What is the Recycled Polyethylene Terephthalate Market Size?

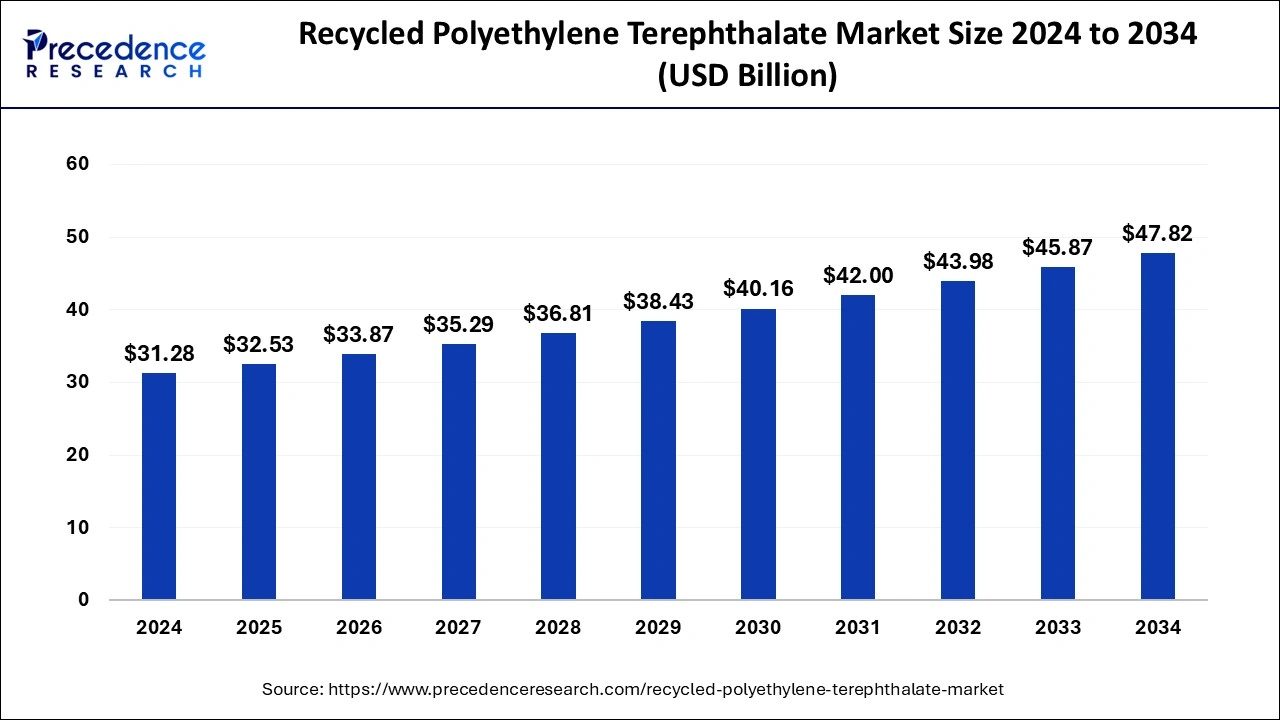

The global recycled polyethylene terephthalate market size was estimated at USD 32.53 billion in 2025 and is predicted to increase from USD 33.87 billion in 2026 to approximately USD 49.73billion by 2035, expanding at a CAGR of 4.34% from 2026 to 2035.

Recycled Polyethylene Terephthalate Market Key Takeaways

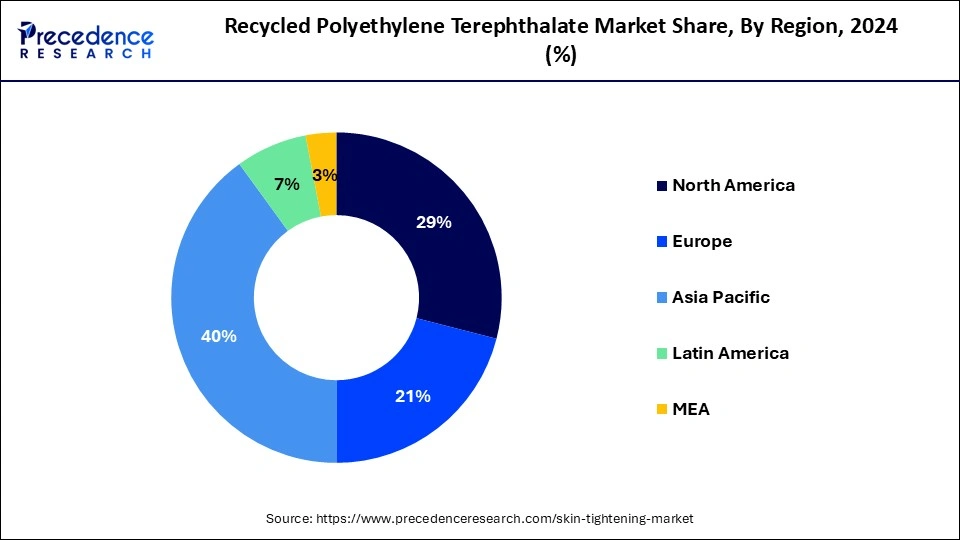

- Asia Pacific has captured a revenue share of around 40% in 2025.

- By end-use, the fiber segment has accounted for a market share of 40.4% in 2025.

- By product, the clear segment has generated a revenue share of 76% in 2025.

What is the Recycled Polyethylene Terephthalate?

The growth of global recycled polyethylene terephthalate market is mainly attributed to growing consumer awareness regarding environment and rising demand for sustainable alternatives. Furthermore, various companies from food and beverage industry such as Coca-Cola planned to move from virgin PET bottles with recycled polyethylene terephthalate by 2025 in Western European region. On the other hand, emission of carcinogenic compounds is expected hamper the growth of global recycled polyethylene terephthalate market in near future. Even so, rising demand for recycled polyethylene terephthalate from non-food sector is predicted to open massive opportunities for market players in years to come.

How is AI contributing to the Recycled Polyethylene Terephthalate Industry?

Artificial intelligence increases rPET recycling by allowing specific sorting, contamination, and efficiency of the process. Computer vision, robots, and predictive models can increase the purity of materials, further optimize the recycling process, guarantee food-grade quality, minimize the downtime of operations, and enable sustainable supply chain management throughout recycling plants.

Recycled Polyethylene Terephthalate Market Growth Factors

- The annual production capacity of polyethylene terephthalate is expected to increase nearly 35 million metric tons by 2024.

- In 2022, the total manufacturing capacity of PET in India was more than 3,200 kilotons.

- Reliance Industries Limited was a major producer of PET with a capacity of nearly 1000 kilotons in 2022.

Market Outlook

- Industry Growth Overview: Recycling content requirements, recycling innovation, and sustainable packaging demand boost the growth of the recycled polyethylene terephthalate market.

- Sustainability Trends: Recycling of bottles in closed loops is becoming more popular as brands become circular and lower their carbon footprint.

- Major Investors: Plastipak, Amcor, Veolia, Indorama Ventures, Coca-Cola increase rPET capacity in food grade.

- Startup Ecosystem: Startups progress chemical recycling and AI sorting to open more valuable PET waste streams.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 49.73 Billion |

| Market Size in 2025 | USD 32.53 Billion |

| Market Size in 2026 | USD 33.29 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.34% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising utilization of PET material from the food and beverages industry

In August 2024, Coco Cola India announced the launch of 100% recycled bottles made with PET material. With this launch, the company becomes first in India to use 100% recycled polyethylene terephthalate for the food and beverage industry. Coco Cola has set a goal to use at least 50% recycled material for its packaging purposes. As consumer awareness of environmental concerns rises, industries are actively seeking sustainable packaging solutions. PET, known for its durability and lightweight nature, has become a popular choice for packaging bottled water and other food and beverage products. The surge in PET usage has led to a significant rise in plastic waste, prompting the need for recycling initiatives. Recycled polyethylene terephthalate offers an eco-friendly alternative by repurposing used PET materials. multiple food and beverage companies are committing to using a certain percentage of recycled material, this commitment also grows the demand for recycled polyethylene terephthalate material. Thus, the rising utilization of PET materials from the food and beverage industry is observed to drive the growth of the market.

Market Restraint

Consumer perception about the quality

The obstacle to the market's growth is caused by consumer perception. Consumers might worry about potential contamination, reduced durability and visual imperfections in products made with recycled polyethylene terephthalate. Despite its environmental benefits, there can be skepticism surrounding the quality and safety of products made from recycled polyethylene terephthalate. Lack of awareness and knowledge about such products can cause the perception. To address such restraints, the manufacturers or key players may have to adopt market strategies in order to demonstrate trust in the quality of the product.

Opportunity

Supportive government regulations

Supportive government regulations can enhance consumer awareness and preference for products made from recycled polyethylene terephthalate. Transparent labeling and certifications indicating the use of recycled content can foster trust and enable consumers to make more sustainable choices. Government support also fosters innovation in recycling technologies, leading to more efficient and cost-effective PET recycling methods. This, in turn, makes recycled PET products more competitive in the market, potentially lowering prices and expanding their applications across various industries. Thus, supportive government regulations present a significant opportunity for the market.

Market Challenge

Lack of infrastructure

The lack of infrastructure poses a major challenge for the recycled polyethylene terephthalate market. Recycled polyethylene terephthalate is a crucial component of sustainable packaging solutions and products. However, its growth is hindered by the absence of proper collection, sorting and processing facilities. Insufficient recycling infrastructure leads to challenges in collecting post-consumer PET waste. Inadequate recycling programs and collection systems result in limited availability of high-quality PET waste feedstock for recycling facilities. This impacts the overall supply chain and can lead to increased costs for sourcing suitable materials.

Segment Insights

Product Type Insights

Based on product type, the global recycled polyethylene terephthalate market is segmented into clear and colored. Clear recycled PET held the largest share in product type segment of the global recycled polyethylene terephthalate market in 2025 and is also expected hold its place in forecast period. The growth of this segment is mainly attributed to rising demand for production of fibers and resins paired with rising demand for bottles. Furthermore, clear recycledpolyethylene terephthalate containers possess the characteristics like flexibility, lightweight and durability. Colored recycled PET segment is predicted to account noticeable share in coming years.

End Use Insights

Fiber, sheet and film, strapping, food & beverage containers and bottles, non-food containers and bottles and others are the end user segment of global recycled polyethylene terephthalate market. In 2025, fiber end user segment accounted highest sales volume, the growth of fiber end user segment is primarily driven by growing demand from clothing and accessories automobiles and textile. Rising demand of recycled polyethylene terephthalate in non-food sector is also predicted to shape the global recycled polyethylene terephthalate market in coming years. Food and beverage containers and bottles segment is predicted to show growth at a CAGR of 7.9% during forecast period.

Regional Insights

What is the Asia Pacific Recycled Polyethylene Terephthalate Market Size?

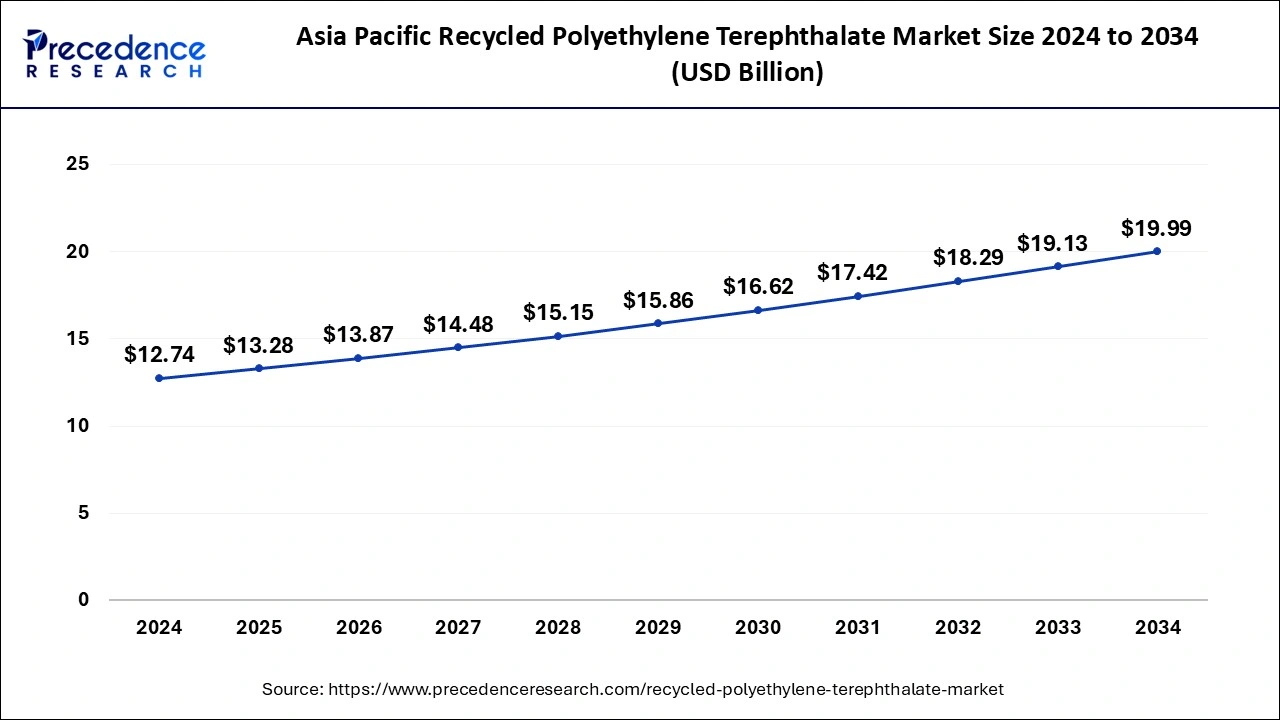

The Asia Pacific recycled polyethylene terephthalate market size reached USD 13.28 billion in 2025 and is projected to be worth around USD 20.84 billion by 2035, growing at a CAGR of 4.61% from 2026 to 2035.

Asia Pacific held the majority share of global recycled polyethylene terephthalate industry in 2025. This trend is estimated to continue as brand owners initiate the growth in usage of recycled materials in their products. The growth of Asia Pacific recycled polyethylene terephthalate market is mainly attributed by shift in production facilities of various end uses towards countries particularly in China, India and Indonesia. Japan's rate of PET bottle recycling is among the highest in the world which is about 85%. With the commitment of brand owners to increase the amount of recycled materials in their packaging, PET recyclers have to catch-up to meet the growing demand.

In April 2025, the following nine companies are launching an initiative that uses PET beverage bottles and non-food-use PET in the chemical recycling (CR) process to produce recycled beverage bottles: JEPLAN, INC. (JEPLAN), Kirin Holdings Co., Ltd (Kirin Holdings), TDK Corp. (TDK), Murata Manufacturing Co., Ltd. (Murata Manufacturing), Kao Corp. (Kao), FANCL Corp. (FANCL), Kirin Beverage Co., Ltd. (Kirin Beverage), PET REFINE TECHNOLOGY CO., LTD. (PET REFINE TECHNOLOGY), and Asahi Soft Drinks Co., Ltd. (Asahi Soft Drinks). The initiative to recycle non-food contact material grade PET materials into PET beverage bottles is the first of its kind in Japan. This initiative aims to address the issue that the current recycling methods do not achieve an adequate level of PET resource recycling, expanding non-food contact PET as a CR feedstock in the production of PET beverage bottles.

Additionally, the surge in investment by key players to expand their presence and gain strategic benefits over competitors, driving the expansion of the recycled polyethylene terephthalate market. For instance, in November 2024, Revalyu Resources, a leading chemical PET recycling company with a global presence, commissioned its second technology-leading PET recycling plant at its site in Nashik, India, to bolster its production capacity and meet growing customer demands. The recent commissioningof the second plant means the revalyu site now recycles over 20 million used PET bottles a day into 160 tonnes per day of high-quality PET chips and PET polymer.

Contribution of Asian Countries for Recycled Polyethylene Terephthalate Market

Corporate Actions: Companies like Reliance Industries are leading the way by processing billions of PET bottles annually into rPET chips, catering to the growing demand in textiles and packaging sectors.

Circular Economy Policies: China's 14th Five-Year Plan emphasizes enhancing resource efficiency and recycling industries, with targets such as achieving a 60% utilization rate for construction waste and producing 20 million tons of recycled non-ferrous metals annually.

Regulatory Framework: Japan has established the Container and Packaging Recycling Act, which mandates the recycling of PET bottles and other packaging materials.

Furthermore, rising concerns regarding sustainability of natural resources in developing economies of North America and Europe are likely to escalate the product demand over the forecast period. Latin America is also predicted to show noticeable growth in global recycled polyethylene terephthalate market owing to rising demand from non-food containers and bottles.

United States: The United States is a leader in recycling due to strong policies, efficient collection systems, and high demand from the beverage and food industries. Robust recycling policies at federal and state levels encourage responsible waste management, often mandating recycling and providing incentives for greener practices. Large-scale collection systems, including curbside recycling programs and dedicated drop-off centers, make it easy for households to participate, thereby increasing recycling rates. The growing demand from beverage and food companies for recycled materials further enhances these efforts, as businesses recognize the value of sustainability in appealing to environmentally conscious consumers. Together, these factors create a strong recycling ecosystem, positioning the U.S. as a frontrunner in promoting sustainability and a circular economy.

In April 2025, Berry Global Group, Inc. collaborated with Nestlé Purina PetCare, manufacturer of some of the world's most trusted and popular pet care products, to convert the packaging for its Friskies Party Mix 20oz and 30oz cat treat canisters are made of 100% recycled plastic (excluding the label and lid). The new canisters is available across the U.S., will be widely recyclable, and made of 100% mechanically recycled PET (polyethylene terephthalate).

Canada: The circular economy represents a transformative approach to sustainable development, aiming to minimize waste and make the most of resources. Investment in circular economy models not only enhances sustainability but also drives innovation and economic growth. Advanced material recovery facilities play a crucial role in this system by efficiently reclaiming valuable materials from waste. These facilities employ cutting-edge technologies to sort, process, and recycle materials such as metals, plastics, and paper.

This not only reduces the environmental impact of waste but also supports a steady growth in industries that depend on recycled materials, creating a more resilient and sustainable economy. By closing the loop on resource use, circular economy practices lead to decreased reliance on virgin material extraction, lower carbon emissions, and a reduction in landfill waste.

Value Chain Analysis of the Recycled Polyethylene Terephthalate Market

- Chemical Synthesis and Processing: converting PET waste collected using mechanical or chemical recycling to reusable polymers.

Key Players: DuPont, Dow Inc., BASF SE, Eastman, SABIC - Compound Formulation and Blending: Blending recycled PET, additives, and polymers to attain desired material characteristics.

Key Players: BASF, DuPont - Quality Testing and Certification: The assessment of the recycled PET to ensure compliance with the standards of safety, regulations, and food grade.

Key Players: EFSA, FDA

Recycled Polyethylene Terephthalate MarketCompanies

- Placon: Manufactures EcoStar recycled PET sheet and rollstock to produce high-clarity and food-safe packaging with curbside bottles.

- Ergis Recycling: PET bottles are reused to create clear flakes and pellets that provide an effective source of recycled raw material that is useful in food manufacturing.

- Phoenix Technologies: Plastic Manufacturers use special filtration and decontamination technologies to package in rPET food-grade.

Other Major Key Players

- Libolon

- M&G Chemicals

- BariQ

- Zhejiang AnshunPettechsFibre Co. Ltd.

- PolyQuest

- Clear Path Recycling LLC

- Verdeco Recycling, Inc.

- Sorema

- Evergreen Plastics, Inc.

Recent Developments

- In August 2025, UNDP, funded by the EU and partnered with Deir Alla Municipality, launched a USD 1 million plastic recycling plant in the Jordan Valley. This initiative enhances solid waste management, fosters a circular economy, creates over 50 green jobs, and stimulates economic growth in the waste management sector and surrounding areas. (Source: https://www.undp.org/arab-states )

- In June 2025, UFlex introduced an FSSAI-compliant single-pellet solution for Recycled PET in food packaging, responding to the upcoming FY26 requirement for 30% recycled content. The company plans to invest ₹317 crore in two new recycling plants in Noida to support this initiative. (Source:https://www.thehindubusinessline.com )

- In October 2024, Iterum, formerly known as PET Baltija, opened Latvia's largest PET recycling plant in Olaine. At a planned capacity of 80,000 tonnes per year, the plant is one of the largest PET recycling facilities in Northern Europe and one of Latvia's largest industrial buildings. It spans an outdoor area of around 40,000 square metres, and a total interior area covering 30,000 square meters, including production facilities, office space, and various shared facilities.

- In June 2024, Arkema, a leader in specialty materials, announced a breakthrough in new manufacturing processes that integrate up to 40% post-consumer recycled PET into powder coating resins, reducing product carbon footprint by up to 20%. This new technology will empower end markets to better respond to increasing societal expectations to preserve resources and reduce climate impact. Arkema, with Adhesive Solutions, Advanced Materials, and Coating Solutions, achieved €9.5 billion in 2023 sales across 55 countries.

- In January 2025, Oerlikon Barmag and Evonik announced their cooperation to promote chemical recycling of Polyethylene terephthalate (PET) waste. Both companies are committed to developing technologies for robust and efficient depolymerisation and purification processes, coupled with an integrated concept for repolymerisation and the associated EPC business models.

- In April 2024, S&P global commodity insight that provides information, analysis and benchmark prices for the energy markets launched India's first price assessment for R-PET.

- From january to November 2022, India exported 10,000 metric tons of R-PET.

- In March 2024, the oil experts of Russia reached to the highest level since April 2020. The revenue from exports increased by $1 billion.

- In October 2024, coca cola, an american multinational non-alcoholic beverage manufacturing corporation has announced that by early 2024, all 500 milliliter bottles of Coca-Cola sparkling beverages sold in Canada will be constructed entirely of recycled plastic.

- Biffa, sustainable management leader in UK has acquired North Yorkshire based Esterpet Ltd, a recycler of Polyethylene Terephthalate (PET) plastic. Biffa's closed-loop food grade plastic recycling capabilities, which include its Seaham, Redcar, and Washington operations that currently turn over 165,000 tonnes of plastic annually into premium recycled polymers, are strengthened by this acquisitions.

Segments Covered in the Report

By Product Type

- Clear

- Colored

By End UseType

- Food & Beverage Containers and Bottles

- Fiber

- Sheet and Film

- Strapping

- Non-Food Containers and Bottles

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting