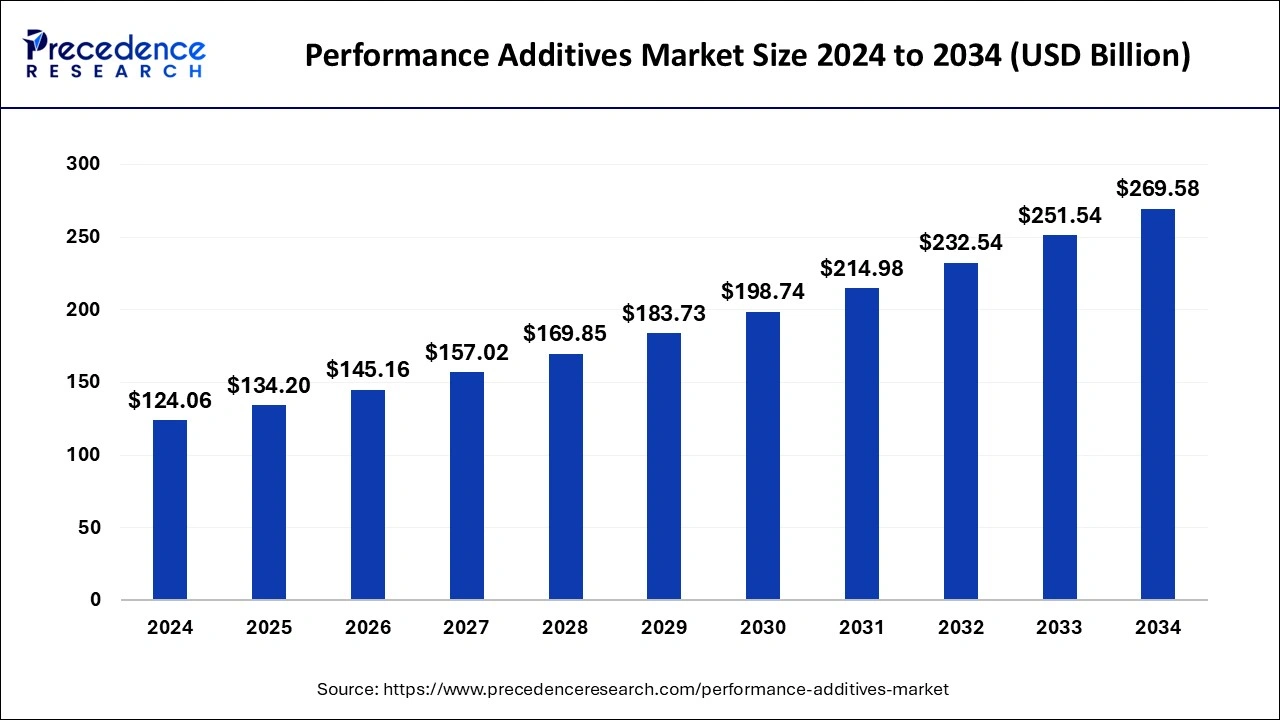

The global performance additives market size was estimated at USD 124.06 billion in 2024 and is predicted to increase from USD 134.20 billion in 2025 to approximately USD 269.58 billion by 2034, expanding at a CAGR of 8.07% from 2025 to 2034. The performance additives market is driven by a growing need in the automotive sector for lightweight materials.

Performance Additives Key Takeaways

- The global performance additives market was valued at USD 124.06 billion in 2024.

- It is projected to reach USD 269.58 billion by 2034.

- The performance additives market is expected to grow at a CAGR of 8.07% from 2025 to 2034.

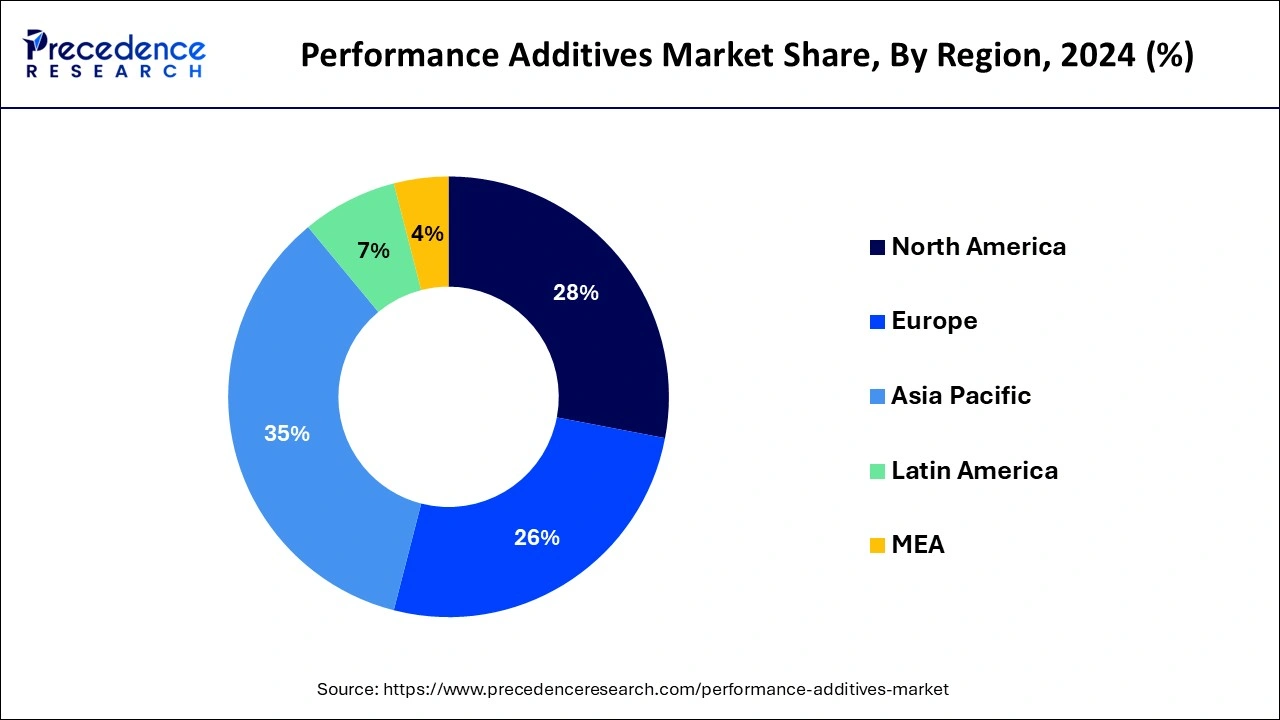

- Asia-Pacific dominated the market with the largest market share of 35% in 2024.

- By type, the plastic additives segment dominated the market in 2024.

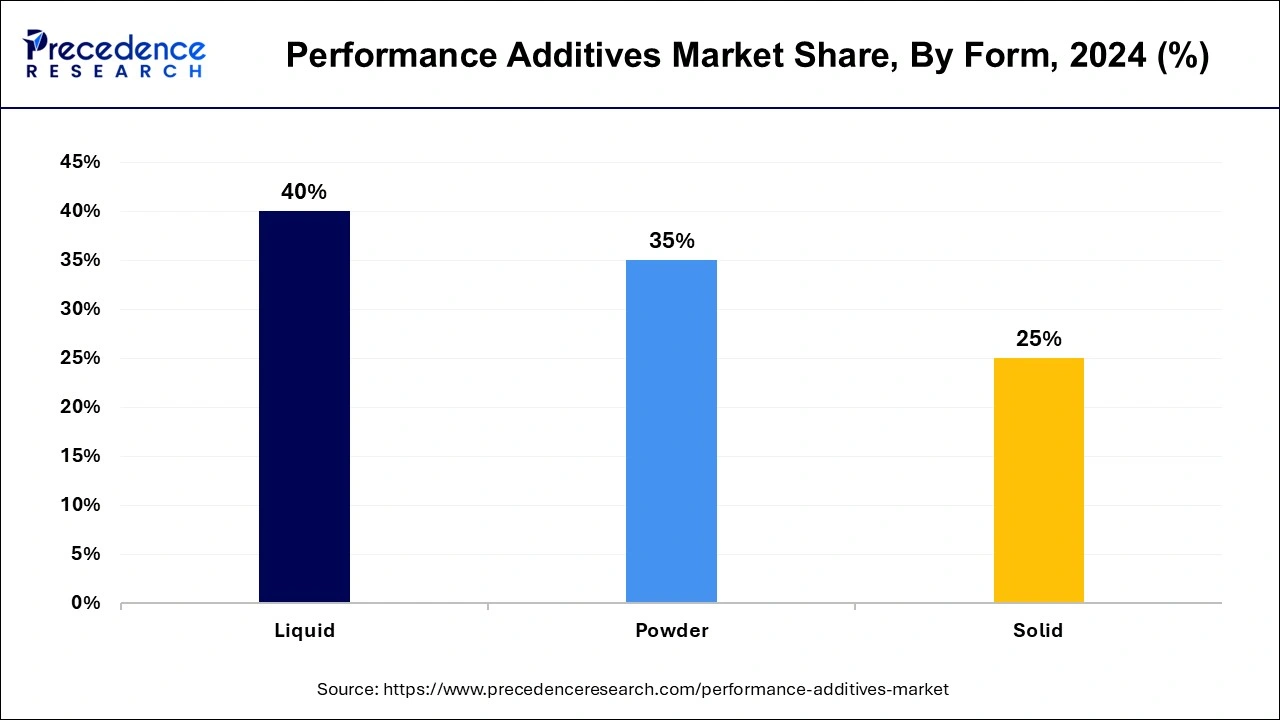

- By form, the liquid segment dominated the market in 2024.

- By functionality, the antioxidants segment dominated the market in 2024.

- By end- use, the automotive segment dominated the performance additives market in 2024.

- By end-use, the packaging segment shows a notable growth in the market during the forecast period.

Asia PacificPerformance Additives Market Size and Growth 2025 to 2034

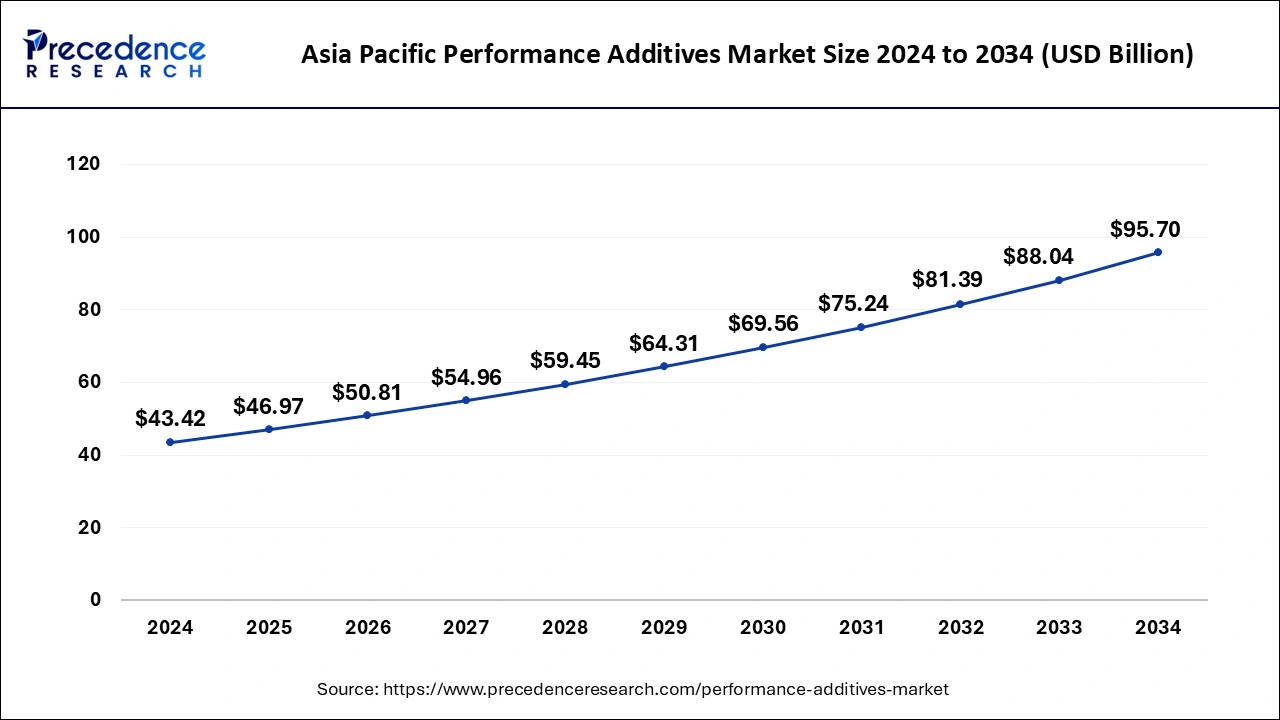

The Asia Pacific performance additives market size surpassed USD 43.42 billion in 2024 and is expected to be worth around USD 95.70 billion by 2034 at a CAGR of 8.22% from 2025 to 2034.

Asia-Pacific had the largest share in 2024 in the performance additives market and the region is observed to carry the position throughout the predicted timeframe. Governments throughout the Asia-Pacific region invest significantly in infrastructure development projects, including highways, bridges, trains, and airports to support urbanization and economic growth. These projects fuel the need for building supplies, polymers, and coatings, all of which use performance additives to improve attributes like strength, durability, and weather resistance. Through partnerships, investments, and joint ventures with local players, several global firms operating in the performance additives sector deliberately extend their footprint in the Asia-Pacific area.

North America is the fastest growing performance additives market during the forecast period. The automotive, aerospace, and electronics industries are experiencing a surge in demand for high-performance polymers due to the growing emphasis on lightweight materials, fuel efficiency, and sustainability. Performance additives are essential for improving these polymers' qualities and increasing their suitability for demanding applications. The demand for suitable additives is rising along with the use of high-performance polymers. Performance additives, including fuel, tires, coatings, and lubricants, are widely used in automobile parts. They enhance the longevity, efficiency, and performance of vehicles.

Market Overview

The industry that creates compounds added to different materials to improve their performance attributes is known as the performance additives market. These additives are added to items during production to enhance their flexibility, strength, heat resistance, durability, and appearance. Performance additives are essential for raising the caliber and performance of materials in various industries. For instance, additives can prolong the life of engine components, lower emissions, and increase fuel efficiency in the automotive industry.

The performance additives market is expanding due to the growing need for high-performance materials in various end-user industries, including electronics, automotive, construction, and packaging. The market for performance additives grows as industries change and demand more specialized materials.

Performance Additives Market Trends

- The increasing demand for better quality products is spearheading the industry growth in the current period. As individuals increasingly prefer paints, plastics, and other things which has a long life and look better with years. Thus, several companies are using this advanced performance additive to maintain product quality in the coming years.

- The heavy expansion of the construction and automotive industry is driving the growth of the market in recent years, as additives are used in concrete, paint, and other materials in construction due to durability. Moreover, the additives are increasingly observed in improving the durability of car parts in recent years.

- The sudden shift toward sustainability is increasingly providing a huge consumer base for eco-friendly additives in the current period. Moreover, manufacturers are also looking for eco-friendly raw materials in their additives. Also, several governments are supporting these sustainable initiatives while giving benefits to manufacturers, such as tax reduction and offering subsidies in the past few years, as per the observation.

Performance Additives Market Growth Factors

- Due to growing activity in the automotive, construction, electronics, and packaging industries, performance additives are required to improve material qualities.

- Performance additives enhance materials' mechanical, thermal, electrical, and chemical qualities, increasing their durability, efficiency, and suitability for uses.

- Due to the growth of the automotive, construction, and packaging industries, an increasing number of adhesives, sealants, paints, and coatings require performance additives.

- Because of their benefits, plastics with performance additives are becoming more used in a variety of applications. This is especially true for developing countries.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.07% |

| Market Size in 2025 | USD 134.20 Billion |

| Market Size by 2034 | USD 269.58 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Form, By Functionality, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in technology

Manufacturers can customize performance additives to match individual consumer needs with technology. By enabling virtual development and optimization of additive formulations before actual manufacturing, sophisticated simulation tools minimize the requirement for physical testing and shorten the time to market. Manufacturers can efficiently handle niche markets and accommodate a variety of applications because of this customization capacity.

Focus on sustainable solutions

Resource efficiency and sustainable solutions frequently go hand in hand. Businesses see that maximizing resource utilization improves operational performance and cost-effectiveness while lessening its adverse environmental effects. As a result, additives that enhance material performance at lower quantities or using alternative, renewable resources have been developed.

Restraint

Compatibility issues

Products, including plastics, coatings, rubbers, and fuels, use performance additives. Meanwhile, not all additives work well with every material matrix. Incompatibility can result in poor adhesion, diminished mechanical strength, or weakened durability. For example, poor dispersion of an incompatible additive in a polymer matrix might impact the material's mechanical characteristics and surface finish. The incompatibility of base materials and additions might result in variable performance attributes.

For sectors like electronics or aircraft, where product quality and dependability are crucial, this lack of consistency can be a severe problem. Inadequate performance can lead to warranty claims, product malfunctions, and reputational harm to the brand.

Opportunities

Rising demand for high-performance polymers

The growing need for high-performance polymers propels research and development efforts in the performance additives market. Additives manufacturers are always developing new ideas to create innovative formulas that meet industry demands and legal standards. This covers the creation of environmentally friendly additives, nano-additives with enhanced qualities at lower concentrations, and multifunctional additives with several uses.

Expanding packaging sector

As e-commerce and international trade grow, packaging must handle many different things, such as storage, shipping, and changing weather. Performance additives can be designed to improve resistance to mechanical loads, moisture, UV radiation, and temperature changes to meet these functional requirements. As a result, packaged goods have a longer shelf life and are less likely to be damaged in transit.

The variety of performance additives on the market is growing thanks to developments in material science and additive manufacturing technology. The packaging industry can now offer high-performing, value-added packaging solutions thanks to the ongoing innovation in performance additives. These solutions range from nanotechnology-based additives for better barrier qualities to smart additives for active packaging applications.

Type Insights

The plastic additives segment dominated the performance additives market in 2024. The increasing demand for plastic products in various industries, including consumer goods, automotive, packaging, and construction, has led to a considerable increase in the requirement for additives that improve the performance and characteristics of plastics. Plastic additives are essential for enhancing plastic materials' strength, flexibility, durability, and appearance and meeting a wide range of application requirements.

- In September 2023, the first biomass-balanced plastic additives, which have the potential to cut a product's carbon footprint by as much as 60%, have been introduced, according to German chemical giant BASF.

The adhesive additives segment is observed to be the fastest growing in the performance additives market during the forecast period. Adhesives are essential in many industries, including electronics, construction, automotive, and packaging. High-performance adhesives are becoming more necessary as the market for these end products expands. Adhesive additives improve the effectiveness, robustness, and versatility of adhesives. Lightweight materials like composites and polymers are used more often in industries like aerospace and automotive to cut emissions and increase fuel efficiency.

Adhesive chemicals are essential for successfully joining these lightweight materials. The need for high-performance adhesive additives is growing along with the demand for lightweight solutions.

- In August 2023, EPS 2133, an all-acrylic polymer sans APEO surfactant, was introduced by Engineered Polymer Solutions. It can be used for pressure-sensitive adhesive applications that are both permanent and removable.

Form Insights

The liquid segment dominated the performance additives market with revenue share of 44% in 2024. The application of liquid additives is numerous in various industries, including textiles, construction, automotive, and packaging. Because of their adaptability, producers can incorporate them into multiple formulas to satisfy performance standards. Improved durability, adhesion, and resistance to environmental elements, including UV radiation, moisture, and chemicals, are just a few of the enhanced performance attributes it frequently offers. Because of this, they are very sought after in applications, including coatings, adhesives, and sealants where performance is crucial.

The powder segment is observed to be the fastest growing in the performance additives market during the forecast period. Powder additives can be used in various industries, such as consumer goods, construction, automotive, and aerospace. These additives, including adhesives, paints, coatings, and plastics, can be added to various products to improve their performance. There is a shift toward eco-friendly additives due to increased regulatory demand to enhance product safety and eliminate harmful emissions, and environmental sustainability concerns. Compared to liquid additives, powder additives frequently have less influence on the environment and low emissions of volatile organic compounds (VOCs).

Functionality Insights

The antioxidants segment dominated the performance additives market in 2024. Antioxidants are essential for increasing various items' durability and shelf life, from fuels to polymers. The automobile, plastics, and food packaging industries have seen a sharp increase in the demand for antioxidants. Consumers seek products with longer lifespans, and producers try to satisfy these expectations. Global industrial activity and economic growth have constantly increased the need for performance additives, such as antioxidants. Rapid industrialization and urbanization in emerging economies are increasing demand for materials and chemicals to improve the performance and durability of produced goods.

End-use Insights

The automotive segment dominated the performance additives market in 2024. Even if the automotive industry is gradually moving toward electric vehicles, performance additives are still essential for extending the life and efficiency of EV parts like electric motors and batteries. To maximize the longevity and performance of EV systems, additives like corrosion inhibitors and thermally conductive materials are necessary.

The industrial manufacturing segment is observed to be the fastest growing in the performance additives market during the forecast period. Industrial businesses are embracing sustainable materials and processes at an increasing rate due to legislation and growing environmental concerns. Performance additives reduce raw material consumption, increase energy efficiency, and improve recyclability, all of which contribute to developing environmentally friendly goods. In the industrial production industry, additives, including bio-based polymers, renewable fillers, and environmentally friendly stabilizers, are becoming increasingly popular.

- In November 2023, Setting the stage for Clariant to present its most recent innovations devoted to more environmentally friendly and sustainable formulations and coating applications that support public health and safety is China Coat 2023 in Shanghai.

The packaging segment shows a notable growth in the performance additives market during the forecast period. A significant shift is emerging toward sustainable packaging options as consumer knowledge of environmental issues grows. Performance additives are essential when it comes to improving the strength, weight, and recyclable nature of packing materials. Eco-friendly packaging solutions are developed using UV stabilizers, barrier coatings, and bio-based polymers, which spurs growth.

Performance Additives Market Companies

- BASF SE

- Evonik Industries AG

- Akzo Nobel N.V.

- Clariant AG

- Dow Chemical Company

- Eastman Chemical Company

- Solvay S.A.

- Arkema Group

- Huntsman Corporation

- Croda International Plc

- Lubrizol Corporation

Recent Developments

- In 2024, the CAI unveiled its latest batch of additives, called the VOC removal batch. According to a company report, these additives are specifically designed for electric , Source: - (https://polymer-additives.specialchem.com)

- In 2024, CAI introduced its latest product line of foaming agents. This newly launched foaming agent is called the ST-BA13MBTM. Moreover, this foaming agent is free from hazardous substances such as formamide and azo while enabling suitability for the injection molding, extraction, and blow molding process, as per the company's claim. (Source: - https://polymer-additives.specialchem.com)

- In 2024, EnerG and GAT GmbH unveiled their latest product line of automotive additives in India. Also, EnerG and GAT GmbH made a partnership for the development of this product. Moreover, the product line called the GAT x EnerG, as per the report published by the company recently. (source: https://www.autocarpro.in)

- In May 2023, a subsidiary of PTT Global Chemical PLC (GC), GC Ventures (GCV) is investing in Interface Polymers Ltd., a British company. With this investment, GC Group can now recycle plastic more sustainably and effectively.

Segments Covered in the Report

By Type

- Plastic Additives

- Rubber Additives

- Coating Additives

- Adhesive Additives

- Ink Additives

- Lubricant Additives

- Fuel Additives

- Pigment Additives

By Form

- Liquid

- Powder

- Solid

By Functionality

- Antioxidants

- UV Stabilizers

- Flame Retardants

- Antistatic Agents

- Rheology Modifiers

- Dispersants

- Impact Modifiers

- Wetting Agents

- Lubricity Additives

- Adhesion Promoters

- Emulsifiers

By End-use

- Automotive

- Construction

- Packaging

- Consumer Goods

- Industrial Manufacturing

- Agriculture

- Electronics

- Pharmaceuticals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting